The Annually Investment Portfolio Excel Template for Individual Investors helps track and manage yearly investment performance efficiently. It allows users to analyze asset allocation, monitor portfolio growth, and calculate returns with ease. Ensuring accurate financial planning, this template supports better decision-making for personal investment strategies.

Annual Investment Portfolio Tracker for Individuals

An Annual Investment Portfolio Tracker for individuals typically contains detailed records of all investments made throughout the year, including stocks, bonds, mutual funds, and other assets. It provides a clear summary of portfolio performance, asset allocation, and changes in value over time. This document helps investors monitor progress, make informed decisions, and achieve financial goals effectively.

Key suggestions for maintaining an effective tracker include regularly updating all transactions, categorizing investments by type and risk level, and including notes on market conditions or personal investment strategies. Additionally, incorporating visual aids such as charts and graphs can enhance understanding of portfolio trends and diversification. Consistency and accuracy are crucial to maximizing the utility of the tracker for annual review and planning.

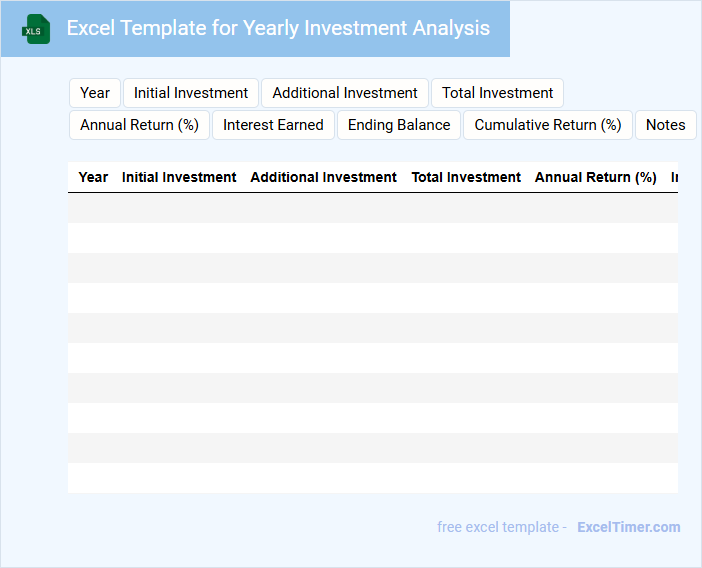

Excel Template for Yearly Investment Analysis

An Excel Template for Yearly Investment Analysis typically contains detailed financial data, including income, expenses, and investment returns over a calendar year. It organizes information to help track performance trends and conduct comparative analysis efficiently.

The document usually features charts, summary tables, and key metrics like ROI and growth rates for a clear visualization of investment health. Incorporating dynamic formulas and up-to-date market assumptions is essential for accuracy and relevance.

For optimal usage, ensure the template includes customizable sections for different asset classes and allows easy updates for changing financial conditions.

Annual Asset Allocation Spreadsheet for Investors

An Annual Asset Allocation Spreadsheet is a crucial tool for investors to systematically organize and track their investment portfolios over the year. It typically contains detailed information on various asset classes, their proportions, and performance metrics. This document helps investors make informed decisions by providing a clear overview of portfolio diversification and adjustments needed.

Important elements to include are categories of assets like stocks, bonds, and cash equivalents; target versus actual allocation percentages; and notes on rebalancing strategies. Incorporating historical data and future projections can enhance strategic planning. Ensuring accuracy and regularly updating the spreadsheet are essential for maintaining effective portfolio management.

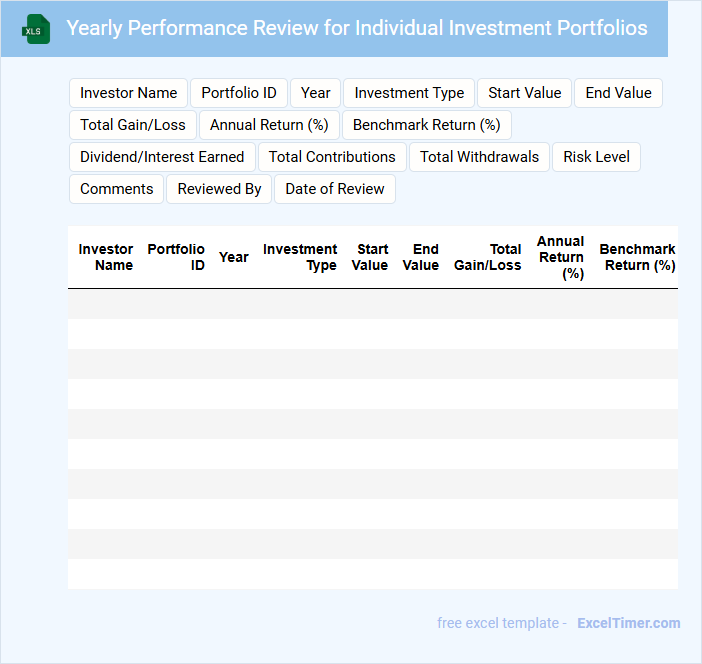

Yearly Performance Review for Individual Investment Portfolios

A Yearly Performance Review for Individual Investment Portfolios typically contains a summary of the investment performance, asset allocation analysis, and recommendations for future adjustments.

- Performance Summary: An overview of portfolio returns compared to benchmarks.

- Asset Allocation: Detailed breakdown of investments across various asset classes.

- Recommendations: Suggestions for rebalancing or shifting investment strategies to optimize returns.

Annual Dividend Tracking Template for Stock Investors

Annual Dividend Tracking Templates for Stock Investors typically contain detailed records of dividend payments received from various stocks over a fiscal year. These documents help investors monitor income streams and analyze investment performance effectively.

- Include the stock name, dividend amount, and date received for accurate tracking.

- Update the template regularly to reflect dividend reinvestments and stock splits.

- Summarize total dividends per stock and overall portfolio for financial review.

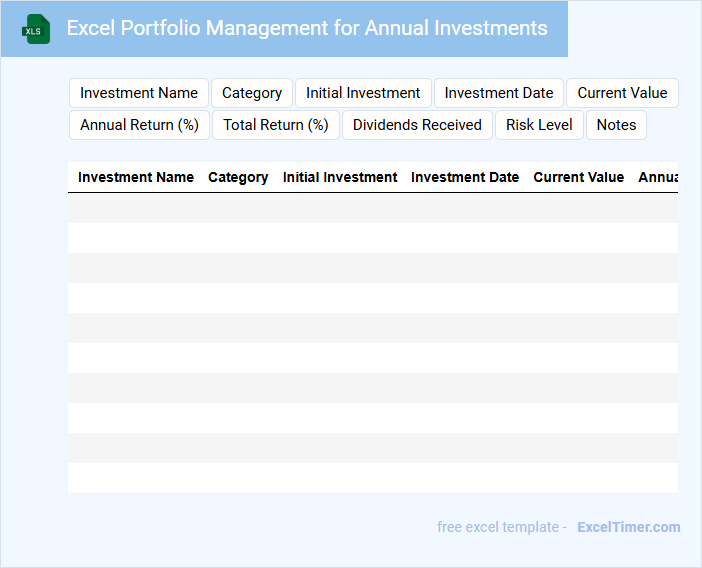

Excel Portfolio Management for Annual Investments

An Excel portfolio management document typically contains detailed records of investment assets, tracking performance, allocations, and returns over a specified period. It provides a structured overview to facilitate informed decision-making and risk assessment.

For annual investments, this document highlights yearly contributions, withdrawals, and growth metrics, enabling evaluation of investment strategy effectiveness. Regular updates and accurate data entry are crucial for maintaining its reliability and usefulness.

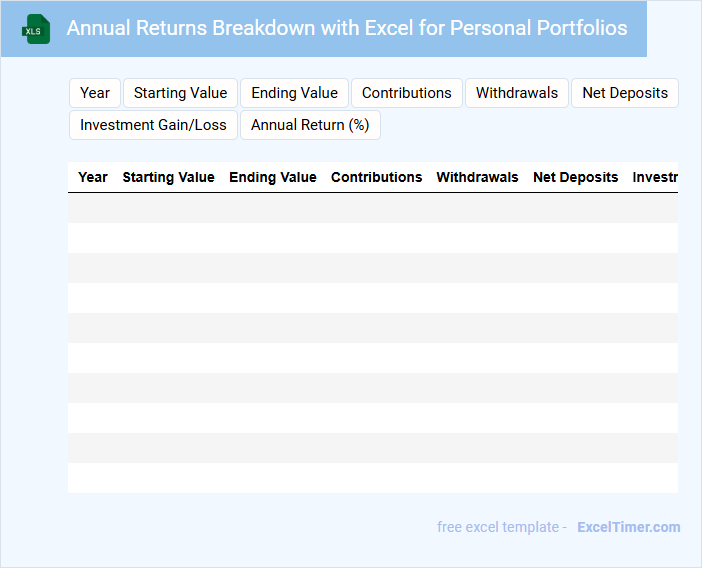

Annual Returns Breakdown with Excel for Personal Portfolios

Annual Returns Breakdown with Excel for Personal Portfolios typically contains a detailed analysis of investment performance over a specific period, presented in a structured and easy-to-understand format. This document highlights annual returns, enabling investors to track growth, losses, and trends effectively. Key components often include charts, formulas, and comparative data to assist in informed decision-making and portfolio optimization.

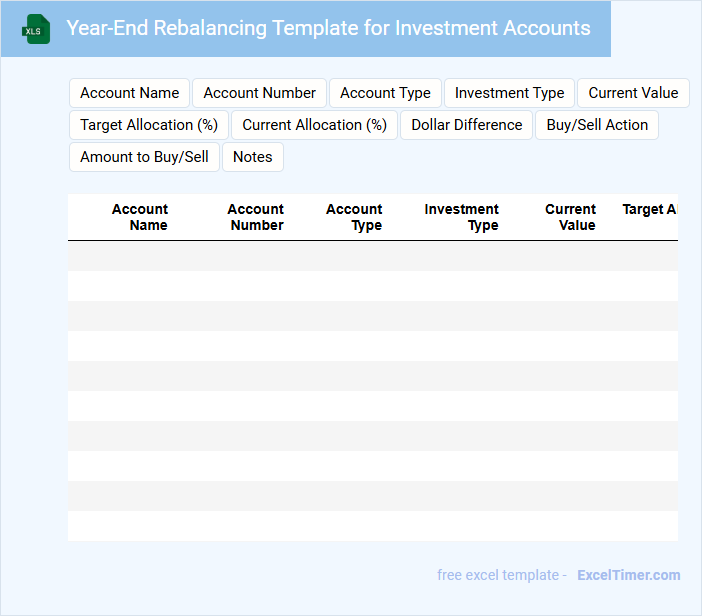

Year-End Rebalancing Template for Investment Accounts

What does a Year-End Rebalancing Template for Investment Accounts typically contain?

This type of document usually includes a detailed summary of current investment allocations, target portfolio percentages, and recommended transactions to realign the portfolio according to investment goals. It also provides a review of account performance and tax implications to assist in making informed adjustments.

Important considerations when using this template include ensuring accurate asset valuation, considering tax consequences of trades, and setting realistic target allocations based on risk tolerance and financial objectives. Regularly updating the template helps maintain a balanced portfolio aligned with long-term investment strategies.

Annual Investment Growth Tracker for Individuals

What does an Annual Investment Growth Tracker for Individuals typically contain? This document usually includes detailed records of yearly investment performance, tracking the growth or decline of various assets. It provides a clear overview of portfolio development and helps investors assess the effectiveness of their financial strategies over time.

What is an important feature to include in this tracker? It is essential to incorporate a comparison of actual returns against targeted goals to evaluate progress accurately. Additionally, including summaries of asset allocation and risk adjustments enhances decision-making for future investments.

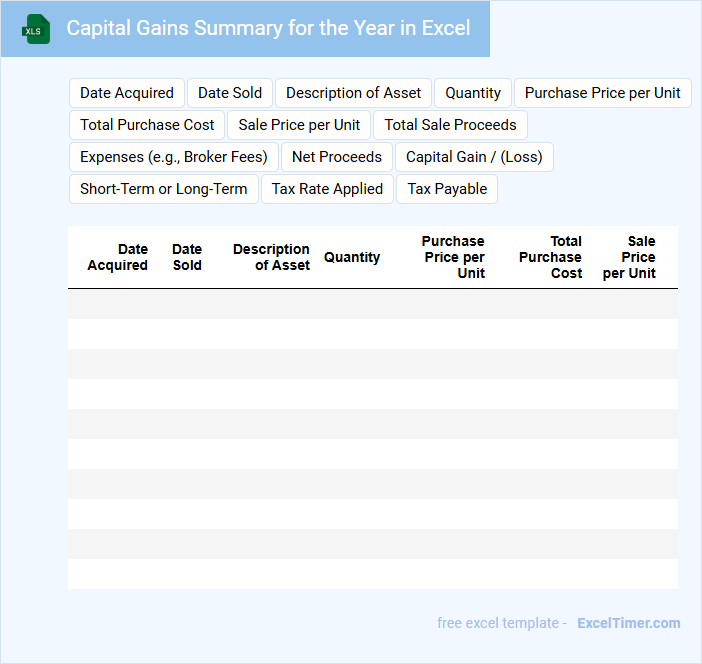

Capital Gains Summary for the Year in Excel

The Capital Gains Summary document typically contains a detailed record of profits or losses realized from the sale of assets within a specific year. It aggregates transactions including stocks, bonds, and real estate to provide a clear financial overview.

For preparation in Excel, it's essential to include accurate purchase and sale dates, cost basis, and sale prices to calculate gains or losses correctly. Ensuring precise categorization of short-term and long-term gains improves tax reporting efficiency.

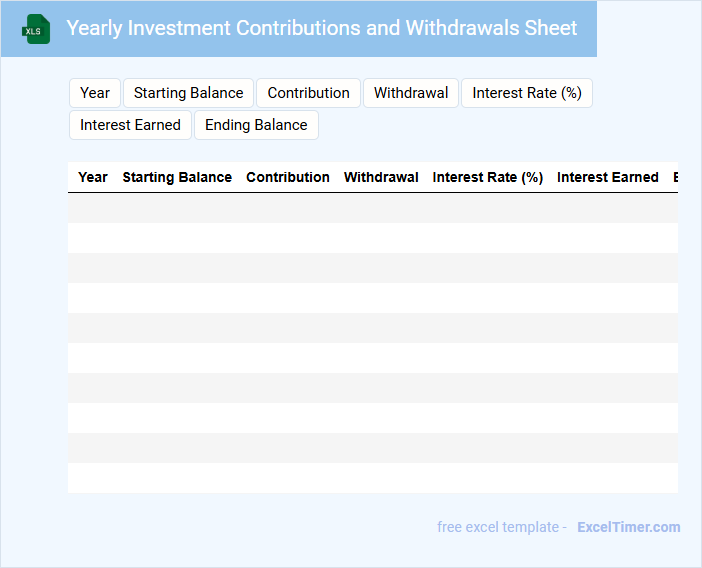

Yearly Investment Contributions and Withdrawals Sheet

The Yearly Investment Contributions and Withdrawals Sheet typically contains detailed records of all financial inputs and outputs related to investment accounts over a calendar year. It helps in tracking the cash flow for investments and maintaining an organized overview of fund movements.

Key components include dates, amounts contributed or withdrawn, and the type of investment involved, ensuring clarity in financial planning. Regularly updating the sheet is crucial for accurate tax reporting and assessing investment performance effectively.

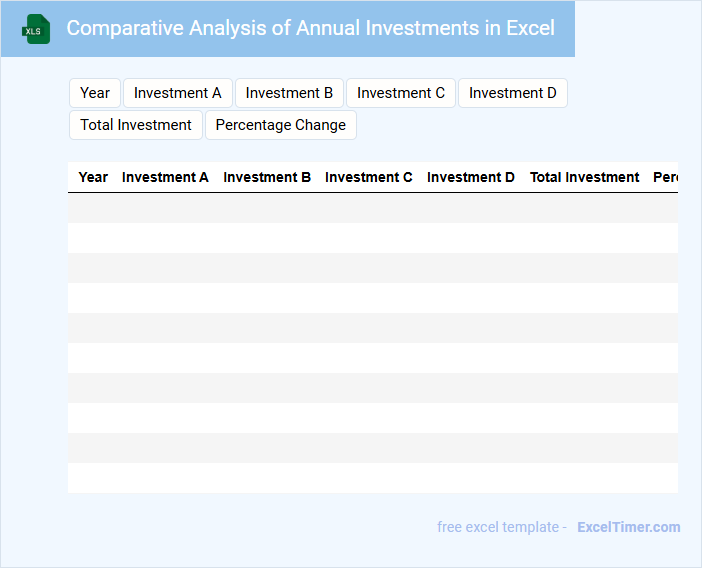

Comparative Analysis of Annual Investments in Excel

What is usually contained in a Comparative Analysis of Annual Investments document in Excel? This type of document typically includes detailed data tables comparing investment returns, risks, and durations across different years. It visually represents trends using charts and summarizes key findings to facilitate informed decision-making.

What important elements should be included for an effective comparative analysis? Essential components include clear labeling of investment categories, consistent time frames, comprehensive metrics such as ROI and volatility, and insightful summaries that highlight significant differences and patterns.

Investment Goal Progress Tracker for the Year

What is typically included in an Investment Goal Progress Tracker for the Year? This document usually contains a clear outline of specific investment goals, timelines, and key performance indicators to monitor progress throughout the year. It helps investors systematically track returns, adjust strategies, and stay focused on their financial objectives.

What is an important consideration when using this tracker? Consistent and accurate data entry is crucial to ensure meaningful insights, allowing for timely adjustments based on market conditions and personal financial changes. Regular reviews can enhance decision-making and improve overall investment outcomes.

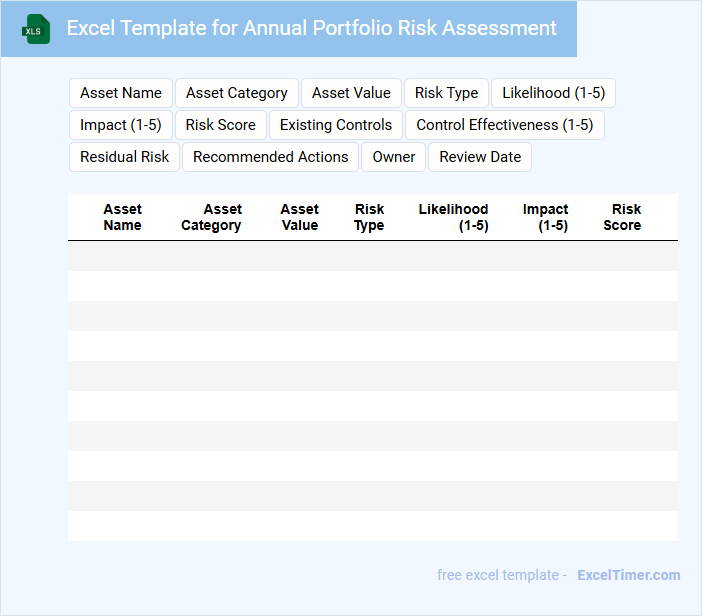

Excel Template for Annual Portfolio Risk Assessment

An Excel Template for Annual Portfolio Risk Assessment is typically designed to evaluate and document the potential risks within an investment portfolio over a year. It contains data fields for asset allocation, risk metrics, historical performance, and scenario analysis. Key insights and recommendations help stakeholders make informed decisions to mitigate potential financial losses.

Annual Expense Tracking with Investment Returns Excel

What information is typically included in an Annual Expense Tracking with Investment Returns Excel document? This type of document usually contains detailed records of yearly expenses categorized by type alongside tracking of investment returns over the same period. It helps individuals or businesses monitor spending habits and evaluate the performance of investments to make informed financial decisions.

What are the essential data columns needed to track an annually updated investment portfolio in Excel?

Essential data columns for tracking an annually updated investment portfolio in Excel include Investment Name, Asset Type, Purchase Date, Purchase Price, Quantity Held, Current Market Price, Current Value, Annual Dividends, Annual Returns, and Portfolio Allocation Percentage. Including columns for Risk Level, Sector, and Tax Implications helps in detailed portfolio analysis. These columns enable comprehensive tracking of performance, income, and diversification throughout the year.

How do you calculate and display annual returns and compound growth rates for each investment?

Annual returns for each investment are calculated by dividing the difference between the ending and beginning values by the beginning value, then multiplying by 100 to express as a percentage. Compound Annual Growth Rate (CAGR) is computed using the formula CAGR = [(Ending Value / Beginning Value)^(1/Number of Years)] - 1, converting the result to a percentage. Display results in separate columns labeled "Annual Return (%)" and "CAGR (%)" to clearly track investment performance over time.

What is the most effective way to represent asset allocation and diversification using charts or tables?

The most effective way to represent asset allocation and diversification in your annual investment portfolio is through a pie chart that visually breaks down percentage allocations across asset classes. Complement this with a table listing each asset type, its value, and portfolio weight to provide precise numerical details. Combining these visual and numeric tools enhances understanding of diversification and investment balance.

How can you automate annual investment summary reports using formulas and pivot tables?

Automate annual investment summary reports by using Excel formulas like SUMIFS and YEAR to aggregate transactions by year and investment type. Create pivot tables to dynamically summarize data, showing total returns, contributions, and asset allocation for each year. Link pivot table results to a dashboard for real-time updates and easy visualization of portfolio performance.

What features in Excel help monitor risk, volatility, and portfolio rebalancing needs each year?

Excel's built-in functions like Data Analysis Toolpak enable advanced risk and volatility calculations, including standard deviation and correlation matrices. PivotTables and conditional formatting help track portfolio performance and highlight assets needing rebalancing. You can create dynamic dashboards using charts and slicers to monitor your investment portfolio annually with precision.