The Annually Financial Overview Excel Template for Startups provides a comprehensive framework to track yearly revenues, expenses, and profits. It simplifies budget management and enhances financial forecasting accuracy for early-stage businesses. Utilizing this template ensures startups maintain clear visibility on their financial health, aiding strategic decision-making.

Annual Financial Overview with Key Metrics Tracker

The Annual Financial Overview is a comprehensive document that summarizes a company's financial performance over the fiscal year. It typically contains detailed summaries of income statements, balance sheets, and cash flow statements. This document is essential for stakeholders to assess fiscal health and strategic direction.

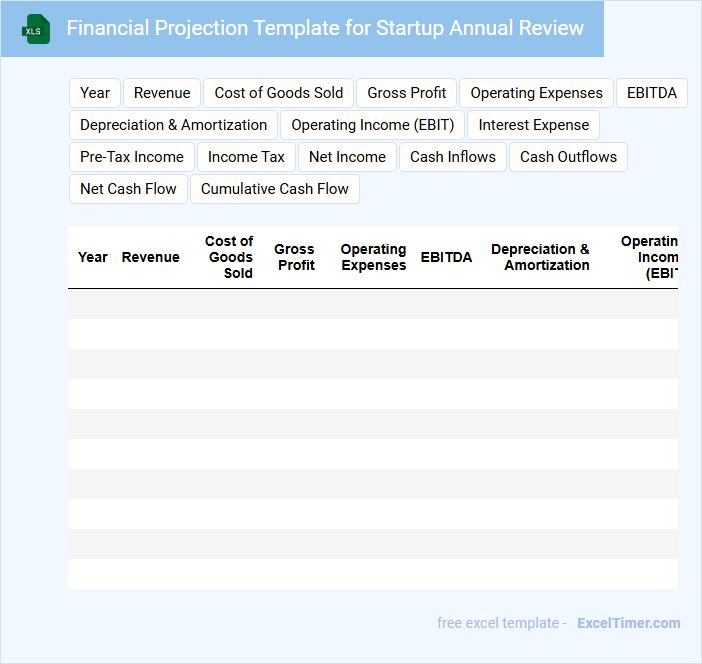

Financial Projection Template for Startup Annual Review

A Financial Projection Template for a startup annual review typically contains estimated revenue, expenses, and cash flow forecasts. It also includes key metrics such as profit margins, break-even analysis, and funding requirements.

This document helps stakeholders assess the startup's financial health and growth potential. Regularly updating these projections ensures informed decision-making and strategic planning for future success.

It is important to incorporate realistic assumptions and regularly compare projections with actual performance to refine forecasts effectively.

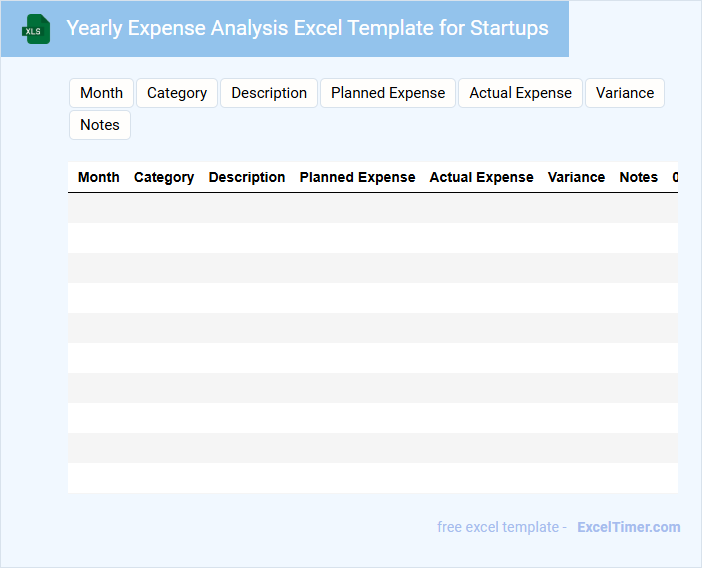

Yearly Expense Analysis Excel Template for Startups

The Yearly Expense Analysis Excel Template for startups is typically a comprehensive document that tracks and categorizes all business expenses throughout the year. It helps entrepreneurs monitor spending patterns, forecast budgets, and identify cost-saving opportunities. This template usually includes sections for fixed and variable expenses, charts for visual analysis, and summary reports.

When using this template, it is crucial to ensure accuracy in data entry and consistency in categorization to achieve meaningful insights. Regular updates and reviewing trends quarterly can help startups adjust budgets proactively. Additionally, integrating revenue tracking alongside expenses provides a clearer picture of overall financial health.

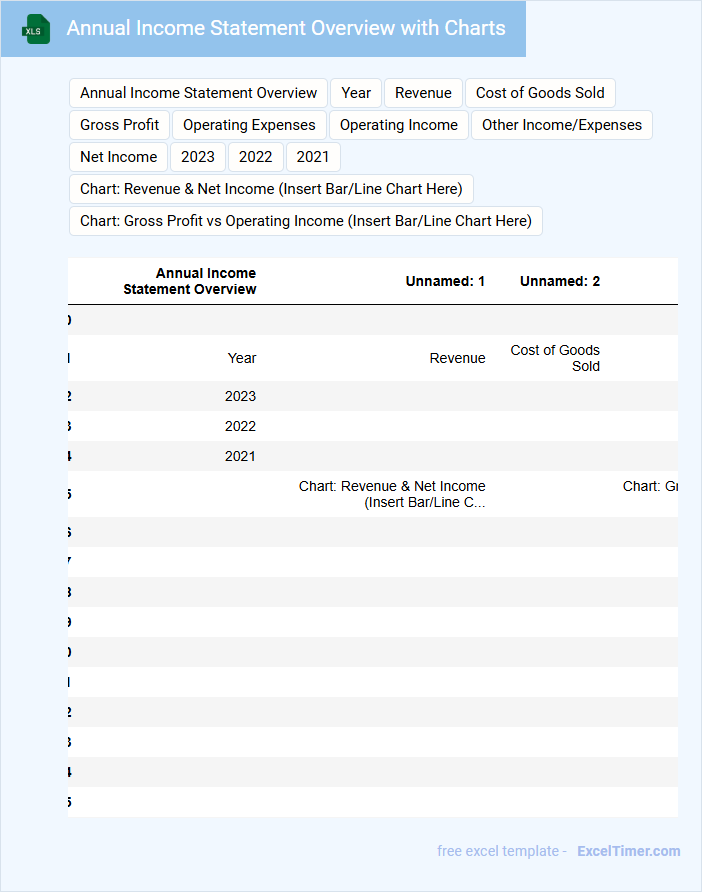

Annual Income Statement Overview with Charts

What information does an Annual Income Statement Overview with Charts typically contain? This document usually summarizes a company's revenues, expenses, and net income over the fiscal year to provide a clear financial performance snapshot. Incorporating charts helps visualize trends, comparisons, and key financial metrics for better understanding and decision-making.

Why is it important to include visual data representations in an Annual Income Statement Overview? Charts enhance clarity by presenting complex financial data in an easy-to-interpret format, making it accessible for stakeholders such as investors and management. Ensuring accuracy and simplicity in these visuals is crucial for effective communication of the financial health and growth opportunities of the business.

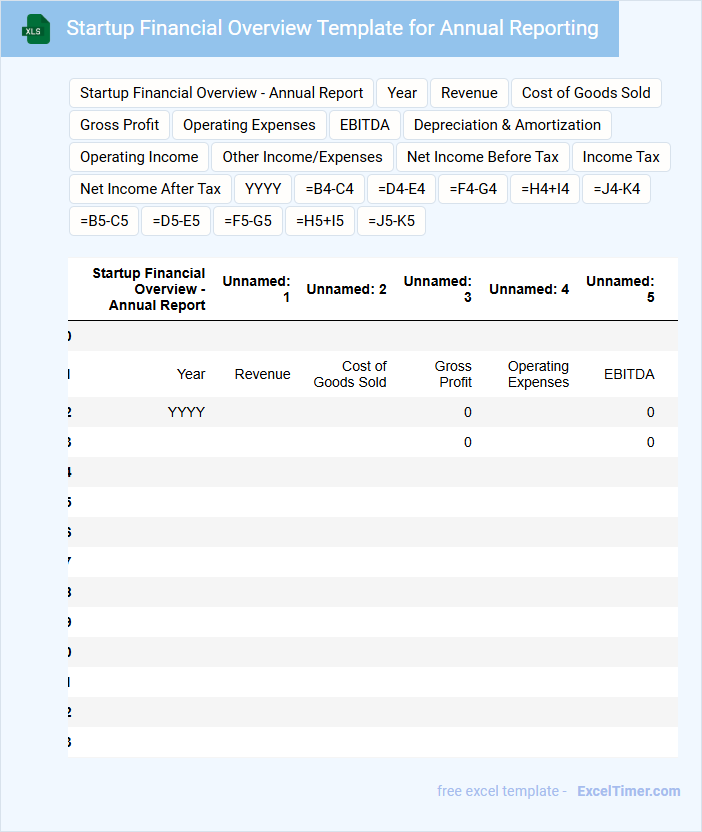

Startup Financial Overview Template for Annual Reporting

A Startup Financial Overview Template for Annual Reporting typically contains essential financial statements and key performance indicators to provide a clear picture of the startup's financial health over the year.

- Income Statement: summarizes revenue, expenses, and profit or loss for the reporting period.

- Balance Sheet: outlines assets, liabilities, and shareholders' equity to show overall financial position.

- Cash Flow Statement: tracks cash inflows and outflows to highlight liquidity and operational efficiency.

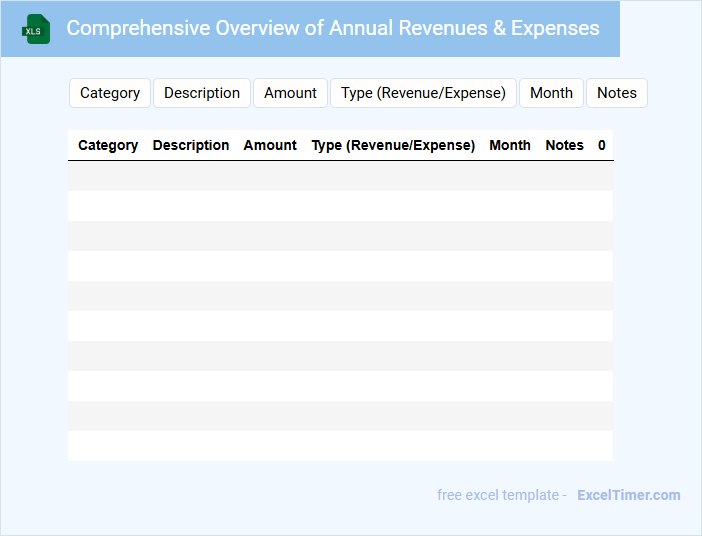

Comprehensive Overview of Annual Revenues & Expenses

This document provides a detailed summary of an organization's yearly financial performance, encompassing all income and expenditures. It is essential for evaluating fiscal health and guiding future budgeting decisions.

- Include a clear breakdown of revenue streams and expense categories to enhance transparency.

- Highlight significant changes compared to previous years to identify trends.

- Incorporate visual aids like charts or graphs for easier data interpretation.

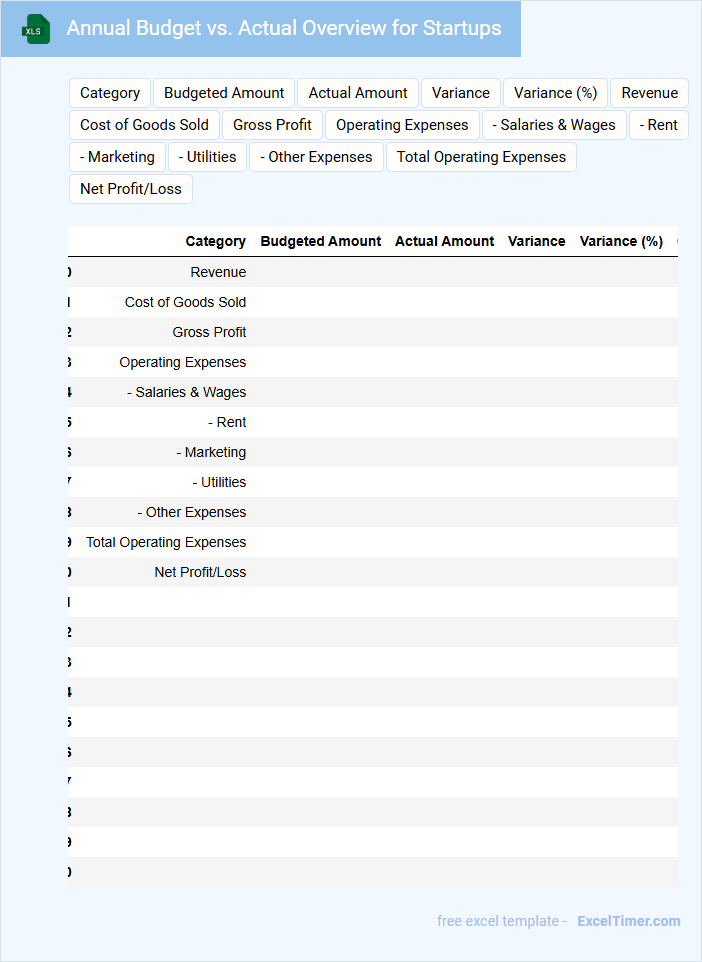

Annual Budget vs. Actual Overview for Startups

What information is typically included in an Annual Budget vs. Actual Overview for Startups? This document usually contains a detailed comparison between the projected budget and the actual financial performance over a set period, highlighting variances in revenue, expenses, and cash flow. It helps startups track financial progress, identify discrepancies, and make informed decisions for future planning and growth.

What is an important consideration when preparing an Annual Budget vs. Actual Overview for Startups? It is crucial to ensure accuracy in both budget estimates and actual financial data, while regularly updating and reviewing the overview to reflect any changes in business conditions. Additionally, startups should focus on key performance metrics and actionable insights to optimize resource allocation and improve financial management.

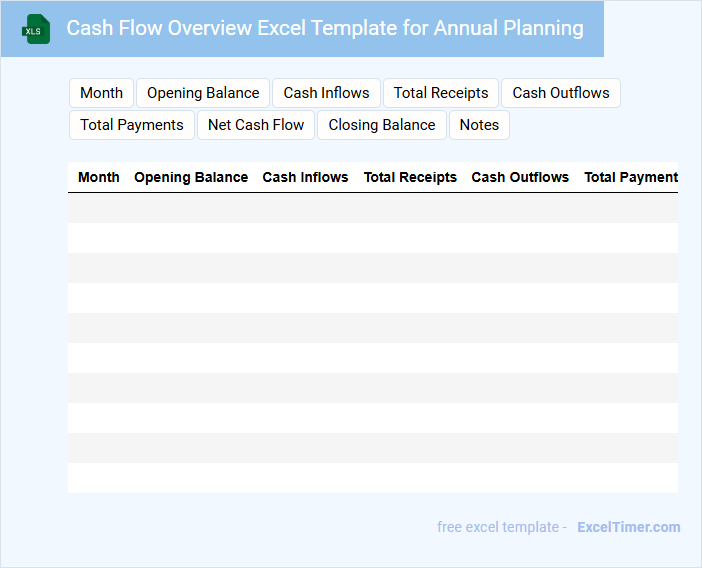

Cash Flow Overview Excel Template for Annual Planning

This document typically contains detailed financial data to track and project cash inflows and outflows for effective annual financial planning.

- Cash Inflows: Record all expected sources of income, including sales, investments, and other revenue streams.

- Cash Outflows: Document all planned expenses such as operating costs, salaries, and capital expenditures.

- Cash Flow Projections: Use estimated timings and amounts to forecast future cash positions and identify potential shortfalls.

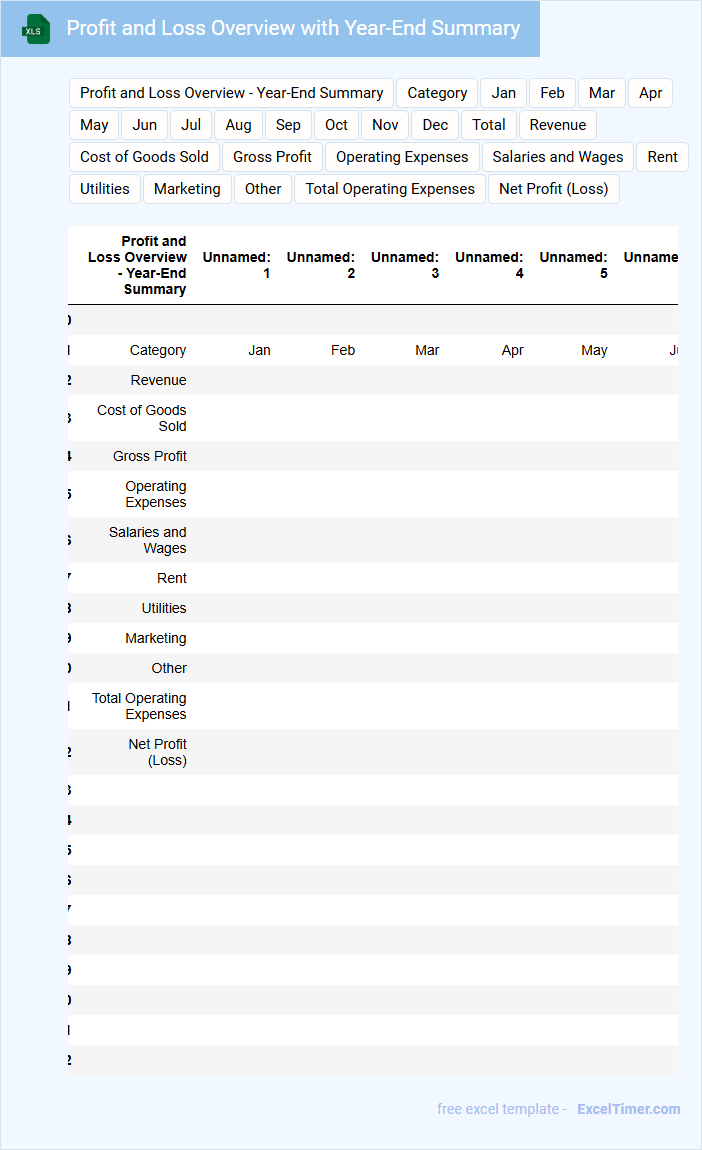

Profit and Loss Overview with Year-End Summary

A Profit and Loss Overview with Year-End Summary typically contains a detailed financial report summarizing revenues, expenses, and net profit for the fiscal year.

- Revenue analysis: highlights total income streams and their growth compared to previous periods.

- Expense breakdown: categorizes operational and non-operational costs to identify areas for cost savings.

- Net profit evaluation: assesses the overall profitability and financial health of the business at year-end.

Annual Financial Goals Tracker for Startup Growth

An Annual Financial Goals Tracker for startup growth typically contains detailed records of projected revenues, expenses, and net profits throughout the fiscal year. It serves as a crucial tool to monitor financial performance against set targets, enabling timely adjustments to strategies. Including milestone deadlines and key performance indicators improves accountability and supports informed decision-making.

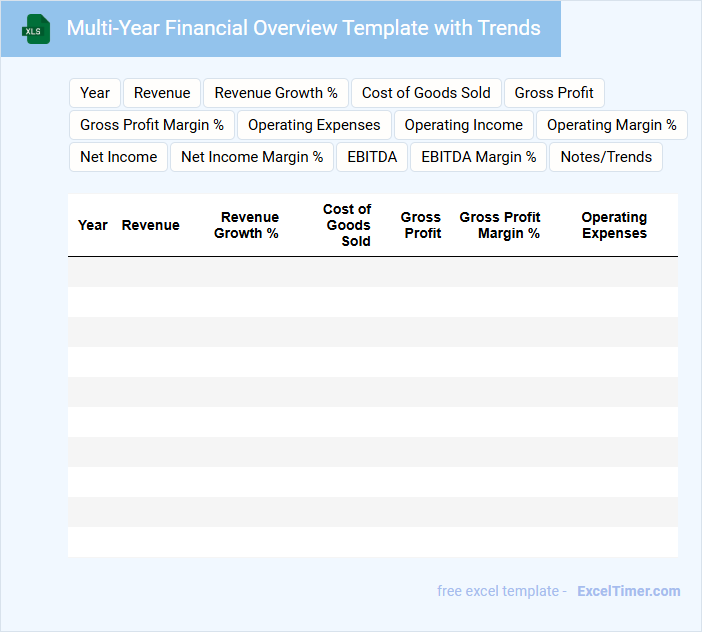

Multi-Year Financial Overview Template with Trends

A Multi-Year Financial Overview Template with Trends typically contains summarized financial data spanning several years, highlighting key performance indicators and trend analysis. It provides stakeholders with insights into the company's financial health and growth patterns over time.

- Include comparative financial statements to illustrate changes across multiple years.

- Incorporate visual trend graphs for revenues, expenses, and profits to enhance readability.

- Highlight significant financial events or anomalies that impacted trends for context.

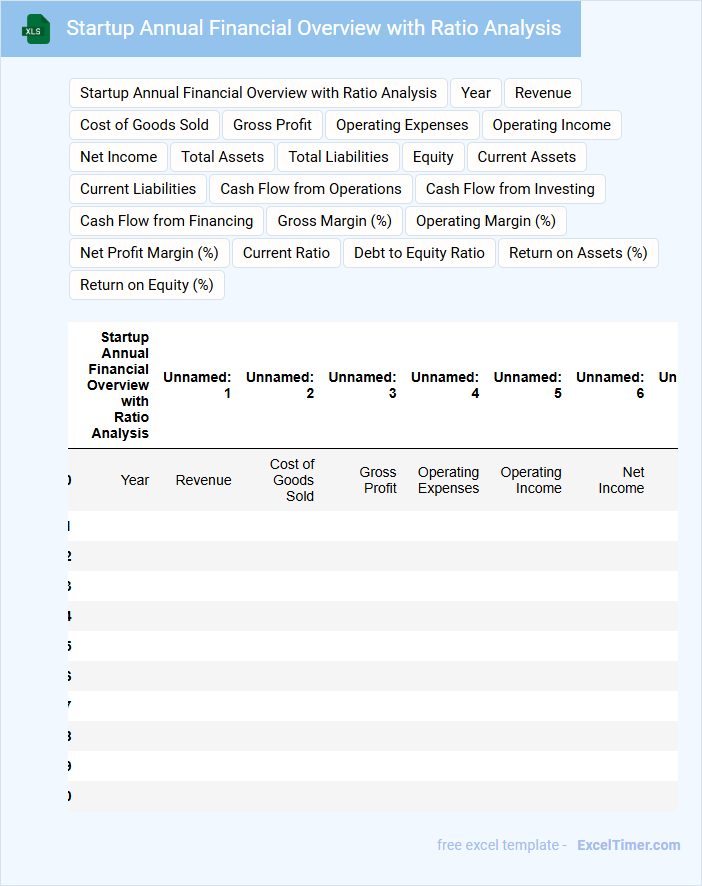

Startup Annual Financial Overview with Ratio Analysis

A Startup Annual Financial Overview document typically contains a summary of the company's financial performance over the past year, including income statements, balance sheets, and cash flow statements. It highlights key financial metrics and trends to provide insights into the startup's economic health. Incorporating ratio analysis helps stakeholders understand profitability, liquidity, and efficiency through standardized financial indicators.

Important elements to include are detailed ratio calculations such as current ratio, debt-to-equity ratio, and return on equity, as these facilitate benchmarking against industry standards. Clear visualizations like charts and graphs enhance the interpretability of financial data. Additionally, a concise executive summary provides an at-a-glance understanding for investors and management.

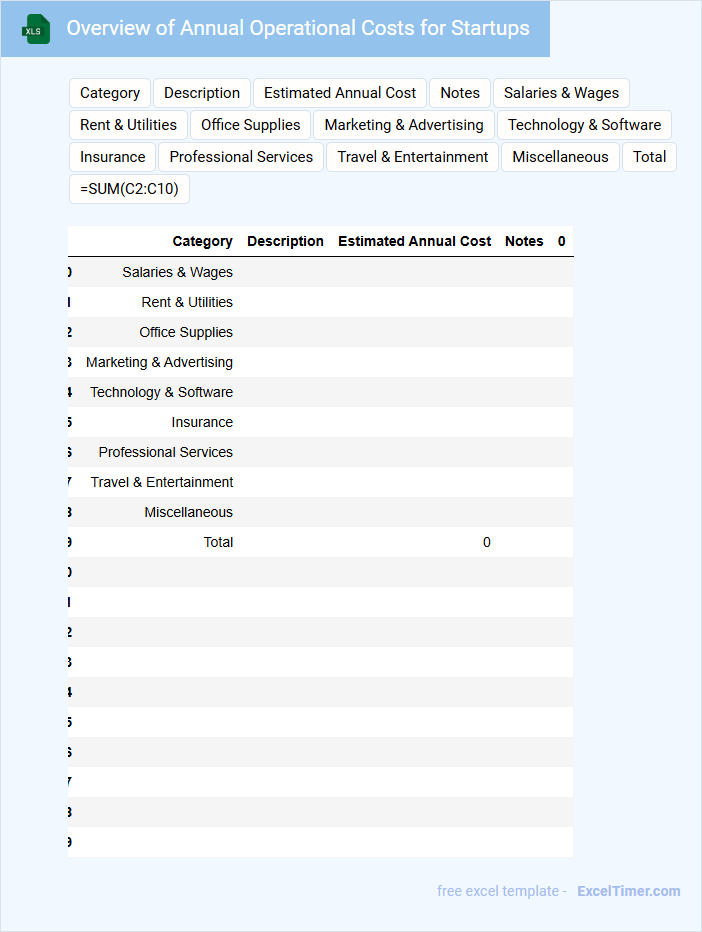

Overview of Annual Operational Costs for Startups

The Annual Operational Costs document typically outlines the fixed and variable expenses that a startup incurs over the course of a year. It helps in budgeting and forecasting financial needs. This overview assists stakeholders in understanding the financial health and sustainability of the business.

Such documents are crucial for tracking expenditures like salaries, rent, utilities, and marketing. They provide clear insights to optimize spending and improve cash flow management. Including detailed cost categories and contingency plans is highly recommended.

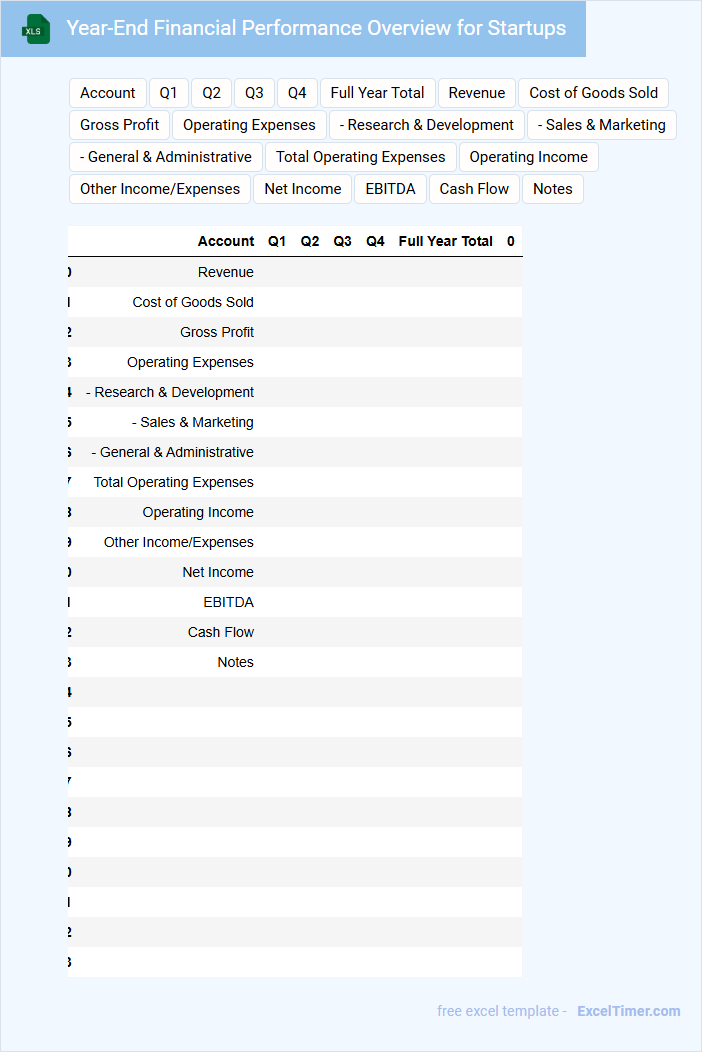

Year-End Financial Performance Overview for Startups

A Year-End Financial Performance Overview for startups typically contains a detailed summary of the company's financial activities and results over the past year. It highlights key metrics such as revenue growth, expenses, profit margins, and cash flow status. This document is crucial for stakeholders to understand the startup's financial health and strategic positioning.

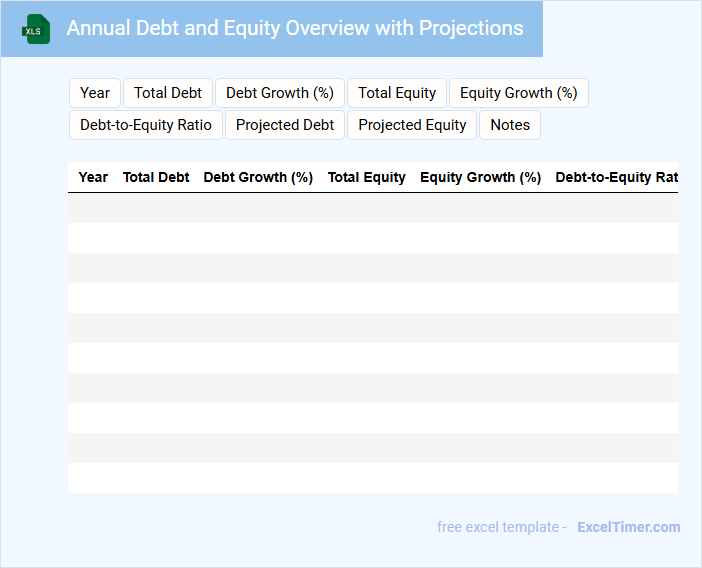

Annual Debt and Equity Overview with Projections

An Annual Debt and Equity Overview with Projections typically contains a comprehensive summary of a company's current financial obligations and equity status along with forward-looking estimates.

- Debt Analysis: Detailed information on current debts, interest rates, and repayment schedules is crucial for assessing financial health.

- Equity Breakdown: Clear reporting on ownership structure, equity investments, and shareholder distributions helps in understanding capital composition.

- Projection Accuracy: Reliable future projections based on realistic assumptions ensure better strategic financial planning.

What key financial statements should be included in an annual financial overview for startups?

Your annual financial overview for startups should include the balance sheet, income statement, and cash flow statement. These key financial statements provide a comprehensive view of your startup's financial health, profitability, and liquidity. Investors and stakeholders rely on these documents to assess growth potential and operational efficiency.

How do revenue streams and cost structures impact annual profitability in a startup's Excel summary?

Revenue streams determine the total income generated by various business activities, directly influencing the startup's annual profitability. Cost structures outline fixed and variable expenses, affecting net profit margins by controlling operational efficiency. An Excel summary visualizes these components to identify cash flow trends and optimize financial decision-making.

What are the critical metrics (e.g., burn rate, runway, EBITDA) to track annually for early-stage startups?

Track your startup's burn rate, runway, and EBITDA to maintain financial health annually. Monitoring cash flow, customer acquisition cost (CAC), and lifetime value (LTV) provides insights into operational efficiency and growth potential. These critical metrics enable strategic decisions and investor confidence for early-stage startups.

How should projections versus actuals be represented in an Excel document for yearly performance review?

In your Excel document for an annual financial overview of startups, projections versus actuals should be represented using clear, side-by-side columns for each month or quarter, enabling easy comparison. Use conditional formatting to highlight variances, and include summary rows that calculate total deviations and percentages. Visual elements like bar charts or line graphs can enhance insight into performance trends throughout the year.

Which visualizations (charts, tables, dashboards) best illustrate the startup's annual financial health in Excel?

Your Excel document should include dynamic dashboards combining line charts for revenue growth, bar charts for expense breakdown, and pivot tables summarizing profit margins. Visualizing cash flow trends with area charts and key financial ratios in scorecards highlights the startup's annual financial health effectively. These semantic-optimized visualizations provide clear insights into financial performance and support strategic decision-making.