![]()

The Annually Investment Tracker Excel Template for Financial Advisors enables precise monitoring of yearly investment performance, asset allocation, and portfolio growth. It offers customizable fields for tracking client portfolios, ensuring data accuracy and improving financial decision-making. This tool is essential for streamlining reporting and enhancing client communication.

Annual Investment Performance Tracker for Financial Advisors

What is typically contained in an Annual Investment Performance Tracker for Financial Advisors? This document usually includes detailed records of investment returns, asset allocations, and benchmark comparisons over a specific year. It is designed to provide a clear and comprehensive overview of portfolio performance to inform client discussions and strategic decision-making.

What important elements should be included in this tracker? Key components should feature consistent performance metrics, risk assessments, and personalized notes on market conditions. Ensuring accuracy and clarity in the presentation helps advisors maintain transparency and build trust with clients.

Yearly Portfolio Growth Tracker with Charts

A Yearly Portfolio Growth Tracker is a document that records the performance and value changes of investments over a year. It typically contains detailed charts illustrating growth trends, asset allocations, and comparative analyses. Including clear visualization helps investors make informed decisions and monitor portfolio health effectively.

Annual Asset Allocation Tracker for Clients

What information is typically included in an Annual Asset Allocation Tracker for Clients? This document usually contains a detailed summary of the client's investment distribution across various asset classes such as stocks, bonds, real estate, and cash equivalents over the year. It helps track changes, monitor portfolio diversification, and ensure alignment with the client's financial goals and risk tolerance.

What is important to focus on when using this tracker? Ensuring accurate and up-to-date data input is crucial, as it directly impacts decision-making and portfolio adjustments. Additionally, highlighting performance metrics and risk assessments can provide valuable insights to optimize the client's investment strategy effectively.

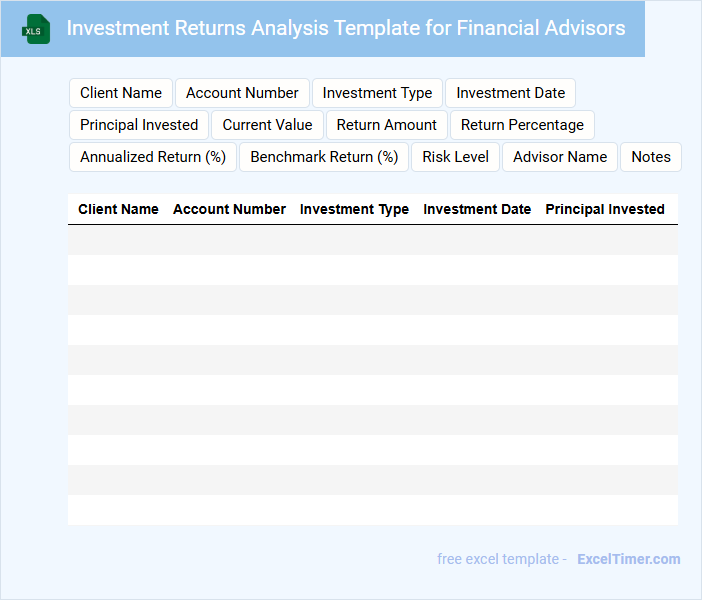

Investment Returns Analysis Template for Financial Advisors

An Investment Returns Analysis Template is a structured document used by financial advisors to evaluate the performance of various investment portfolios. It typically contains detailed data on historical returns, risk metrics, and comparison benchmarks to help analyze the effectiveness of investment strategies. This template aids in providing a clear and comprehensive report to clients, facilitating informed decision-making.

Important elements to include are consistent timeframes for returns, clear differentiation between net and gross returns, and an analysis of risk-adjusted performance. Visual aids like charts and graphs improve clarity and client engagement. Additionally, ensuring the document is customizable to reflect individual client goals enhances its practical value.

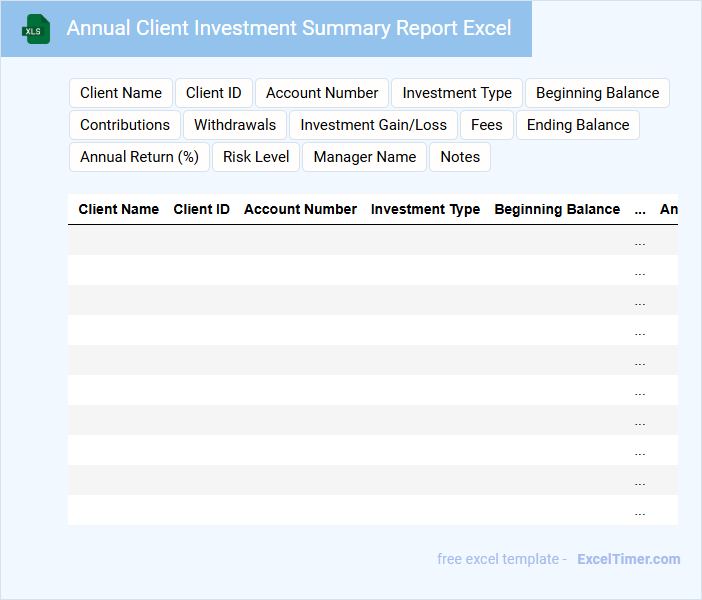

Annual Client Investment Summary Report Excel

An Annual Client Investment Summary Report Excel document typically contains a detailed overview of a client's investment portfolio performance over the year. It includes key financial metrics, transaction histories, and comparisons against benchmarks. This report helps clients understand their investment growth and make informed decisions.

Important elements to include are clear charts, accurate data tables, and a summary of investment goals versus achieved returns. Ensuring data accuracy and readability enhances client trust and engagement. Including actionable insights or recommendations can also add significant value.

Yearly Dividend and Interest Income Tracker

A Yearly Dividend and Interest Income Tracker is a document designed to record and monitor earnings from dividends and interest over a year. It helps investors keep track of their passive income sources and analyze financial performance.

- Include columns for the date, source of income, and amount received to ensure detailed tracking.

- Regularly update the document to maintain accuracy and capture all income events.

- Summarize total income monthly and annually to assess growth and plan future investments.

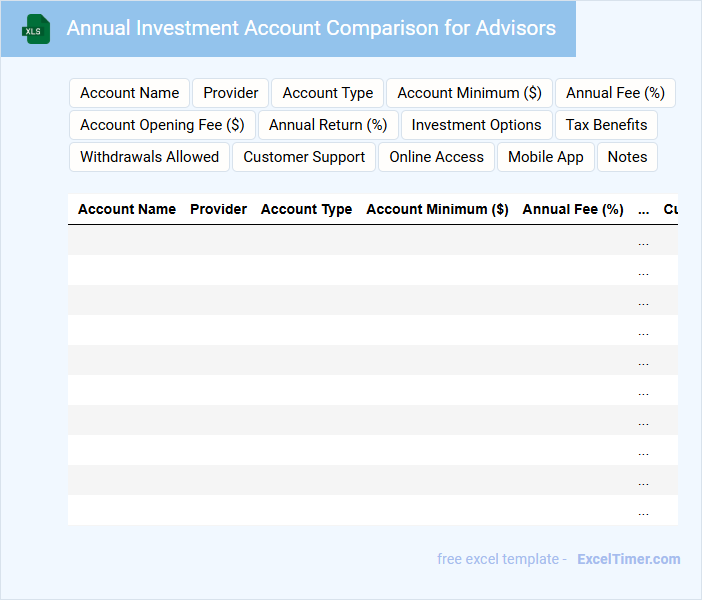

Annual Investment Account Comparison for Advisors

What information does an Annual Investment Account Comparison for Advisors typically contain? This document usually includes a detailed analysis of various investment accounts over the past year, highlighting performance metrics, fees, and asset allocations. It helps advisors evaluate the effectiveness of different investment options to make informed decisions for their clients.

Why is it important for advisors to use this comparison? Utilizing this document ensures advisors can identify the best-performing accounts while considering costs and risks, ultimately optimizing client portfolios. Emphasizing transparency and accuracy in data presentation is crucial for clear, trustworthy investment guidance.

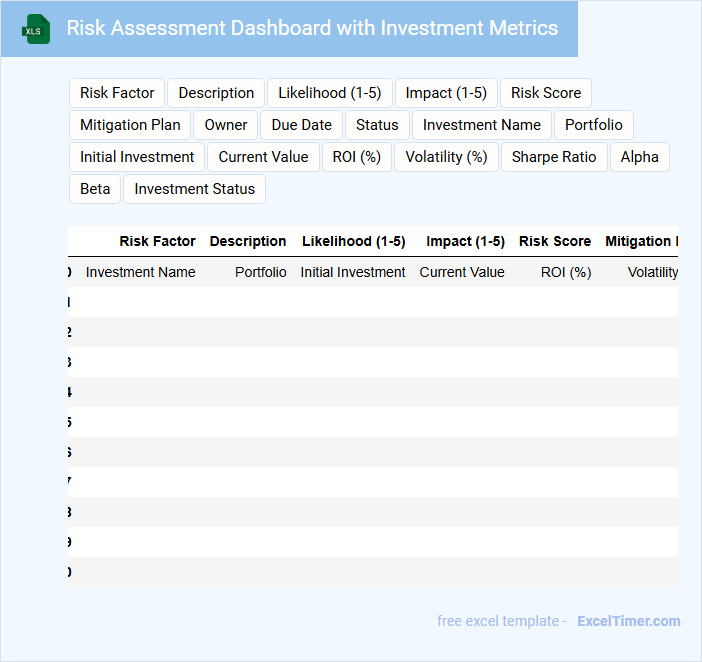

Risk Assessment Dashboard with Investment Metrics

A Risk Assessment Dashboard typically contains a comprehensive overview of potential risks associated with investments, including visualizations of risk levels and metrics. It helps stakeholders identify, evaluate, and prioritize risks to make informed decisions.

Investment metrics such as ROI, volatility, and value at risk are crucial for analyzing the financial impact and performance of assets within the dashboard. Regular updates and real-time data integration ensure accuracy and relevance.

To optimize this document, include clear risk indicators, comparative benchmarks, and interactive elements for dynamic analysis.

Year-End Investment Review Template for Financial Consultants

A Year-End Investment Review Template for financial consultants typically includes a comprehensive summary of the client's portfolio performance, asset allocation, and risk assessment throughout the year. It also features a detailed analysis of market trends and the impact on individual investments.

Important components include a clear presentation of gains and losses, tax implications, and recommendations for portfolio adjustments in the upcoming year. Ensuring the review is client-focused and data-driven enhances trust and supports strategic financial planning.

Annual Investment Contributions Tracker with Projections

An Annual Investment Contributions Tracker with projections is a document that systematically records yearly investment amounts and forecasts future contributions based on past trends. It typically contains detailed sections for tracking various account types, contribution dates, and estimated growth projections to assist in financial planning. Including clear charts, summary tables, and personalized investment goals enhances usability and ensures effective portfolio monitoring and adjustments over time.

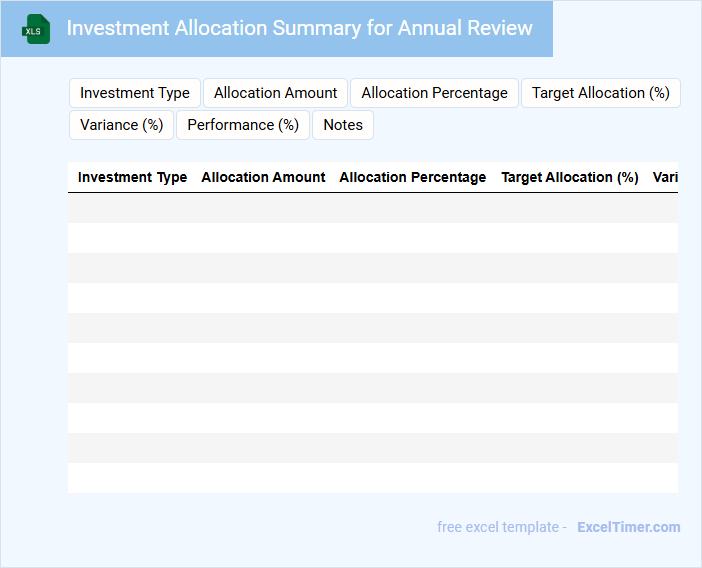

Investment Allocation Summary for Annual Review

What information does an Investment Allocation Summary for Annual Review typically contain? This document usually outlines the distribution of investments across various asset classes and sectors to provide a clear overview of the portfolio's diversification. It helps investors assess performance, rebalance holdings, and align their investments with financial goals.

Tax Planning Worksheet for End-of-Year Investments

A Tax Planning Worksheet for End-of-Year Investments helps individuals and businesses organize their financial information to optimize tax savings. This document typically contains details about income sources, deductible expenses, and potential investment opportunities. Using this worksheet ensures strategic decisions are made to minimize tax liabilities before the year's end.

Annual ROI Tracker with Multi-Portfolio Support

An Annual ROI Tracker with Multi-Portfolio Support documents the yearly return on investment across various portfolios to provide a comprehensive financial overview. It typically includes detailed performance metrics, asset allocations, and comparative analyses to facilitate informed decision-making. Such documents are crucial for investors and portfolio managers aiming to evaluate profitability and adjust strategies effectively.

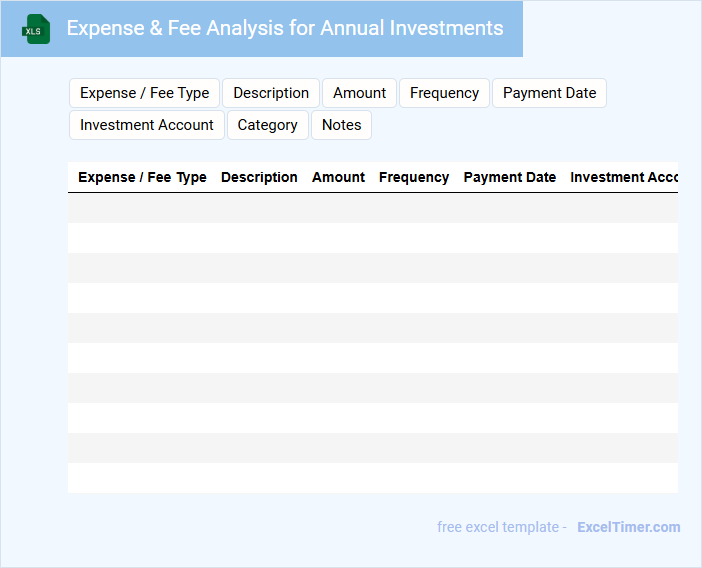

Expense & Fee Analysis for Annual Investments

An Expense & Fee Analysis for annual investments typically contains a detailed breakdown of all costs associated with managing investment portfolios over the year. It includes management fees, transaction fees, and any other incidental expenses that impact net returns. Understanding these fees is crucial for investors to assess the true cost of their investments and improve portfolio efficiency.

Important considerations include identifying hidden fees, comparing fee structures against industry benchmarks, and evaluating the impact of fees on overall investment performance. This analysis helps in making informed decisions to minimize costs and maximize returns. Regular reviews ensure transparency and alignment with financial goals.

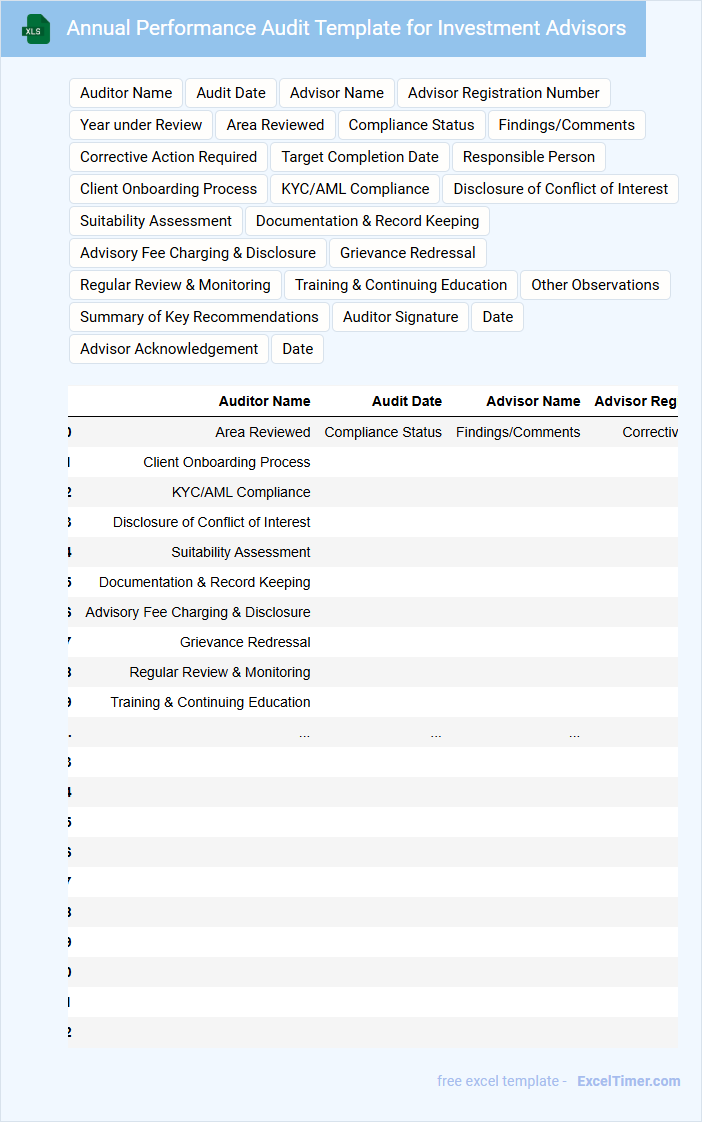

Annual Performance Audit Template for Investment Advisors

What key elements does an Annual Performance Audit Template for Investment Advisors typically contain? This document usually includes sections for evaluating compliance with regulatory standards, performance metrics, and client satisfaction indices. It helps ensure transparency and accountability while identifying areas for improvement in advisory practices.

What important aspects should be included in such a template to maximize its effectiveness? The template should incorporate clear performance benchmarks, comprehensive risk assessment criteria, and thorough documentation of advisory activities. Additionally, incorporating feedback mechanisms and action plans for addressing identified issues is essential for ongoing improvement.

What key data points should be captured in an Annually Investment Tracker for clients' portfolios?

An Annually Investment Tracker for Financial Advisors should capture key data points such as initial investment amount, annual contributions, portfolio value at year-end, asset allocation percentages, and annual returns. It should also record dividend income, realized and unrealized gains or losses, fees incurred, and benchmark comparisons. Including client risk profile and target goals assists in personalized portfolio performance evaluation and strategic planning.

How can conditional formatting be used to highlight underperforming investments annually?

Conditional formatting in your Annual Investment Tracker can automatically highlight underperforming investments based on predefined criteria such as yearly return thresholds or negative growth rates. By applying color scales or icons to cells that fall below your performance benchmarks, you can quickly identify and focus on investments needing attention. This visual aid enhances decision-making efficiency for financial advisors tracking investment performance annually.

Which Excel formulas are most effective for calculating year-over-year returns and portfolio growth?

Effective Excel formulas for tracking year-over-year returns in an Annually Investment Tracker include the RATE function to calculate the annual growth rate from cash flows. The XIRR formula handles irregular investment dates for precise internal rate of return computation. Portfolio growth can be accurately measured using the Compound Annual Growth Rate (CAGR) formula: ((Ending Value/Beginning Value)^(1/Number of Years)) - 1.

What security measures should be applied to protect sensitive client investment data in Excel?

Protect sensitive client investment data in Excel by enabling password protection and using strong encryption methods such as AES-256. Restrict access with user-level permissions and apply worksheet-level protection to prevent unauthorized editing. Regularly back up files and use trusted antivirus software to guard against data breaches and malware attacks.

How can Excel tables and PivotTables be leveraged for comprehensive annual investment summaries?

Excel tables organize your annual investment data efficiently, enabling easy sorting and filtering of transactions. PivotTables summarize large datasets to reveal trends, asset allocations, and performance metrics quickly. You can create dynamic reports that update automatically as new data is added, streamlining your annual investment tracking process.