The Annually Financial Statement Excel Template for Consultants offers a structured format to track income, expenses, and profits over the fiscal year, tailored specifically for consulting professionals. This template simplifies financial analysis by providing customizable fields and automated calculations, ensuring accurate and efficient reporting. Its user-friendly design helps consultants maintain clear records for tax purposes and strategic decision-making.

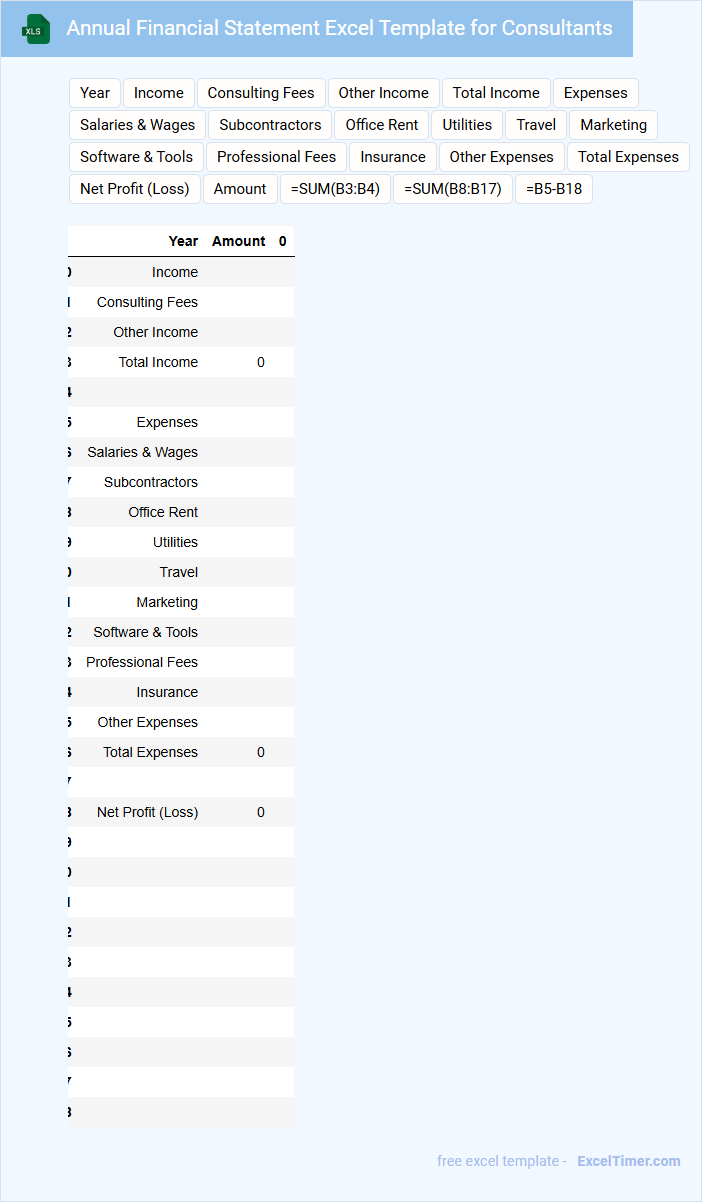

Annual Financial Statement Excel Template for Consultants

An Annual Financial Statement Excel Template for consultants typically contains detailed records of income, expenses, assets, and liabilities for the fiscal year. It provides a clear overview of the financial health and performance of the consulting business. This document helps in tracking revenue sources and managing costs effectively.

Key components such as profit and loss statements, balance sheets, and cash flow analysis are usually included to ensure comprehensive financial reporting. The template should be customizable to reflect specific consulting services and fee structures. Regular updates and accuracy are crucial for making informed business decisions.

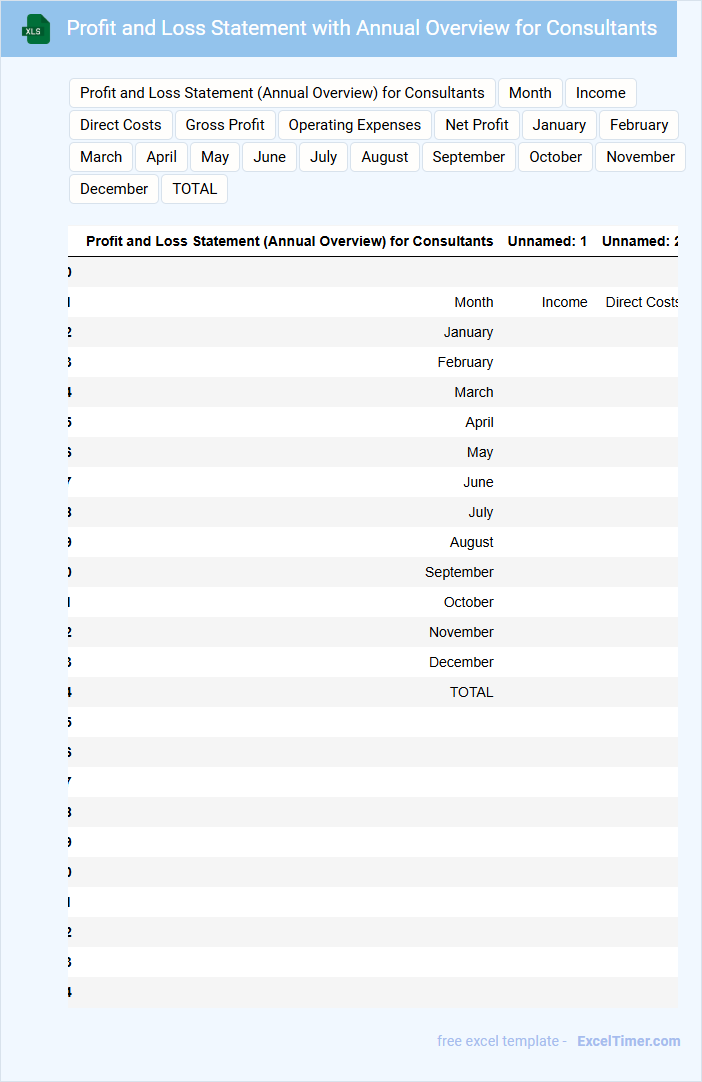

Profit and Loss Statement with Annual Overview for Consultants

The Profit and Loss Statement is a financial document that summarizes the revenues, costs, and expenses incurred during a specific period, typically one fiscal year. It provides consultants with an overview of their net profit or loss, helping to assess business performance and financial health.

For consultants, including an Annual Overview highlights trends and variations in income and expenses over time, offering valuable insights into business growth and opportunities for improvement. It is important to ensure accuracy, categorize all sources of income and expenses clearly, and review regularly for strategic decision-making.

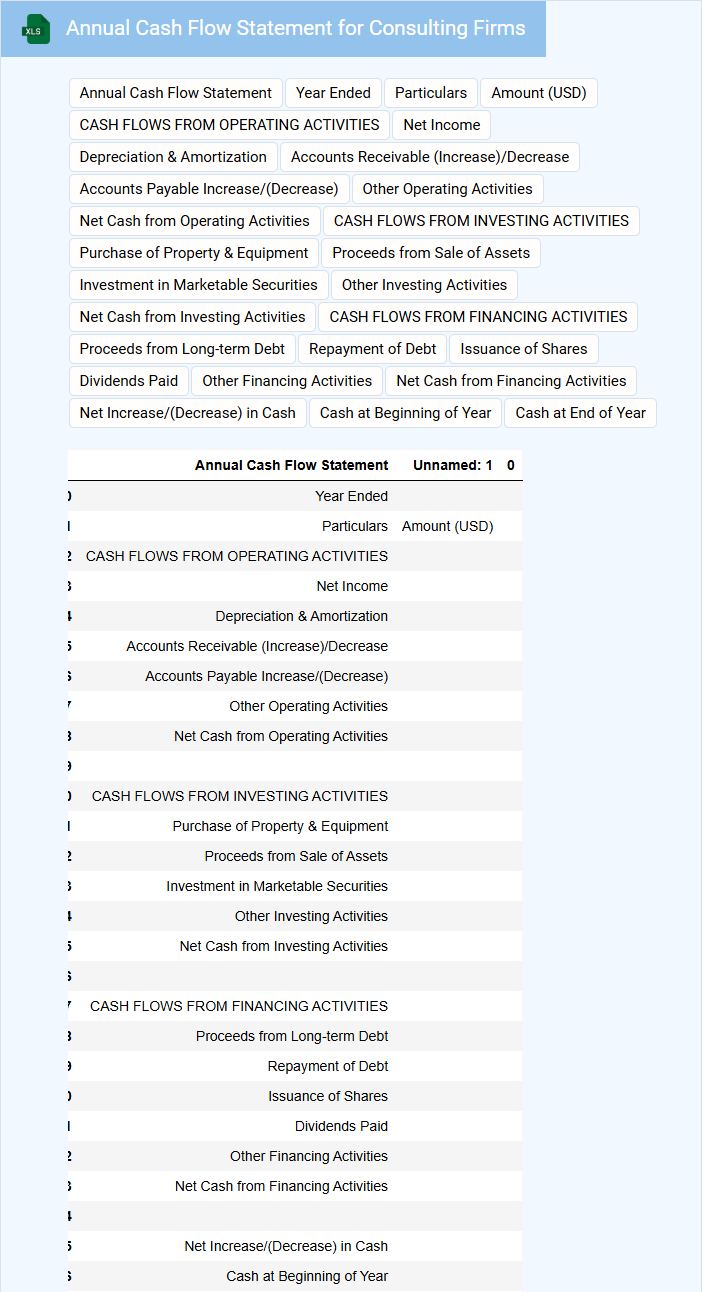

Annual Cash Flow Statement for Consulting Firms

What information is typically contained in an Annual Cash Flow Statement for Consulting Firms? This document usually details the inflows and outflows of cash over a fiscal year, highlighting operational, investing, and financing activities. It provides insight into how cash is generated and used, ensuring the firm's liquidity and financial health.

What important aspects should consulting firms focus on in their Annual Cash Flow Statement? They should emphasize accurate tracking of client payments, expenses related to project delivery, and investments in business growth. Clear categorization and timely reconciliation are essential for strategic planning and maintaining trust with stakeholders.

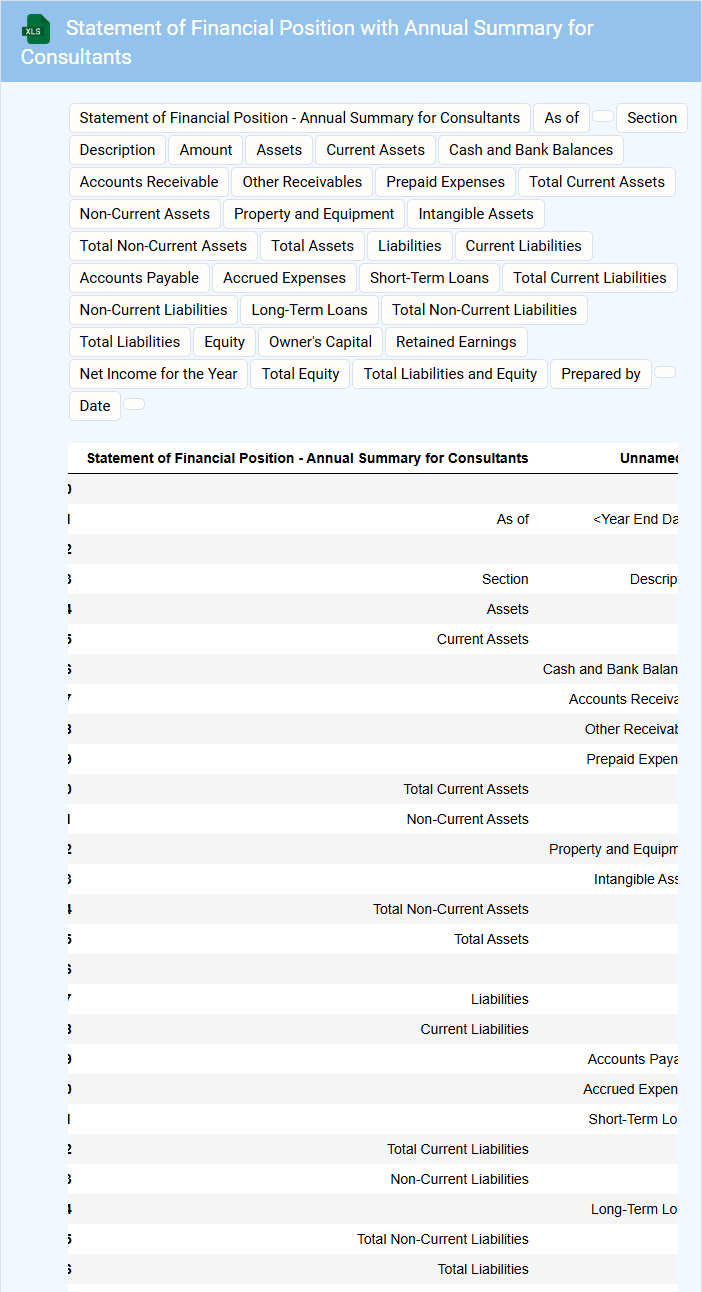

Statement of Financial Position with Annual Summary for Consultants

What information does a Statement of Financial Position with an Annual Summary for Consultants typically contain? This document usually presents a detailed snapshot of a consultant's financial status at a specific date, including assets, liabilities, and equity. It also provides an annual summary highlighting income, expenses, and overall financial performance to help assess the consultant's fiscal health and sustainability.

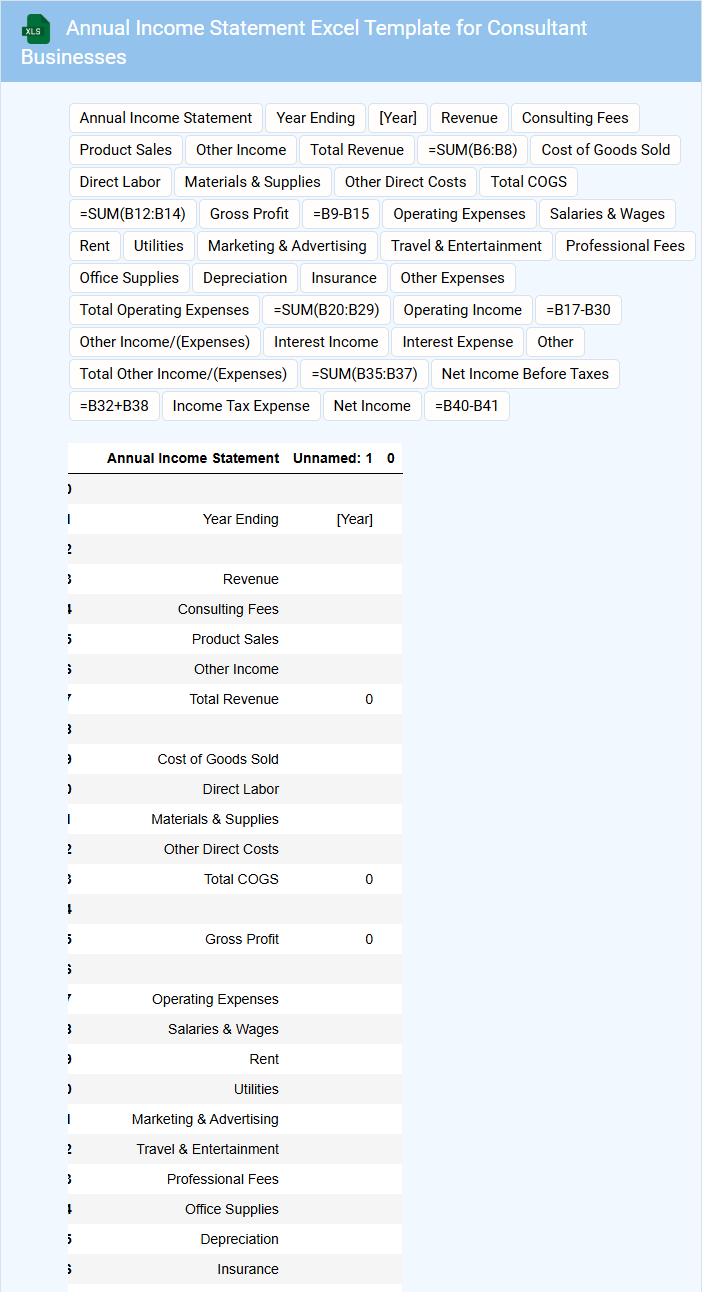

Annual Income Statement Excel Template for Consultant Businesses

What information does an Annual Income Statement Excel Template for Consultant Businesses typically contain?

This template usually includes detailed sections for revenue, expenses, and net profit, tailored specifically for consulting services. It helps consultants track their financial performance throughout the year by organizing income from clients and deducting business-related costs.

What is an important consideration when using this template?

Ensuring accurate categorization of income and expenses is crucial for reliable financial analysis and tax reporting. Customizing the template to reflect unique consulting activities and costs will provide more meaningful insights.

Annual Budget Tracking with Financial Statements for Consultants

The Annual Budget Tracking document typically contains detailed financial data, including projected versus actual expenses, revenue streams, and cash flow analysis. It integrates comprehensive Financial Statements such as balance sheets, income statements, and cash flow statements to provide a holistic view of the organization's fiscal health. For consultants, ensuring accuracy and up-to-date information in these reports is crucial for strategic planning and decision making.

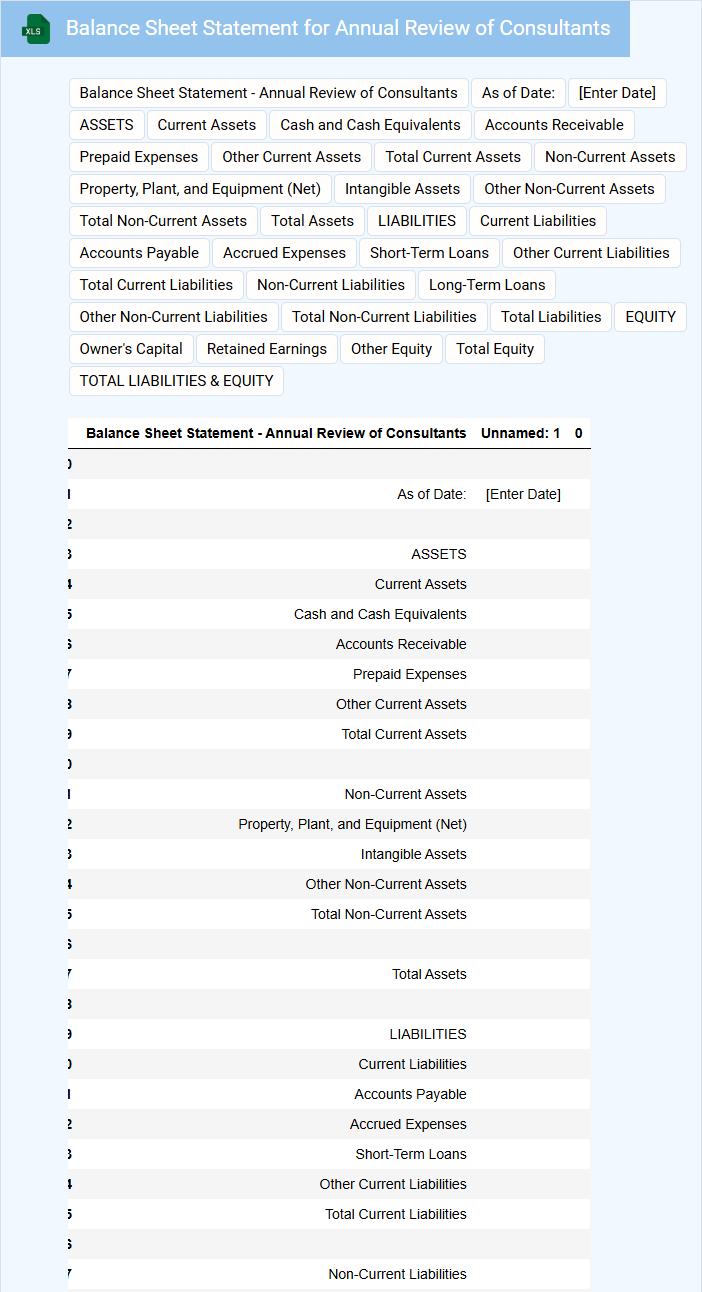

Balance Sheet Statement for Annual Review of Consultants

A Balance Sheet Statement for the Annual Review of Consultants typically contains a summary of the financial position of the consulting firm at a specific point in time, detailing assets, liabilities, and equity. This document is crucial for evaluating the company's financial health and ensuring accountability in financial reporting.

- Include a clear breakdown of current and non-current assets to reflect liquidity and long-term investments.

- Accurately categorize liabilities to distinguish between short-term obligations and long-term debts.

- Present equity components transparently to provide insight into retained earnings and capital contributions.

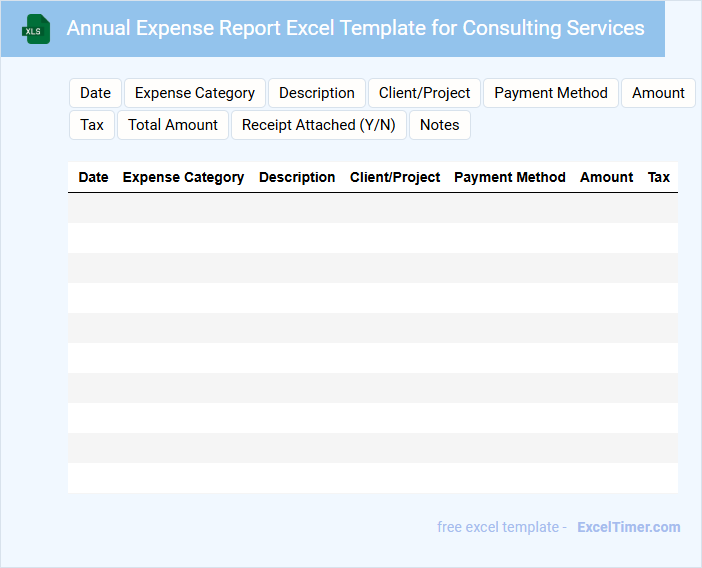

Annual Expense Report Excel Template for Consulting Services

An Annual Expense Report Excel Template for Consulting Services typically contains detailed financial records related to consulting activities over a year.

- Expense Categories: A clear breakdown of various consulting-related expenses such as travel, materials, and salaries.

- Monthly and Annual Totals: Summarized data for periodic and overall expense tracking to monitor budget adherence.

- Notes and Justifications: Sections for explanations and approvals to ensure transparency and accountability.

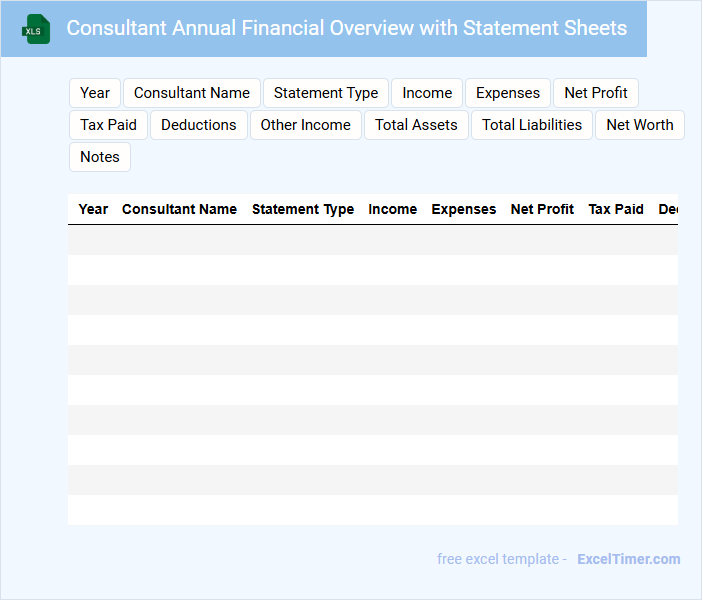

Consultant Annual Financial Overview with Statement Sheets

The Consultant Annual Financial Overview typically contains a detailed summary of a consultant's yearly financial performance, including income, expenses, and net profit. It incorporates statement sheets such as balance sheets, income statements, and cash flow reports to provide clarity on financial health. This document is essential for evaluating financial trends and making informed business decisions.

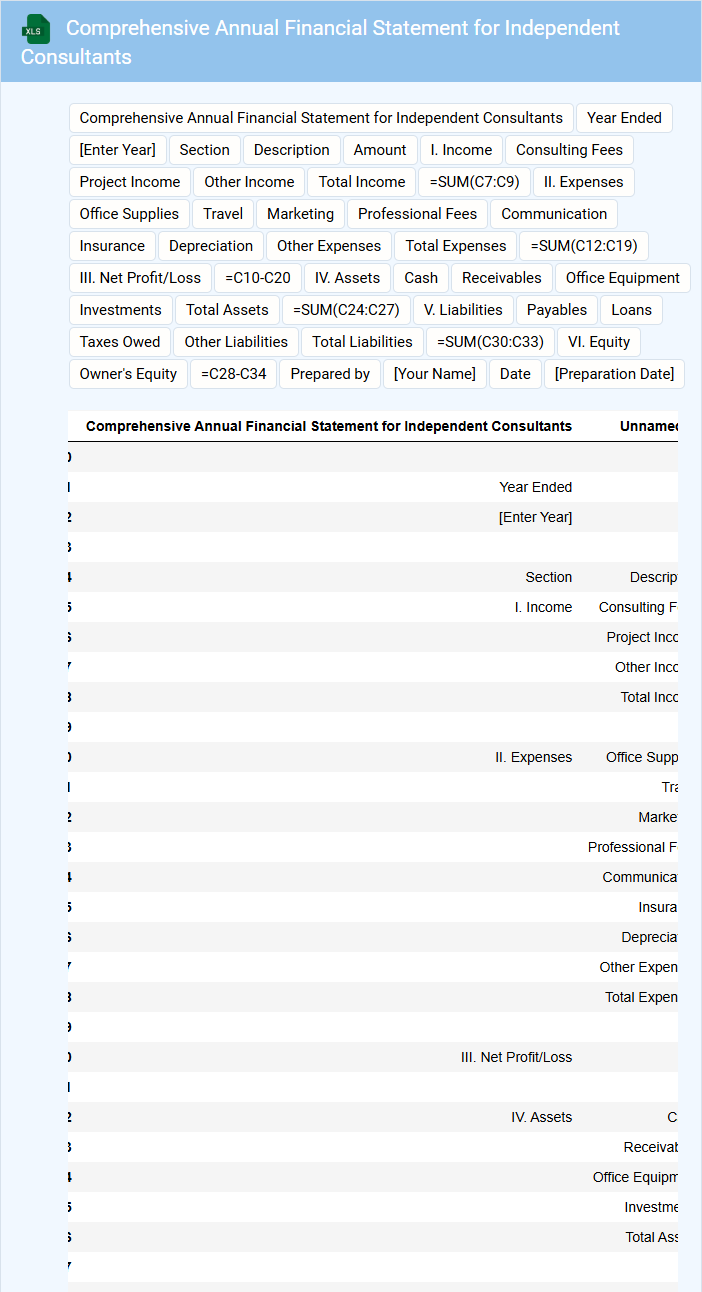

Comprehensive Annual Financial Statement for Independent Consultants

The Comprehensive Annual Financial Statement for Independent Consultants typically contains detailed financial data including income, expenses, assets, and liabilities. It provides a structured overview of the consultant's financial performance and position over the fiscal year. This document is essential for transparency, budgeting, and strategic planning.

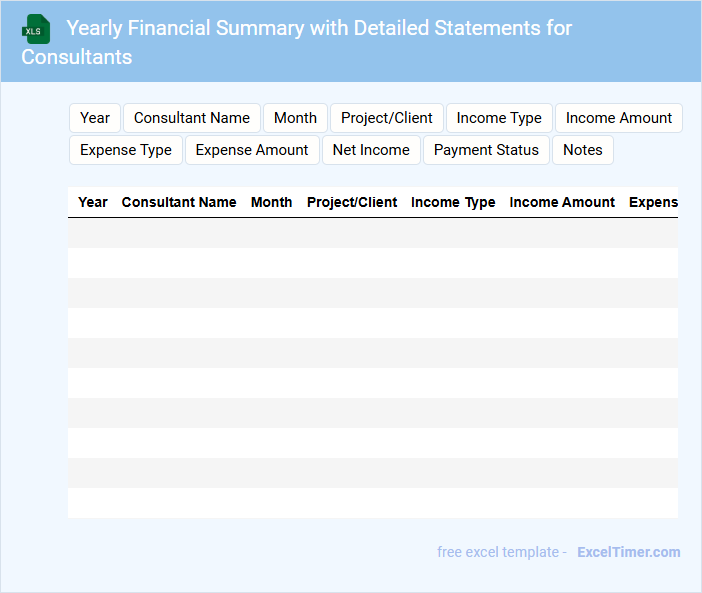

Yearly Financial Summary with Detailed Statements for Consultants

A Yearly Financial Summary with detailed statements for consultants typically includes an overview of the annual earnings, expenses, and net profit. It provides a comprehensive breakdown of income sources and cost allocations to help consultants understand their financial status. This document is essential for accurate tax filing, budgeting, and evaluating business performance.

Important elements to include are a clear summary of total revenue, itemized expense reports, and a comparison to previous years to track growth trends. Detailed statements should highlight payment timeline, outstanding invoices, and any reimbursable expenses. Additionally, it's vital to include notes on any financial anomalies and recommendations for financial improvements.

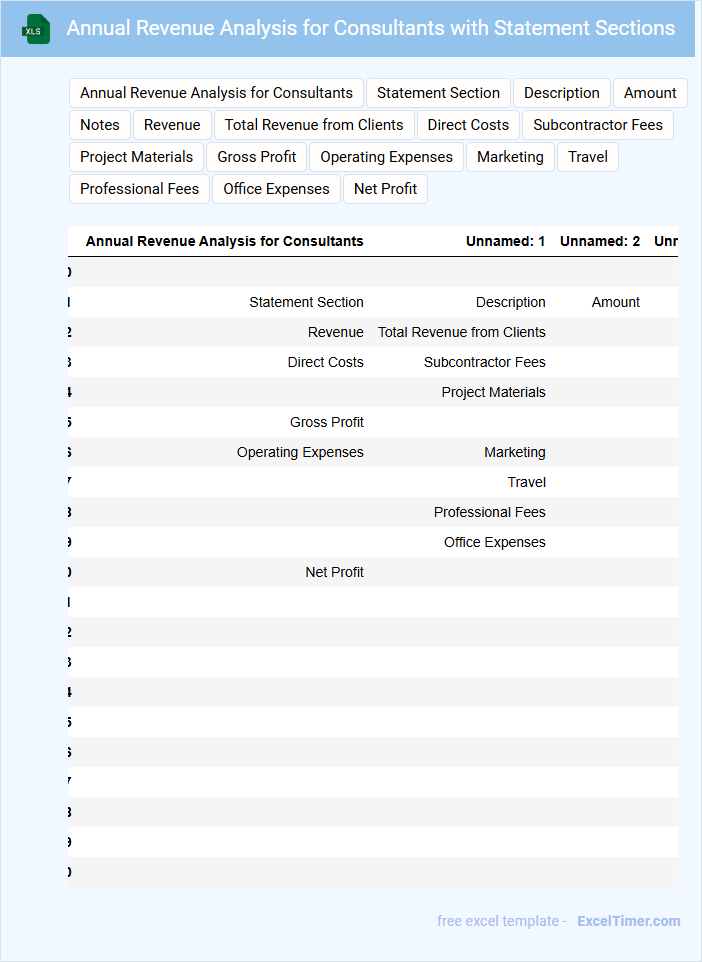

Annual Revenue Analysis for Consultants with Statement Sections

An Annual Revenue Analysis document for consultants typically contains detailed financial data, including total earnings, revenue streams, and expense breakdowns. It provides insights into profitability and financial trends over the year, helping to identify key growth areas.

The statement sections within this document usually present categorized income statements, balance sheets, and cash flow reports. These sections ensure clarity and support informed decision-making for future consulting strategies and budgeting.

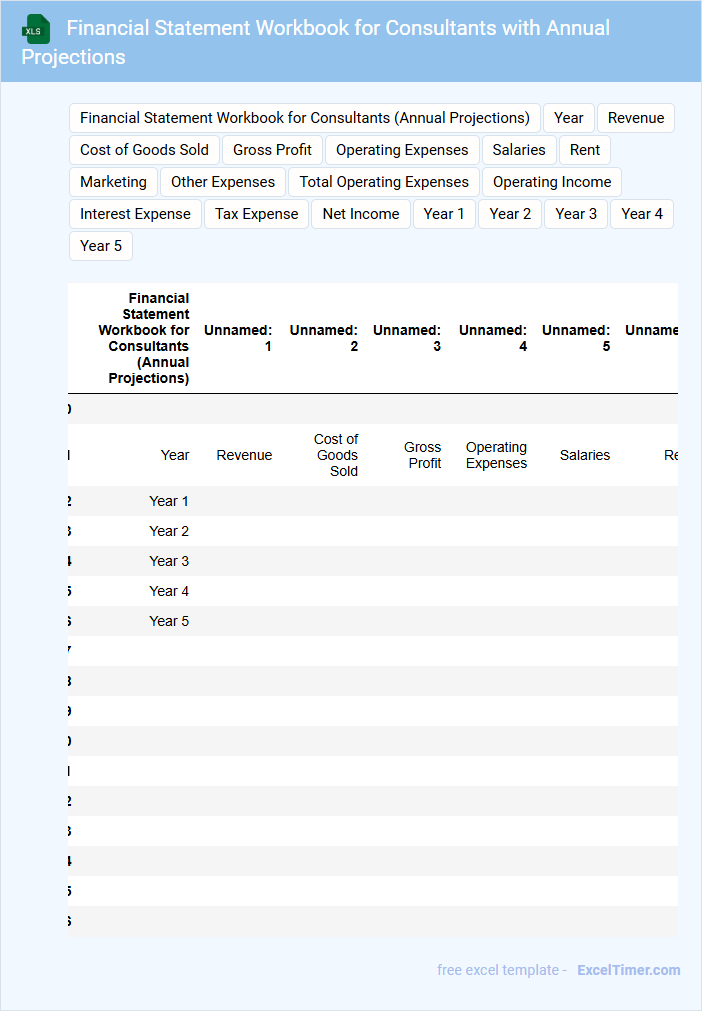

Financial Statement Workbook for Consultants with Annual Projections

Financial Statement Workbooks for Consultants with Annual Projections typically contain detailed financial data and forecasts that help in strategic planning and decision-making. These documents consolidate historical financial performance with future projections to provide a comprehensive financial overview.

- Ensure accuracy in historical data to maintain credibility and reliability.

- Include clear assumptions behind projections to facilitate understanding.

- Incorporate sensitivity analysis to assess potential risks and opportunities.

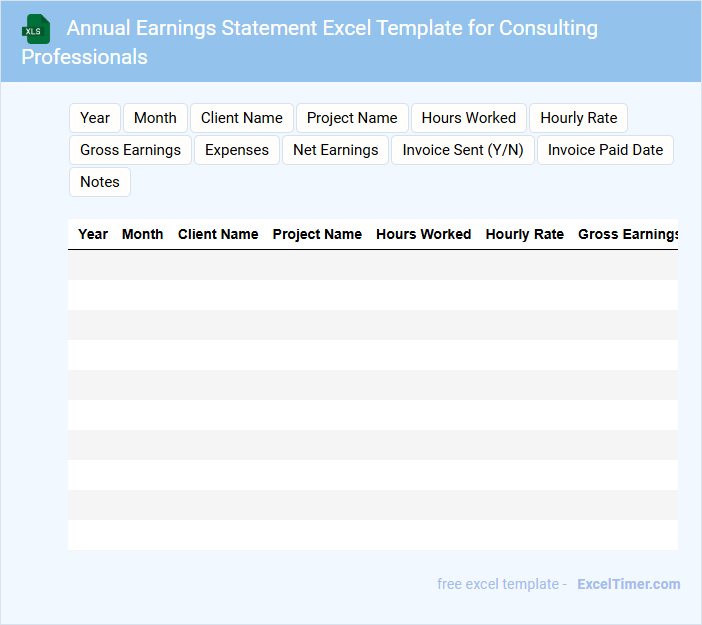

Annual Earnings Statement Excel Template for Consulting Professionals

The Annual Earnings Statement Excel template is designed to summarize the yearly income and financial transactions of consulting professionals. It typically contains detailed breakdowns of revenue sources, expenses, and net profits.

This document helps consultants track their financial performance and prepare for tax filing. Including clear categories for billable hours and client payments is an important feature to ensure accuracy.

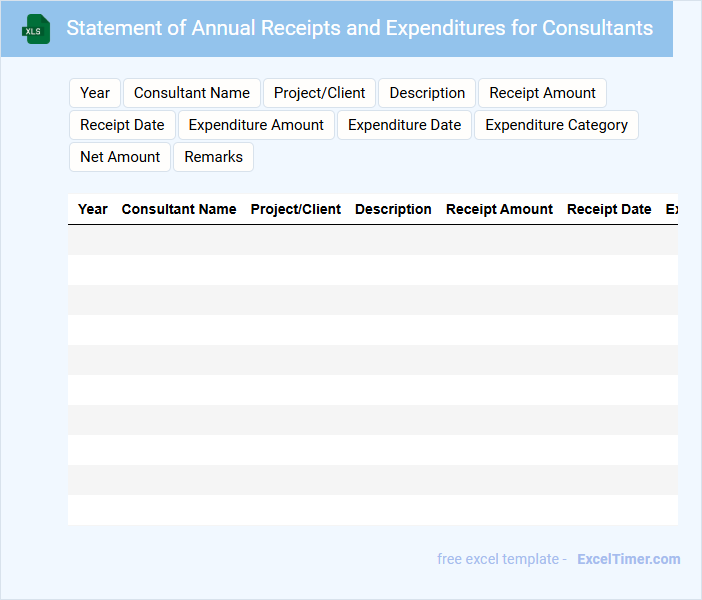

Statement of Annual Receipts and Expenditures for Consultants

A Statement of Annual Receipts and Expenditures for consultants typically contains a detailed record of all financial transactions, including payments received and expenses incurred over the year. This document provides transparency and accountability by summarizing income sources and costs related to consultancy services. It is essential for tracking financial performance and ensuring compliance with contractual or regulatory requirements.

When preparing this statement, it is important to include accurate dates, itemized receipts, and clear categorization of expenses to maintain clarity. Supporting documents such as invoices and payment proofs should be attached for verification purposes. Ensuring consistency in reporting format helps in easy comparison and financial analysis year-over-year.

What key financial reports compose an annual financial statement for consultants (e.g., balance sheet, profit & loss statement, cash flow statement)?

An annual financial statement for consultants typically includes a balance sheet, profit and loss statement, and cash flow statement. The balance sheet provides a snapshot of assets, liabilities, and equity at year-end. The profit and loss statement details revenues and expenses to show net income, while the cash flow statement tracks cash inflows and outflows from operating, investing, and financing activities.

How should consulting revenue streams and client billing be accurately represented in the annual financial statement?

Consulting revenue streams and client billing should be accurately represented in the annual financial statement by categorizing income from each consulting service and client separately, ensuring clear identification of revenue sources. Detailed invoices and payment records must be reconciled with reported figures to maintain accuracy and compliance. Your statement should reflect precise revenue recognition aligned with contract terms and billing cycles.

Which expenses and liabilities are essential for consultants to track annually in their financial statements?

Consultants must track essential expenses such as office supplies, software subscriptions, travel costs, and marketing fees in their annual financial statements. Key liabilities include client advances, tax obligations, and outstanding invoices. Accurate documentation of these elements ensures precise financial analysis and compliance.

How does an annual financial statement support tax filing and regulatory compliance for consultants?

An annual financial statement provides a comprehensive record of your income, expenses, and profits, essential for accurate tax filing and meeting regulatory requirements. It ensures transparency and helps identify deductible expenses, reducing tax liabilities. Maintaining this statement supports compliance with financial regulations and audit readiness for consultants.

What best practices ensure data accuracy and completeness when creating annual financial statements in Excel for consulting businesses?

Ensure data accuracy and completeness in annual financial statements for consultants by implementing automated error-checking formulas and validating input data against source documents. Organize worksheets with clear labels and structured tables to facilitate accurate data entry and review. Regularly perform reconciliation between Excel statements and accounting software to maintain consistency and identify discrepancies early.