The Annually Donation Record Excel Template for Nonprofits streamlines tracking yearly contributions, ensuring accurate financial management. This template helps nonprofits maintain organized donor information, monitor donation trends, and simplify tax reporting. Reliable record-keeping enhances transparency and supports effective fundraising strategies.

Annual Donation Record with Donor Details Excel Template

An Annual Donation Record with Donor Details Excel Template is typically used to track yearly contributions made by donors. It contains donor names, contact information, donation amounts, and dates. Maintaining this data helps organizations analyze giving patterns and ensure accurate reporting.

To optimize the template, it is important to include columns for donor contact preferences and payment methods. Accurate data entry and regular updates improve donor relationship management and financial transparency. Implementing validation rules in Excel can minimize errors and keep records consistent.

Excel Template for Yearly Donation Tracking of Nonprofits

An Excel template for yearly donation tracking is designed to help nonprofits efficiently record and manage their donations throughout the year. This type of document typically contains fields for donor information, donation amounts, dates, and payment methods. It also includes summary sections for tracking total funds raised and identifying trends over time.

For optimal use, ensure the template is user-friendly and includes automated calculations for quick updates. Incorporate data validation to minimize entry errors and maintain consistent formatting for easy analysis. Regular backups and clear instructions for data entry are important for accuracy and long-term usability.

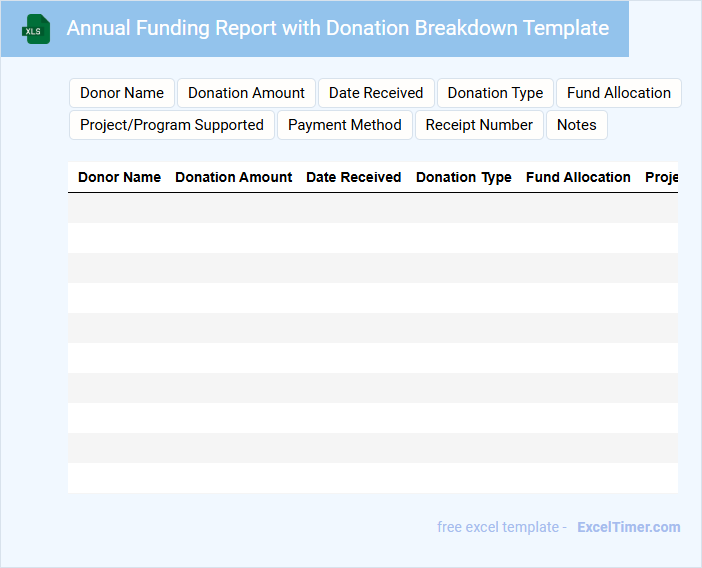

Annual Funding Report with Donation Breakdown Template

The Annual Funding Report typically contains a detailed overview of the organization's financial health over the year, highlighting sources of income and allocation of funds. This document often includes a comprehensive donation breakdown, categorizing contributions by donor type, campaign, or time period. It serves as a transparent record for stakeholders to assess funding effectiveness and inform strategic planning.

Important elements to include are clear financial summaries, visual data representations such as charts or graphs, and donor recognition sections. Accuracy and clarity in reporting donation amounts and fund usage promote trust and accountability. Additionally, incorporating future funding goals can guide donor engagement and organizational growth.

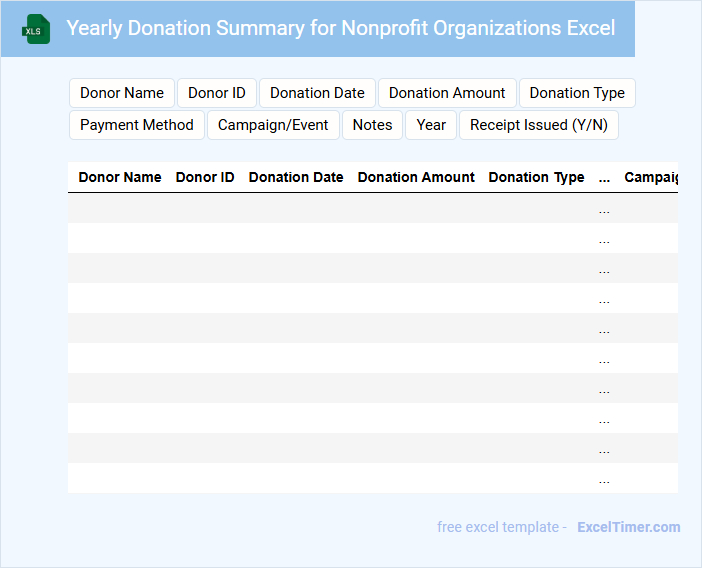

Yearly Donation Summary for Nonprofit Organizations Excel

The Yearly Donation Summary for Nonprofit Organizations typically contains detailed records of all contributions received throughout the year, including donor names, donation amounts, and dates. This document helps track fundraising progress and financial support transparently.

It is essential to organize data clearly and ensure accuracy for effective reporting and tax purposes. Including a summary of total donations and categorizing donors can enhance usability and strategic planning.

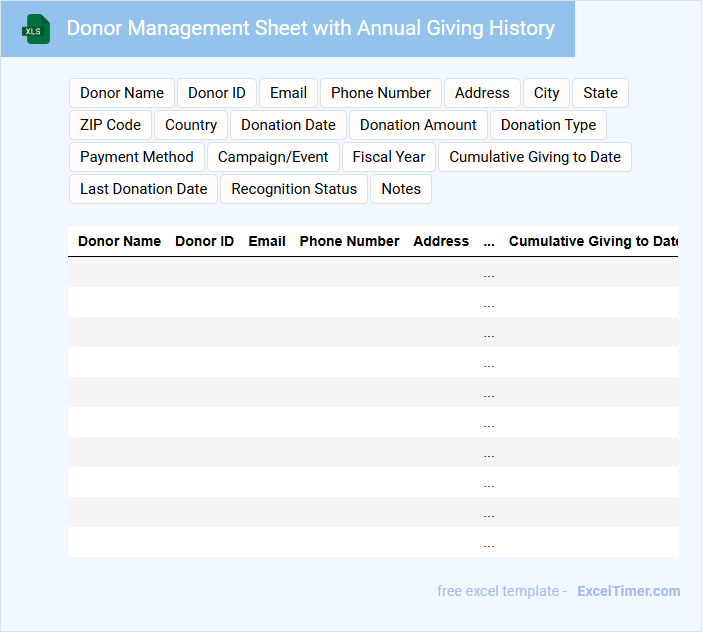

Donor Management Sheet with Annual Giving History

What information is typically included in a Donor Management Sheet with Annual Giving History? This document usually contains detailed records of individual donor contributions over multiple years, including donation amounts, dates, and frequency. It helps organizations track giving patterns, recognize valuable supporters, and plan future fundraising strategies effectively.

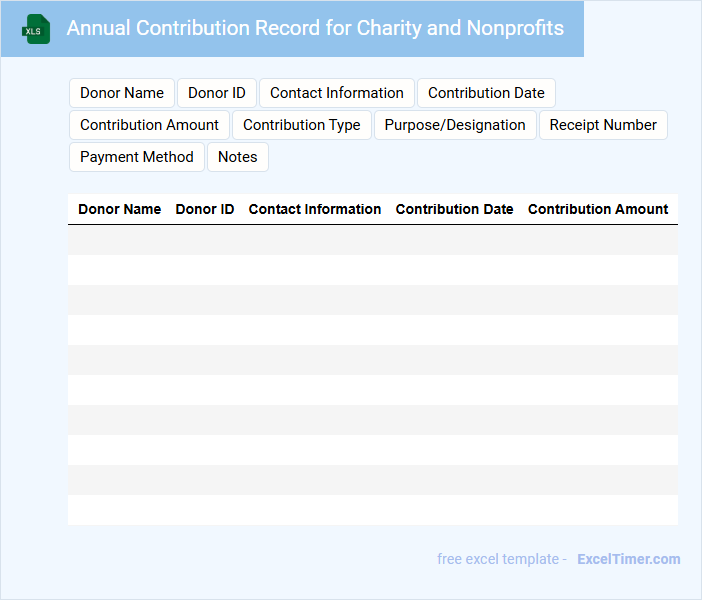

Annual Contribution Record for Charity and Nonprofits

An Annual Contribution Record for charities and nonprofits typically contains detailed information about donations received throughout the year, including donor names, contribution amounts, and dates. This document serves as a transparent record to acknowledge donor generosity and ensure compliance with legal and tax requirements. It is crucial for both organizational accountability and fostering trust with contributors.

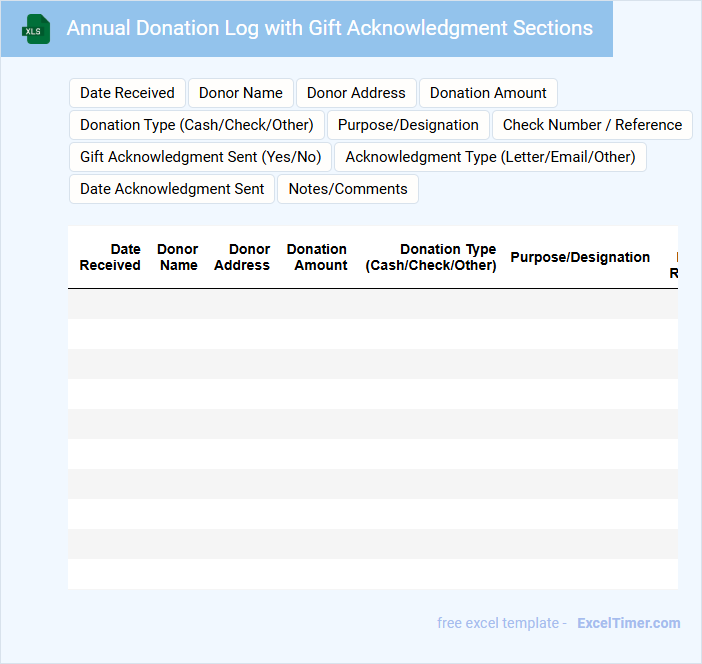

Annual Donation Log with Gift Acknowledgment Sections

An Annual Donation Log with Gift Acknowledgment Sections is a document used by organizations to record and track donations received throughout the year. It also includes sections to formally acknowledge donors and their contributions.

- Ensure each donor's information and donation details are accurately recorded.

- Include dates and descriptions of acknowledgment sent to donors.

- Maintain confidentiality and secure storage of donor information.

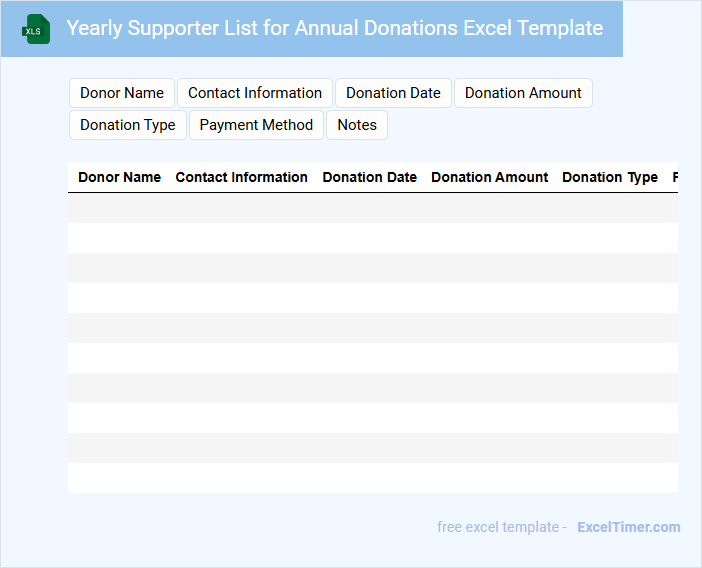

Yearly Supporter List for Annual Donations Excel Template

This document typically contains a comprehensive list of individuals or organizations that have made annual donations, including their contact information and donation amounts. It is used to track and manage yearly supporter contributions efficiently.

- Include columns for donor names, contact details, and donation dates to ensure clarity.

- Summarize total donations per supporter for quick annual financial overviews.

- Incorporate a section to note special recognitions or donor categories to enhance reporting and acknowledgment.

Annual Donation Tracker with Reporting Features

An Annual Donation Tracker is a document used to systematically record and monitor all donations received throughout the year. It typically includes donor information, donation amounts, dates, and payment methods to ensure transparency and accountability.

For effective reporting, it's important to include summary statistics, visual charts, and detailed reports for stakeholder review. This enhances decision-making and facilitates better fundraising strategies.

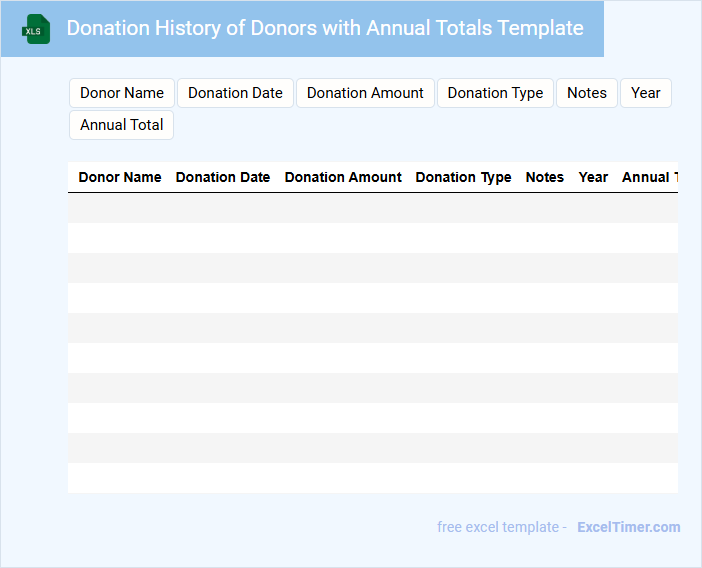

Donation History of Donors with Annual Totals Template

This document typically contains a comprehensive record of all donations made by donors over a specified period, categorized by year. It highlights individual donor contributions and aggregates annual totals to track giving patterns. Such a template is essential for maintaining transparent and organized donation history data.

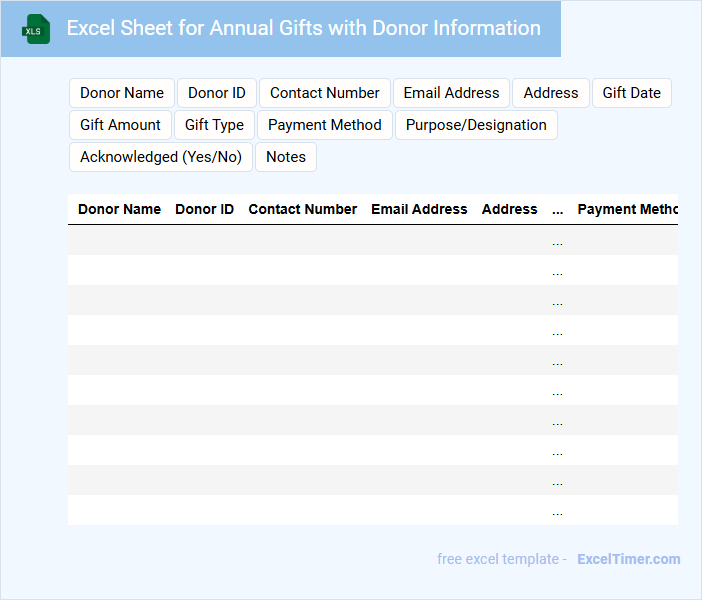

Excel Sheet for Annual Gifts with Donor Information

An Excel Sheet for Annual Gifts typically contains detailed records of donations received throughout the year, including donor names, contact information, and donation amounts. It helps organizations track giving patterns and manage fundraising efforts effectively.

Key information in this document often includes donation dates, payment methods, and purpose of gifts for accurate reporting. Regular updates and secure data management are essential to maintain the integrity of donor information.

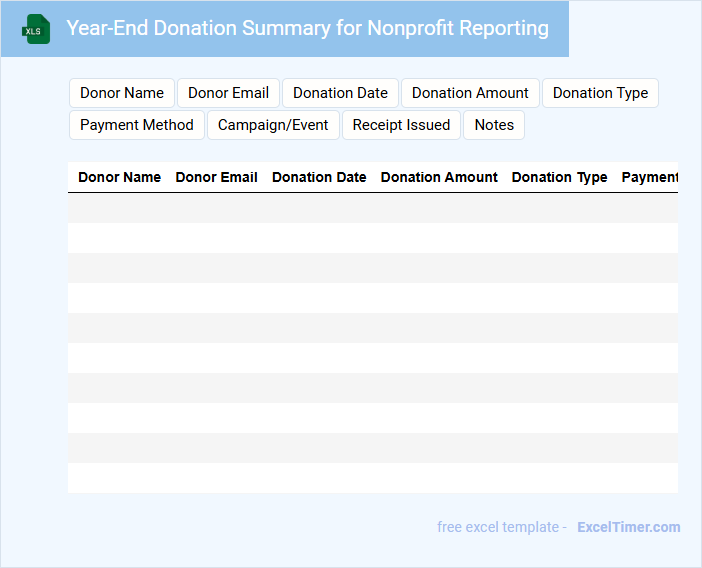

Year-End Donation Summary for Nonprofit Reporting

What information is typically included in a Year-End Donation Summary for nonprofit reporting? This document usually contains a detailed record of all donations received throughout the year, including donor names, amounts, dates, and donation types. It serves as a tool for transparency, helping nonprofits report accurately to stakeholders and comply with tax regulations.

What are important considerations when creating this summary? Ensure the data is complete and accurate, categorize donations clearly, and protect donor privacy. Additionally, including a clear summary of impact and acknowledgment of donor contributions can enhance trust and encourage future giving.

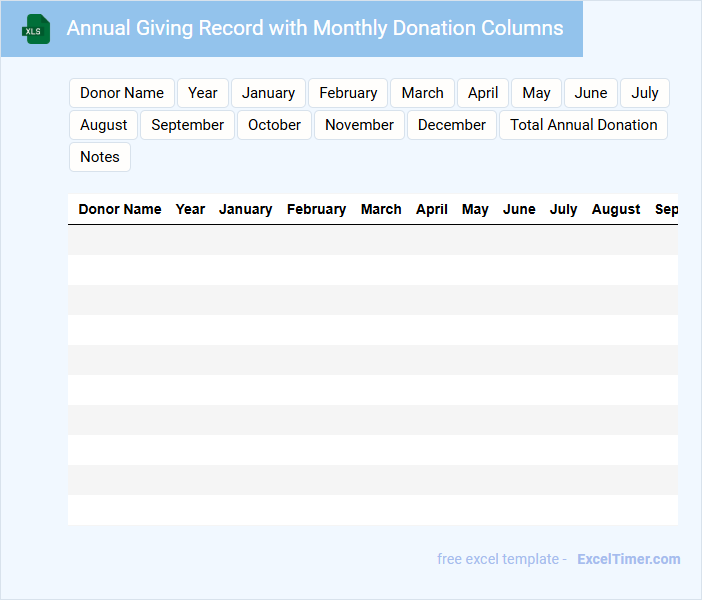

Annual Giving Record with Monthly Donation Columns

An Annual Giving Record with Monthly Donation Columns is a document that tracks the contributions made by donors throughout the year. It typically includes donor names, donation amounts, and monthly breakdowns to monitor giving patterns accurately.

This record helps organizations maintain transparency and manage fundraising efforts efficiently by providing a clear summary of support over time. To ensure accuracy, it is important to update the document regularly and include notes for any special donations or changes.

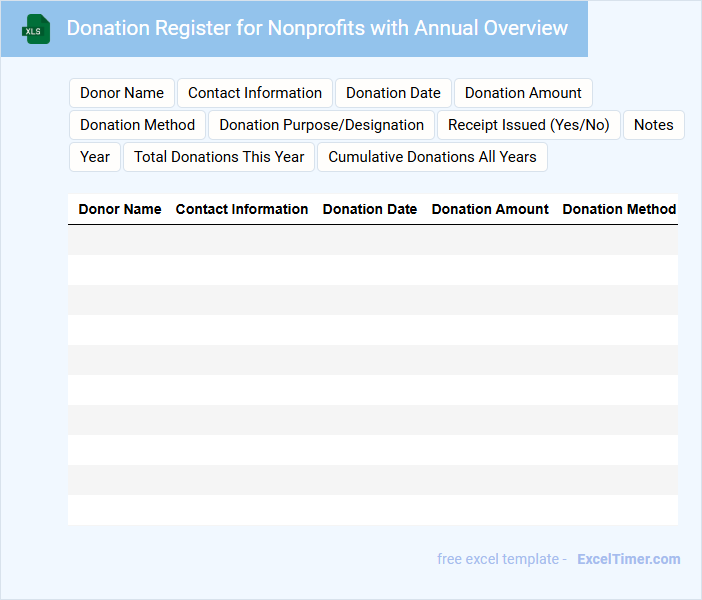

Donation Register for Nonprofits with Annual Overview

What information is typically included in a Donation Register for Nonprofits with Annual Overview? This document usually contains detailed records of all donations received throughout the year, including donor names, donation amounts, dates, and purposes. It also provides a summarized annual overview to help nonprofits track fundraising progress, ensure transparency, and maintain compliance with legal and tax regulations.

Why is it important to maintain an accurate Donation Register for Nonprofits? Keeping precise and up-to-date records enables organizations to build trust with donors, generate accurate financial reports, and plan future fundraising strategies effectively. Additionally, regular audits of the register help prevent errors and enhance accountability within the nonprofit.

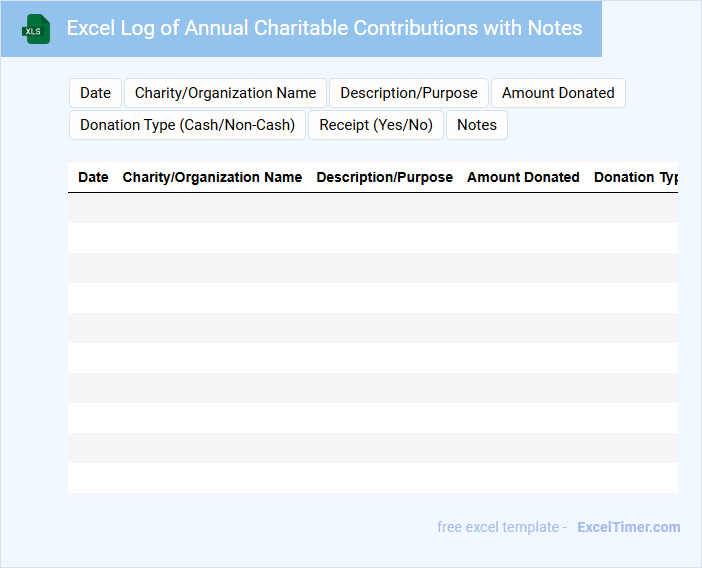

Excel Log of Annual Charitable Contributions with Notes

An Excel log of annual charitable contributions typically contains detailed records of donations made throughout the year, including dates, amounts, and recipient organizations. This document is essential for tracking financial contributions for personal or organizational tax purposes and maintaining transparency.

Such logs often include additional notes that specify the purpose of each donation, acknowledgment receipts, or any restrictions associated with the funds. It is important to ensure accuracy and consistency in data entry to facilitate easy referencing and auditing.

What key donor information should be consistently tracked in an annually donation record for nonprofits?

Your annual donation record for nonprofits should consistently track key donor information including full name, contact details, donation amounts, dates, and payment methods. Recording donation frequency and designation for specific campaigns or projects enhances data accuracy and supports targeted fundraising efforts. Maintaining this data ensures effective donor relationship management and compliance with financial reporting standards.

How can you structure your Excel document to summarize total annual donations per donor?

Organize your Excel document by listing donors in one column and monthly donations in adjacent columns, then use the SUM function to calculate each donor's total annual donation in a separate column. Apply filters or pivot tables to easily summarize and analyze the donation data by donor or year. This structure helps you efficiently track and report total annual contributions for your nonprofit's fundraising efforts.

Which columns are essential to include for transparency and compliance in an annual donation record?

Essential columns for an annual donation record include Donor Name, Donation Date, Donation Amount, Donation Type (e.g., cash, in-kind), Donation Purpose or Campaign, Receipt Issued (Yes/No), and Tax Deductibility Status. Including Donor Contact Information and Payment Method enhances traceability and compliance with regulatory requirements. Accurate record-keeping with these fields ensures transparency, audit readiness, and donor trust.

How can Excel formulas be used to automatically calculate year-over-year donation growth?

Excel formulas such as =((CurrentYearTotal - PreviousYearTotal) / PreviousYearTotal) * 100 can automatically calculate year-over-year donation growth by referencing annual donation totals. Your Annually Donation Record spreadsheet can leverage SUMIFS and dynamic cell references to streamline tracking nonprofit contributions and growth percentages. This method provides an efficient way to analyze donation trends and support fundraising strategies.

What methods can ensure data accuracy and prevent duplication in an annually donation Excel sheet?

Implement data validation rules to restrict entries to valid formats and preset lists, reducing input errors in the annual donation Excel sheet. Use Excel's built-in Remove Duplicates feature or conditional formatting with formulas like COUNTIF to identify and prevent duplicate donation records. Regularly audit data through pivot tables or Power Query to cross-check totals and donor details, ensuring accuracy and consistency.