The Annually Insurance Premium Excel Template for Policyholders simplifies tracking and managing yearly insurance payments with organized tables and automated calculations. It ensures accurate premium summaries, helping policyholders avoid missed payments and maintain coverage. The template's customizable format enhances financial planning by providing clear insights into annual costs.

Annual Insurance Premium Tracker for Policyholders

The Annual Insurance Premium Tracker is a document that helps policyholders monitor their insurance costs throughout the year. It typically contains detailed records of premium payments, policy renewal dates, and coverage details.

To maximize its effectiveness, the tracker should highlight important dates and payment deadlines clearly. Regular updates and accurate entries are key to ensuring policyholders remain informed and avoid missed payments.

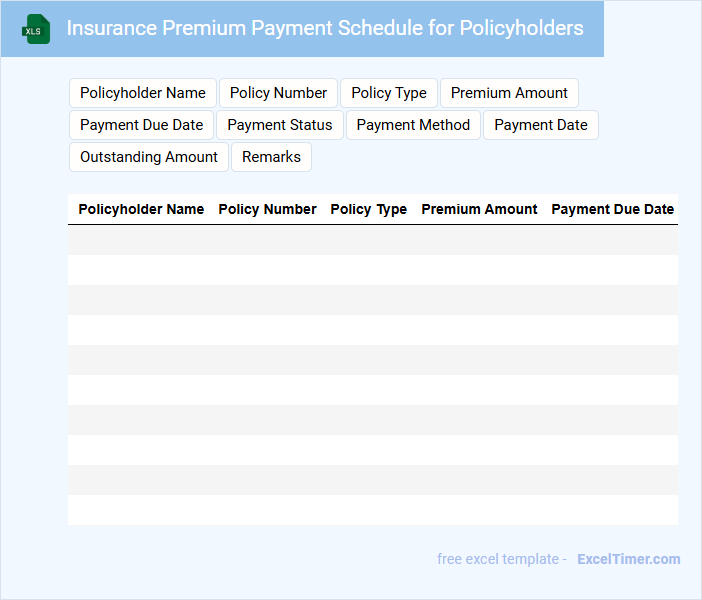

Insurance Premium Payment Schedule for Policyholders

What information does an Insurance Premium Payment Schedule for Policyholders typically contain? This document usually details the dates and amounts of premiums that a policyholder must pay to maintain their insurance coverage. It also helps policyholders track their payment obligations and avoid lapses in their insurance protection.

Why is it important to pay attention to an Insurance Premium Payment Schedule? Timely payments ensure continuous coverage and prevent penalties or policy cancellations. Policyholders should verify the accuracy of amounts and due dates to avoid unexpected charges or coverage gaps.

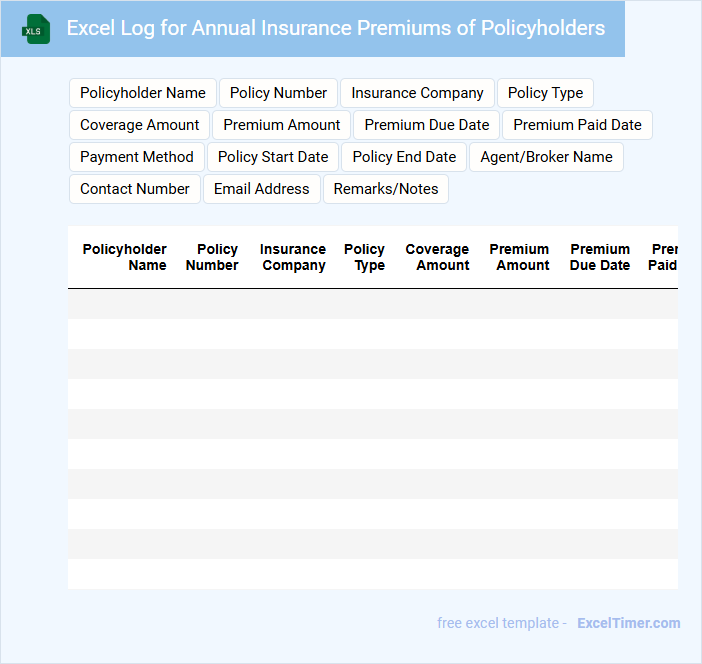

Excel Log for Annual Insurance Premiums of Policyholders

This type of document, an Excel Log, typically contains detailed records of annual insurance premiums paid by policyholders, including payment dates, amounts, and policy numbers. It serves as a crucial tool for tracking financial transactions related to insurance policies efficiently. Properly maintaining this log ensures accurate financial analysis and easy retrieval of payment history.

Key elements to include for optimization are clear column headers, consistent data entry, and secure access controls to protect sensitive information. Incorporating formulas to automatically calculate totals and due dates enhances the document's functionality. Regular updates and backups are important to avoid data loss and maintain accuracy.

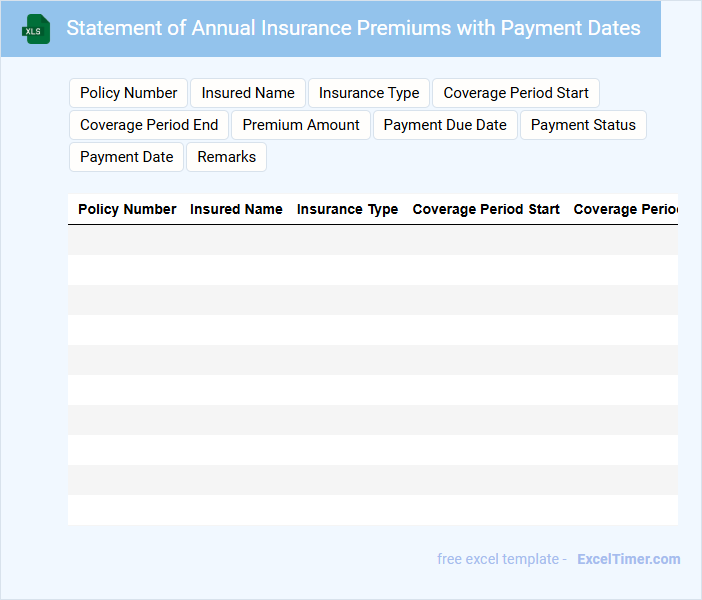

Statement of Annual Insurance Premiums with Payment Dates

A Statement of Annual Insurance Premiums is a detailed document that lists all insurance policies held by an individual or entity along with the corresponding premium amounts for the year. It typically includes payment dates, coverage periods, and policy numbers for easy reference.

This document is crucial for tracking insurance expenses and ensuring timely payments to avoid lapses in coverage. Always verify the accuracy of the premium amounts and payment dates to maintain uninterrupted protection.

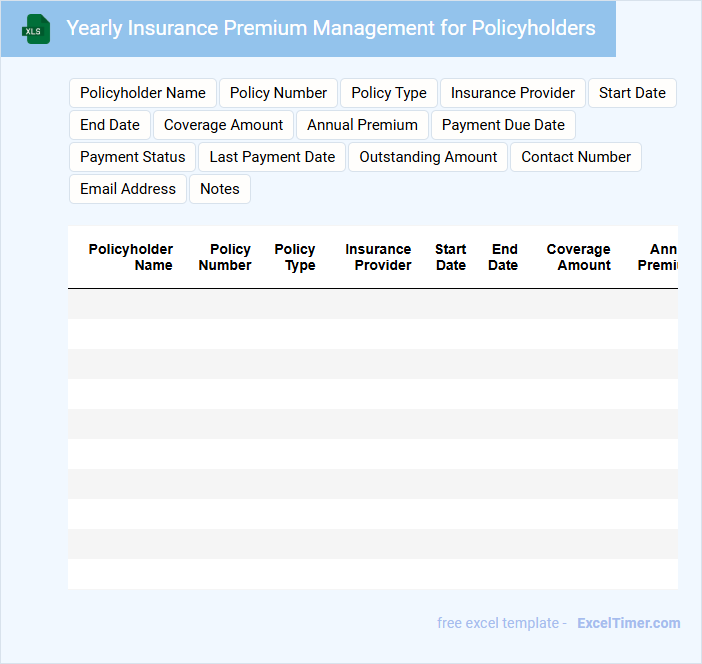

Yearly Insurance Premium Management for Policyholders

What information is typically contained in a Yearly Insurance Premium Management document for policyholders? This document usually includes detailed records of premium amounts, payment schedules, and due dates to help policyholders stay informed about their yearly obligations. It also outlines any discounts, policy changes, or updates that may affect the premium cost for accurate financial planning.

What is an important suggestion for effectively managing yearly insurance premiums? Policyholders should regularly review their premiums and payment details to avoid missed payments and potential policy lapses. Keeping track of any policy adjustments or benefits ensures they receive the best possible coverage at a competitive price.

Premium Calculation Sheet for Policyholders’ Annual Insurance

The Premium Calculation Sheet typically contains detailed information about the insurance policyholder's annual premium amounts, including base rates, discounts, and additional charges. It serves as a transparent breakdown of how the total premium is computed for the policy period.

Key elements often include risk assessments, coverage details, and payment schedules to ensure clarity. For accuracy, it's important to regularly update the sheet with current rates and any policy changes.

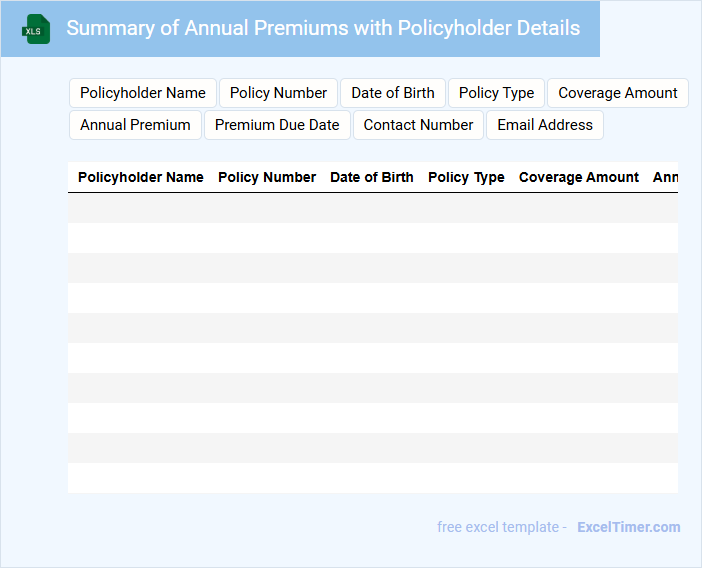

Summary of Annual Premiums with Policyholder Details

The Summary of Annual Premiums document typically contains a detailed overview of the premiums paid by the policyholder over the year. It includes payment dates, amounts, and any outstanding balances related to insurance policies.

This document also provides essential Policyholder Details such as name, contact information, policy number, and coverage type. Ensuring accuracy in these details is crucial for proper record-keeping and claims processing.

It is important to regularly review this summary to verify all payments have been correctly recorded and to address any discrepancies promptly.

Insurance Policy Renewal Tracker for Annually Paid Premiums

What information does an Insurance Policy Renewal Tracker for Annually Paid Premiums typically contain? This type of document usually includes details such as policy numbers, renewal dates, premium amounts, and insurer contact information. It helps policyholders stay organized and ensures timely renewals, preventing coverage lapses.

What is important to include when managing an Insurance Policy Renewal Tracker? It is crucial to track key dates, set reminders for upcoming renewals, and record any changes in premium or coverage terms. Maintaining accuracy and regular updates will help in evaluating policy performance and costs efficiently.

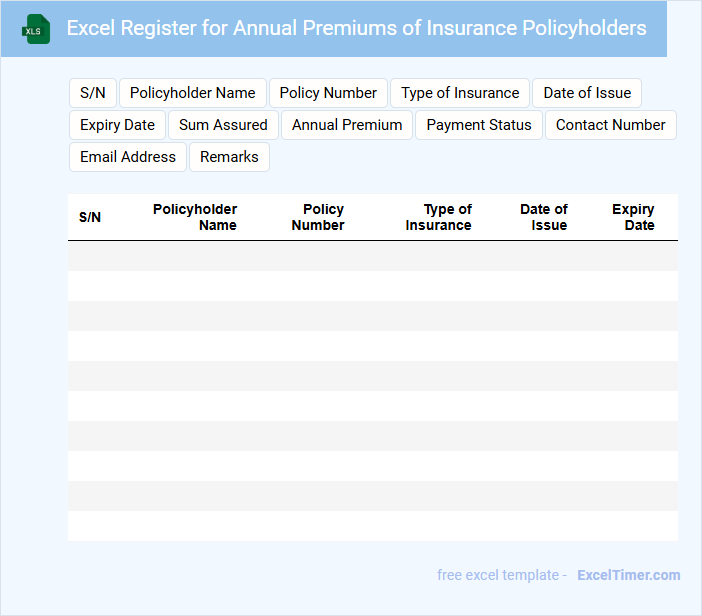

Excel Register for Annual Premiums of Insurance Policyholders

The Excel Register for Annual Premiums of Insurance Policyholders is a structured document that tracks yearly premium payments. It typically contains policyholder details, premium amounts, and payment dates to ensure accurate financial management. Maintaining this register helps in monitoring renewals and identifying outstanding premiums efficiently.

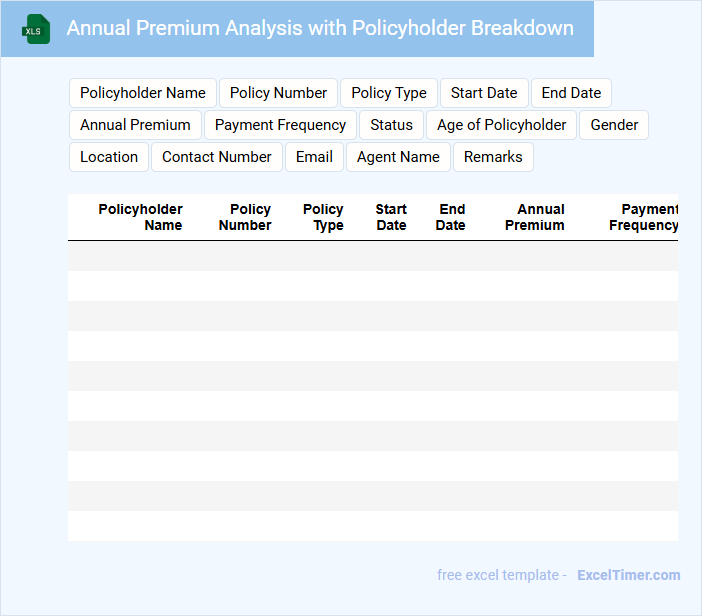

Annual Premium Analysis with Policyholder Breakdown

Annual Premium Analysis with Policyholder Breakdown typically contains an overview of premium revenues segmented by different policyholder categories to identify trends and opportunities.

- Premium Trends: Detailed insights into how total premiums evolve over time for each segment.

- Policyholder Segmentation: Breakdown of policyholders by demographics, product types, or risk profiles.

- Recommendations: Actionable suggestions for optimizing pricing and customer retention strategies.

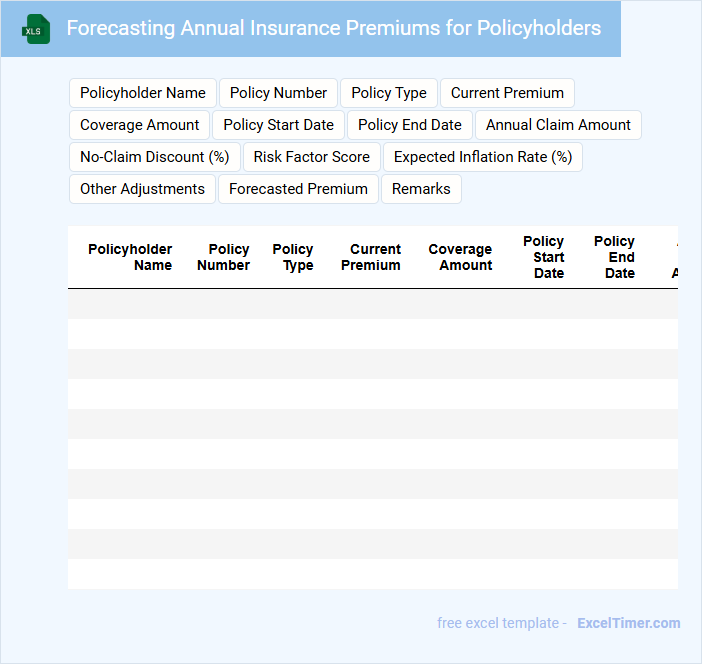

Forecasting Annual Insurance Premiums for Policyholders

The document typically contains detailed data analysis and projections related to insurance premiums. It includes historical data, risk assessments, and statistical models to predict future costs.

Forecast accuracy depends on key variables such as policyholder demographics and claim history. Important considerations include regulatory changes and market trends.

Ensuring clarity and transparency in assumptions enhances stakeholder trust and decision-making.

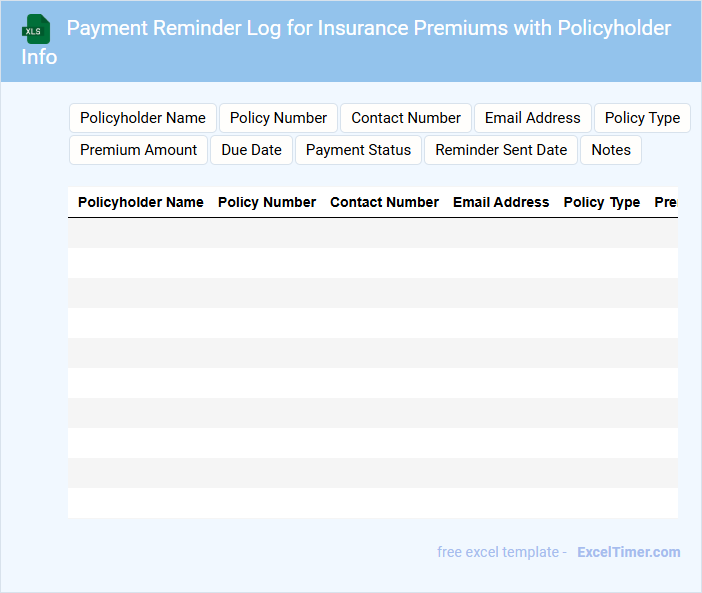

Payment Reminder Log for Insurance Premiums with Policyholder Info

A Payment Reminder Log for Insurance Premiums with Policyholder Info is a document used to track outstanding premium payments and communicate reminders to policyholders. It ensures timely payments and helps maintain accurate records of policyholder contact details.

- Include policyholder name, contact information, and policy number for easy identification.

- Record payment due dates, amounts, and reminder sent dates systematically.

- Maintain notes on payment status and follow-up actions for clear accountability.

Tracker for Annual Insurance Premium Receipts of Policyholders

This document typically contains a detailed record of annual insurance premium payments made by policyholders. It helps in tracking receipt issuance and payment status efficiently.

- Include policyholder details such as name, policy number, and contact information.

- Record premium payment dates, amounts, and receipt numbers for accuracy.

- Maintain a status column to indicate if payments are pending, completed, or overdue.

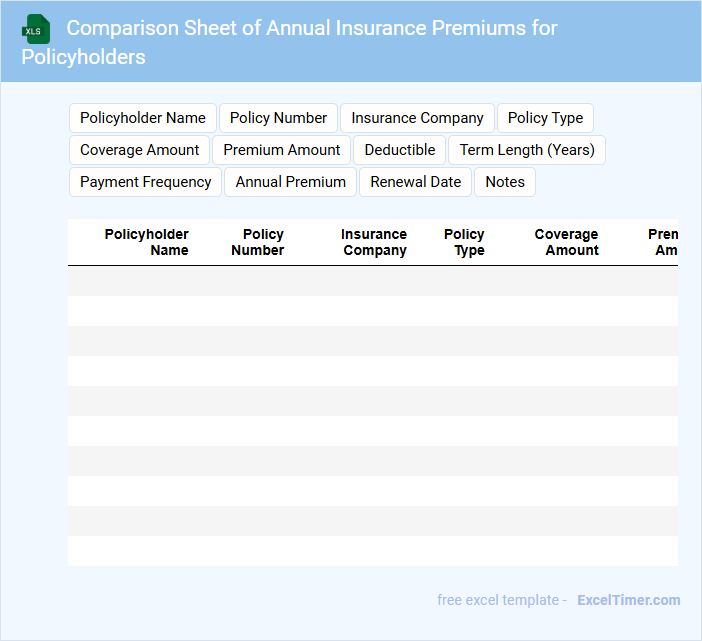

Comparison Sheet of Annual Insurance Premiums for Policyholders

A Comparison Sheet of Annual Insurance Premiums provides a detailed overview of various insurance policies and their yearly costs. It typically includes policyholder details, coverage benefits, premium amounts, and additional features for easy evaluation. This document helps consumers make informed decisions by clearly contrasting different insurance options.

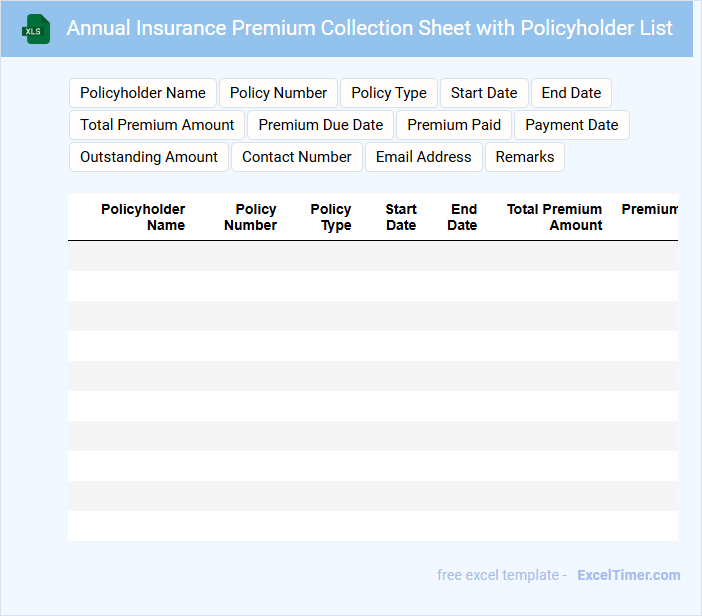

Annual Insurance Premium Collection Sheet with Policyholder List

An Annual Insurance Premium Collection Sheet with Policyholder List is a document that records the premiums collected from various policyholders throughout the year. It serves as a detailed financial tracking tool to ensure accurate premium management and accountability.

- Include the policyholder's name, policy number, and premium amount for clarity.

- Ensure the dates of premium payments are clearly documented for timely follow-up.

- Summarize total premiums collected to provide an overview of annual revenue.

What is the definition and purpose of an Annually Insurance Premium for policyholders in Excel documentation?

An Annually Insurance Premium in Excel documentation represents the total yearly amount a policyholder must pay for insurance coverage. It helps you track and analyze payment schedules, ensuring timely renewals and financial planning. This premium data supports accurate record-keeping and policy management for your insurance needs.

How do you calculate the Annually Insurance Premium for a policyholder using Excel formulas?

Calculate the Annual Insurance Premium by multiplying the policyholder's coverage amount by the premium rate using the formula =CoverageAmount * PremiumRate in Excel. Include any discounts or fees by adjusting the formula to = (CoverageAmount * PremiumRate) - Discount + Fees. Use cell references to dynamically update premiums based on varying policyholder data.

Which key data fields should be included in an Excel document tracking Annually Insurance Premiums?

Essential data fields for an Excel document tracking Annual Insurance Premiums include Policyholder Name, Policy Number, Insurance Type, Premium Amount, Payment Due Date, Payment Status, and Coverage Period. Incorporating Contact Information and Renewal Date enhances tracking efficiency. Accurate entry of these fields ensures effective premium management and policyholder communication.

How can policy status (active, lapsed, renewed) be monitored in relation to Annually Insurance Premium payments in Excel?

You can monitor policy status in Excel by creating a dynamic table that links annually insurance premium payments with policyholder information. Use conditional formatting and data validation to track active, lapsed, and renewed statuses based on payment dates and amounts. PivotTables and charts help visualize trends and ensure timely premium management for each policy.

What are the implications of missed or late Annually Insurance Premium payments for policyholders as tracked in Excel?

Missed or late Annual Insurance Premium payments recorded in Excel indicate increased risk of policy lapse or cancellation for policyholders. These delays can lead to loss of coverage, financial penalties, or higher future premiums. Accurate tracking ensures timely reminders and helps maintain continuous insurance benefits.