The Annually Income & Expense Excel Template for Freelancers provides a streamlined way to track yearly earnings and expenditures, helping freelancers maintain accurate financial records. This template features customizable categories and automated calculations for net income, ensuring efficient budgeting and tax preparation. Easy to use and update regularly, it is essential for freelancers aiming to optimize financial management and monitor cash flow effectively.

Annual Income & Expense Tracker for Freelancers

The Annual Income & Expense Tracker for freelancers is a document designed to record all earnings and expenditures over the course of a year. It helps in keeping finances organized for accurate tax filing and budget planning.

This tracker usually contains detailed entries of invoices, payments received, and categorized expenses such as supplies, software, and travel costs. Regular updates and thorough documentation are important to maintain financial clarity and ensure compliance.

Yearly Income and Expenses Spreadsheet for Freelancers

Yearly Income and Expenses Spreadsheets for Freelancers typically contain detailed records of all financial transactions throughout the year to help manage and analyze business cash flow.

- Comprehensive Income Tracking: Document every source of revenue including client payments, project fees, and any additional earnings.

- Detailed Expense Categorization: Record all costs such as software subscriptions, office supplies, and travel expenses to identify deductible amounts.

- Periodic Financial Overview: Summarize monthly and yearly totals to monitor profitability and prepare accurate tax reports.

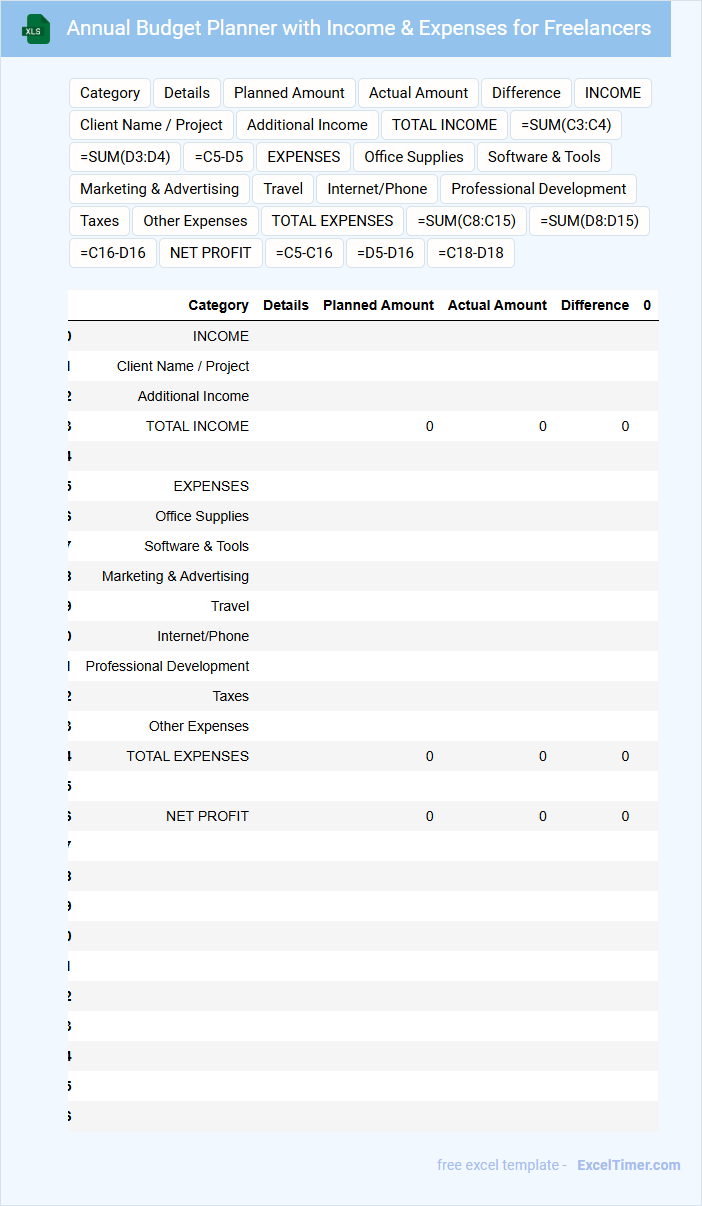

Annual Budget Planner with Income & Expenses for Freelancers

What does an Annual Budget Planner with Income & Expenses for Freelancers typically contain? This document usually includes detailed sections for tracking monthly income sources and categorizing expenses related to freelance work. It helps freelancers organize their finances, monitor cash flow, and plan for tax season efficiently.

What important aspects should be considered when using this planner? Freelancers should ensure all income streams are accurately recorded, including irregular payments, and categorize expenses by type to maximize deductions. Additionally, regularly updating the planner promotes better financial decision-making and long-term budgeting success.

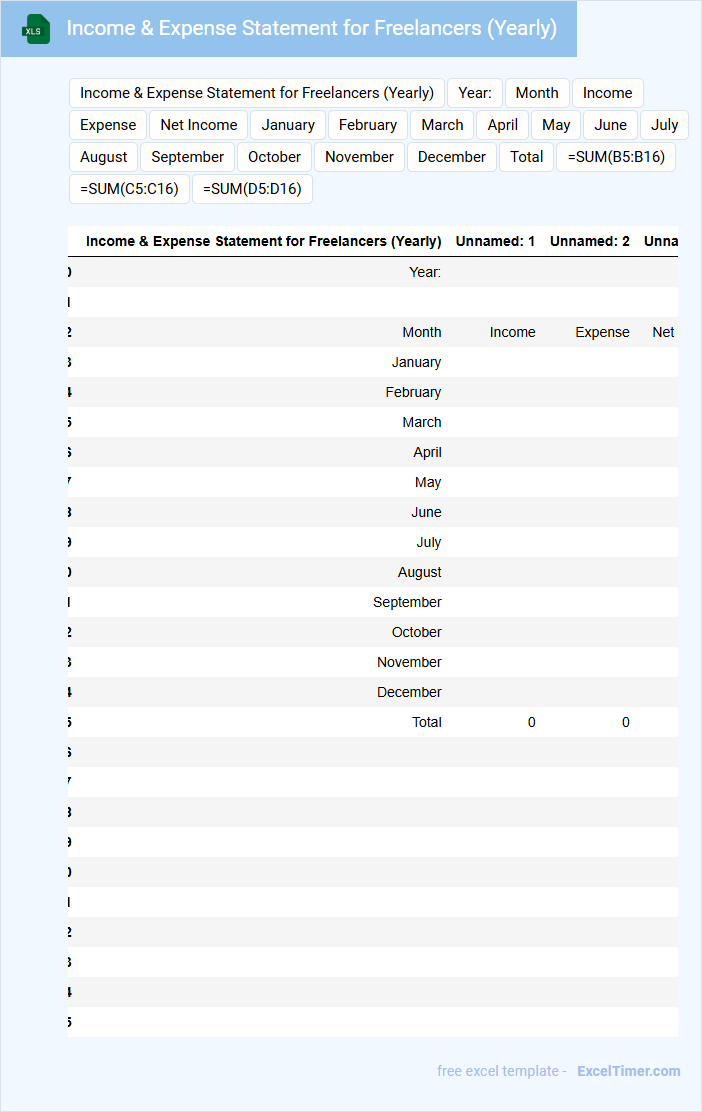

Income & Expense Statement for Freelancers (Yearly)

An Income & Expense Statement for freelancers is a financial document that summarizes all earnings and expenditures over a specified year. It typically includes detailed categories such as project revenue, service fees, operational costs, and deductions. This statement is crucial for understanding net income and preparing accurate tax filings.

To optimize its usefulness, freelancers should ensure all entries are categorized consistently and supported by receipts or invoices. Tracking both fixed and variable expenses separately provides clearer insight into spending patterns. Additionally, including a summary section highlighting total income, total expenses, and net profit helps facilitate quick financial assessments.

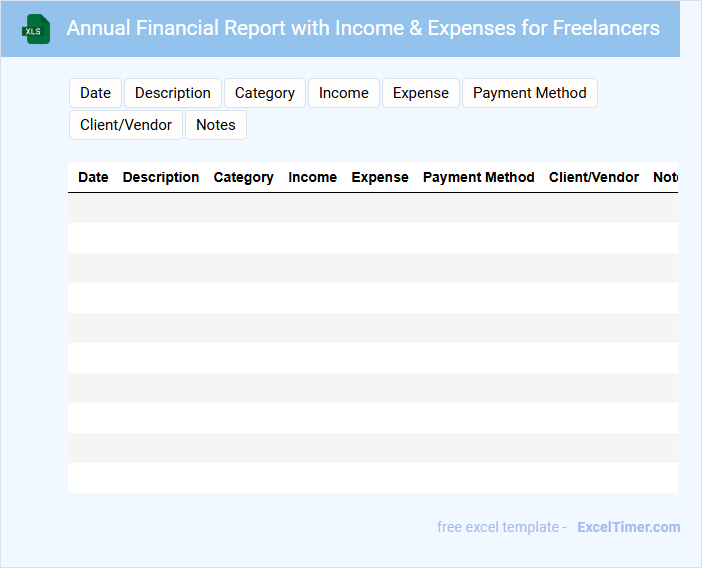

Annual Financial Report with Income & Expenses for Freelancers

An Annual Financial Report for freelancers typically includes a comprehensive summary of income and expenses over the fiscal year. It helps in tracking financial performance and preparing for tax obligations. Key components often consist of detailed income sources, categorized expenses, and profit or loss statements.

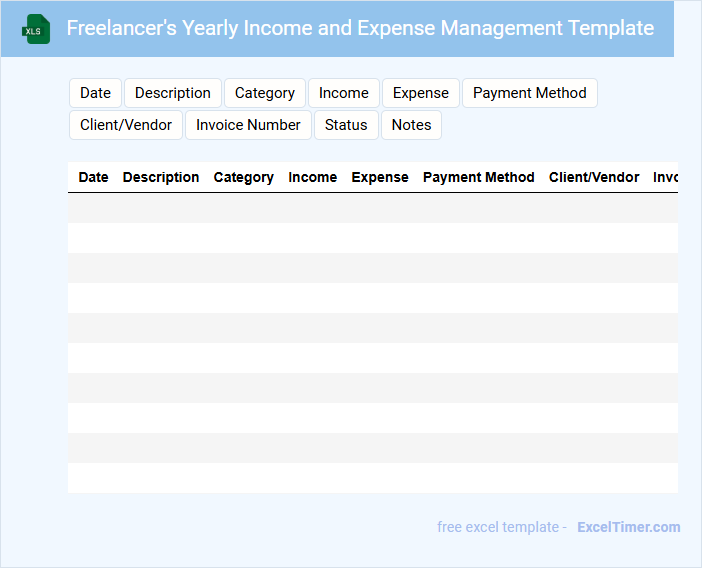

Freelancer's Yearly Income and Expense Management Template

A Freelancer's Yearly Income and Expense Management Template is a structured document designed to help freelancers track their earnings and expenditures throughout the year. It usually contains sections for recording income sources, categorizing expenses, and summarizing profit or loss. Utilizing this template can simplify tax preparation and improve financial planning.

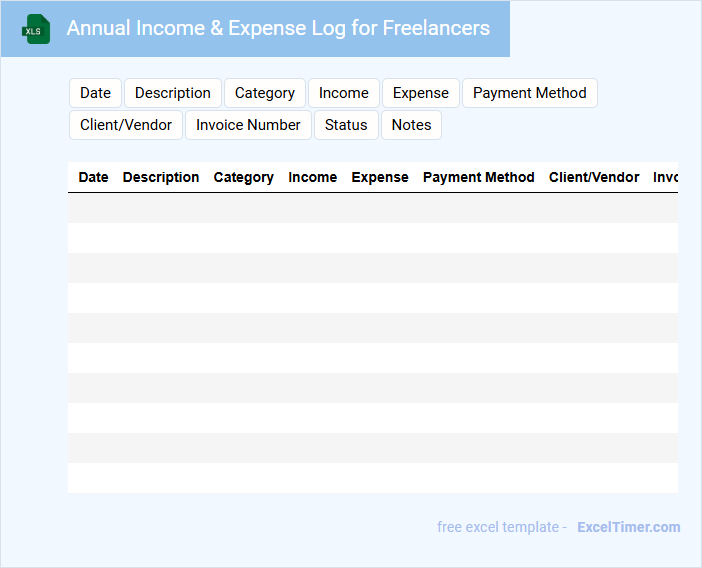

Annual Income & Expense Log for Freelancers

An Annual Income & Expense Log for freelancers is a critical document that records all earnings and expenditures throughout the year. It helps track financial performance, manage budgets, and prepare accurate tax filings. Maintaining detailed entries ensures transparency and simplifies financial decision-making.

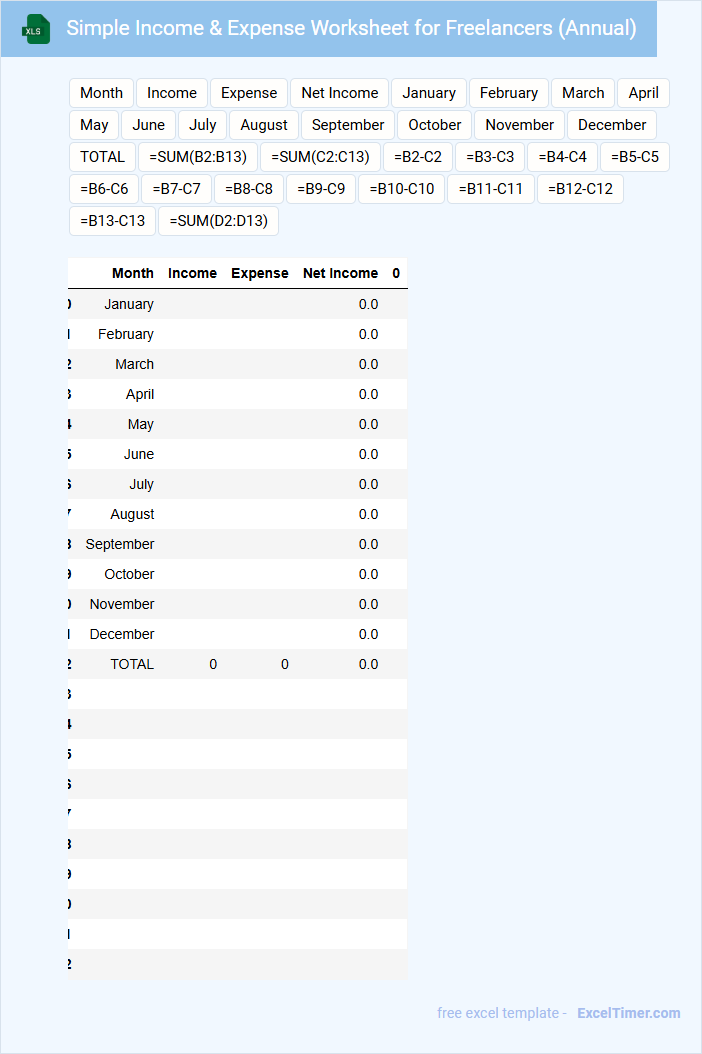

Simple Income & Expense Worksheet for Freelancers (Annual)

A Simple Income & Expense Worksheet for freelancers typically contains detailed records of all income sources and business-related expenses throughout the year. It helps freelancers track their financial performance and prepare accurate tax documents with ease.

This type of document usually includes categories like client payments, office supplies, software subscriptions, and travel expenses. Keeping organized and complete records is important to maximize deductions and streamline tax filing.

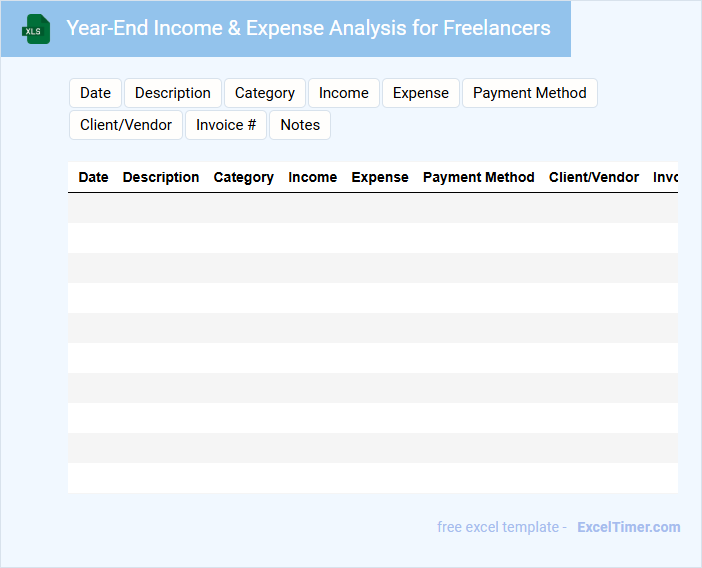

Year-End Income & Expense Analysis for Freelancers

The Year-End Income & Expense Analysis document for freelancers is a comprehensive summary of all earnings and expenditures throughout the fiscal year. It typically contains detailed records of income sources, categorized expenses, and tax-related deductions. This analysis helps freelancers assess their financial performance and prepare for tax filing effectively.

Annual Profit and Loss Statement for Freelancers

The Annual Profit and Loss Statement for freelancers is a crucial financial document summarizing income and expenses over a year. It helps freelancers assess their profitability and manage taxes effectively. Including accurate revenue streams, deductible expenses, and net profit is essential for a clear financial overview.

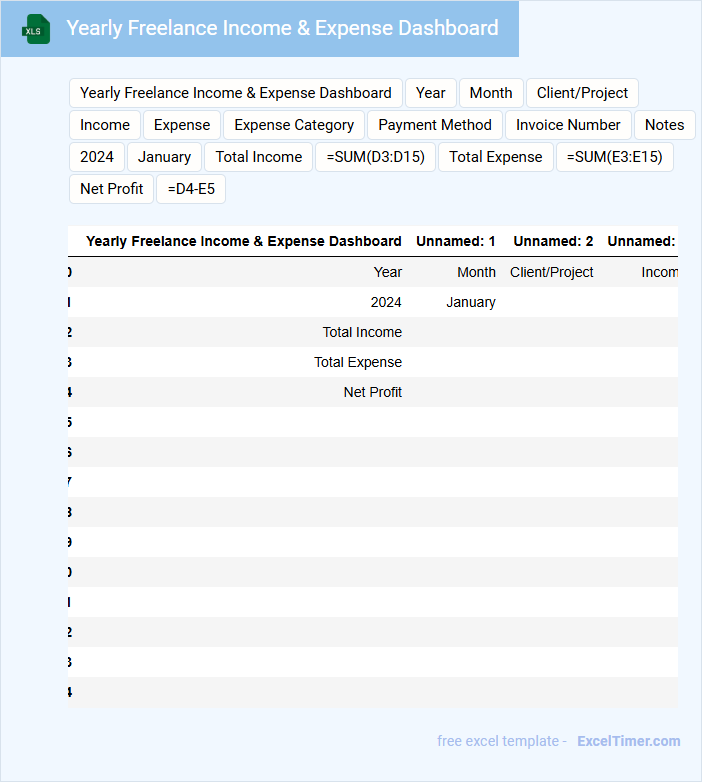

Yearly Freelance Income & Expense Dashboard

A Yearly Freelance Income & Expense Dashboard typically contains detailed records of earnings and expenditures throughout the year. It visually represents financial trends to help freelancers monitor their cash flow effectively.

This document is essential for precise tax preparation and budgeting, providing a clear overview of deductible expenses and net income. It aids in making informed decisions for future projects and financial planning.

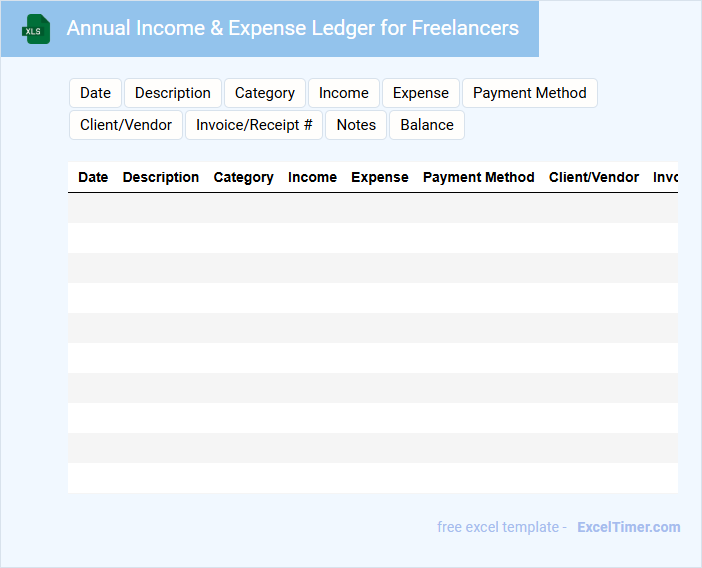

Annual Income & Expense Ledger for Freelancers

An Annual Income & Expense Ledger for Freelancers is a detailed record of all earnings and expenditures throughout the year, enabling accurate financial tracking and tax preparation.

- Comprehensive Income Tracking: Document all sources of freelance income including client payments and royalties.

- Detailed Expense Recording: Log all business-related expenses such as software subscriptions, office supplies, and travel costs.

- Regular Updates: Maintain the ledger consistently to ensure accuracy and streamline end-of-year tax filing.

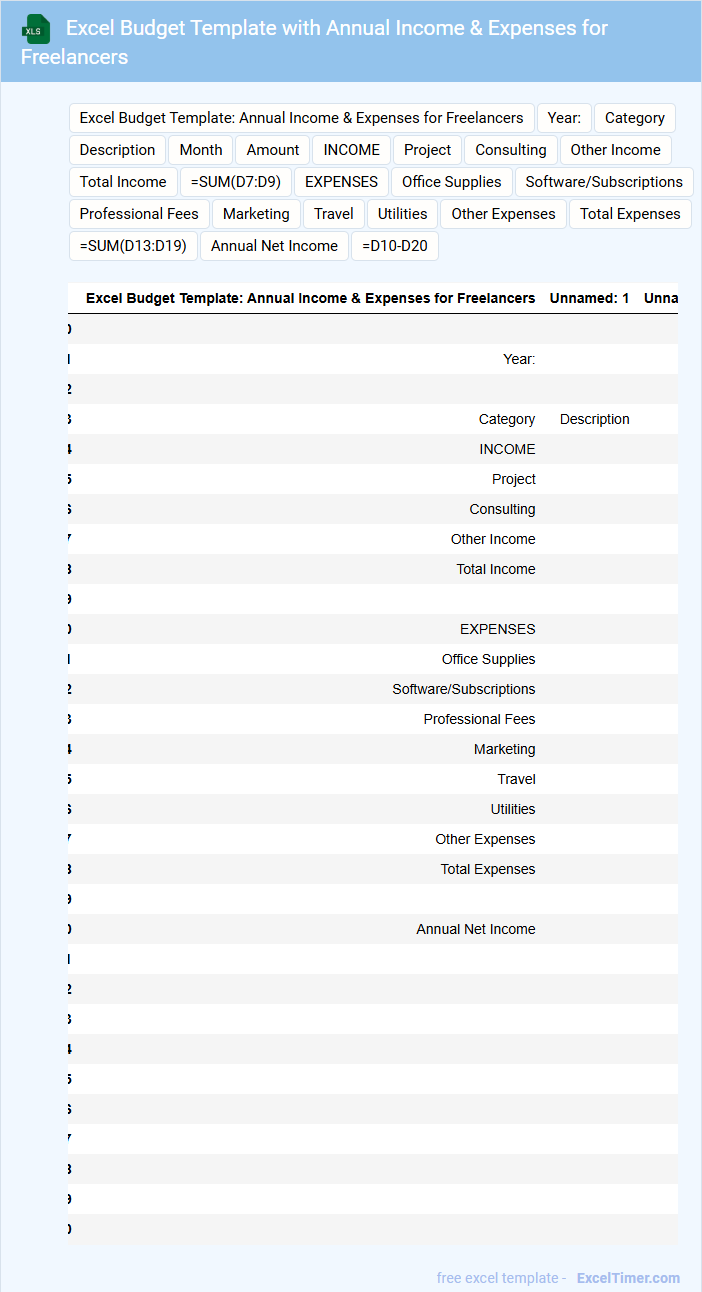

Excel Budget Template with Annual Income & Expenses for Freelancers

An Excel Budget Template with Annual Income & Expenses for Freelancers typically contains detailed categories for tracking monthly and yearly cash flow, including income sources and various expenses. It helps freelancers organize their finances by providing a clear overview of net profit and financial trends over time.

To maximize its effectiveness, it is important to regularly update the template with accurate data and review it to adjust budget categories as needed. This ensures better financial planning and improved management of freelance income and expenditure.

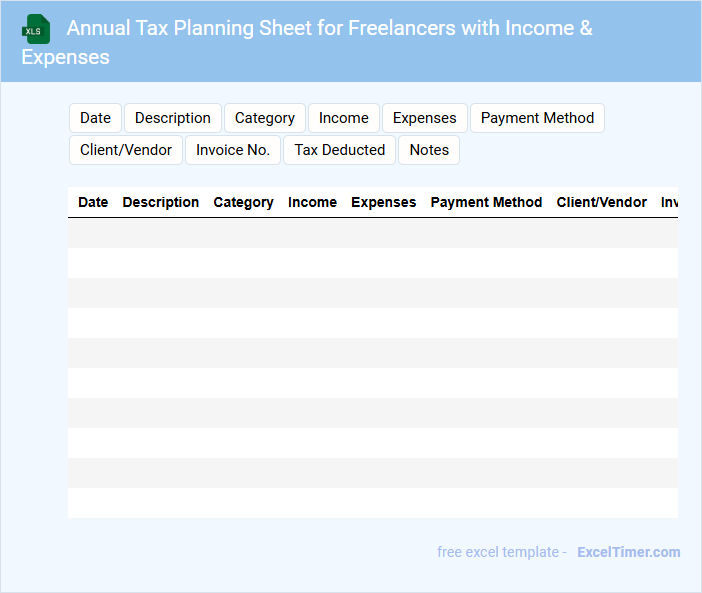

Annual Tax Planning Sheet for Freelancers with Income & Expenses

What information is typically included in an Annual Tax Planning Sheet for Freelancers with Income & Expenses? This document usually contains detailed records of all freelance income and categorized expenses throughout the year to help track financial performance. It also includes projections and tax estimates to assist freelancers in optimizing their tax payments and ensuring compliance.

What important elements should be highlighted in such a planning sheet? It is crucial to accurately record all sources of income and classify deductible expenses clearly, such as equipment costs, travel, and home office expenses. Additionally, including a section for tax deadlines and estimated payments can help freelancers stay organized and avoid penalties.

Comprehensive Income & Expense Summary for Freelancers (Annually)

A Comprehensive Income & Expense Summary for freelancers is a detailed document that outlines all earnings and expenditures related to freelance work over a year. It typically includes sources of income, categorized expenses, and net profit or loss to provide a clear financial overview. Maintaining this summary helps freelancers monitor their financial health and prepare accurate tax returns.

What formulas can you use in Excel to automatically calculate total annual income and expenses for freelancers?

You can use the SUM formula in Excel to automatically calculate your total annual income and expenses by summing monthly values across the year. Applying SUMIF helps categorize income and expenses based on specific criteria such as project type or client. Utilizing these formulas streamlines financial tracking, making it easier to manage your freelance earnings and expenditures efficiently.

How can you structure an Excel sheet to categorize and track different sources of freelance income and expenses?

Create separate sheets for Income and Expenses, each using columns like Date, Category, Description, and Amount to organize entries clearly. Use category lists such as Client Payments, Project Fees, Software Costs, and Office Supplies for precise tracking. Implement Excel formulas like SUMIFS and PivotTables to analyze total earnings and expenditures by category and month efficiently.

Which Excel charts or graphs are best for visualizing annual income versus expenses data?

Column charts effectively compare annual income and expenses side-by-side, highlighting trends over time. Stacked bar charts showcase the proportion of different expense categories relative to total income. Line charts reveal income and expense fluctuations, facilitating year-over-year performance analysis.

How do you use Excel's filtering or pivot table functions to analyze income and expense patterns across months or clients?

Use Excel's filter function to quickly sort and view specific income or expense entries by month or client, helping you identify trends. Pivot tables summarize your annual data, allowing you to compare total income and expenses across categories efficiently. You can customize pivot table fields to analyze fluctuations and optimize your freelance financial planning.

What are effective ways to set up Excel alerts or conditional formatting to flag overspending or low income months?

Set up conditional formatting in Excel using rules that highlight cells when expenses exceed income or fall below a set threshold. Use formulas such as "=B2>A2" to flag overspending and "=A2