The Annually Depreciation Schedule Excel Template for Fixed Assets provides a clear, organized way to track asset value reduction over time. It simplifies calculations by automatically updating depreciation expenses based on customizable asset details and depreciation methods. This template helps businesses maintain accurate financial records and comply with accounting standards.

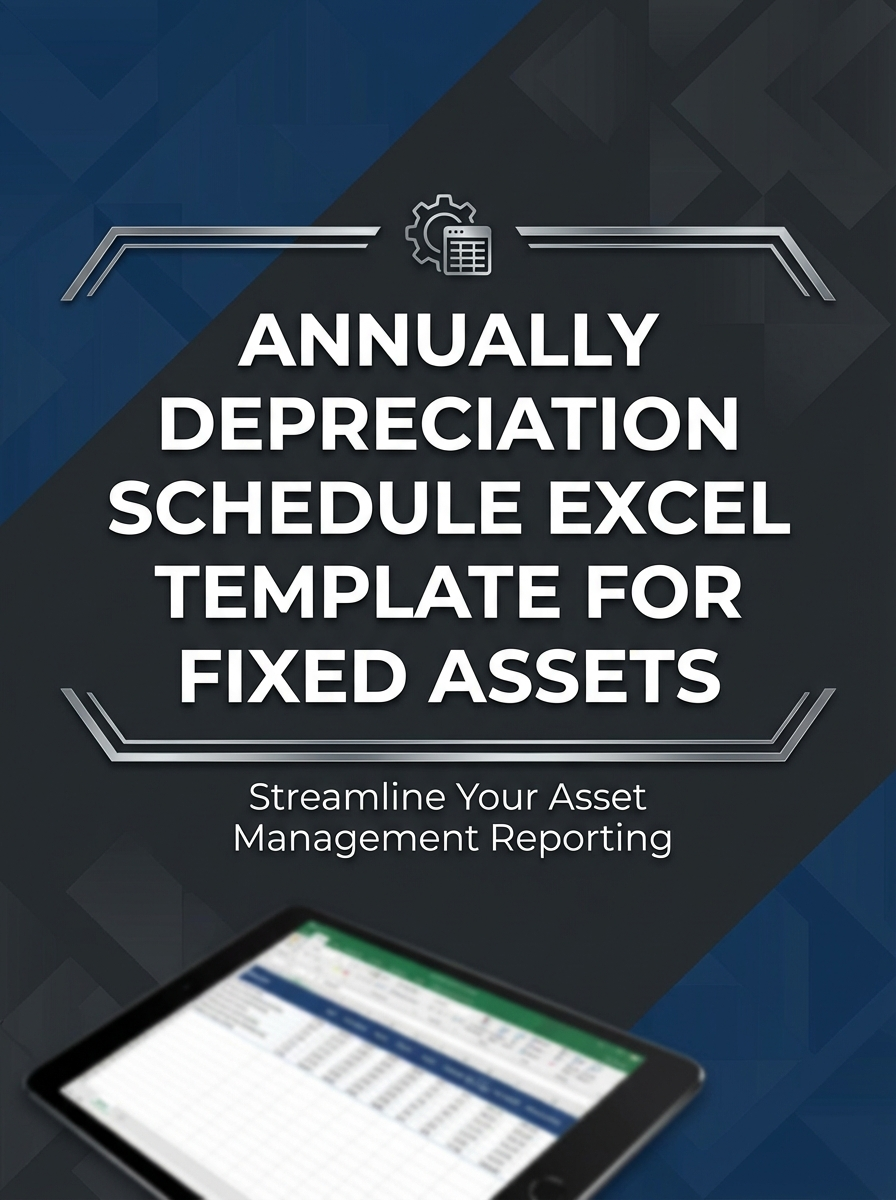

Annual Depreciation Schedule with Fixed Asset Details

What information does an Annual Depreciation Schedule with Fixed Asset Details typically contain? This document usually includes a detailed list of fixed assets owned by an organization, along with their depreciation values calculated for the year. It helps track the asset's value reduction over time for accurate financial reporting and tax purposes.

What is important to include in this schedule for accuracy? It is crucial to record the acquisition date, cost, useful life, depreciation method, and accumulated depreciation for each fixed asset. Maintaining precise and up-to-date details ensures compliance with accounting standards and aids in effective asset management.

Fixed Assets Depreciation Report for Year-End

What information is typically included in a Fixed Assets Depreciation Report for Year-End? This report usually contains detailed data on all fixed assets, including acquisition dates, costs, accumulated depreciation, and net book values. It provides a clear summary of depreciation expenses charged throughout the year to help assess asset value and support financial statements.

What is an important consideration when preparing a Fixed Assets Depreciation Report for Year-End? Ensuring accuracy in asset details and depreciation calculations is critical to maintain compliance with accounting standards and provide reliable financial insights. Additionally, regular updates and validation of asset registers help in avoiding discrepancies and improving audit readiness.

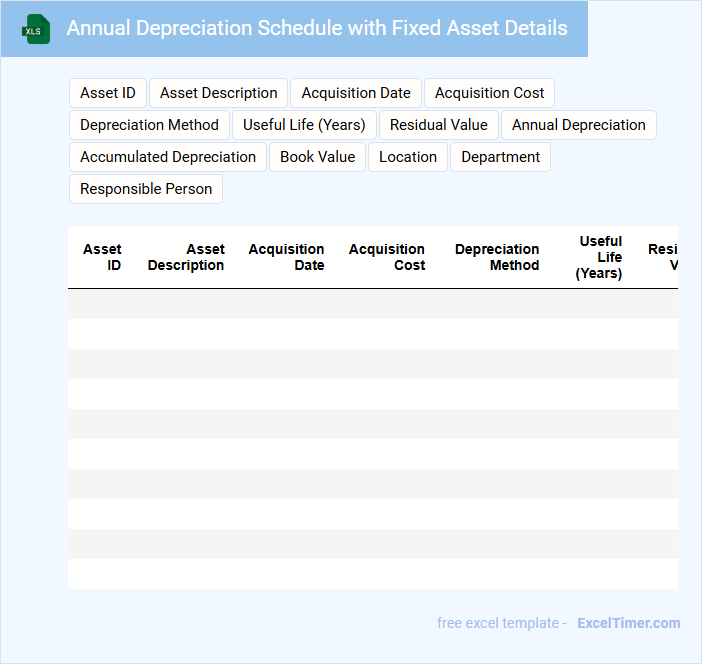

Straight-Line Depreciation Schedule for Assets

Straight-line depreciation schedules for assets typically outline the consistent expense allocation over an asset's useful life.

- Asset Cost: The original purchase price of the asset is essential for accurate calculations.

- Useful Life: The estimated duration the asset will be productive must be clearly defined.

- Salvage Value: The expected residual value at the end of the asset's useful life should be included.

Depreciation Calculation Sheet with Asset Register

What information is typically contained in a Depreciation Calculation Sheet with Asset Register? This document usually includes detailed records of fixed assets, their acquisition costs, accumulated depreciation, and current book values. It helps in systematically tracking asset depreciation over time for accurate financial reporting and tax purposes.

What is an important consideration when maintaining this document? Ensuring accurate asset identification and consistent application of depreciation methods is crucial for reliability. Regular updates and reconciliation with physical asset counts improve accountability and financial accuracy.

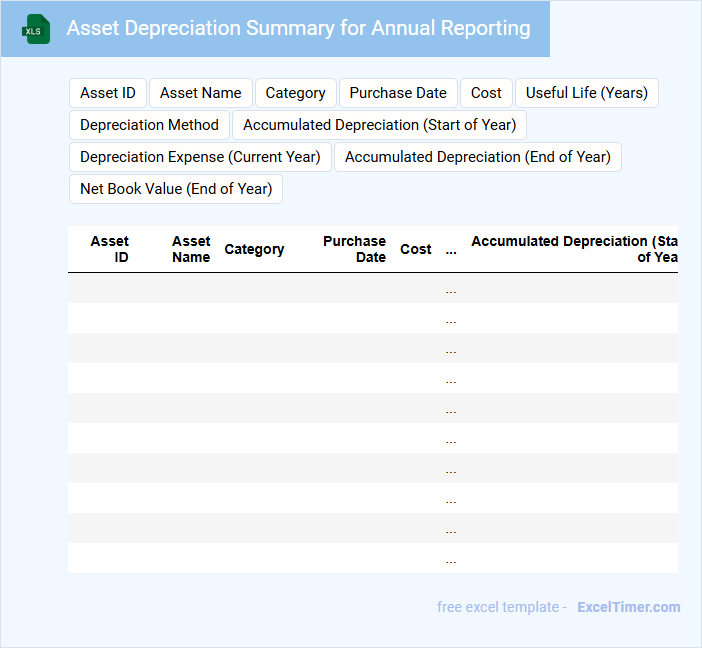

Asset Depreciation Summary for Annual Reporting

The Asset Depreciation Summary is a financial document that provides a comprehensive overview of the depreciation expenses related to an organization's fixed assets over a fiscal year. It typically includes details such as asset categories, depreciation methods, accumulated depreciation, and book values.

For Annual Reporting, this summary is crucial as it impacts the accuracy of financial statements and tax calculations. Ensuring clarity and consistency in data presentation helps stakeholders better understand asset values and company performance.

Yearly Depreciation Tracker with Useful Life

A Yearly Depreciation Tracker with Useful Life is a document used to monitor the annual depreciation of assets over their estimated useful life. It helps in budgeting and financial analysis by providing clear insights into asset value reduction.

- Include accurate acquisition dates and costs for each asset to ensure precise calculations.

- Track the estimated useful life to schedule timely replacements or disposals.

- Update the depreciation values annually based on standard accounting methods.

Fixed Asset Management with Depreciation Tracking

Fixed Asset Management with Depreciation Tracking documents typically contain detailed records of company assets, their values, usage, and loss of value over time.

- Asset Identification: Clear and unique identifiers for each fixed asset ensure accurate tracking and reporting.

- Depreciation Methods: Consistent application of depreciation calculation methods is critical for accurate financial statements.

- Regular Audits: Periodic verification of asset condition and existence helps maintain data integrity and compliance.

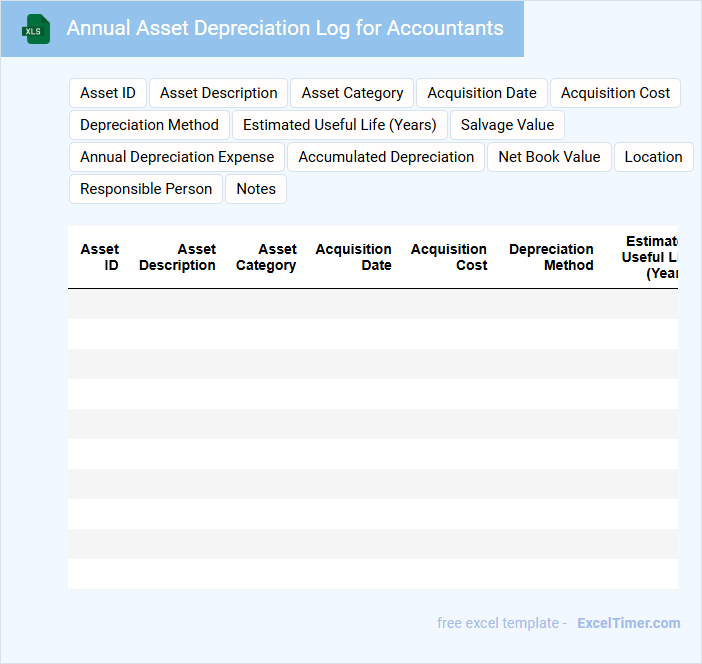

Annual Asset Depreciation Log for Accountants

What information is typically included in an Annual Asset Depreciation Log for Accountants? This document usually contains detailed records of all company assets, including purchase dates, costs, and depreciation methods applied. It helps accountants track the decreasing value of assets over time for accurate financial reporting and tax purposes.

Why is maintaining an accurate Annual Asset Depreciation Log important for accountants? Consistent updates ensure compliance with accounting standards and assist in budgeting and asset management decisions. Including asset condition and useful life estimates enhances the accuracy of depreciation calculations and overall asset valuation.

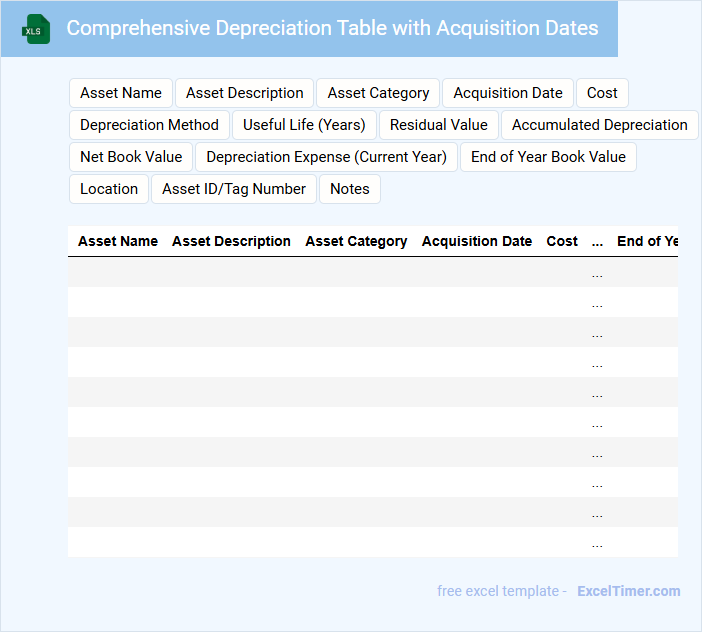

Comprehensive Depreciation Table with Acquisition Dates

A Comprehensive Depreciation Table typically contains detailed records of asset values, acquisition dates, and accumulated depreciation over time. This document is essential for tracking the decreasing value of fixed assets for accounting and tax purposes. Including accurate acquisition dates helps ensure precise calculation of depreciation expenses and useful asset life.

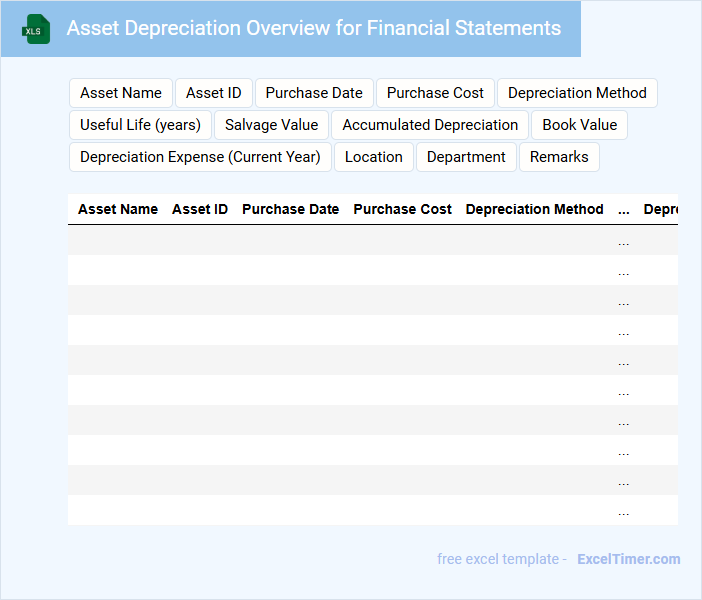

Asset Depreciation Overview for Financial Statements

What information is typically included in an Asset Depreciation Overview for Financial Statements? This document usually contains detailed data on the depreciation methods used, accumulated depreciation, and the net book value of fixed assets. It is essential for accurately reflecting asset value over time and ensuring compliance with accounting standards.

What key elements should be highlighted in this overview to enhance financial clarity? Important aspects to emphasize include the depreciation schedules, useful life assumptions, and any changes in depreciation policy. These details help stakeholders understand asset valuation impacts and support informed financial decision-making.

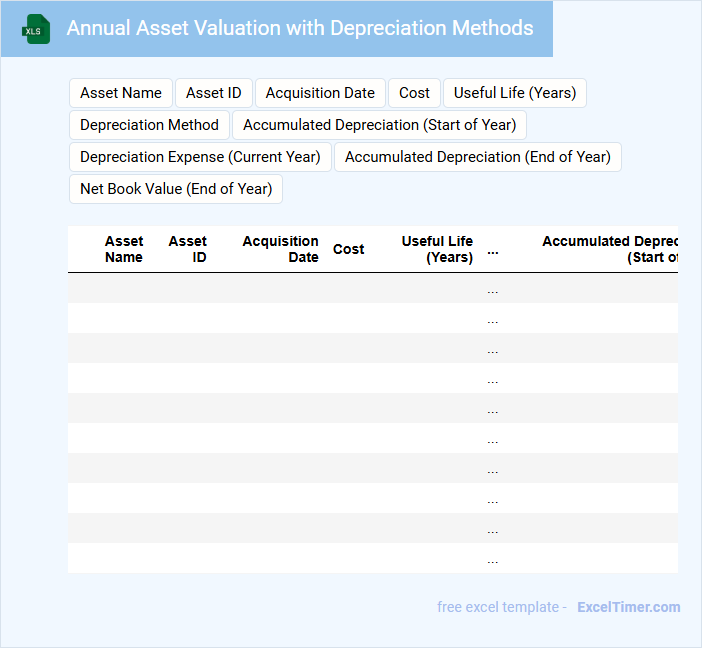

Annual Asset Valuation with Depreciation Methods

An Annual Asset Valuation document typically details the financial value of company assets and their depreciation over a fiscal year. It provides crucial information for accurate accounting and investment decisions.

- Include clear descriptions of assets and their acquisition dates for context.

- Apply consistent depreciation methods aligned with accounting standards.

- Regularly update asset values to reflect market changes and conditions.

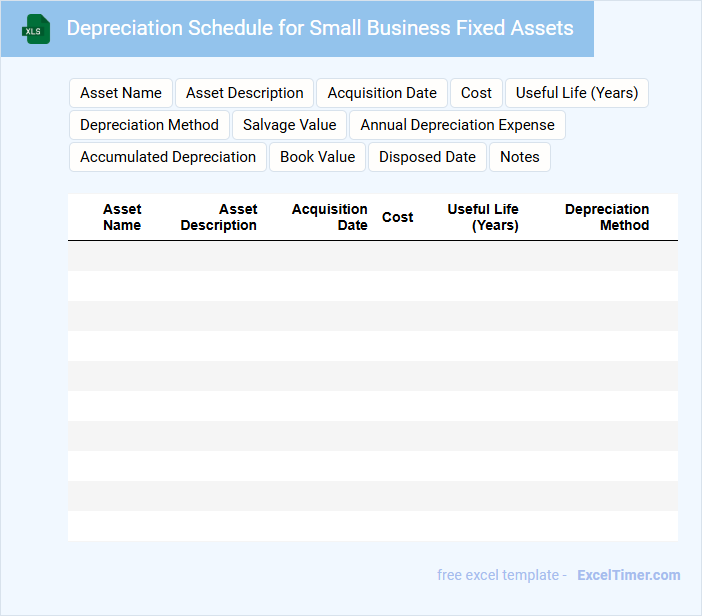

Depreciation Schedule for Small Business Fixed Assets

What information is typically included in a Depreciation Schedule for Small Business Fixed Assets? A Depreciation Schedule lists all fixed assets owned by a small business along with details such as acquisition dates, costs, useful life, and accumulated depreciation. This document helps track the reduction in asset value over time for accurate accounting and tax reporting.

Why is maintaining an accurate Depreciation Schedule important? Keeping precise records ensures compliance with tax regulations and assists in financial planning by providing a clear picture of asset values and expenses. Small businesses should regularly update the schedule with any new purchases, disposals, or changes in asset condition to maintain accuracy.

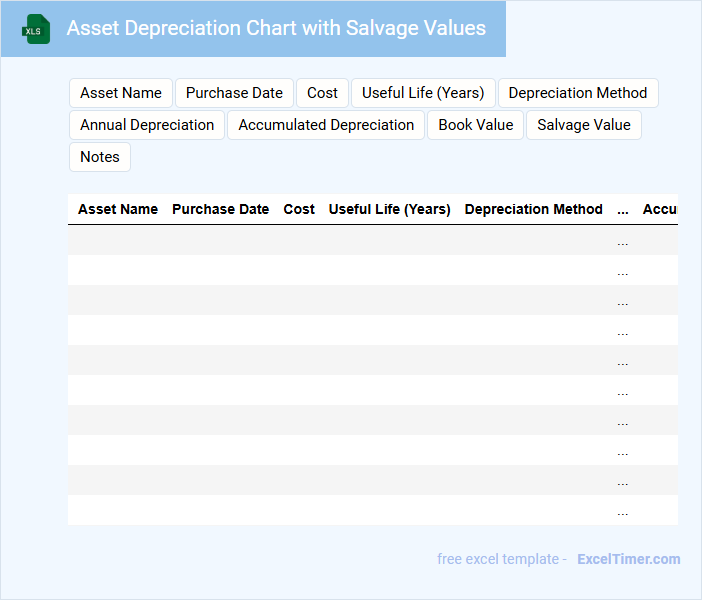

Asset Depreciation Chart with Salvage Values

What information does an Asset Depreciation Chart with Salvage Values typically contain? This document usually includes the initial cost of the asset, its estimated useful life, the depreciation method applied, and the salvage value at the end of its useful life. It visually represents the reduction in asset value over time while highlighting the expected residual value, which is crucial for accurate financial planning and tax reporting.

What important considerations should be kept in mind when creating this chart? Ensure that the salvage value is realistically estimated to prevent over- or under-depreciation, and select a depreciation method that aligns with the asset's usage pattern. Additionally, regularly updating the chart based on asset performance and market conditions improves financial accuracy and asset management.

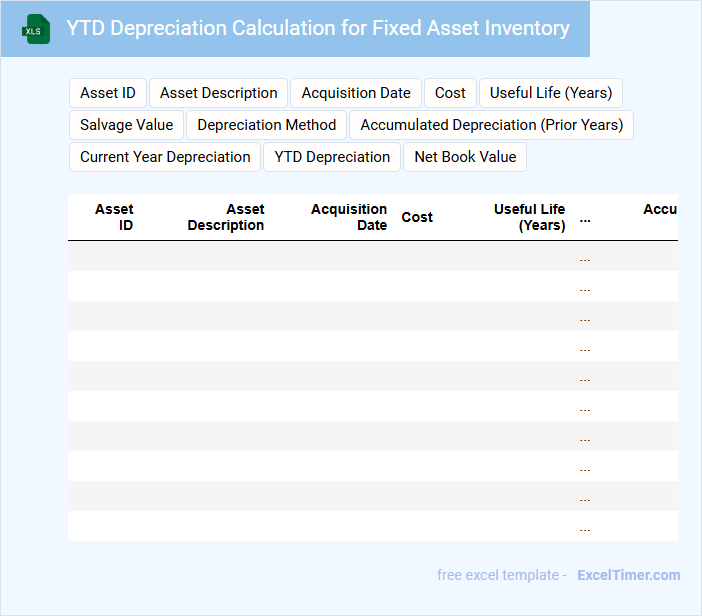

YTD Depreciation Calculation for Fixed Asset Inventory

A YTD Depreciation Calculation document for fixed asset inventory typically contains detailed records of assets, depreciation methods applied, and accumulated depreciation values year-to-date. It serves as a crucial tool for tracking the reduction in value of fixed assets over time, ensuring accurate financial reporting and compliance. Key components include asset descriptions, purchase dates, useful life estimates, depreciation rates, and cumulative depreciation amounts.

Important considerations for this document include maintaining accuracy in asset categorization, consistently applying chosen depreciation methods such as straight-line or declining balance, and regularly updating calculations to reflect asset disposals or impairments. Ensuring clear audit trails and reconciliations with the general ledger is essential for transparency and verification. Additionally, incorporating a review process to assess asset useful lives and salvage values periodically enhances reliability and financial integrity.

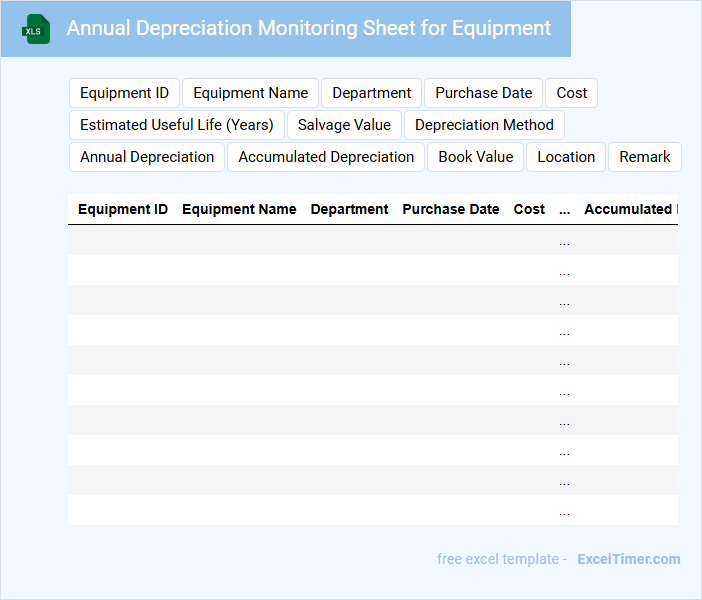

Annual Depreciation Monitoring Sheet for Equipment

An Annual Depreciation Monitoring Sheet for Equipment typically contains detailed records of the depreciation values assigned to various assets over a fiscal year. This document helps in tracking the reduction in the value of equipment, ensuring accurate financial reporting and asset management. Keeping this sheet up-to-date is essential for budgeting and compliance with accounting standards.

What methods can be used to calculate annual depreciation for fixed assets in Excel?

Common methods to calculate annual depreciation for fixed assets in Excel include the Straight-Line method, which spreads cost evenly over the asset's useful life; the Declining Balance method, applying a fixed rate to the asset's reducing book value; and the Sum-of-Years' Digits method, which accelerates depreciation based on a fraction of remaining life. Excel functions like SLN, DB, and SYD streamline these calculations by automating depreciation schedules. Choosing the appropriate method depends on the asset type, usage pattern, and financial reporting requirements.

How do you structure columns for asset name, purchase date, cost, useful life, and depreciation per year?

Structure the Excel columns as follows: "Asset Name," "Purchase Date," "Cost," "Useful Life (Years)," and "Depreciation Per Year." Calculate "Depreciation Per Year" by dividing "Cost" by "Useful Life (Years)" for straight-line depreciation. Ensure date formatting for "Purchase Date" to enable accurate scheduling and tracking.

How is the accumulated depreciation and book value computed each year on the schedule?

The accumulated depreciation is computed by adding the annual depreciation expense to the previous year's accumulated depreciation. The book value is calculated by subtracting the accumulated depreciation from the asset's original cost. This process is repeated each year to reflect the asset's decreasing value over its useful life.

How do you automate year-by-year depreciation calculations using Excel formulas?

You can automate year-by-year depreciation calculations in Excel by using the SLN function, which computes straight-line depreciation based on asset cost, salvage value, and useful life. Create a schedule table with columns for each year and apply the formula to calculate consistent annual depreciation expenses. This method streamlines your fixed asset management and ensures accurate tracking of asset value over time.

What checks or controls should be included to ensure data accuracy in the depreciation schedule?

Your annual depreciation schedule must include verification of asset acquisition dates, depreciation methods, and useful life to ensure accurate calculations. Cross-check asset cost and accumulated depreciation against the fixed asset ledger for consistency. Implement automated error alerts in Excel to flag anomalies such as negative values or unexpected rate changes.