The Annually Budget Planner Excel Template for Small Businesses streamlines financial management by offering a clear overview of income, expenses, and cash flow throughout the year. This template enables small business owners to track their budget accurately, identify cost-saving opportunities, and plan for future growth. Its user-friendly design and customizable categories make financial forecasting efficient and accessible.

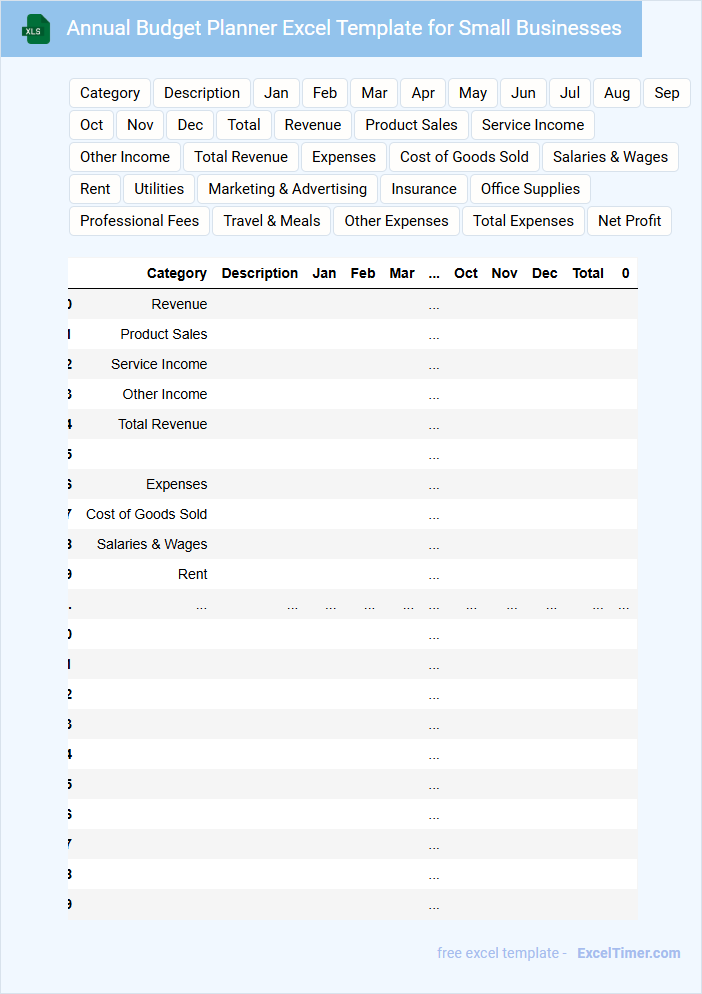

Annual Budget Planner Excel Template for Small Businesses

An Annual Budget Planner Excel Template for Small Businesses is a comprehensive financial tool designed to help track income, expenses, and forecast budgets throughout the year. It simplifies organizing business finances for better decision-making and resource allocation.

- Include detailed categories for revenue streams and expense types to ensure accurate tracking.

- Incorporate monthly and yearly summaries for quick financial overview and performance analysis.

- Add customizable fields for taxes, savings, and unexpected costs to maintain budget flexibility.

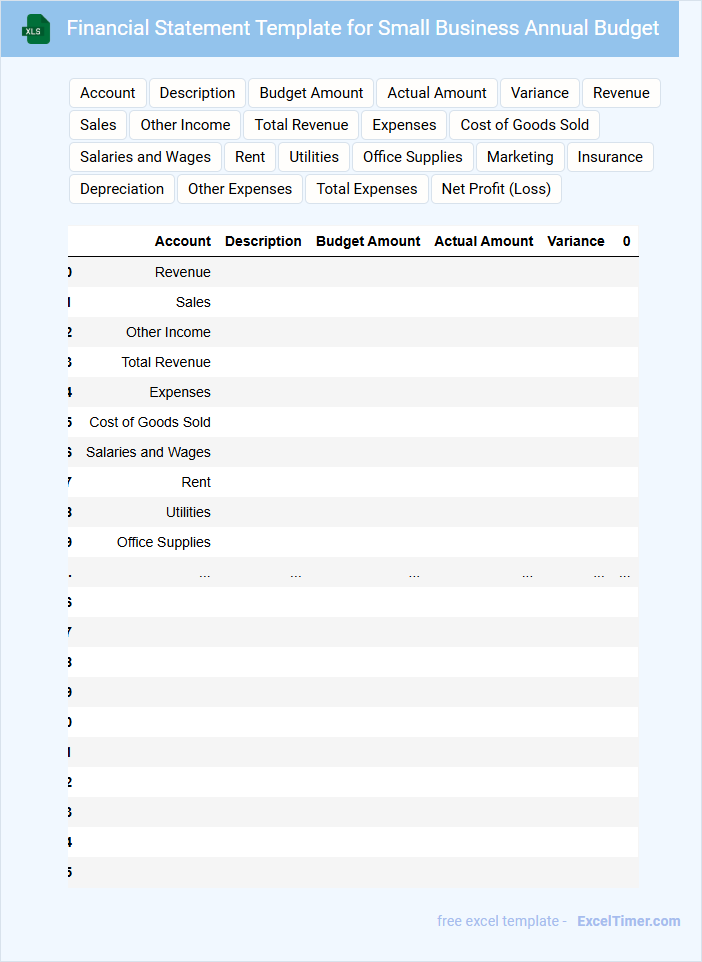

Financial Statement Template for Small Business Annual Budget

A Financial Statement Template for a small business annual budget typically contains a summary of income, expenses, assets, and liabilities. It provides an organized format to track financial performance over the fiscal year, aiding in strategic planning.

This document is essential for ensuring accurate budgeting and financial forecasting, helping small businesses maintain control over cash flow. Including clear categories and regularly updated figures is crucial for effective financial management and decision-making.

Annual Expense Tracker with Monthly Breakdown for Small Businesses

What information does an Annual Expense Tracker with Monthly Breakdown for Small Businesses typically contain? This document usually includes detailed records of all business expenses categorized by month, such as rent, utilities, salaries, and supplies. It helps small businesses monitor their financial health by providing a clear overview of spending patterns and identifying areas for cost control.

What is an important aspect to consider when creating this type of tracker? Accuracy in recording expenses and consistency in monthly updates are crucial to maintain reliable data. Additionally, integrating categories tailored to the specific business operations enhances the tracker's usefulness for budgeting and financial planning.

Income and Expenditure Spreadsheet for Small Business Annual Planning

An Income and Expenditure Spreadsheet for small business annual planning typically contains detailed records of all revenue streams and expenses. This document helps track financial performance and identify profit margins over the fiscal year.

It usually includes categories such as sales income, operational costs, payroll, and unexpected expenditures. Maintaining accuracy and regularly updating the spreadsheet are crucial for effective budgeting and decision-making.

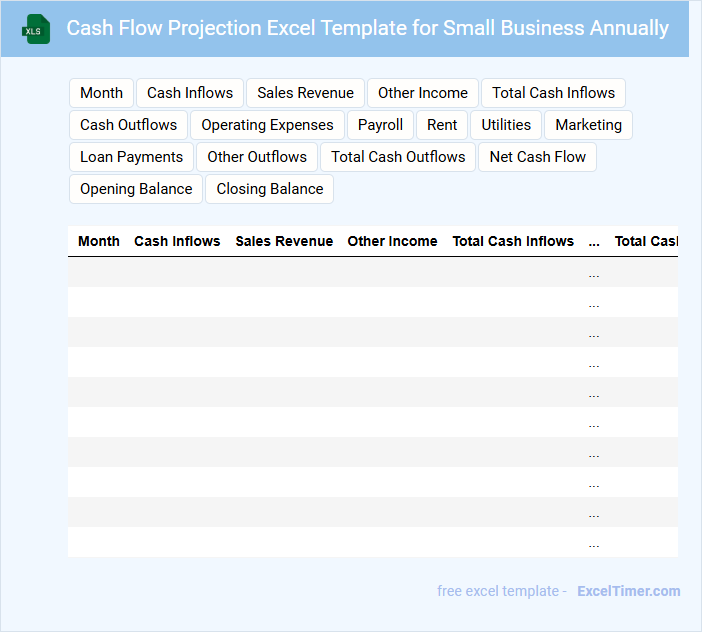

Cash Flow Projection Excel Template for Small Business Annually

A Cash Flow Projection Excel Template for small businesses typically contains detailed monthly and annual cash inflow and outflow forecasts. It helps business owners track expected revenue, expenses, and net cash balance over the year. This document is essential for planning financial stability and securing funding.

Important elements to include are clear categorization of income sources, fixed and variable expenses, and a summary section highlighting net cash flow trends. Incorporating assumption notes and sensitivity analysis enhances decision-making accuracy. Regularly updating the template ensures realistic projections and effective cash management.

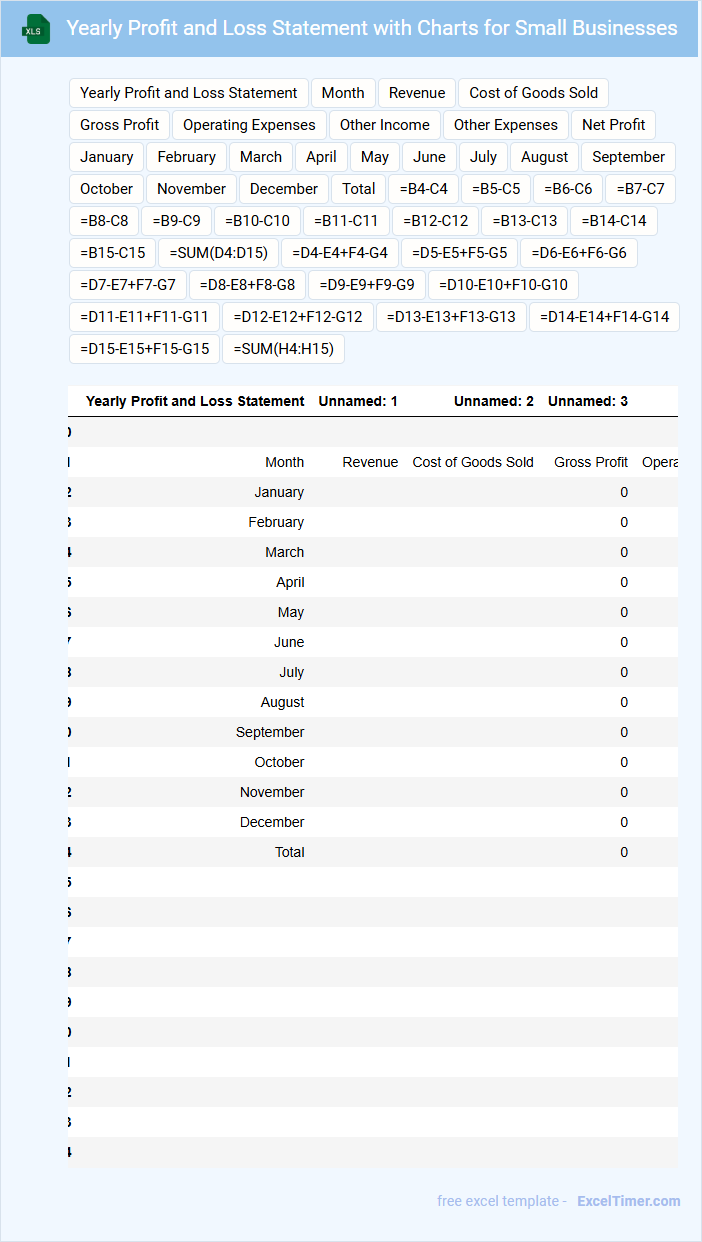

Yearly Profit and Loss Statement with Charts for Small Businesses

What information does a Yearly Profit and Loss Statement with Charts for Small Businesses typically contain? This document usually includes a detailed summary of revenues, costs, and expenses over a fiscal year, providing insight into the company's financial performance. It also features visual charts to help small business owners quickly understand trends in profitability and financial health.

Why is it important to include clear categorization and accurate data in this statement? Clear categorization of income and expenses ensures accurate analysis, helping identify profitable areas and cost-saving opportunities. Accurate data combined with visual charts supports better decision-making and strategic planning for growth.

Annual Sales Forecast Template for Small Business Budgeting

An Annual Sales Forecast Template typically contains projected sales data, estimated revenue, and key financial assumptions for a small business. It helps in budgeting by providing a structured overview of expected income over the year. Using this template, businesses can plan expenses, allocate resources effectively, and set realistic sales targets.

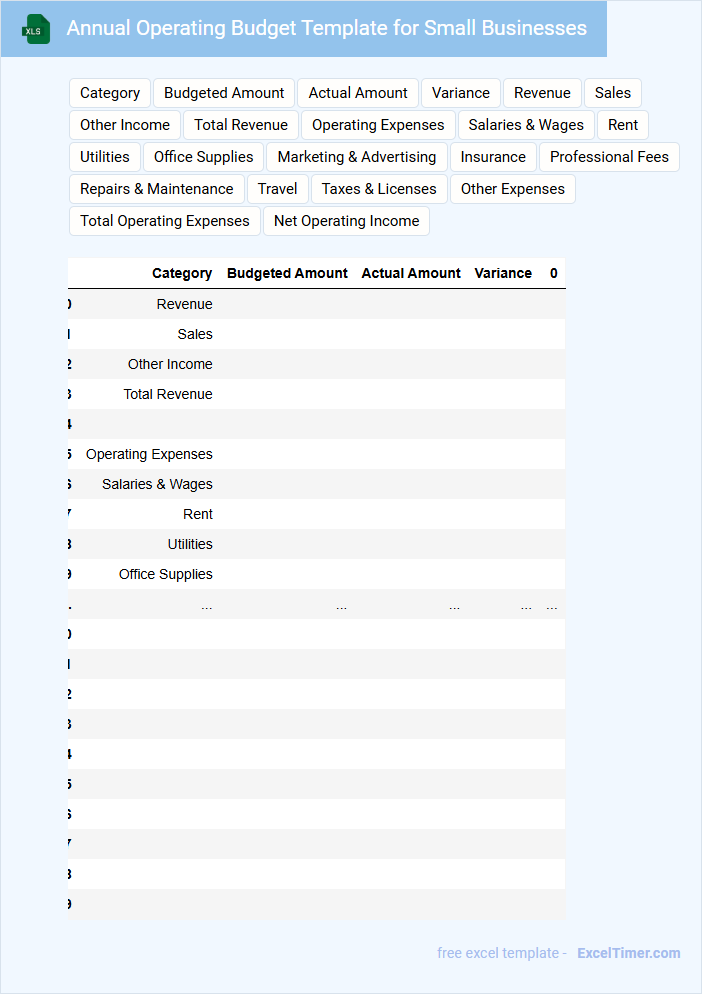

Annual Operating Budget Template for Small Businesses

What is typically included in an Annual Operating Budget Template for Small Businesses? This document usually contains detailed projections of income, expenses, and cash flow for the fiscal year. It helps small businesses plan financially, allocate resources effectively, and track performance against their financial goals.

What is an important aspect to consider when using this template? Accurate forecasting of revenues and expenses is crucial to avoid overspending or underfunding key operations, ensuring sustainable business growth. Additionally, regularly updating the budget to reflect actual results helps maintain financial control and adaptability.

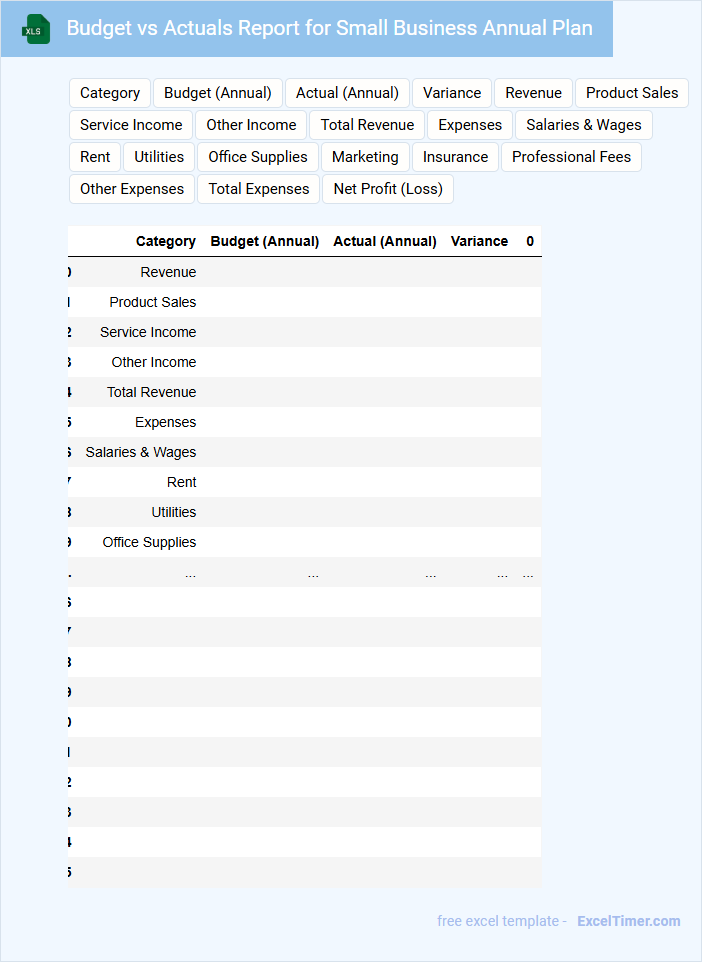

Budget vs Actuals Report for Small Business Annual Plan

A Budget vs Actuals Report for a Small Business Annual Plan is a financial document that compares the projected budget against the actual expenses and revenues incurred over the fiscal year. This report helps identify variances and assess the financial performance of the business. It is essential for making informed decisions, controlling costs, and planning accurate future budgets.

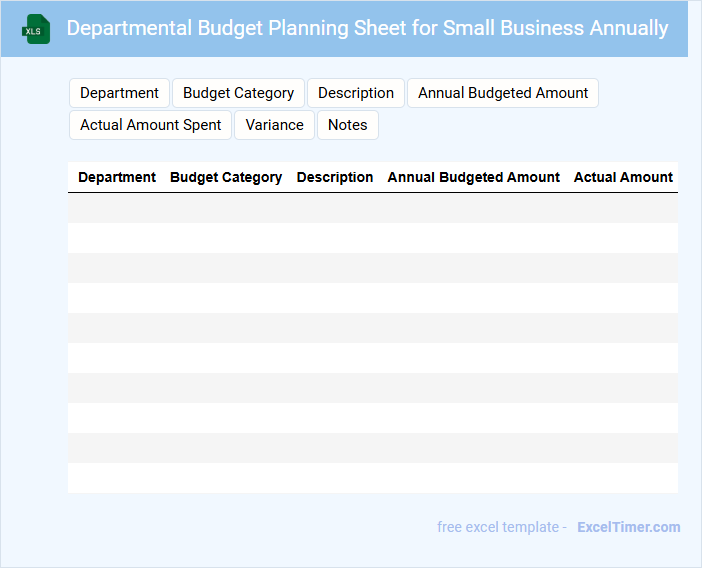

Departmental Budget Planning Sheet for Small Business Annually

The Departmental Budget Planning Sheet is a crucial document used to outline the expected income and expenses for each department within a small business over the course of a year. It helps in managing financial resources effectively by tracking individual departmental costs and revenues.

This document typically contains detailed sections for projected sales, operational costs, salaries, and other departmental expenses. One important suggestion is to regularly review and adjust the budget to reflect actual performance and changing business needs.

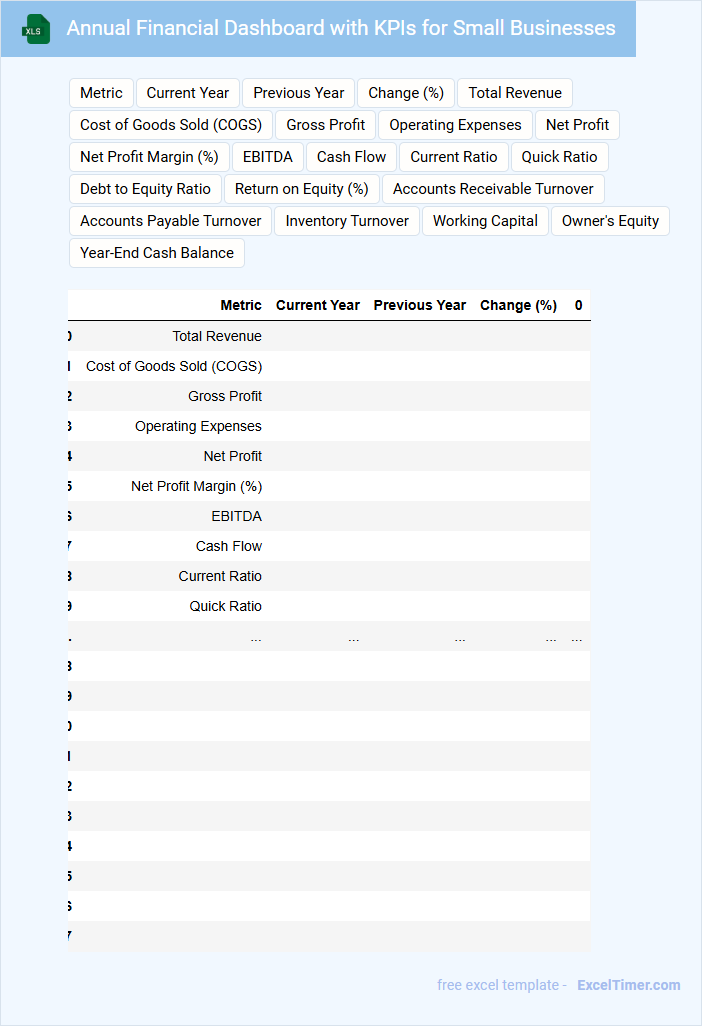

Annual Financial Dashboard with KPIs for Small Businesses

An Annual Financial Dashboard typically contains key financial metrics that provide a comprehensive overview of a small business's performance throughout the year. It includes KPIs such as revenue, expenses, profit margins, and cash flow trends to help monitor financial health. An important suggestion for effective use is to ensure data accuracy and update the dashboard regularly for informed decision-making.

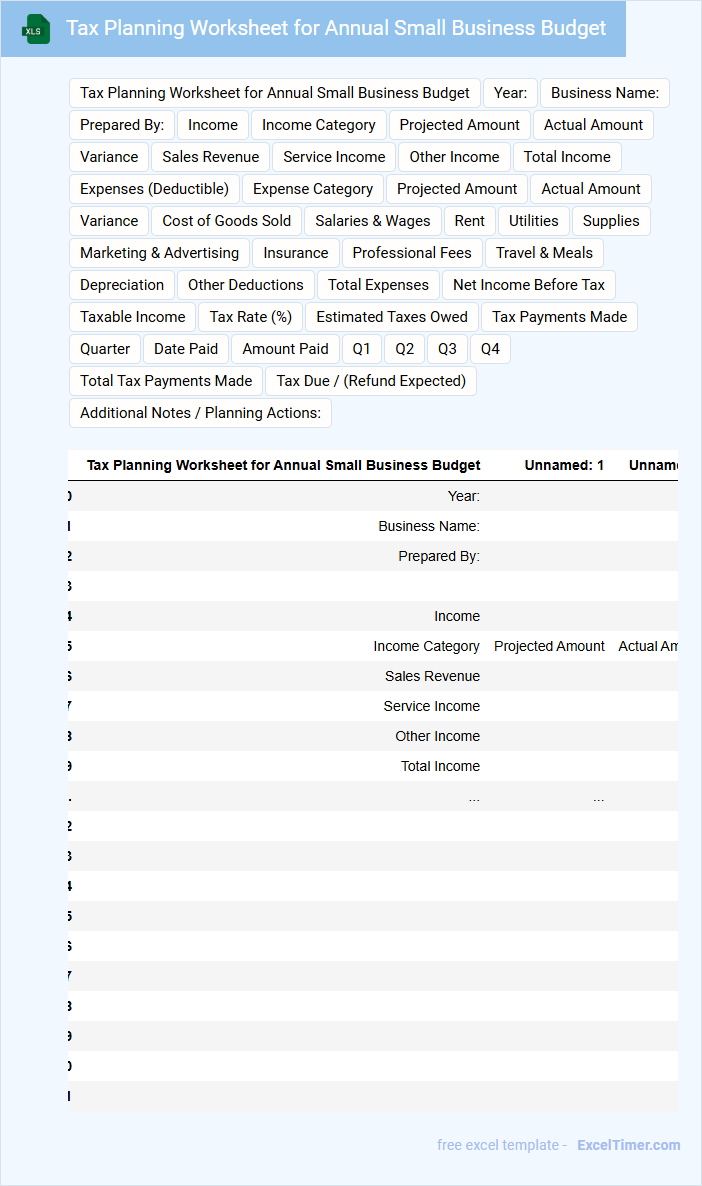

Tax Planning Worksheet for Annual Small Business Budget

A Tax Planning Worksheet for an annual small business budget is designed to organize and calculate estimated tax liabilities throughout the year. It typically includes sections for income projections, deductible expenses, and anticipated tax payments. Utilizing this document helps small businesses optimize tax strategies and ensure compliance with tax regulations.

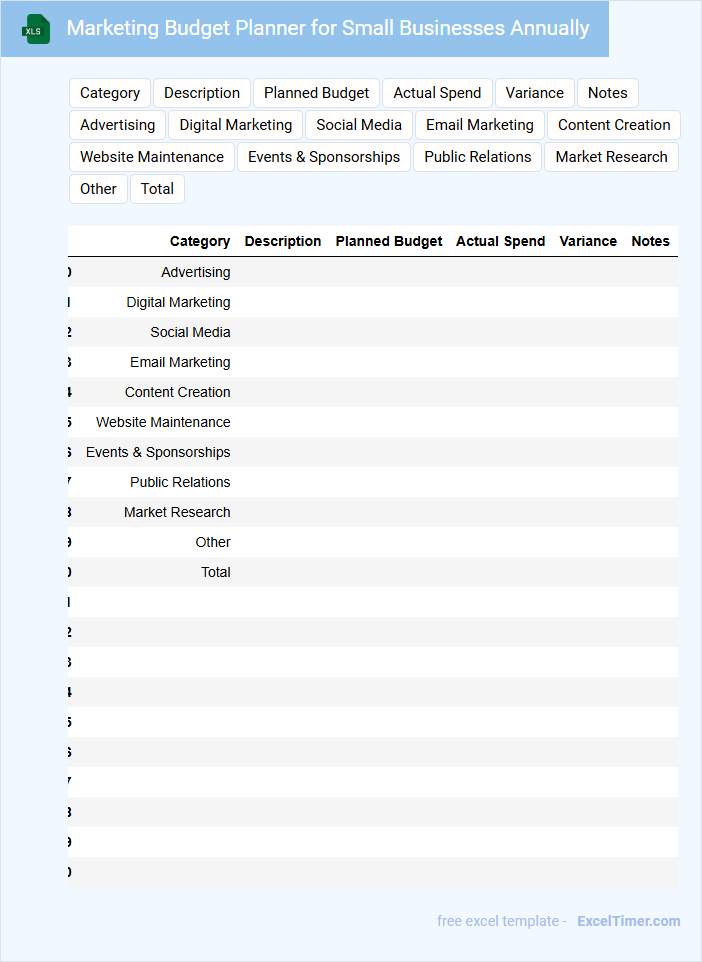

Marketing Budget Planner for Small Businesses Annually

A Marketing Budget Planner for small businesses annually typically contains detailed forecasts of expenses related to advertising, promotions, and digital marketing campaigns. It helps businesses allocate their resources efficiently and track spending against set goals throughout the year. This document is essential for strategic planning and ensuring a balanced marketing approach aligned with business objectives.

Important elements to include are estimated costs for each channel, timelines for campaign execution, and a contingency fund. Additionally, regularly updating the budget planner based on actual performance can optimize spending and maximize ROI. Small businesses should also align the planner with overall business goals to maintain a consistent growth strategy.

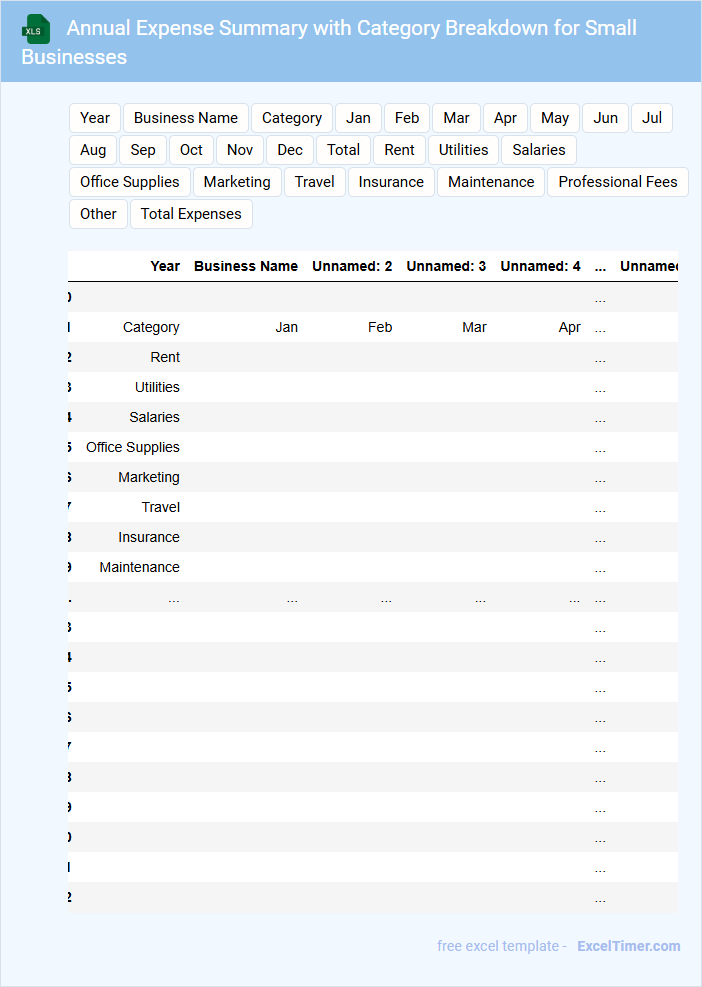

Annual Expense Summary with Category Breakdown for Small Businesses

An Annual Expense Summary with Category Breakdown for Small Businesses is a detailed financial report summarizing all expenditures over the year. It helps business owners analyze spending patterns and make informed budgeting decisions.

- Include clear categories to organize expenses such as marketing, operations, and salaries.

- Provide a visual breakdown with charts or graphs for quick analysis.

- Ensure accuracy by cross-referencing with receipts, invoices, and bank statements.

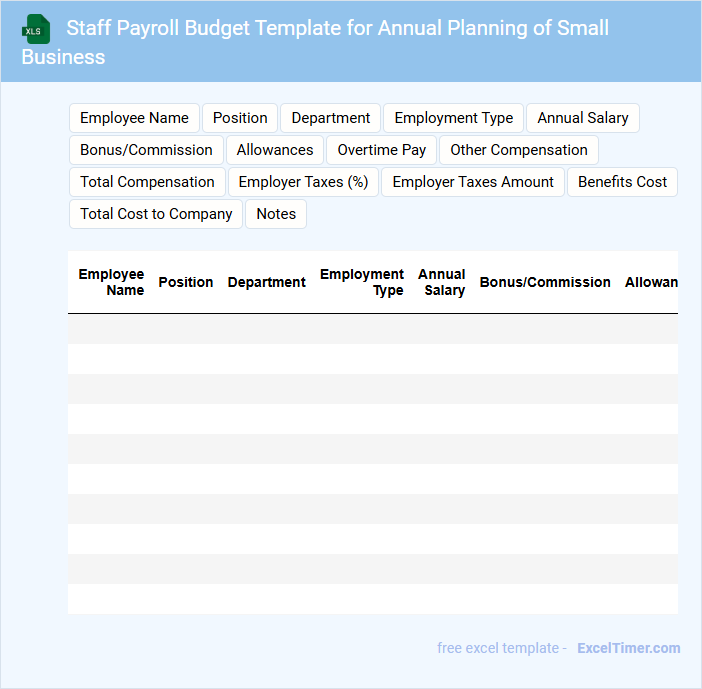

Staff Payroll Budget Template for Annual Planning of Small Business

What information does a Staff Payroll Budget Template for Annual Planning of Small Business typically contain? This document usually includes detailed salary data for each employee, including fixed wages, bonuses, and tax withholdings, essential for accurate financial forecasting. It also outlines projected payroll expenses across months or quarters, helping businesses allocate funds effectively throughout the year.

What important factors should be considered when creating this template? It is crucial to account for potential salary increases, benefits, and seasonal employment variations to avoid budget shortfalls. Additionally, incorporating compliance with local tax regulations ensures the payroll budget remains accurate and legally sound.

What key categories should be included in an annual budget planner for small businesses?

An annual budget planner for small businesses should include key categories such as revenue projections, fixed and variable expenses, payroll costs, marketing and advertising budgets, operational expenses, and tax obligations. Tracking cash flow, inventory costs, and contingency funds ensures comprehensive financial management. Accurate categorization aids in forecasting, expense control, and profitability analysis.

How can historical financial data be leveraged when creating an annual budget in Excel?

Historical financial data provides a foundation for your annual budget in Excel by identifying spending patterns and revenue trends. This information enables accurate forecasting, helping set realistic goals and allocate resources effectively. Analyzing past performance reduces uncertainties and improves financial decision-making for small businesses.

What Excel functions best support monthly versus annual expense tracking within the planner?

SUMIFS and MONTH functions excel in monthly expense tracking by summing costs based on specific months, while SUM efficiently calculates total annual expenses in the Annual Budget Planner for Small Businesses. VLOOKUP and IFERROR enhance data retrieval and error handling within the planner. Combining these functions ensures precise and organized financial monitoring throughout the fiscal year.

How should income projections and cash flow be incorporated and visualized in the document?

Income projections should be incorporated as monthly or quarterly estimates based on historical data and market trends, while cash flow must be tracked by recording inflows and outflows to highlight liquidity status. Visualize these with dynamic charts such as line graphs for income trends and bar charts for cash flow variations, enabling clear assessment of financial health. Your budget planner should include interactive dashboards to quickly identify gaps, surpluses, and forecast accuracy.

What safeguards and review processes can be built into the Excel planner to ensure budget accuracy and adaptability?

Incorporate automated formula checks and conditional formatting to detect data inconsistencies and prevent input errors within your annual budget planner for small businesses. Utilize version control and protected sheets to maintain data integrity while allowing controlled updates. Set periodic review alerts and integrate scenario analysis features to ensure the budget remains accurate and adaptable to changing financial conditions.