The Annually Donation Record Excel Template for Nonprofit Organizations streamlines tracking yearly contributions, ensuring accurate financial management and donor accountability. This template helps nonprofits organize donor information, donation dates, and amounts in a clear, user-friendly format. Efficient record-keeping enhances transparency and supports fundraising efforts by providing easy access to detailed donation histories.

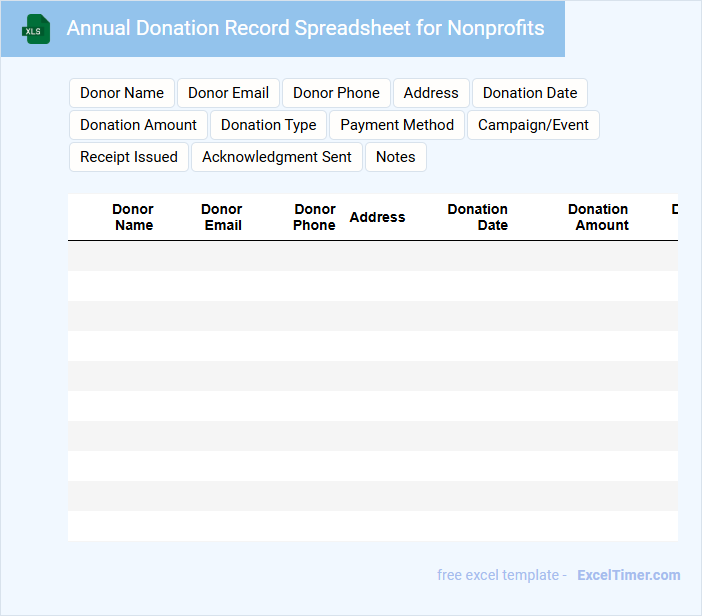

Annual Donation Record Spreadsheet for Nonprofits

An Annual Donation Record Spreadsheet for Nonprofits typically contains detailed information about donors and their contributions throughout the year. It helps organizations track fundraising progress and maintain transparency.

- Include donor names, contact details, and donation amounts for accurate record-keeping.

- Organize data by date to monitor giving trends and seasonality.

- Incorporate notes on donation purposes or restrictions to manage funds responsibly.

Excel Template for Yearly Donation Tracking

What information is typically included in an Excel Template for Yearly Donation Tracking? This type of document usually contains detailed records of donor names, donation amounts, dates, and methods of donation to provide a comprehensive overview of charitable contributions throughout the year. It helps organizations efficiently monitor donation trends, maintain accurate financial reports, and ensure transparency.

What is important to consider when using such a template? It is crucial to ensure the template is easy to update regularly and includes fields for categorizing donations by type, purpose, or campaign. Additionally, incorporating automated summaries and charts can enhance data analysis and support better decision-making for future fundraising efforts.

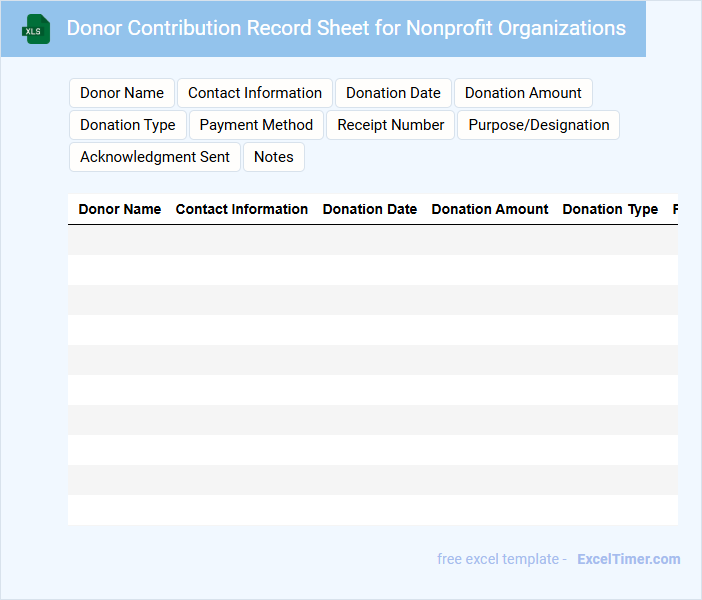

Donor Contribution Record Sheet for Nonprofit Organizations

The Donor Contribution Record Sheet is an essential document for nonprofit organizations that tracks individual or corporate donations. It typically includes donor names, contact information, donation amounts, and dates to maintain transparent financial records. Keeping accurate records helps nonprofits acknowledge contributions and comply with legal and tax requirements.

Important elements to include are clear donor identification, precise contribution details, and dates of receipt. Organizations should also ensure data privacy and implement regular updates to maintain current and reliable information. A well-organized record sheet supports fundraising efforts and fosters trust with donors and stakeholders.

Annual Giving Tracker Excel Template for Nonprofits

An Annual Giving Tracker Excel Template for nonprofits is primarily used to monitor and organize all donation activities throughout the year. It helps organizations maintain clear records of donor information, contribution amounts, and donation dates.

This document typically includes sections for donor contact details, giving categories, and monthly or yearly donation summaries. To maximize efficiency, ensure the template allows for easy data filtering and includes visual charts for quick insight into giving trends.

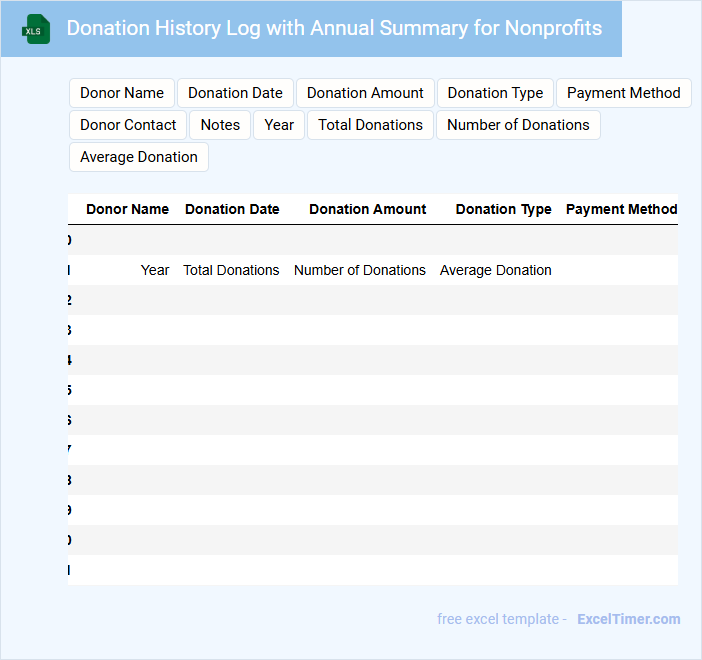

Donation History Log with Annual Summary for Nonprofits

What information is typically included in a Donation History Log with Annual Summary for Nonprofits?

This document usually contains detailed records of all donations received over a specific period, including donor names, amounts, dates, and donation types. It also provides an annual summary that highlights total funds raised, trends, and key contributors to help the organization analyze its fundraising effectiveness.

Important elements to focus on include accurate and consistent data entry, clear categorization of donations, and a comprehensive summary that supports financial reporting and strategic planning for future fundraising efforts.

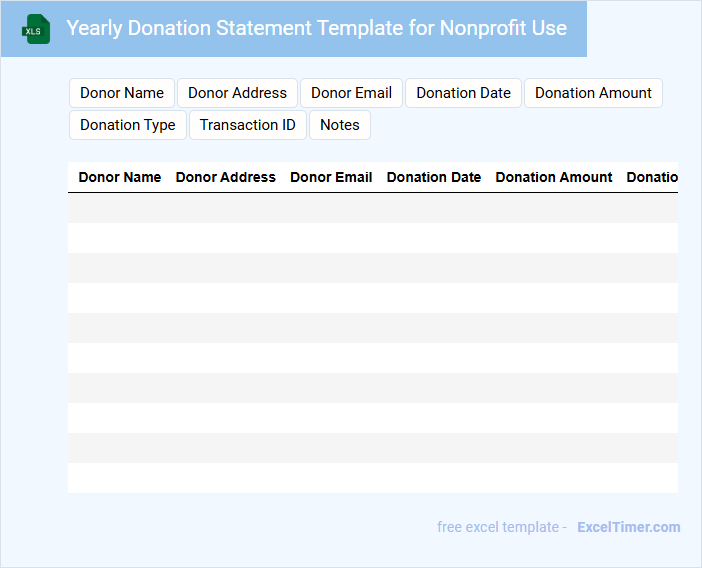

Yearly Donation Statement Template for Nonprofit Use

The Yearly Donation Statement Template is a crucial document for nonprofits, summarizing all contributions made by donors within a given year. It typically contains donor information, donation amounts, and dates of contributions, serving as an official record for tax and acknowledgment purposes. Including a clear thank-you note and contact details enhances donor relations and compliance.

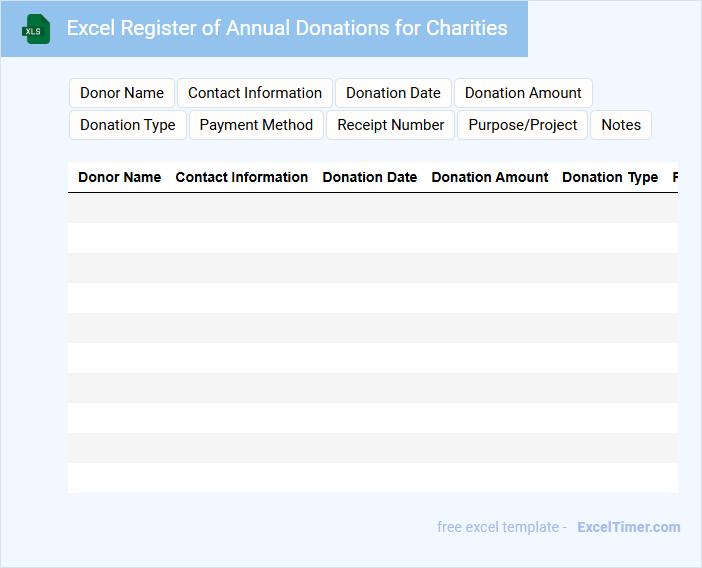

Excel Register of Annual Donations for Charities

What information is typically included in an Excel Register of Annual Donations for Charities? This document usually contains detailed records of donors, donation amounts, dates, and purposes of contributions, helping organizations track their fundraising efforts efficiently. It also organizes data to facilitate reporting and ensure transparency to stakeholders.

Why is it important to maintain accuracy and consistency in this register? Accurate and consistent entries prevent discrepancies and support compliance with financial regulations and audit requirements. Additionally, regularly updating the document helps in analyzing donation trends and planning future fundraising campaigns effectively.

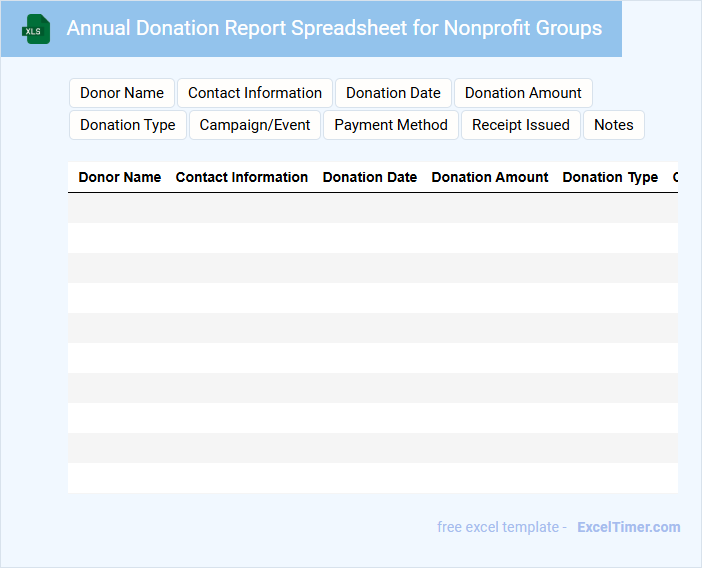

Annual Donation Report Spreadsheet for Nonprofit Groups

What information is typically included in an Annual Donation Report Spreadsheet for Nonprofit Groups? This type of document usually contains detailed records of all donations received throughout the year, including donor names, donation amounts, dates, and types of donations. It helps nonprofit organizations track their fundraising progress, maintain transparency, and generate financial reports for stakeholders.

What is an important consideration when preparing this report? Ensuring accurate and consistent data entry is crucial to maintain the integrity of the report. Additionally, including categories for donation sources and purposes can enhance the analysis and strategic planning for future fundraising efforts.

Excel Tracker for Yearly Contributions of Donors

An Excel Tracker for yearly contributions of donors serves as a detailed record of all donations made throughout the year. It helps organizations monitor financial support and identify patterns in donor giving behavior.

This type of document typically contains donor names, contribution amounts, dates of donations, and cumulative totals. For accuracy, it is important to include clear categorization and regular updates to maintain data integrity.

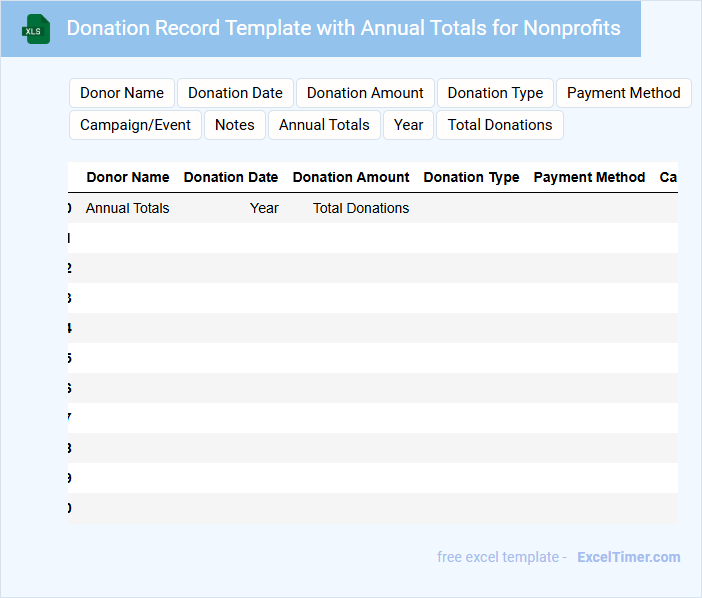

Donation Record Template with Annual Totals for Nonprofits

A Donation Record Template for nonprofits is a structured document used to track all contributions received throughout the year. It typically includes donor details, donation amounts, dates, and payment methods, organized to provide clear annual totals. This template helps nonprofit organizations maintain accurate financial records and ensure transparency with donors and regulatory bodies.

Important elements to include are donor contact information, donation purpose or designation, and a summary of yearly totals to monitor fundraising progress. Additionally, incorporating a column for tax receipt issuance dates can improve compliance with tax regulations. Using this template regularly supports effective financial management and donor relationship building.

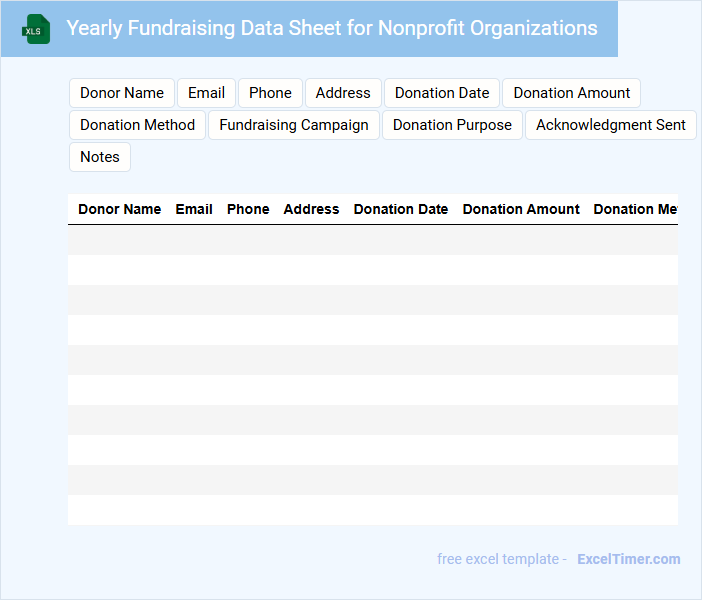

Yearly Fundraising Data Sheet for Nonprofit Organizations

The Yearly Fundraising Data Sheet is a crucial document for nonprofit organizations, summarizing all financial contributions and donor details over the course of a year. It typically includes total funds raised, donor demographics, and campaign performance metrics. This sheet helps nonprofits analyze trends, evaluate fundraising effectiveness, and plan future strategies.

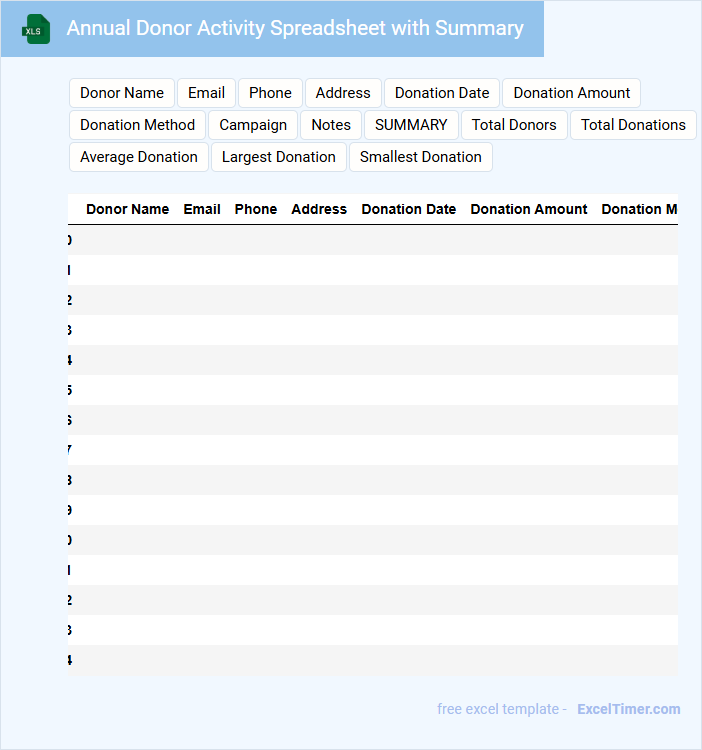

Annual Donor Activity Spreadsheet with Summary

The Annual Donor Activity Spreadsheet typically contains detailed records of donor engagement, including donation amounts, dates, and frequency. It provides an organized overview of individual and organizational contributions over the year.

A Summary section highlights key metrics such as total funds raised, donor retention rates, and notable trends in giving patterns. This helps stakeholders quickly assess the effectiveness of fundraising efforts.

Ensure accuracy in data entry and include clear labels for easy analysis and reporting.

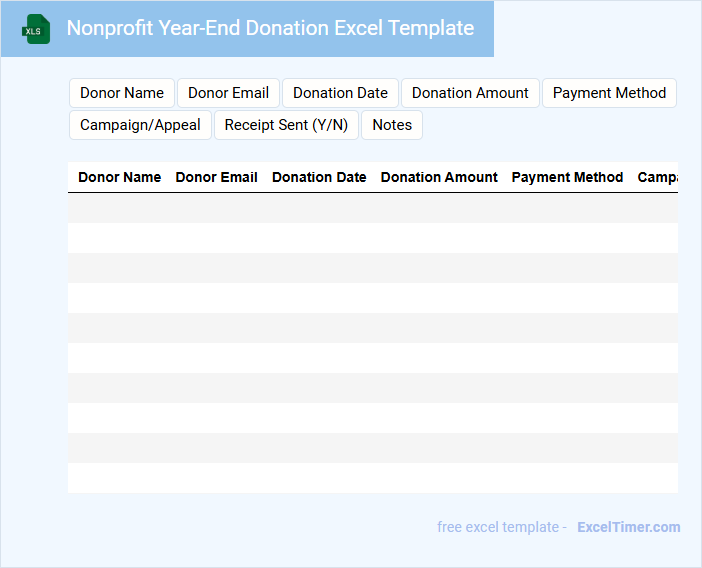

Nonprofit Year-End Donation Excel Template

A Nonprofit Year-End Donation Excel Template is typically used to track and organize donations received throughout the year. It helps nonprofit organizations manage their donor information and financial records for reporting and tax purposes.

- Include detailed donor contact information and donation amounts for accurate record-keeping.

- Incorporate columns for donation dates and payment methods to facilitate auditing.

- Use summary tables and charts to visualize total donations and identify trends.

Excel Sheet for Management of Annual Donations

An Excel Sheet for Management of Annual Donations typically contains detailed records of donor information, donation amounts, and dates. It is designed to track the inflow of funds and categorize donations for easy reporting.

This document is essential for maintaining accurate financial records and ensuring transparency in donation management. Regular updates and data validation are important to avoid errors and improve reliability.

Consider including summary charts and automated formulas to enhance data analysis and decision-making processes.

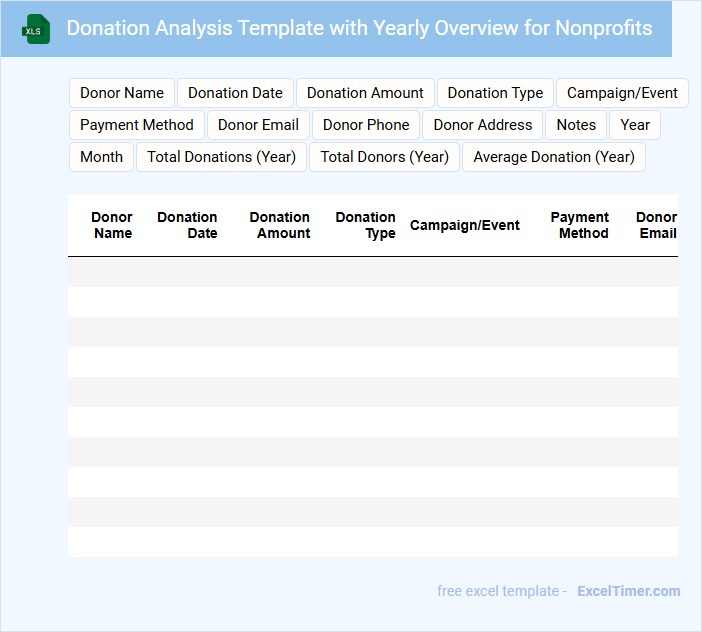

Donation Analysis Template with Yearly Overview for Nonprofits

What information does a Donation Analysis Template with Yearly Overview for Nonprofits typically contain? This document usually includes detailed records of donations received throughout the year, categorized by donor type, amount, and frequency. It helps nonprofits track fundraising performance and identify trends to optimize future campaigns effectively.

Why is it important to include a yearly overview in this template? A yearly overview provides a comprehensive snapshot of donation patterns over time, enabling organizations to measure growth and assess the impact of outreach efforts. Including key performance indicators and visual summaries can enhance data interpretation and strategic planning.

How can you structure an Excel sheet to track donor names, donation amounts, and donation dates annually?

Create an Excel sheet with columns labeled Donor Name, Donation Amount, and Donation Date to organize annual donation records efficiently. Include a Year column to filter and analyze donations by year, enabling clear tracking of yearly contributions. Use Excel functions like SUMIFS and filters to summarize total donations per donor and identify donation trends annually.

What formulas can be used to sum total donations and calculate the average annual donation per donor?

Use the SUM formula to calculate total donations, for example, =SUM(B2:B100) if donations are in column B. Calculate the average annual donation per donor with the AVERAGE formula, like =AVERAGE(B2:B100). Employing these formulas helps track total contributions and donor giving trends efficiently.

How can you use Excel filters or pivot tables to generate donation reports by year or donor category?

Excel filters enable quick sorting and isolating donations by specific years or donor categories, streamlining data analysis for nonprofit annual donation records. Pivot tables summarize large donation datasets efficiently, allowing users to aggregate amounts by year or donor type and easily visualize trends. Both tools enhance reporting accuracy and support strategic fundraising decisions through dynamic, customizable views.

What data validation techniques help ensure accuracy in donor contact and donation entry fields?

Implementing data validation techniques such as dropdown lists for predefined categories, date pickers for donation dates, and format restrictions for phone numbers and email addresses ensures accurate donor contact and donation entries in annual donation records. Utilizing conditional formatting highlights inconsistent or missing data, prompting correction before final submission. Integrating these validations within Excel streamlines data integrity for nonprofit organization records.

How can you visualize annual donation trends with charts or graphs in Excel for nonprofit reporting?

Create line charts in Excel to visualize annual donation trends by plotting donation amounts on the y-axis and years on the x-axis, highlighting growth or decline. Use bar charts to compare yearly donation totals across different nonprofit organizations for clearer insights. Incorporate pivot tables to aggregate donation data before graphing for dynamic trend analysis and reporting efficiency.