The Annually Financial Statement Excel Template for Nonprofits is designed to streamline financial reporting, ensuring accuracy and clarity in tracking income, expenses, and grants. It supports compliance with regulatory requirements and enhances transparency for stakeholders. Key features include customizable categories, automated calculations, and easy-to-understand summaries tailored specifically for nonprofit organizations.

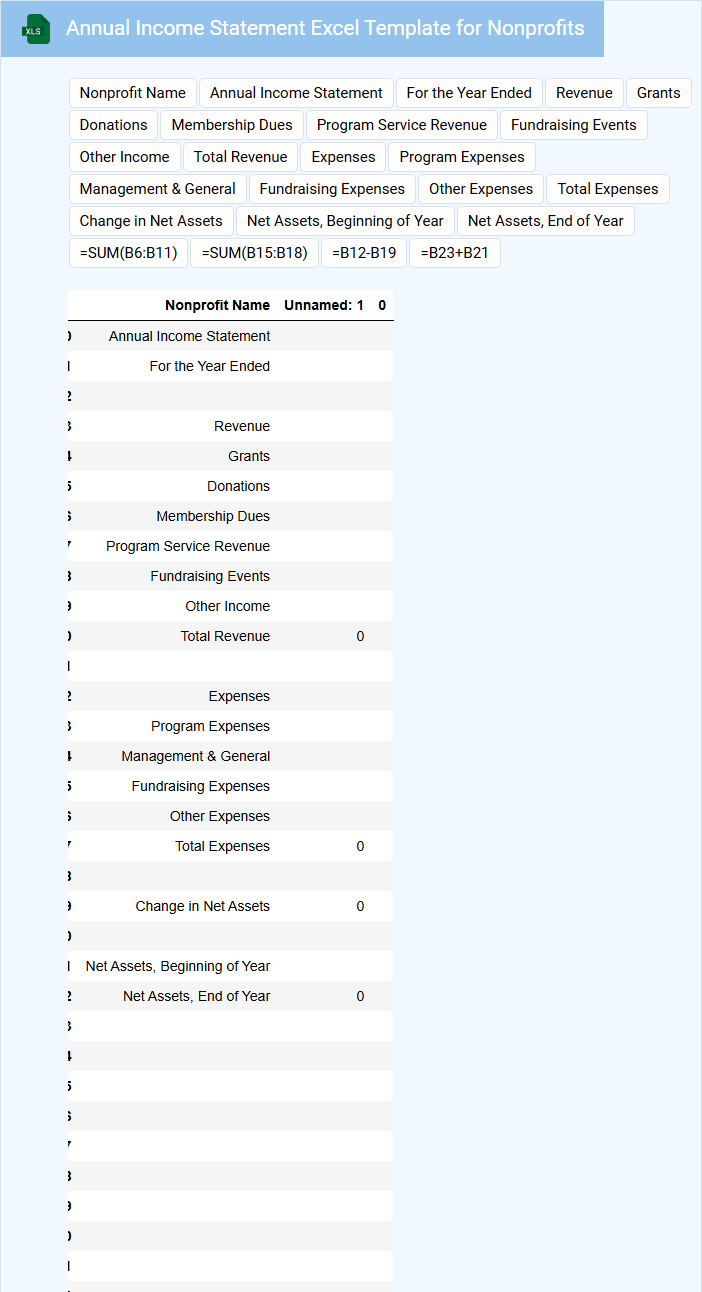

Annual Income Statement Excel Template for Nonprofits

An Annual Income Statement Excel template for nonprofits summarizes the organization's financial performance over a fiscal year, detailing revenues, expenses, and net income. It provides a clear overview of the financial health, helping stakeholders make informed decisions.

Typically, this document contains sections for donations, grants, program expenses, and administrative costs, allowing for transparent tracking of funds. For accuracy, ensure all income and expenses are categorized consistently and updated regularly.

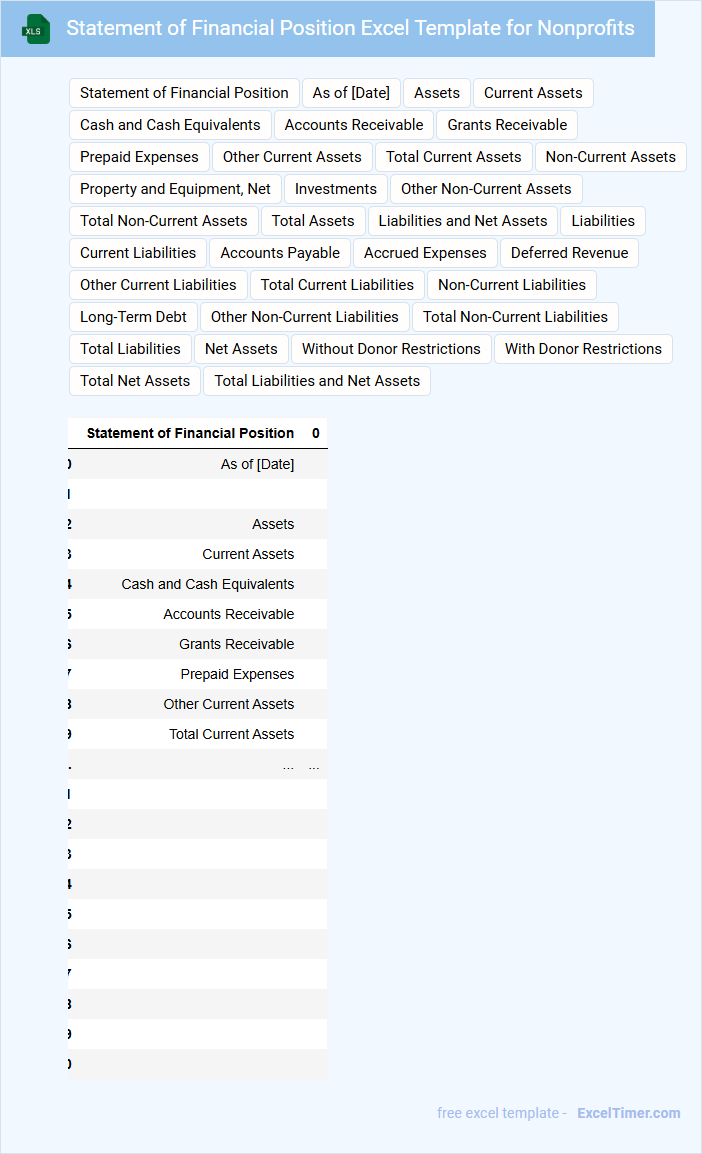

Statement of Financial Position Excel Template for Nonprofits

The Statement of Financial Position Excel Template for nonprofits typically contains details about assets, liabilities, and net assets, providing a snapshot of the organization's financial health. It is designed to help track the value of resources and obligations at a specific point in time.

Important features to include are clearly labeled categories for current and long-term assets and liabilities, as well as equity sections tailored for nonprofit accounting standards. Accurate and up-to-date data entry is crucial for generating reliable financial reports.

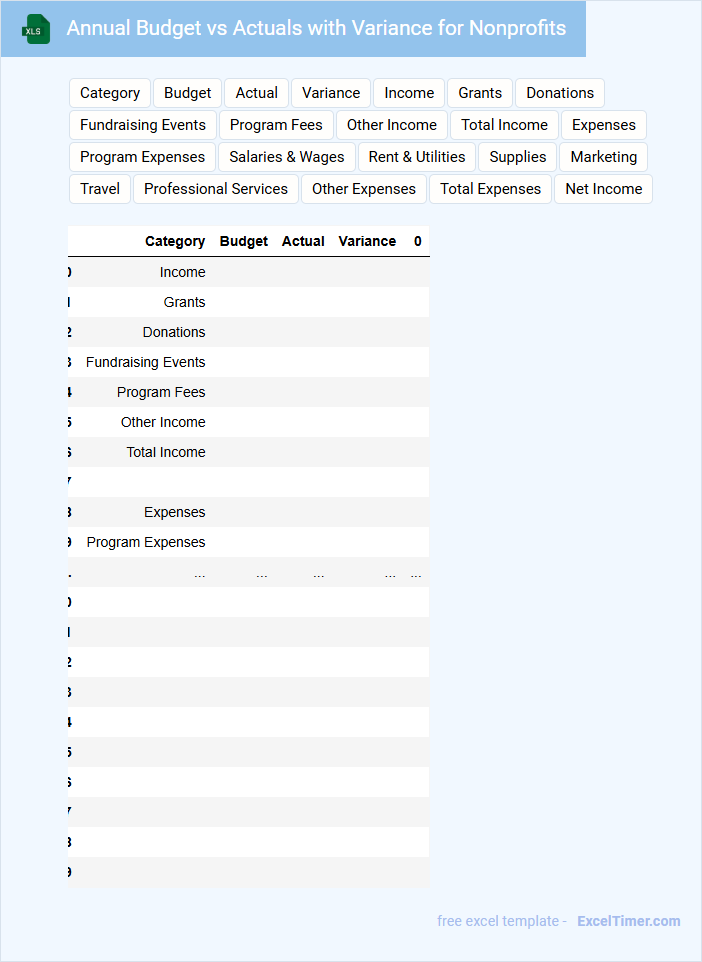

Annual Budget vs Actuals with Variance for Nonprofits

An Annual Budget vs Actuals with Variance document for nonprofits typically contains detailed comparisons between projected financial plans and actual expenditures and revenues. This helps organizations assess their financial performance and identify discrepancies throughout the fiscal year.

- Include clear line items for revenues, expenses, and the resulting variances to pinpoint overspending or underspending.

- Highlight key funding sources and restricted versus unrestricted funds to comply with nonprofit reporting standards.

- Use variance analysis to inform strategic adjustments and improve future budgeting accuracy.

Fund Balance Report for Nonprofit Organizations

What information is typically included in a Fund Balance Report for Nonprofit Organizations? This report usually contains detailed records of the organization's fund balances, categorized by restricted, unrestricted, and temporarily restricted funds. It provides insight into the financial health and resource availability, helping stakeholders understand how funds are allocated and used.

What is an important consideration when preparing a Fund Balance Report for Nonprofit Organizations? It is crucial to ensure accuracy in fund classification and transparency in reporting to maintain trust with donors and comply with accounting standards. Clear explanations of any restrictions or designations on funds help in communicating effectively with board members and external auditors.

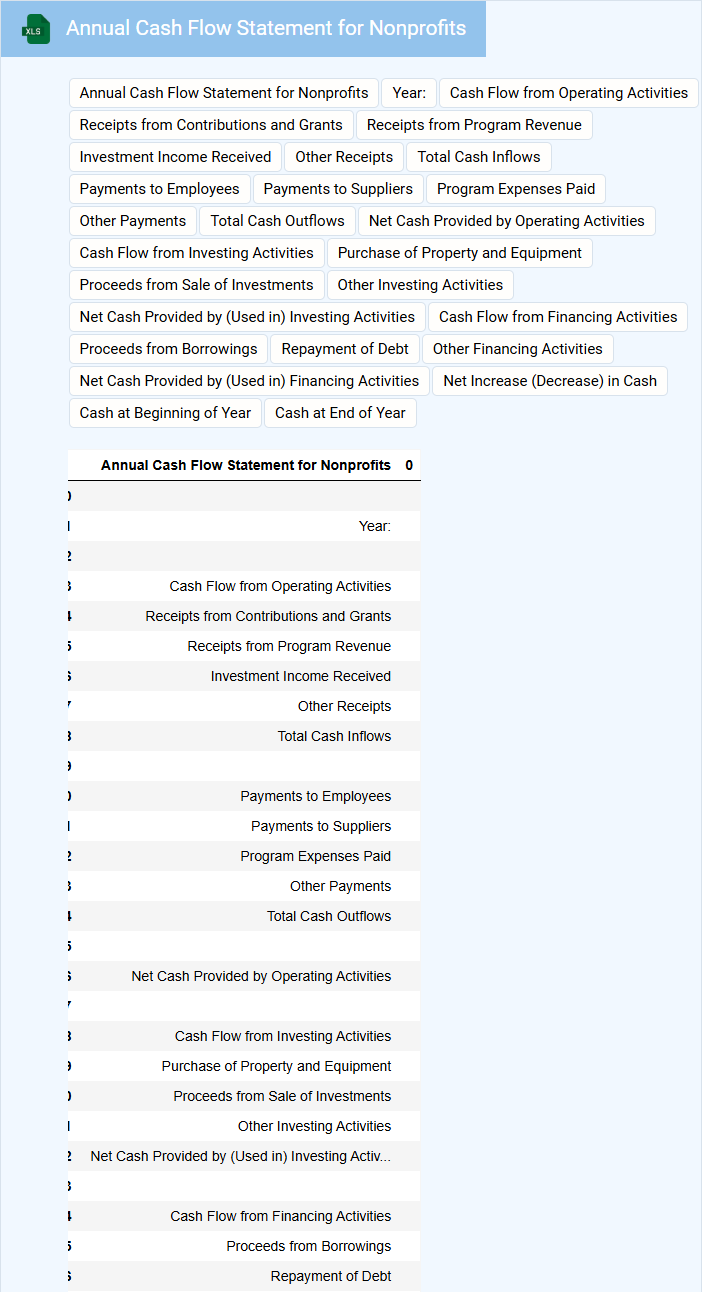

Annual Cash Flow Statement for Nonprofits

The Annual Cash Flow Statement for nonprofits provides a detailed report of cash inflows and outflows over the fiscal year, highlighting how funds are generated and utilized. It helps organizations assess liquidity and ensure they have sufficient cash to support their mission and operations.

Typically, this document includes cash received from donations, grants, program services, and cash spent on operating expenses, programs, and capital expenditures. Key suggestions for preparation include accurately categorizing cash activities and regularly reconciling accounts to maintain transparency and financial health.

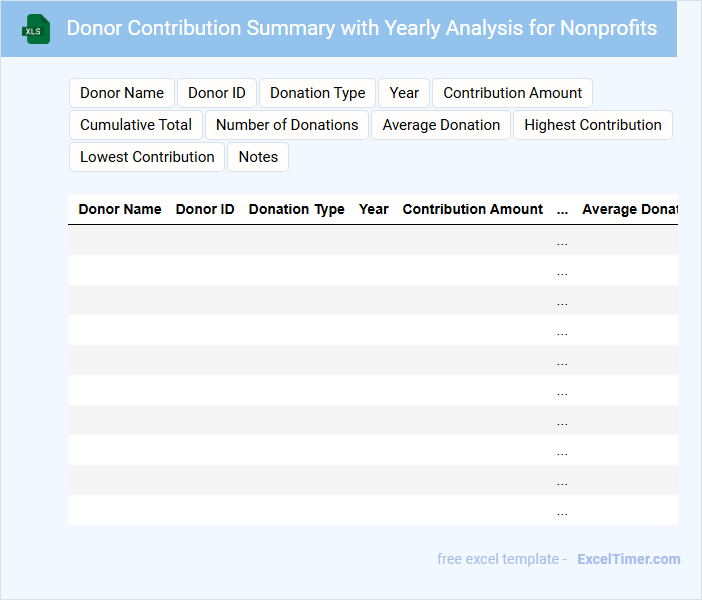

Donor Contribution Summary with Yearly Analysis for Nonprofits

A Donor Contribution Summary with Yearly Analysis for Nonprofits typically contains detailed records of donations, donor demographics, and financial trends over specified years.

- Donation Records: Comprehensive data on individual and corporate contributions including amounts and dates.

- Donor Demographics: Information about donor age, location, and giving frequency to identify key supporter groups.

- Financial Trends: Year-over-year analysis highlighting increases, decreases, and patterns in donation behavior.

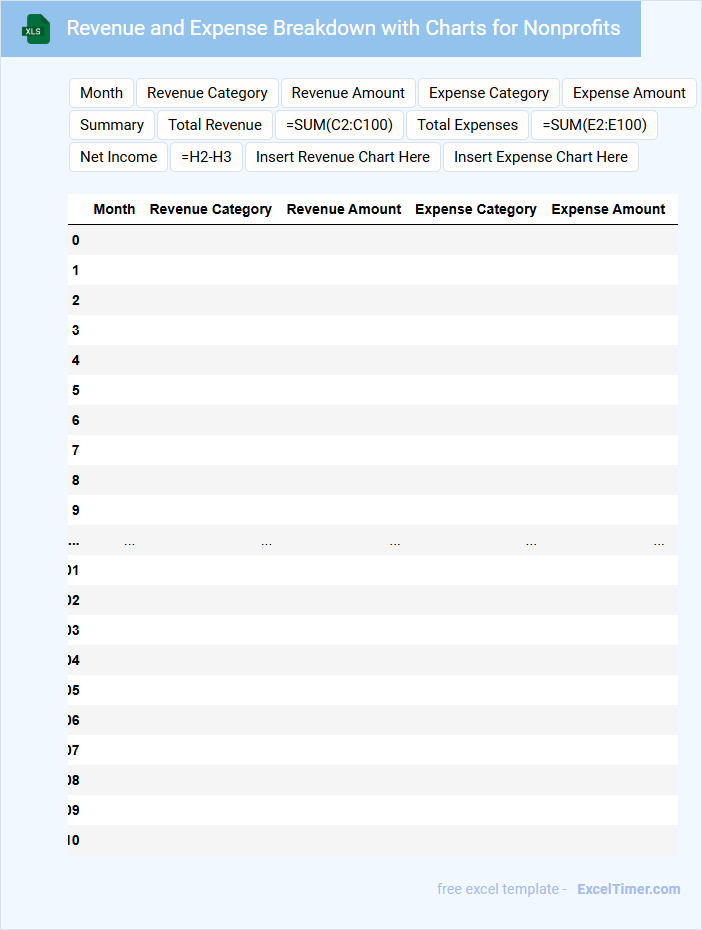

Revenue and Expense Breakdown with Charts for Nonprofits

What does a Revenue and Expense Breakdown document for nonprofits typically contain? This document usually includes detailed listings of income sources and expenditures, accompanied by visual charts to illustrate the financial distribution clearly. It helps stakeholders understand where funds are generated and how they are allocated, ensuring transparency and accountability.

Why is it important to include charts in this document? Charts such as pie charts or bar graphs provide a quick visual summary that highlights key financial trends and balances. Including them improves comprehension and supports effective decision-making by board members and donors.

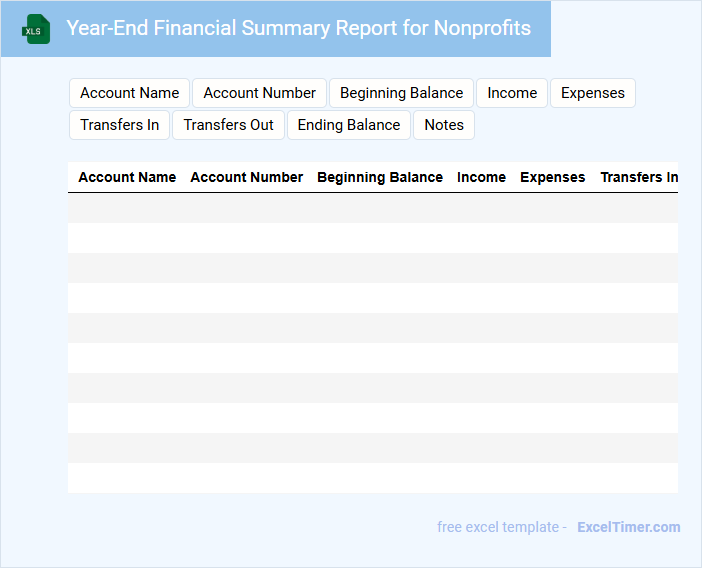

Year-End Financial Summary Report for Nonprofits

A Year-End Financial Summary Report for Nonprofits typically contains a comprehensive overview of the organization's financial performance and position over the past year.

- Income and expenses: Detailed breakdown of revenue sources and expenditure categories to assess financial health.

- Compliance and transparency: Clear documentation to ensure accountability and adherence to regulatory requirements.

- Future budgeting insights: Analysis to guide strategic planning and resource allocation for the upcoming year.

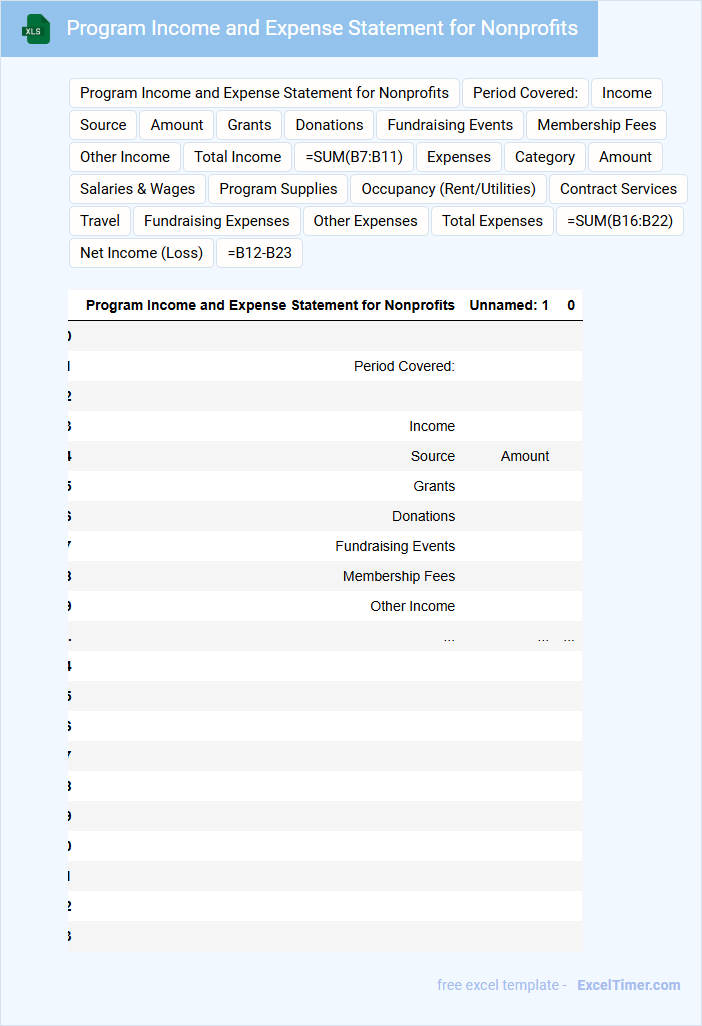

Program Income and Expense Statement for Nonprofits

The Program Income and Expense Statement for nonprofits provides a detailed overview of the financial activities related to specific programs. It typically includes income generated from program services and expenses incurred to operate those programs. This document is essential for tracking the financial performance and ensuring accountability to stakeholders.

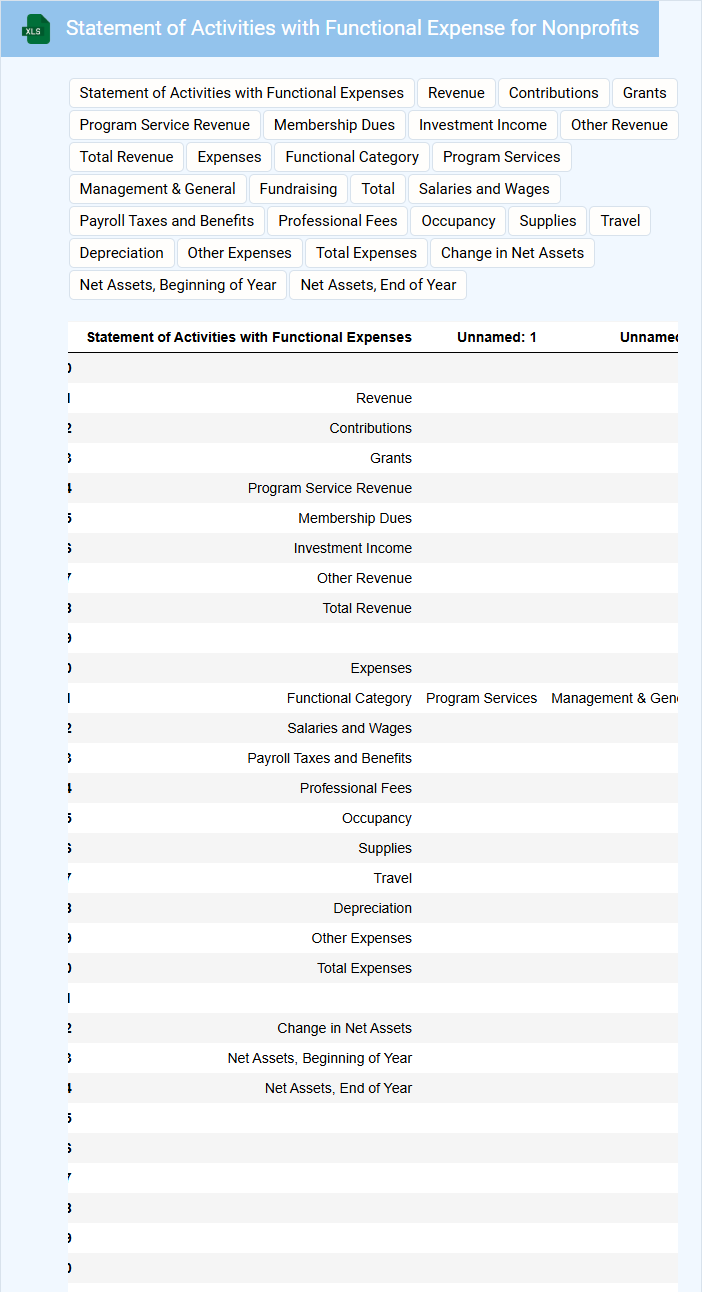

Statement of Activities with Functional Expense for Nonprofits

A Statement of Activities with Functional Expense for Nonprofits is a financial report that details the organization's income, expenses, and how funds are allocated across various functional categories.

- Revenue Breakdown: Clearly categorize all sources of income such as donations, grants, and program fees.

- Expense Allocation: Separate expenses into program services, management, and fundraising for transparency.

- Functional Reporting: Ensure expenses are reported by function to demonstrate effective resource use in fulfilling the mission.

Restricted vs Unrestricted Funds Tracking for Nonprofits

This document typically contains guidelines and methodologies for accurately tracking Restricted vs Unrestricted Funds in nonprofit organizations.

- Restricted Funds: must be used only for specific purposes as dictated by donors or grantors.

- Unrestricted Funds: provide flexible use, supporting general operations and strategic initiatives.

- Accurate Reporting: is crucial to maintain transparency, donor trust, and regulatory compliance.

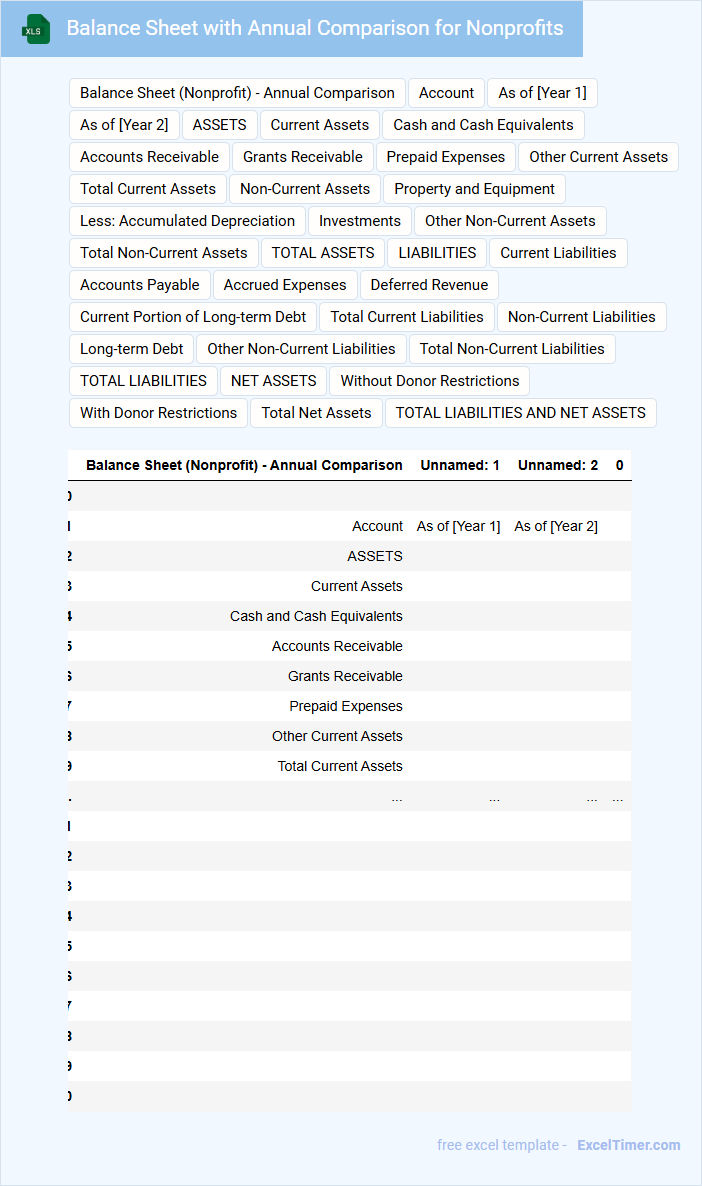

Balance Sheet with Annual Comparison for Nonprofits

A Balance Sheet with Annual Comparison for Nonprofits provides a snapshot of an organization's financial position at a specific point in time, showing assets, liabilities, and net assets. It highlights changes between fiscal years to help track financial health and trends over time.

Key elements often include current and long-term assets, liabilities, and unrestricted, temporarily restricted, and permanently restricted net assets. Ensuring accuracy and consistency in categorizing these elements is crucial for meaningful analysis and donor transparency.

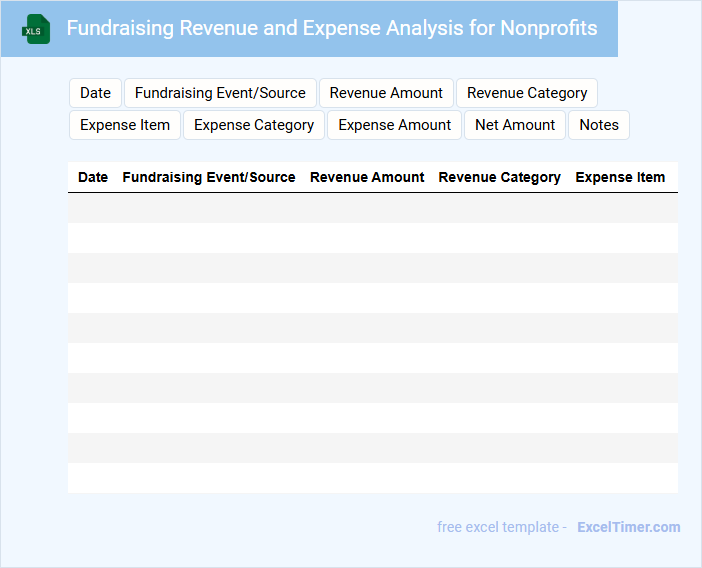

Fundraising Revenue and Expense Analysis for Nonprofits

Fundraising Revenue and Expense Analysis for Nonprofits is a document that outlines the financial performance related to fundraising activities. It helps organizations assess the efficiency and impact of their fundraising efforts.

- Include a detailed breakdown of revenue sources by campaign or event.

- Clearly categorize all fundraising-related expenses to identify cost-effectiveness.

- Provide comparisons to previous periods to highlight trends and areas for improvement.

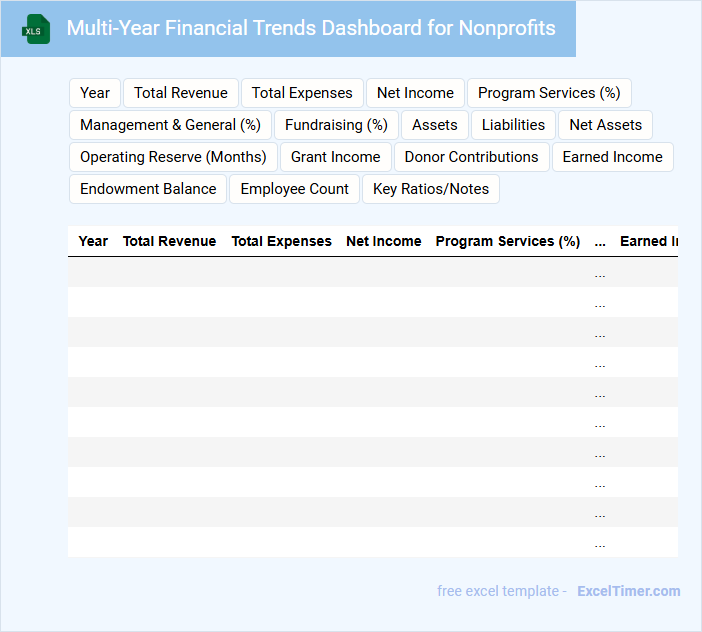

Multi-Year Financial Trends Dashboard for Nonprofits

A Multi-Year Financial Trends Dashboard for nonprofits typically contains comprehensive data visualizations that track revenue, expenses, and funding sources over multiple years. It provides insights into financial stability and growth patterns, supporting strategic planning and decision-making. Key components include comparative charts, trend lines, and year-over-year performance metrics.

It is important to regularly update the dashboard with accurate financial data to maintain reliability and relevance. Highlighting significant changes and anomalies helps stakeholders quickly identify opportunities and risks. Clear labeling and intuitive design enhance usability for diverse audiences, including board members, donors, and financial managers.

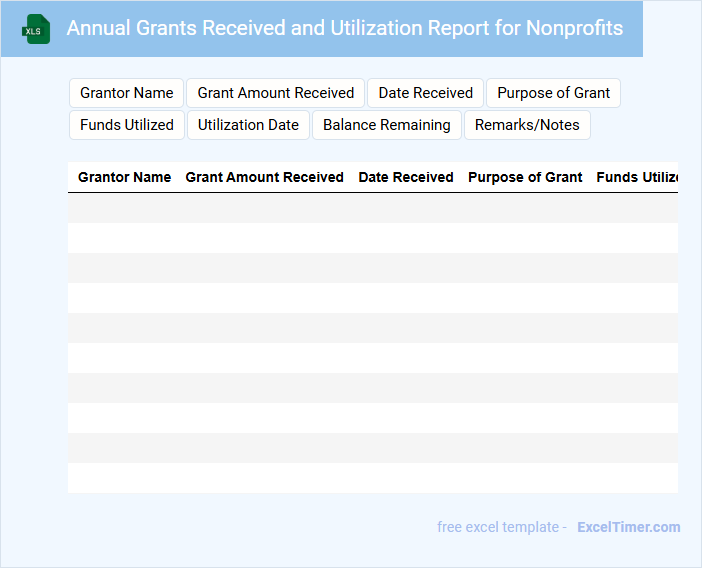

Annual Grants Received and Utilization Report for Nonprofits

An Annual Grants Received and Utilization Report for Nonprofits is a document that details the funds received from grants within the year and outlines how these funds were allocated and spent to support organizational goals. It ensures transparency and accountability to donors and stakeholders.

- Include a comprehensive summary of all grants received, specifying sources and amounts.

- Provide detailed accounts of expenditures linked to each grant to demonstrate proper utilization.

- Highlight outcomes and impacts achieved through the funded activities to validate grant effectiveness.

What key components must be included in an annual financial statement for nonprofits?

An annual financial statement for nonprofits must include the statement of financial position, statement of activities, and cash flow statement to offer a clear view of financial health. Your report should also feature notes to the financial statements that explain accounting policies and provide additional details. Accurate inclusion of these components ensures transparency and compliance with regulatory standards.

How does an annual financial statement support transparency and accountability for a nonprofit organization?

An annual financial statement provides a detailed summary of your nonprofit's financial activities, ensuring clear disclosure of income, expenses, and asset management. This transparency builds trust among donors, stakeholders, and regulatory bodies by validating responsible use of funds. Accurate financial reporting strengthens accountability and supports regulatory compliance, enhancing your organization's reputation and funding opportunities.

What are the primary differences between nonprofit and for-profit annual financial statements?

Nonprofit annual financial statements focus on fund accounting, emphasizing revenue restrictions and net assets without owners' equity, unlike for-profit statements centered on profitability and shareholder equity. Nonprofits report on functional expenses to demonstrate program versus administrative costs, while for-profits prioritize income statements and balance sheets reflecting profit margins. Financial transparency and donor restrictions are critical for nonprofits, shaping their statement structure distinctively from for-profit entities.

Why is the Statement of Activities crucial in a nonprofit's annual financial reporting?

The Statement of Activities provides a detailed summary of a nonprofit's revenues, expenses, and changes in net assets over the fiscal year. It is crucial for demonstrating financial accountability and transparency to donors, grantors, and regulatory agencies. This report helps stakeholders evaluate the organization's financial health and program effectiveness.

How do annual financial statements help nonprofits comply with donor and regulatory requirements?

Annual financial statements provide nonprofits with a transparent record of income, expenses, and asset management, ensuring accountability to donors and regulatory bodies. These statements enable accurate reporting for tax purposes and compliance with standards set by organizations like the IRS and the Financial Accounting Standards Board (FASB). Consistent financial documentation fosters donor trust and supports eligibility for grants and funding opportunities.