The Annually Financial Statement Excel Template for Charities simplifies the process of tracking and reporting financial data crucial for nonprofit organizations. It ensures accuracy and transparency in financial statements, helping charities maintain compliance with legal and regulatory requirements. Customizable features allow users to organize income, expenses, and donations efficiently for clear year-end summaries.

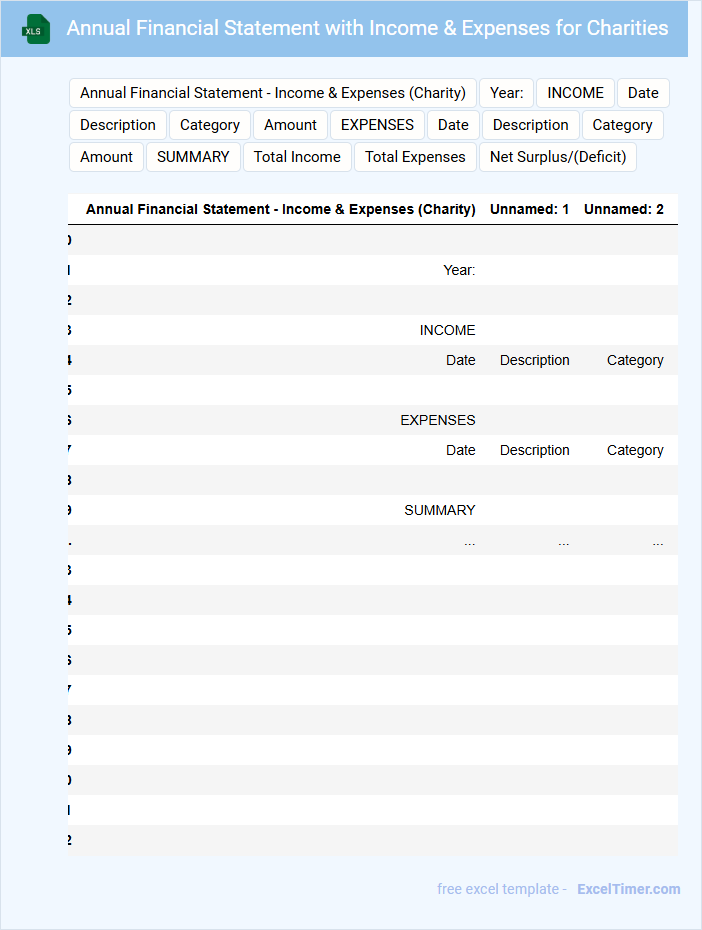

Annual Financial Statement with Income & Expenses for Charities

The Annual Financial Statement for charities typically contains a comprehensive overview of income and expenses, providing transparency to donors and stakeholders. It includes detailed records of donations received, grants, and various operational costs incurred throughout the year. Accurate documentation is essential to maintain trust and comply with legal requirements.

Important elements to include are clear categorization of income sources, itemized expense reports, and comparison against the budget. Incorporating notes that explain significant variances or unusual transactions enhances understanding and accountability. Additionally, including a summary of the financial position and audit results helps in demonstrating financial health and governance.

Ensuring the document is easy to read and accessible promotes stakeholder engagement and supports fundraising efforts. Visual aids such as charts or graphs can improve clarity and impact. Ultimately, the Annual Financial Statement serves as a critical tool in showcasing the charity's stewardship of funds and its overall mission effectiveness.

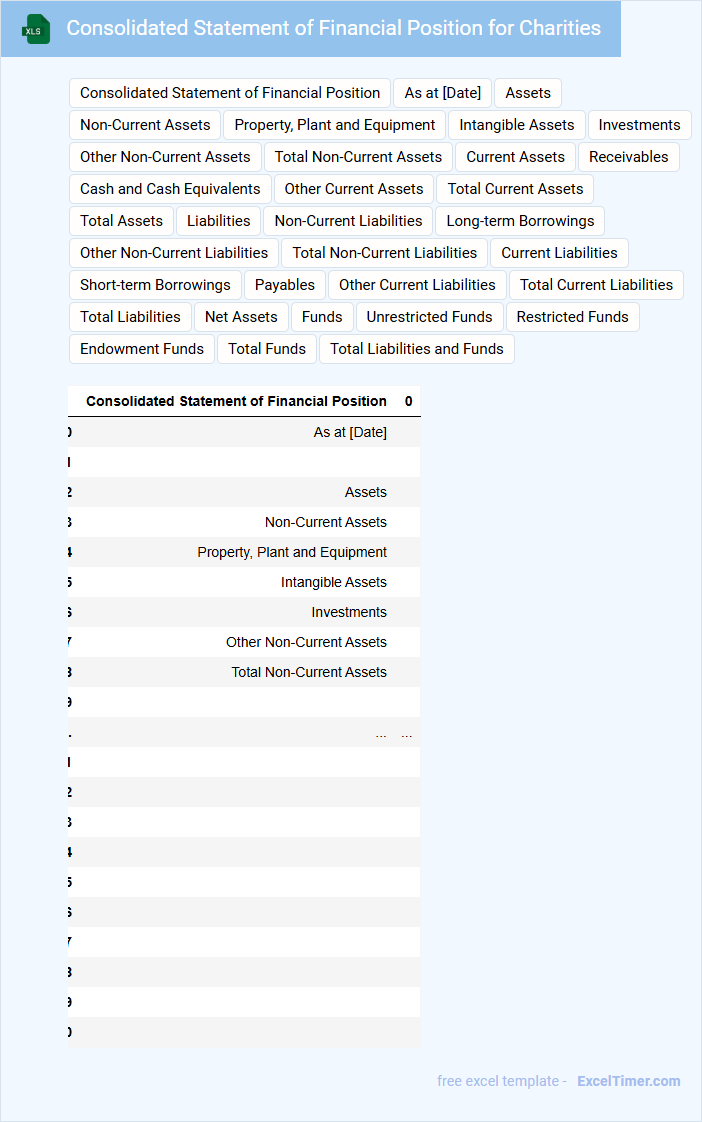

Consolidated Statement of Financial Position for Charities

The Consolidated Statement of Financial Position for Charities typically presents the charity's assets, liabilities, and net assets at a specific point in time. It provides a snapshot of the charity's financial health and stability.

- Ensure all assets and liabilities are accurately classified between current and non-current categories.

- Include clear disclosures about restricted and unrestricted funds.

- Provide detailed notes to explain significant balances or changes.

Statement of Activities with Yearly Comparison for Charities

The Statement of Activities with Yearly Comparison for Charities is a financial report that summarizes the annual revenues, expenses, and changes in net assets over two or more fiscal years. It provides donors, management, and regulatory bodies with a clear overview of the charity's financial performance and resource allocation. Key elements typically include contributions, grants, program expenses, administrative costs, and fundraising activities.

Accurate categorization of income and expenses is vital to reflect the charity's financial health transparently. Including comparative data helps identify trends, enabling better strategic planning and increased donor confidence. Ensure that notes highlight significant changes or unusual transactions for clarity and compliance.

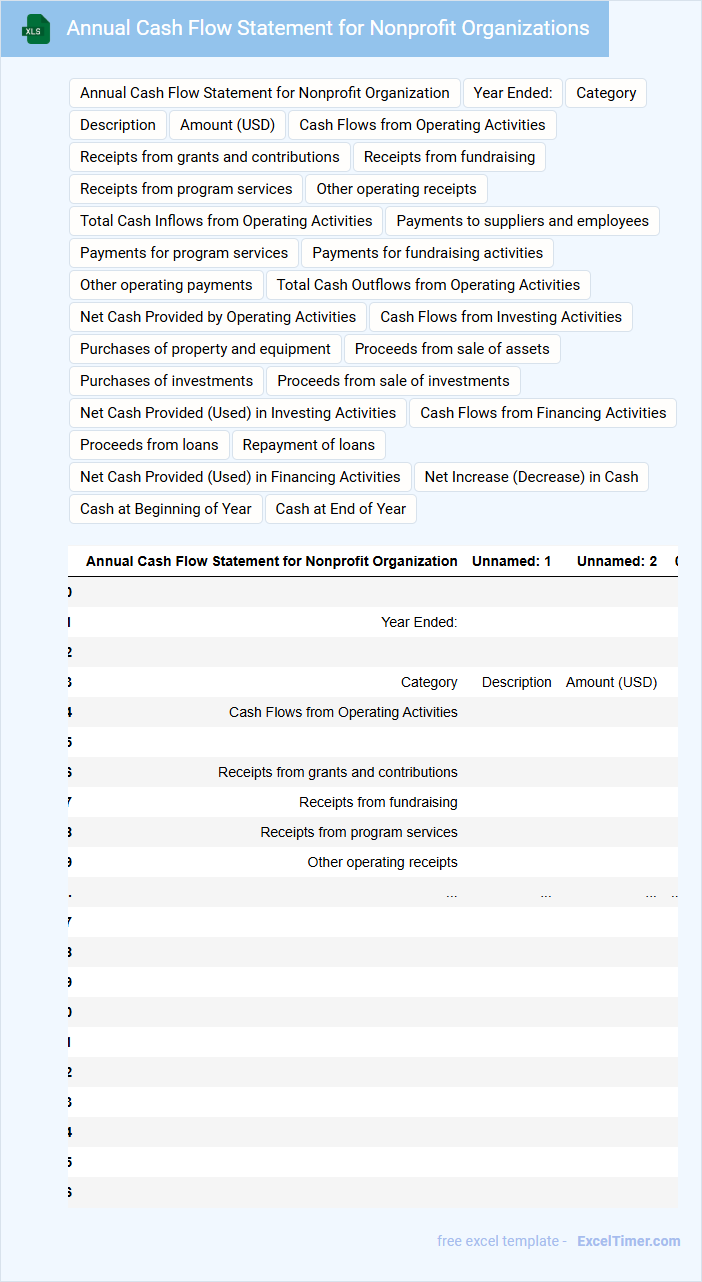

Annual Cash Flow Statement for Nonprofit Organizations

The Annual Cash Flow Statement for Nonprofit Organizations details the inflows and outflows of cash throughout the fiscal year. It provides a clear view of how the organization manages its funding sources and spending activities. This document is essential for ensuring transparency and financial accountability to donors and stakeholders.

Key components usually include operating, investing, and financing activities broken down by cash received and cash spent. It should also highlight any significant fluctuations or irregularities that affect the organization's liquidity. Clear categorization and accurate reporting help in effective financial planning and maintaining donor trust.

Important suggestions for preparing this statement are to ensure timely and consistent updates, verify all transactions for accuracy, and provide accompanying notes that explain major cash flow changes. Integrating this statement with other financial reports strengthens the overall financial health assessment. Adherence to generally accepted accounting principles (GAAP) tailored to nonprofits enhances credibility and compliance.

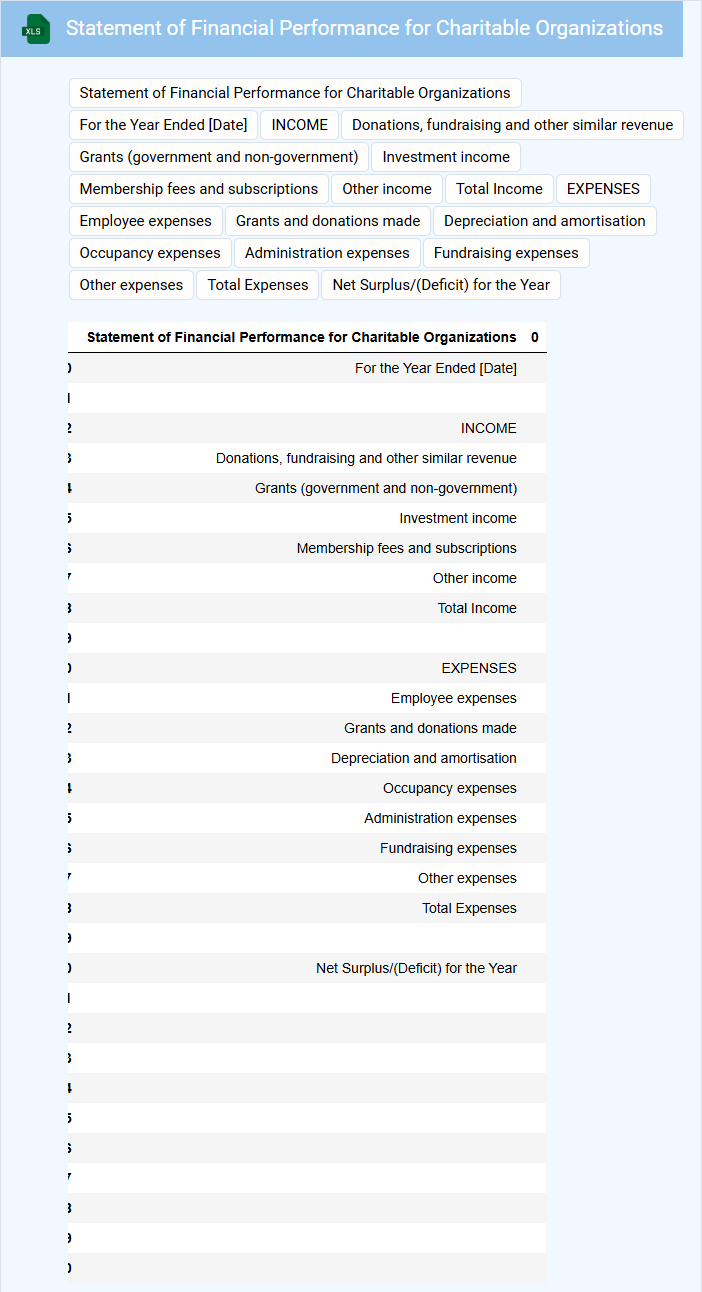

Statement of Financial Performance for Charitable Organizations

The Statement of Financial Performance for charitable organizations primarily details the revenues and expenses during a specific period, illustrating the financial health and operational success. This document highlights contributions, grants, fundraising income, and program service expenses to provide a clear overview of financial activities. Maintaining transparency and accuracy in this statement is crucial for building trust with donors and stakeholders.

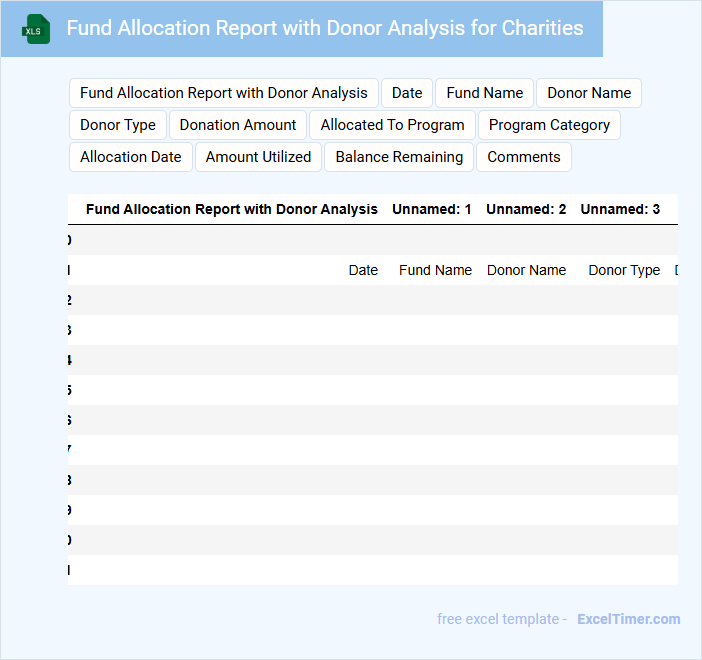

Fund Allocation Report with Donor Analysis for Charities

A Fund Allocation Report with Donor Analysis for charities typically details how financial resources are distributed across various programs and initiatives, ensuring transparency and accountability. It includes a breakdown of donor contributions, highlighting trends and patterns in giving behavior. Such reports are crucial for evaluating the effectiveness of fundraising efforts and optimizing future campaigns.

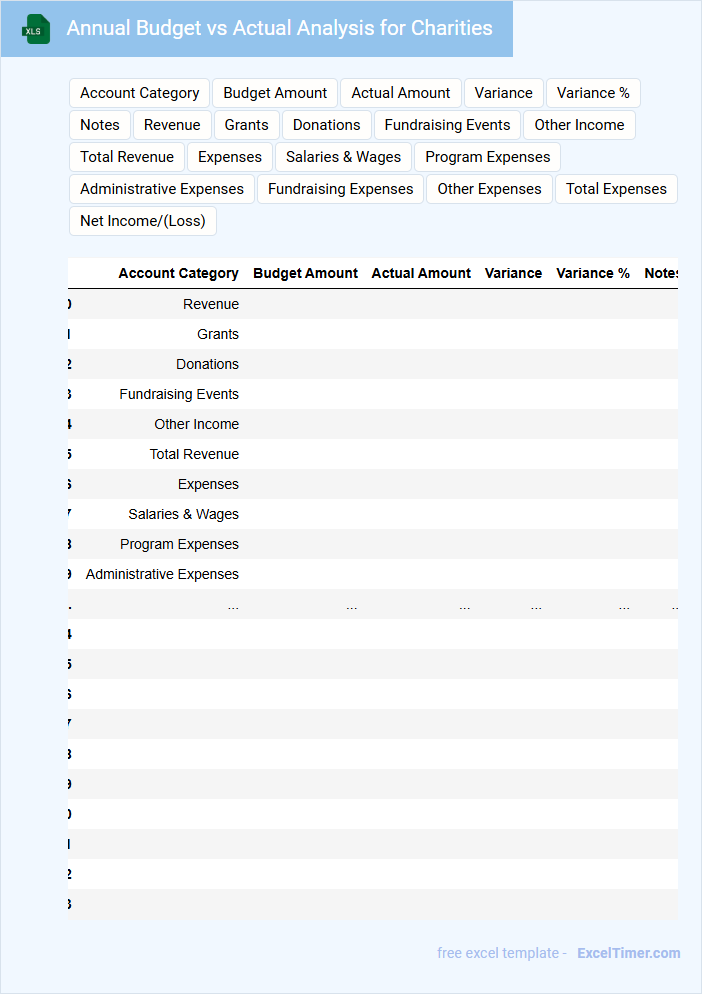

Annual Budget vs Actual Analysis for Charities

What information is typically included in an Annual Budget vs Actual Analysis for Charities? This document usually contains a detailed comparison of the projected budgeted revenues and expenses against the actual financial outcomes throughout the year. It highlights variances to provide insights into financial performance and helps organizations identify areas of overspending or underspending.

Why is this analysis important for charities? Conducting this analysis ensures transparency and accountability to donors and stakeholders by demonstrating how funds are managed and allocated. It also supports strategic planning and resource optimization by pinpointing financial trends and enabling data-driven decision-making.

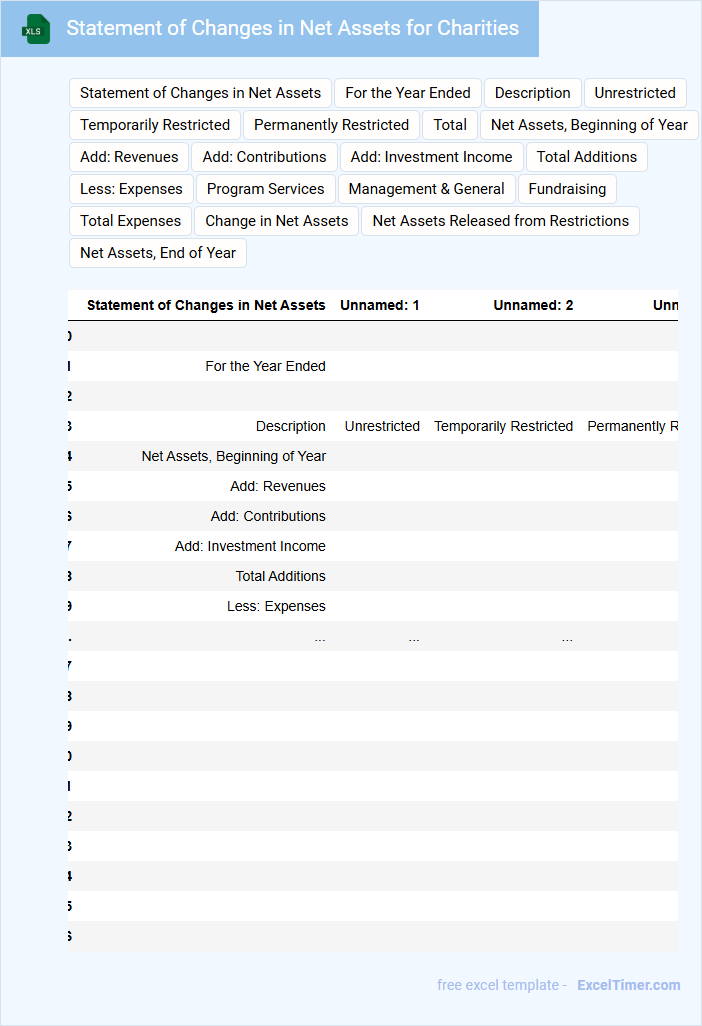

Statement of Changes in Net Assets for Charities

The Statement of Changes in Net Assets for Charities typically provides a detailed account of changes in a charity's net assets over a specific period.

- Sources of Changes: It highlights all increases and decreases in net assets from donations, grants, and other revenue streams.

- Classification of Net Assets: The statement categorizes net assets as restricted, unrestricted, or endowment funds to show their specific purposes.

- Transparency and Accountability: It ensures stakeholders understand how the charity's resources have been managed and utilized during the reporting period.

Financial Summary Report for Year-End Review of Charities

What information is typically included in a Financial Summary Report for the Year-End Review of Charities? This report usually contains a detailed overview of the charity's financial activities throughout the year, including income sources, expenditures, and overall financial health. It highlights key financial metrics and compliance with donor restrictions to ensure transparency and accountability.

What important aspects should be emphasized in this report? It is crucial to include clear summaries of funding allocations, administrative costs, and program expenses, as well as any audit findings or significant financial changes. Providing a comparative analysis with previous years' data helps stakeholders understand trends and make informed decisions.

Annual Grant Tracking Sheet with Fund Utilization for Charities

An Annual Grant Tracking Sheet is a crucial document used by charities to monitor the receipt and allocation of grant funds throughout the year. It usually contains detailed records of grant sources, amounts awarded, disbursements made, and the specific purposes for which funds are utilized. Maintaining accurate data helps ensure transparency, accountability, and effective financial management for grant compliance.

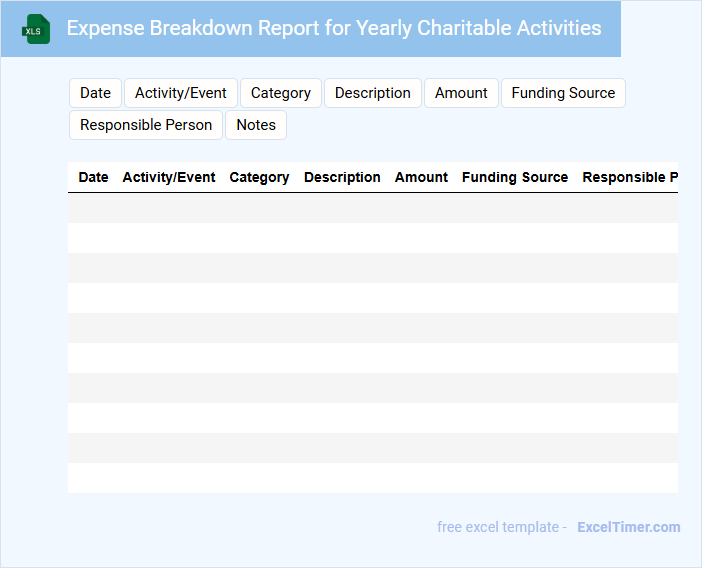

Expense Breakdown Report for Yearly Charitable Activities

An Expense Breakdown Report for yearly charitable activities typically contains detailed financial data on how funds were allocated and spent over the course of the year. It includes categories such as administrative costs, program expenses, and fundraising expenditures to provide a clear overview of resource management. This document is essential for transparency, accountability, and strategic planning in non-profit organizations.

Important suggestions for this report include ensuring accuracy in financial records, categorizing expenses clearly, and including comparative data from previous years to highlight trends and improvements. Additionally, incorporating narrative explanations for significant expenditures helps stakeholders understand the impact and necessity of each cost. Visual aids such as charts or graphs can enhance readability and engagement.

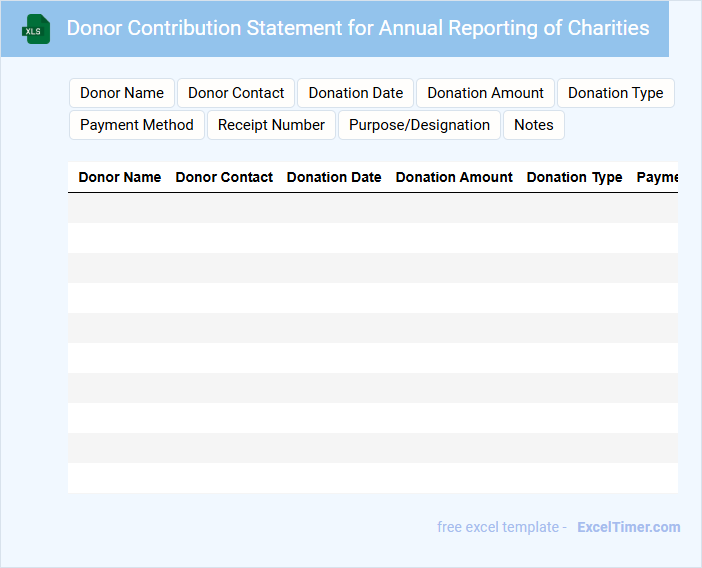

Donor Contribution Statement for Annual Reporting of Charities

A Donor Contribution Statement is a crucial document used in the annual reporting process of charities, summarizing individual or organizational donations over the year. It typically includes donor names, contribution amounts, dates, and the purpose of donations, ensuring transparency for both donors and regulatory bodies. This statement supports accountability and helps maintain donor trust by clearly documenting financial support.

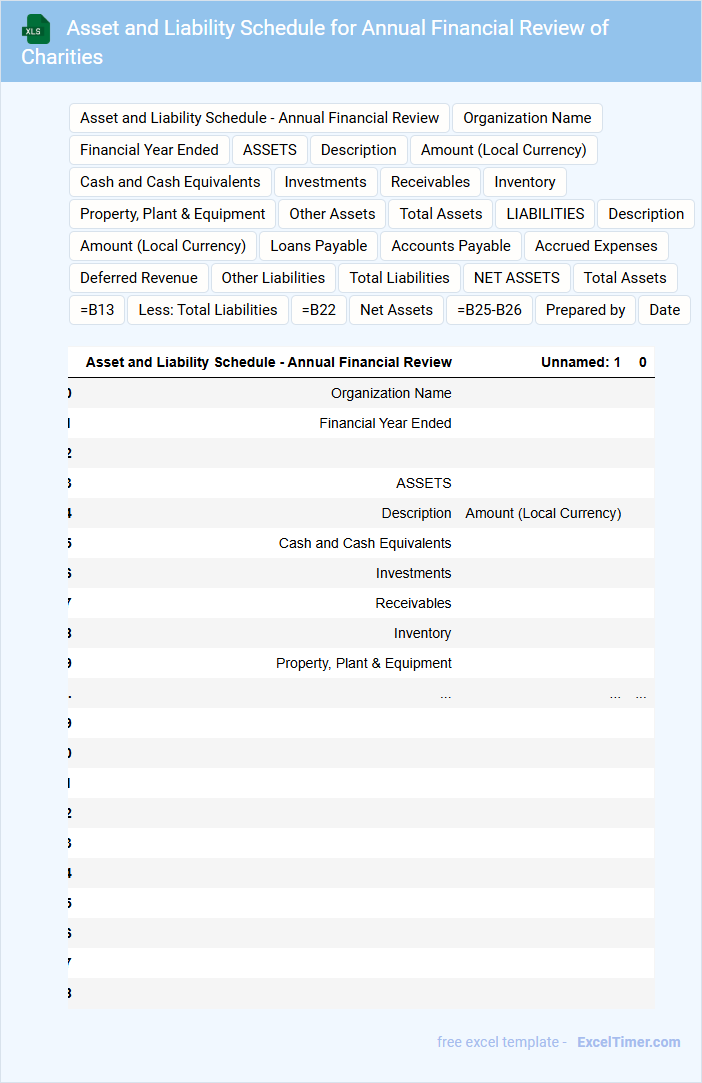

Asset and Liability Schedule for Annual Financial Review of Charities

An Asset and Liability Schedule is a crucial document that outlines the financial position of a charity by detailing its assets and liabilities. It provides transparency and accountability during the Annual Financial Review, ensuring stakeholders understand the organization's financial health. Important elements to include are clearly categorized assets, detailed liabilities, and accurate valuations to support effective decision-making.

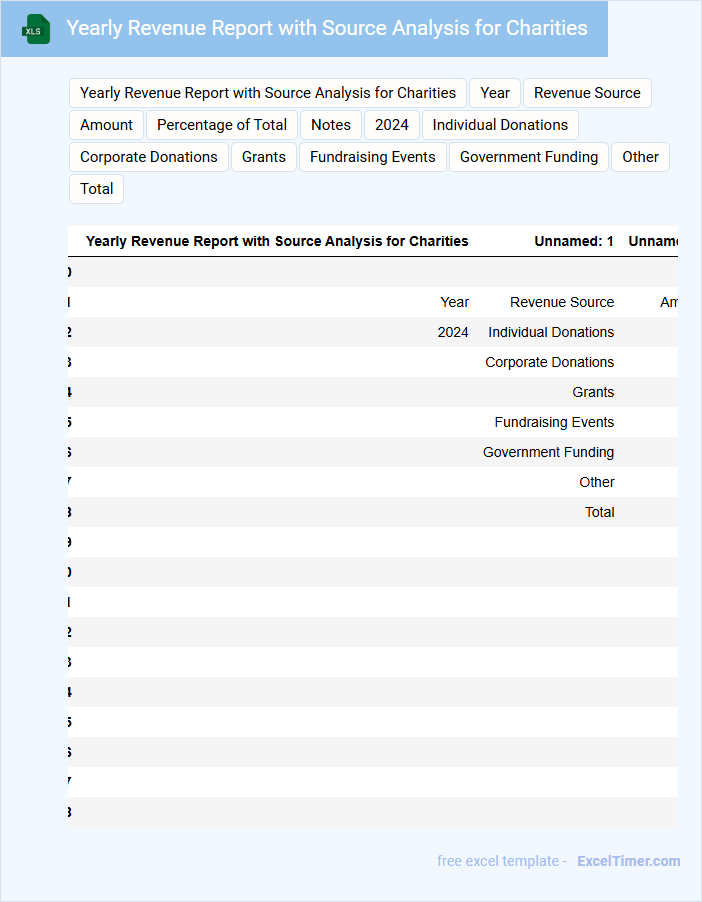

Yearly Revenue Report with Source Analysis for Charities

The Yearly Revenue Report for charities typically contains comprehensive financial data outlining the total income generated over the fiscal year. It includes detailed source analysis, breaking down contributions from donations, grants, fundraising events, and other revenue streams. This report is essential for transparency, strategic planning, and demonstrating accountability to stakeholders.

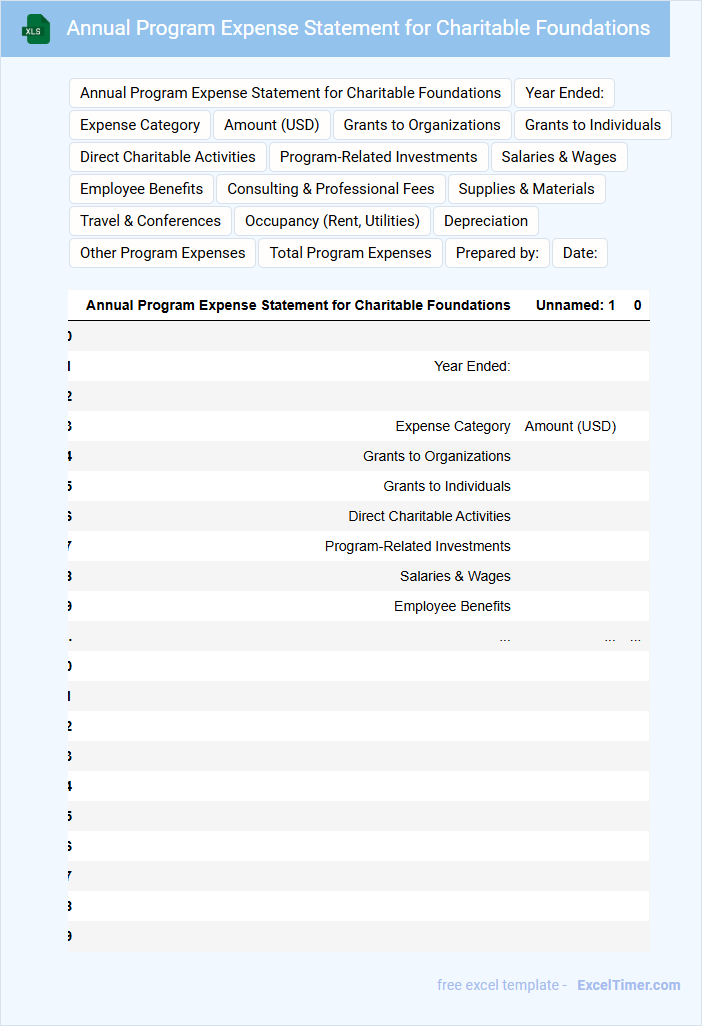

Annual Program Expense Statement for Charitable Foundations

Annual Program Expense Statements for Charitable Foundations typically outline the foundation's yearly expenditures related to its charitable activities and programs.

- Detailed Program Costs: This section breaks down expenses linked to specific charitable initiatives.

- Supporting Documentation: Financial records and receipts that validate the reported expenses.

- Compliance Information: Ensures alignment with legal and regulatory financial reporting requirements for nonprofits.

What key financial statements must a charity include in its annual financial statement?

A charity's annual financial statement must include the Statement of Financial Activities, the Balance Sheet, and the Cash Flow Statement. The Statement of Financial Activities details income and expenditure, ensuring transparency in how funds are utilized. The Balance Sheet presents assets, liabilities, and reserves, while the Cash Flow Statement outlines the charity's liquidity and cash movements during the year.

How should donations and other sources of income be categorized and reported in Excel?

Donations and other sources of income should be categorized under distinct income accounts such as "Donations," "Grants," and "Fundraising Revenue" in your Excel financial statement for charities. Accurately label each entry with the date, donor information, and amount to ensure transparent tracking and reporting. This structured approach helps you generate precise annual summaries and comply with regulatory requirements.

Which Excel functions can help automate the calculation of surplus or deficit for the year?

Excel functions like SUM, IF, and SUMIF can help automate the calculation of surplus or deficit in your annual financial statement for charities. Using SUM, you can total income and expenses, while IF allows you to set conditions to identify whether the result is a surplus or deficit. SUMIF can further help by summing amounts based on specific criteria, ensuring accurate financial analysis.

What are the best practices for structuring expense categories for nonprofit transparency in the document?

Organize expense categories into clear sections such as Program Services, Management and General, and Fundraising to enhance transparency in your annual financial statement. Use standardized labels and detail individual line items for accurate tracking and donor trust. Ensure consistency with regulatory guidelines and include notes explaining significant expenses for comprehensive understanding.

How can Excel be used to track and reconcile restricted vs. unrestricted funds in the annual report?

Excel can be used to track and reconcile restricted vs. unrestricted funds in your annual financial statement by creating separate worksheets or tables for each fund type, allowing for clear categorization and monitoring of fund usage. Formulas and pivot tables help summarize transactions, ensuring accurate allocation and balance reconciliation. Conditional formatting highlights discrepancies, making financial oversight efficient and transparent.