![]()

The Annually Expense Tracker Excel Template for Homeowners provides a streamlined way to monitor and categorize yearly household expenses, enhancing budget management. It offers customizable fields for utilities, maintenance, and property taxes, making it easier to identify spending patterns and potential savings. Accurate tracking with this template ensures homeowners stay financially organized and prepared for future expenses.

Annual Expense Tracker with Monthly Breakdown

An Annual Expense Tracker with a monthly breakdown typically contains detailed records of all expenditures categorized by type and month. This document helps in monitoring spending patterns and managing budgets efficiently throughout the year.

It usually includes sections for fixed and variable expenses, summaries, and comparison charts to visualize financial trends. For optimal use, regularly update the tracker and review it monthly to identify areas for cost-saving.

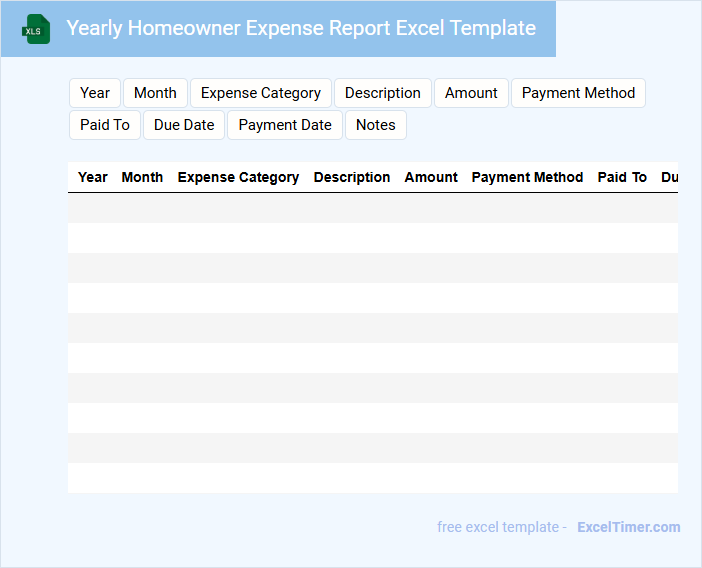

Yearly Homeowner Expense Report Excel Template

What is typically included in a Yearly Homeowner Expense Report Excel Template? This document usually contains detailed records of all expenses related to home ownership, such as mortgage payments, property taxes, repairs, utilities, and maintenance costs. It helps homeowners track their annual spending and budget effectively for future expenses.

What important features should be considered when using this template? It is essential to include clear categories for each type of expense, customizable fields for variable costs, and summary sections for total annual expenditures. Additionally, incorporating visual charts or graphs can aid in visualizing spending patterns and identifying areas for cost-saving.

Annual Financial Tracker for Home Expenses

An Annual Financial Tracker for home expenses is a document that systematically records and categorizes all household spending throughout the year. It typically contains detailed entries of monthly bills, groceries, maintenance costs, and unexpected expenditures. This helps homeowners to analyze spending patterns and plan budgets more effectively.

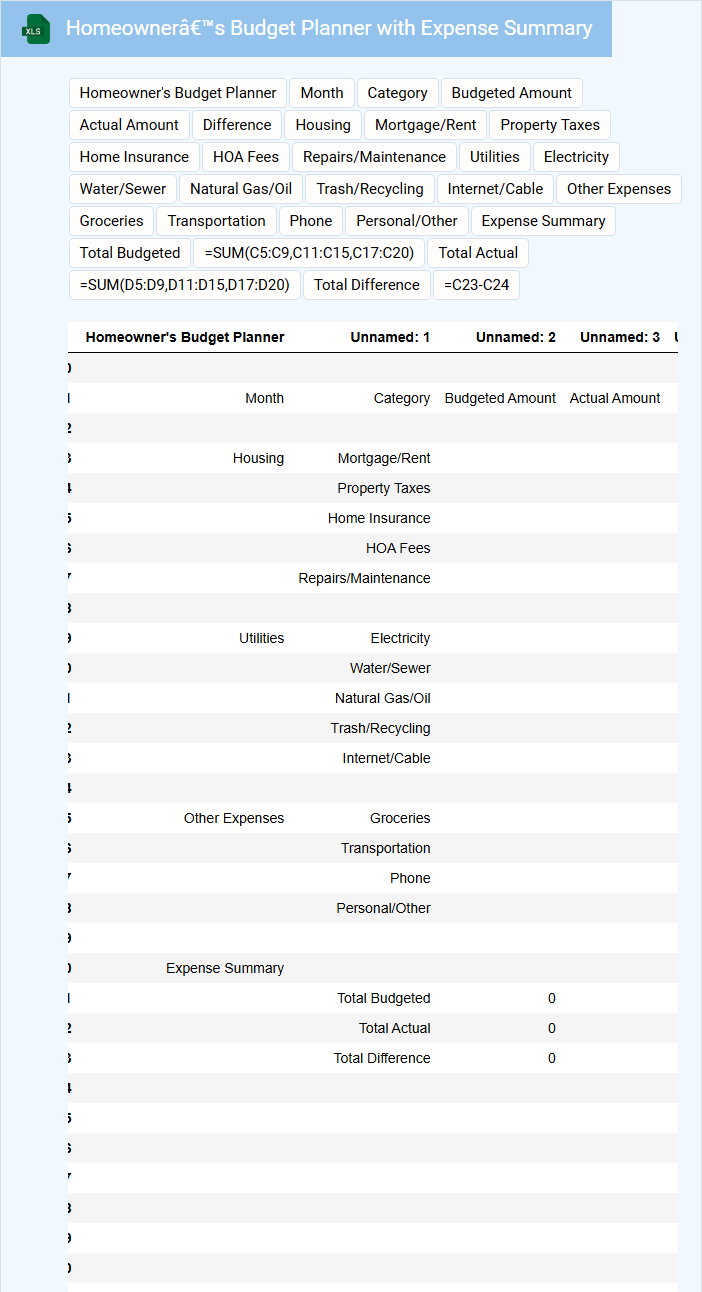

Homeowner’s Budget Planner with Expense Summary

A Homeowner's Budget Planner is a document designed to help individuals track their monthly income and expenses related to homeownership. It typically includes sections for mortgage payments, utilities, maintenance, and other housing-related costs.

The Expense Summary provides a clear overview of total expenditures, helping homeowners identify spending patterns and areas for potential savings. This summary is essential for maintaining financial stability and planning future home improvements.

Including accurate income details and regularly updating expenses ensures the budget planner remains an effective tool for managing home finances.

Yearly Expense Tracker with Chart for Homeowners

A Yearly Expense Tracker for homeowners is a document designed to record and monitor all expenses related to home maintenance, utilities, and other property-associated costs throughout the year. It typically contains categorized expense entries, monthly totals, and an overall annual summary. Including a visual chart helps in quickly identifying spending patterns and budgeting efficiently.

Important elements to include are clear category labels such as repairs, utilities, and taxes, accurate date tracking for each expense, and a summary chart that visually compares monthly or category-wise spending. Ensuring data accuracy and timely updates will enhance financial planning and control for homeowners.

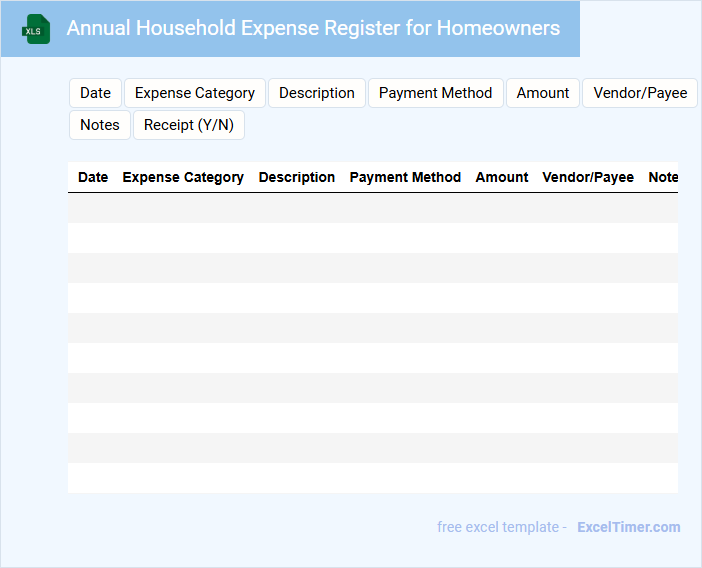

Annual Household Expense Register for Homeowners

The Annual Household Expense Register for homeowners is a detailed document that tracks all expenses related to managing and maintaining a home throughout the year. It typically includes categories such as utilities, repairs, mortgage payments, insurance, and property taxes.

This register helps homeowners monitor spending patterns and budget effectively for future costs. For accuracy, it is important to regularly update receipts and invoices within the register to ensure comprehensive financial oversight.

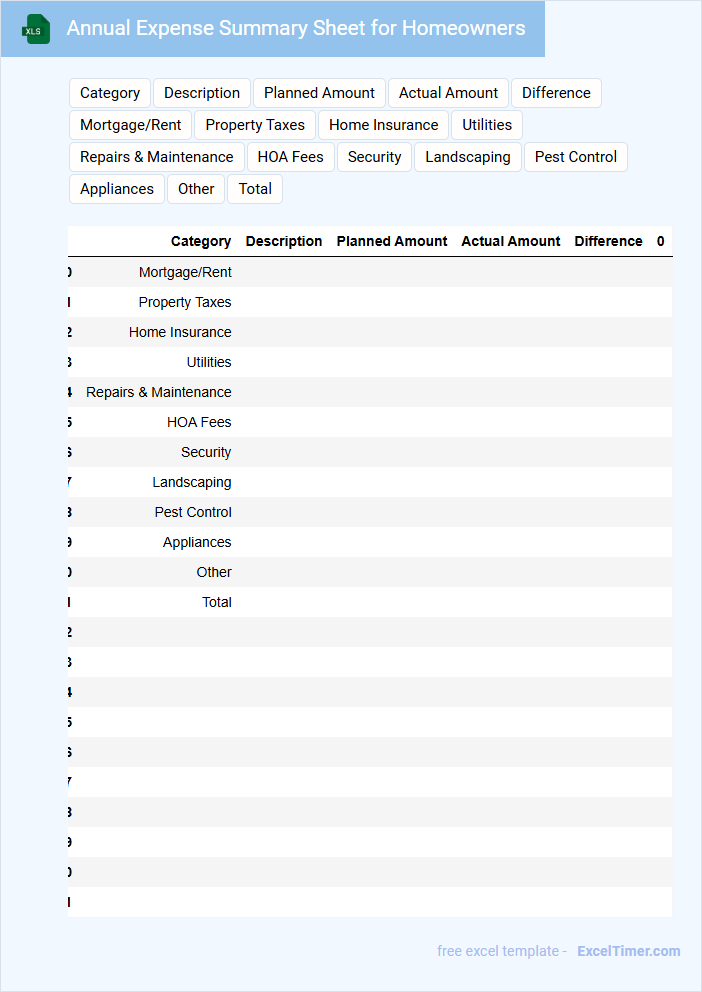

Annual Expense Summary Sheet for Homeowners

What information is typically included in an Annual Expense Summary Sheet for Homeowners? This document generally contains a detailed list of all expenses related to home maintenance, utilities, property taxes, insurance, and any renovation costs incurred throughout the year. It helps homeowners track their spending patterns, budget effectively, and prepare for future financial planning.

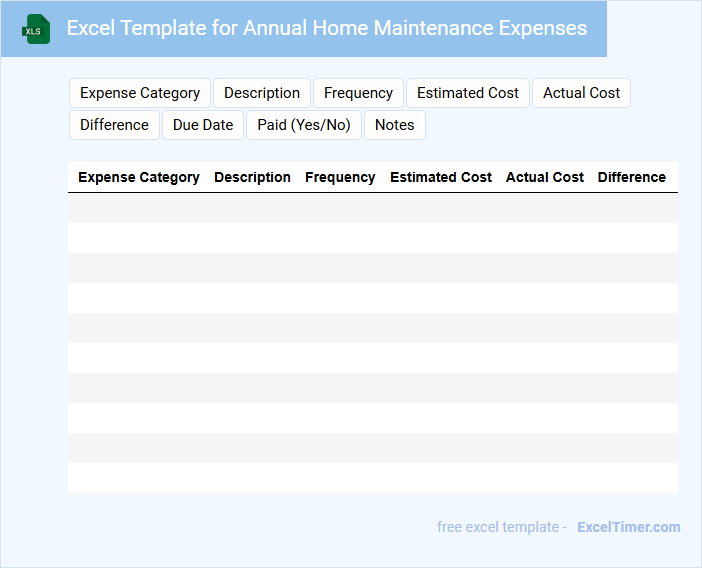

Excel Template for Annual Home Maintenance Expenses

An Excel Template for Annual Home Maintenance Expenses typically contains detailed sections for tracking repair costs, routine maintenance schedules, and budgeting estimates throughout the year. It helps homeowners organize all their expenses in a structured format, ensuring nothing is overlooked. Important features often include categories for different home systems, date reminders, and summary charts for easy financial review.

Homeowner Expense Tracker with Category Analysis

An Expense Tracker for homeowners typically contains detailed records of all household expenses categorized by type, such as utilities, maintenance, and mortgage payments. It helps in monitoring spending patterns and budgeting effectively for home-related costs.

Category Analysis provides insights into where the most money is being spent, enabling better financial decisions and cost-saving opportunities. Including a summary section with monthly and yearly totals is an important feature to track overall spending efficiently.

Annual Expenditure Log for Residential Owners

An Annual Expenditure Log for Residential Owners typically contains detailed records of all expenses related to property maintenance, repairs, and utilities incurred throughout the year. It helps homeowners monitor their spending and plan budgets effectively.

Key components include date, description, amount, and payment method to ensure transparency and accurate tracking. An important suggestion is to regularly update the log to avoid missing or inaccurate entries.

Yearly Expense Spreadsheet for Homeowners

What does a Yearly Expense Spreadsheet for Homeowners typically contain?

A Yearly Expense Spreadsheet for Homeowners usually includes detailed records of all home-related expenditures such as mortgage payments, utilities, maintenance, repairs, and insurance costs. It helps in tracking spending patterns and budgeting effectively throughout the year. This type of document is essential for managing finances and planning future home investments.

Important Suggestions

It is important to categorize expenses clearly and update the spreadsheet regularly for accuracy. Including sections for unexpected costs and potential savings can enhance financial preparedness and control.

Annual Cost Tracker with Utilities and Maintenance

An Annual Cost Tracker with Utilities and Maintenance is a document used to monitor and manage yearly expenses related to utilities and property upkeep. It helps in budget planning and identifying cost-saving opportunities.

- Include detailed records of monthly utility bills such as electricity, water, and gas.

- Track maintenance costs by categorizing routine and unexpected repairs separately.

- Regularly compare actual expenses against budgeted amounts to control overspending.

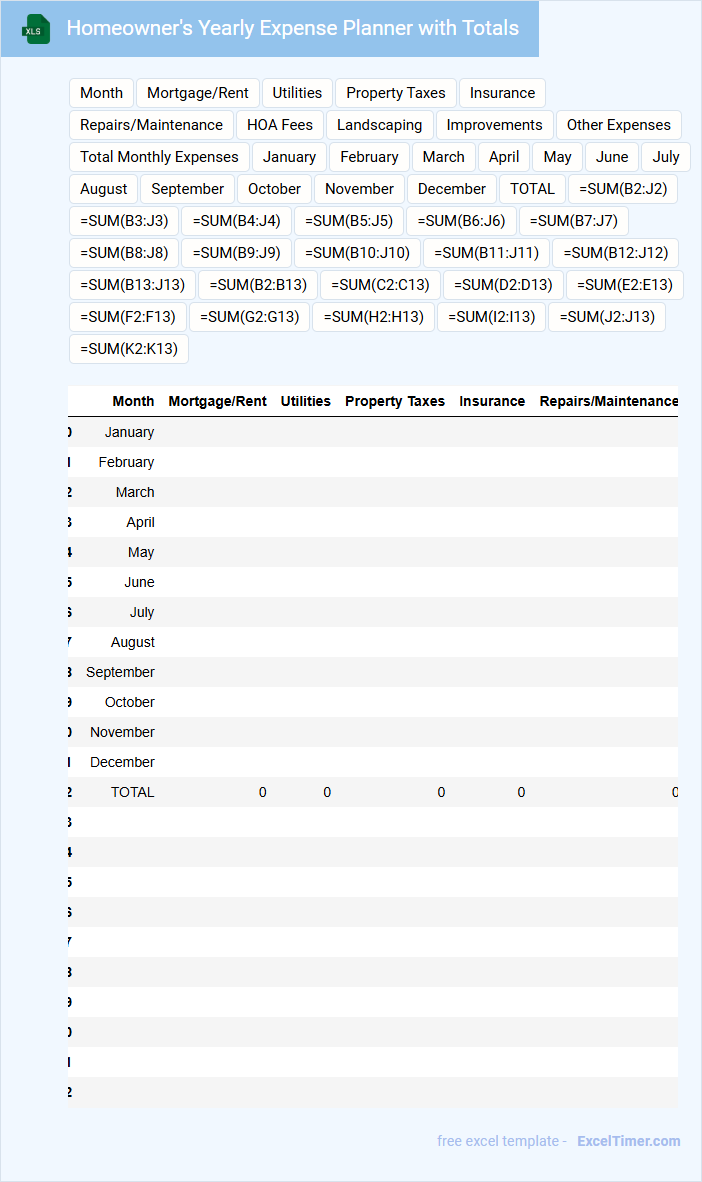

Homeowner's Yearly Expense Planner with Totals

A Homeowner's Yearly Expense Planner with Totals is a document that helps homeowners track and manage all their annual housing-related expenses efficiently. It provides a clear overview of costs to ensure budgeting and financial planning are on point.

- Include categories such as mortgage payments, utility bills, and maintenance costs.

- Update the planner regularly to reflect actual expenses and avoid surprises.

- Summarize totals monthly and yearly to monitor spending trends and adjust budgets accordingly.

Annual Expense Organizer for Private Homes

An Annual Expense Organizer for Private Homes is a detailed document that helps homeowners track and manage their yearly household expenses efficiently. It typically includes categorized records to ensure comprehensive financial oversight and planning.

- List all major expense categories such as utilities, maintenance, property taxes, and insurance.

- Include monthly and yearly totals to monitor spending patterns and budget accuracy.

- Regularly update the document to reflect actual expenses and identify saving opportunities.

Yearly Home Budget Tracker with Expense Categories

A Yearly Home Budget Tracker is a financial document designed to help individuals or families monitor their income and expenses throughout the year. It typically contains categorized expense sections such as housing, utilities, groceries, transportation, and entertainment to provide a clear picture of spending habits. Using this tracker regularly ensures better financial planning and helps identify areas where savings can be made.

Important elements to include are monthly income, fixed and variable expenses, and a summary section for total savings or deficits. Categorizing expenses accurately aids in pinpointing unnecessary spending and making informed budget adjustments. Additionally, incorporating notes for irregular or annual expenses ensures a comprehensive financial overview.

What essential categories should be included in an annual expense tracker for homeowners?

An annual expense tracker for homeowners should include essential categories such as mortgage or rent payments, property taxes, home insurance, utilities, and maintenance costs. Tracking landscaping, repairs, and renovation expenses helps you monitor total homeownership expenditures effectively. Including these categories ensures accurate budgeting and financial planning for your home throughout the year.

How can Excel formulas be utilized to automatically calculate yearly totals and subtotals?

Excel formulas like SUM and SUMIF efficiently calculate yearly totals and subtotals by aggregating expense data based on categories or date ranges. Structured references enable dynamic updates as new monthly entries are added throughout the year. You can automate your annual expense tracking by applying these formulas to quickly analyze and manage your homeowner costs.

What methods can be used in Excel to visualize spending trends throughout the year?

Excel offers methods such as creating line charts and bar graphs to visualize monthly spending trends in an Annual Expense Tracker for Homeowners. PivotTables paired with slicers allow dynamic analysis of expense categories and time periods. Conditional formatting highlights spending spikes and patterns, enhancing trend identification across the year.

How can recurring and non-recurring expenses be efficiently differentiated and tracked in Excel?

Use separate columns to label expenses as "Recurring" or "Non-Recurring" with dropdown data validation for consistency. Apply Excel formulas like SUMIFS to calculate total costs separately based on these categories. Utilize conditional formatting to visually distinguish recurring expenses for easier tracking and analysis.

What are the best practices for organizing and updating receipts and documentation within the expense tracker?

Organize receipts by date, category, and payment method to streamline data entry and tracking in the Annual Expense Tracker for Homeowners. Use consistent file naming conventions and store digital copies in cloud storage linked within the Excel document for easy access. Regularly update entries weekly to maintain accuracy and ensure timely budget adjustments.