The Annually Tax Preparation Excel Template for Solopreneurs simplifies tax filing by organizing income, expenses, and deductions in one easy-to-use spreadsheet. It helps solopreneurs track financial data throughout the year, ensuring accurate tax calculations and minimizing errors. This template is essential for efficient tax management and maximizing deductions without needing complex accounting software.

Annual Tax Expense Tracker for Solopreneurs

What information is typically included in an Annual Tax Expense Tracker for Solopreneurs? This document usually contains detailed records of all business-related expenses and income throughout the fiscal year, organized to simplify tax filing and financial analysis. It helps solopreneurs monitor deductible expenses, keep track of tax payments, and ensure compliance with tax regulations.

Why is it important to maintain an Annual Tax Expense Tracker? Keeping an organized record prevents mistakes during tax season and can maximize eligible deductions, potentially lowering tax liability. Regular updates and categorization of expenses such as office supplies, travel, and professional services are crucial for accurate reporting and financial planning.

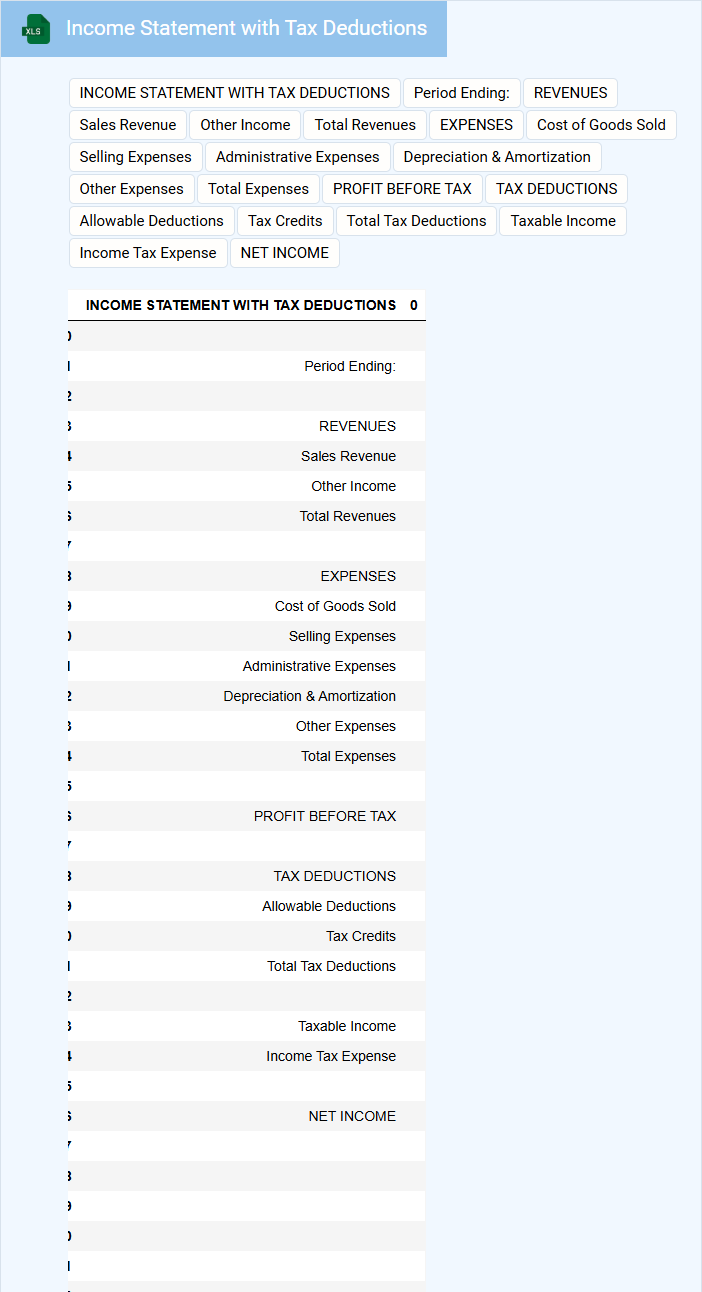

Income Statement with Tax Deductions

An Income Statement with Tax Deductions is a financial report that summarizes revenues, expenses, and tax-related deductions to determine net income for a specific period.

- Revenue Recognition: Ensure all income sources are accurately recorded to reflect true earnings.

- Expense Categorization: Properly classify deductible expenses to optimize tax benefits.

- Tax Compliance: Verify all deductions comply with current tax laws to avoid penalties.

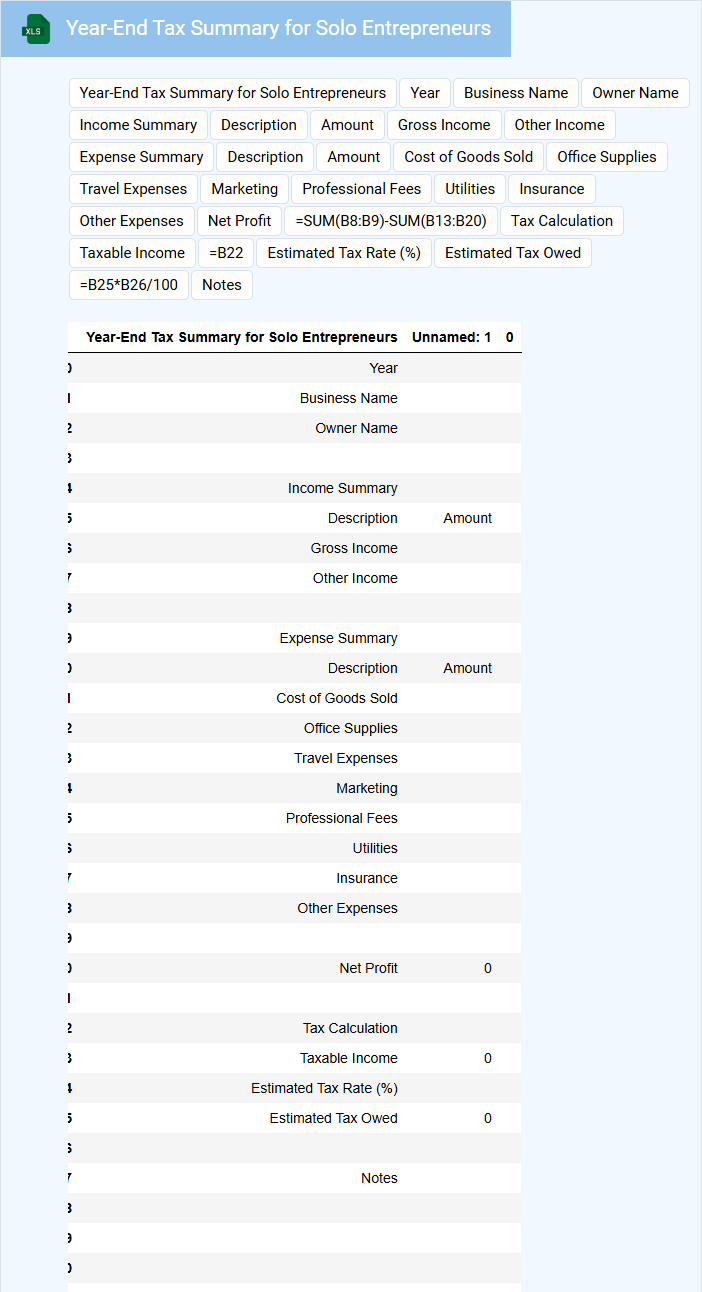

Year-End Tax Summary for Solo Entrepreneurs

The Year-End Tax Summary is a crucial document for solo entrepreneurs, detailing all income and expenses throughout the fiscal year. It provides a comprehensive overview of financial transactions that impact tax liabilities. Keeping accurate records ensures compliance and maximizes deductions.

This summary typically includes a breakdown of revenues, deductible expenses, and any tax payments made during the year. Solo entrepreneurs should pay close attention to tracking receipts and categorizing expenses correctly. Consulting a tax professional can help optimize tax benefits and avoid errors.

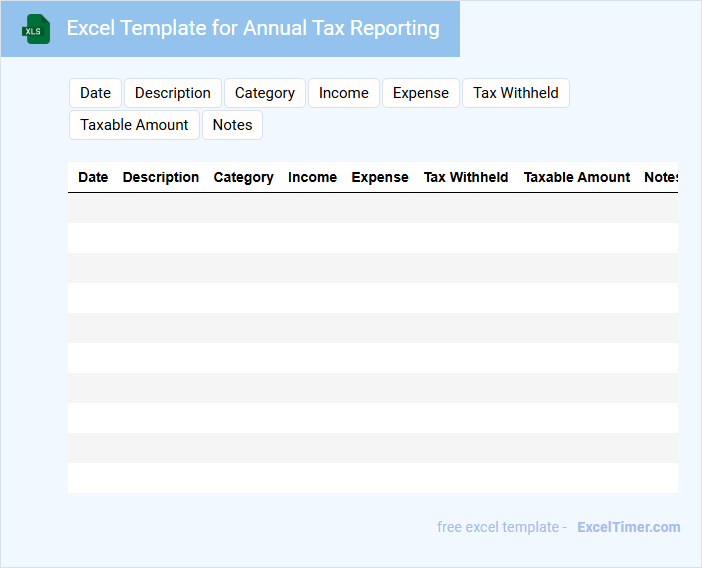

Excel Template for Annual Tax Reporting

This document typically contains structured financial data and calculations necessary for accurate annual tax reporting. It helps in organizing income, expenses, and tax deductions efficiently.

- Ensure all income sources and expenses are clearly categorized for easy reference.

- Include formulas to automate tax calculations and reduce manual errors.

- Regularly update tax rates and regulations to maintain compliance.

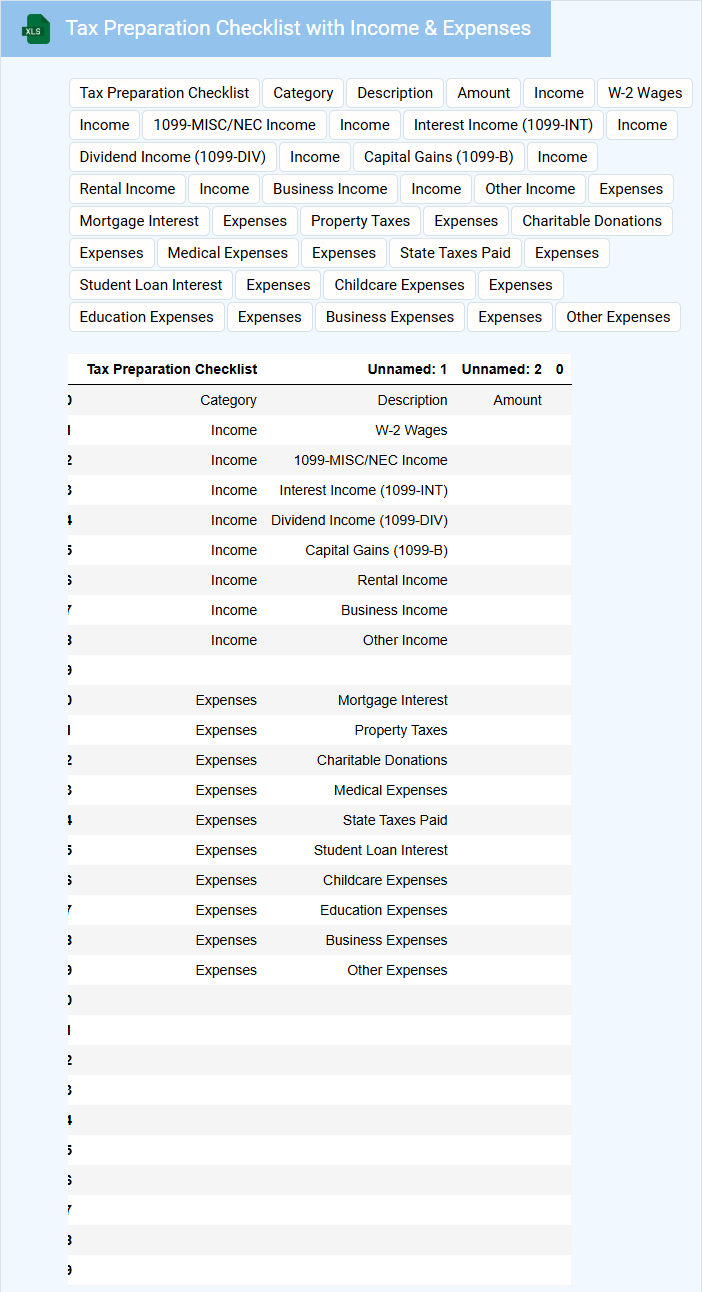

Tax Preparation Checklist with Income & Expenses

A Tax Preparation Checklist typically contains a comprehensive list of documents required to file taxes accurately. It includes records of all sources of income, such as wages, dividends, and rental income, as well as detailed expense receipts and statements. Organizing these documents ensures a smoother filing process and helps maximize deductions and credits.

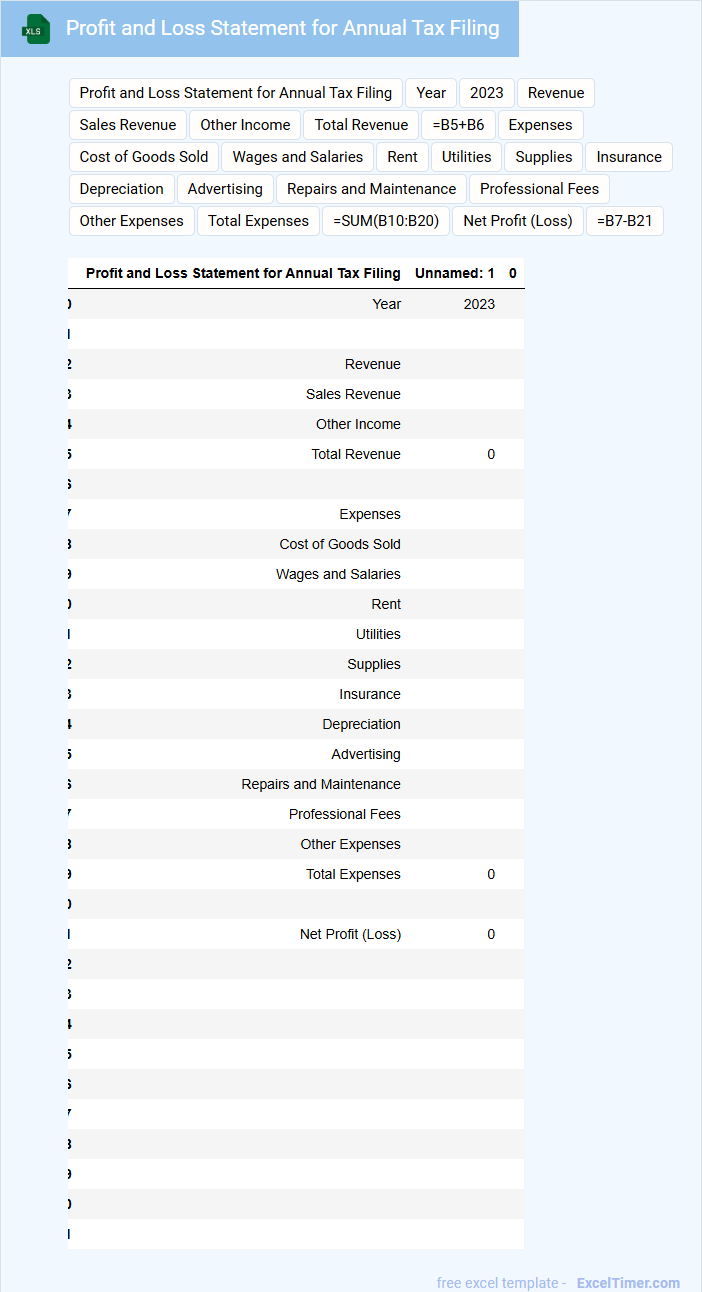

Profit and Loss Statement for Annual Tax Filing

What information is typically contained in a Profit and Loss Statement for Annual Tax Filing? This document usually includes detailed records of revenues, costs, and expenses over the fiscal year to determine the net profit or loss. It helps accurately report financial performance to tax authorities and supports compliance with tax regulations.

What is important to consider when preparing a Profit and Loss Statement for Annual Tax Filing? Ensuring all income and deductible expenses are thoroughly documented and categorized is crucial. Additionally, reconciling figures with supporting financial records reduces errors and facilitates smooth tax reporting.

Tax Document Organizer with Receipt Log

A Tax Document Organizer with Receipt Log is a vital tool for efficiently managing your financial records during tax season. It typically contains categorized sections for storing various tax forms, receipts, and important financial documents. Keeping a detailed receipt log ensures accurate tracking of deductible expenses, which simplifies the tax filing process and aids in audits.

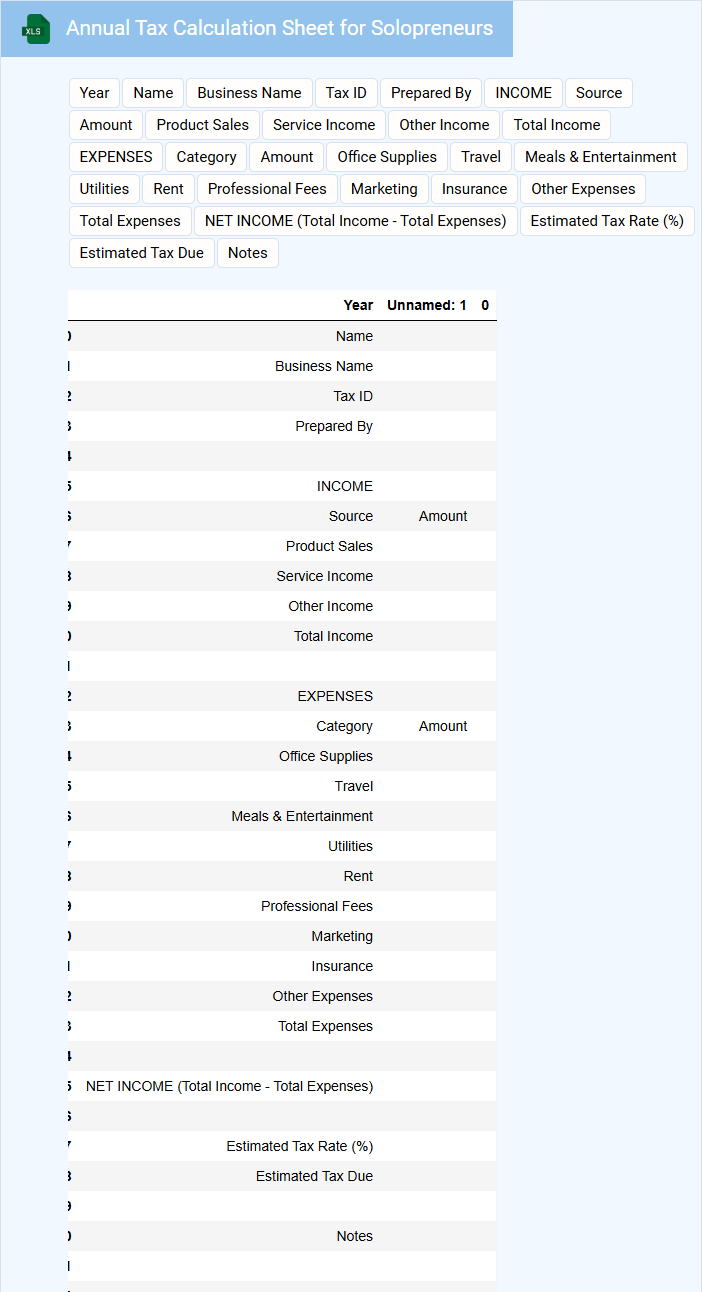

Annual Tax Calculation Sheet for Solopreneurs

What information is typically included in an Annual Tax Calculation Sheet for Solopreneurs? This document usually contains detailed records of income, expenses, deductions, and tax liabilities relevant to the solopreneur's business activities. It helps in accurately determining the annual tax due and ensures compliance with tax regulations.

What important aspects should solopreneurs focus on in this document? Accurate tracking of all income sources and business expenses is crucial, along with proper categorization for maximizing deductible items. Maintaining up-to-date records and consulting with a tax professional can help avoid errors and optimize tax savings.

Mileage Log with Tax Deduction Tracker

A Mileage Log with Tax Deduction Tracker is typically used to record the distance traveled for business purposes, ensuring accurate and organized documentation. This type of document helps in calculating tax-deductible expenses related to vehicle use efficiently. Keeping detailed entries such as date, purpose, starting and ending odometer readings is essential for validity. To maximize tax benefits, consistently update the log and retain supporting receipts.

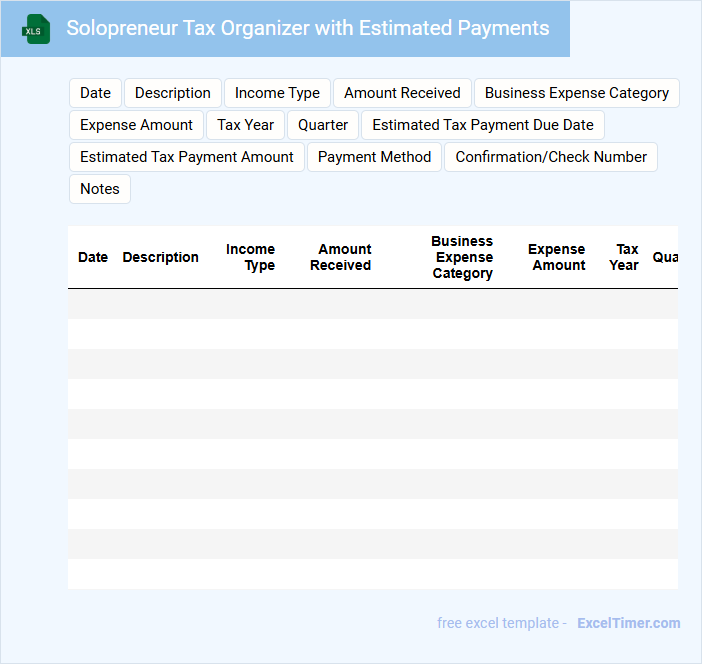

Solopreneur Tax Organizer with Estimated Payments

This Solopreneur Tax Organizer typically contains detailed records of income, expenses, and deductions relevant to a solopreneur's business activities. It helps streamline the tax preparation process by organizing important financial documents and receipts in one place.

The organizer also includes sections for tracking Estimated Payments made throughout the year to avoid penalties and manage cash flow effectively. Keeping accurate records of these payments is crucial for accurate tax filing.

It is important to regularly update the organizer and keep copies of all receipts, invoices, and payment confirmations to ensure a smooth tax season.

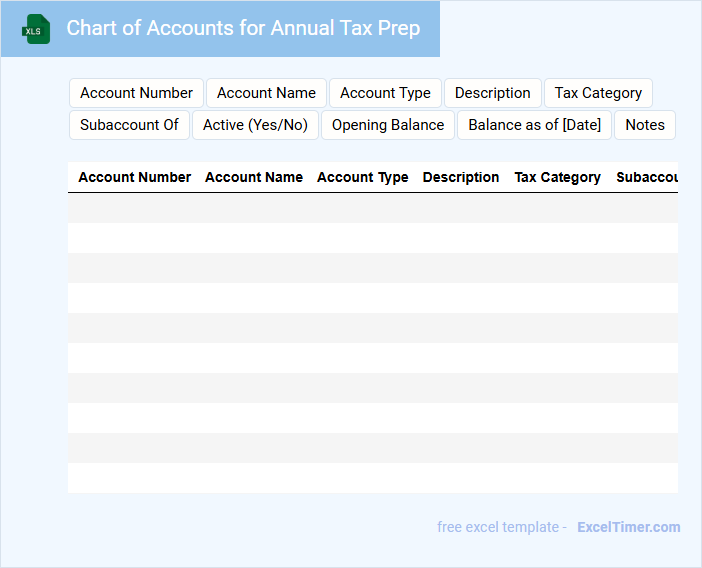

Chart of Accounts for Annual Tax Prep

The Chart of Accounts is a systematic listing of all accounts used by an organization to record financial transactions. It provides a clear structure for categorizing income, expenses, assets, liabilities, and equity.

This document is essential for accurate Annual Tax Preparation, ensuring all relevant financial data is organized and accessible. Maintaining consistency and clarity in account naming enhances the efficiency of tax reporting and compliance.

Ensure that the Chart of Accounts includes detailed sub-accounts tailored to your business activities and aligns with tax regulations to avoid errors during filing.

Tax-Deductible Expense Tracker for Individuals

A Tax-Deductible Expense Tracker for Individuals is a document used to organize and record expenses that can reduce taxable income when filing taxes.

- Accurate Expense Recording: Consistently log all deductible expenses with dates and receipts for validation.

- Category Segmentation: Separate expenses into categories like medical, charitable donations, and work-related costs for clarity.

- Regular Updates: Update the tracker frequently to avoid missing deductible expenses and ensure thorough tax preparation.

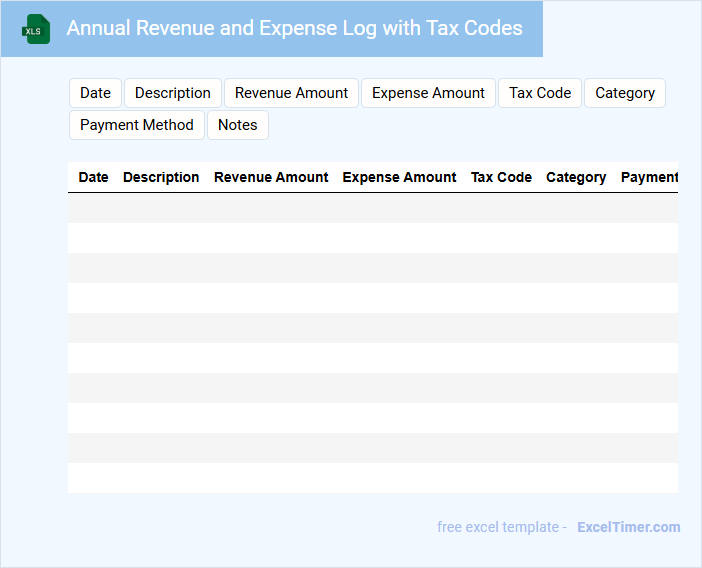

Annual Revenue and Expense Log with Tax Codes

An Annual Revenue and Expense Log is a detailed record of all income and expenditures over a fiscal year. It helps businesses track financial performance and identify trends.

Including Tax Codes ensures compliance with regulations and simplifies tax filing processes. Proper categorization with tax codes aids in accurate reporting and audit readiness.

Ensure entries are consistent, verified, and regularly updated to maintain accuracy and reliability throughout the year.

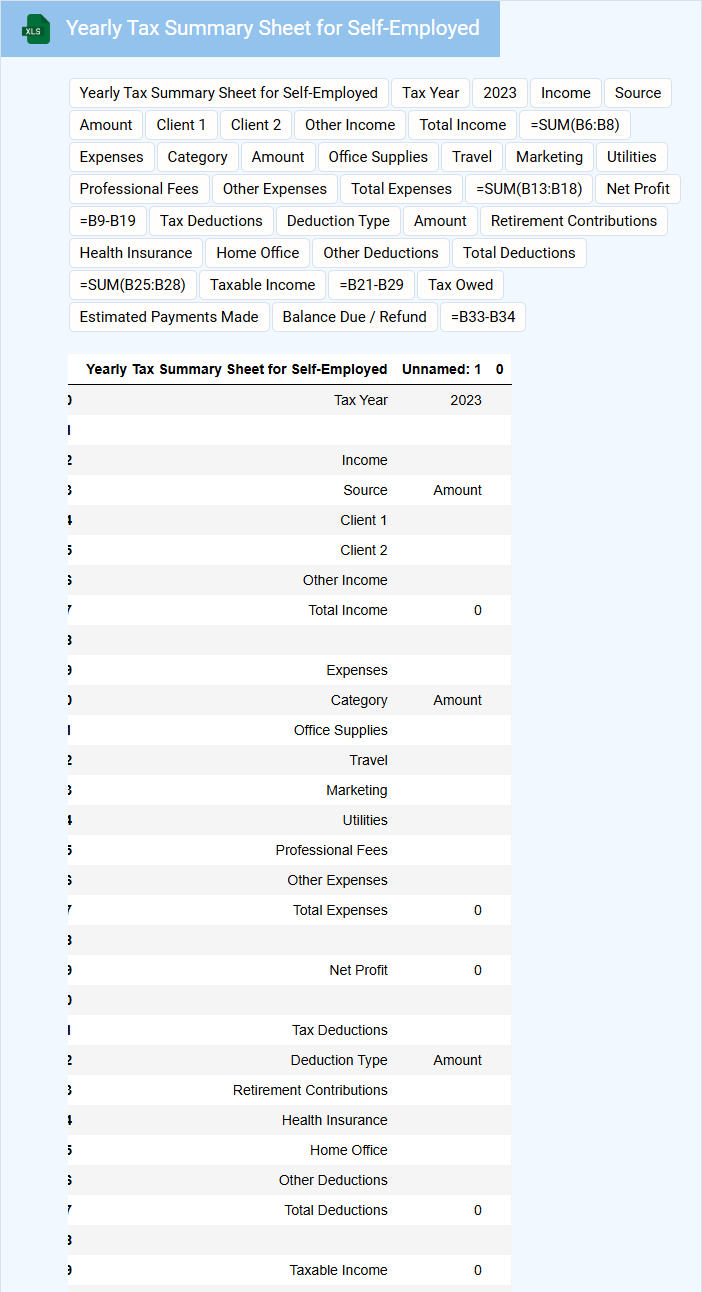

Yearly Tax Summary Sheet for Self-Employed

What information does a Yearly Tax Summary Sheet for Self-Employed typically contain?

This document summarizes annual income, expenses, and tax liabilities for individuals running their own business. It provides a clear overview used for accurate tax filing and financial planning.

Important elements to include are total earnings, deductible expenses, estimated tax payments, and net profit. Ensuring these details are accurate helps avoid tax penalties and streamlines the tax preparation process.

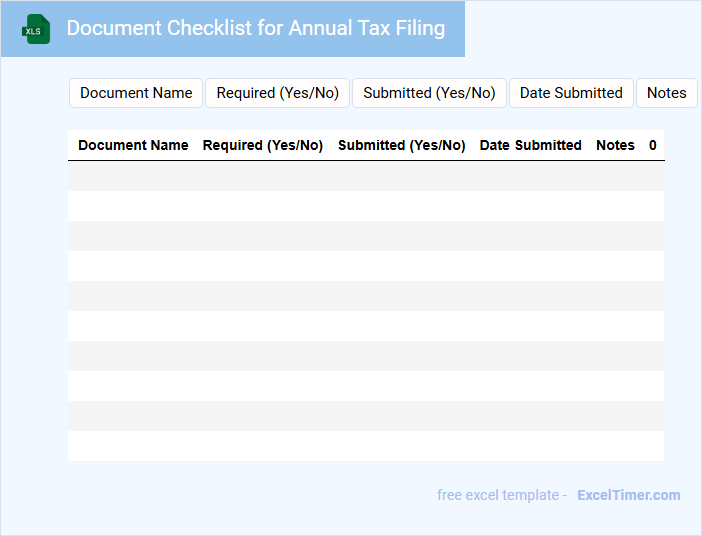

Document Checklist for Annual Tax Filing

This document typically contains a comprehensive list of all necessary paperwork required for annual tax filing. It helps individuals and businesses organize their financial documents to ensure accurate and timely submission.

- Include income statements such as W-2s or 1099s to report earnings.

- Gather receipts and records for deductible expenses to maximize tax benefits.

- Prepare identification documents and previous tax returns for reference and verification.

What are the key annual tax forms required for solopreneurs to complete and file?

Key annual tax forms for solopreneurs include Form 1040 with Schedule C to report income and expenses, Schedule SE for self-employment tax, and Form 1099-NEC to report income from clients. You must also file Form 1040-ES to pay estimated quarterly taxes throughout the year. Maintaining accurate records ensures proper completion and timely filing of all required tax forms.

Which deductible business expenses should solopreneurs track throughout the year in Excel?

Solopreneurs should track deductible business expenses such as office supplies, software subscriptions, travel costs, and client meals in their Excel document. Recording home office expenses, business insurance, and marketing costs monthly ensures accurate tax preparation. Keeping detailed logs of vehicle mileage and professional services paid enhances expense verification during tax filing.

How can Excel be used to organize income and expense categories for accurate annual tax reporting?

Excel efficiently organizes income and expense categories using customizable spreadsheets and formulas, enabling solopreneurs to track transactions by type and date. PivotTables summarize financial data for clear insights into taxable income and deductible expenses, ensuring accurate annual tax reporting. Pre-built templates streamline data entry and maintain consistency, reducing errors during tax preparation.

What essential financial data should solopreneurs consistently update in their yearly tax preparation spreadsheet?

Solopreneurs should consistently update income streams, including total revenue from all clients and sources, in their annual tax preparation spreadsheet. Expense categories such as office supplies, travel, marketing, and professional services must be accurately recorded to maximize deductible items. Tracking estimated tax payments and any tax credits claimed ensures precise tax liability calculations and compliance.

Which Excel formulas or tools can simplify year-end tax calculations for solopreneurs?

Excel formulas like SUMIFS and IFERROR streamline expense categorization and error handling in year-end tax calculations for solopreneurs. PivotTables efficiently summarize income and deductions, providing clear financial insights. Data Validation and Conditional Formatting tools ensure accurate data entry and highlight key tax figures for faster review.