The Annually Sinking Fund Excel Template for Homeowners Associations helps efficiently manage reserve funds for future repairs and capital projects. It allows accurate tracking of contributions, withdrawals, and fund growth, ensuring financial stability for the association. This template is essential for long-term planning and transparent communication with homeowners.

Annually Sinking Fund Schedule for Homeowners Associations

What information is typically included in an Annually Sinking Fund Schedule for Homeowners Associations? This document usually contains detailed projections of future major repair and replacement costs for common areas, broken down annually. It helps homeowners associations plan financially to ensure sufficient funds are available when large expenses arise.

Why is maintaining an accurate sinking fund schedule important for homeowners associations? Properly updated schedules protect the community from unexpected special assessments and financial shortfalls. It also provides transparency and confidence to homeowners regarding the association's long-term financial health.

Excel Template with Sinking Fund Analysis for HOA

An Excel Template with Sinking Fund Analysis is typically a structured spreadsheet designed to help Homeowners Associations (HOAs) plan and manage long-term financial reserves. It contains details such as projected expenses, contribution schedules, and fund growth calculations.

These templates are essential for forecasting future capital needs and ensuring adequate funds for repairs or replacements of community assets. Regularly updating assumptions and reviewing funding goals are important to maintain accurate and effective financial planning.

Sinking Fund Calculation Worksheet for HOA Annual Planning

The Sinking Fund Calculation Worksheet is a crucial document used by Homeowners Associations (HOAs) for financial planning. It typically contains detailed projections of future expenses and accumulated reserves to ensure long-term community maintenance. This worksheet helps in estimating the required annual contributions to cover large capital repairs or replacements.

Important considerations include accurately forecasting repair timelines, accounting for inflation, and ensuring transparent communication with homeowners about funding needs. Regular updates and reviews are essential to maintain the fund's adequacy. Proper use of this worksheet supports sustainable financial health and community trust.

Annual Reserve Sinking Fund Tracker with Charts for HOAs

An Annual Reserve Sinking Fund Tracker for HOAs typically contains detailed records of contributions, expenditures, and projected reserves essential for maintaining community assets. It helps ensure financial stability by monitoring fund balances throughout the year.

The inclusion of charts provides a clear visual representation of fund trends, facilitating easier analysis and decision-making by board members. This document is crucial for transparent financial planning and future repair or replacement projects.

It is important to regularly update the tracker and verify accuracy to support informed budgeting and long-term asset management.

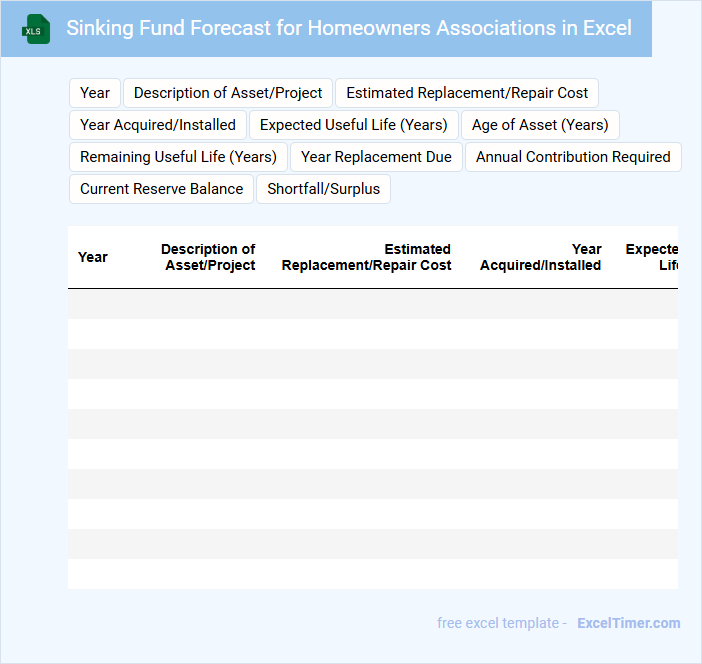

Sinking Fund Forecast for Homeowners Associations in Excel

A Sinking Fund Forecast for Homeowners Associations in Excel is a financial tool used to plan and allocate funds for future major repairs and replacements of common property elements. It typically contains detailed schedules of expected expenses, contribution plans, and projected fund balances over time. This document is essential for ensuring the association maintains adequate reserves and avoids unexpected special assessments. Important suggestions include regularly updating the forecast with actual expenses, including inflation estimates, and ensuring transparency with homeowners for budget approval.

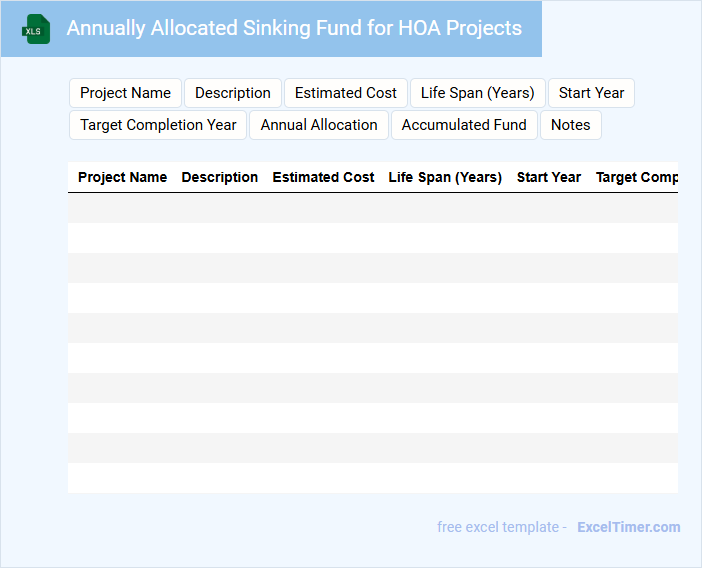

Annually Allocated Sinking Fund for HOA Projects

What information is typically included in an annual sinking fund document for HOA projects? This document generally outlines the planned financial contributions and projected expenditures for long-term repairs and replacements within the HOA community. It serves as a budgeting tool to ensure adequate funds are set aside annually to maintain common areas and infrastructure efficiently.

Why is it important to monitor the annually allocated sinking fund closely? Regular monitoring helps prevent unexpected special assessments by ensuring the fund growth aligns with the actual maintenance needs. Transparent communication of fund status to HOA members fosters trust and supports proactive financial planning for future projects.

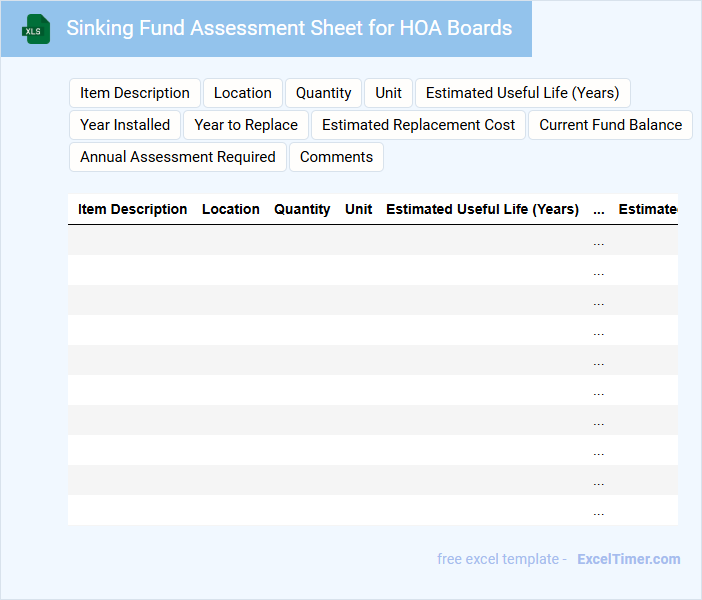

Sinking Fund Assessment Sheet for HOA Boards

The Sinking Fund Assessment Sheet is a crucial document used by HOA Boards to track and manage contributions towards long-term repair and replacement projects. It typically contains details about projected expenses, scheduled payments, and the current fund balance. Maintaining accurate and up-to-date records helps ensure the community's financial stability and preventive maintenance.

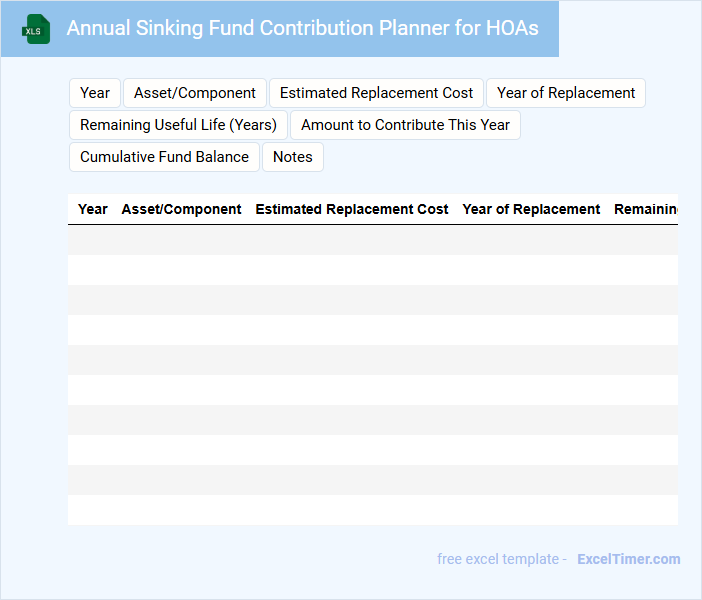

Annual Sinking Fund Contribution Planner for HOAs

The Annual Sinking Fund Contribution Planner is a vital document used by Homeowners Associations (HOAs) to ensure financial readiness for future capital repairs and replacements. It typically contains projected expenses, planned contributions, and a timeline for funding goals. This planner helps maintain the community's infrastructure without sudden special assessments.

Sinking Fund Statement with Reserve Breakdown for Associations

The Sinking Fund Statement is a financial document that details the reserved funds set aside by associations for future capital expenditures. It typically includes a breakdown of reserves allocated for various components such as roofing, plumbing, and landscaping.

These statements help in ensuring that the association maintains adequate funding for long-term repairs and replacements. It is important to regularly review and update the sinking fund to avoid unexpected special assessments.

Projected Sinking Fund Expenses for Homeowners Association

Projected sinking fund expenses for a Homeowners Association typically detail anticipated major repair and replacement costs over time to ensure sufficient reserve funds.

- Reserve Allocations: Estimated amounts to be set aside regularly for future capital expenditures.

- Maintenance Forecasts: Scheduled upkeep and replacement timelines for common property elements.

- Funding Strategies: Plans to manage cash flow and avoid special assessments on homeowners.

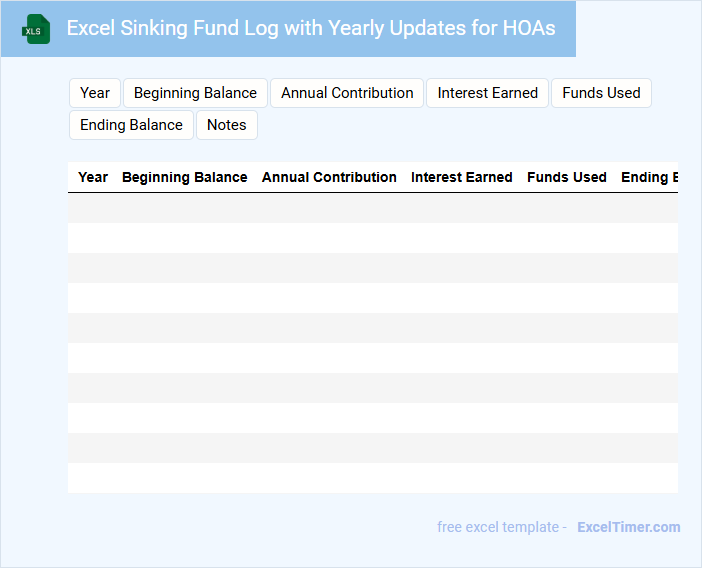

Excel Sinking Fund Log with Yearly Updates for HOAs

An Excel Sinking Fund Log with Yearly Updates for HOAs is a financial document used to track reserve funds allocated for future capital repairs and replacements.

- Comprehensive Tracking: It maintains detailed records of contributions, expenditures, and fund balances over time.

- Yearly Updates: Regular annual adjustments ensure accurate reflection of inflation and changing repair costs.

- Transparency and Planning: Provides homeowners and board members clear insights for informed budgeting and decision-making.

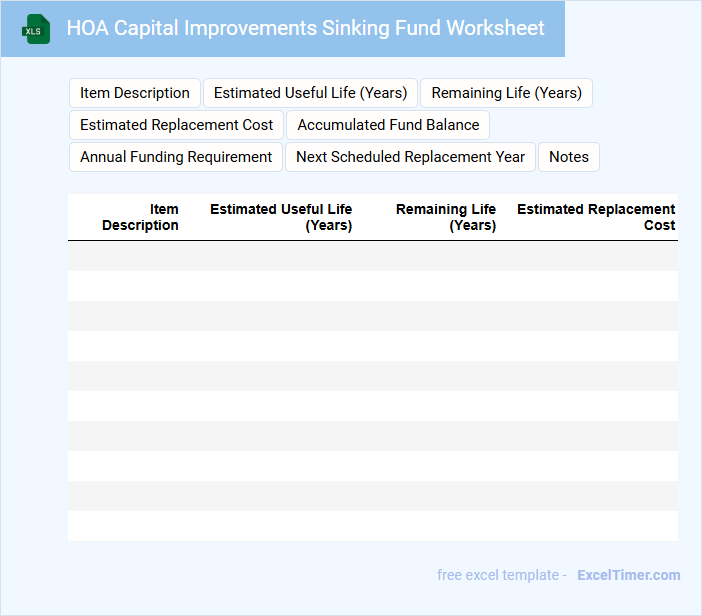

HOA Capital Improvements Sinking Fund Worksheet

The HOA Capital Improvements Sinking Fund Worksheet is a crucial financial document used by homeowners associations to plan for future major repairs and replacements. It typically contains detailed records of expected expenses, contribution schedules, and timelines for various capital projects. This worksheet helps ensure the association maintains adequate reserves to avoid special assessments.

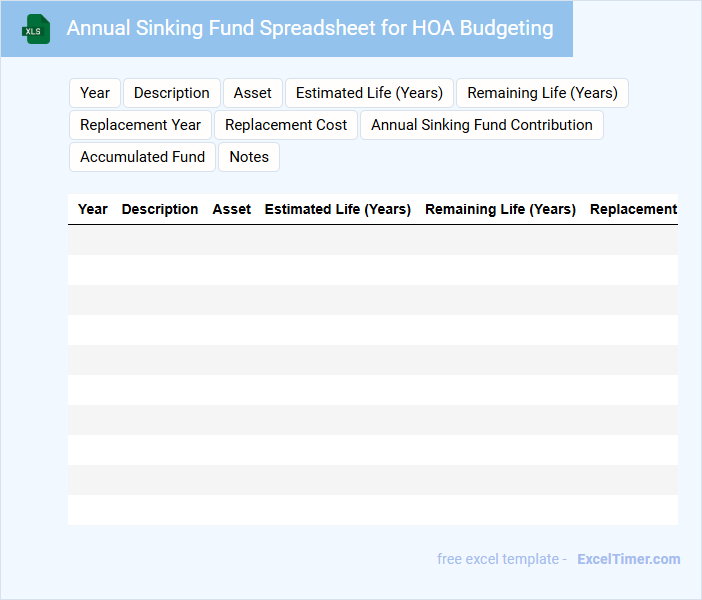

Annual Sinking Fund Spreadsheet for HOA Budgeting

An Annual Sinking Fund Spreadsheet for HOA budgeting is typically a detailed financial document used to plan and allocate money towards long-term repairs and replacements of community assets. It usually contains projections of expenses, scheduled contributions, and remaining fund balances to ensure sufficient reserves over time. Maintaining accuracy and regularly updating the spreadsheet is crucial for effective financial management and avoiding unexpected special assessments.

Sinking Fund Reserve Tracking with Annual Contributions for HOAs

What does a Sinking Fund Reserve Tracking document with Annual Contributions for HOAs typically contain? It usually includes detailed records of the fund's yearly contributions, accumulated balances, and planned reserve expenditures. This document helps HOAs manage long-term capital projects by ensuring adequate funds are reserved and tracked efficiently for future maintenance or replacements.

What is an important consideration when maintaining this document? It is crucial to regularly update contribution amounts and adjustments to account for inflation or changing repair costs. Accurate tracking ensures transparency for homeowners and helps prevent unexpected special assessments or financial shortfalls.

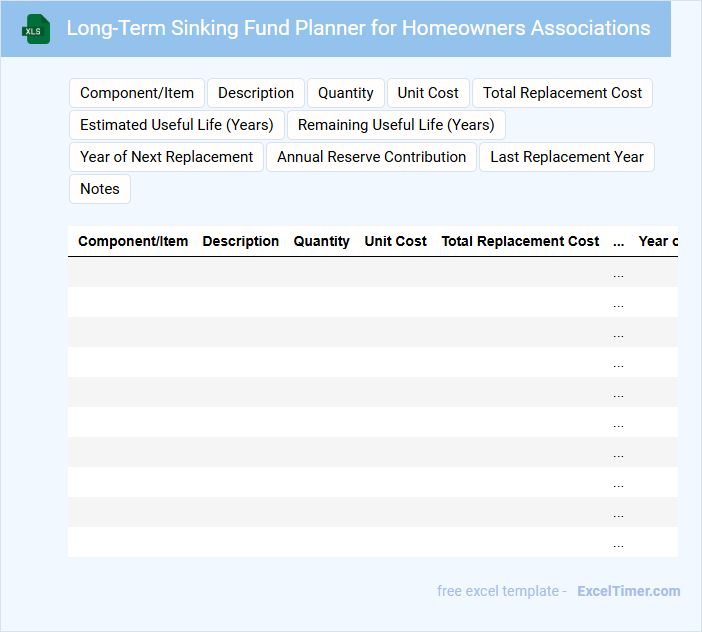

Long-Term Sinking Fund Planner for Homeowners Associations

What information does a Long-Term Sinking Fund Planner for Homeowners Associations typically contain? It usually includes detailed projections of future repair and replacement costs for common area components along with schedules for contribution amounts from members. This planner helps ensure that the association maintains adequate reserves to manage large expenses without needing emergency assessments.

What is an important consideration when using this type of document? Accurate cost estimates and realistic timelines for repairs or replacements are crucial to avoid underfunding. Regular updates and reviews of the planner ensure it remains aligned with changing maintenance needs and financial conditions.

What is the primary purpose of an annually sinking fund for homeowners associations?

An annually sinking fund for homeowners associations is designed to accumulate reserves over time for major repairs and capital improvements. This fund ensures financial stability by spreading out large expenses, reducing the need for special assessments. Properly managed sinking funds help maintain property values and support long-term community maintenance.

How should homeowners associations calculate the required annual sinking fund contributions?

Homeowners associations calculate the required annual sinking fund contributions by dividing the total estimated future repair and replacement costs by the number of years until those expenses are due. Your calculation must include factors such as inflation, current reserve balances, and expected interest earnings to ensure accuracy. Regular updates to this sinking fund analysis help maintain sufficient funds for long-term community maintenance.

Which types of expenses are typically covered by an annual sinking fund in an HOA?

An annual sinking fund in a Homeowners Association (HOA) typically covers major repairs and replacements such as roof repairs, exterior painting, and paving projects. It also allocates funds for infrastructure upgrades and emergency repairs to common areas. Your sinking fund ensures long-term financial stability for these critical community expenses.

What is the impact of underfunding or overfunding the annual sinking fund for an HOA?

Underfunding the annual sinking fund for your Homeowners Association can lead to insufficient reserves for major repairs, causing unexpected special assessments or deferred maintenance. Overfunding ties up capital that could be used for other community improvements or lower dues. Properly balancing the sinking fund ensures financial stability and avoids burdening homeowners with sudden costs.

How should the annual sinking fund balance and transactions be documented and tracked in Excel?

Your annual sinking fund balance and transactions should be documented in Excel using separate columns for dates, descriptions, deposits, withdrawals, and running balances. Utilize formulas such as SUM and SUMIF to maintain accurate totals and track contributions over time. Include a summary section to highlight the current fund status and forecast future needs for your Homeowners Association.