The Annually Insurance Payment Excel Template for Property Managers streamlines tracking and organizing yearly insurance expenses for multiple properties. This template helps ensure accurate budgeting, timely payments, and easy access to insurance details for better financial management. Customizable fields allow property managers to tailor the template to specific insurance policies and payment schedules.

Annual Insurance Payment Tracker for Property Managers

What information does an Annual Insurance Payment Tracker for Property Managers typically contain?

This document usually includes details such as payment dates, insurance provider names, premium amounts, and coverage periods. It helps property managers keep an accurate record of all insurance-related expenses and ensures timely payments to avoid coverage lapses.

What important aspects should be considered when using this tracker?

It is essential to regularly update the tracker with the latest payment statuses and verify policy renewals to maintain continuous insurance protection. Additionally, including notes on claim history and contact information for insurance agents can improve management efficiency.

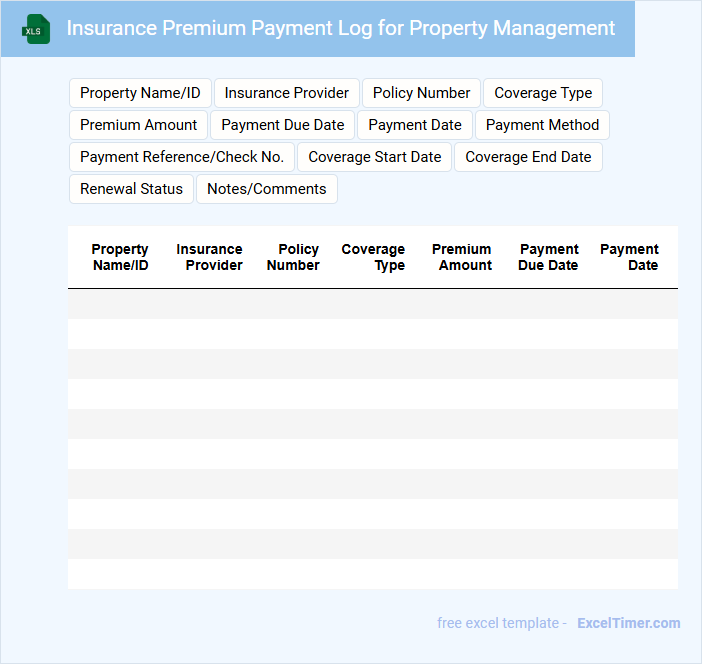

Insurance Premium Payment Log for Property Management

The Insurance Premium Payment Log is a crucial document in property management, detailing all insurance-related transactions to ensure financial accuracy and compliance. It typically contains payment dates, amounts, insurance providers, and policy details. Maintaining this log helps property managers avoid missed payments and supports audit processes.

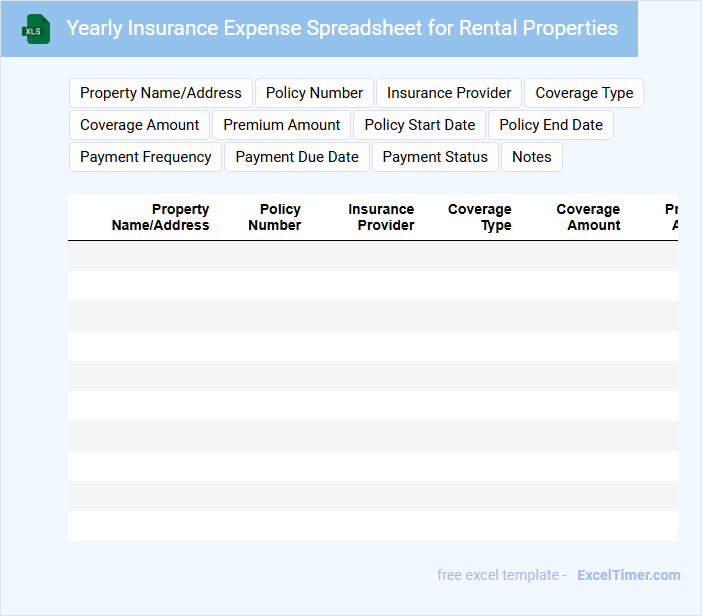

Yearly Insurance Expense Spreadsheet for Rental Properties

What information is typically included in a Yearly Insurance Expense Spreadsheet for Rental Properties? This type of document usually contains detailed records of all insurance-related expenses incurred on rental properties throughout the year, including policy types, coverage amounts, payment dates, and premium costs. Maintaining this spreadsheet helps landlords track insurance expenses accurately, ensure timely payments, and optimize budgeting for property management.

What are important considerations when creating a Yearly Insurance Expense Spreadsheet for Rental Properties? It's crucial to include clear categories for different insurance policies such as property, liability, and flood insurance, along with renewal dates and payment methods. Additionally, integrating notes for claim history or changes in coverage can provide valuable insights for future insurance planning and financial decision-making.

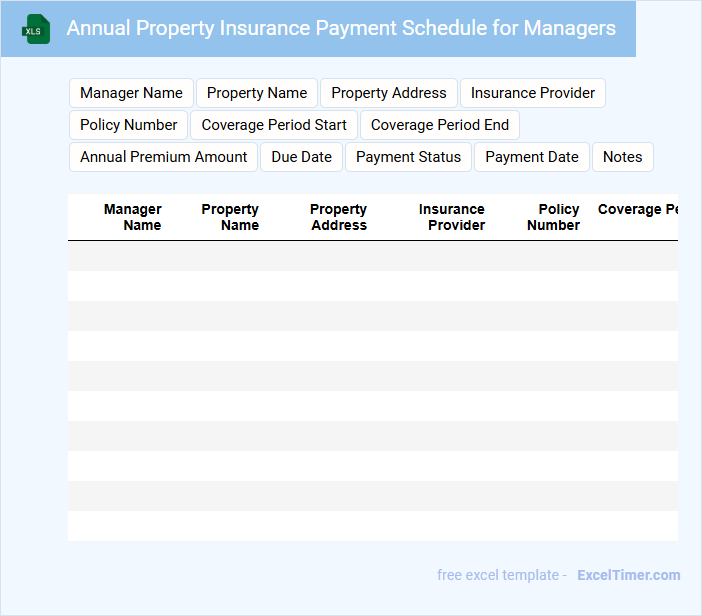

Annual Property Insurance Payment Schedule for Managers

What information is typically included in an Annual Property Insurance Payment Schedule for Managers? This document usually contains a detailed timeline of insurance premium due dates along with payment amounts and policy coverage periods. It helps managers ensure timely payments and maintain continuous insurance protection on the property.

Why is it important for managers to use this schedule effectively? Utilizing the schedule allows managers to plan budgets accurately and avoid penalties from late payments, ensuring smooth property operations. It also serves as a reference for verifying insurance coverage and coordinating with insurance providers.

Insurance Policy Payment Register for Property Managers

An Insurance Policy Payment Register for Property Managers typically contains detailed records of all insurance premium payments made, including dates, amounts, and policy details. It serves as a financial tracking tool to ensure all properties are adequately insured and payments are up to date.

Maintaining an accurate register helps in managing compliance and avoiding lapses in coverage. It is important to regularly update the register and reconcile it with insurance statements for accuracy and accountability.

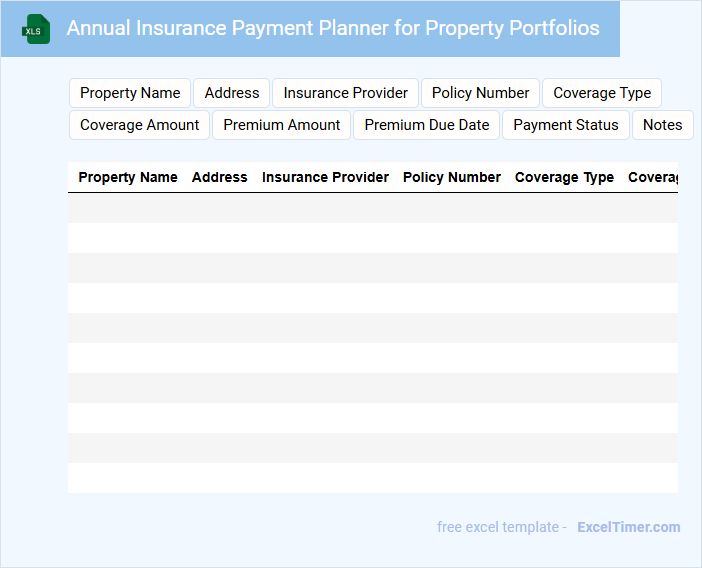

Annual Insurance Payment Planner for Property Portfolios

An Annual Insurance Payment Planner for Property Portfolios is a document that outlines scheduled insurance payments and coverage details for multiple properties over a fiscal year. It typically contains payment dates, premium amounts, and policy terms to ensure timely payments and comprehensive coverage. Including reminders and contact information for insurers is crucial to efficiently manage insurance obligations and avoid lapses.

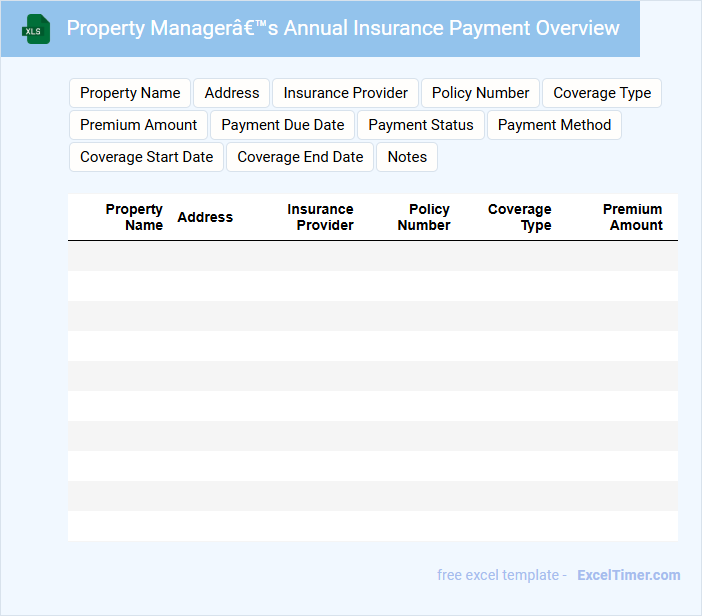

Property Manager’s Annual Insurance Payment Overview

Property Manager's Annual Insurance Payment Overview document typically contains a summary of insurance premiums, coverage details, and payment schedules for property management purposes.

- Insurance premium summary: Outlines the total cost and breakdown of various insurance policies applicable to the property.

- Coverage details: Specifies the types of insurance coverage included, such as liability, property damage, and loss of rental income.

- Payment schedule: Lists important due dates and payment methods for the annual insurance fees.

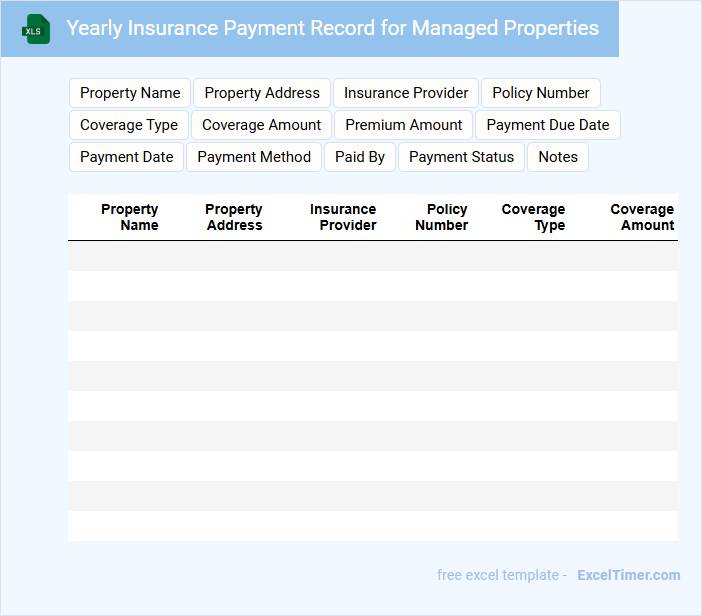

Yearly Insurance Payment Record for Managed Properties

This document typically contains detailed records of yearly insurance payments for managed properties, outlining payment dates, amounts, and coverage details. It serves as a crucial tool for tracking insurance expenses and ensuring compliance with property management policies.

- Include comprehensive payment schedules to avoid missed or late insurance premiums.

- Maintain clear records of policy coverage types and expiration dates for each property.

- Regularly update the document to reflect any changes in insurance providers or policy terms.

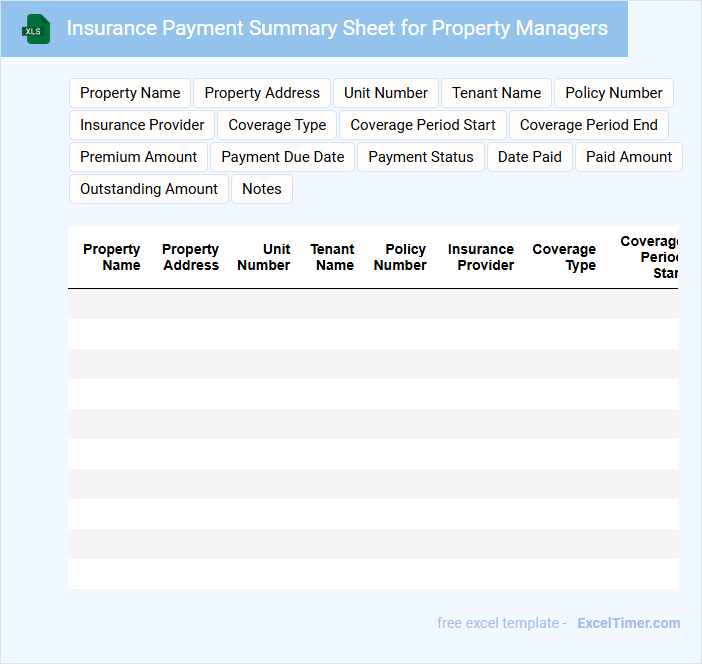

Insurance Payment Summary Sheet for Property Managers

The Insurance Payment Summary Sheet for property managers is a detailed document that outlines all insurance-related payments and claims associated with property management. It usually contains information such as payment dates, amounts, insurance provider details, and claim statuses. This sheet helps property managers track financial transactions related to insurance efficiently, ensuring all payments are accounted for and discrepancies are minimized.

Key elements to include are accurate policy numbers, clear descriptions of insured properties, and detailed breakdowns of premiums, deductibles, and claim payouts. Maintaining an organized record facilitates smooth communication with insurance companies and supports financial auditing. Regular updates and verification of payment details are crucial to avoid missed payments or coverage interruptions.

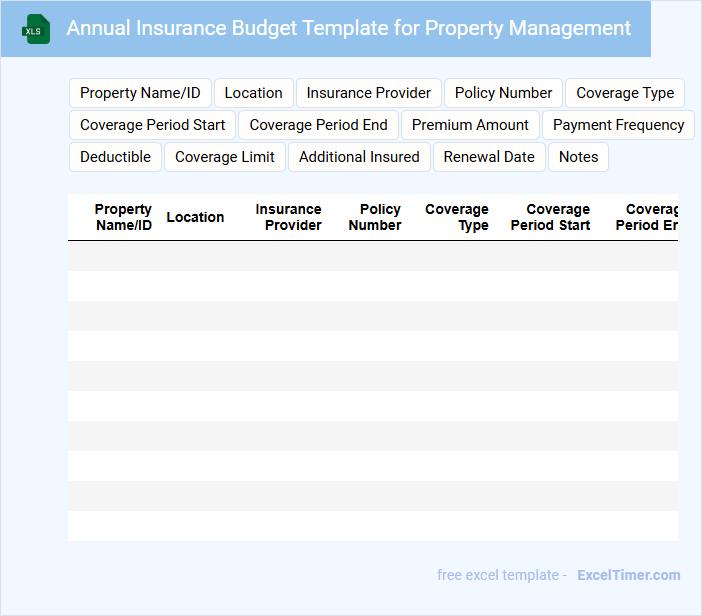

Annual Insurance Budget Template for Property Management

An Annual Insurance Budget Template for Property Management typically contains detailed financial projections related to insurance premiums, claims, and reserves for various properties. It includes categorized expense tracking, policy renewal dates, and coverage limits to ensure comprehensive risk management. This document helps property managers allocate funds efficiently, anticipate potential costs, and maintain compliance with insurance requirements.

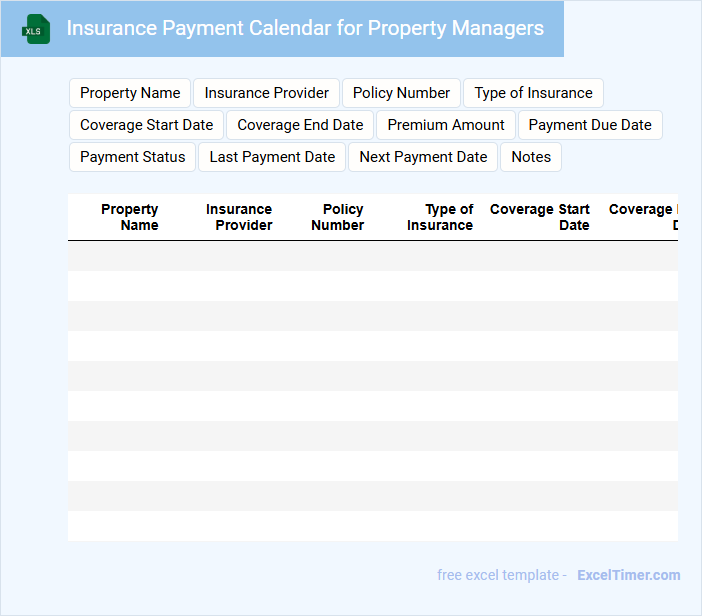

Insurance Payment Calendar for Property Managers

An Insurance Payment Calendar for property managers is a crucial document that outlines all scheduled insurance premium payments related to properties. It helps ensure timely payments and avoids lapses in coverage. Maintaining an accurate calendar reduces financial risks and keeps property insurance compliant.

This calendar typically contains payment due dates, amounts, insurer contact information, and policy details. Property managers should regularly update and review the calendar to accommodate any changes in policy terms or premiums. Prioritizing clear communication with insurers helps prevent missed deadlines.

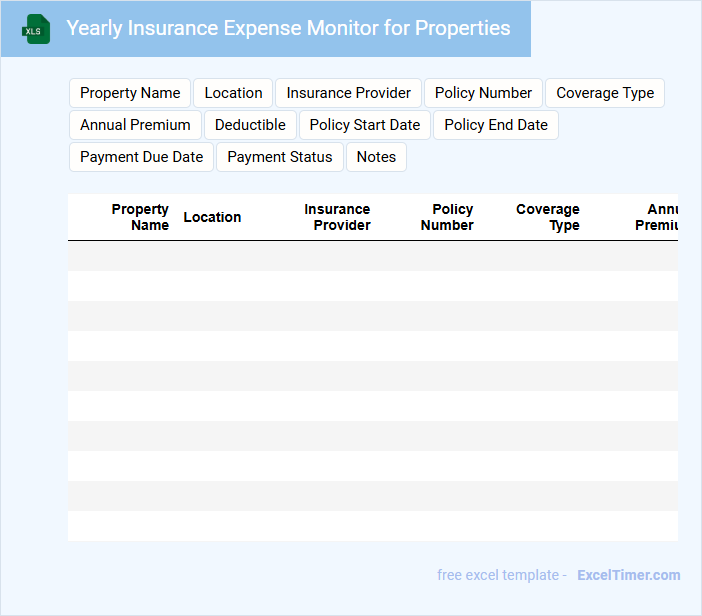

Yearly Insurance Expense Monitor for Properties

The Yearly Insurance Expense Monitor is a document that tracks annual insurance costs related to properties, providing a clear overview of spending trends. It typically contains detailed records of policy premiums, coverage limits, and claim histories for each property. This document is essential for budgeting and ensuring adequate protection against property risks.

An important element to include is a comparative analysis of insurance expenses year-over-year to identify cost changes or potential savings. Additionally, maintaining updated contact information for insurance providers and noting any policy changes is crucial. Finally, incorporating risk assessment summaries helps prioritize insurance needs and optimize coverage.

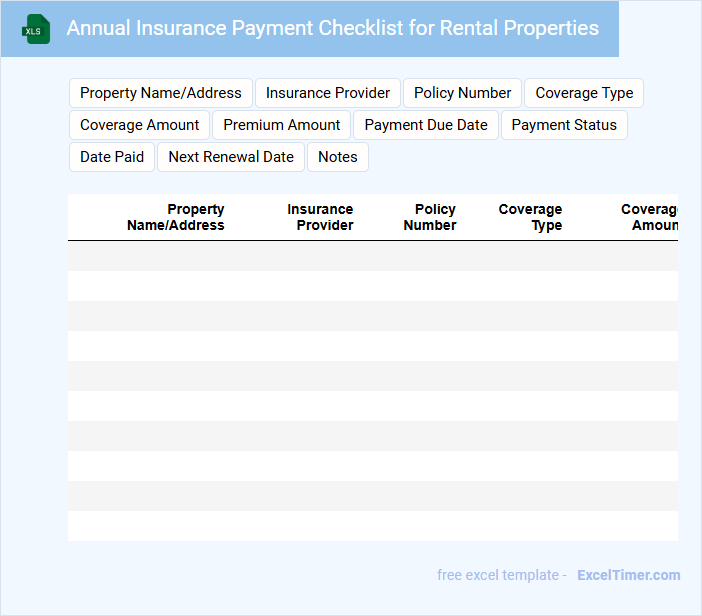

Annual Insurance Payment Checklist for Rental Properties

An Annual Insurance Payment Checklist for rental properties typically includes detailed records of all insurance premiums paid throughout the year. It ensures landlords track costs and verify that all required insurances remain current.

This document also helps in preventing missed payments and supports financial planning for property management. Important elements to include are payment dates, policy numbers, coverage types, and contact information for insurance providers.

Insurance Payment Due Dates Tracker for Property Managers

An Insurance Payment Due Dates Tracker is a crucial document for property managers to monitor and organize insurance premium deadlines efficiently. It typically contains detailed information such as payment amounts, due dates, insurance providers, and policy numbers. This helps ensure timely payments, avoiding lapses in coverage and potential financial risks.

To optimize its effectiveness, include automated reminders, clear categorization by property, and a section for notes on payment status or follow-ups. Maintaining accurate and up-to-date details is essential for managing multiple insurance policies across various properties. Implementing such a tracker improves financial management and reduces the risk of missed payments.

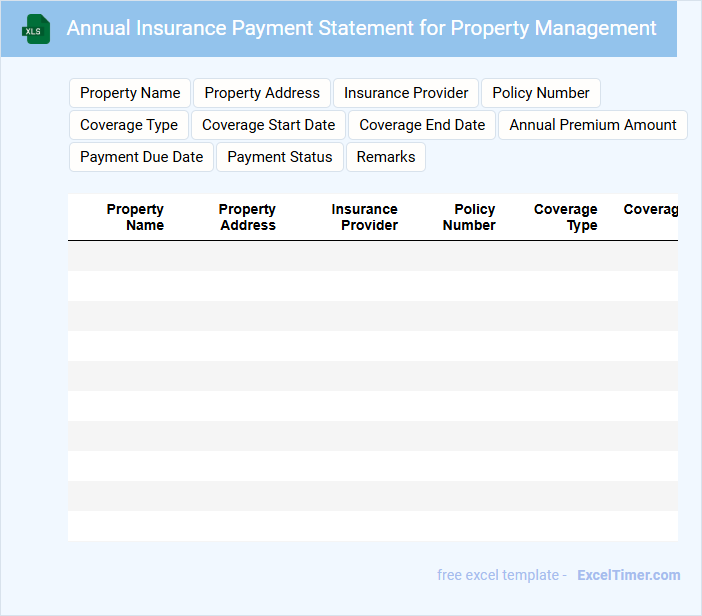

Annual Insurance Payment Statement for Property Management

The Annual Insurance Payment Statement for Property Management typically contains detailed information about the insurance premiums paid over the year, including coverage types and payment dates. It serves as a financial record for property managers to track insurance expenses accurately.

Important details include the policy period, total amount paid, and any changes in coverage or premiums from previous years. This document ensures transparency and supports budgeting and compliance efforts in property management.

What columns are essential to include when tracking annual insurance payments for managed properties in Excel?

Essential columns for tracking annual insurance payments in Excel include Property Name, Manager Name, Insurance Provider, Policy Number, Coverage Type, Annual Premium, Payment Due Date, Payment Status, and Notes. Your spreadsheet should also feature columns for Contact Information and Policy Expiration Date to ensure timely renewals and communication. Including these columns helps you maintain accurate records and manage payments efficiently.

How can conditional formatting highlight overdue or upcoming annual insurance payments?

Conditional formatting in Excel can highlight overdue or upcoming annual insurance payments by applying color codes based on due dates relative to today's date. You can set rules to turn cells red if payments are past due or yellow if they are within a specified upcoming period. This visual alert system helps property managers quickly identify and prioritize insurance payments for timely action.

What Excel formula efficiently calculates total annual insurance costs across all properties for a specific year?

To efficiently calculate the total annual insurance costs across all properties for a specific year in Excel, use the SUMIFS formula. For example, =SUMIFS(InsurancePayments, YearColumn, YourYear) sums payments in the InsurancePayments range where the corresponding YearColumn matches YourYear. This formula helps you quickly aggregate annual insurance expenses in your property management records.

How can data validation ensure accurate entry of policy renewal dates and payment amounts in an insurance payment log?

Data validation in Excel enforces correct formats for policy renewal dates by restricting entries to valid date ranges and ensuring payment amounts are positive numbers within defined limits. Drop-down lists and custom formulas prevent input errors, maintaining consistent and reliable insurance payment logs. Accurate data entry supports timely renewals and precise financial tracking for property managers.

What reporting features in Excel best summarize annual insurance payment status and trends for property management review?

Excel's PivotTables and PivotCharts efficiently summarize annual insurance payment status and trends by aggregating data by month, property, or payment type for clear visualization. Conditional formatting highlights overdue or outstanding payments, enabling quick identification of issues. Use slicers to filter data dynamically, allowing you to analyze specific properties or time periods within your annual insurance payment report.