The Annually Profit and Loss Statement Excel Template for Cafes streamlines financial tracking by organizing yearly revenue and expenses in a clear, easy-to-read format. It helps cafe owners identify profit margins, monitor cost control, and make informed decisions for growth. Customizable categories accommodate unique cafe operations, ensuring accurate financial analysis throughout the year.

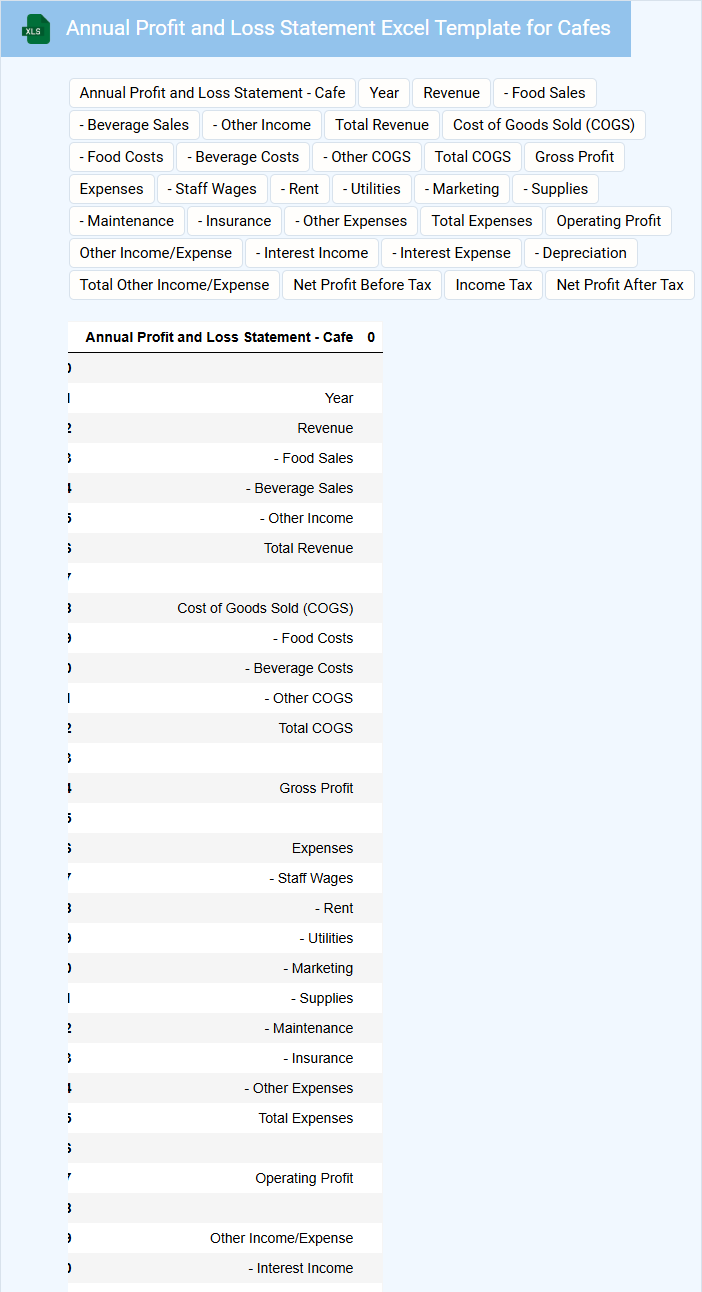

Annual Profit and Loss Statement Excel Template for Cafes

An Annual Profit and Loss Statement Excel Template for Cafes is a financial document used to track and analyze the revenue, expenses, and net profit of a cafe over a year. It helps cafe owners make informed business decisions by providing a clear overview of their financial performance.

- Include detailed categories for both fixed and variable expenses relevant to cafe operations.

- Ensure the template allows for monthly data entry to observe trends throughout the year.

- Incorporate formulas to automatically calculate totals, profit margins, and year-end summaries.

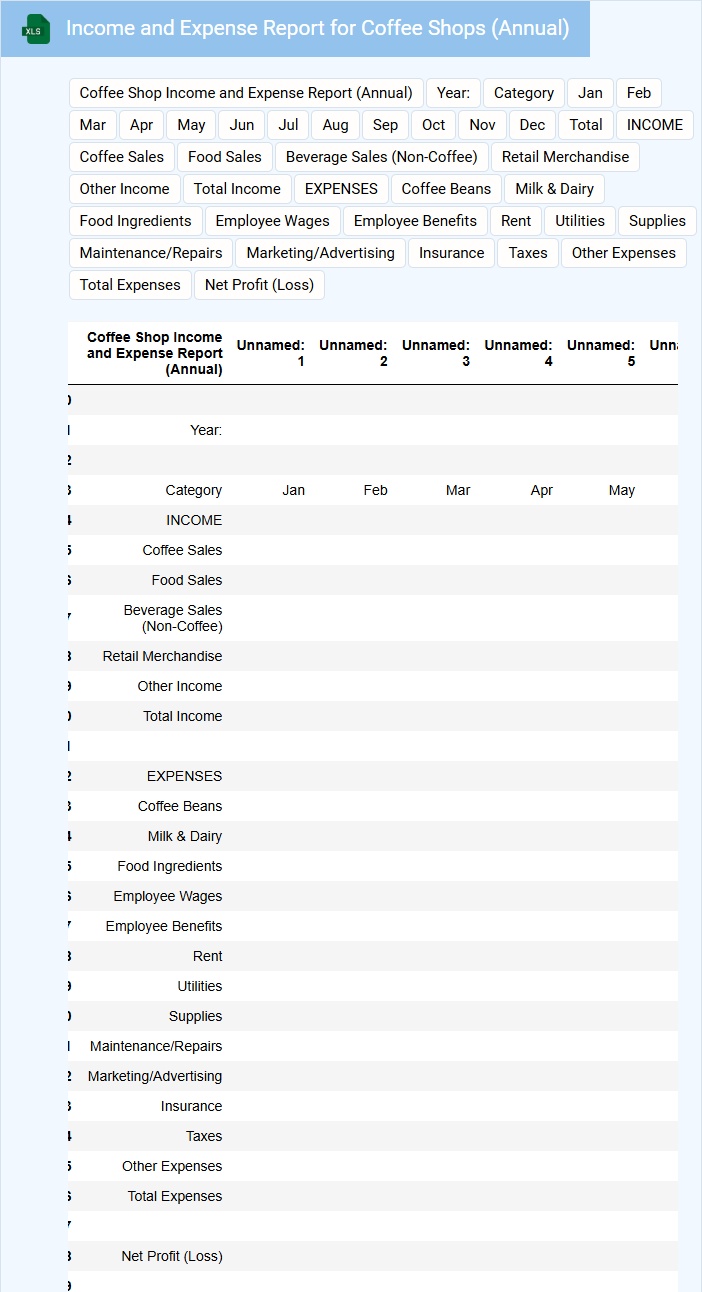

Income and Expense Report for Coffee Shops (Annual)

An Income and Expense Report for coffee shops is a critical financial document summarizing all revenues and costs over the course of a year. It provides insight into the café's profitability by detailing sales, operational expenses, and net income. This report helps stakeholders make informed decisions to optimize financial health and plan for future growth.

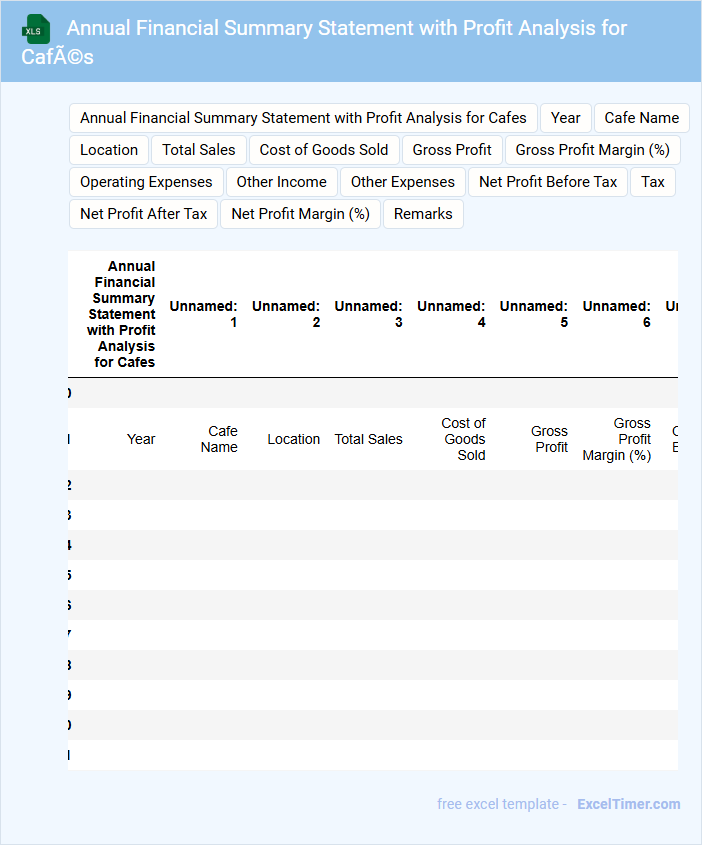

Annual Financial Summary Statement with Profit Analysis for Cafés

An Annual Financial Summary Statement typically contains comprehensive financial data, including revenue, expenses, and net profit over the fiscal year. This document helps stakeholders understand the overall financial health and performance of the café. A detailed profit analysis is crucial to identify key drivers of profitability and areas for cost improvement.

Yearly Profit and Loss Tracker for Café Businesses

The Yearly Profit and Loss Tracker is a financial document used by café businesses to monitor their revenue and expenses over the course of the year. It helps owners analyze profitability and make informed operational decisions.

Typically, this document contains detailed records of sales, costs of goods sold, operating expenses, and net profit or loss figures. For effective use, it is important to regularly update the tracker and categorize expenses accurately for clear financial insights.

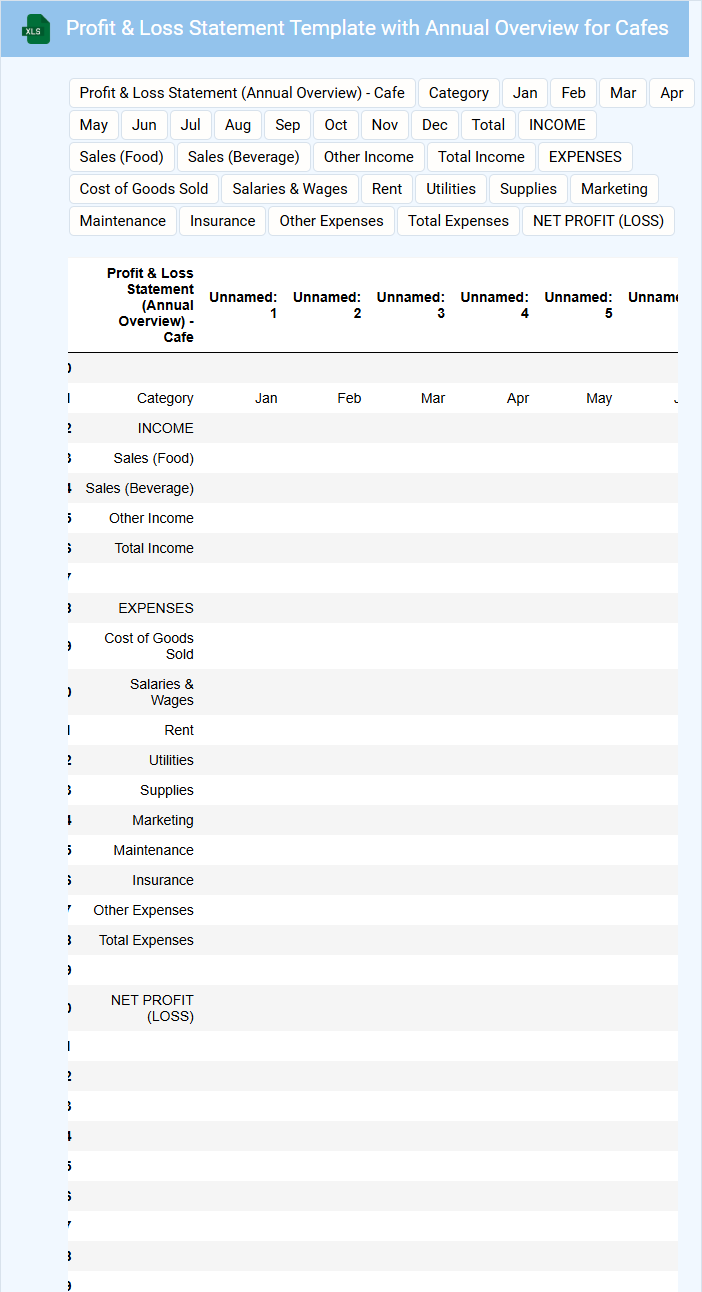

Profit & Loss Statement Template with Annual Overview for Cafes

A Profit & Loss Statement Template for cafes typically contains detailed records of income, costs, and expenses to assess the financial performance over a specific period. It highlights revenues from sales and subtracts costs such as supplies, labor, and overhead to calculate net profit.

Including an Annual Overview allows owners to track seasonal trends and make informed budgeting decisions. This comprehensive view helps identify areas for cost control and revenue growth throughout the year.

Ensure the template includes clear categories for all revenue streams and expense types, as well as year-to-date summaries for easy comparison.

Annual Revenue and Expense Spreadsheet for Café Owners

An Annual Revenue and Expense Spreadsheet for café owners typically contains detailed financial records, including monthly sales, operational costs, and profit margins. It helps monitor the overall financial health and cash flow of the café.

This document is crucial for budgeting, tax preparation, and identifying areas to cut costs or increase revenue. Regular updates ensure accurate tracking and informed business decisions.

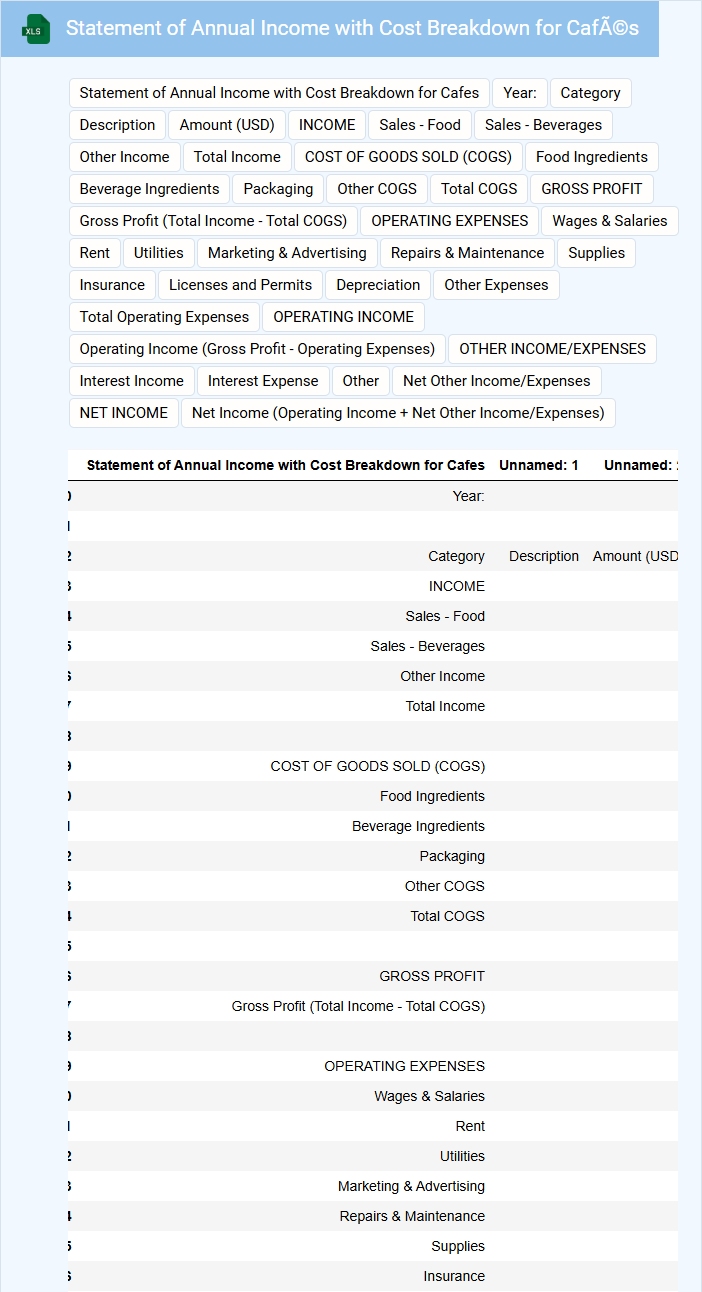

Statement of Annual Income with Cost Breakdown for Cafés

A Statement of Annual Income with Cost Breakdown for Cafés typically contains a detailed summary of revenue and expenses over a year, providing insights into the café's financial health and operational efficiency.

- Revenue Sources: Include all income streams such as sales of food, beverages, and other services.

- Expense Categories: Break down costs into key areas like supplies, labor, rent, and utilities.

- Profit Analysis: Highlight net income and identify areas for cost optimization to improve profitability.

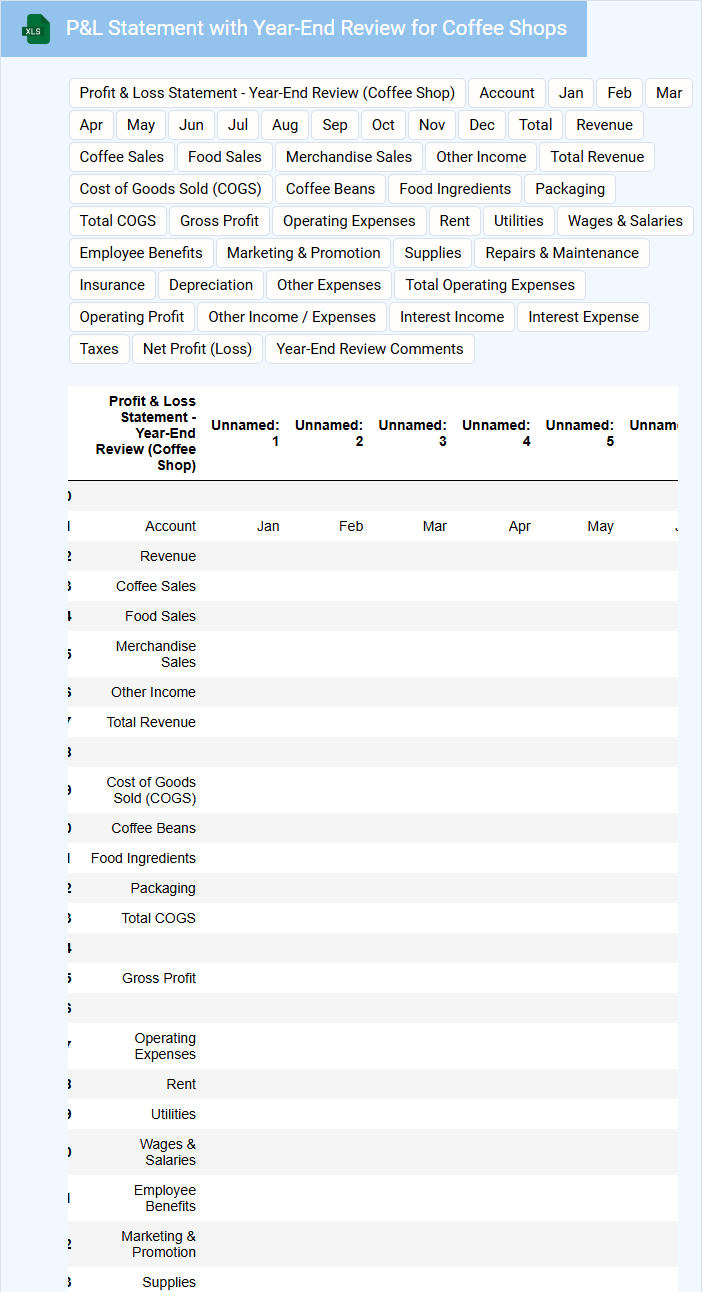

P&L Statement with Year-End Review for Coffee Shops

What does a P&L Statement with Year-End Review for Coffee Shops typically contain? This document usually includes detailed revenue sources, cost of goods sold, operating expenses, and net profit or loss for the year. It provides a comprehensive overview of the financial performance, helping owners evaluate profitability and make informed decisions for future growth.

Why is it important to highlight key trends and seasonal variations in this review? Identifying peak sales periods and expense fluctuations allows coffee shop managers to optimize inventory, staffing, and marketing strategies. Including actionable insights helps enhance financial planning and operational efficiency year over year.

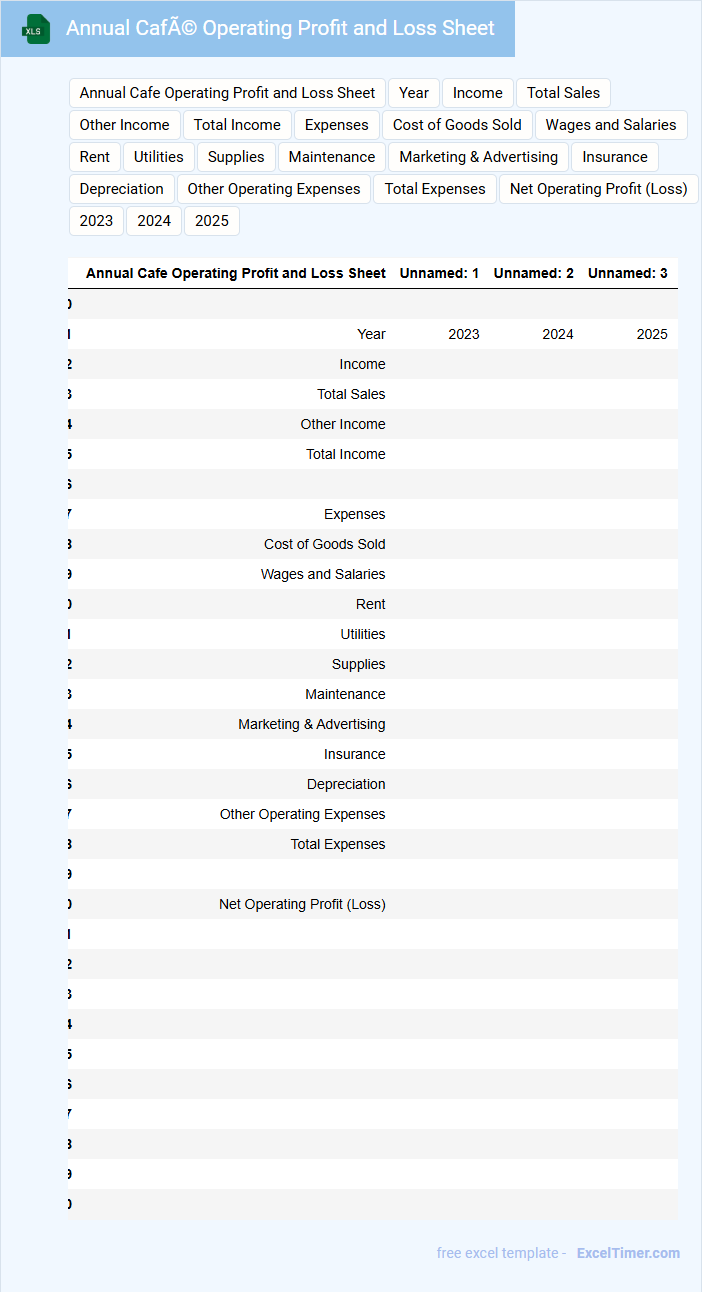

Annual Café Operating Profit and Loss Sheet

What information is typically included in an Annual Café Operating Profit and Loss Sheet? This document usually contains detailed records of all revenues and expenses incurred by the café over the year, including sales, cost of goods sold, labor costs, and operational expenses. It serves as a financial summary to assess profitability and identify areas for cost management and growth opportunities.

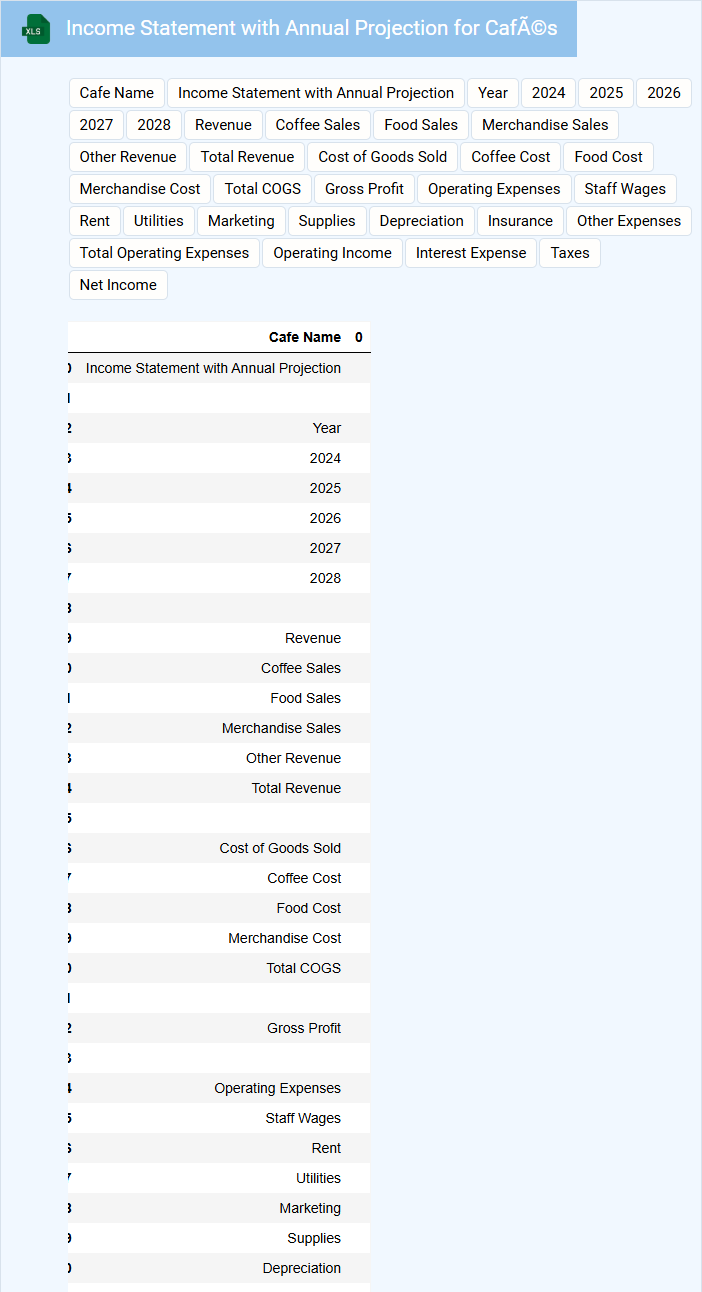

Income Statement with Annual Projection for Cafés

What information is typically included in an Income Statement with Annual Projection for Cafés? This document usually contains detailed revenue streams, operating expenses, and net profit forecasts for the upcoming year. It provides a clear financial overview that helps café owners and investors anticipate profitability and manage resources effectively.

What is an important consideration when preparing this type of statement? Ensuring accurate sales projections based on historical data and market trends is critical, as well as accounting for seasonal fluctuations and potential cost variations to create realistic and useful financial forecasts.

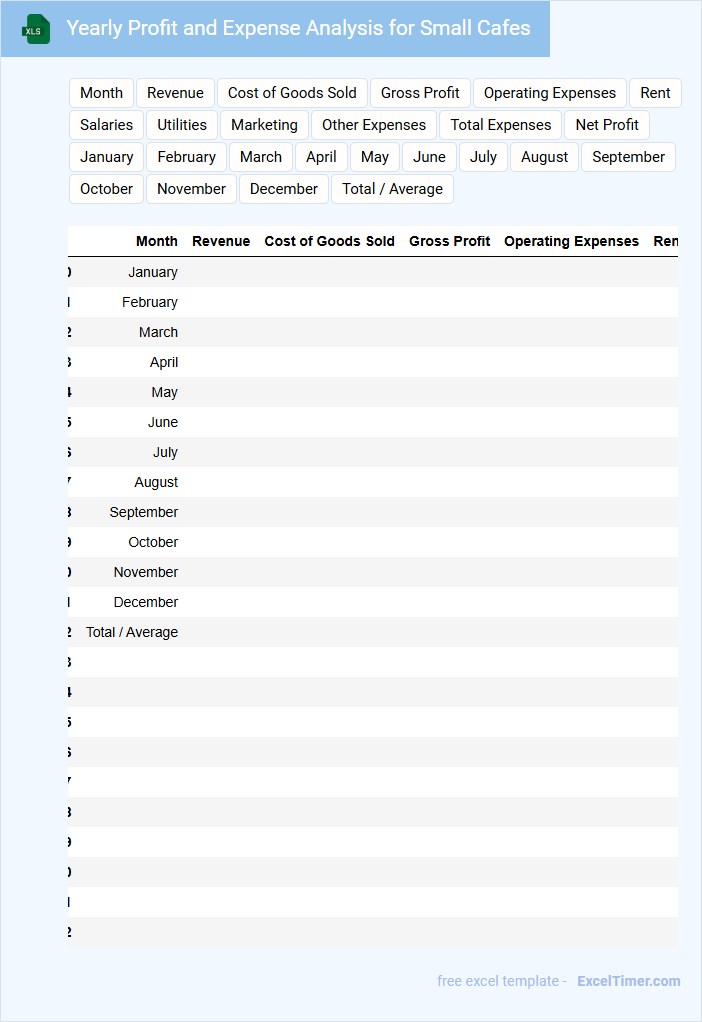

Yearly Profit and Expense Analysis for Small Cafes

This document contains a comprehensive yearly profit and expense analysis for small cafes, detailing all income streams and cost factors. It typically includes monthly revenue breakdowns, categorized expenses, and net profit calculations, offering insights into financial health. Key suggestions focus on identifying major cost drivers and optimizing operational efficiency for improved profitability.

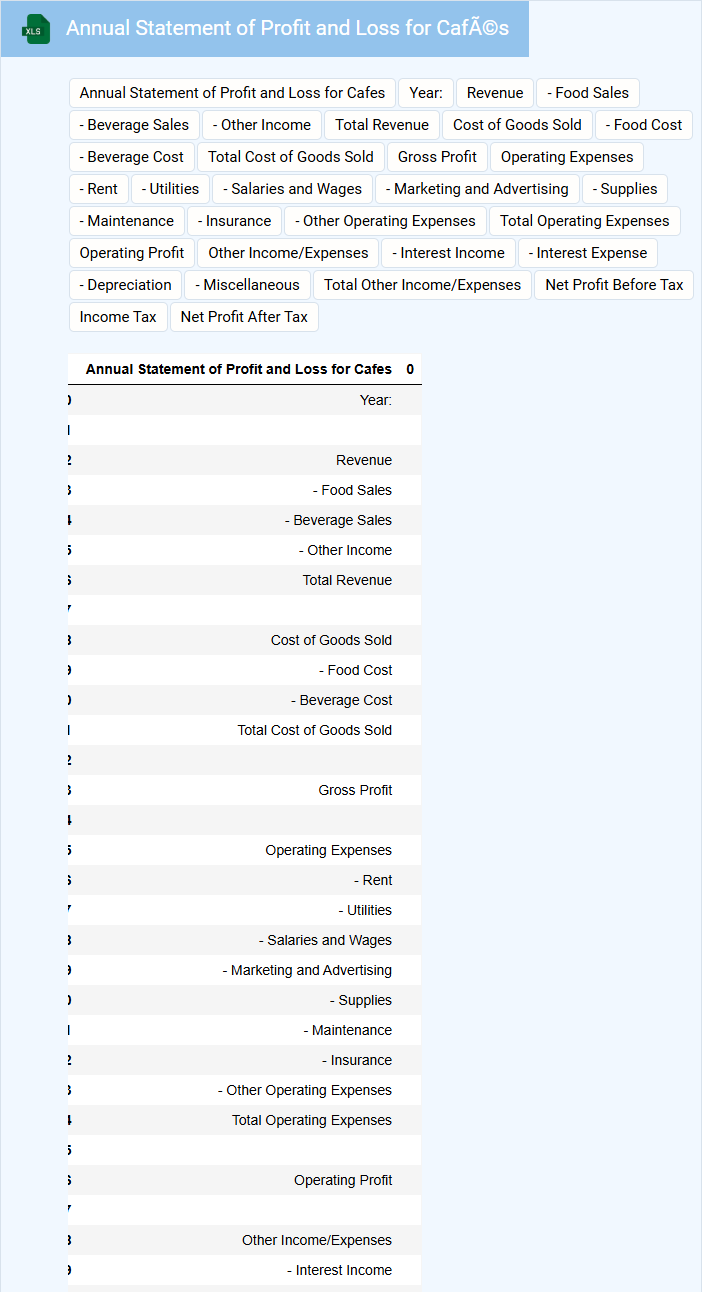

Annual Statement of Profit and Loss for Cafés

What information does an Annual Statement of Profit and Loss for Cafés typically contain? This document usually includes detailed records of all revenues generated from sales, along with the costs and expenses incurred throughout the year. It summarizes the café's financial performance by showing net profit or loss, helping owners understand profitability and make informed business decisions.

What is an important consideration when preparing this statement for cafés? Accurate categorization of income streams and expense items, such as food and beverage costs, labor, and rent, is crucial. Consistent record-keeping and including seasonal factors can provide clearer insights and improve financial planning for the business.

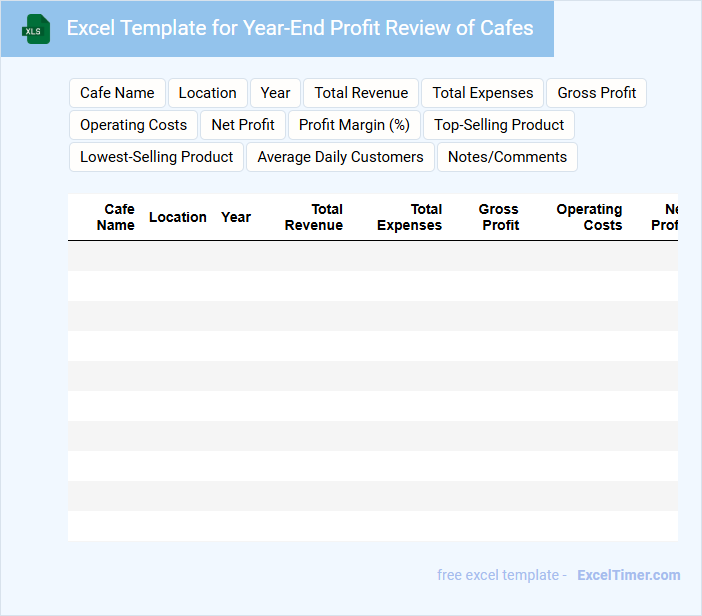

Excel Template for Year-End Profit Review of Cafes

What information is typically included in an Excel Template for Year-End Profit Review of Cafes? This document usually contains detailed financial data such as revenue streams, expense categories, and profit margins to analyze the cafe's yearly performance. It helps cafe owners identify trends, optimize costs, and make informed decisions for future growth.

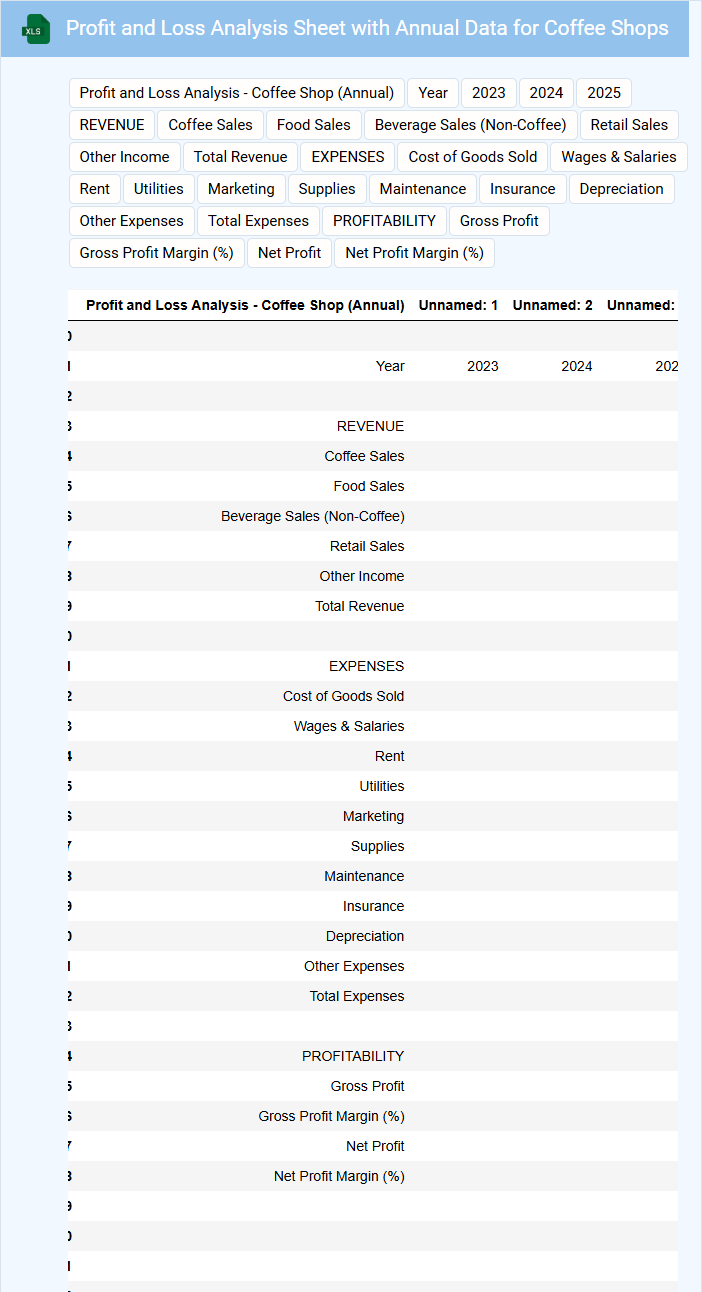

Profit and Loss Analysis Sheet with Annual Data for Coffee Shops

Profit and Loss Analysis Sheets with Annual Data for Coffee Shops typically contain detailed financial information reflecting the shop's revenue, expenses, and net profit over a year.

- Revenue Breakdown: This section highlights all sources of income such as sales of coffee, snacks, and merchandise.

- Expense Categories: It details fixed and variable costs including rent, salaries, ingredients, and utilities.

- Profit Calculation: Summarizes the net profit or loss by subtracting total expenses from total revenue, aiding in financial decision-making.

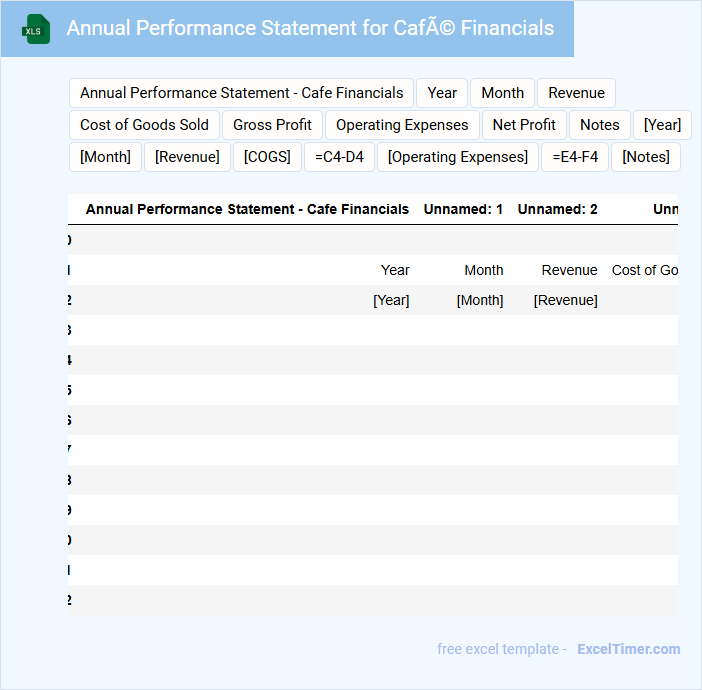

Annual Performance Statement for Café Financials

What does an Annual Performance Statement for Café Financials usually contain? This document typically includes a comprehensive overview of the café's financial performance over the year, such as revenue, expenses, profit margins, and cash flow. It also highlights key performance indicators and compares actual results against budgeted projections to assess financial health.

What important elements should be considered when preparing this statement? It is crucial to ensure accuracy and transparency in financial reporting, including detailed breakdowns of income sources and cost centers. Additionally, providing insights into trends, challenges, and opportunities can help stakeholders make informed decisions.

What are the key revenue streams typically included in an annual profit and loss statement for cafes?

The key revenue streams in an annual profit and loss statement for cafes include sales from food and beverages, catering services, and merchandise. Your statement should also capture income from events held on the premises and revenue from loyalty programs or partnerships. Tracking these categories helps identify the most profitable areas of your cafe business.

How should direct costs like ingredients and beverages be categorized in the Excel document?

Direct costs such as ingredients and beverages should be categorized under "Cost of Goods Sold (COGS)" in the Excel Profit and Loss Statement for cafes. This classification accurately reflects expenses directly tied to production and sales. Properly categorizing these costs ensures precise calculation of gross profit and financial analysis.

What are the main fixed and variable operating expenses a cafe should track yearly?

Your annual Profit and Loss statement for cafes should include fixed operating expenses like rent, salaries, and insurance alongside variable costs such as food and beverage supplies, utilities, and hourly wages. Tracking these expenses annually helps identify trends and manage profitability effectively. Accurate monitoring ensures better financial decisions and maximizes your cafe's success.

How is net profit calculated from gross profit on an annual basis in a cafe's P&L statement?

Net profit in a cafe's annual Profit and Loss (P&L) statement is calculated by subtracting total operating expenses, including rent, utilities, salaries, and taxes, from the gross profit. Gross profit represents total revenue minus the cost of goods sold (COGS). This calculation reveals the actual profitability after all business costs are accounted for.

Which financial ratios or metrics in the statement indicate the cafe's overall profitability and performance?

The Annually Profit and Loss Statement for Cafes highlights key financial metrics such as Gross Profit Margin, Net Profit Margin, and Operating Expense Ratio to indicate overall profitability and performance. Your evaluation should focus on Net Profit Margin, which measures the cafe's ability to generate profit after all expenses. Tracking these ratios provides a clear understanding of financial health and operational efficiency.