![]()

The Annually Investment Tracker Excel Template for Stock Portfolios is designed to help investors efficiently monitor yearly performance and manage stock holdings. It provides clear visualization of gains, losses, dividends, and portfolio diversification, enabling better financial decisions. Customizable fields and automated calculations reduce errors and save time in tracking investments throughout the fiscal year.

Annually Investment Tracker Excel Template for Stock Portfolios

An Annually Investment Tracker Excel Template for Stock Portfolios is a structured document designed to monitor and analyze yearly stock investments. It helps investors keep track of performance, dividends, and portfolio changes over the fiscal year.

- Include detailed columns for purchase dates, quantities, prices, and current values for clear record-keeping.

- Incorporate visual charts to quickly assess portfolio growth and individual stock contributions.

- Use formulas to automatically calculate gains, losses, and dividend yields for accurate performance metrics.

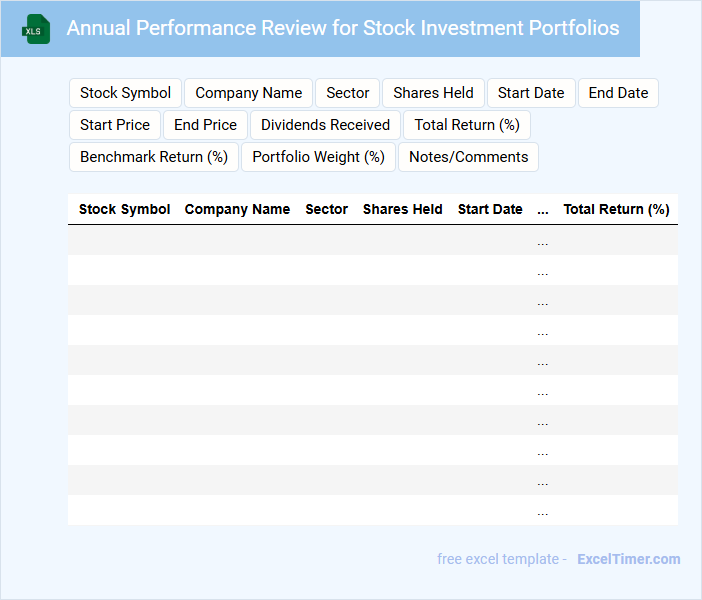

Annual Performance Review for Stock Investment Portfolios

What information does an Annual Performance Review for Stock Investment Portfolios typically contain? This type of document usually includes a comprehensive summary of the portfolio's returns over the past year, comparing them to relevant benchmarks and market indices. It also analyzes asset allocation, risk levels, and significant market events that impacted performance to provide investors with a clear understanding of their investment outcomes.

What are important considerations when preparing this review? It is essential to include clear metrics on portfolio growth, dividend income, and capital gains, along with visual aids like charts and graphs for easier interpretation. Additionally, offering forward-looking insights and recommendations based on current market trends helps investors make informed decisions for future investment strategies.

Yearly Stock Portfolio Analysis with Tracking Tools

What information is typically contained in a Yearly Stock Portfolio Analysis with Tracking Tools document? This document usually includes detailed summaries of stock performance, annual returns, and risk assessments to provide a comprehensive overview of investment outcomes. It also features tracking tools such as charts and metrics that help investors monitor portfolio progress and make informed decisions for future allocations.

What is an important aspect to consider when preparing this type of document? Ensuring data accuracy and incorporating clear visualizations is crucial, as they enhance understanding and allow for effective comparison over time. Additionally, including actionable insights and recommendations based on the analysis helps maximize portfolio growth and risk management.

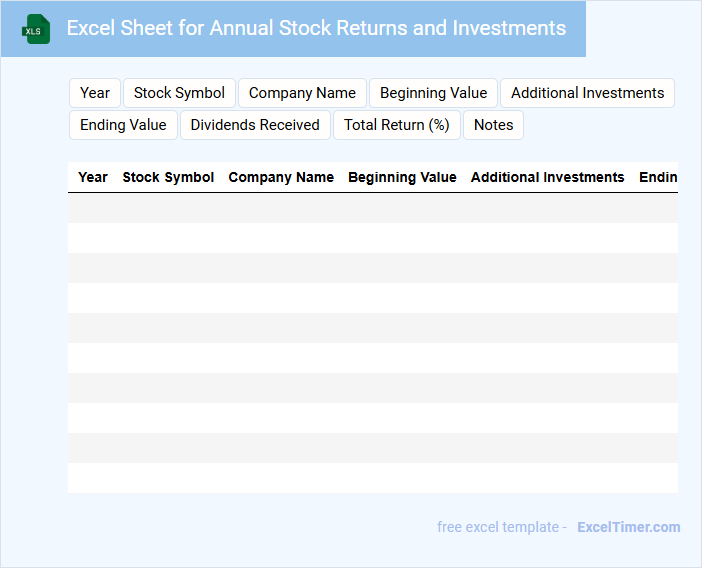

Excel Sheet for Annual Stock Returns and Investments

What information is typically contained in an Excel Sheet for Annual Stock Returns and Investments? This document usually includes detailed records of investment amounts, stock performance metrics, and annual return rates, allowing users to track and analyze their financial growth over time. It is designed to help investors make informed decisions by providing clear insights into the profitability and trends of their stock portfolio.

What is an important suggestion when creating this type of Excel Sheet? It is essential to organize the data with clearly labeled columns and use formulas for automatic calculations to ensure accuracy and ease of analysis. Additionally, incorporating visual elements like charts and conditional formatting can enhance understanding and highlight key performance indicators.

Annual Investment Overview with Stock Allocation Tracker

An Annual Investment Overview document typically contains a detailed summary of the yearly performance of various investments, including gains, losses, and overall portfolio growth. It provides insights into asset allocation and market trends that influenced the investment strategy.

A Stock Allocation Tracker monitors the distribution of stocks within the portfolio, ensuring the desired balance is maintained according to investment goals. It highlights shifts in stock weights and suggests rebalancing actions to optimize returns.

Including clear visuals and regularly updating data are important to maximize the effectiveness of this combined report.

Yearly Dividend Tracker for Stock Portfolios in Excel

A Yearly Dividend Tracker for stock portfolios in Excel is designed to monitor and record the annual dividends earned from various stock investments. It typically contains information such as stock names, dividend payout dates, amounts received, and total dividends per year. Tracking this data helps investors analyze income, compare stock performances, and plan future investments effectively.

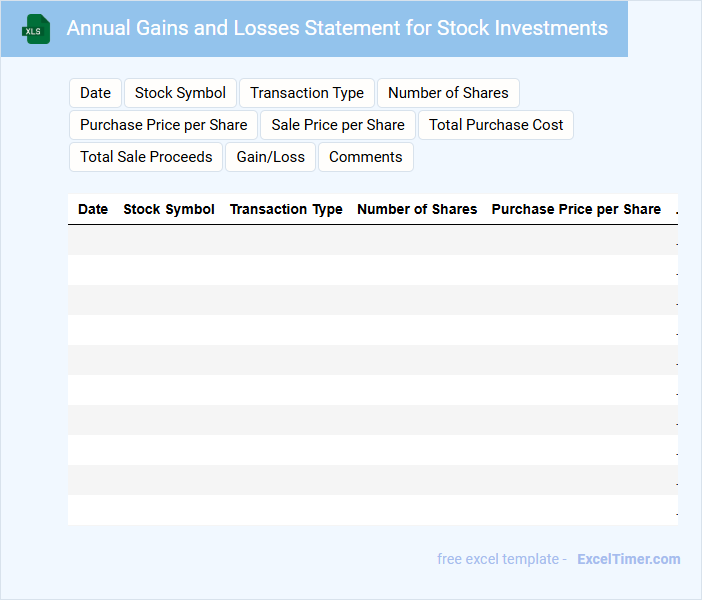

Annual Gains and Losses Statement for Stock Investments

What information does an Annual Gains and Losses Statement for Stock Investments typically contain? This document summarizes the total profits and losses realized from stock transactions over the fiscal year, providing a clear overview of investment performance. It includes details such as transaction dates, purchase and sale prices, dividends received, and capital gains or losses, which are essential for accurate tax reporting and financial analysis.

What important elements should be considered when reviewing this statement? Attention should be given to correctly identifying short-term versus long-term gains, as they have different tax implications. Additionally, ensuring all stock splits, dividends, and reinvestments are accurately reflected will help provide a comprehensive picture of total investment returns.

Stock Portfolio Yearly Summary with Growth Tracking

A Stock Portfolio Yearly Summary with Growth Tracking document typically contains an overview of investment performance over the past year and detailed growth metrics. It helps investors evaluate their portfolio's success and make informed decisions for future investments.

- Include a clear summary of total returns and percentage growth year-over-year.

- Provide detailed breakdowns by individual stocks or sectors for deeper analysis.

- Incorporate charts or graphs to visually represent growth trends and comparisons.

Annual Rebalancing Tracker for Investment Portfolios

What does an Annual Rebalancing Tracker for Investment Portfolios typically contain? This document usually includes a detailed summary of portfolio asset allocations, changes made during the year, and comparisons to target allocation goals. It helps investors maintain their desired risk level and ensure their portfolio stays aligned with their financial objectives.

Year-over-Year Stock Portfolio Tracker with Charts

A Year-over-Year Stock Portfolio Tracker document typically contains detailed records of stock performances over multiple years, enabling users to analyze long-term trends and returns. It often includes charts that visually represent data such as portfolio growth, dividend yields, and asset allocation changes. An important suggestion is to incorporate clear, interactive charts and concise summary statistics to facilitate quick, insightful comparisons across different years.

Annual Cash Flow Tracker for Stock Portfolio Investments

What information does an Annual Cash Flow Tracker for Stock Portfolio Investments typically contain? This document usually includes detailed records of all cash inflows and outflows related to stock investments over the year, such as dividends received, stock sales proceeds, and investment purchases. It provides a clear overview of the portfolio's liquidity and helps investors monitor and manage their financial performance effectively.

What important aspects should be considered when maintaining this tracker? Accuracy in recording dates, amounts, and transaction types is crucial for reliable financial analysis, while categorizing cash flows helps identify trends and tax implications. Additionally, regularly updating the tracker ensures timely insights for better investment decisions and portfolio optimization.

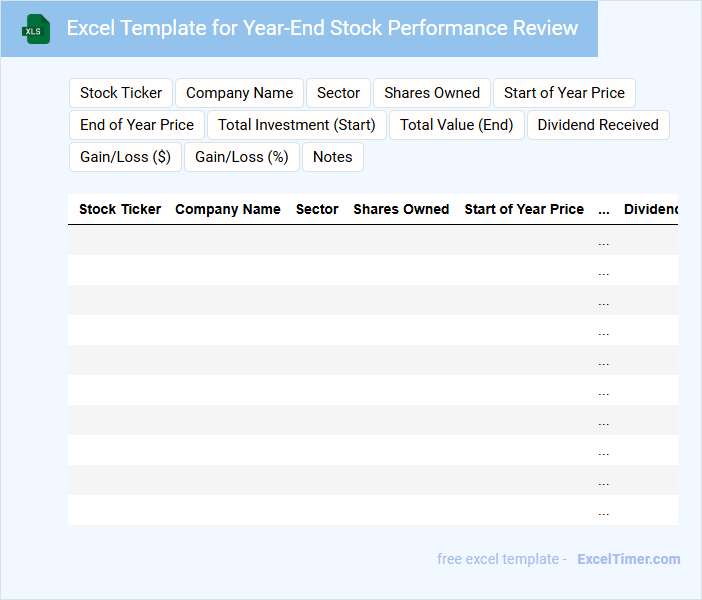

Excel Template for Year-End Stock Performance Review

What information does an Excel Template for Year-End Stock Performance Review typically contain? This type of document usually includes detailed data on stock prices, dividends, and overall portfolio performance throughout the year. It helps investors analyze trends, calculate returns, and make informed decisions about future investments.

What are important considerations when using this template? Ensure that the data is accurate and updated regularly to reflect true market conditions. Additionally, incorporating visual charts and summaries can enhance understanding and support more effective decision-making.

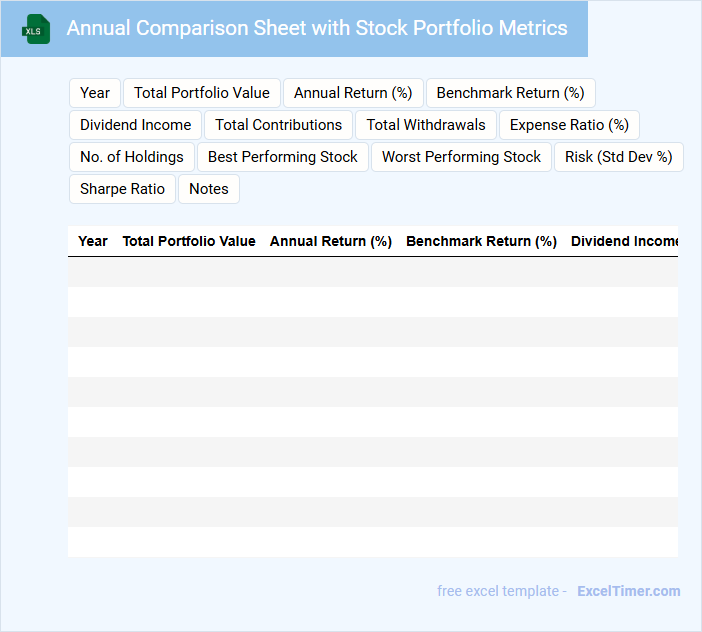

Annual Comparison Sheet with Stock Portfolio Metrics

The Annual Comparison Sheet typically contains a detailed overview of a stock portfolio's performance over the year, including key metrics such as returns, dividends, and asset allocation. It highlights trends and changes in the portfolio to help investors make informed decisions.

Key components often include portfolio metrics like risk ratios, growth percentages, and comparison against benchmarks. Regular updates and clear visualization tools are important to track progress and optimize investment strategies.

Income and Capital Gains Tracker for Annual Investments

An Income and Capital Gains Tracker is a financial document that records all income received and capital gains realized from various investments over the year. It typically includes details such as the amount, date, source, and type of income or gain, helping investors monitor their financial performance. Keeping this tracker updated is crucial for accurate tax reporting and effective investment management.

Annual Holdings Overview with Performance Metrics for Stocks

What information is typically included in an Annual Holdings Overview with Performance Metrics for Stocks? This document usually contains a detailed list of stock holdings over the year, including acquisition dates, quantities, and valuation changes. It also provides performance metrics such as returns, dividends received, and risk assessments to evaluate investment effectiveness.

Why is it important to include both holdings data and performance metrics? Combining these elements offers a comprehensive view of portfolio health, helping investors make informed decisions. Clear visualization of gains, losses, and market trends enhances transparency and supports strategic planning for future investments.

What key columns should be included in an annual investment tracker for stock portfolios (e.g., Ticker, Buy Date, Buy Price, Shares, Current Value)?

An annual investment tracker for stock portfolios should include key columns such as Ticker, Buy Date, Buy Price, Shares, Current Value, Dividends Received, Annual Return, and Portfolio Allocation. These columns enable comprehensive tracking of investment performance, income, and diversification. Including Currency and Fees Paid columns helps maintain accurate financial analysis.

How does the tracker calculate annual returns (%) for each stock and for the overall portfolio?

The Annually Investment Tracker calculates annual returns (%) for each stock by comparing the stock's closing price at the end of the year with its purchase price, adjusting for dividends and splits. For the overall portfolio, it aggregates individual stock returns weighted by their share in the total investment value. This method ensures accurate tracking of both individual and portfolio performance over time.

What formulas are used to display total dividends received per stock annually?

To display total dividends received per stock annually in an Excel investment tracker, use the SUMIFS formula, e.g., =SUMIFS(DividendAmountRange, StockNameRange, "StockName", YearRange, Year). Use DATE or YEAR functions to extract the year from dividend payment dates for precise annual calculation. Ensure dividend amounts, stock names, and dates are organized in columns for accurate referencing.

How can conditional formatting be applied to highlight top and underperforming stocks each year?

Use Excel's conditional formatting with formulas to highlight top-performing stocks by applying a rule that identifies the highest annual returns using the LARGE function. Similarly, highlight underperforming stocks by creating a rule that detects the lowest annual returns with the SMALL function. Apply these rules across each year's data range to visually distinguish stock performance in the investment tracker.

What method is implemented to update and visualize year-over-year portfolio growth in the document?

The Excel document uses dynamic formulas such as SUMIF and YEAR functions to aggregate annual investment data for each stock portfolio. PivotTables and charts visualize year-over-year portfolio growth, providing clear insights on performance trends. Conditional formatting highlights significant increases or decreases in portfolio value year-over-year.