The Annually Expense Report Excel Template for Freelancers helps track and categorize yearly expenses efficiently, ensuring accurate financial management. This template simplifies budgeting, tax preparation, and identifying deductible costs, enhancing overall financial clarity. Customizable features allow freelancers to tailor the report to their specific needs, improving expense monitoring and business planning.

Annual Expense Report with Categories for Freelancers

An Annual Expense Report for freelancers typically contains detailed records of all expenses incurred throughout the year, organized into specific categories such as office supplies, travel, and software subscriptions. This document is crucial for tracking financial outflows and preparing accurate tax returns.

Including categorized expenses helps freelancers identify deductible costs and manage budgets effectively. It is important to maintain receipts and invoices to support all reported expenses for verification purposes.

Yearly Expense Tracking Spreadsheet for Freelancers

What information does a Yearly Expense Tracking Spreadsheet for Freelancers typically contain? This document usually includes categorized expense entries, dates, payment methods, and total amounts to provide a comprehensive overview of financial outflows. It helps freelancers monitor spending habits and prepare accurate tax reports. What is an important feature to include? Clear categorization and summary sections are essential for easy analysis, enabling freelancers to identify deductible expenses and optimize their budgeting strategy.

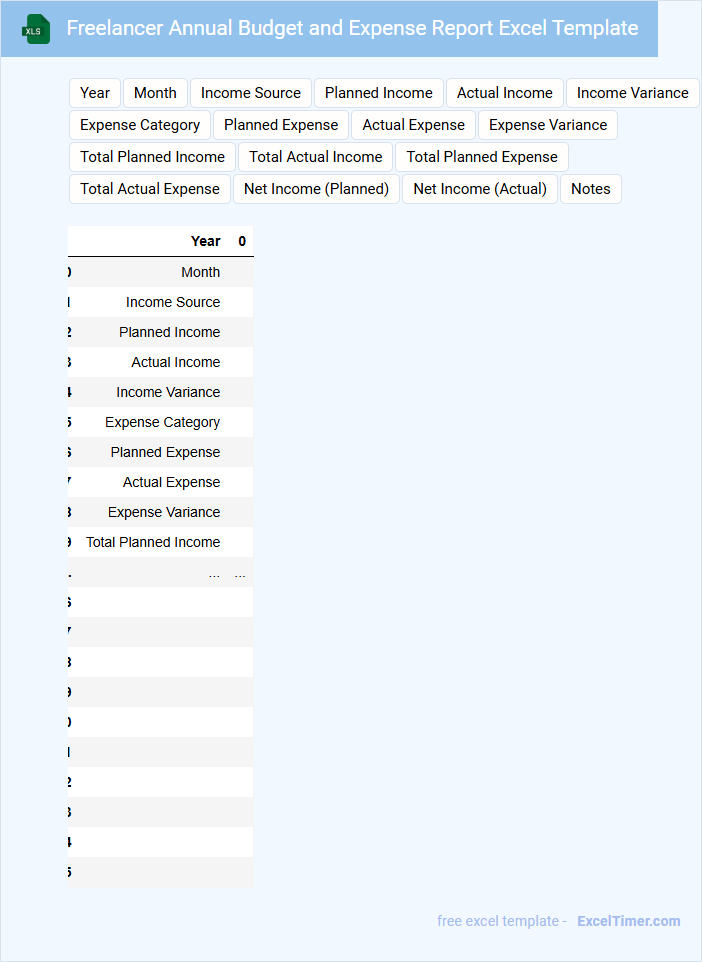

Freelancer Annual Budget and Expense Report Excel Template

What does a Freelancer Annual Budget and Expense Report Excel Template typically contain?

This document usually includes sections for tracking yearly income, categorizing expenses, and summarizing net profits. It helps freelancers organize finances, manage cash flow, and prepare for tax reporting efficiently.

Important features to include are customizable expense categories, automated calculations, and clear visual summaries such as charts to monitor financial health throughout the year.

Annual Expense Overview with Charts for Freelancers

What information does an Annual Expense Overview with Charts for Freelancers typically contain? This type of document usually includes a detailed summary of all expenses incurred throughout the year, categorized by type such as office supplies, travel, and software subscriptions. Visual charts like pie charts and bar graphs are used to represent spending patterns, making it easier for freelancers to analyze their financial habits and optimize budgeting.

What are the important elements to include in an Annual Expense Overview for freelancers? Essential components include accurate categorization of expenses, clear visualization through charts for quick understanding, and the inclusion of monthly or quarterly breakdowns to identify trends over time. Including notes or explanations for significant or unusual expenses can also enhance the document's usefulness for financial planning and tax preparation.

Excel Template for Tracking Yearly Freelancer Expenses

An Excel Template for Tracking Yearly Freelancer Expenses is designed to help freelancers organize and monitor their financial activities throughout the year. It usually contains categorized expense entries, monthly summaries, and automated calculations for totals and taxes.

This document is essential for maintaining accurate records, ensuring tax compliance, and managing budgets effectively. Important considerations include updating entries regularly and including sections for income and receipt attachments.

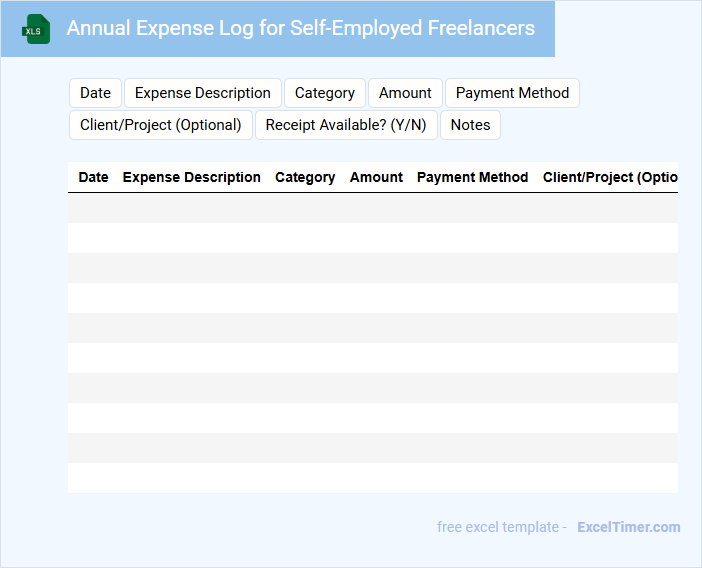

Annual Expense Log for Self-Employed Freelancers

What information does an Annual Expense Log for Self-Employed Freelancers typically include? This document usually contains detailed records of all business-related expenses incurred throughout the year, such as office supplies, travel, meals, and equipment. Keeping an accurate and organized expense log helps freelancers track deductible costs for tax purposes and manage their finances effectively.

What is important to remember when maintaining an Annual Expense Log? It is crucial to categorize expenses correctly and retain all receipts and invoices to ensure accuracy and compliance with tax regulations. Consistently updating the log and reviewing it regularly can prevent errors and provide valuable insights into spending patterns.

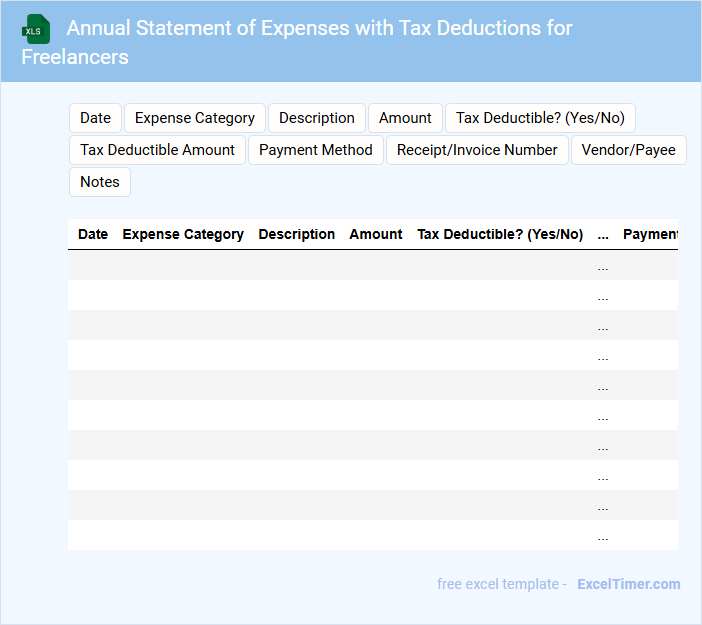

Annual Statement of Expenses with Tax Deductions for Freelancers

What does an Annual Statement of Expenses with Tax Deductions for Freelancers usually contain? This document typically includes a detailed list of all business-related expenses incurred by a freelancer throughout the year, alongside the applicable tax deductions allowable by law. It helps freelancers accurately report their income and expenses to optimize tax benefits.

What is an important consideration when preparing this document? Ensuring all receipts and proofs of expenditure are well-organized and categorized is crucial, as it facilitates precise tax reporting and minimizes errors during tax filing. Additionally, freelancers should keep updated on current tax deduction rules relevant to their profession to maximize their financial advantage.

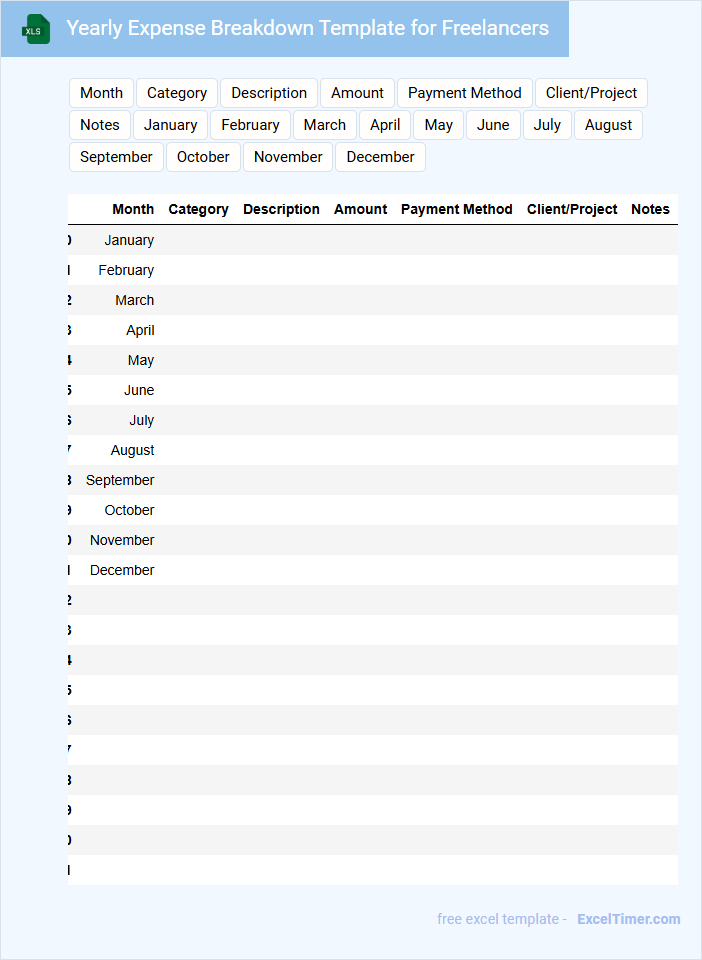

Yearly Expense Breakdown Template for Freelancers

A Yearly Expense Breakdown Template for Freelancers is a document used to track and organize all expenses incurred throughout the year. It helps freelancers manage their finances efficiently and prepares them for tax season.

Key elements to include are:

- Detailed categorization of expenses such as equipment, software, and travel costs.

- Monthly and yearly totals to easily monitor spending patterns.

- Space for notes to document any unusual or deductible expenses.

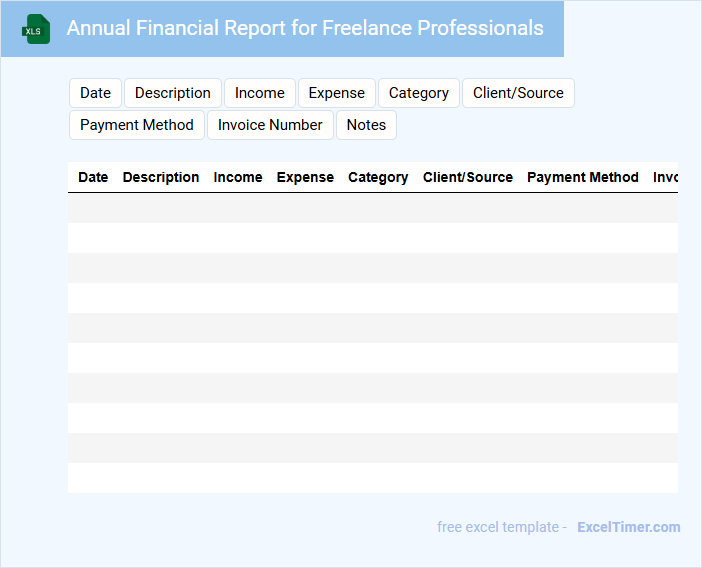

Annual Financial Report for Freelance Professionals

The Annual Financial Report for freelance professionals typically contains a detailed summary of their income, expenses, and overall financial performance over the year. It includes key elements such as profit and loss statements, tax liabilities, and cash flow analysis. This document is essential for tracking financial health and preparing for tax season efficiently.

Annual Expense Summary with Income Tracker for Freelancers

What does an Annual Expense Summary with Income Tracker for Freelancers typically contain?

This document usually contains detailed records of all income received and expenses incurred over the course of a year, categorized by type and date. It helps freelancers monitor financial health, prepare for taxes, and make informed budgeting decisions.

Important elements to include are accurate income entries, expense categories, totals for each section, and notes for unusual transactions. Regular updating ensures clarity and maximizes tax deductions while providing a clear financial overview.

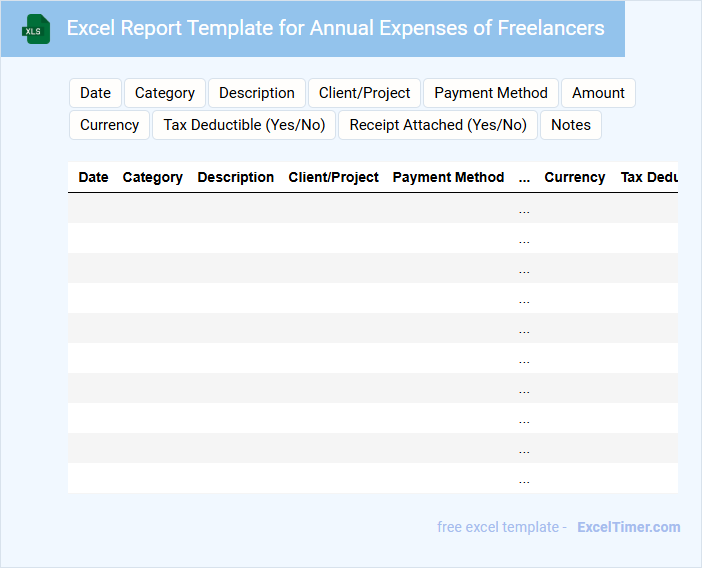

Excel Report Template for Annual Expenses of Freelancers

Excel Report Templates for Annual Expenses of Freelancers typically contain detailed financial data categorized by expense types to help manage and analyze yearly spending efficiently.

- Comprehensive Expense Categories: Include all relevant categories such as equipment, software, travel, and office supplies.

- Clear Totals and Summaries: Ensure the template calculates yearly totals and summaries for quick financial overview.

- Customizable Fields: Provide adjustable input fields to accommodate unique freelancer expenses and tax requirements.

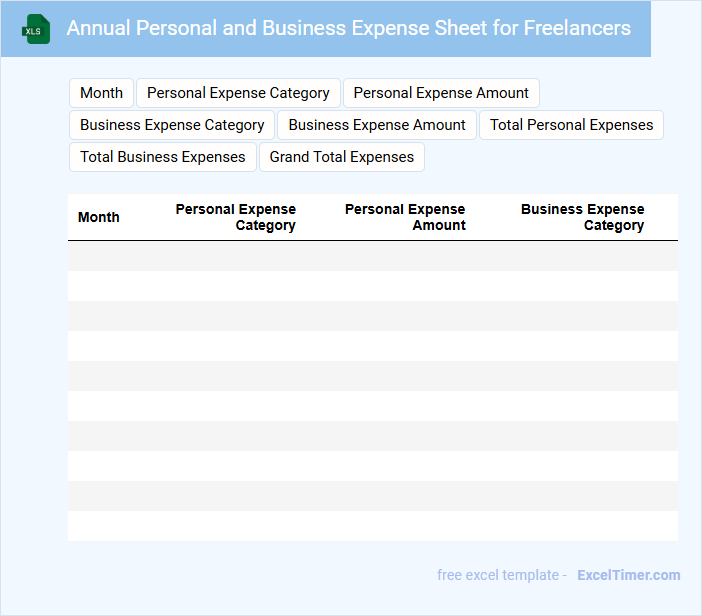

Annual Personal and Business Expense Sheet for Freelancers

An Annual Personal and Business Expense Sheet for Freelancers is a document used to track and categorize all personal and business-related expenses throughout the year. It helps freelancers manage their finances, prepare for taxes, and analyze spending patterns effectively.

- Include detailed categories for business expenses such as office supplies, travel, and software subscriptions.

- Separate personal expenses clearly to maintain accurate financial records.

- Regularly update the sheet to ensure accuracy and easy tax preparation.

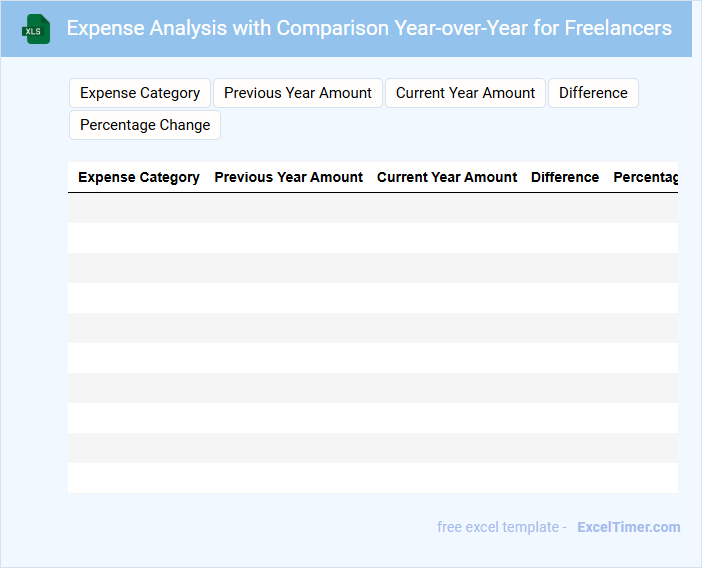

Expense Analysis with Comparison Year-over-Year for Freelancers

An Expense Analysis document for freelancers typically contains detailed records of income and expenditures, categorized by type and date. It highlights trends and patterns by comparing current expenses with those from previous years to identify areas for cost-saving. This analysis helps freelancers maintain financial health and make informed budgeting decisions for future projects.

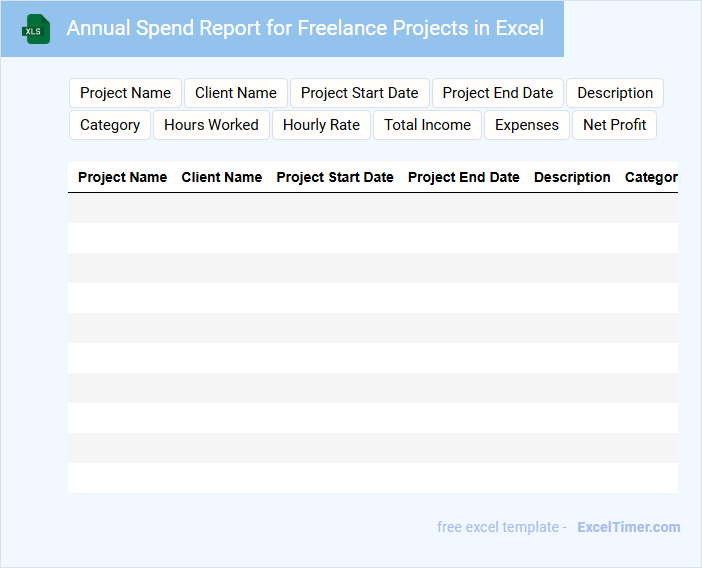

Annual Spend Report for Freelance Projects in Excel

An Annual Spend Report for freelance projects in Excel typically contains a detailed summary of all expenses related to freelance work throughout the year. It includes categories such as project costs, payment dates, client details, and total spend per project or client. This document helps track financial performance and budget adherence for freelance activities.

Important components to include are clear expense categories, accurate date tracking, and a summary dashboard for quick insights. Utilizing Excel functions like pivot tables and charts can enhance data visualization and decision-making. Ensuring data consistency and regularly updating the report will maintain its accuracy and usefulness.

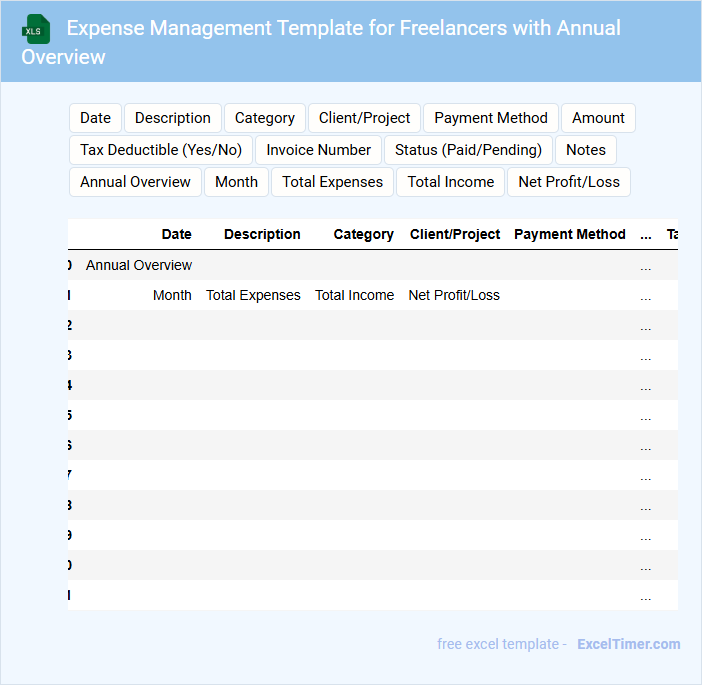

Expense Management Template for Freelancers with Annual Overview

An Expense Management Template for freelancers is designed to systematically track and categorize all business-related expenses throughout the year. It typically contains detailed monthly expenditure entries, overall annual summaries, and budget comparison charts. Such a document helps freelancers maintain financial clarity, ensure tax compliance, and optimize spending efficiency.

What are the key categories to include in an Annually Expense Report for freelancers?

Key categories in an Annual Expense Report for freelancers include Office Supplies, Software and Subscriptions, Travel and Transportation, Marketing and Advertising, Professional Services, Training and Education, and Home Office Expenses. Tracking these categories helps freelancers accurately monitor deductible expenses for tax purposes. Detailed documentation supports financial planning and enhances the clarity of expense management throughout the fiscal year.

How can you use Excel formulas to automatically calculate total yearly expenses?

Excel formulas like SUM and SUMIF enable you to automatically calculate total yearly expenses by adding values in specified cells or ranges. Using functions such as SUM, you can total all monthly expense entries, while SUMIF allows categorization based on expense types or dates. This streamlines tracking and ensures your freelance financial records stay accurate throughout the year.

What methods can be used in Excel to track deductible versus non-deductible expenses?

Excel offers methods like creating separate columns or sheets to categorize deductible and non-deductible expenses, using data validation to restrict entries, and applying conditional formatting to highlight each type. Formulas such as SUMIF can summarize total amounts in each category, providing clarity in your annual expense report for freelancers. You can also use pivot tables to dynamically analyze and compare these expenses for accurate tax preparation.

How do you organize receipts and supporting documents within your Excel Annually Expense Report?

Organize receipts and supporting documents by categorizing them into expense types such as travel, supplies, and software within your Excel Annual Expense Report. Use separate columns for date, vendor, amount, and receipt reference number to ensure accurate tracking and easy cross-referencing. Attach digital receipts as hyperlinks or embed scanned images to maintain documentation integrity and streamline audit processes.

What are the best Excel practices for visualizing annual expense trends as a freelancer?

Use dynamic pivot tables and line charts to clearly visualize your annual expense trends, enabling quick identification of spending patterns. Apply conditional formatting to highlight key variances, ensuring important data points stand out. Incorporate slicers for easy filtering by month, category, or project to enhance your data exploration and decision-making.