![]()

The Annually Donation Tracking Excel Template for Churches is a powerful tool designed to streamline the management of yearly contributions, ensuring accurate record-keeping and easy access to donation history. It enables churches to monitor donor information, track donation amounts, and generate detailed reports for financial transparency and accountability. Utilizing this template enhances fundraising efforts by providing clear insights into donation patterns and supporting efficient stewardship of church resources.

Annually Donation Tracking Sheet for Churches

An Annually Donation Tracking Sheet for churches is a vital document used to record and monitor yearly contributions from members and donors. It typically contains donor names, donation amounts, dates, and specific purposes or funds allocated. This tracking helps maintain financial transparency, aids in tax reporting, and supports budgeting for church activities.

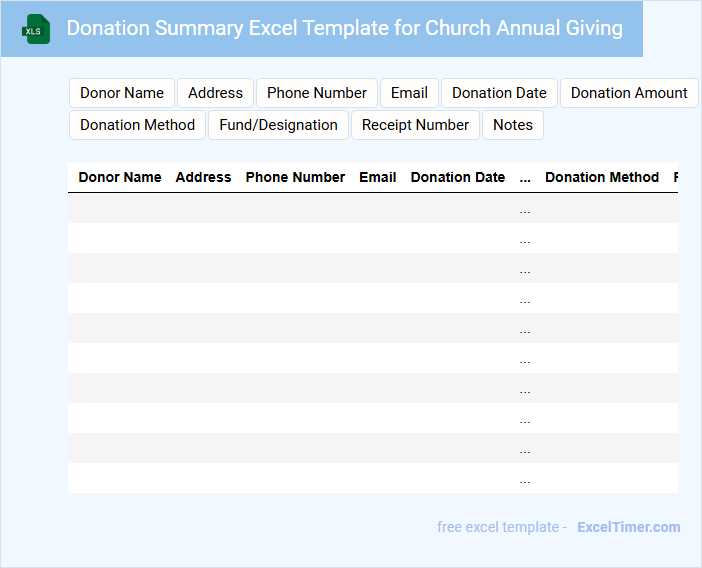

Donation Summary Excel Template for Church Annual Giving

A Donation Summary Excel Template for church annual giving is typically designed to organize and track contributions from members and donors over the year. It usually contains columns for donor names, dates, amounts, and giving categories to provide a clear financial overview. This template helps church administrators manage records efficiently and prepare reports for transparency.

Important elements to include are a summary dashboard with total donations, donor contact information, and categorical filters to easily analyze giving trends. Additionally, incorporating automated calculations for subtotals and year-to-date totals improves accuracy and saves time. Ensuring data privacy and security features is also crucial for handling sensitive donor information.

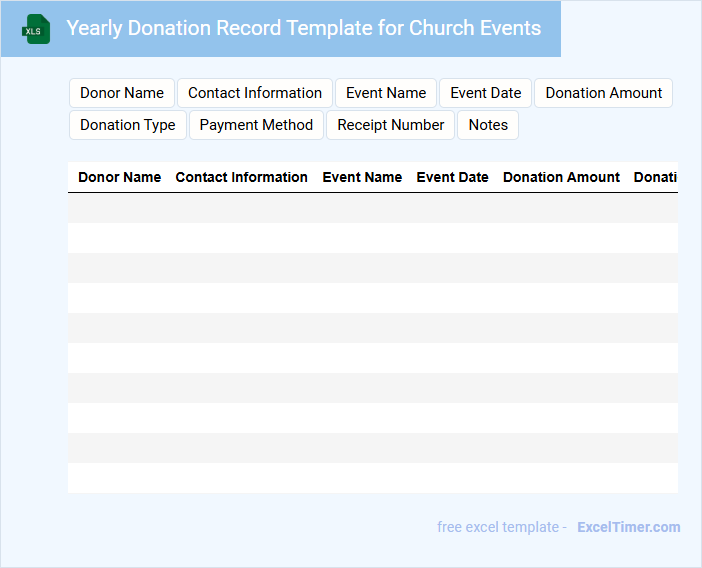

Yearly Donation Record Template for Church Events

This Yearly Donation Record Template for church events is designed to systematically track all contributions received throughout the year. It includes donor names, donation amounts, dates, and specific event details. Such documents provide transparency and accountability to both church members and regulatory bodies.

Maintaining an organized donation record helps in financial planning and acknowledges the generosity of the church community. It is important to regularly update the template and ensure data accuracy. Additionally, secure storage and confidentiality of donor information are essential.

Annual Church Giving Tracker with Donor Details

What information is typically included in an Annual Church Giving Tracker with Donor Details? This document usually contains detailed records of donations made by church members throughout the year, including donor names, dates, amounts, and types of contributions. It helps churches monitor giving patterns, maintain transparency, and acknowledge donors effectively.

What is an important consideration when managing this tracker? Ensuring data privacy and accuracy is crucial, so sensitive donor information should be securely stored and regularly updated to reflect all transactions. Additionally, categorizing donations by fund type or campaign can improve financial reporting and decision-making.

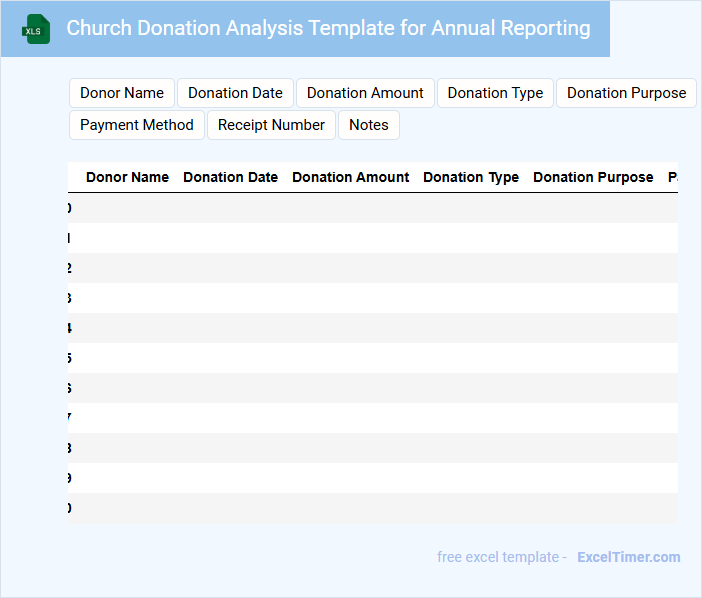

Church Donation Analysis Template for Annual Reporting

The Church Donation Analysis Template is a crucial document for annual reporting, summarizing donation patterns and financial contributions received by the church. It typically contains detailed records of donor information, donation amounts, and dates to track giving trends over the year. This template helps church leaders evaluate fundraising effectiveness and plan future stewardship strategies.

Important elements to include are categorized donation sources, comparative year-over-year analysis, and graphical representations of data for easy interpretation. Emphasizing accuracy and confidentiality of donor information ensures trust and compliance with reporting standards. Incorporating notes on donor engagement and appeals can further enhance strategic decision-making.

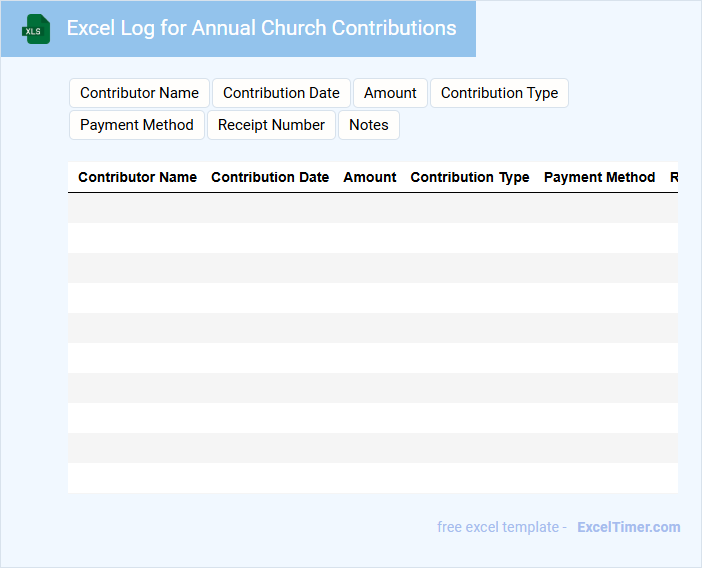

Excel Log for Annual Church Contributions

Excel logs for annual church contributions typically contain detailed records of donations made by church members throughout the year. They help in tracking financial support and preparing reports for transparency and accountability.

- Include donor names, dates of contributions, and donation amounts in the log.

- Use clear categories or columns for various types of contributions such as tithes, offerings, and special donations.

- Regularly update and back up the log to ensure accuracy and prevent data loss.

Yearly Pledge Tracking Spreadsheet for Churches

What information is typically included in a Yearly Pledge Tracking Spreadsheet for Churches? This document usually contains members' names, pledge amounts, payment schedules, and actual contributions to help track financial commitments throughout the year. It allows church leaders to monitor giving patterns, manage budgets effectively, and communicate progress with the congregation.

What is an important feature to include in this spreadsheet? A clear summary section with total pledged versus received amounts is essential to provide quick insights on the church's financial health. Additionally, incorporating automated reminders for upcoming payments helps ensure members stay informed and contributions remain consistent.

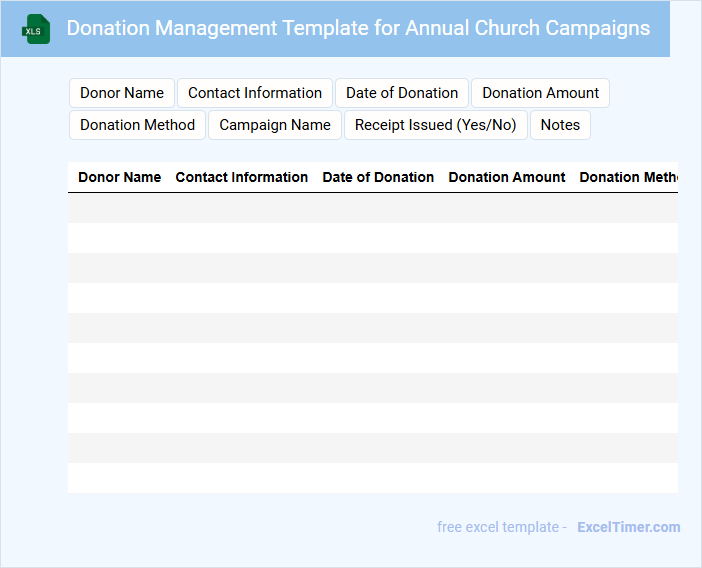

Donation Management Template for Annual Church Campaigns

This Donation Management Template is specifically designed for organizing and tracking contributions during annual church campaigns. It typically includes donor information, donation amounts, and giving dates to streamline reporting and acknowledgment processes.

For effective use, ensuring accuracy in data entry and timely updates is crucial to maintain donor trust and transparency. Additionally, setting reminders for follow-ups and thank-you notes enhances donor relationships and campaign success.

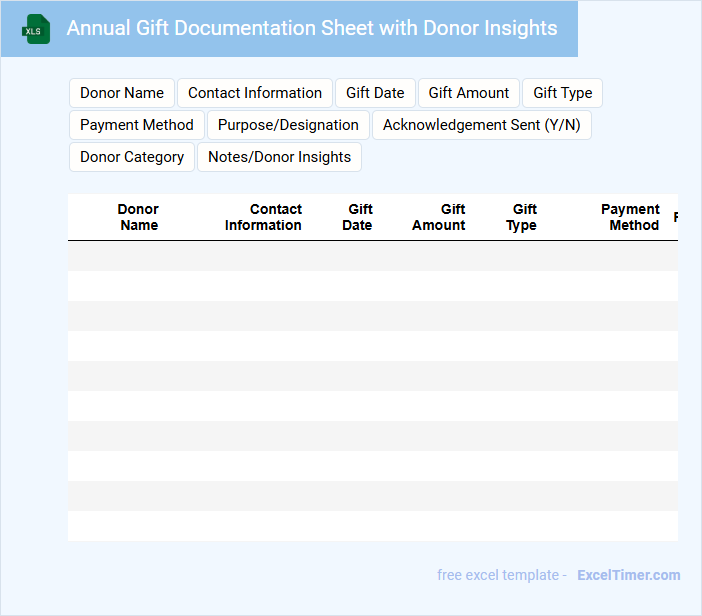

Annual Gift Documentation Sheet with Donor Insights

The Annual Gift Documentation Sheet typically contains detailed records of all donations received within a year, including donor information, gift amounts, and dates. It serves as a vital tool for tracking fundraising progress and ensuring accurate financial reporting. Incorporating Donor Insights helps organizations tailor future outreach and deepen relationships by understanding donor behavior and preferences.

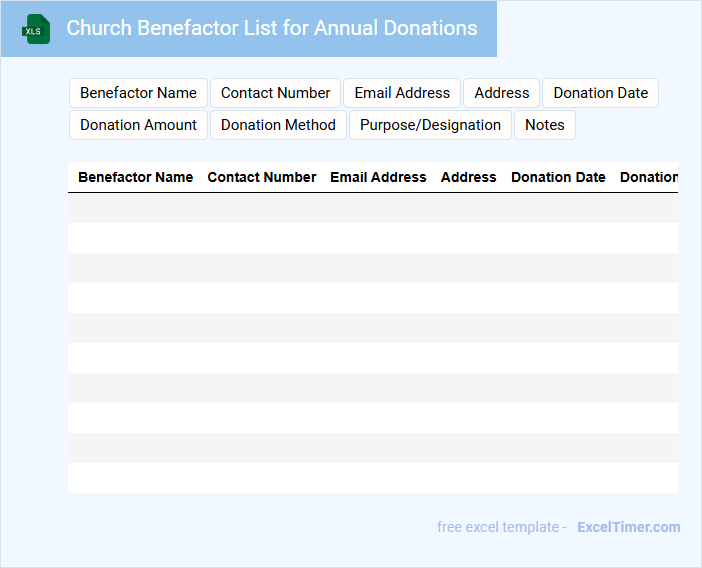

Church Benefactor List for Annual Donations

The Church Benefactor List is a document typically containing names of individuals and organizations who have made significant contributions to the church over the past year. It usually includes donation amounts, dates, and contact information for accurate record-keeping. This list serves as both an acknowledgement and a tool for encouraging continued generosity.

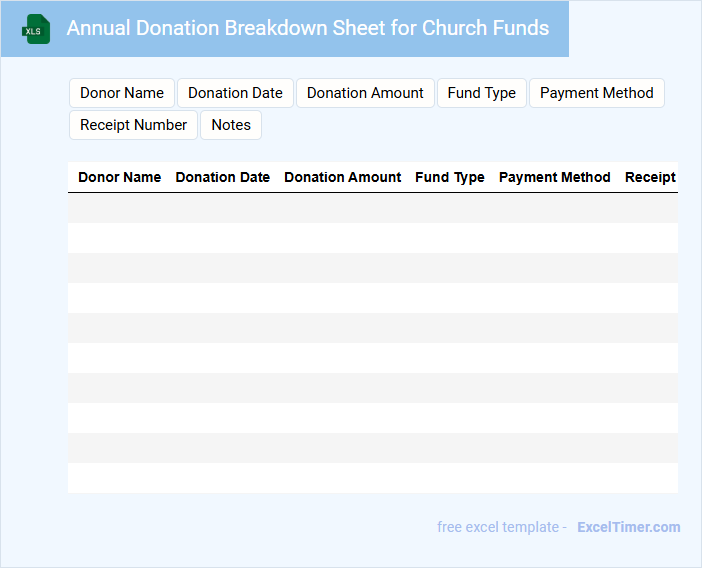

Annual Donation Breakdown Sheet for Church Funds

An Annual Donation Breakdown Sheet for Church Funds typically details the financial contributions received throughout the year. It helps in transparent reporting and budget planning for the church community.

- Include a clear summary of total donations received by category or fund.

- Record individual or group donations with dates to maintain accountability.

- Highlight any special campaigns or major contributions for reference.

Excel Tracker for Yearly Church Donor History

What information is typically included in an Excel tracker for yearly church donor history? This type of document usually contains detailed records of donor names, contact information, and annual donation amounts. It also tracks donation dates and methods, providing a clear overview of the church's financial support history.

Why is it important to maintain an accurate yearly donor history? Keeping precise records helps the church monitor giving trends, recognize loyal donors, and plan future fundraising strategies effectively. Additionally, it ensures transparency and accountability in financial reporting.

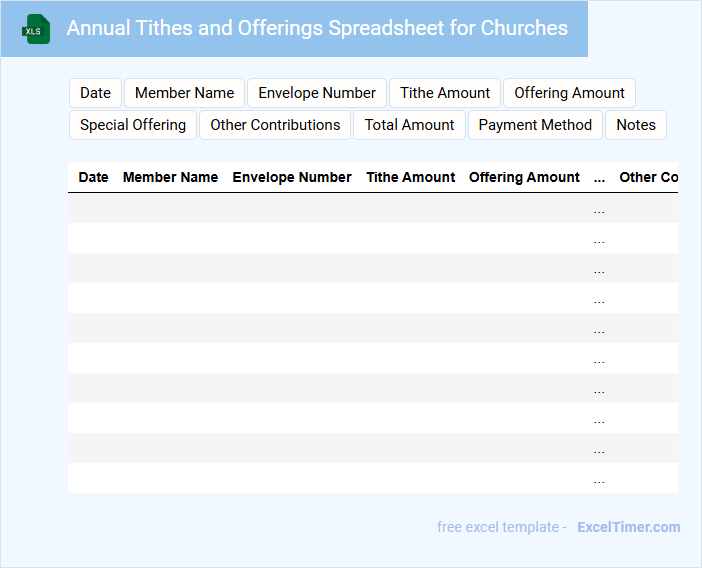

Annual Tithes and Offerings Spreadsheet for Churches

What information is typically included in an Annual Tithes and Offerings Spreadsheet for Churches? This document usually contains detailed records of all tithes and offerings received throughout the year, organized by donor and date. It helps churches track financial contributions accurately and ensures transparency in managing church funds.

What is an important aspect to consider when creating this spreadsheet? It is crucial to maintain clear categorization of different types of donations and to regularly update the spreadsheet for accuracy. Additionally, including a summary section that highlights total amounts and trends can greatly assist in financial planning and reporting.

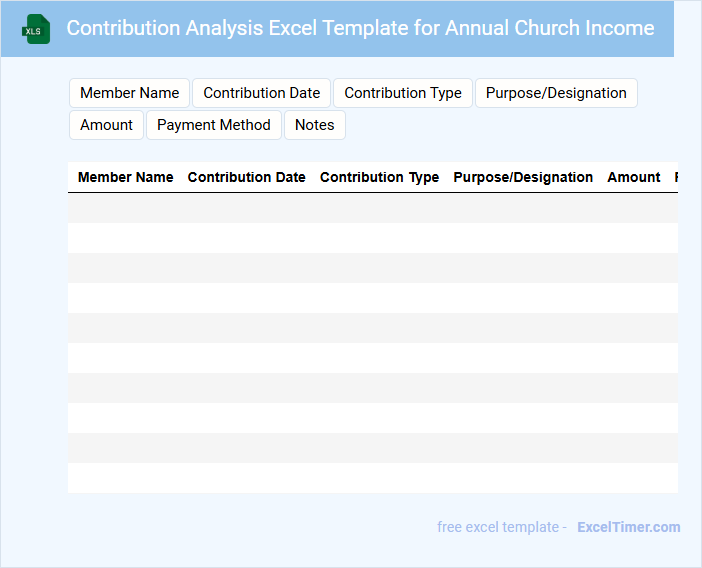

Contribution Analysis Excel Template for Annual Church Income

What does a Contribution Analysis Excel Template for Annual Church Income typically contain?

This type of document usually includes detailed records of individual and group contributions, categorized by date, amount, and donor information. It allows churches to systematically track, analyze, and report their annual income for financial planning and transparency.

Important suggestions for this template include incorporating automated summary charts for quick visualization of income trends and ensuring data validation to maintain accuracy in input. Additionally, sections for notes or comments can help clarify unusual entries or special donation events.

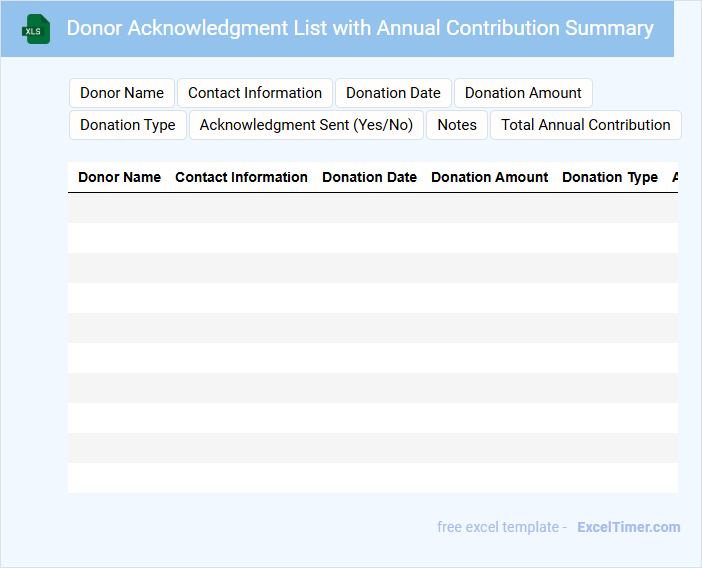

Donor Acknowledgment List with Annual Contribution Summary

What information is typically included in a Donor Acknowledgment List with Annual Contribution Summary? This document generally contains the names of donors along with the total contributions they made over the year. It serves as both a recognition of donor generosity and a transparent summary of fundraising efforts.

What important details should be highlighted in this type of document? It is essential to clearly present donor names, the amount donated, and the dates of contributions to ensure accuracy and appreciation. Additionally, expressing gratitude and including a summary of how the funds have been utilized can enhance donor engagement and trust.

What essential donor information should be recorded for annual donation tracking in the Excel document?

Your annual donation tracking Excel document should include essential donor information such as full name, contact details, donation dates, and amounts. Recording donation methods and frequency enhances data accuracy for churches. Maintaining a donor ID or unique identifier helps in organizing and analyzing annual contributions effectively.

How should recurring and one-time donations be categorized and summarized annually?

Recurring donations should be categorized separately from one-time donations in your annual donation tracking to provide clear insights into consistent giving patterns. Summarize recurring donations by total monthly or yearly amounts, while one-time donations should be aggregated by individual events or dates. This organized structure helps churches accurately analyze donation trends and forecast future contributions.

What formulas and functions can be used to calculate total annual donations per donor?

Use the SUMIF function to calculate total annual donations per donor, e.g., =SUMIF(DonorRange, DonorName, DonationAmountRange). The SUMPRODUCT function can also aggregate donations by matching donor names and filtering by year. PivotTables provide dynamic summaries by allowing quick grouping and totaling of donations across multiple donors annually.

How can the Excel document be structured to generate year-end giving statements automatically?

An Excel document for annually tracking church donations should include structured columns such as Donor Name, Donation Date, Amount, and Fund Designation, organized in a tabular format. Using Excel functions like SUMIFS combined with pivot tables allows automatic aggregation of yearly donations per donor. Incorporate donor contact details and dynamic date filters to generate customizable year-end giving statements efficiently.

What data validation techniques should be implemented to ensure accuracy in annual donation records?

Implement drop-down lists and date pickers to standardize input formats for donor details and donation dates in your annual donation tracking Excel sheet. Use data validation rules to restrict entries to positive numeric values for donation amounts, ensuring accuracy and preventing errors. Apply conditional formatting to highlight inconsistencies or duplicates, enhancing the reliability of your church's donation records.