The Annually Tax Deduction Checklist Excel Template for Self-employed helps streamline expense tracking and ensures accurate tax filing by organizing deductible items efficiently. This template includes categories like business expenses, home office costs, and mileage, making it easier to identify eligible deductions. Maintaining a detailed and up-to-date checklist reduces errors and maximizes potential tax savings for self-employed individuals.

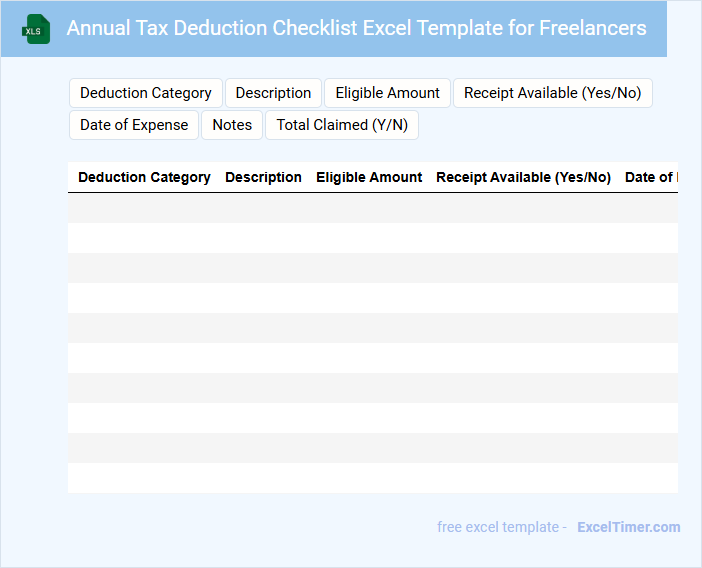

Annual Tax Deduction Checklist Excel Template for Freelancers

The Annual Tax Deduction Checklist Excel Template for Freelancers is a crucial tool designed to help freelancers track their deductible expenses throughout the year. It typically contains categories such as business expenses, equipment purchases, travel costs, and home office deductions. Utilizing this template ensures accurate tax filing and maximizes possible deductions.

Important things to consider when using the checklist include maintaining organized and timely records, regularly updating the template with receipts and invoices, and consulting tax laws relevant to freelance income. Additionally, freelancers should customize the template to fit their specific industry and financial activities. This proactive approach can help prevent missed deductions and simplify year-end tax preparation.

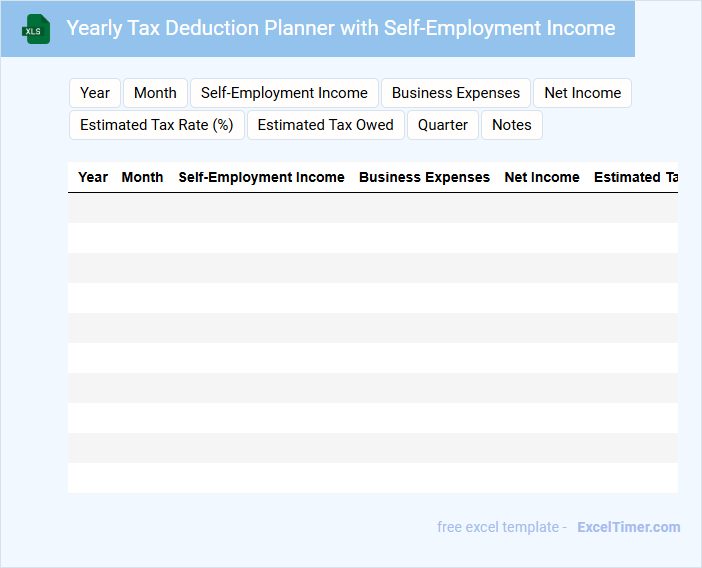

Yearly Tax Deduction Planner with Self-Employment Income

The Yearly Tax Deduction Planner for self-employment income is a crucial document used to track and organize deductible expenses throughout the fiscal year. It helps individuals estimate their tax liabilities accurately while ensuring compliance with tax regulations. Understanding common deductible categories is essential for maximizing tax savings.

Self-employed individuals should include sections for business expenses, estimated quarterly tax payments, and income tracking in the planner. Regular updates and detailed record-keeping enable effective tax planning and minimize surprises during tax season.

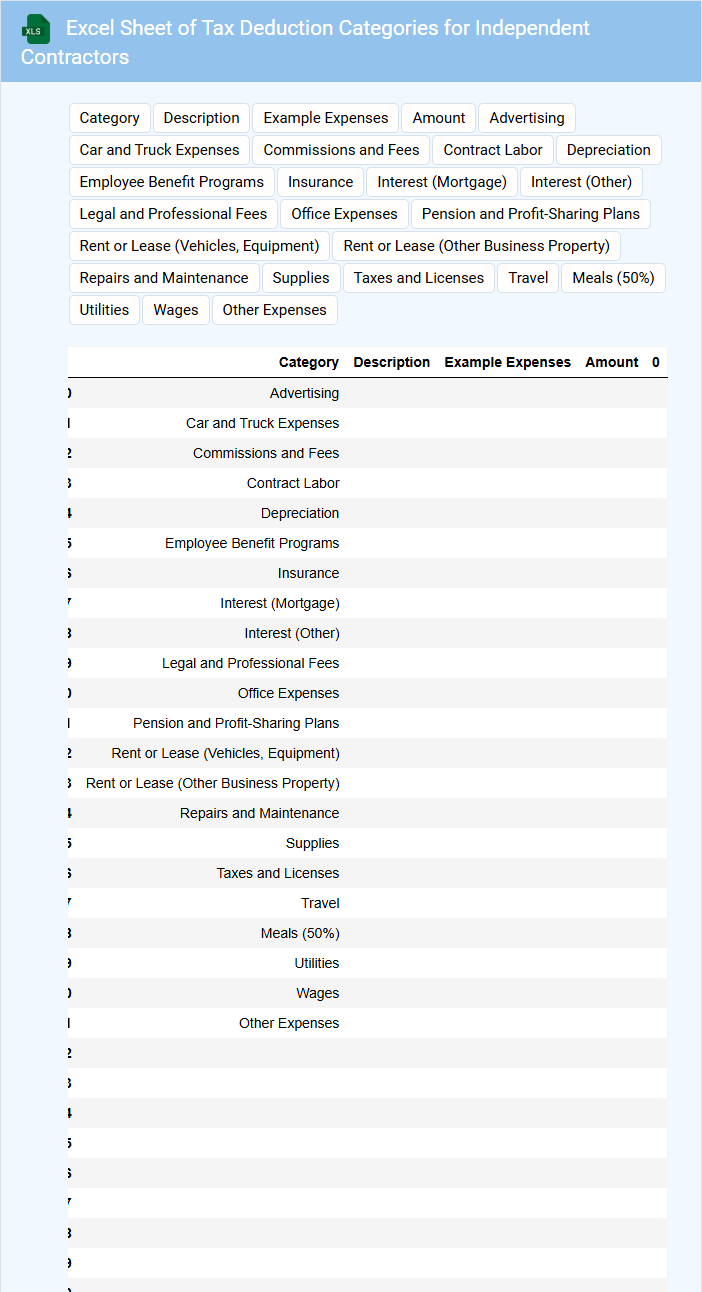

Excel Sheet of Tax Deduction Categories for Independent Contractors

An Excel sheet of tax deduction categories for independent contractors typically contains a comprehensive list of deductible expenses such as office supplies, travel costs, and professional services. It serves as a crucial tool for organizing and tracking expenses to ensure accurate tax reporting.

Maintaining clear categorization of each deduction type helps maximize tax benefits and simplifies the filing process. It is important to regularly update the sheet with all relevant transactions to avoid missing any eligible deductions.

Tax Deduction Tracking Template for Small Business Owners

This document is a Tax Deduction Tracking Template designed specifically for small business owners to systematically record and organize deductible expenses. It typically includes fields for expense description, date, amount, and category to simplify tax preparation.

Using this template helps ensure no eligible deductions are overlooked, thereby maximizing potential tax savings. It is important to regularly update the template and keep receipts as proof for all recorded transactions.

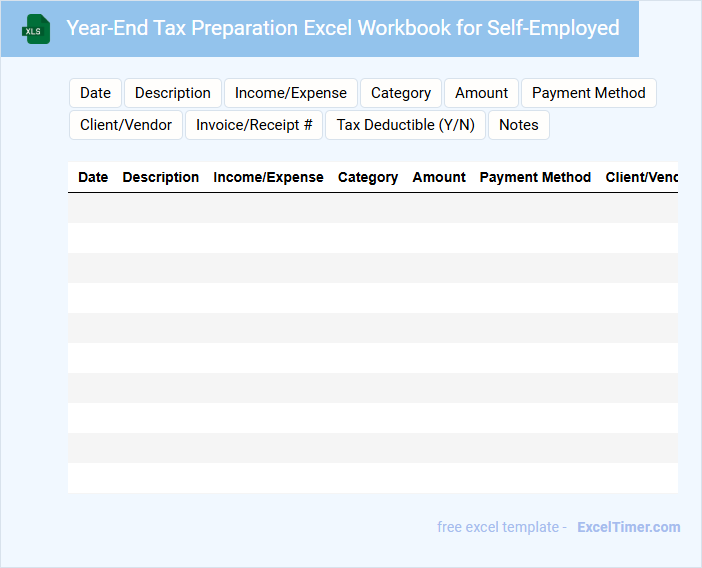

Year-End Tax Preparation Excel Workbook for Self-Employed

A Year-End Tax Preparation Excel Workbook for the self-employed typically contains detailed worksheets to track income, expenses, and deductible items throughout the fiscal year. It helps organize financial data necessary for accurate tax filing and ensuring compliance with tax regulations. Important elements often include sections for mileage, business expenses, estimated tax payments, and profit and loss summaries.

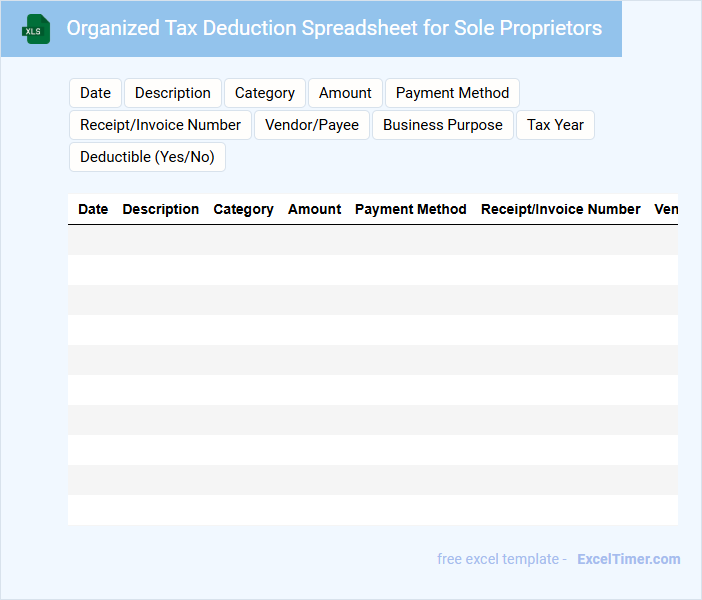

Organized Tax Deduction Spreadsheet for Sole Proprietors

An Organized Tax Deduction Spreadsheet for Sole Proprietors typically contains detailed records of business expenses, categorized by type and date, to simplify tracking deductible items. It also includes income entries, totaling all earnings to accurately calculate taxable income.

Maintaining clear documentation of receipts and dates is crucial to support deductions during tax filings. Ensure the spreadsheet is regularly updated and backed up to prevent data loss and facilitate smooth tax preparation.

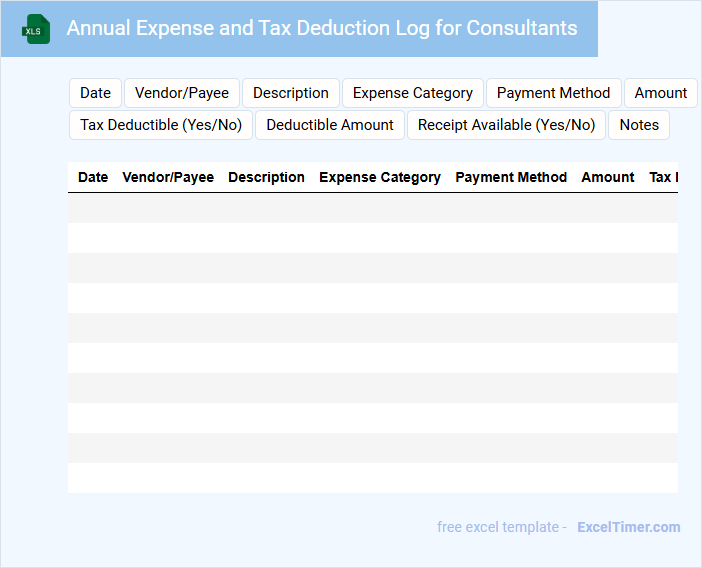

Annual Expense and Tax Deduction Log for Consultants

What does an Annual Expense and Tax Deduction Log for Consultants usually contain? This document typically includes detailed records of all business-related expenses and corresponding tax deductions claimed by consultants throughout the fiscal year. It is designed to help manage financial data systematically and ensure accurate tax reporting.

Why is maintaining this log important for consultants? Keeping an organized log aids in maximizing deductible expenses, minimizing tax liabilities, and providing proof for audits. It is crucial to include date, amount, category, and purpose of each expense for thorough and compliant financial tracking.

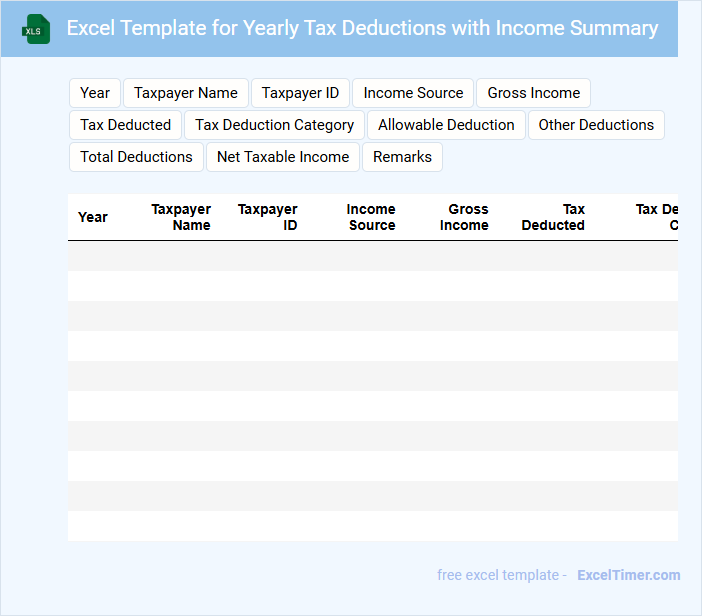

Excel Template for Yearly Tax Deductions with Income Summary

What information is typically included in an Excel Template for Yearly Tax Deductions with Income Summary? This type of document usually contains detailed records of an individual's or company's annual income alongside categorized tax deductions to calculate taxable income accurately. It helps users organize financial data systematically and ensures compliance with tax regulations.

What is an important consideration when using this template? It is crucial to ensure that all income sources and deductible expenses are accurately recorded and updated regularly. Additionally, verifying that the tax rates and deduction limits reflect the current fiscal year regulations enhances the reliability and usefulness of the summary.

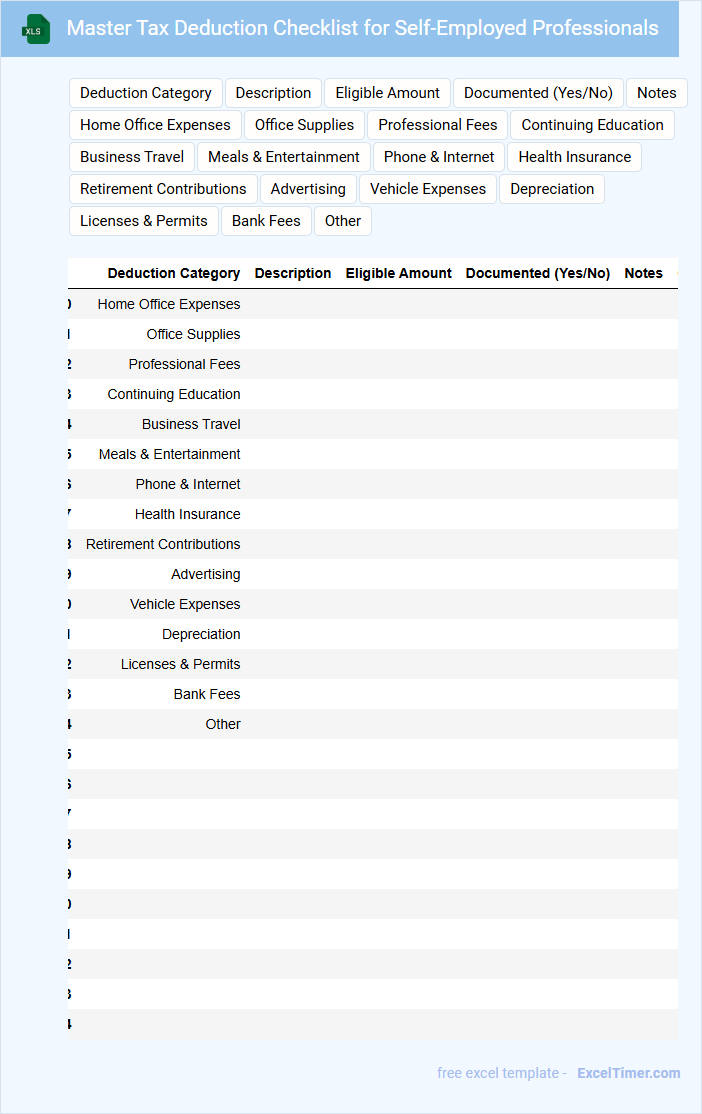

Master Tax Deduction Checklist for Self-Employed Professionals

A Master Tax Deduction Checklist for self-employed professionals is a vital document that outlines all possible deductible expenses to minimize tax liability. It typically includes sections for business expenses, home office costs, travel, and professional services. Utilizing this checklist ensures comprehensive record-keeping and maximizes eligible deductions during tax filing.

Tax Deduction Documentation Sheet with Receipts Tracker

The Tax Deduction Documentation Sheet is a crucial document that helps individuals and businesses organize and track deductible expenses systematically. It usually contains detailed information about various expenses, dates, amounts, and related receipts to ensure accurate tax reporting.

A Receipts Tracker is essential for maintaining proof of these expenses, preventing the loss of important financial records. It helps streamline the tax filing process and supports claims during audits. Ensure to record each receipt promptly and categorize expenses clearly for maximum efficiency.

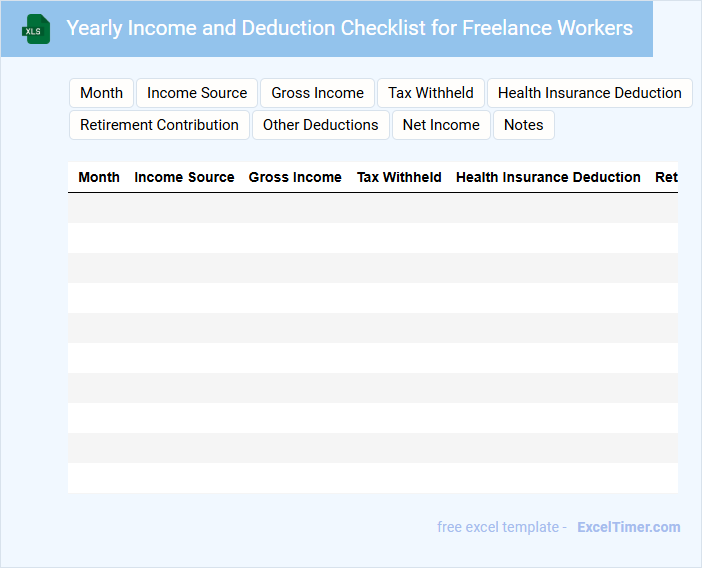

Yearly Income and Deduction Checklist for Freelance Workers

What information is typically included in a Yearly Income and Deduction Checklist for Freelance Workers? This document usually contains a comprehensive list of all income sources received throughout the year and possible deductible expenses to lower taxable income. It helps freelancers organize their finances for accurate tax filing and ensures no important deductions are overlooked.

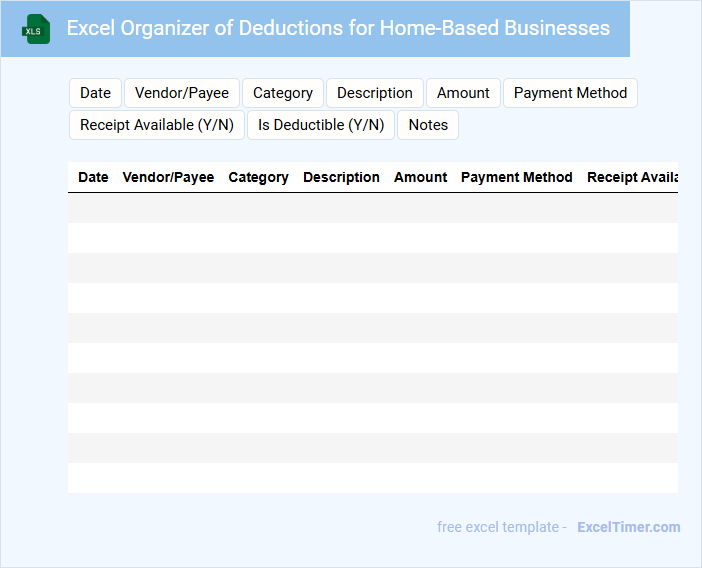

Excel Organizer of Deductions for Home-Based Businesses

An Excel Organizer of Deductions for Home-Based Businesses typically contains a detailed spreadsheet that tracks expenses and revenues related to running a business from home. It categorizes costs such as utilities, supplies, and office space usage to simplify tax preparation.

Including accurate deduction records ensures compliance and maximizes tax benefits for business owners. Regularly updating the organizer helps maintain clear financial documentation throughout the fiscal year.

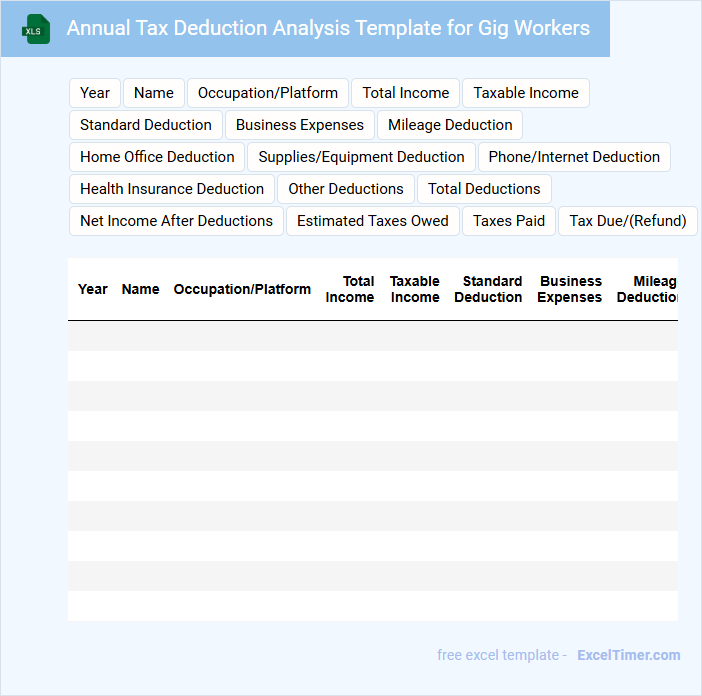

Annual Tax Deduction Analysis Template for Gig Workers

An Annual Tax Deduction Analysis Template for gig workers is designed to help individuals systematically track their income and deductible expenses throughout the fiscal year. This type of document usually contains sections for recording various income sources, categorizing expenses, and calculating total deductions to ensure accurate tax filing. It is essential for gig workers to maintain this template regularly to optimize their tax savings and avoid potential compliance issues.

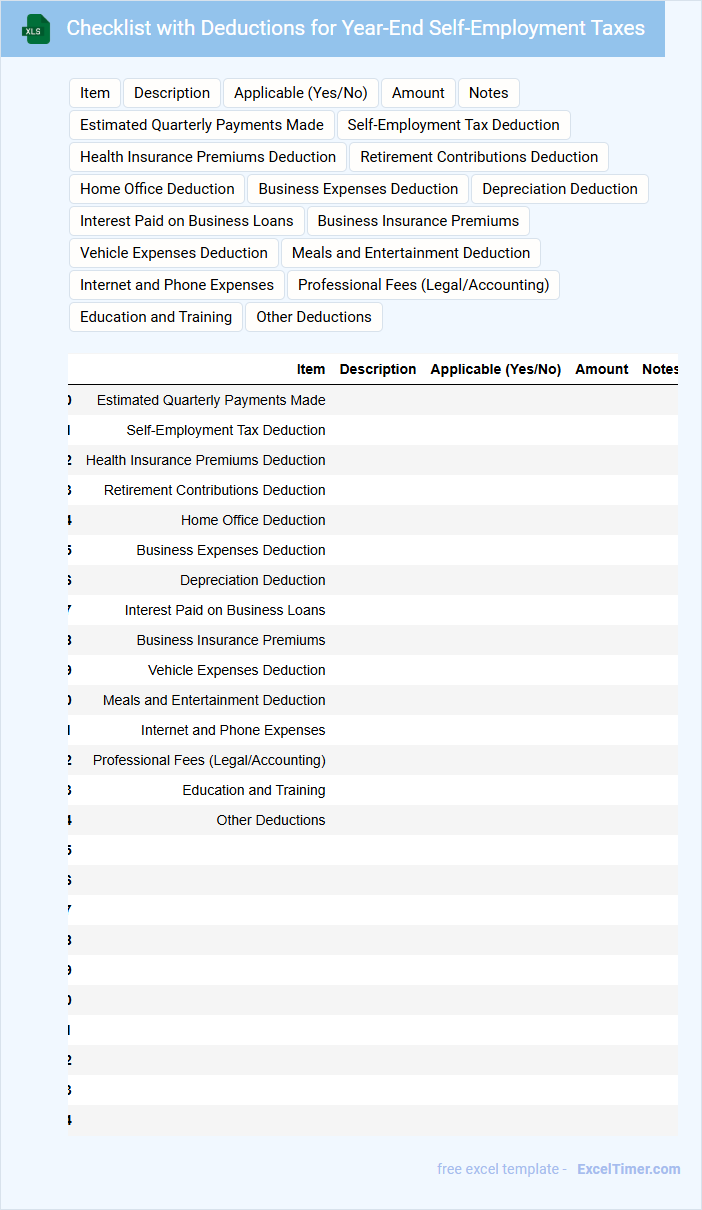

Checklist with Deductions for Year-End Self-Employment Taxes

What information is typically included in a Checklist with Deductions for Year-End Self-Employment Taxes? This document usually contains a comprehensive list of potential deductible expenses that self-employed individuals can claim to reduce their taxable income. It helps taxpayers ensure they don't overlook important deductions such as business expenses, home office costs, and retirement contributions when preparing their taxes.

Why is it important to use this checklist? Using this checklist helps self-employed individuals maximize their tax savings and maintain organized financial records for accurate reporting. It is crucial to keep thorough documentation for all deductions to support claims in case of an audit.

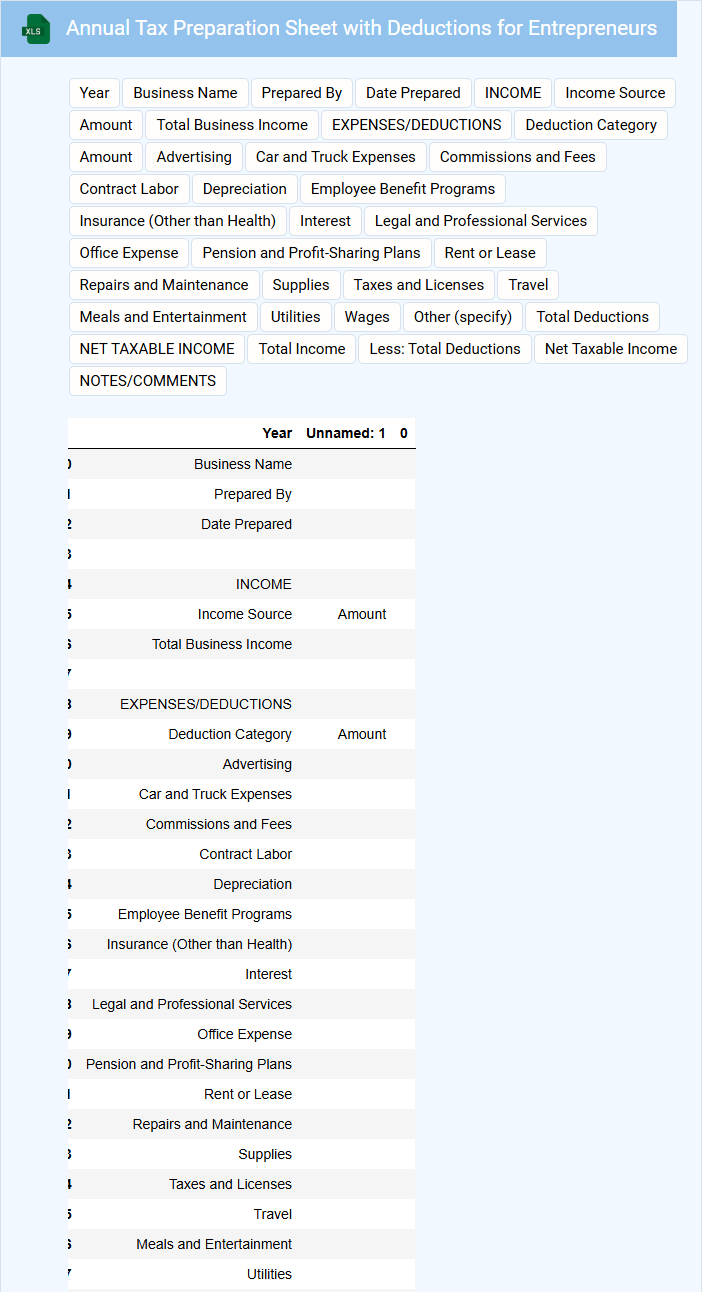

Annual Tax Preparation Sheet with Deductions for Entrepreneurs

What information is typically included in an Annual Tax Preparation Sheet with Deductions for Entrepreneurs? This document generally contains detailed records of income, expenses, and eligible deductions that entrepreneurs can claim to minimize their tax liability. It helps organize financial data efficiently, ensuring compliance and maximizing tax benefits.

What are the essential expense categories to include in an annually tax deduction checklist for self-employed individuals?

Essential expense categories in an annual tax deduction checklist for self-employed individuals include office supplies, travel expenses, and professional services fees. Health insurance premiums, home office expenses, and business-related meals also qualify as deductible costs. Accurate categorization of vehicle expenses, utilities, and retirement contributions maximizes tax savings.

Which documents should be organized and maintained for accurate annual tax deductions?

Organize and maintain income statements, receipts for business expenses, mileage logs, and invoices to ensure accurate annual tax deductions for self-employed individuals. Keep copies of bank statements, tax forms such as 1099-MISC, and records of home office expenses. Proper documentation supports deduction claims and compliance with tax regulations.

How should home office expenses be calculated and documented for year-end tax deduction purposes?

Home office expenses for self-employed individuals should be calculated based on the percentage of the home used exclusively and regularly for business purposes, applying this proportion to related costs such as rent, utilities, and maintenance. Detailed records including receipts, floor plans, and expense logs must be maintained to substantiate deductions during tax filing. Accurate documentation ensures compliance with tax regulations and maximizes eligible deductions on the annual tax deduction checklist.

What common business-related deductions are often overlooked by self-employed taxpayers?

Common business-related deductions often overlooked by self-employed taxpayers include home office expenses, professional development costs, and vehicle expenses related to business use. Meal and entertainment expenses, when properly documented, can also provide significant tax savings. Tracking health insurance premiums and retirement plan contributions frequently increases annual deductions for self-employed individuals.

How can mileage and travel expenses be effectively tracked and reported annually for tax deduction compliance?

Track mileage using a reliable mileage log app or a manual written log documenting dates, destinations, purpose, and miles driven for business. Keep receipts and records of travel expenses such as fuel, tolls, parking fees, and accommodation relevant to your self-employment activities. You must organize and categorize this data annually to ensure accurate reporting and maximize tax deduction benefits on your tax return.