![]()

The Annually Donation Tracker Excel Template for Charities is an essential tool designed to help nonprofit organizations efficiently monitor and manage yearly contributions. It provides detailed records of donor information, donation amounts, and dates, enabling better financial transparency and reporting. Using this template enhances fundraising efforts by simplifying data analysis and ensuring accurate tracking of charitable donations.

Annually Donation Tracker with Donor Details

An Annually Donation Tracker is a document designed to systematically record and monitor all donations received within a year. It typically contains donor information such as names, contact details, donation amounts, and dates. This helps organizations maintain transparency and accountability in their fundraising efforts.

Including detailed Donor Details allows for personalized communication and effective donor relationship management. It often features columns for donor categories, payment methods, and donation purposes. Regularly updating this information ensures accurate financial reporting and aids in planning future campaigns.

Excel Template for Yearly Donation Tracking

An Excel Template for Yearly Donation Tracking is typically used to organize and monitor contributions received over a year. It helps in maintaining a clear record of donors, amounts, and dates.

- Include columns for donor names, donation amounts, and dates to ensure accurate tracking.

- Incorporate summary charts or pivot tables for quick analysis of monthly or yearly totals.

- Add space for notes or comments to capture additional relevant information about each donation.

Annual Giving Tracker with Gift Amounts

What information is typically included in an Annual Giving Tracker with Gift Amounts? This document usually contains detailed records of donors, dates of donations, and the corresponding gift amounts. It helps organizations monitor fundraising progress, identify major contributors, and strategize future solicitation efforts effectively.

Donation Tracker Spreadsheet for Nonprofits

What information does a Donation Tracker Spreadsheet for Nonprofits usually contain? It typically includes donor details, donation amounts, dates, and payment methods to efficiently manage and monitor contributions. This document helps nonprofits maintain organized records, ensuring transparency and aid in financial reporting.

What are important features to include in a Donation Tracker Spreadsheet? Key elements are clear categories for donor information, automatic calculation of totals, donation frequency tracking, and columns for notes or acknowledgments. Incorporating filters and summaries ensures quick access to vital data for decision-making and donor engagement.

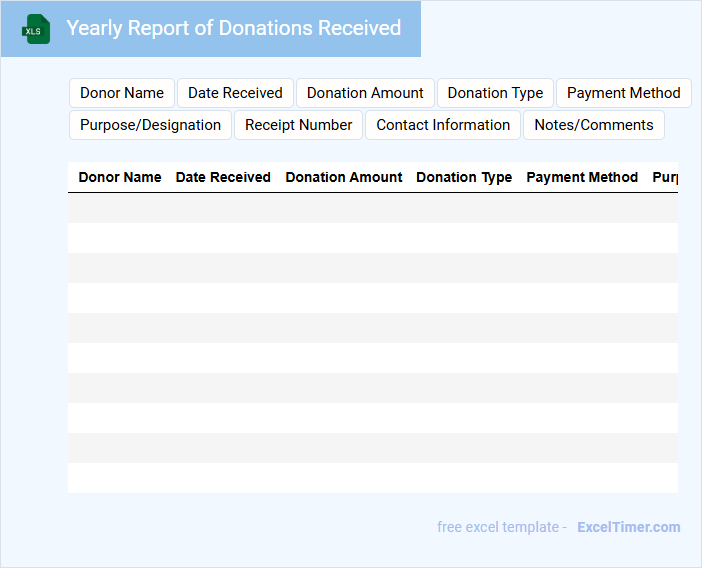

Yearly Report of Donations Received

What information is typically included in a Yearly Report of Donations Received? This document usually contains detailed records of all donations received throughout the year, including donor names, donation amounts, and dates. It also summarizes the total funds raised and highlights key contributors to provide transparency and accountability.

Why is it important to include a clear breakdown of donation sources? A clear breakdown helps stakeholders understand the composition of funding and ensures trust by showing diversity in support. Including this information also assists in strategic planning and recognizing loyal donors.

Donor Contribution Summary with Annual Totals

A Donor Contribution Summary typically contains a detailed listing of individual and organizational donations made over a specific period, highlighting the total contributions received annually. This document is crucial for maintaining transparency and providing a clear overview of fundraising efforts. It is important to include donor names, contribution amounts, dates, and cumulative annual totals to ensure comprehensive financial tracking and reporting.

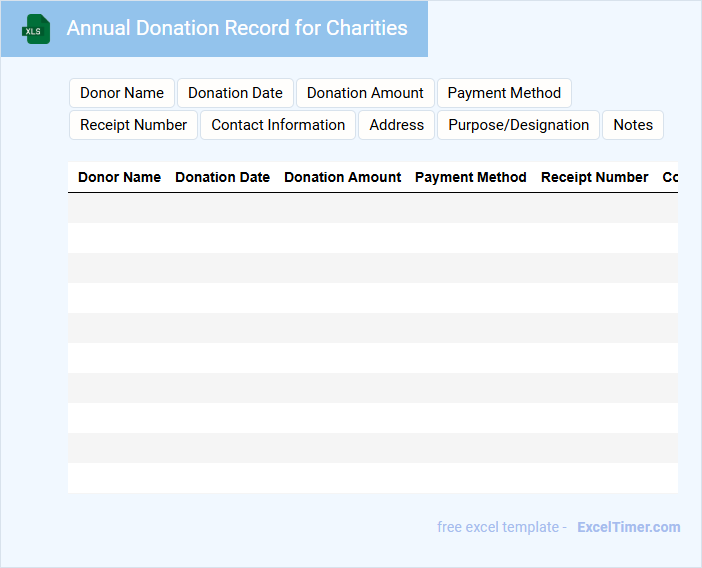

Annual Donation Record for Charities

The Annual Donation Record for charities is a document that summarizes the total contributions received throughout the year. It typically includes donor information, donation amounts, and dates, ensuring transparency and accountability.

This record is essential for both organizational reporting and donor tax purposes. An important consideration is maintaining accurate, up-to-date entries to facilitate audits and strengthen donor trust.

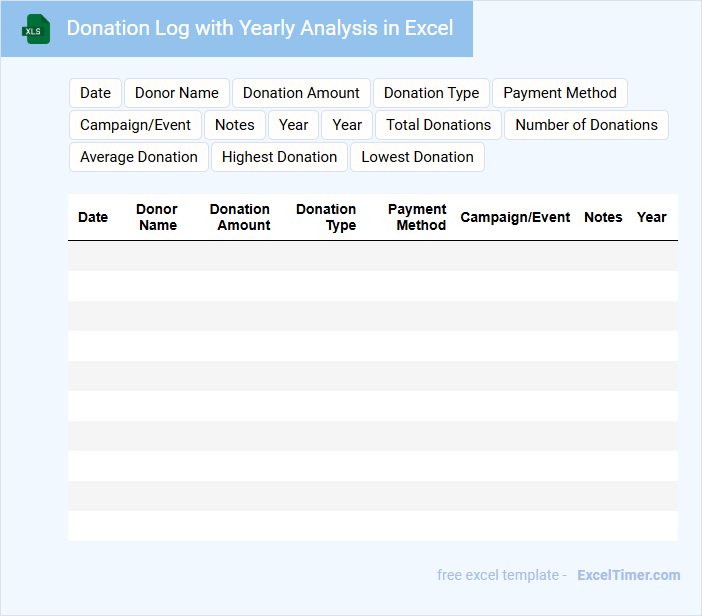

Donation Log with Yearly Analysis in Excel

A Donation Log in Excel is typically used to track individual contributions, including donor names, amounts, and dates. This document helps in organizing donation data systematically for easy reference and management.

The Yearly Analysis component summarizes donation trends over the year, highlighting patterns, growth, or decline in contributions. It assists organizations in making informed decisions for fundraising strategies.

Ensuring accurate data entry and regularly updating the log are crucial for maintaining reliable records and meaningful analysis.

Excel Sheet for Tracking Annual Charity Donations

An Excel sheet for tracking annual charity donations is typically used to record, organize, and analyze contribution data throughout the year.

- Donor Details: Include names, contact information, and donation frequency for accurate record keeping.

- Donation Amounts: Track the amount given per donation along with the date to monitor giving patterns.

- Summary Reports: Create summary tables and charts to visualize total donations and identify trends annually.

Report of Donors with Annual Gifts

What information is typically included in a Report of Donors with Annual Gifts? This document usually lists all contributors who have made donations within a specific fiscal year, including their names, gift amounts, and dates of contributions. It offers a comprehensive overview of fundraising efforts and donor engagement, helping organizations acknowledge support and analyze giving patterns.

What key elements should be emphasized in such a report? It is important to ensure accuracy in donor names and gift amounts, provide clear categorization of gift levels, and include personalized acknowledgments to foster donor appreciation and encourage future contributions. Transparent presentation and easy-to-read formatting also enhance the report's effectiveness.

Annual Fundraising Tracker for Nonprofit Organizations

An Annual Fundraising Tracker is a crucial document for nonprofit organizations that records and monitors the donations and fundraising activities throughout the year. It helps in maintaining transparency and accountability while assessing the overall fundraising performance.

Typically, this document contains donor details, donation amounts, fundraising campaign timelines, and goal progress. Including a summary of key metrics and donor engagement strategies is an important aspect for effective future planning.

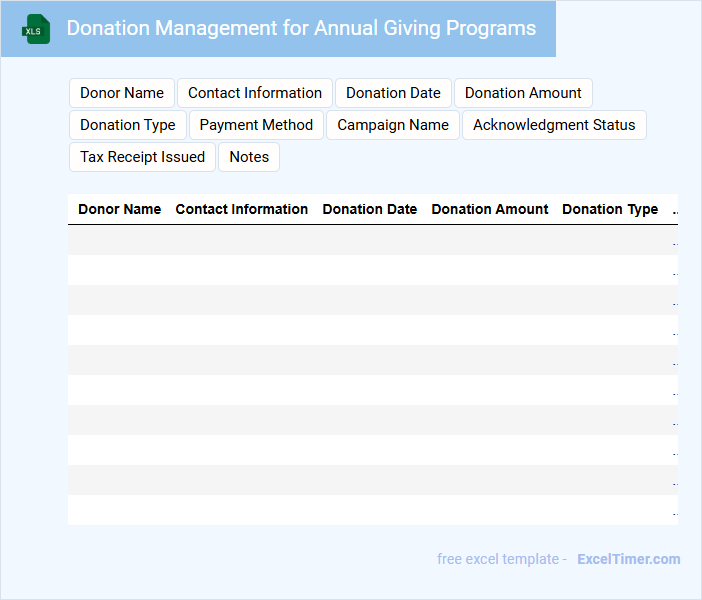

Donation Management for Annual Giving Programs

Donation Management documents typically include detailed information about donor records and contribution tracking. They ensure accurate accounting and reporting of all financial donations received during the annual giving cycle.

For Annual Giving Programs, it is crucial to highlight donor engagement strategies that encourage recurring gifts and long-term support. Clear guidelines for acknowledgment and stewardship practices should also be emphasized.

Maintaining transparency and regularly updating donors on the impact of their contributions fosters trust and sustained giving.

Yearly Donation Tracker with Source Breakdown

A Yearly Donation Tracker is a document used to monitor and record all donations received throughout the year. It helps organizations maintain a clear and organized log of contributions by date and amount.

Additionally, the Source Breakdown provides insights into where donations originate, such as individual donors, corporate sponsors, or fundraising events. This allows for targeted fundraising strategies and better resource allocation.

Including detailed donor information and regularly updating the tracker ensures accuracy and enhances donor relationship management.

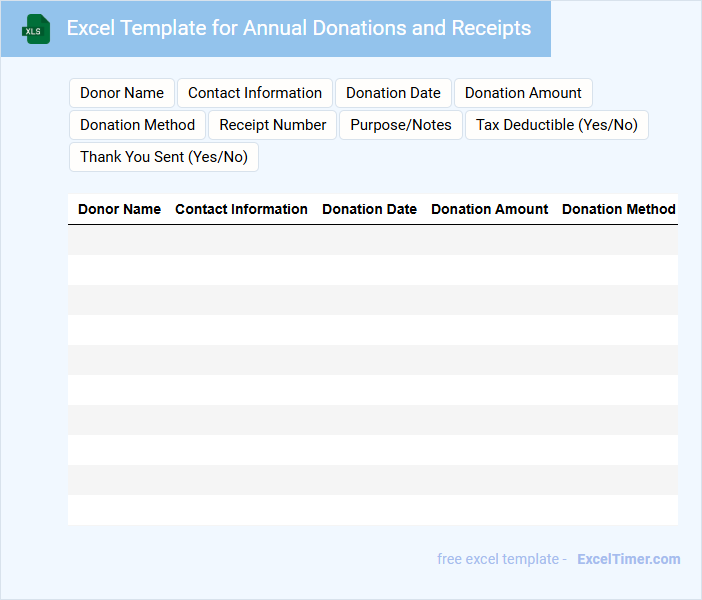

Excel Template for Annual Donations and Receipts

What information is typically included in an Excel template for annual donations and receipts? This type of document usually contains details such as donor names, donation amounts, dates of donations, and receipt numbers. It is designed to help organizations track contributions efficiently and generate accurate donation receipts for tax or accounting purposes.

What important features should be included in this template? Key elements include clear categorization of donations by date or campaign, automated calculations of total donations, and a section for generating printable, compliant receipts. Ensuring easy data entry and retrieval will optimize record keeping and donor management.

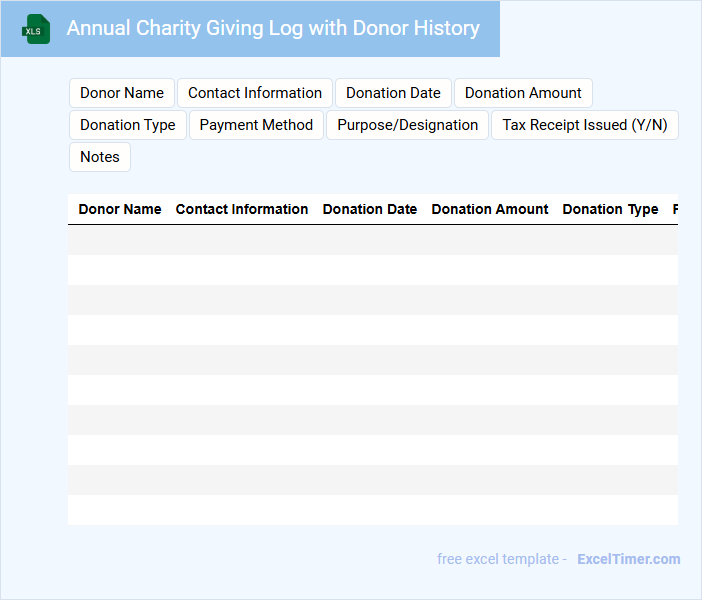

Annual Charity Giving Log with Donor History

The Annual Charity Giving Log typically contains detailed records of donations made throughout the year, including amounts, dates, and donor information. It serves as an essential tool for tracking the history of contributions and managing donor relationships. Keeping an accurate log helps organizations maintain transparency and plan future fundraising efforts effectively.

What key donor information should be included in the Annually Donation Tracker for accurate records?

Your Annually Donation Tracker should include key donor information such as full name, contact details, donation amount, date of donation, and payment method for accurate records. Including donor categories and donation frequency helps analyze giving patterns. Tracking matching gifts and notes on donor preferences enhances personalized engagement and reporting.

How can the tracker categorize donation types (e.g., cash, in-kind, online) for annual reporting?

Your Annually Donation Tracker categorizes donation types by using dedicated columns for cash, in-kind, and online contributions. Each entry is labeled with its donation type, allowing easy filtering and sorting for accurate annual reporting. This structured approach ensures clear insight into donation sources and trends year over year.

Which Excel features can help automate yearly summaries and donation totals for each donor?

Excel features like PivotTables can efficiently summarize annual donation data by donor, providing automated yearly totals. Using SUMIFS formulas allows precise calculation of donations filtered by donor and year. Conditional Formatting highlights key donation trends or thresholds, enhancing data analysis visually.

What methods can ensure data privacy and security within the donation tracking document?

Implementing password protection and encryption within the Excel document ensures that only authorized users can access sensitive donor information. Utilizing Excel's data validation and restricted editing features prevents unauthorized modifications to the donation records. Regularly backing up the donation tracker file to secure cloud storage platforms safeguards data integrity and recovery in case of accidental loss or breaches.

How can the tracker highlight recurring donors and flag missed or overdue contributions annually?

An Annually Donation Tracker in Excel can highlight recurring donors by using conditional formatting to identify consistent yearly contributions based on donor IDs and previous donation dates. It can flag missed or overdue donations with formulas comparing the current year to the last donation year, automatically marking entries that lack donations for the current cycle. Implementing these functions helps charities efficiently monitor donor commitment and manage follow-up tasks for late or missed contributions.