![]()

The Annually Income & Expense Tracker Excel Template for Freelancers provides a clear and organized way to monitor yearly earnings and expenses, helping freelancers maintain accurate financial records. Key features include customizable categories, automatic calculations, and visual summaries that simplify budget management and tax preparation. This tool enhances financial clarity, enabling freelancers to make informed decisions and optimize their cash flow throughout the year.

Annual Income & Expense Tracker for Freelancers

An Annual Income & Expense Tracker is a crucial document for freelancers to monitor their financial health throughout the year. It typically contains detailed records of all sources of income and categorized expenses to help manage cash flow effectively. Regularly updating this tracker aids in accurate budgeting and simplifies tax preparation.

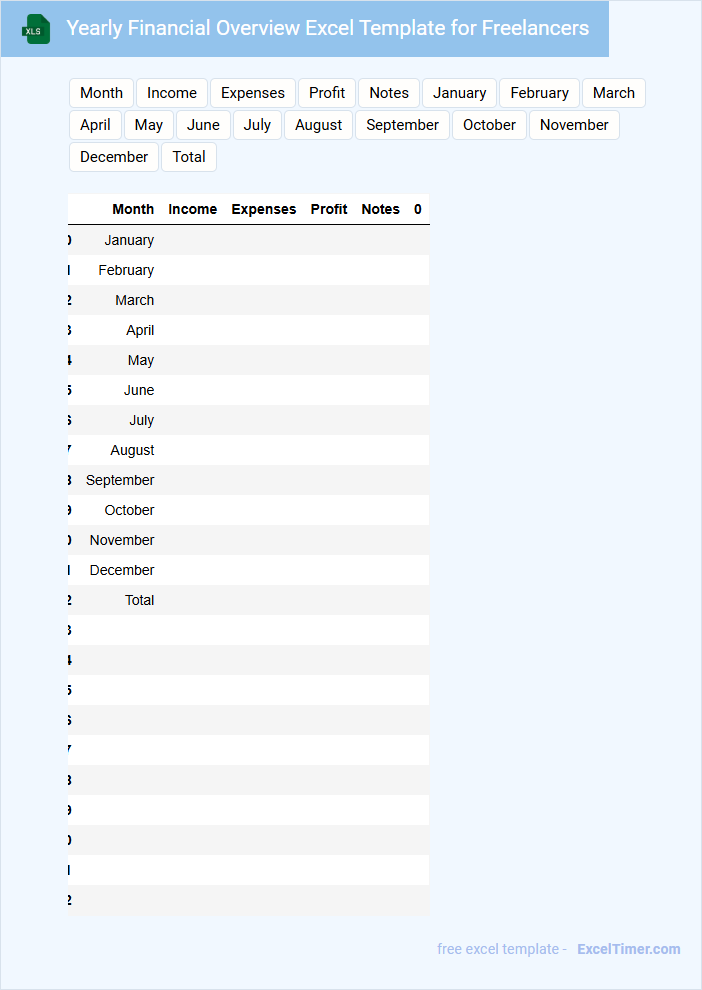

Yearly Financial Overview Excel Template for Freelancers

What information is typically included in a Yearly Financial Overview Excel Template for Freelancers? This document usually contains a comprehensive summary of income, expenses, and net profit for the entire year, organized monthly. It helps freelancers track financial performance, prepare for taxes, and make informed business decisions.

What important features should be included in this template? It should incorporate clear categories for income and expenses, automatic calculations for totals and profit, and options for adding notes or tax deductions. Additionally, visual charts or graphs for quick insights and a summary section for yearly highlights enhance usability and decision-making.

Annual Earnings & Spending Tracker with Freelancer-Friendly Features

An Annual Earnings & Spending Tracker is a vital tool for freelancers to monitor their income and expenses throughout the year. This document typically contains detailed records of earnings from various clients, categorized expenditures, and summaries to visualize financial health. Incorporating freelancer-friendly features like invoice tracking and tax deduction sections can greatly enhance its practicality.

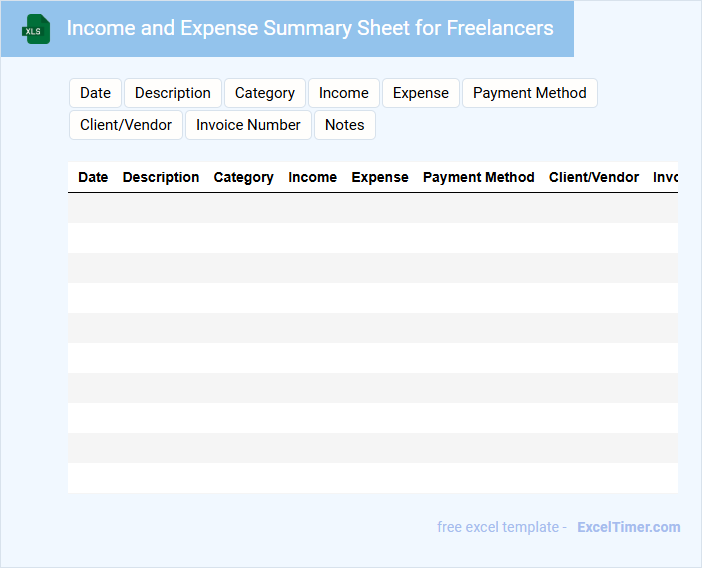

Income and Expense Summary Sheet for Freelancers

An Income and Expense Summary Sheet for freelancers is a financial document that records all earnings and expenditures over a specific period. It provides a clear overview of cash flow, helping freelancers manage their finances effectively.

This type of document typically includes categories such as client payments, project costs, software subscriptions, and other operational expenses. Maintaining accurate and detailed records is crucial for budgeting and tax preparation.

It is important to regularly update the sheet and categorize each entry correctly to gain meaningful insights and ensure compliance with tax regulations.

Freelance Budget Planner with Annual Income & Expense Tracking

A Freelance Budget Planner is a crucial document designed to help freelancers manage their finances effectively by tracking both annual income and expenses. It typically contains categorized sections for listing various income sources, fixed and variable expenses, and savings goals. Ensuring accurate and consistent tracking within this planner assists freelancers in maintaining financial stability and planning for future tax obligations.

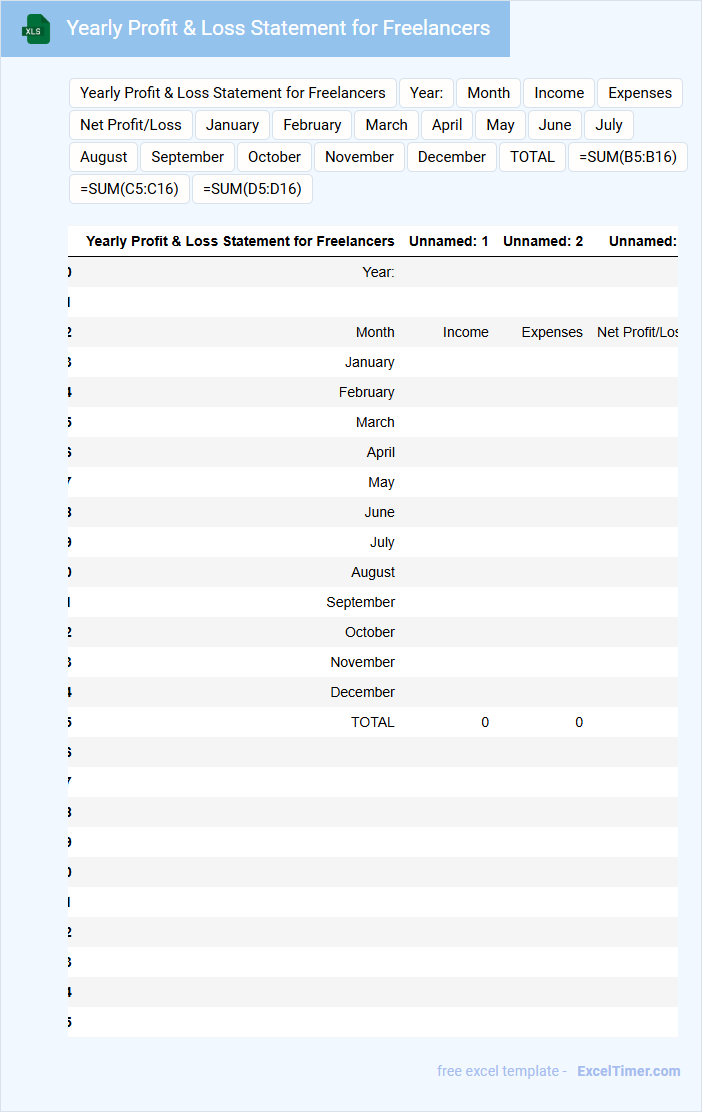

Yearly Profit & Loss Statement for Freelancers

What information is typically included in a Yearly Profit & Loss Statement for Freelancers? This document usually contains detailed records of all income generated and expenses incurred throughout the year, allowing freelancers to calculate their net profit or loss. It helps freelancers track their financial health and prepare accurate tax filings.

What is an important consideration when preparing a Yearly Profit & Loss Statement for Freelancers? It is crucial to categorize income and expenses correctly to ensure clarity and compliance with tax regulations. Keeping organized records and including all deductible expenses can maximize tax benefits and provide a clearer financial overview.

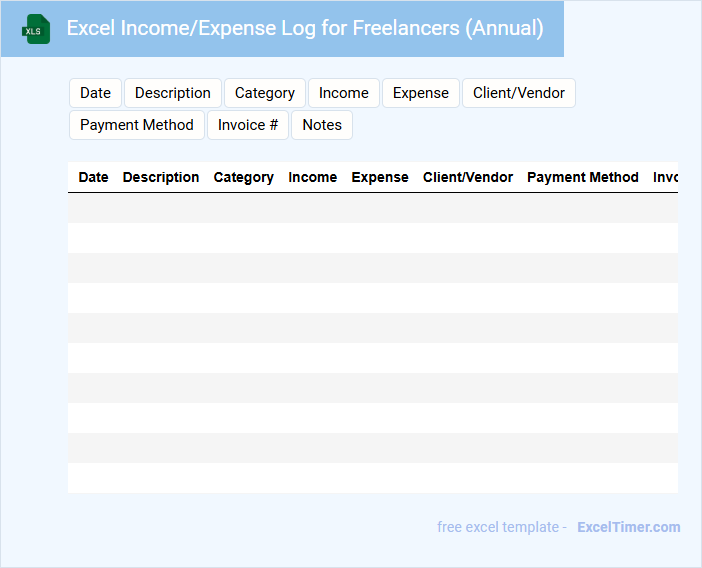

Excel Income/Expense Log for Freelancers (Annual)

An Excel Income/Expense Log for Freelancers (Annual) is a structured document used to track all earnings and expenditures over the course of a year. It helps freelancers maintain clear financial records for budgeting and tax purposes.

- Include detailed categories for income sources and expense types to ensure comprehensive tracking.

- Regularly update the log to monitor cash flow and avoid missing any transactions.

- Use formulas to automate calculations for totals, taxes, and profit margins for accuracy and efficiency.

Annual Cash Flow Tracker with Categories for Freelancers

What information does an Annual Cash Flow Tracker with Categories for Freelancers usually contain? It typically includes detailed records of income and expenses categorized by source or type, helping freelancers monitor their financial health throughout the year. This document allows for clear tracking of cash inflows and outflows, making it easier to identify trends and plan budgets effectively.

What important features should be included in an Annual Cash Flow Tracker for freelancers? Key elements include categorization of income (such as client payments, project types) and expenses (like software, marketing, and office supplies), monthly summaries, and an annual overview. Additionally, incorporating notes for irregular transactions and setting budget targets can help freelancers maintain financial control and prepare for tax time.

Year-End Financial Report Template for Freelancers

What does a Year-End Financial Report Template for Freelancers usually contain? This document typically includes a summary of income, expenses, and profits over the year, providing a clear snapshot of financial performance. It also helps freelancers track tax liabilities and plan for future financial goals efficiently.

What important aspects should be emphasized in this report? It is crucial to highlight accurate categorization of income sources and deductible expenses to maximize tax benefits, as well as to include clear visuals like charts or graphs for easy understanding. Additionally, freelancers should ensure all financial data is supported by receipts and invoices for transparency and record-keeping.

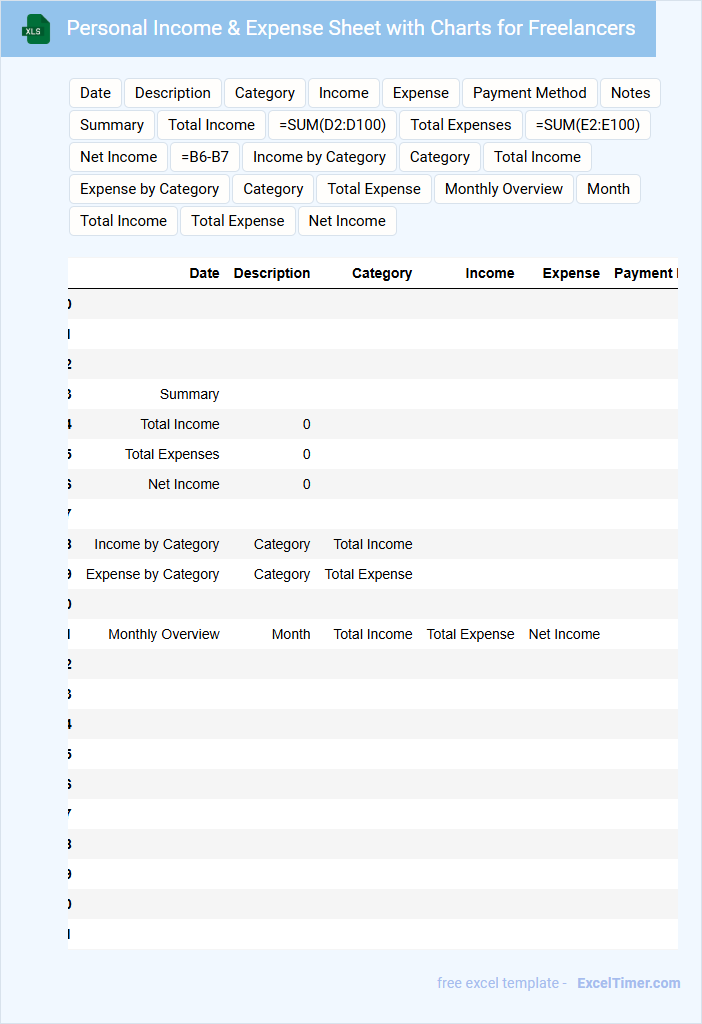

Personal Income & Expense Sheet with Charts for Freelancers

What information does a Personal Income & Expense Sheet with Charts for Freelancers typically contain? It usually includes detailed records of all sources of income and various expenses related to freelancing activities. This document provides a clear overview of financial health, helping freelancers track earnings, manage budgets, and identify spending patterns efficiently.

What are important considerations when using this type of document? It is essential to maintain accurate and up-to-date entries to ensure meaningful insights from the charts. Additionally, categorizing income and expenses properly allows for better tax preparation and financial planning throughout the freelance career.

Annual Invoice & Payment Tracker for Freelancers

What information is typically included in an Annual Invoice & Payment Tracker for Freelancers? This document usually contains details such as invoice numbers, client names, invoice dates, amounts billed, payment statuses, and due dates. It helps freelancers maintain organized records of earnings and track timely payments throughout the year.

Why is it important to keep an Annual Invoice & Payment Tracker updated? Keeping this tracker current ensures accurate financial management and simplifies tax filing processes. It also helps freelancers identify overdue payments and manage cash flow effectively.

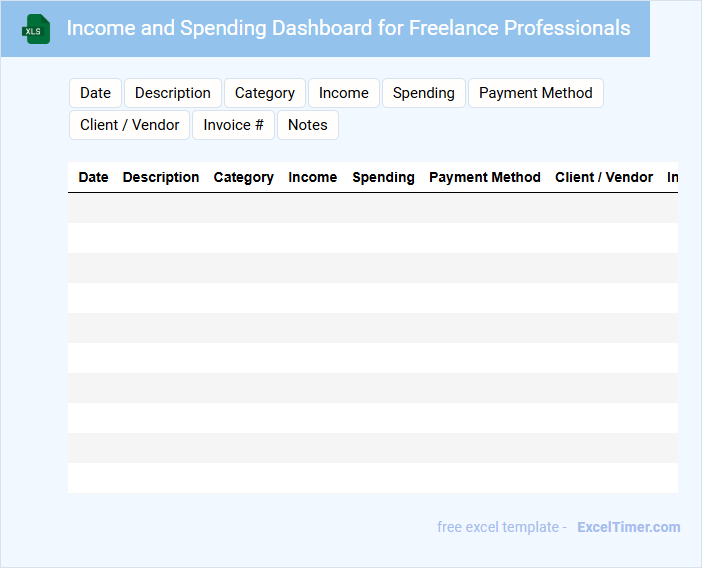

Income and Spending Dashboard for Freelance Professionals

An Income and Spending Dashboard for Freelance Professionals is a specialized tool designed to track earnings and expenses efficiently. It provides a clear overview of financial health to support better budgeting and decision-making.

- It typically contains detailed records of invoices, payments received, and categorized expenses.

- Important features include real-time financial summaries, visual charts, and tax tracking capabilities.

- Ensuring data security and easy integration with accounting software enhances usability and accuracy.

Annual Budget vs. Actuals Tracker for Freelancers

What does an Annual Budget vs. Actuals Tracker for Freelancers typically contain? It includes detailed projections of income and expenses alongside actual financial performance throughout the year. This document helps freelancers monitor their financial health and identify variances to adjust their budgeting strategies effectively.

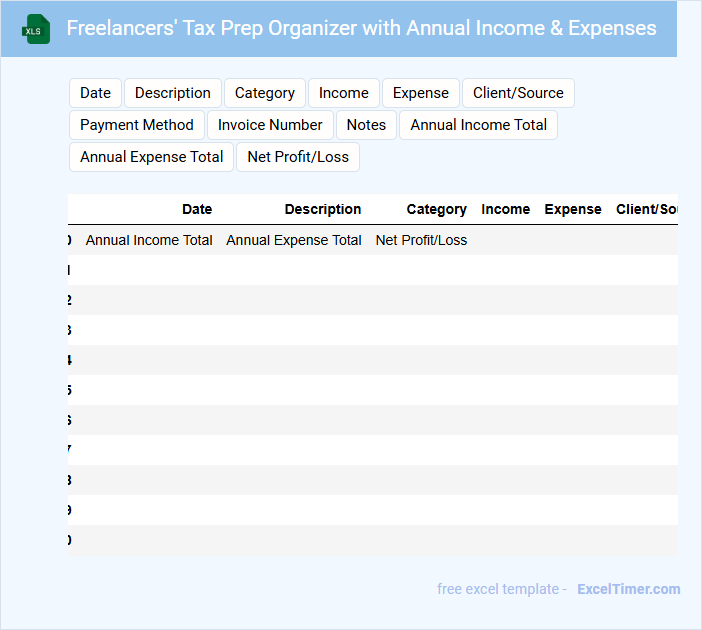

Freelancers' Tax Prep Organizer with Annual Income & Expenses

The Freelancers' Tax Prep Organizer is a crucial document designed to compile all necessary financial information related to annual income and expenses. It typically contains detailed records of payments received from various clients, categorized business expenses, and relevant tax deductions. Utilizing this organizer helps freelancers stay organized and ensures accurate tax reporting, reducing the risk of errors and audits.

To maximize efficiency, freelancers should regularly update their income and expenses throughout the year and maintain clear receipts for all deductible costs. Additionally, it's important to include sections for tracking estimated tax payments and mileage logs if applicable. Keeping this document comprehensive will streamline the tax filing process and support financial planning.

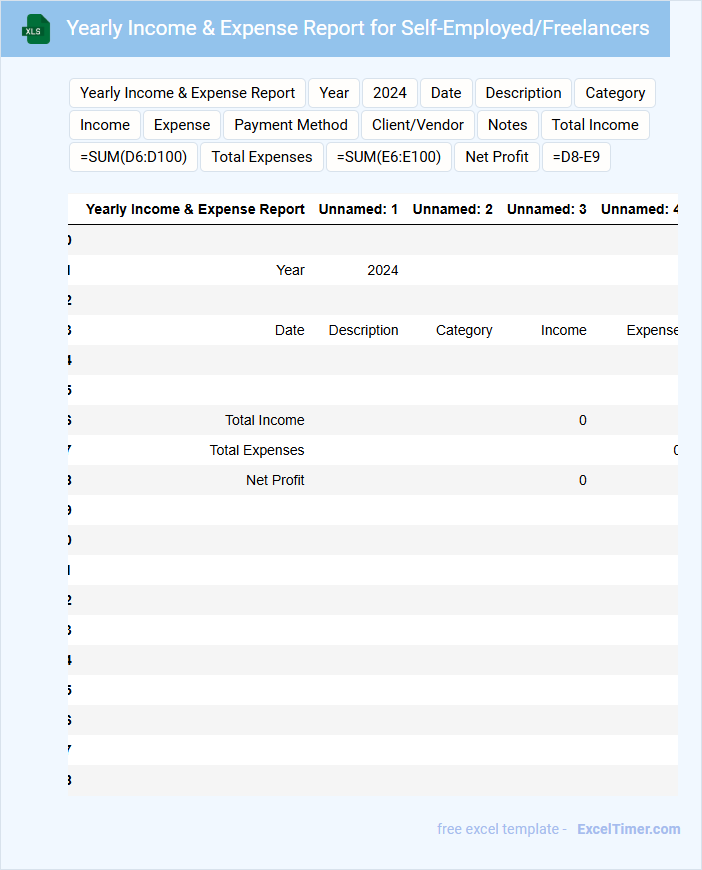

Yearly Income & Expense Report for Self-Employed/Freelancers

What does a Yearly Income & Expense Report for Self-Employed/Freelancers usually contain? This document typically includes detailed records of all income earned and expenses incurred throughout the year, helping to track financial performance. It also summarizes tax-deductible expenses, net profit, and provides essential data for tax filing and financial planning purposes.

What important aspects should be considered when preparing this report? It's crucial to accurately categorize all income sources and expenses to ensure compliance with tax laws and maximize deductions. Maintaining organized receipts and documentation throughout the year enhances accuracy and simplifies the reporting process.

What are the essential columns to include in an Annually Income & Expense Tracker for freelancers?

An Annually Income & Expense Tracker for freelancers should include essential columns such as Date, Client/Source, Income Amount, Expense Category, Expense Amount, Payment Method, and Notes. These columns help you accurately monitor your cash flow, categorize expenditures, and analyze financial trends throughout the year. Including a Tax Deductible column can also optimize your record-keeping for tax reporting.

How can you categorize different types of income and expenses for accurate annual reporting?

To ensure accurate annual reporting in your Freelancers Income & Expense Tracker, categorize income by client, project type, or payment frequency. Classify expenses into groups such as software subscriptions, office supplies, and professional services to streamline tax deductions. You can customize categories to reflect your unique freelance activities for precise financial analysis.

What formulas can be used in Excel to calculate total annual income, total expenses, and net profit for freelancers?

Use the SUM formula to calculate total annual income, e.g., =SUM(B2:B13) for income entries. Apply SUM similarly for total expenses using the expenses range, such as =SUM(C2:C13). Compute net profit by subtracting total expenses from total income with =SUM(B2:B13) - SUM(C2:C13).

How can you use Excel filters and PivotTables to analyze yearly financial trends as a freelancer?

Excel filters allow freelancers to sort and view specific income and expense categories by year, making it easier to identify spending patterns and revenue sources. PivotTables enable dynamic summarization of annual financial data, highlighting trends such as peak earning months and fluctuating expenses. Using these tools helps freelancers make informed decisions by visualizing comprehensive yearly financial summaries and trends.

Which built-in Excel charts best visualize annual income versus expenses for freelance financial planning?

The built-in Excel Clustered Column Chart effectively compares annual income versus expenses for freelancers by displaying side-by-side bars for each category. The Line Chart highlights income and expense trends over time, aiding in financial planning and forecasting. A Combination Chart, merging columns for expenses and a line for income, provides a clear visual contrast of financial performance throughout the year.