The Annually Tax Calculation Excel Template for Freelancers simplifies tracking income and expenses throughout the year, ensuring accurate tax liability estimation. This template helps freelancers organize financial data efficiently, minimizing errors during tax filing. Key features include customizable fields for deductions, tax rates, and automatic summary reports tailored to individual tax requirements.

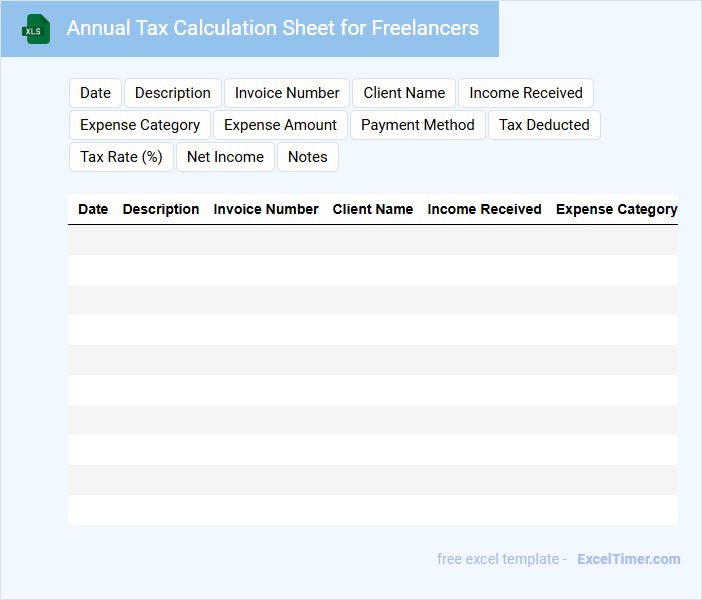

Annual Tax Calculation Sheet for Freelancers

An Annual Tax Calculation Sheet for freelancers typically contains detailed records of income, expenses, and deductions throughout the fiscal year. It serves as a crucial tool to accurately determine the total taxable income and calculate the tax liability owed.

Important elements to include are categorized income sources, deductible business expenses, and records of estimated tax payments. Maintaining organized documentation ensures compliance and simplifies the filing process.

Income & Expense Tracker with Tax Calculation for Freelancers

What does an Income & Expense Tracker with Tax Calculation for Freelancers typically contain, and why is it important?

This type of document usually contains detailed records of all income sources and expenses incurred by freelancers, along with tax calculation fields to estimate liability accurately. It helps freelancers manage their finances effectively, ensuring accurate tax reporting and maximizing deductions. Keeping track of these details is essential for maintaining financial health and compliance with tax regulations.

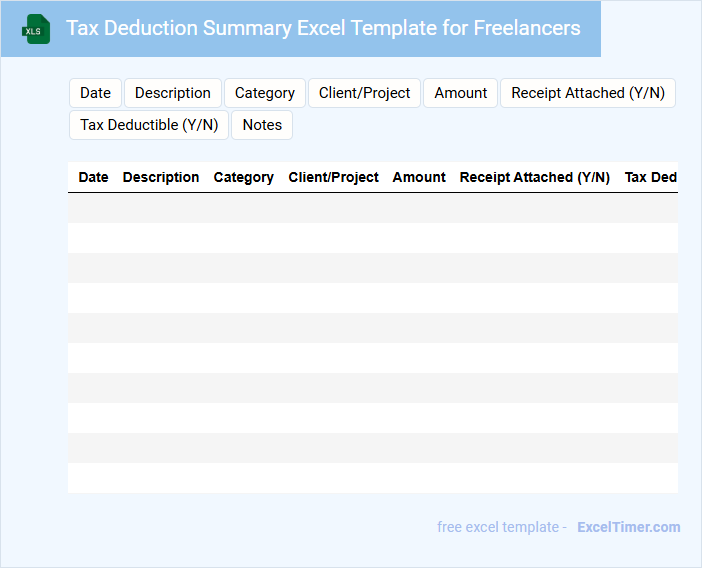

Tax Deduction Summary Excel Template for Freelancers

This Tax Deduction Summary Excel Template for Freelancers helps track and organize deductible expenses throughout the fiscal year. It simplifies tax filing by summarizing key deductions in one easily accessible document.

- Include categories for different types of expenses such as office supplies, travel, and professional services.

- Ensure the template allows for monthly or quarterly data entry to maintain up-to-date records.

- Incorporate formulas to automatically calculate total deductions and taxable income.

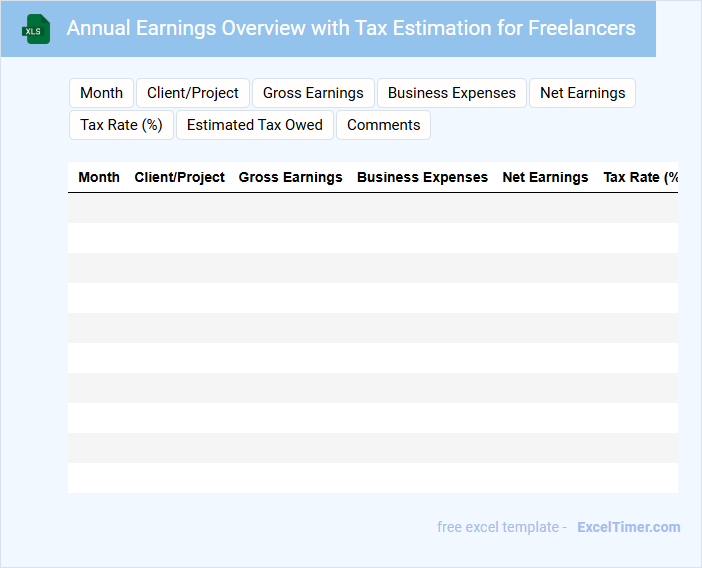

Annual Earnings Overview with Tax Estimation for Freelancers

This document provides an annual earnings overview for freelancers, summarizing total income received throughout the year. It typically includes detailed breakdowns of earnings from various projects or clients to maintain clear financial records. Additionally, it offers a preliminary tax estimation to help freelancers prepare for their tax obligations efficiently.

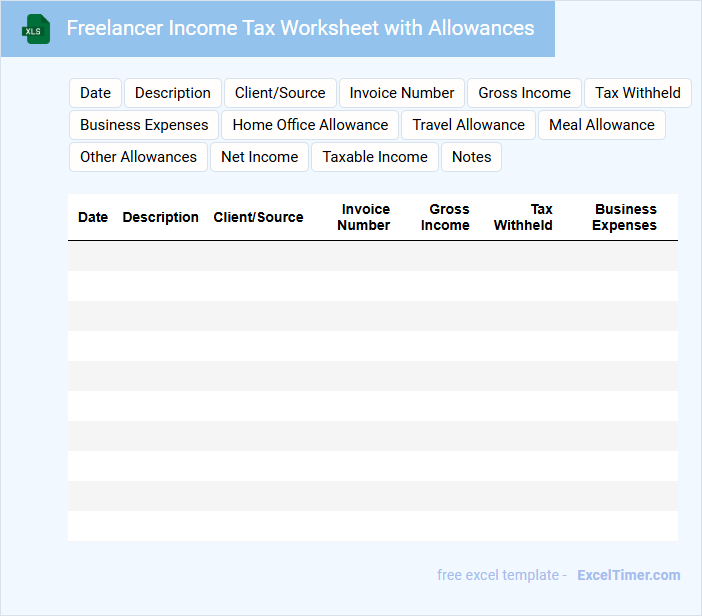

Freelancer Income Tax Worksheet with Allowances

What information is typically included in a Freelancer Income Tax Worksheet with Allowances? This document usually contains detailed records of income earned from freelance work, alongside applicable allowances and deductions that reduce taxable income. It helps in accurately calculating the freelancer's tax liability by organizing earnings, expenses, and allowances in one place.

What are important considerations when filling out a Freelancer Income Tax Worksheet with Allowances? It is essential to track all sources of income and keep receipts for deductible expenses to maximize allowable deductions. Additionally, freelancers should clearly specify any applicable personal or business allowances to ensure compliance with tax regulations and avoid underpayment or penalties.

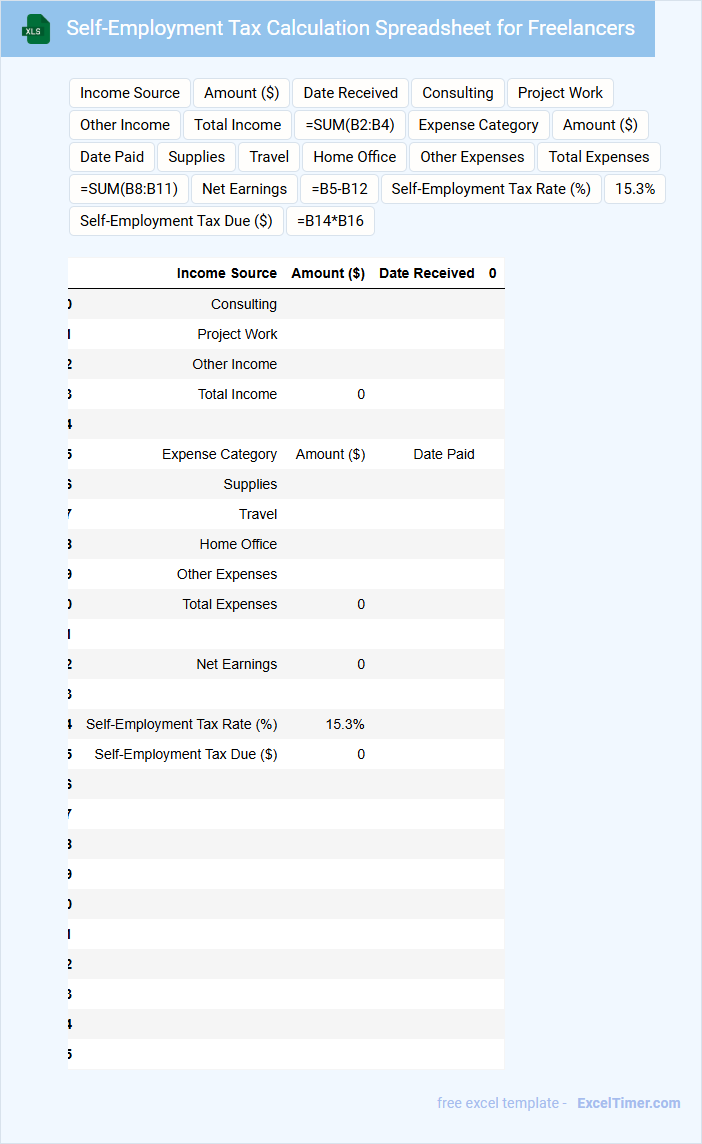

Self-Employment Tax Calculation Spreadsheet for Freelancers

A Self-Employment Tax Calculation Spreadsheet for freelancers typically contains detailed entries of income, allowable expenses, and tax rates to accurately compute the amount owed to tax authorities. This document often includes sections for quarterly tax estimates and deductions to ensure compliance with tax laws. It is essential for freelancers to regularly update the spreadsheet to avoid underpayment penalties and effectively manage their tax liabilities.

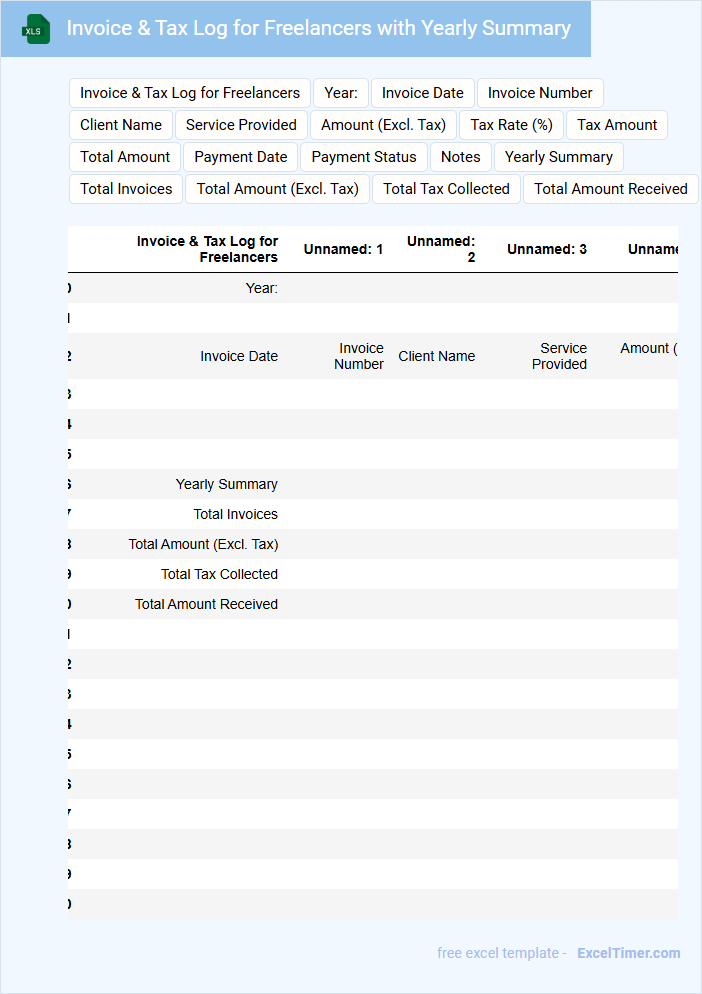

Invoice & Tax Log for Freelancers with Yearly Summary

An Invoice & Tax Log for Freelancers typically contains detailed records of payments received, services rendered, and tax deductions throughout the fiscal year. It acts as an organized ledger to track income and expenses systematically for accurate financial reporting.

Including a Yearly Summary allows freelancers to quickly assess total earnings and tax obligations at a glance. Ensuring all entries are complete and accurate is crucial for smooth tax filing and avoiding potential audits.

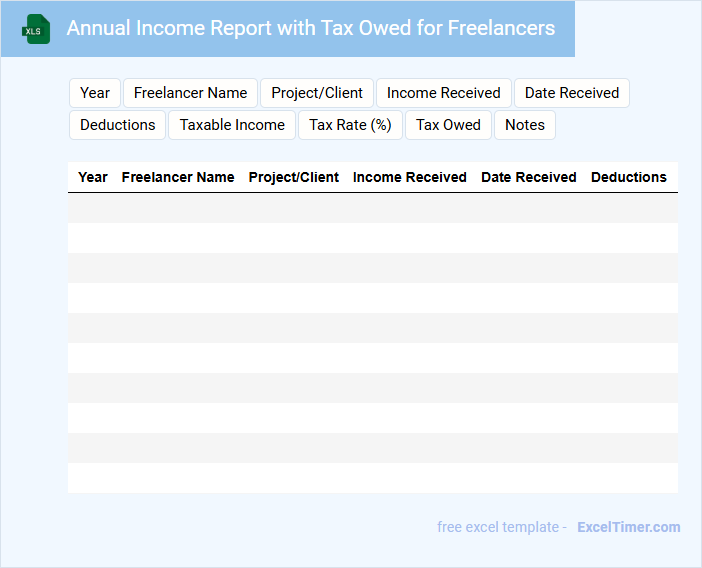

Annual Income Report with Tax Owed for Freelancers

An Annual Income Report with Tax Owed for Freelancers is a financial document summarizing yearly earnings and the corresponding tax liabilities. It serves both as a record for personal finance management and as proof for tax filing purposes.

- Include total income from all freelance projects and sources to ensure accuracy.

- Clearly itemize deductible expenses to reduce taxable income.

- Calculate estimated taxes owed using up-to-date tax rates and codes to avoid penalties.

Tax Payment Tracker for Freelancers with Quarterly Estimates

A Tax Payment Tracker for freelancers is a specialized document designed to monitor and organize tax-related payments throughout the year. It typically contains sections for recording income, estimated tax payments, and due dates to ensure timely compliance. Using quarterly estimates helps freelancers avoid penalties by managing their tax liabilities proactively.

Important aspects to include are clear categorization of income sources, tracking of deductible expenses, and reminders for quarterly tax deadlines. Accuracy and regular updates ensure the tracker remains effective in preventing underpayment. Integrating notes about changes in tax laws relevant to freelancers can also be beneficial.

Year-End Tax Planning Sheet with Expense Tracker for Freelancers

A Year-End Tax Planning Sheet with Expense Tracker for Freelancers is a crucial document that helps freelancers organize their income and deductible expenses throughout the year. It typically contains sections for tracking earnings, categorizing expenses, and calculating estimated taxes owed. Proper use of this sheet can streamline tax filing and optimize tax savings by ensuring all deductible expenses are accounted for.

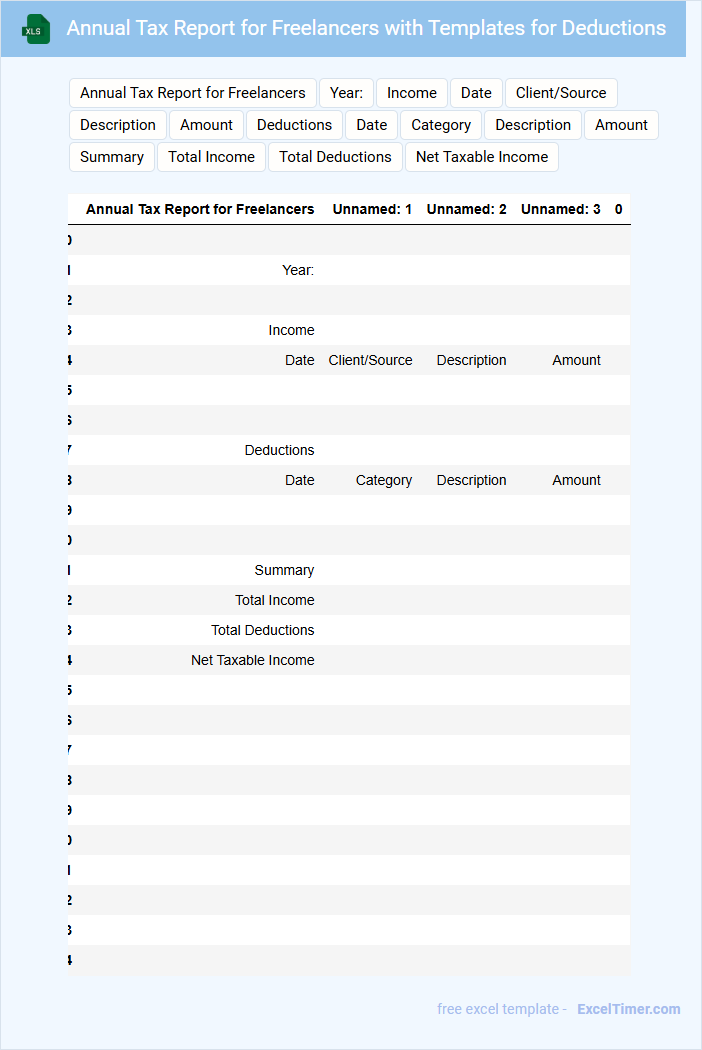

Annual Tax Report for Freelancers with Templates for Deductions

Annual Tax Reports for Freelancers typically detail income, expenses, and tax obligations for the fiscal year. They provide a structured way to ensure accurate and compliant tax filing.

- Include a clear summary of total earnings and categorically list deductible expenses.

- Use templates optimized for common freelancer deductions like home office, travel, and equipment.

- Ensure documentation and receipts are organized and attached to support all claims.

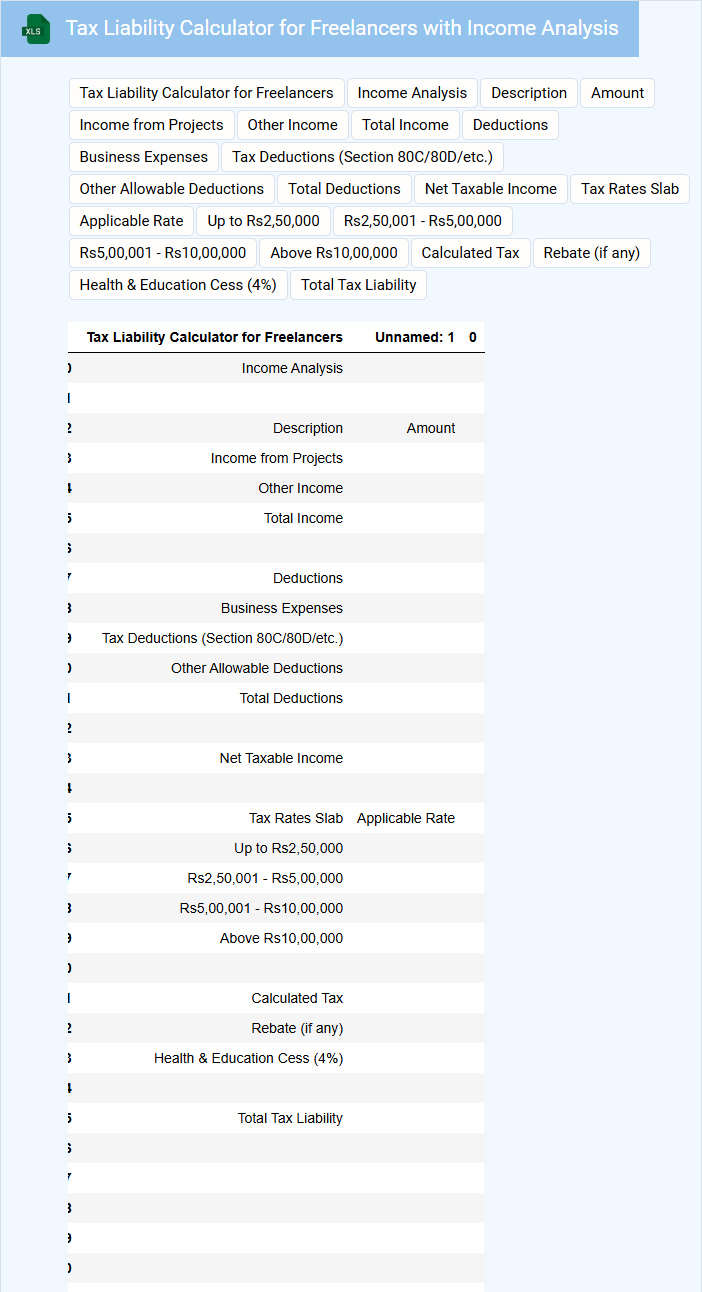

Tax Liability Calculator for Freelancers with Income Analysis

A Tax Liability Calculator for Freelancers with Income Analysis typically contains tools and data to help freelancers estimate their taxes and understand their income sources.

- Income Breakdown: Displays all income streams separately to clarify tax responsibilities.

- Deduction Inputs: Allows entry of deductible expenses to reduce taxable income.

- Tax Estimation: Calculates approximate tax liability based on current laws and freelance income.

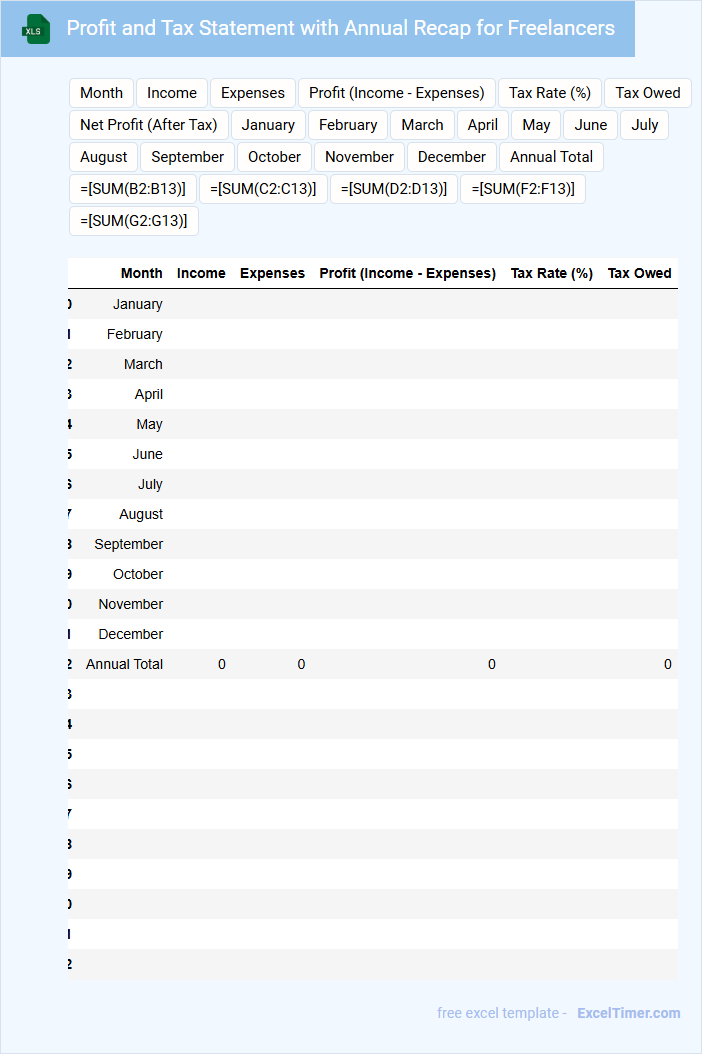

Profit and Tax Statement with Annual Recap for Freelancers

A Profit and Tax Statement with Annual Recap is a financial document that summarizes a freelancer's income and expenses over the fiscal year. It typically includes detailed records of earnings, tax deductions, and net profit to help in accurate tax filing and financial planning. Ensuring all transactions are correctly categorized and receipts are maintained is crucial for compliance and maximizing tax benefits.

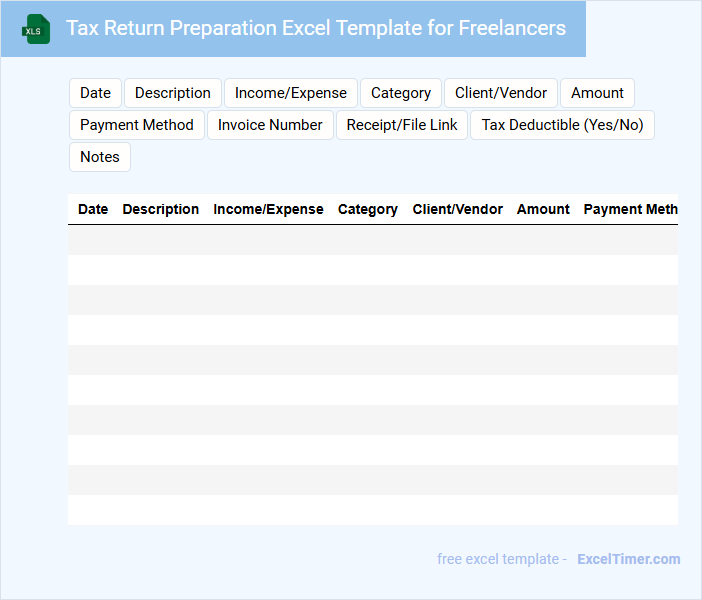

Tax Return Preparation Excel Template for Freelancers

This document typically contains organized financial data and formulas to help freelancers accurately calculate their tax liabilities. It simplifies the complex tax return process by automating calculations and ensuring all necessary details are recorded.

- Include detailed income and expense categories relevant to freelancing activities.

- Incorporate clear instructions and tax deduction tips applicable to freelancers.

- Ensure the template is easy to update with current tax year rates and regulations.

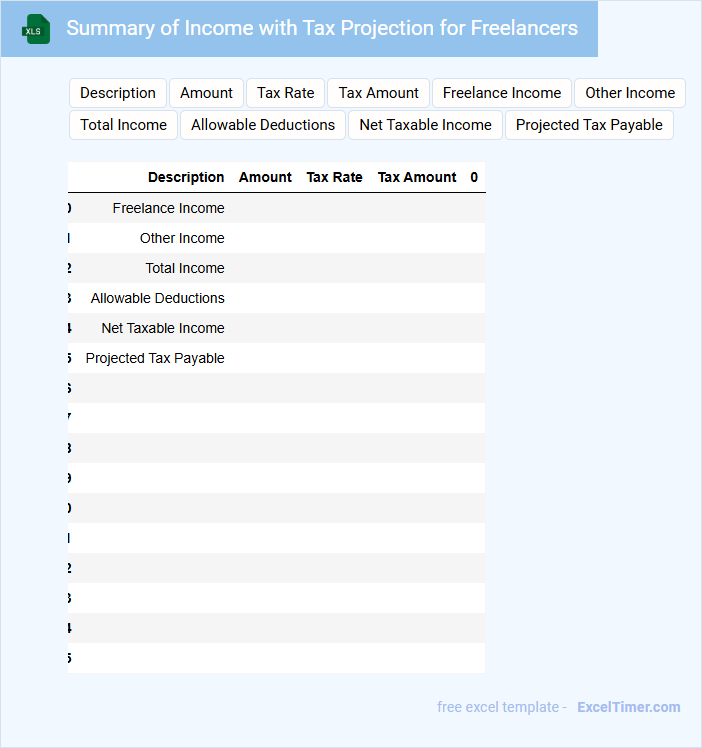

Summary of Income with Tax Projection for Freelancers

A Summary of Income with Tax Projection for Freelancers typically contains an overview of earnings, estimated tax liabilities, and potential deductions to help manage financial planning efficiently.

- Income Breakdown: Detailed listing of all income sources including freelance projects and passive earnings.

- Tax Estimates: Projected tax obligations based on current income and applicable tax rates.

- Expense Tracking: Important deductions and expenses to reduce taxable income.

What are the key columns needed to track income and expenses for annual tax calculations as a freelancer in Excel?

Key columns to track income and expenses for annual tax calculations as a freelancer in Excel include Date, Description, Income Amount, Expense Amount, Category, Payment Method, and Tax Deductible Status. Your spreadsheet should also feature columns for Client/Source, Invoice Number, and Notes to ensure detailed record-keeping. These fields enable accurate calculation of taxable income and optimize tax reporting efficiency.

How do you set up formulas to automatically calculate total taxable income for the year?

To set up formulas for automatically calculating your total taxable income annually in Excel, input each income source in separate cells and use the SUM function to combine them, e.g., =SUM(B2:B12). Include any deductible expenses in adjacent cells and subtract their total from the gross income formula. This method ensures accurate, dynamic tax calculations tailored for freelancers.

What Excel functions can be used to categorize deductible and non-deductible expenses for tax purposes?

Excel functions such as IF, SUMIF, and VLOOKUP can effectively categorize deductible and non-deductible expenses in an annual tax calculation for freelancers. IF functions enable logical tests to separate expenses based on predefined criteria, while SUMIF aggregates totals of categorized expenses. VLOOKUP assists in referencing expense types from a separate data table to ensure accurate classification.

How can you create a summary sheet to visualize total tax owed based on annual earnings and deductions?

Create a summary sheet by linking cells from each monthly or quarterly tax calculation to aggregate annual earnings and deductions. Use Excel formulas like SUM to total your income and deductions, then apply the tax rate formula to compute the total tax owed. Visualize these results with charts or tables for clear insights into your tax liabilities as a freelancer.

What methods can be applied in Excel to track and forecast estimated tax payments throughout the year for freelancers?

Excel can utilize formulas such as SUMIFS to aggregate income and deductible expenses, enabling precise quarterly tax calculations for freelancers. Creating dynamic tables with built-in functions like PMT can forecast estimated tax payments based on current earnings and tax rates. Incorporating pivot tables and data validation enhances data organization and accuracy in tracking tax liabilities year-round.