Annually Budget Excel Template for Nonprofit Organizations simplifies financial planning by providing a structured format to track income, expenses, and funding sources. This template ensures transparency and accountability, helping nonprofits manage resources effectively and align budgets with their mission objectives. Accurate budgeting supports strategic decision-making and enhances donor confidence.

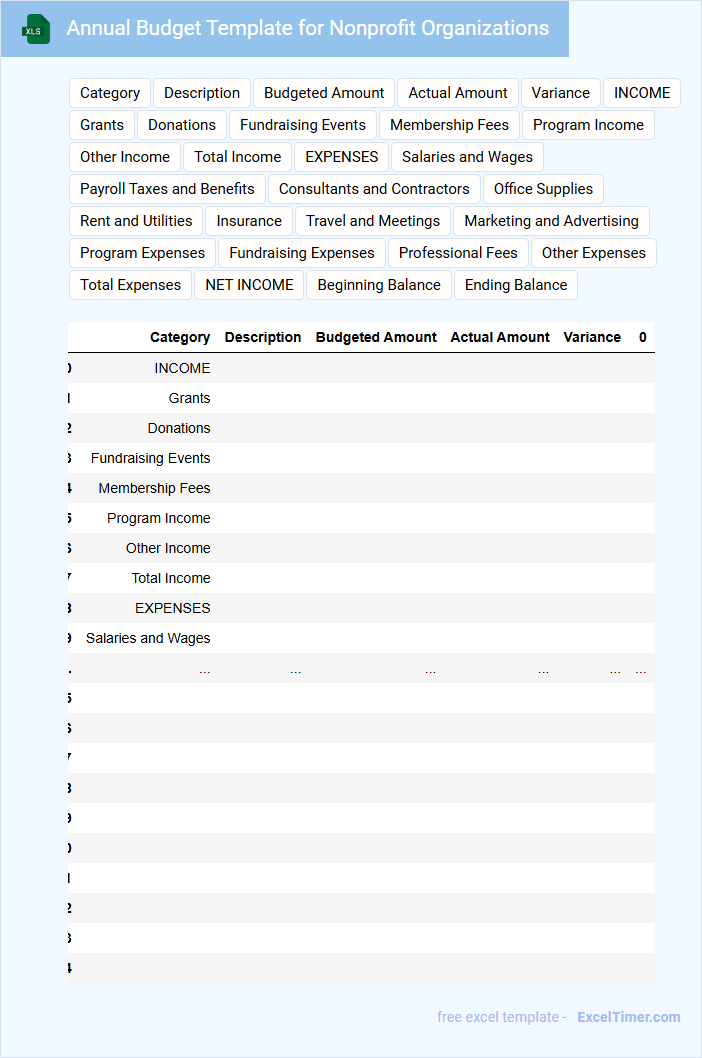

Annual Budget Template for Nonprofit Organizations

An Annual Budget Template for Nonprofit Organizations typically outlines projected income and expenses over the fiscal year to ensure financial accountability and strategic planning. It helps nonprofits allocate resources effectively to fulfill their mission.

- Include detailed categories for revenues such as donations, grants, and fundraising events.

- List all anticipated expenses including program costs, administrative fees, and operational overhead.

- Regularly update and review the budget to reflect actual financial performance and adjustments.

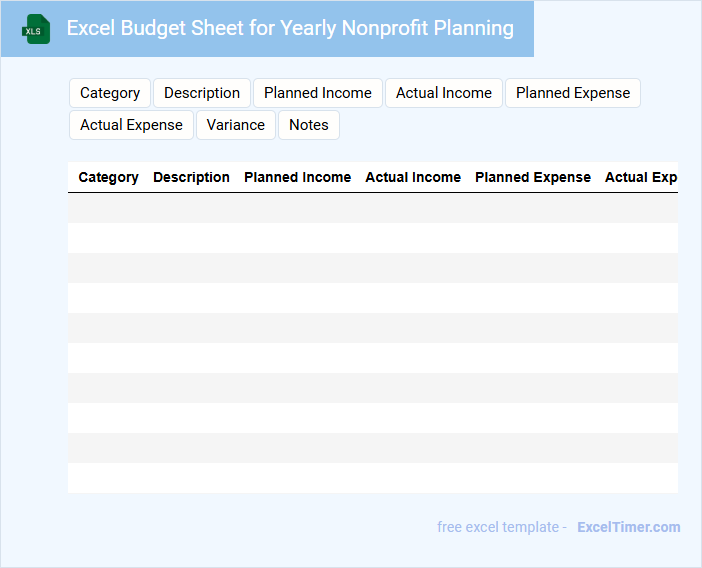

Excel Budget Sheet for Yearly Nonprofit Planning

What information is typically included in an Excel Budget Sheet for Yearly Nonprofit Planning? This document usually contains detailed financial data such as projected income, expenses, funding sources, and allocations categorized by programs or departments. It helps nonprofits strategically manage their resources throughout the year, ensuring transparency and accountability in their financial planning.

What is an important consideration when creating this budget sheet? It is essential to regularly update the budget with actual figures versus projections to monitor financial health and make informed adjustments. Additionally, incorporating clear notes and assumptions enhances understanding among stakeholders and supports effective decision-making.

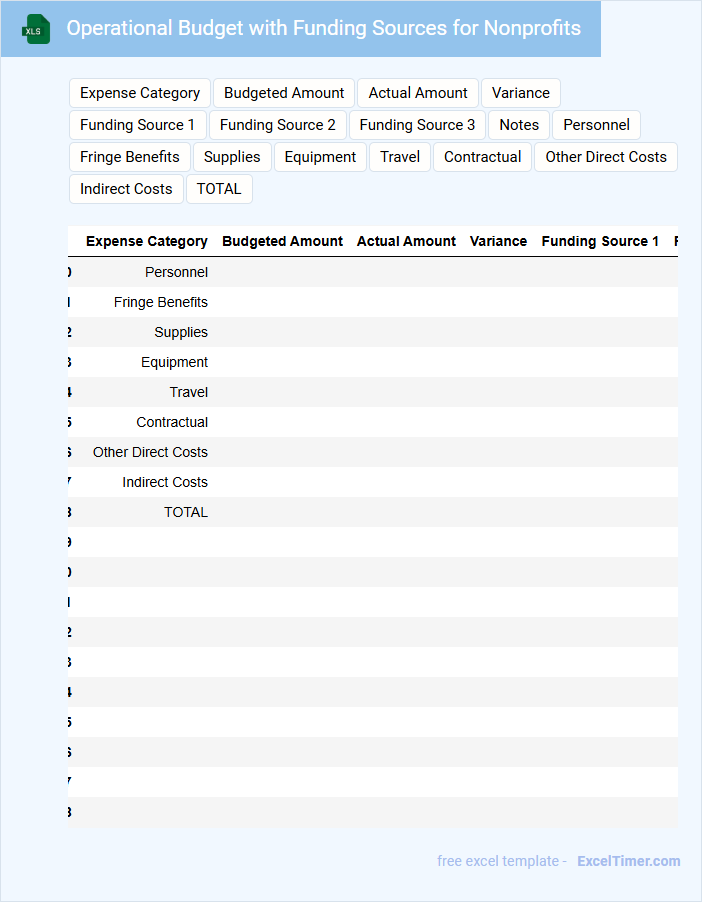

Operational Budget with Funding Sources for Nonprofits

An Operational Budget for nonprofits outlines the expected income and expenses necessary to support daily activities over a specific period. It includes detailed allocations for programs, administration, and fundraising efforts to ensure financial sustainability. Understanding funding sources is crucial for accurate projections and resource management.

Common funding sources listed in this document are grants, donations, service fees, and government contracts. These sources must be tracked carefully to maintain compliance and transparency with stakeholders. Including contingency plans for funding fluctuations strengthens the budget's reliability.

Annual Revenue & Expense Tracker for Nonprofit Entities

What information is typically contained in an Annual Revenue & Expense Tracker for Nonprofit Entities? This document usually includes detailed records of income sources such as donations, grants, and fundraising events, along with all operational and program-related expenses. It is essential for monitoring financial health and ensuring transparency and accountability to stakeholders throughout the fiscal year.

Grant Allocation Tracker for Nonprofit Annual Budget

A Grant Allocation Tracker for a nonprofit annual budget is a crucial document that records and monitors the distribution of grant funds received throughout the year. It typically contains detailed entries of each grant, including sources, amounts allocated, and specific projects funded. This tracker ensures transparent financial management and helps in assessing the impact and compliance with grant requirements.

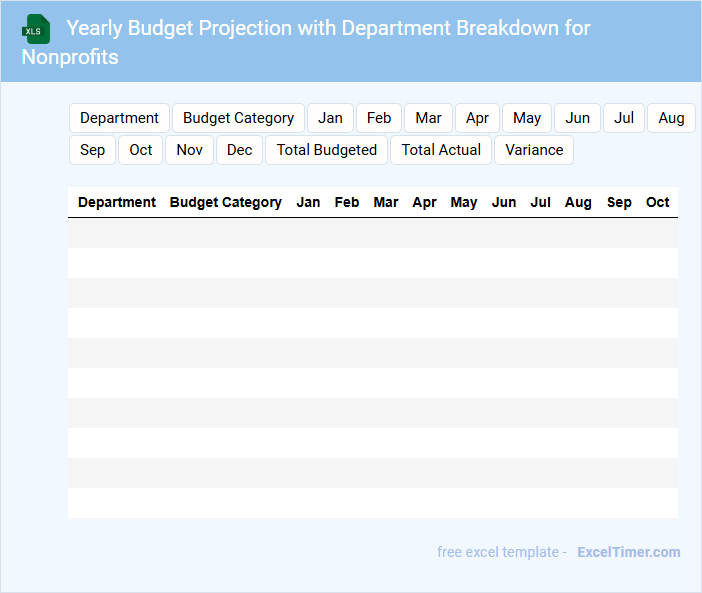

Yearly Budget Projection with Department Breakdown for Nonprofits

A Yearly Budget Projection with Department Breakdown for Nonprofits typically contains detailed financial forecasts segmented by each department to ensure effective resource allocation and strategic planning.

- Comprehensive Expense Estimates: Outline anticipated costs across various departments to identify funding needs.

- Revenue Projections: Include expected income sources to balance and justify expenditures.

- Regular Review Schedule: Establish timelines for reviewing and adjusting the budget to maintain accuracy.

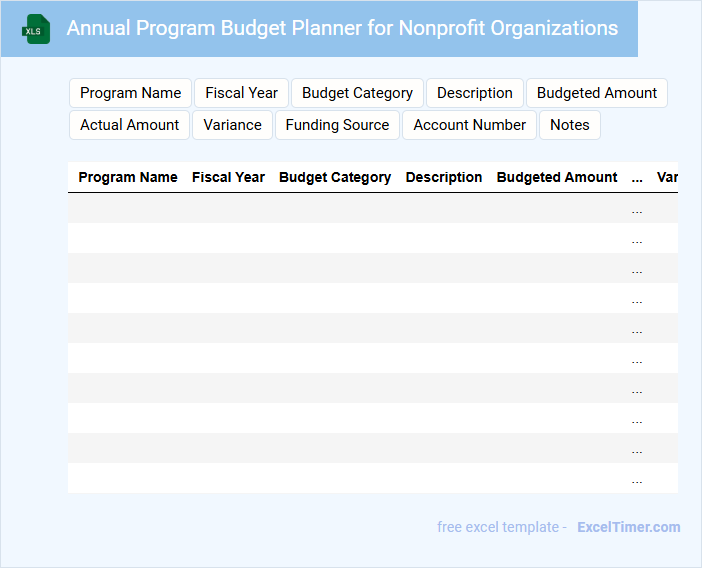

Annual Program Budget Planner for Nonprofit Organizations

What does an Annual Program Budget Planner for Nonprofit Organizations typically contain? This document usually includes detailed estimates of income, expenses, and resource allocations for various programs throughout the year. It helps nonprofits strategically plan their finances to ensure sustainability and effective program delivery.

What is an important consideration when creating this budget planner? It is crucial to prioritize transparency and accuracy to build trust with stakeholders and guide informed decision-making. Additionally, including contingency plans for unexpected expenses can enhance financial resilience.

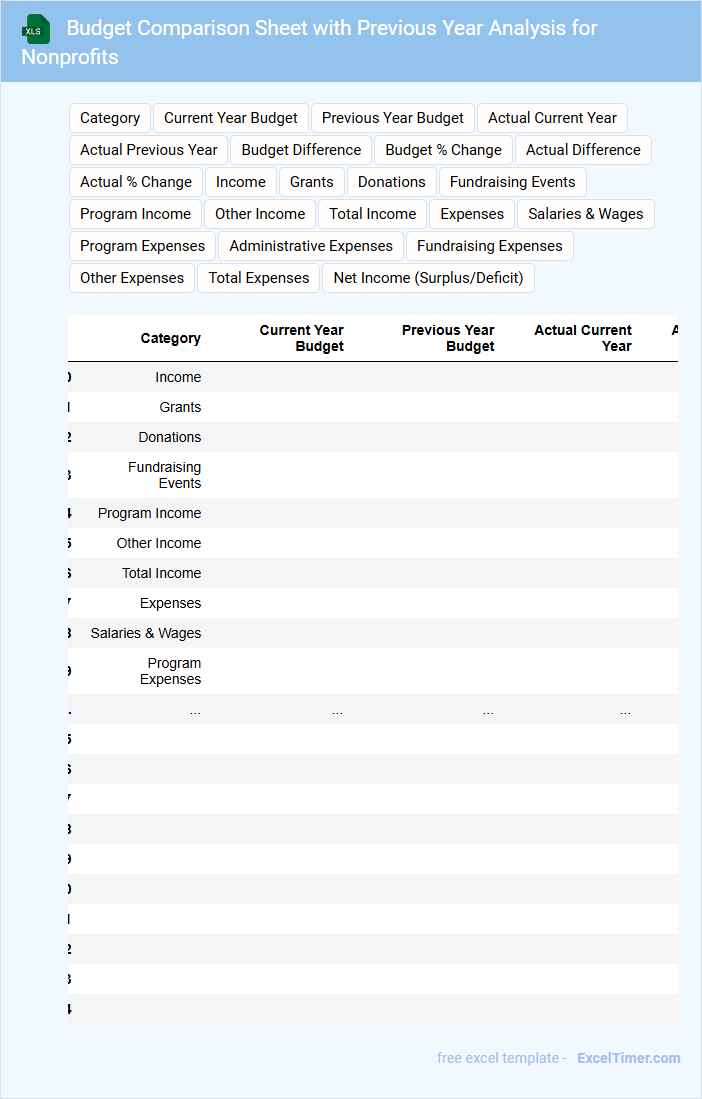

Budget Comparison Sheet with Previous Year Analysis for Nonprofits

A Budget Comparison Sheet with Previous Year Analysis for Nonprofits typically contains financial data comparison to highlight variances.

- Accurate Revenue Tracking: Ensure all income sources are clearly recorded to assess fundraising effectiveness.

- Expense Categorization: Break down expenses by program, administration, and fundraising for transparency.

- Variance Analysis: Identify significant differences between current and previous years to inform budgeting decisions.

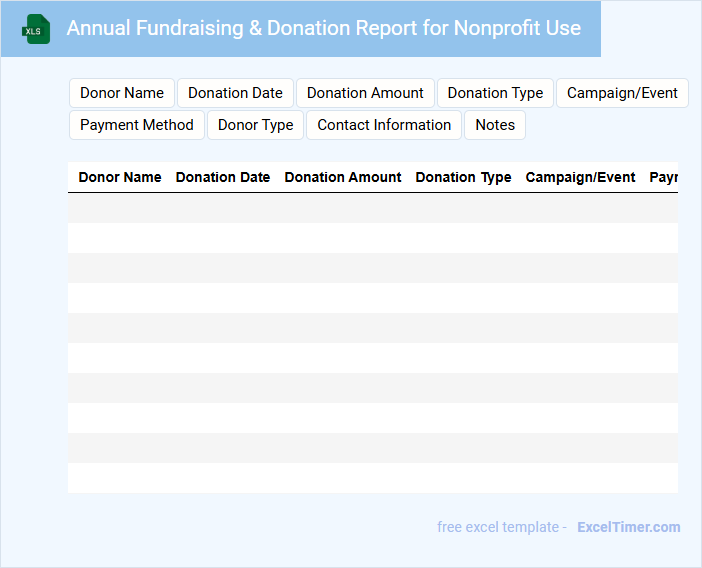

Annual Fundraising & Donation Report for Nonprofit Use

What information is typically included in an Annual Fundraising & Donation Report for nonprofit use?

This report usually contains a detailed summary of donations received, fundraising activities conducted, and the allocation of funds throughout the year. It highlights key achievements, donor recognition, financial transparency, and future fundraising goals to maintain stakeholder trust and support.

Important suggestions for this document include ensuring accuracy in financial data, clearly showcasing the impact of donations, and including compelling stories or testimonials to engage donors and encourage continued generosity.

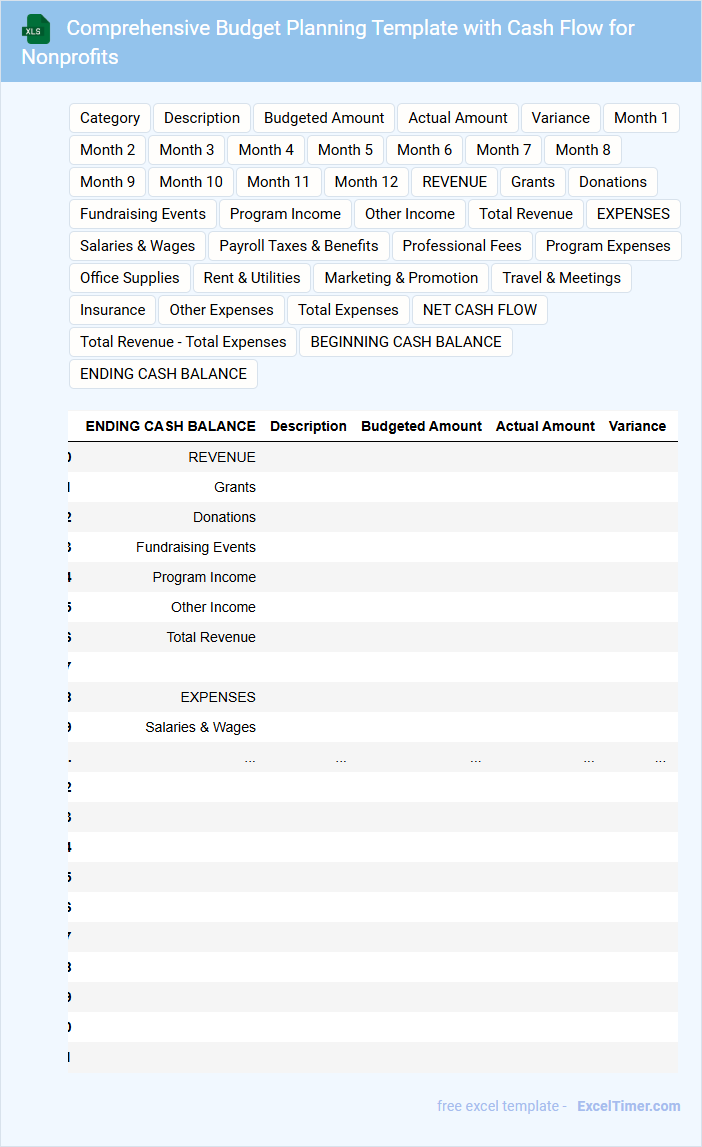

Comprehensive Budget Planning Template with Cash Flow for Nonprofits

A Comprehensive Budget Planning Template with Cash Flow for Nonprofits is a crucial document that outlines projected income and expenses to ensure financial stability. It helps organizations manage resources effectively and plan for future financial needs.

- Include detailed income sources and funding streams to track revenue accurately.

- Incorporate expense categories with realistic estimates to prevent overspending.

- Regularly update cash flow projections to maintain liquidity and support decision-making.

Annual Financial Statement Template for Nonprofit Organizations

The Annual Financial Statement for nonprofit organizations typically includes a detailed summary of the organization's financial activities over the fiscal year, such as revenues, expenses, assets, and liabilities. This document provides transparency and accountability to stakeholders, donors, and regulatory bodies.

It is crucial to include audited financial statements, a clear breakdown of funding sources, and summaries of program expenditures. Ensuring accuracy and compliance with relevant accounting standards is an important suggestion for creating a reliable and effective financial statement.

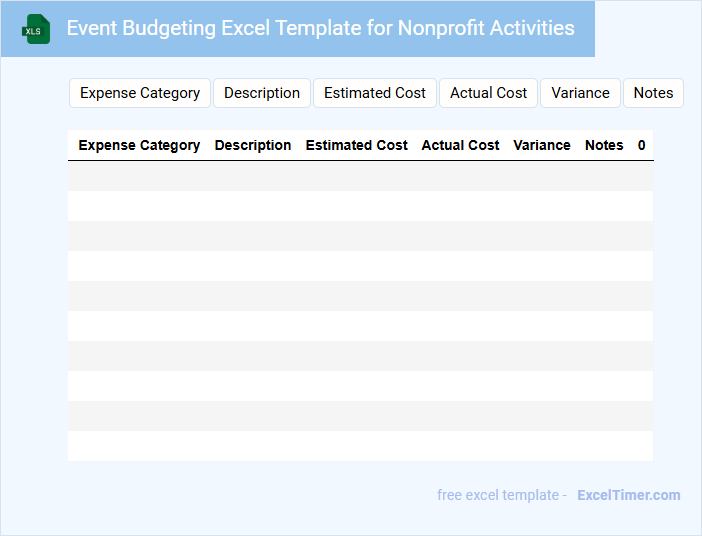

Event Budgeting Excel Template for Nonprofit Activities

An Event Budgeting Excel Template for Nonprofit Activities typically contains detailed financial planning tools to help manage and track event expenses efficiently.

- Comprehensive Expense Categories: Includes predefined sections for venue, catering, marketing, and miscellaneous costs.

- Automated Calculations: Features formulas to automatically sum totals and calculate remaining budgets.

- Donation Tracking: Allows recording and monitoring of sponsorships and donations specific to the event.

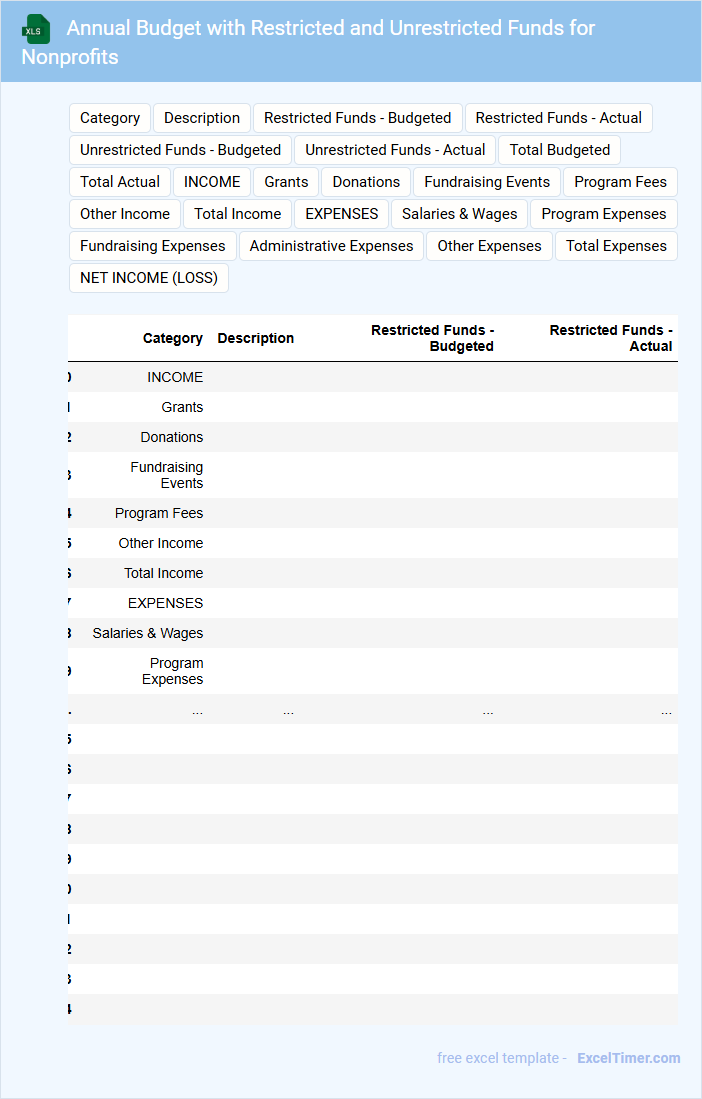

Annual Budget with Restricted and Unrestricted Funds for Nonprofits

An Annual Budget for nonprofits typically includes detailed allocations of both restricted and unrestricted funds. It reflects planned income and expenses, helping organizations manage resources effectively throughout the year.

Restricted funds are designated for specific purposes by donors, while unrestricted funds provide flexibility in general operations. Ensuring clear separation and accurate tracking of these categories is crucial for transparency and compliance.

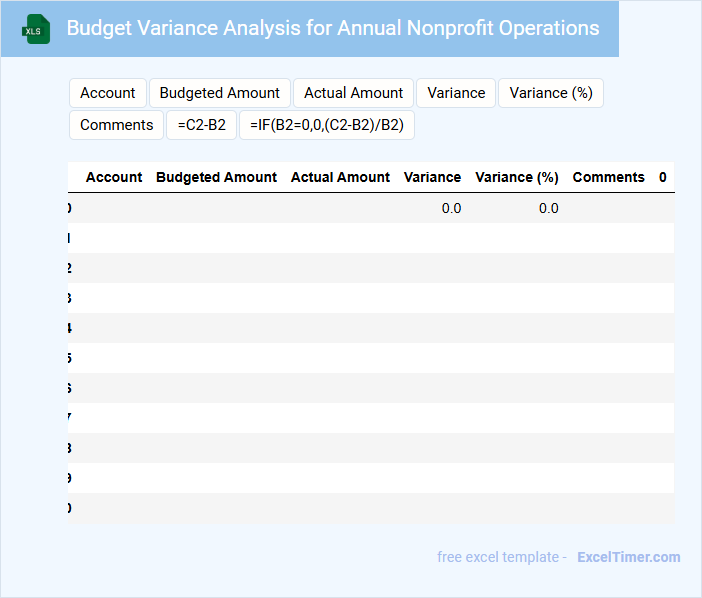

Budget Variance Analysis for Annual Nonprofit Operations

The Budget Variance Analysis document typically contains a detailed comparison between the approved budget and the actual expenditures for the year. It highlights areas where spending deviated, either over or under the planned amounts.

This analysis is crucial for nonprofit organizations to assess financial performance and ensure resources are aligned with mission goals. Regular review helps identify trends and improve future budgeting accuracy.

Important aspects to focus on include tracking major expense categories, identifying causes of variances, and providing actionable recommendations for corrective measures.

Multi-Project Budget Tracker for Nonprofit Organizations

A Multi-Project Budget Tracker is an essential document for nonprofit organizations to monitor and manage the finances of multiple projects simultaneously. It typically contains detailed budget allocations, expenditures, and funding sources for each project to ensure transparency and accountability.

Such a tracker helps nonprofits stay organized and make informed financial decisions to maximize their impact. It is important to update the tracker regularly and include clear categories for expenses to maintain accuracy and efficiency.

What are the key revenue sources to include in an annual budget for a nonprofit organization?

Key revenue sources to include in an annual budget for a nonprofit organization are individual donations, grants from foundations and government agencies, fundraising event proceeds, membership fees, and earned income from services or products. Tracking corporate sponsorships and in-kind contributions also enhances budget accuracy. Accurate forecasting of these revenue streams supports sustainable financial planning and mission fulfillment.

How should projected expenses be categorized and tracked throughout the fiscal year?

Projected expenses for a nonprofit's annual budget should be categorized by program services, administrative costs, and fundraising activities. Each category must be tracked monthly using detailed expense reports and budget variance analysis to ensure accuracy and accountability. Your fiscal year tracking system should integrate automated tools for real-time monitoring and timely adjustments.

What methods ensure alignment between budget allocations and the nonprofit's mission priorities?

Establishing a clear budgeting framework aligned with your nonprofit's mission involves prioritizing program funding based on impact metrics and strategic goals. Implementing zero-based budgeting ensures every dollar is justified and supports mission-critical activities, enhancing financial accountability. Regular performance reviews link budget adjustments directly to program outcomes and organizational priorities.

How can variance analysis be incorporated into Excel to monitor budget vs. actuals?

In an Excel document for Annual Budgeting of Nonprofit Organizations, variance analysis can be incorporated by creating formulas that calculate the difference between budgeted amounts and actual expenditures. Use conditional formatting to highlight significant variances, enabling quick identification of overspending or underspending. PivotTables and charts enhance data visualization, making it easier to track financial performance against budget in real-time.

What are best practices for updating and revising the annual budget in response to funding changes?

Regularly review actual revenues and expenses against projections to identify funding gaps or surpluses. Adjust budget line items by prioritizing essential programs and reallocating resources based on updated funding forecasts. Maintain transparent documentation of all revisions to support accountability and stakeholder communication.