The Annually Client Billing Excel Template for Legal Firms streamlines financial management by organizing client invoices and tracking payments efficiently throughout the year. It includes customizable fields for client details, billing hours, rates, and payment status, ensuring accurate record-keeping and easy audit preparation. Legal firms benefit from improved cash flow monitoring and enhanced billing transparency using this essential tool.

Annual Client Billing Tracker for Legal Firms

An Annual Client Billing Tracker is a document used by legal firms to systematically monitor and record client billing information throughout the year. It includes details such as hours billed, payment status, and invoice dates to ensure accurate financial tracking.

This tracker helps legal firms maintain transparency and improve cash flow by promptly identifying overdue payments and billing discrepancies. Implementing automated reminders and regularly updating the tracker are important practices for maximizing its effectiveness.

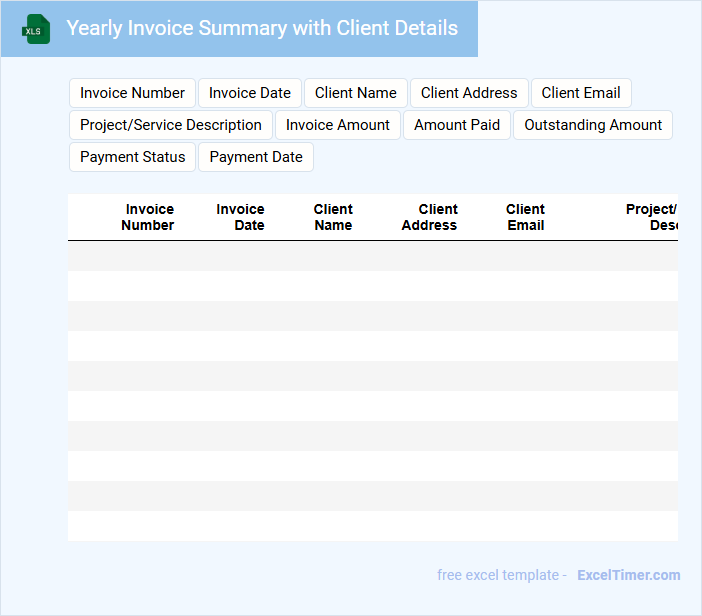

Yearly Invoice Summary with Client Details

A Yearly Invoice Summary with Client Details typically contains a comprehensive record of all transactions made with clients over the course of a year.

- Client Information: Detailed identification data to ensure accurate attribution of invoices.

- Invoice Totals: Summarized financial amounts to facilitate quick assessment of yearly revenue per client.

- Payment Status: Clear indication of paid, pending, or overdue invoices to manage cash flow effectively.

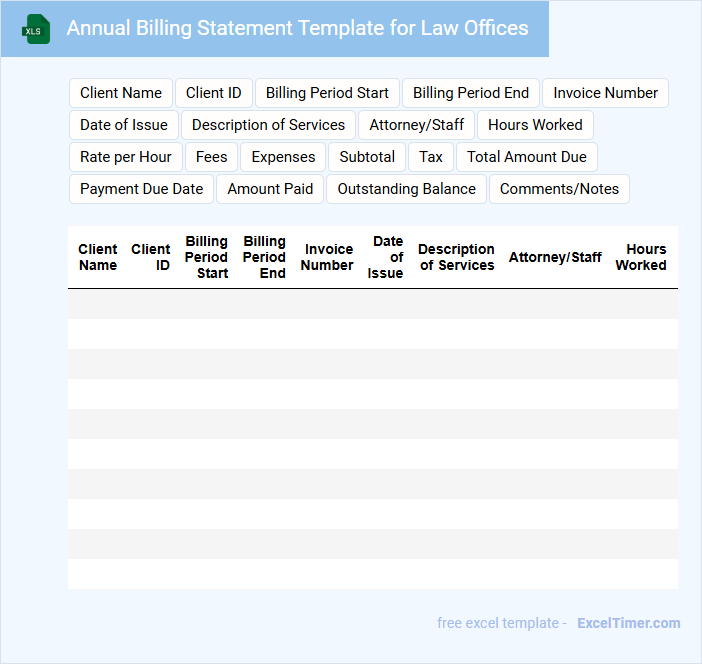

Annual Billing Statement Template for Law Offices

What information does an Annual Billing Statement Template for Law Offices typically contain? This document usually includes detailed records of all legal services provided over the year, itemized charges, payments received, and any outstanding balances. It helps ensure clear communication between the law office and clients regarding financial transactions and service summaries.

Why is accuracy important in this template? Accurate billing statements prevent disputes and maintain client trust by transparently reflecting the fees and hours billed. Including detailed descriptions of services and clear payment terms is essential for professionalism and legal compliance.

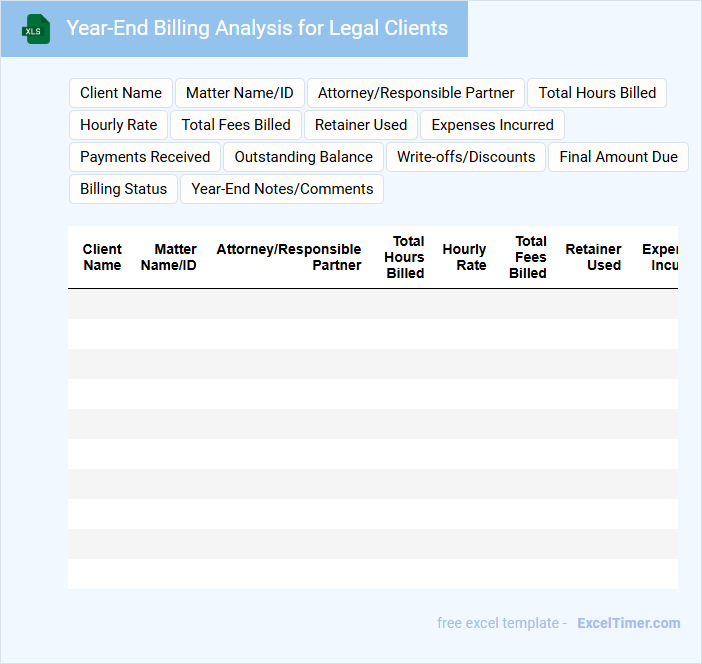

Year-End Billing Analysis for Legal Clients

The Year-End Billing Analysis document for legal clients typically contains a comprehensive review of all invoices issued throughout the year. It summarizes billable hours, expenses, and payments to assess financial performance and client engagement.

Key components include detailed breakdowns of rates, hours spent by each attorney, and outstanding balances. To enhance accuracy, ensure consistent time tracking and verify all billed items against client agreements.

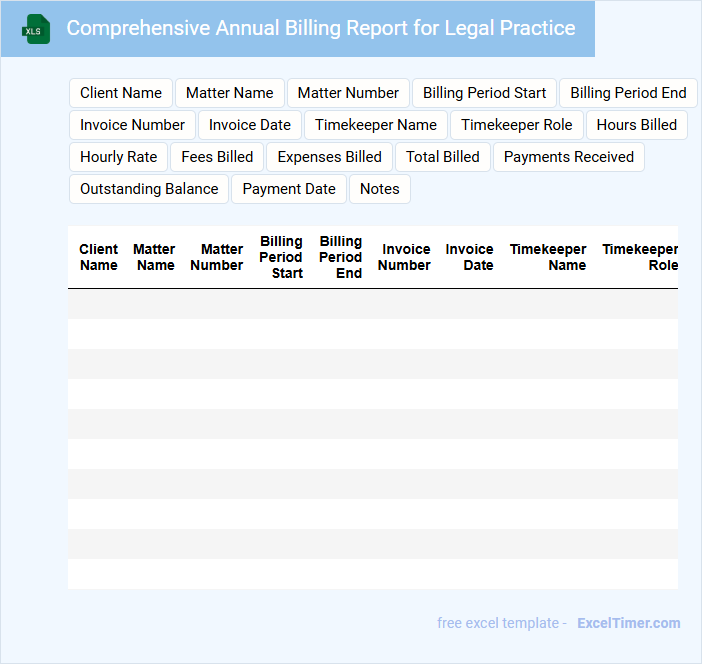

Comprehensive Annual Billing Report for Legal Practice

What information is typically contained in a Comprehensive Annual Billing Report for Legal Practice? This type of document usually includes detailed records of all client billing activities, invoices issued, payments received, and outstanding balances over the fiscal year. It helps firms analyze revenue streams, track service efficiency, and ensure transparent financial management.

What is important to focus on when preparing this report? Accuracy in itemizing billable hours, clear categorization of client matters, and consistent formatting enhance clarity and usability. Additionally, including summaries of billing trends and insights supports strategic planning and improves client communication.

Annual Revenue Tracker with Client Billing Overview

An Annual Revenue Tracker is a financial document that monitors yearly income streams and helps businesses assess their financial growth over time. It typically includes detailed records of sales, income sources, and monthly revenue comparisons. This document is essential for identifying trends and forecasting future earnings. The Client Billing Overview section provides a summary of invoices, payments received, and outstanding balances for each client. It ensures accurate billing and timely follow-ups on overdue accounts. Regular updates and clear communication with clients are important to maintain healthy cash flow.

Legal Firm Client Billing Dashboard for the Year

A Legal Firm Client Billing Dashboard for the Year typically contains detailed financial data and client billing summaries to track expenses and revenue efficiently.

- Client Overview: Displays total billed hours and outstanding payments for each client.

- Revenue Tracking: Summarizes monthly and annual revenue generated from legal services.

- Invoice Status: Highlights paid, pending, and overdue invoices to ensure timely collections.

Invoice Log with Annual Totals for Legal Clients

An Invoice Log with Annual Totals for Legal Clients is a vital record that tracks all billing transactions between a law firm and its clients over the course of a year. This document typically contains detailed invoice entries, including dates, amounts, client names, and descriptions of legal services provided. Maintaining accurate annual totals helps firms monitor financial performance, ensure timely payments, and streamline accounting processes.

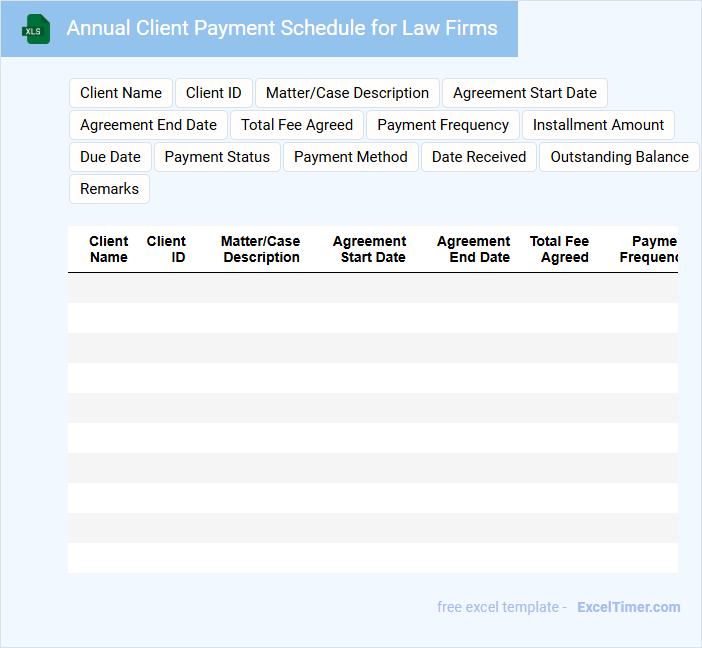

Annual Client Payment Schedule for Law Firms

An Annual Client Payment Schedule for law firms typically contains detailed timelines of expected payments from clients over the fiscal year. It outlines payment due dates, amounts, and terms agreed upon in legal service contracts. This document ensures transparent and organized financial planning for both the firm and its clients.

Important elements to include are clear invoice dates, penalty clauses for late payments, and contact information for billing inquiries. Consistency in payment reminders and secure methods of payment can enhance client compliance. Maintaining updated records within this schedule aids in accurate accounting and cash flow management.

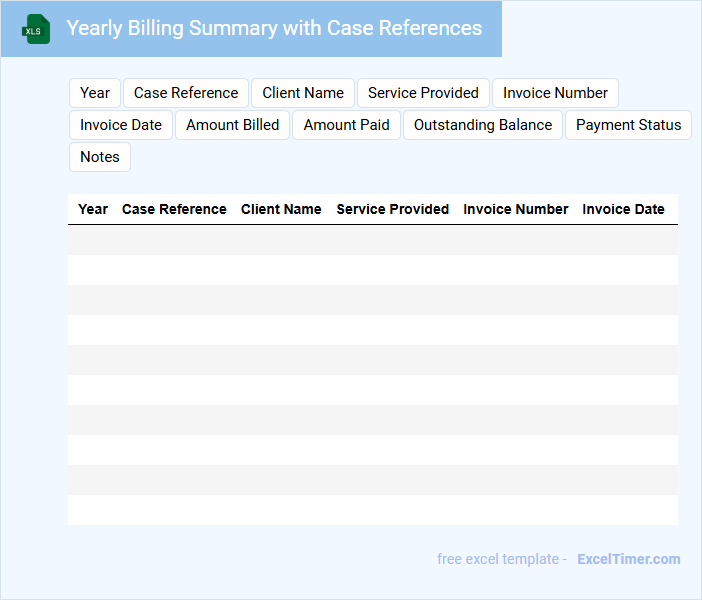

Yearly Billing Summary with Case References

This Yearly Billing Summary typically contains a comprehensive overview of all financial transactions made throughout the year, including detailed case references for clarity. It serves as a crucial document for both clients and service providers to track payment histories and verify charges. Ensuring accuracy and transparency in the billing data is essential for maintaining trust and facilitating smooth financial reconciliation.

Annual Client Fee Statement for Legal Professionals

What information is typically included in an Annual Client Fee Statement for Legal Professionals? This document usually contains a detailed summary of fees charged to a client over the year, including hourly rates, total hours worked, and any disbursements or expenses incurred. It provides transparency and clarity on billing practices, helping clients understand the cost of legal services rendered.

What important aspects should legal professionals consider when preparing this statement? Accuracy in recording all fees and expenses is crucial to maintain trust and avoid disputes. Additionally, clear formatting and concise explanations ensure the statement is easy to comprehend for clients, promoting professionalism and effective communication.

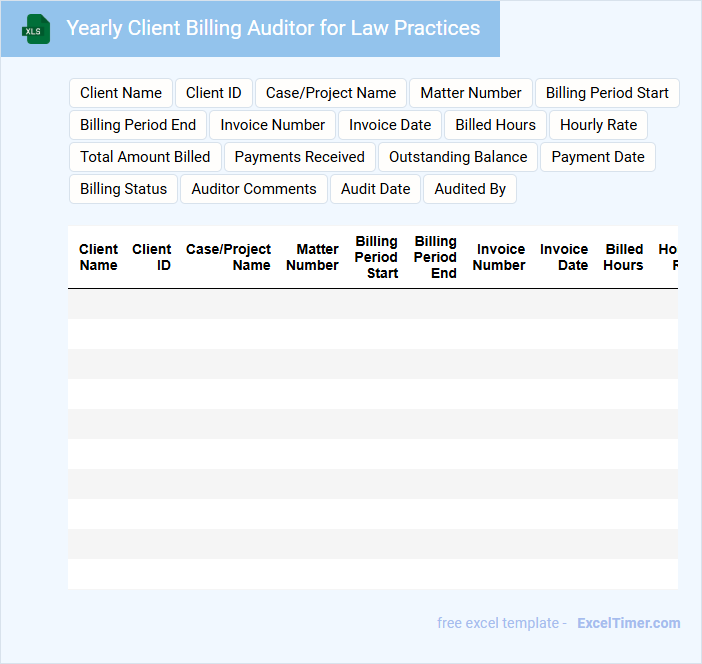

Yearly Client Billing Auditor for Law Practices

The Yearly Client Billing Auditor report for Law Practices typically contains a detailed review of client invoices, payment histories, and compliance with billing standards. It helps identify discrepancies, ensure accuracy, and assess financial transparency. This document is crucial for maintaining trust and improving the billing process within law firms.

Annual Billing Record Template for Legal Services

The Annual Billing Record Template for legal services is a document that systematically tracks all billable hours and expenses incurred throughout the year for various clients. It typically includes detailed descriptions of services rendered, dates of service, rates, and total amounts due. These records help ensure accurate invoicing and financial transparency between legal service providers and their clients.

Important elements to include are clear client information, itemized service descriptions, and payment terms to avoid disputes. Additionally, incorporating a summary section that highlights total billings by client or case can enhance organization. Finally, maintaining compliance with industry billing standards and confidentiality requirements is essential for legal documentation.

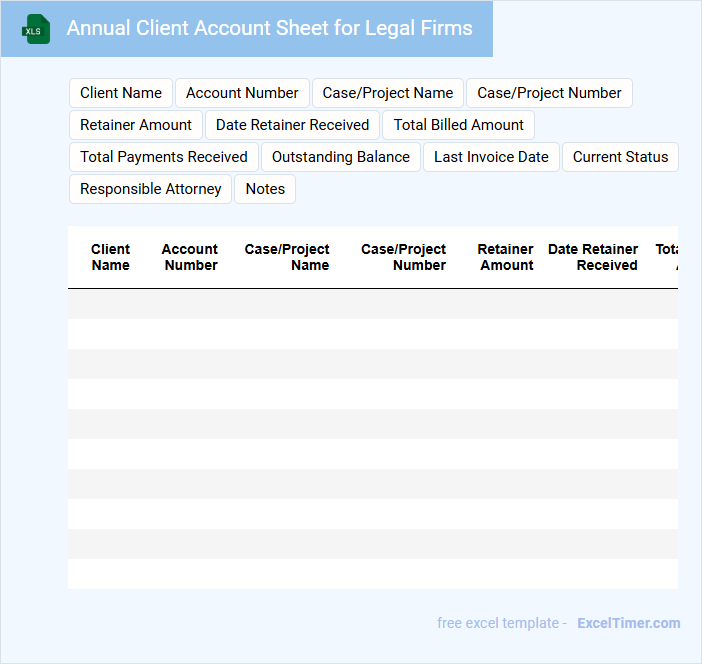

Annual Client Account Sheet for Legal Firms

The Annual Client Account Sheet for legal firms typically contains detailed records of all financial transactions between the client and the firm throughout the year. This includes invoicing, payments, retainer balances, and outstanding dues, ensuring transparency and accountability.

Such documents are essential for maintaining clear communication and accurate financial management within legal practices. It is crucial to regularly update and securely store these sheets to comply with legal and ethical standards.

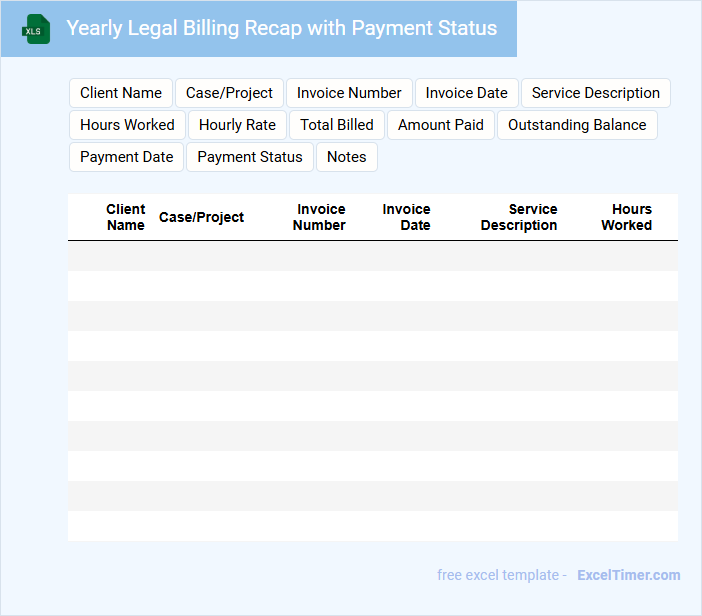

Yearly Legal Billing Recap with Payment Status

What does a Yearly Legal Billing Recap with Payment Status typically contain and why is it important? This document usually summarizes all legal invoices issued over the year along with their current payment statuses, providing a clear financial overview. It helps law firms and clients track outstanding balances, ensure timely payments, and maintain transparent accounting records.

What key data fields are essential for tracking annual client billing in a legal firm's Excel document?

Essential data fields for tracking annual client billing in a legal firm's Excel document include Client Name, Case or Matter ID, Billing Period, Service Description, Hours Billed, Hourly Rate, Total Amount Billed, Payment Status, and Invoice Date. Recording Attorney or Staff Assigned to each case provides accountability, while fields for Payment Due Date and Payment Received Date ensure effective cash flow management. Including Notes or Comments allows tracking of special billing arrangements or client communication details.

How can you implement formulas to automatically calculate yearly billing totals per client?

Use the SUMIF formula to automatically calculate yearly billing totals per client by summing invoice amounts based on client names. Organize data with columns for Client Name, Billing Date, and Amount, then apply =SUMIF(ClientRange, ClientName, AmountRange) to get totals. PivotTables offer another approach to dynamically aggregate annual billing data efficiently by client.

What methods can be used to flag overdue payments within the annual billing worksheet?

Overdue payments in an annual billing worksheet for legal firms can be flagged using conditional formatting rules based on due dates compared to the current date. Formulas like IF and TODAY combined with date differences highlight unpaid invoices past their due dates. Data validation and custom filters also help isolate overdue accounts for focused follow-up and reporting.

How should confidential client information be securely managed in Excel billing records?

Secure confidential client information in your Excel billing records by using password protection on files and enabling encryption features. Limit access through user permissions and regularly update passwords to prevent unauthorized entry. Employ data validation and hidden sheets to minimize exposure of sensitive billing details within legal firm records.

What columns are critical for auditing and reconciliation of annual client invoices in a legal firm?

Critical columns for auditing and reconciliation of annual client invoices in a legal firm include Client Name, Invoice Number, Billing Date, Service Description, Hours Billed, Rate per Hour, Total Amount, Payment Status, and Payment Date. You should also include columns for Tax Applied and Discounts Given to ensure accuracy in financial records. Tracking these data points facilitates thorough review and validation of client billing.