The Annually Asset Depreciation Excel Template for Accountants streamlines the calculation and tracking of asset depreciation over time, ensuring accurate financial reporting. It includes automated formulas to handle various depreciation methods such as straight-line and declining balance, reducing manual errors. This template is essential for accountants aiming to maintain precise asset value records and comply with accounting standards efficiently.

Annual Asset Depreciation Schedule for Accountants

What information is typically included in an Annual Asset Depreciation Schedule for Accountants? This document usually contains detailed records of all fixed assets, their purchase dates, costs, estimated useful lives, and accumulated depreciation. It serves as a crucial tool for accurately calculating asset value reductions over time, ensuring compliance with accounting standards, and aiding in financial reporting.

What important factors should accountants consider when preparing this schedule? Accountants should prioritize the accuracy of asset classifications, consistently apply the chosen depreciation method, and regularly update asset values to reflect disposals or additions. Additionally, maintaining clear documentation supports audit processes and improves fiscal transparency.

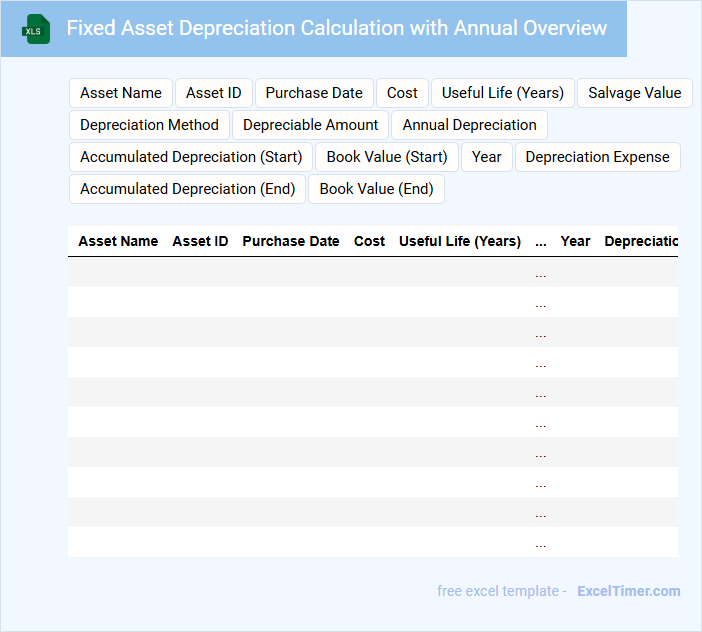

Fixed Asset Depreciation Calculation with Annual Overview

What information is typically included in a Fixed Asset Depreciation Calculation with Annual Overview document? This document usually contains detailed records of fixed assets, their purchase dates, cost, depreciation methods, and accumulated depreciation figures. It provides an annual summary of depreciation expenses, helping businesses track asset value reduction over time for accurate financial reporting.

What is important to consider when preparing this document? It is essential to select the appropriate depreciation method aligned with accounting standards and ensure all asset details are accurately recorded. Additionally, regularly updating the annual overview helps maintain transparency and supports informed decision-making regarding asset management.

Yearly Depreciation Tracker for Office Assets

A Yearly Depreciation Tracker for Office Assets is a document used to monitor the depreciation value of office equipment over time. It helps organizations maintain accurate financial records and asset management.

- Include detailed asset descriptions, purchase dates, and original values.

- Record yearly depreciation amounts and cumulative depreciation accurately.

- Ensure the depreciation method used is clearly stated and consistently applied.

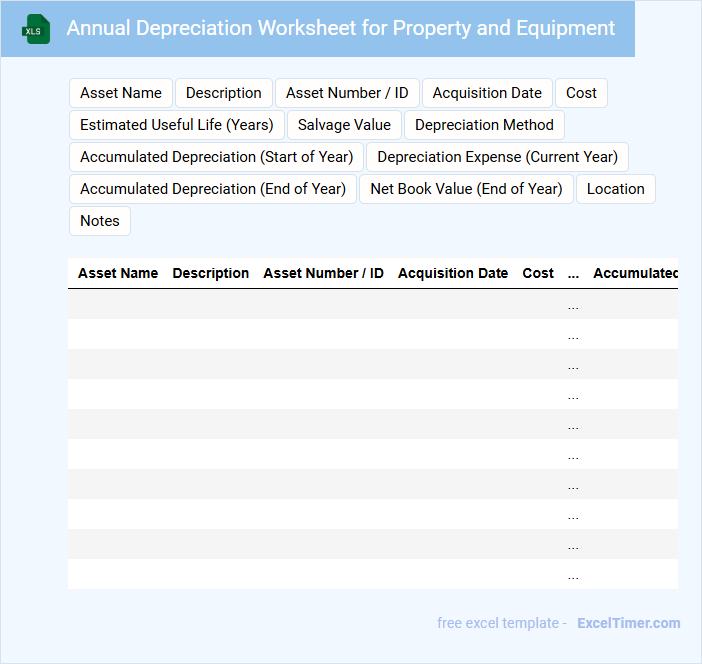

Annual Depreciation Worksheet for Property and Equipment

The Annual Depreciation Worksheet for Property and Equipment is a critical financial document that tracks the yearly depreciation expenses of tangible assets. It typically contains detailed information on the asset's original cost, accumulated depreciation, and remaining book value. This worksheet helps ensure accurate financial reporting and compliance with accounting standards.

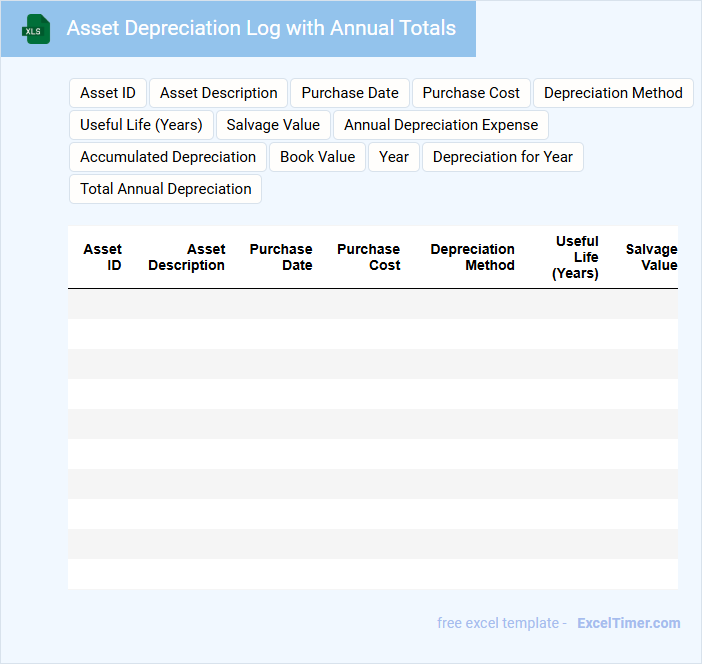

Asset Depreciation Log with Annual Totals

An Asset Depreciation Log with annual totals typically contains a detailed record of an asset's depreciation over time, including acquisition cost, depreciation methods, and accumulated depreciation at year-end. It serves as a crucial document for financial reporting, tax compliance, and asset management. Important considerations include maintaining accuracy, updating the log regularly, and ensuring transparency for audit purposes.

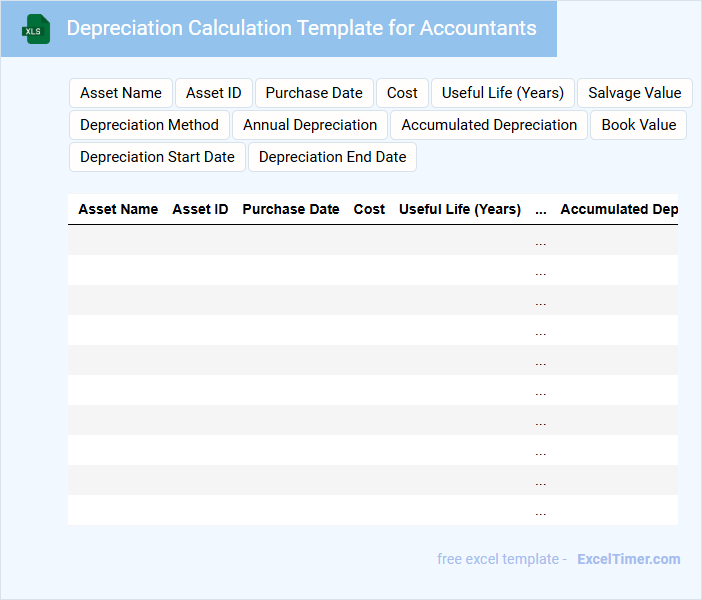

Depreciation Calculation Template for Accountants

This depreciation calculation template is designed to help accountants systematically track the depreciation of assets over time. It typically contains fields for asset details, purchase cost, useful life, and accumulated depreciation. Using this template ensures accuracy in financial reporting and simplifies tax compliance.

Important elements to include are clear asset identification, selection of the appropriate depreciation method, and automated calculations to minimize errors. Additionally, maintaining a section for depreciation schedules and notes on asset disposals enhances transparency. These features help accountants make informed decisions and maintain consistent records.

Annual Asset Value Report with Depreciation Tracking

An Annual Asset Value Report with Depreciation Tracking is a financial document summarizing the value of assets over a year, accounting for their depreciation. It provides insights into asset management and helps in accurate financial reporting.

- Include a detailed list of assets with initial values and acquisition dates.

- Track annual depreciation using consistent methods, such as straight-line or declining balance.

- Highlight changes in asset values and provide depreciation schedules for clarity.

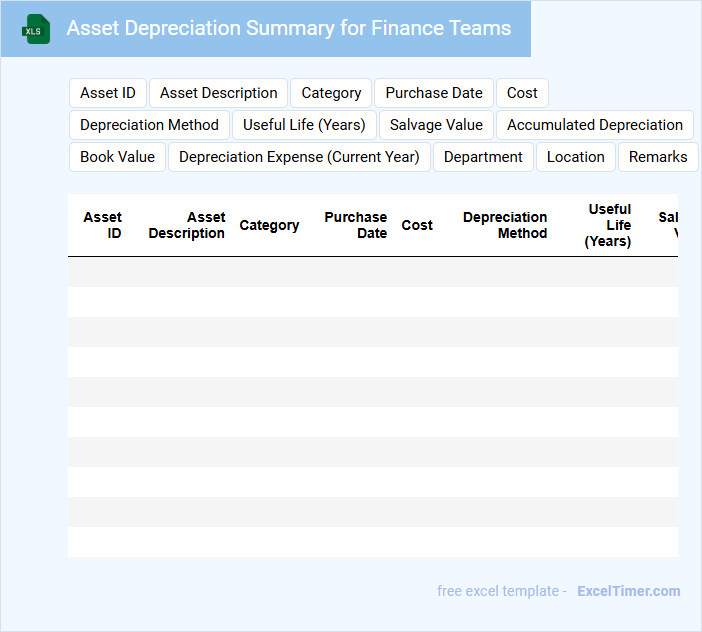

Asset Depreciation Summary for Finance Teams

An Asset Depreciation Summary for Finance Teams typically contains detailed records of asset values and their depreciation over time. It helps in tracking the reduction in the value of company assets for accurate financial reporting and tax purposes.

- Include a clear breakdown of assets and their respective depreciation methods.

- Ensure the summary is updated regularly to reflect current asset values.

- Highlight any significant changes or write-offs for better audit readiness.

Year-End Depreciation Report for Auditors

A Year-End Depreciation Report for Auditors typically contains a detailed summary of asset depreciation schedules and calculations for the fiscal year.

- Accurate Asset Listings: Ensure all assets are correctly listed with their acquisition dates and cost values.

- Depreciation Methods: Clearly state the depreciation methods applied to different asset categories.

- Reconciled Totals: Provide reconciled totals that align with the company's general ledger for audit verification.

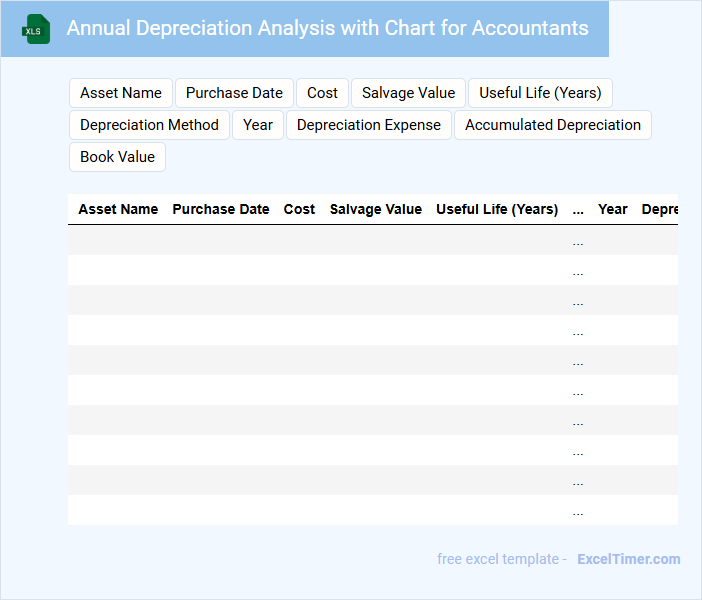

Annual Depreciation Analysis with Chart for Accountants

Annual Depreciation Analysis with Chart for Accountants

What information does an Annual Depreciation Analysis typically contain, and why is it important for accountants? This document generally includes detailed records of asset values, depreciation methods, and yearly depreciation expenses to track the reduction in asset value over time. It helps accountants ensure accurate financial reporting and aids in tax calculations by visually representing trends through charts.

Asset Lifecycle Tracker with Annual Depreciation

An Asset Lifecycle Tracker document typically contains detailed records of an asset's acquisition, usage, maintenance, and disposal phases. It includes financial data such as initial cost, depreciation method, and annual depreciation values to monitor asset value over time. This document is essential for accurate accounting and informed decision-making regarding asset management and replacement planning.

Depreciation of Assets Schedule for Business Accounting

The Depreciation of Assets Schedule is a crucial document in business accounting that tracks the reduction in value of fixed assets over time. It helps in allocating the cost of tangible assets systematically across their useful lives.

This schedule typically contains detailed entries of asset names, acquisition dates, costs, depreciation methods, and accumulated depreciation amounts. Maintaining accuracy and regular updates in this document ensures compliance with accounting standards and aids in financial analysis.

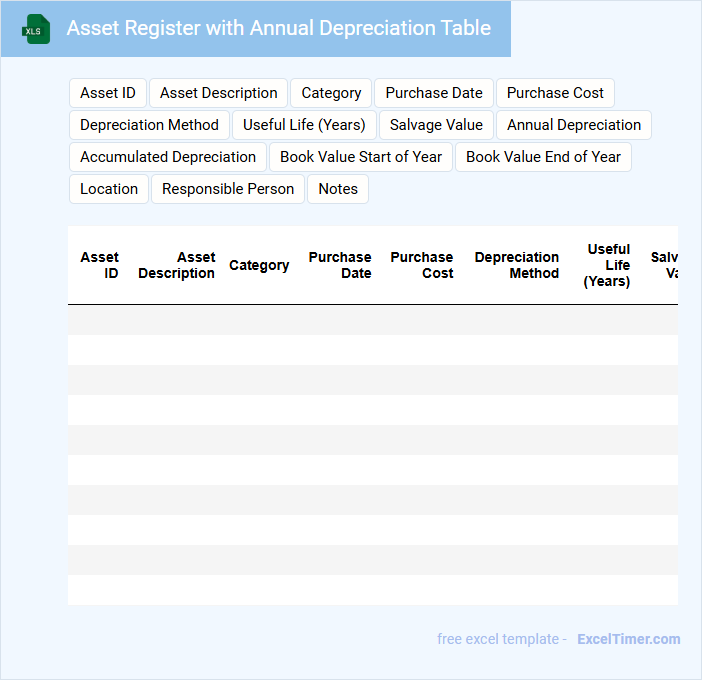

Asset Register with Annual Depreciation Table

What information is typically contained in an Asset Register with an Annual Depreciation Table? This document usually lists all company assets along with detailed descriptions, purchase dates, and initial values. It also includes annual depreciation figures that track the reduction in asset value over time, aiding in accurate financial reporting and asset management.

What is an important consideration when maintaining an Asset Register with Annual Depreciation Table? Consistent updates and accurate calculations of depreciation methods are crucial to ensure compliance with accounting standards and to provide a realistic evaluation of asset worth. Regular audits and reconciliations help maintain data integrity and support informed decision-making.

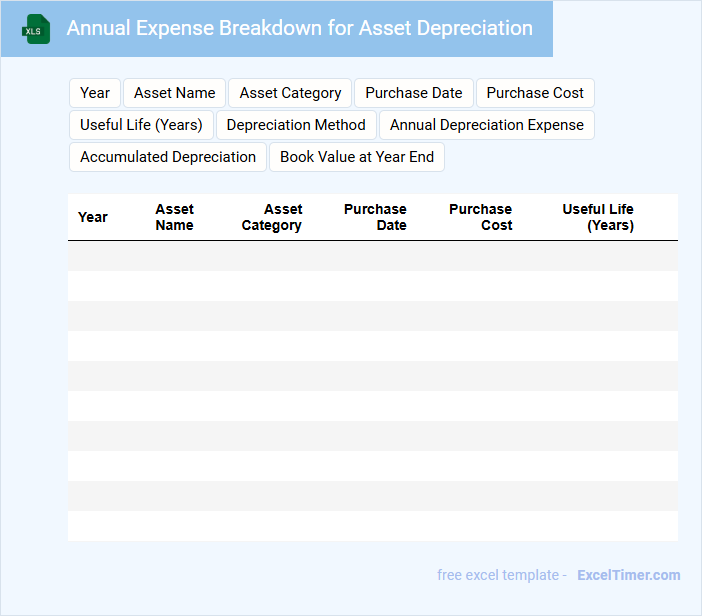

Annual Expense Breakdown for Asset Depreciation

An Annual Expense Breakdown for Asset Depreciation document typically details the allocation of depreciation costs for assets over a fiscal year.

- Depreciation Methods: Specify which accounting methods (e.g., straight-line, declining balance) are used to calculate depreciation.

- Asset Categories: Clearly classify assets to differentiate depreciation rates and useful life spans.

- Expense Reporting: Ensure accurate reporting of depreciation expenses to reflect the true value loss of assets in financial statements.

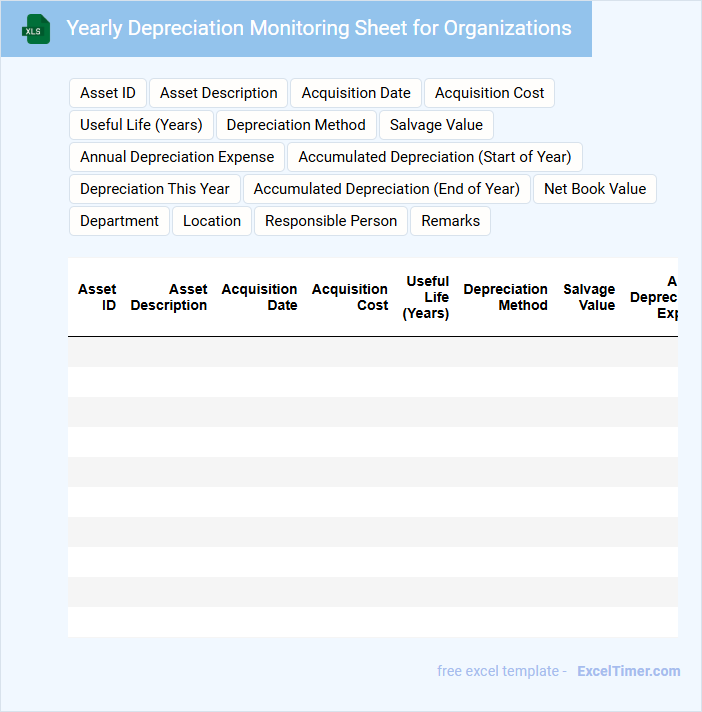

Yearly Depreciation Monitoring Sheet for Organizations

The Yearly Depreciation Monitoring Sheet is a crucial document used by organizations to track the depreciation of their fixed assets over the fiscal year. It provides a detailed summary of the value reduction for each asset, ensuring accurate financial reporting. This sheet is essential for maintaining compliance with accounting standards and optimizing tax calculations.

Typically, it contains asset descriptions, acquisition dates, initial costs, accumulated depreciation, and current book values. Organizations should ensure regular updates and reconciliations to reflect any disposals or asset revaluations. Accurate data entry and periodic reviews are important for effective asset management and financial planning.

What formula is commonly used to calculate annual straight-line depreciation in Excel?

The commonly used formula to calculate annual straight-line depreciation in Excel is = (Cost - Salvage Value) / Useful Life. This formula helps you evenly allocate the asset's cost over its useful life for accurate annual depreciation. Accountants rely on this method for consistent and straightforward asset valuation.

How can the declining balance method be implemented for asset depreciation in Excel spreadsheets?

Implement the declining balance method in Excel by entering the asset's initial cost, useful life, and depreciation rate, then apply the formula =DB(cost, salvage, life, period, [month]) to calculate annual depreciation. Your spreadsheet will automatically adjust the depreciation expense each year based on the declining balance rate, providing accurate asset value reduction. This method helps accountants efficiently track and report asset depreciation over time.

Which Excel functions help automate depreciation schedules for multiple assets?

Excel functions like SLN, DB, and DDB automate depreciation schedules by calculating straight-line, declining balance, and double-declining balance depreciation respectively. The SUM function consolidates total depreciation, while IF and VLOOKUP enable conditional depreciation adjustments and asset classification. Using these functions streamlines annual asset depreciation tracking for accountants managing multiple assets.

What key asset data must be recorded in an Excel document to ensure accurate annual depreciation?

Your Excel document must record the asset's purchase date, original cost, useful life, and salvage value to ensure accurate annual depreciation calculations. Including the depreciation method, such as straight-line or declining balance, allows precise expense tracking. Accurate recording of these key data points guarantees reliable financial reporting and compliance.

How do you use Excel to update and track changes in asset useful life or salvage value for annual depreciation calculations?

Use Excel's built-in depreciation functions like SLN or DB to calculate annual asset depreciation by entering updated useful life and salvage value values. Track changes by maintaining a version-controlled asset register sheet where you log adjustments to these parameters each fiscal year. You can apply conditional formatting and data validation to ensure accuracy in your depreciation updates.