The Annually Tax Deduction Excel Template for Self-Employed simplifies tracking and organizing deductible expenses throughout the year, ensuring accurate tax filings. It provides an easy-to-use format for categorizing business expenses, income, and calculating total deductions to maximize tax savings. This template helps self-employed individuals stay compliant with tax regulations and avoid missing important deductions.

Annual Tax Deduction Tracker for Self-Employed

This document typically contains a detailed record of all deductible expenses and income related to self-employment throughout the fiscal year.

- Comprehensive Expense Tracking: Maintain detailed receipts and invoices to maximize deductible amounts.

- Accurate Income Reporting: Ensure all sources of self-employed income are meticulously documented.

- Regular Updates: Review and update the tracker monthly to avoid year-end rush and errors.

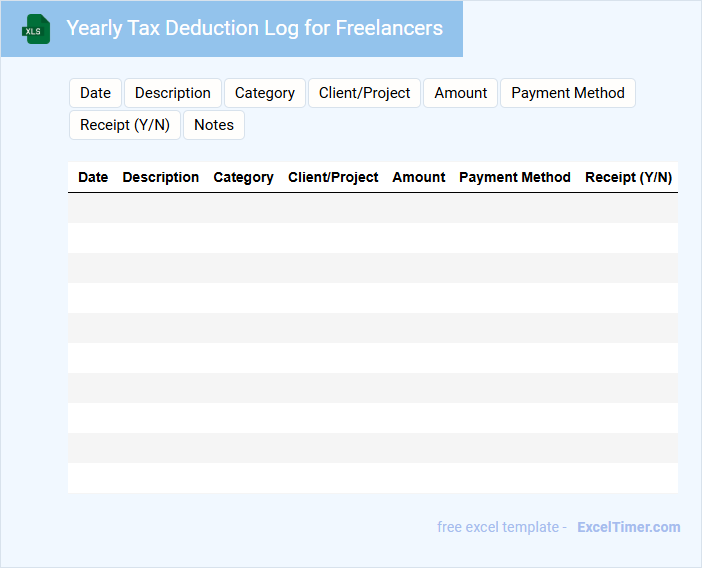

Yearly Tax Deduction Log for Freelancers

A Yearly Tax Deduction Log for freelancers is a detailed record of all taxable income and deductible expenses incurred throughout the fiscal year. It typically contains income statements, receipts for business expenses, and summaries of tax deductions claimed. Maintaining this document accurately ensures compliance with tax laws and simplifies the filing process.

Essential elements to include are date, description, amount of each transaction, and category of expense. It is important to regularly update the log to avoid missing deductible items and to keep digital copies of all supporting documents. Freelancers should also consult tax regulations to maximize deductions and minimize liabilities effectively.

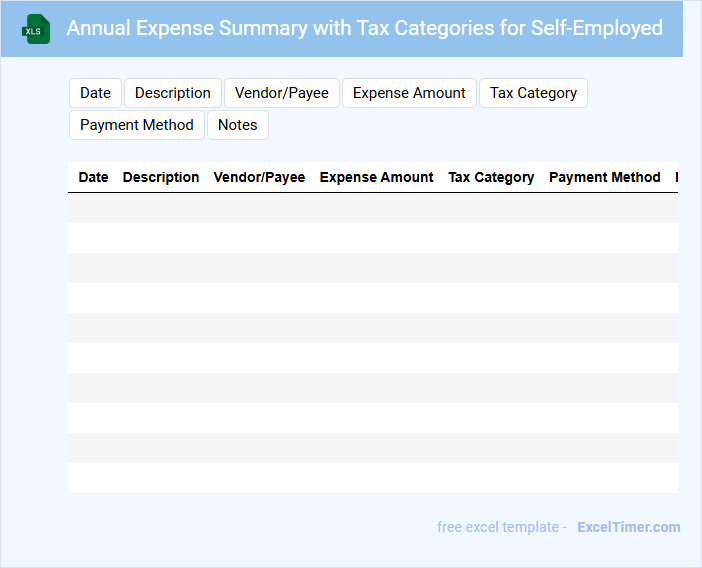

Annual Expense Summary with Tax Categories for Self-Employed

An Annual Expense Summary for self-employed individuals typically includes a detailed list of all business-related costs incurred throughout the fiscal year, categorized by tax deductions and credits. This document is essential for accurate tax reporting and financial planning.

It is important to organize expenses by tax categories such as office supplies, travel, and home office costs to maximize deductions. Keeping thorough records and receipts supports compliance and simplifies tax filing.

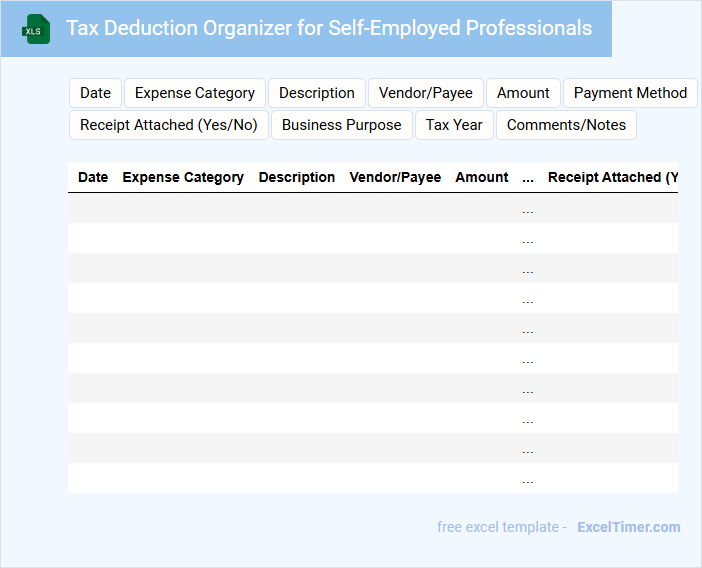

Tax Deduction Organizer for Self-Employed Professionals

A Tax Deduction Organizer for Self-Employed Professionals is a document designed to help track and categorize expenses for tax purposes. It simplifies the process of identifying deductible items to maximize tax savings.

- List all business-related expenses such as office supplies, travel, and software subscriptions.

- Include detailed records of income and receipts to support deductions claimed.

- Maintain accurate mileage and home office usage logs for additional deductions.

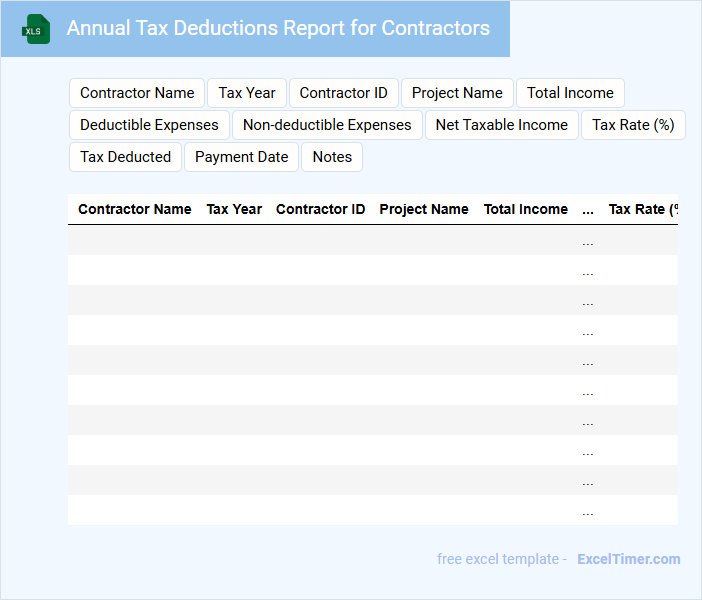

Annual Tax Deductions Report for Contractors

The Annual Tax Deductions Report for Contractors typically contains a comprehensive summary of all deductible expenses and withheld taxes related to a contractor's income over the fiscal year. It includes detailed records of payments made, tax withheld, and relevant financial transactions that impact taxable income. Ensuring accuracy and completeness is crucial for both tax reporting and audit purposes.

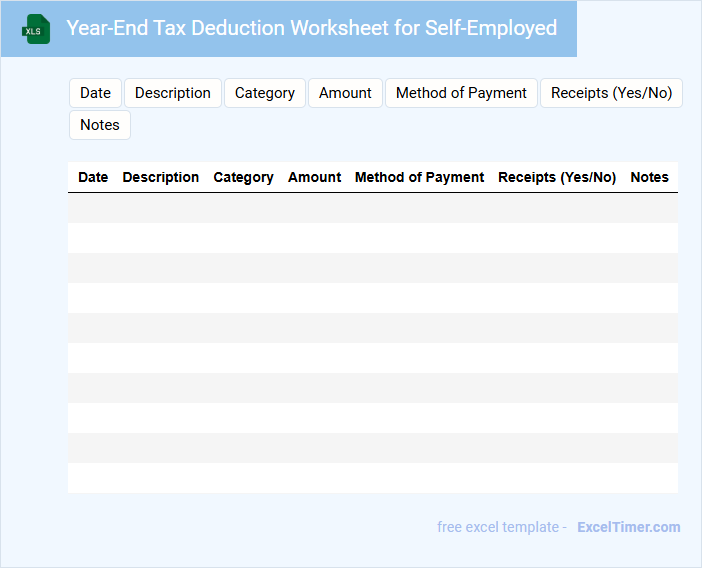

Year-End Tax Deduction Worksheet for Self-Employed

What information is typically included in a Year-End Tax Deduction Worksheet for the Self-Employed? This document usually contains details of income, business expenses, and possible deductions that can reduce taxable income. It helps self-employed individuals accurately report their finances and maximize their tax benefits by organizing receipts, invoices, and relevant tax codes.

What is an important consideration when using this worksheet? It is crucial to keep thorough and accurate records throughout the year to ensure all deductible expenses are captured. Consulting with a tax professional can also help identify all eligible deductions and avoid errors when filing.

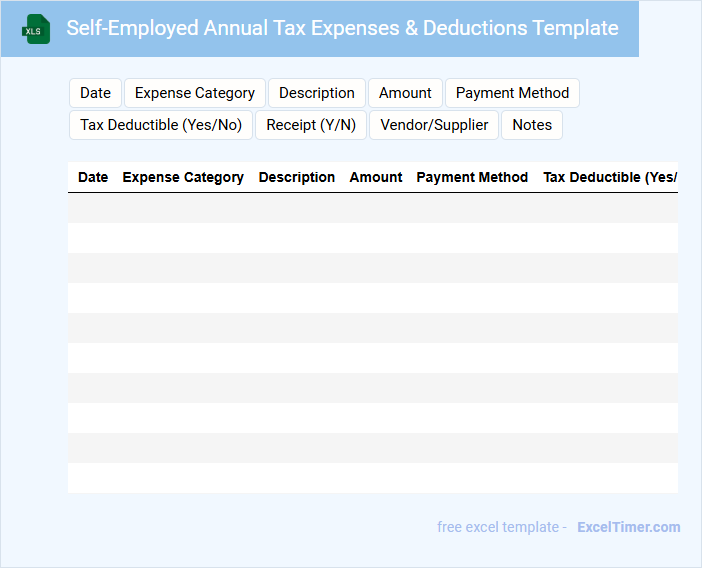

Self-Employed Annual Tax Expenses & Deductions Template

The Self-Employed Annual Tax Expenses & Deductions Template is designed to help freelancers and independent contractors systematically track their yearly business-related expenses and possible tax deductions. Typically, this document contains categorized expense entries such as office supplies, travel costs, and business meals. It is crucial for accurate record-keeping to maximize tax savings and ensure compliance with tax regulations.

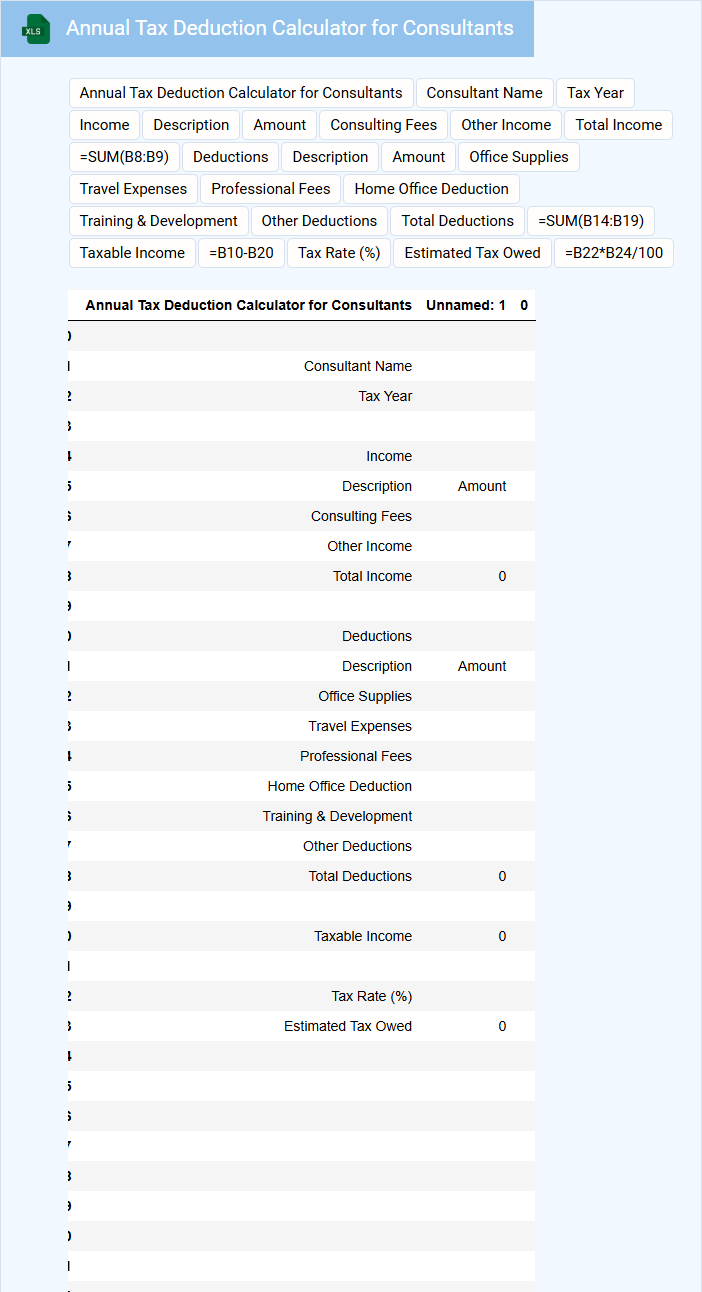

Annual Tax Deduction Calculator for Consultants

An Annual Tax Deduction Calculator for consultants typically contains a detailed breakdown of income, allowable expenses, and applicable tax rates to estimate yearly tax liabilities. It often includes sections for inputting consulting fees, business expenses, and potential deductions such as travel and equipment costs. This tool helps consultants optimize their tax planning by providing an accurate and comprehensive overview of deductible amounts.

Yearly Tax Deduction Record with Income for Self-Employed

The Yearly Tax Deduction Record for self-employed individuals summarizes all deductible expenses and payments made throughout the tax year. It provides a comprehensive overview of the income that will be subject to taxation, helping in accurate tax reporting.

Documenting every source of income and keeping receipts for deductible expenses are crucial for this record. It's important to regularly update this document to avoid discrepancies and ensure compliance with tax regulations.

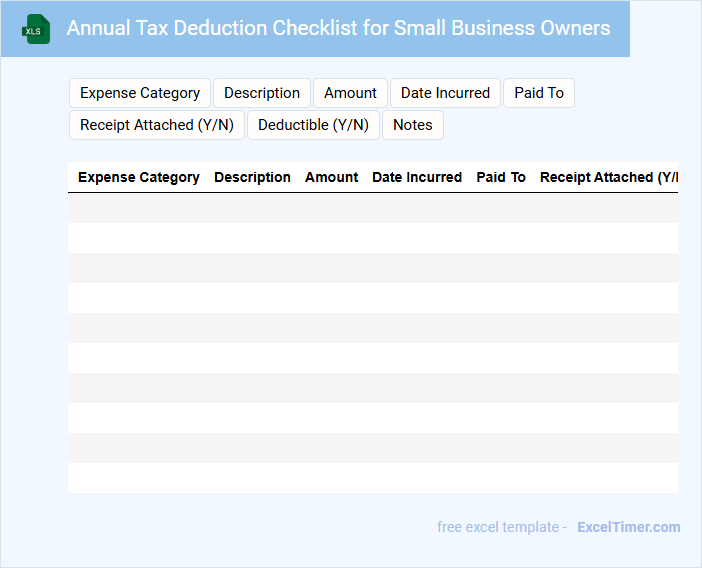

Annual Tax Deduction Checklist for Small Business Owners

The Annual Tax Deduction Checklist for small business owners typically contains a comprehensive list of deductible expenses throughout the fiscal year. It helps in organizing financial records and ensuring compliance with tax regulations.

This document also emphasizes important categories such as office supplies, travel expenses, and employee wages. Keeping accurate receipts and detailed logs is crucial for maximizing deductions and avoiding audits.

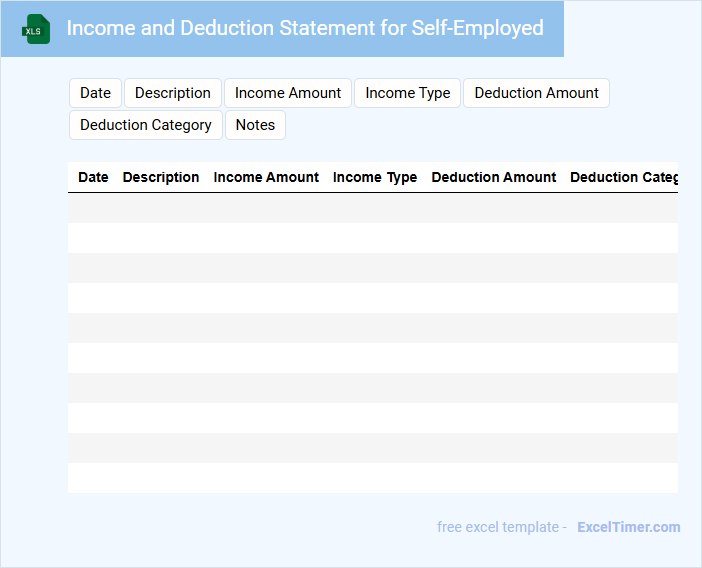

Income and Deduction Statement for Self-Employed

An Income and Deduction Statement for Self-Employed individuals typically outlines earnings and allowable expenses to determine taxable income.

- Income details: Clearly list all sources of self-employment income to ensure accurate reporting.

- Deductible expenses: Include legitimate business costs such as office supplies, travel, and utilities to reduce taxable income.

- Record accuracy: Maintain precise and organized documentation for each income and deduction entry for compliance and audit purposes.

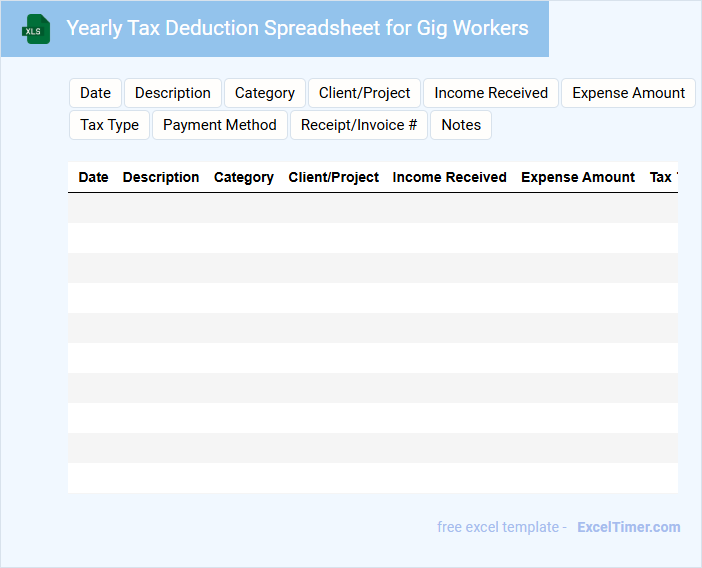

Yearly Tax Deduction Spreadsheet for Gig Workers

What information is typically included in a Yearly Tax Deduction Spreadsheet for Gig Workers? This document usually contains detailed records of all income earned from various gig jobs throughout the year, alongside categorized expenses that can be claimed as tax deductions. It helps gig workers accurately calculate their taxable income and ensure they maximize deductible expenses.

Why is maintaining this spreadsheet important for gig workers? Keeping an organized, up-to-date tax deduction spreadsheet is essential to avoid missed deductions and potential tax penalties. It also simplifies tax filing by providing a clear overview of earnings and expenses in one place.

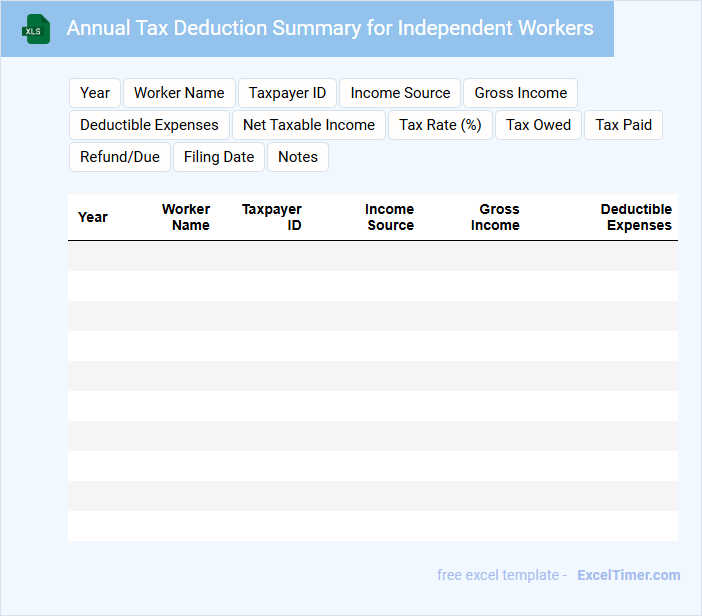

Annual Tax Deduction Summary for Independent Workers

The Annual Tax Deduction Summary for independent workers typically contains detailed records of income earned and taxes withheld throughout the fiscal year. It includes essential information such as deductible expenses, tax credits, and relevant tax identification numbers. This document is crucial for accurate tax filing and financial planning.

Self-Employed Expense Tracker with Tax Deduction Categories

What information does a Self-Employed Expense Tracker with Tax Deduction Categories typically contain? This document usually includes detailed records of all business-related expenses categorized by types to maximize tax deductions. It helps self-employed individuals monitor their spending and organize expenses for easier tax filing.

What is an important consideration when using this type of tracker? Ensuring that expenses are accurately categorized according to current tax laws is crucial for maximizing deductions and avoiding audit issues. Regularly updating the tracker with receipts and invoices helps maintain accurate financial records.

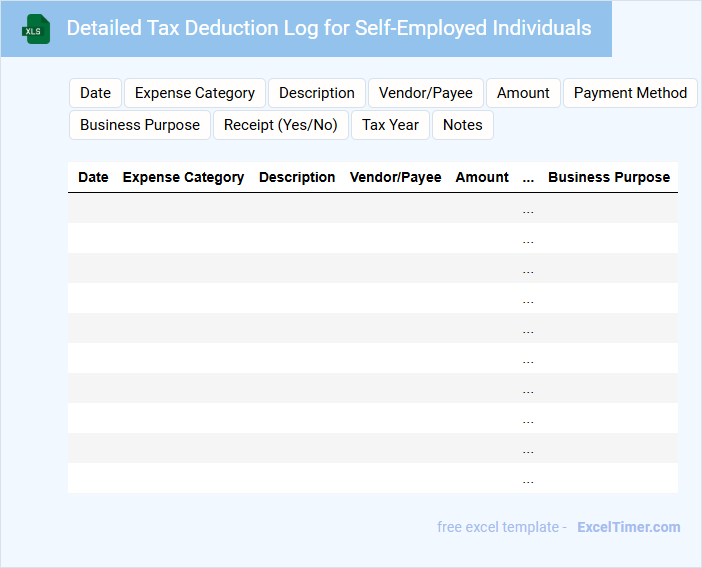

Detailed Tax Deduction Log for Self-Employed Individuals

A Detailed Tax Deduction Log for self-employed individuals is a comprehensive record of all expenses that can be claimed to reduce taxable income. It includes receipts, invoices, and documentation related to business expenditures such as office supplies, travel, and utilities. Proper maintenance ensures accurate tax filing and maximizes allowable deductions.

Keeping a detailed log helps track deductible costs clearly and supports claims during audits. Consistency and accuracy in recording entries are essential for meeting IRS or tax authority requirements. It is important to regularly update the log and categorize expenses precisely.

What are the allowable annual tax deductions specific to self-employed individuals in Excel documentation?

Your allowable annual tax deductions for self-employed individuals include business expenses such as office supplies, equipment, home office costs, and travel expenses. The Excel document outlines categories like health insurance premiums, retirement plan contributions, and self-employment tax deductions. These entries help maximize your taxable income reduction accurately.

How should self-employed income and expenses be categorized for accurate annual tax deduction tracking in Excel?

Self-employed income should be categorized distinctly by revenue streams such as service sales, product sales, and other earnings to ensure precise annual tax deduction tracking in Excel. Expenses must be itemized into categories like office supplies, travel costs, equipment purchases, and subcontractor fees to accurately reflect deductible amounts. Organizing income and expenses with clear labels and date-stamped entries improves accuracy and simplifies tax reporting for self-employed individuals.

Which Excel formulas can optimize the calculation of self-employed annual tax deductions?

To optimize the calculation of your annual tax deductions for self-employed income in Excel, use the SUMIF formula to total deductible expenses based on categories. Incorporate IF and VLOOKUP functions to apply specific tax rates and deduction limits efficiently. Combining these formulas automates accurate and streamlined tax deduction calculations.

What are the best practices for documenting receipts and deductible expenses for taxes in an Excel spreadsheet?

Organize receipts and deductible expenses by date, category, and amount in separate columns for clarity and easy tracking. Use consistent labeling and include notes for each entry to detail the nature of the expense, ensuring accurate tax deduction claims. Regularly update the spreadsheet and reconcile entries with bank statements to maintain accurate, audit-ready records.

How can s be customized to comply with tax authority requirements for annual deductions?

Excel templates for annual tax deductions can be customized by incorporating specific formulas that align with the tax authority's deduction limits and categories. Users can embed dropdown menus and validation rules to ensure data input meets regulatory criteria, such as allowable expense types and deduction caps. Customizing templates with automated summary reports helps self-employed individuals accurately calculate and document their deductible expenses for tax filings.