The Annually Income Statement Excel Template for Startups offers a simple, organized way to track yearly revenues, expenses, and net profit, critical for early-stage business financial planning. This template helps startups project cash flow, analyze profitability trends, and make informed strategic decisions. Customizable fields accommodate varying business models, ensuring precise financial insights tailored to each startup's needs.

Annual Income Statement Excel Template for Startups

An Annual Income Statement Excel Template for startups typically contains detailed records of revenues, expenses, and net profits over a fiscal year. It helps new businesses track financial performance and make informed decisions. Key components include sales figures, operating costs, and profit margins.

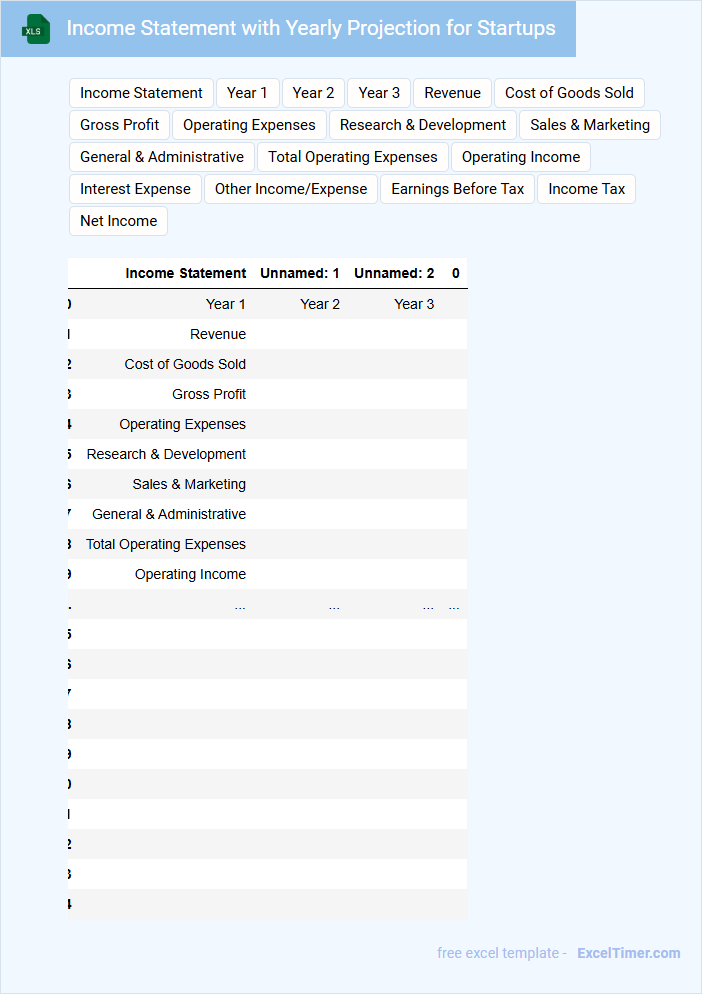

Income Statement with Yearly Projection for Startups

An Income Statement with yearly projection for startups details the company's expected revenues, expenses, and profits over a specific period. It provides investors and stakeholders with insight into financial health and business viability. Key elements to focus on include realistic revenue forecasts, cost management, and anticipated net income for sustainable growth.

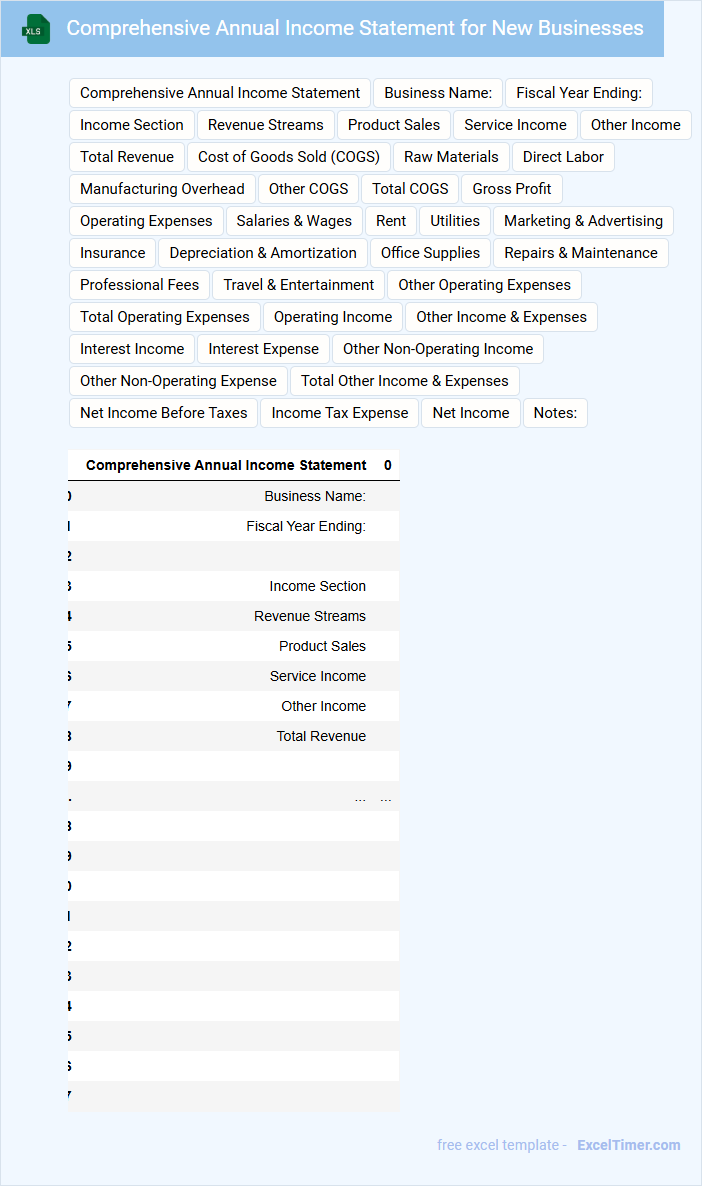

Comprehensive Annual Income Statement for New Businesses

What does a Comprehensive Annual Income Statement for New Businesses typically contain? This document usually includes detailed records of revenues, expenses, and net income over the fiscal year, providing a clear picture of the company's financial performance. It is essential for assessing profitability and making informed decisions for future growth and investment.

What important elements should be included in this statement? Key components such as total sales, cost of goods sold, operating expenses, taxes, and net profit should be clearly itemized to ensure accuracy and transparency. Including notes on unusual items or one-time expenses can also help stakeholders better understand the financial context.

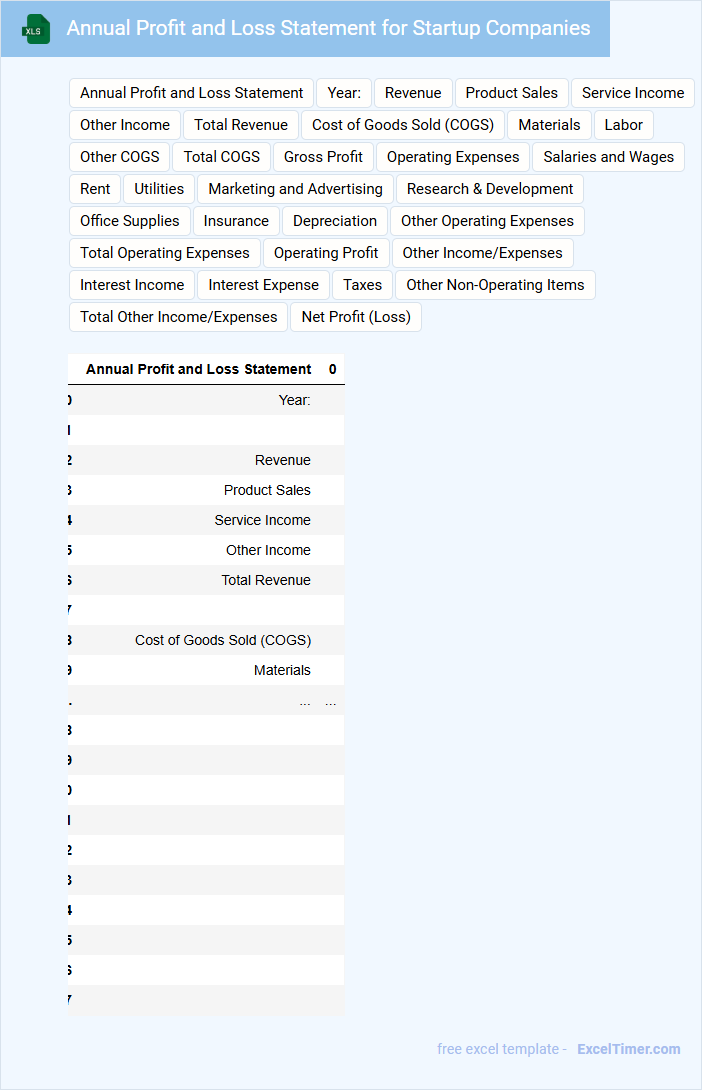

Annual Profit and Loss Statement for Startup Companies

An Annual Profit and Loss Statement for startup companies is a financial document that summarizes the revenues, costs, and expenses incurred during a fiscal year. It helps stakeholders evaluate the company's profitability and operational efficiency. Key components often include sales revenue, gross profit, operating expenses, and net income.

Startups should ensure accurate expense categorization to identify cost-saving opportunities and maintain clear revenue tracking to measure growth effectively. Including forecast comparisons can provide insight into financial performance versus expectations. Regular updates and thorough documentation improve transparency and support investor confidence.

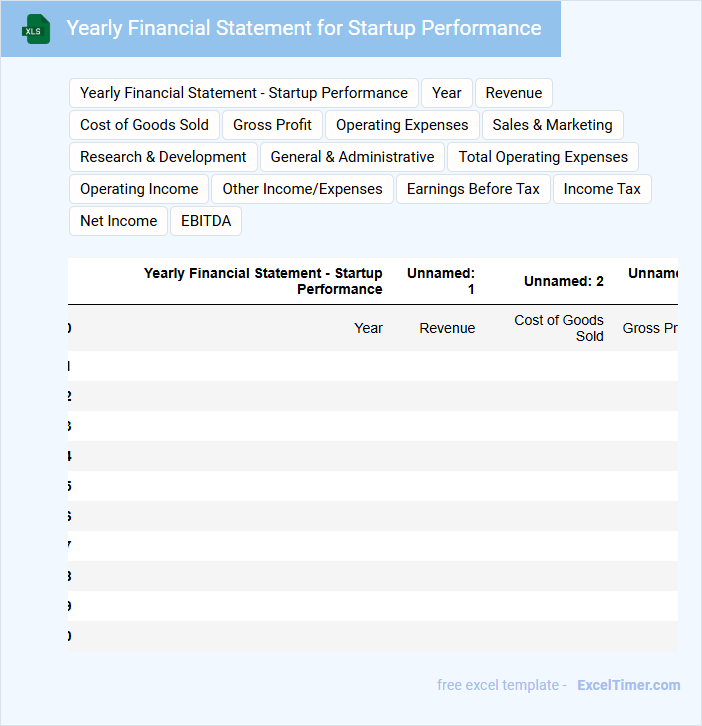

Yearly Financial Statement for Startup Performance

The Yearly Financial Statement for a startup typically contains a comprehensive overview of the company's financial health, including the income statement, balance sheet, and cash flow statement. It provides insights into revenues, expenses, assets, liabilities, and equity over the fiscal year. This document is essential for assessing the startup's performance and making informed business decisions.

Key elements to focus on include accurate revenue reporting, expense tracking, and understanding cash flow patterns. It is important to ensure transparency and compliance with relevant accounting standards. Additionally, highlighting growth trends and financial ratios can help investors and stakeholders evaluate the startup's sustainability and potential.

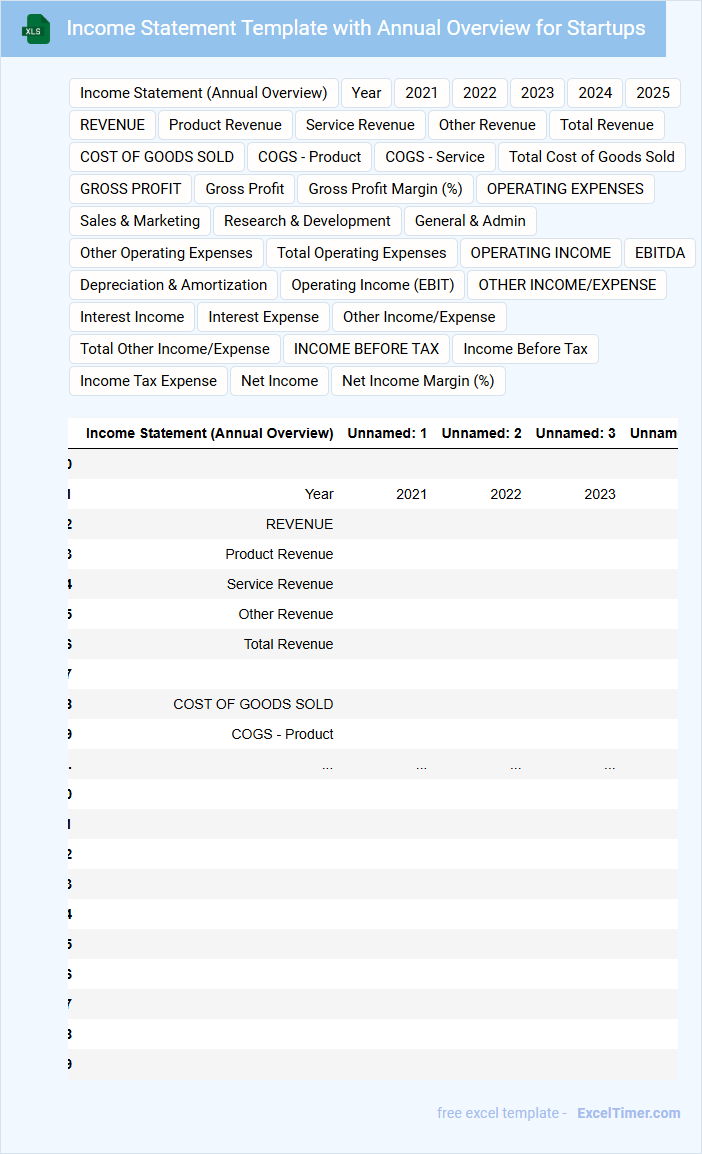

Income Statement Template with Annual Overview for Startups

The Income Statement Template with Annual Overview for Startups typically contains detailed revenue, expenses, and profit data organized by month and summarized annually. It helps startups track financial performance and make informed business decisions.

Important elements include gross profit, operating expenses, net profit, and cash flow projections to ensure accurate budgeting and forecasting. Using this template can provide clear insights into growth trends and financial health for investors and management.

Annual Revenue and Expense Statement for Startups

An Annual Revenue and Expense Statement for Startups is a financial document summarizing income and expenditures over a year, providing insight into financial health. It is essential for tracking business performance and informing strategic decisions.

- Include detailed revenue sources to understand where the income is generated.

- Record all expenses accurately to monitor cost management.

- Regularly compare actual results with forecasts to identify variances and adjust plans accordingly.

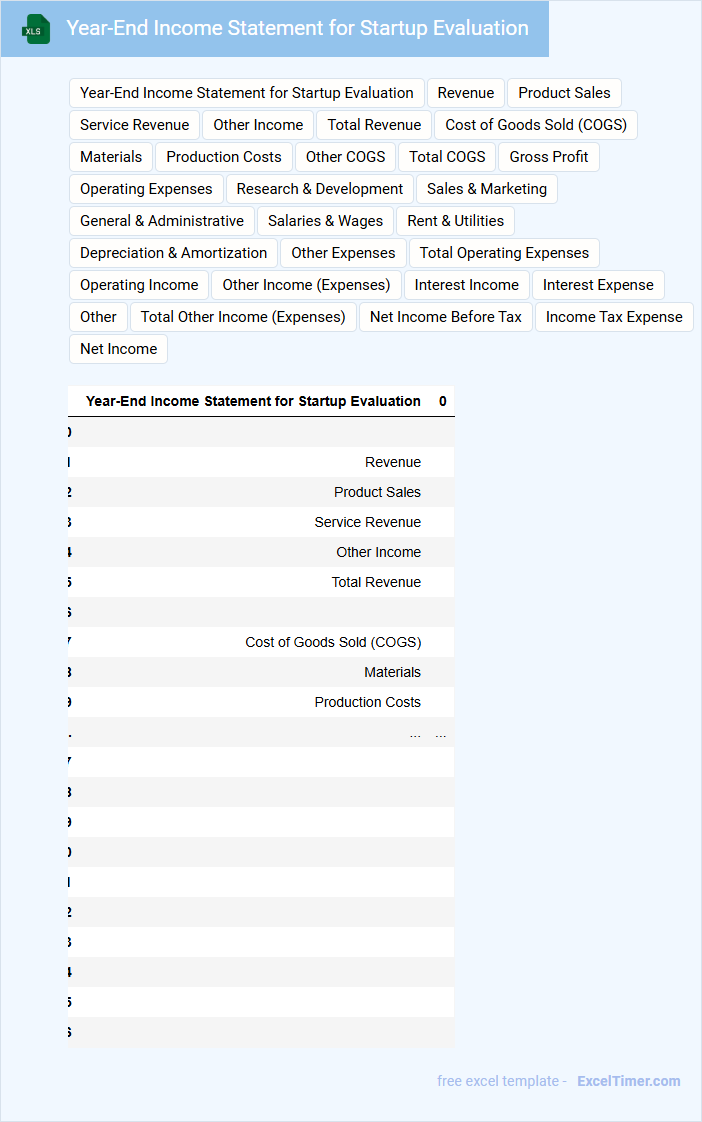

Year-End Income Statement for Startup Evaluation

Year-End Income Statement for Startup Evaluation typically contains a summary of revenues, expenses, and net profit or loss over the fiscal year.

- Revenue Details: Showcase all sources of income generated by the startup.

- Expense Breakdown: Provide a clear categorization of operational and non-operational expenses.

- Net Profit/Loss Summary: Highlight the overall profitability to assess financial health and growth potential.

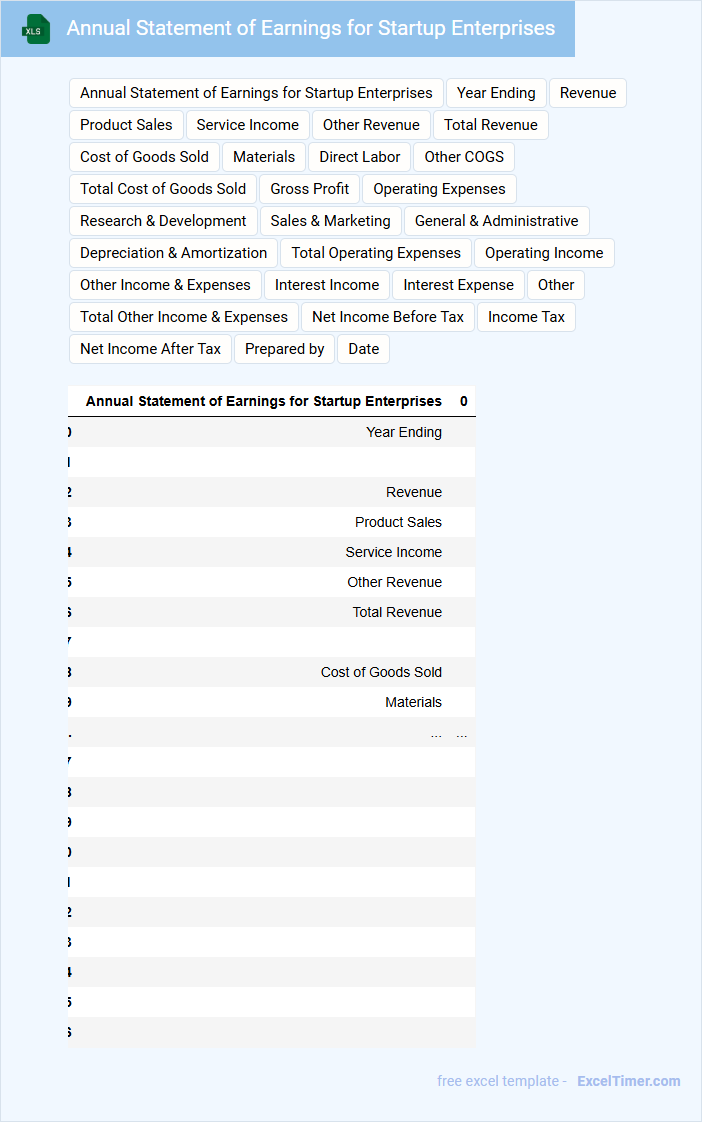

Annual Statement of Earnings for Startup Enterprises

An Annual Statement of Earnings for Startup Enterprises is a financial document that summarizes the company's revenue, expenses, and net income over the fiscal year. It provides insights into the startup's financial performance and profitability.

- Include detailed revenue streams to track different sources of income.

- Highlight major expenses to understand cost drivers and control measures.

- Present net earnings clearly to assess overall financial health and investor appeal.

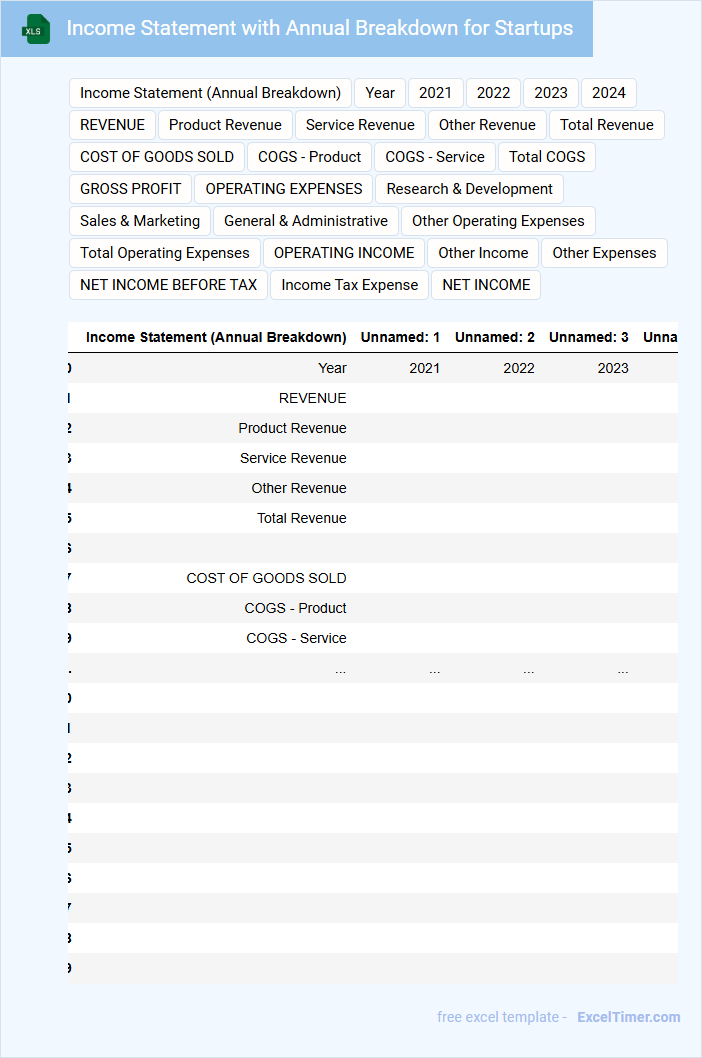

Income Statement with Annual Breakdown for Startups

An Income Statement with Annual Breakdown for Startups is a financial document that summarizes revenues, expenses, and profits over a specific fiscal year. It provides critical insights into the company's profitability and operational efficiency on an annual basis. This type of statement is essential for assessing the financial health and growth potential of the startup.

Typically, it contains revenue streams, cost of goods sold (COGS), operating expenses, taxes, and net income divided by each fiscal year. Including comparative yearly data helps identify trends, seasonality, and areas requiring financial adjustments. Startups should focus on clearly defining income sources and tracking recurring expenses to forecast future performance accurately.

To optimize its usefulness, ensure consistency in accounting periods and include detailed notes explaining significant variances across years. Highlighting gross profit margins and EBITDA can provide deeper operational insights for investors and stakeholders. Periodic reviews and updates of this document support strategic planning and funding negotiations.

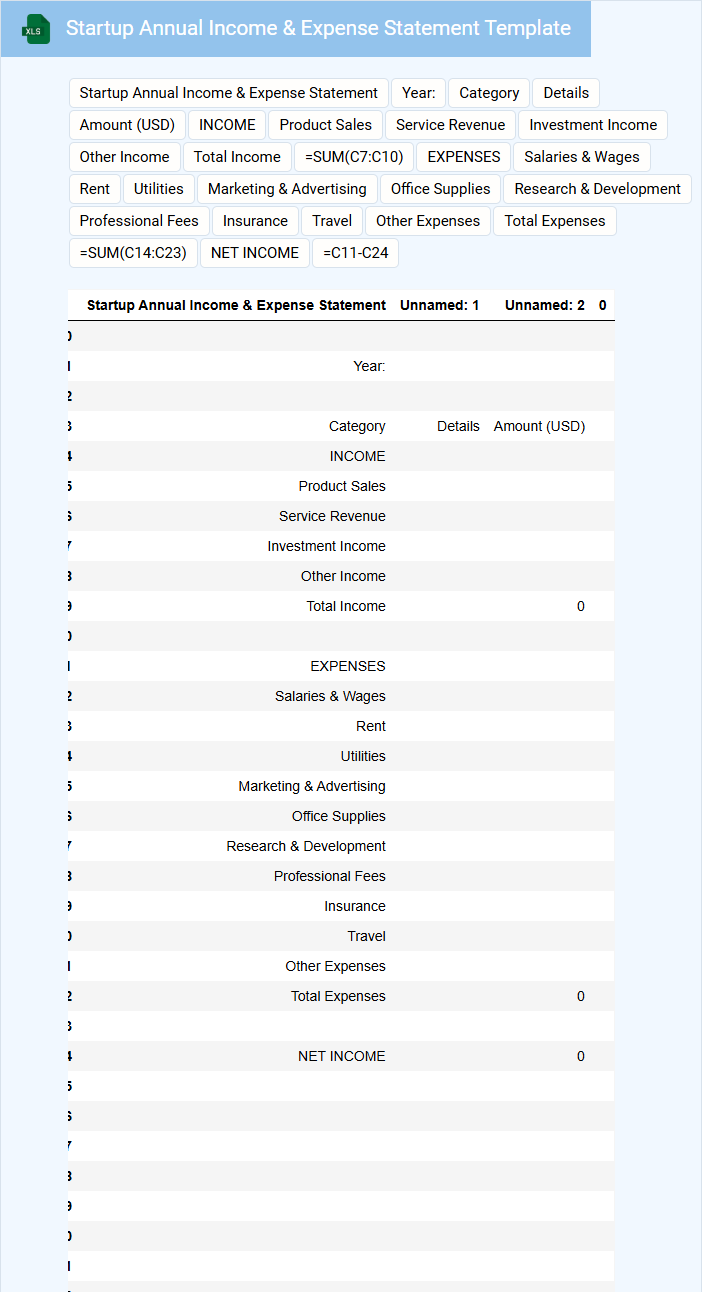

Startup Annual Income & Expense Statement Template

Startup Annual Income & Expense Statement Template typically contains a detailed record of all revenues and expenditures incurred throughout the fiscal year, helping businesses track financial performance. It is essential for budgeting, financial analysis, and making informed decisions to ensure business growth and sustainability.

- Include all sources of income such as sales, investments, and other revenue streams.

- Clearly categorize and record all operating expenses to monitor cash flow effectively.

- Regularly update the statement to reflect accurate and up-to-date financial information.

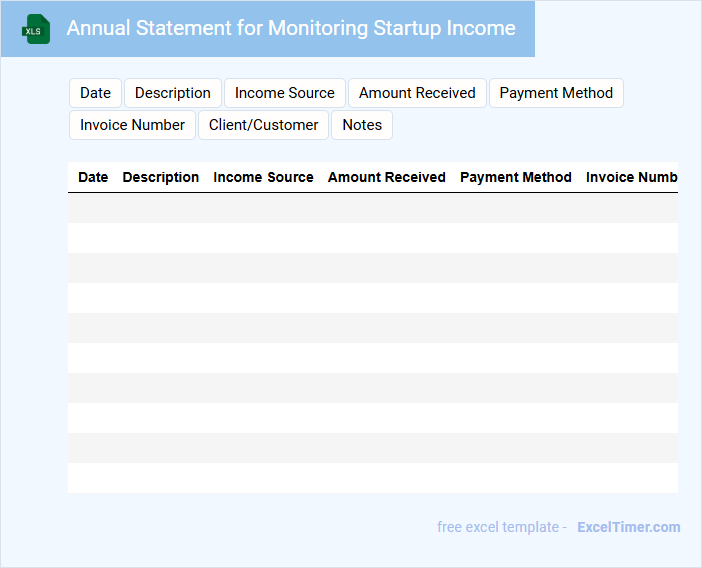

Annual Statement for Monitoring Startup Income

An Annual Statement for Monitoring Startup Income is a financial report that summarizes the revenue and expenses of a startup over the fiscal year. It helps stakeholders understand the company's financial health and growth trajectory.

Typically, this document contains detailed information about income sources, cost of goods sold, operating expenses, and net profit. Including clear categorization and accurate data is essential for effective financial analysis and decision-making.

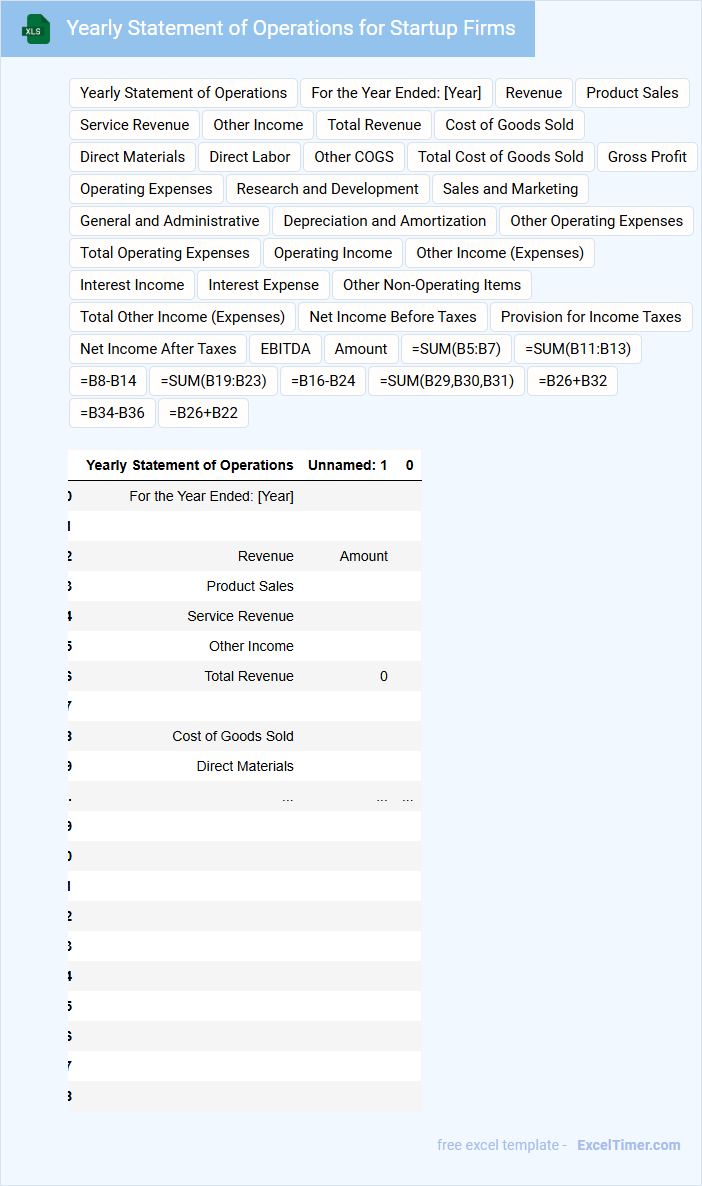

Yearly Statement of Operations for Startup Firms

What information is typically included in a Yearly Statement of Operations for Startup Firms? This document usually contains a detailed summary of revenues, expenses, and net income over the fiscal year, providing a clear overview of the company's financial performance. It helps stakeholders assess profitability, operational efficiency, and financial health to make informed business decisions.

What important factors should startup firms focus on when preparing this statement? Startups should ensure accurate categorization of income and expenses, highlight growth trends, and include notes explaining significant financial events or deviations to enhance transparency and credibility with investors and partners.

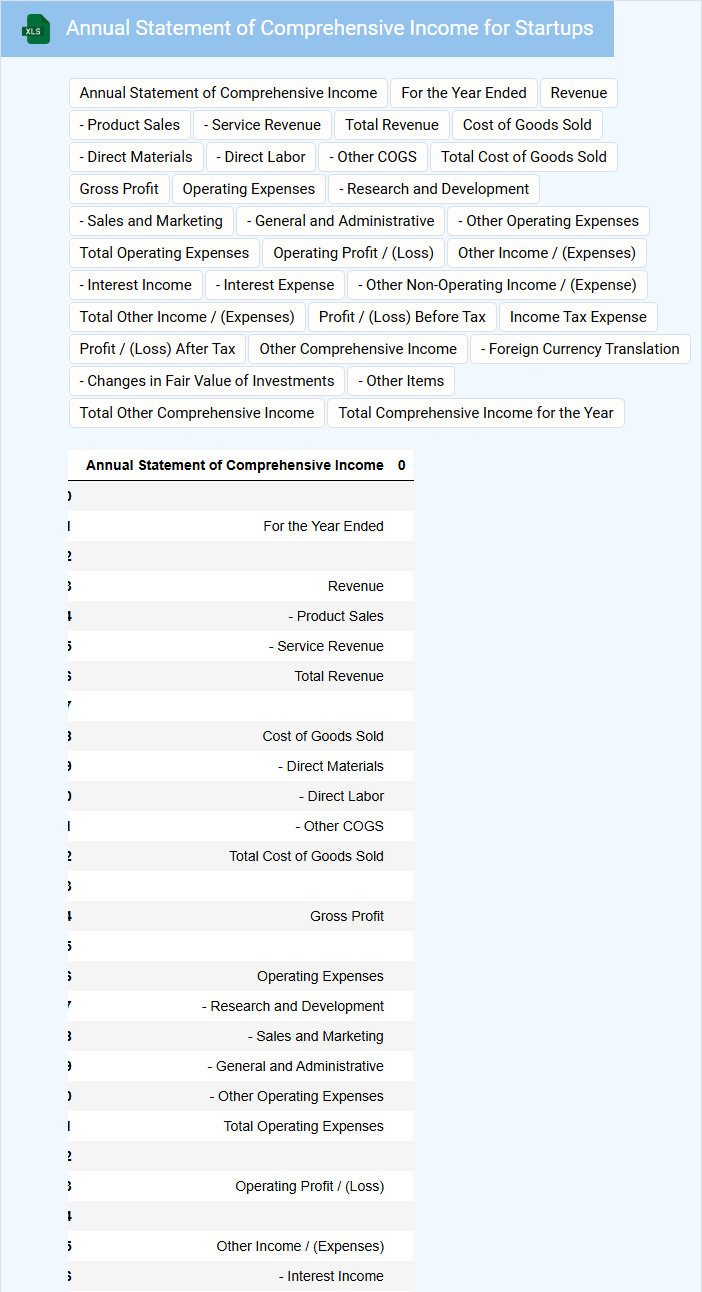

Annual Statement of Comprehensive Income for Startups

The Annual Statement of Comprehensive Income for startups is a financial document that outlines the company's revenues, expenses, and overall profit or loss over a fiscal year. It provides a detailed view of the startup's financial performance, including any other comprehensive income items that affect equity but are not captured in the profit and loss statement. This statement is crucial for stakeholders to assess the startup's financial health and operational success.

Key components typically include total revenue, cost of goods sold, operating expenses, and other comprehensive income such as unrealized gains or losses on investments. Startups should emphasize accuracy in reporting expenses and revenues to reflect true business performance and use clear categorizations to help investors understand financial trends. Regularly updating and reviewing this statement can assist in strategic planning and securing future funding.

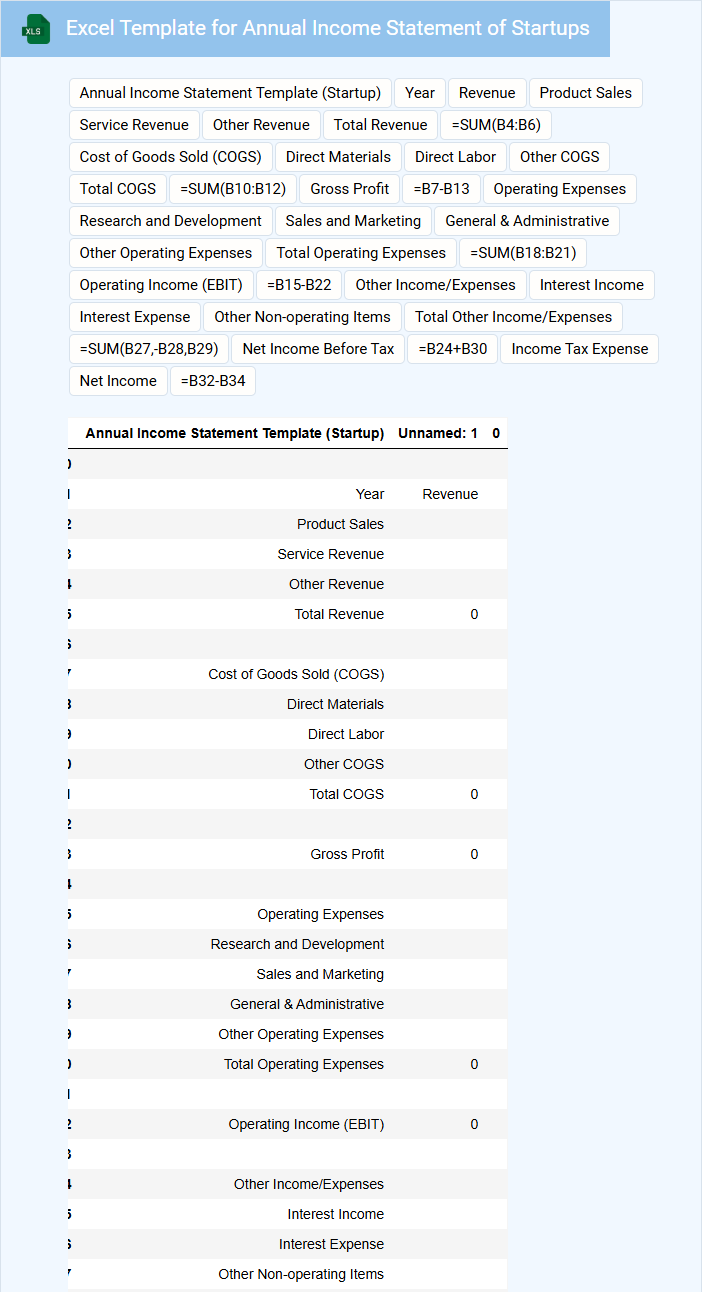

Excel Template for Annual Income Statement of Startups

What information does an Excel Template for Annual Income Statement of Startups typically contain? This type of document usually includes detailed records of revenues, expenses, and profits over a fiscal year, tailored specifically for startup companies. It helps founders track financial performance, plan budgets, and present clear financial summaries to investors and stakeholders.

What important features should be included in this Excel template? It should have customizable categories for income and expenses, automated calculations for net profit or loss, and visual aids like charts to interpret financial trends easily. Ensuring accuracy with error-proof formulas and providing space for notes on financial assumptions are also crucial for informed decision-making.

What are the key revenue streams included in the annual income statement for startups?

Key revenue streams included in the annual income statement for startups typically consist of product sales, service revenue, subscription fees, and licensing income. These streams reflect the primary sources generating cash inflow during the fiscal year. Tracking each revenue category helps startups assess financial performance and growth potential.

How are operating expenses categorized and tracked throughout the year?

Operating expenses in your annual income statement for startups are categorized into fixed costs, variable costs, and one-time expenditures. Each category is tracked monthly to monitor spending trends and optimize budget allocation. This detailed tracking ensures accurate financial analysis and informed decision-making.

What metrics on the income statement indicate profitability and cash flow health?

Key metrics indicating profitability on an Annually Income Statement for startups include Gross Profit, Operating Income, and Net Profit Margin. Cash flow health is reflected by metrics such as Operating Cash Flow and EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization). Monitoring these metrics helps assess financial performance and sustainability.

How does the annual income statement reflect investments or funding rounds for startups?

The annual income statement for startups records investments or funding rounds as non-operating income, impacting the overall financial position without affecting operating revenue. It highlights capital injections that strengthen cash flow and liquidity, essential for growth and operational scalability. Accurate reflection of funding rounds aids investors in assessing startup financial health and sustainability.

Which line items most critically impact net income for early-stage companies?

In early-stage startups, revenue growth and cost of goods sold (COGS) are critical line items that significantly impact net income. Operating expenses, especially salaries and marketing costs, also heavily influence profitability. Closely monitoring these elements helps ensure sustainable financial performance and cash flow management.