![]()

The Annually Income Tracker Excel Template for Rental Properties simplifies managing rental income by providing a clear and organized overview of yearly earnings. It allows landlords to track rent payments, expenses, and profit margins accurately, ensuring efficient financial management. Using this template helps optimize cash flow analysis and aids in making informed investment decisions.

Annual Income Tracker Excel Template for Rental Properties

What information does an Annual Income Tracker Excel Template for Rental Properties typically contain? This type of document generally includes detailed records of rental income, expenses, and net profit or loss for each property over the year. It helps landlords efficiently monitor financial performance and make informed decisions about property management.

Why is it important to use specific categories and consistent entries in this template? Clearly defined income and expense categories ensure accurate tracking and reporting, making tax preparation easier. Consistency in data entry allows for reliable comparisons across different periods and properties.

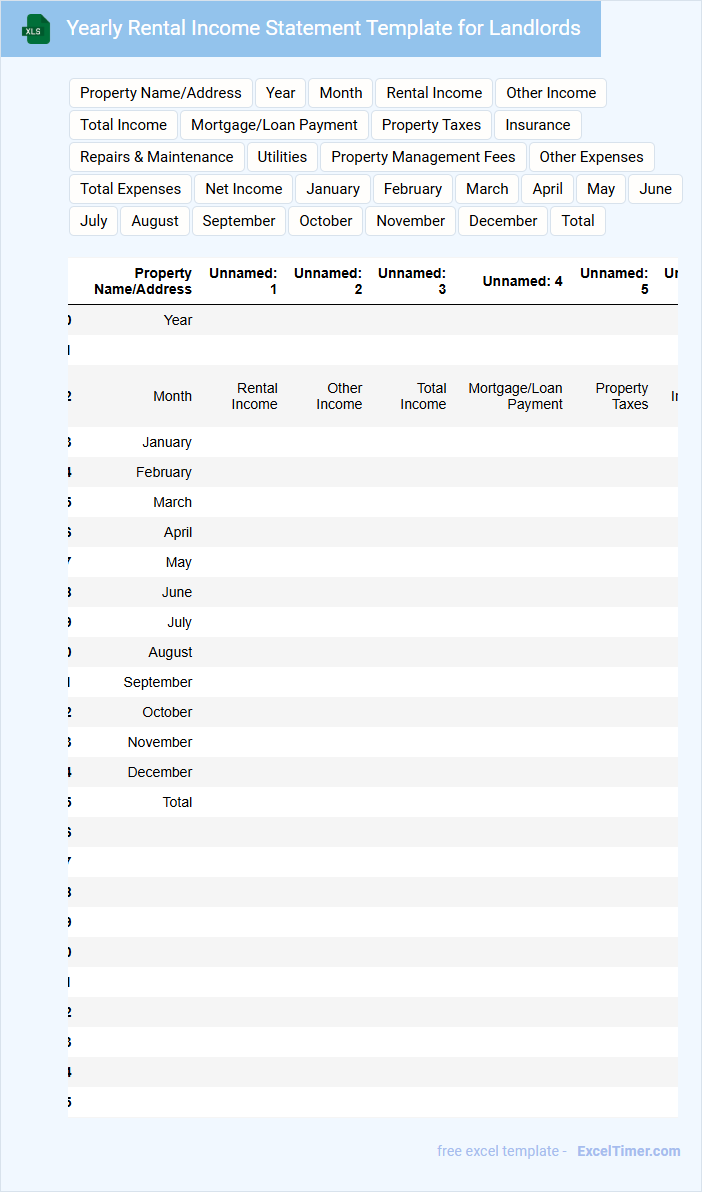

Yearly Rental Income Statement Template for Landlords

The Yearly Rental Income Statement Template is a document used by landlords to summarize their rental incomes and expenses over a fiscal year. It typically includes details such as total rent received, maintenance costs, and other related financial transactions. This helps landlords accurately track their financial performance.

Important things to include are clear segmentation of income and expenses, as well as spaces for notes on any irregular transactions. Maintaining organized records in this template simplifies tax reporting and financial planning for landlords.

Income and Expense Tracker for Rental Properties (Annual)

An Income and Expense Tracker for rental properties typically contains detailed records of all rental income received and expenses incurred throughout the year. This document helps landlords monitor financial performance and prepare accurate tax returns.

It is crucial to include categories such as maintenance costs, mortgage payments, property taxes, and utility bills to maintain clear financial visibility. Keeping organized records ensures better budgeting and maximizes profitability for rental property owners.

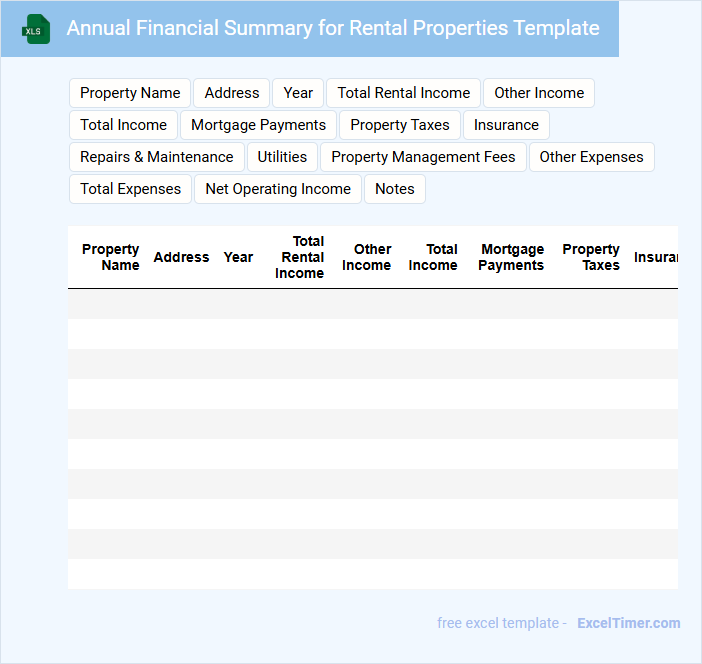

Annual Financial Summary for Rental Properties Template

What information is typically included in an Annual Financial Summary for Rental Properties Template? This document usually contains detailed records of income, expenses, and net profit from rental properties over the fiscal year. It helps landlords track financial performance, prepare taxes, and make informed investment decisions.

Why is it important to include accurate expense categorization in this summary? Properly categorizing expenses such as maintenance, utilities, and mortgage interest ensures clear financial analysis and compliance with tax regulations. This accuracy aids in maximizing tax deductions and maintaining transparent financial records.

Excel Template for Tracking Rental Income Annually

Excel templates for tracking rental income annually typically contain structured spreadsheets designed to record and analyze rental payments over the course of a year. These templates help landlords or property managers monitor income streams and evaluate financial performance efficiently.

- Include columns for tenant names, monthly rent amounts, and payment status to ensure clear tracking.

- Incorporate summary tables or charts to visualize total income and identify outstanding payments quickly.

- Ensure there is space for notes or remarks to record any rent adjustments, late fees, or maintenance deductions.

Annual Cash Flow Tracker for Rental Property Owners

What information is typically included in an Annual Cash Flow Tracker for Rental Property Owners? This document usually contains detailed records of all rental income, expenses, and net cash flow over the year, helping owners monitor the profitability of their properties. It also tracks mortgage payments, maintenance costs, taxes, and other financial transactions relevant to the rental property.

What important factors should rental property owners consider when using this tracker? Owners should ensure the tracker accurately reflects all income sources and expenses to maintain precise financial insights. Additionally, regularly updating the document and categorizing expenses clearly can optimize tax preparation and investment decisions.

Year-End Income Report Template for Rental Properties

The Year-End Income Report Template for Rental Properties is typically used to summarize all rental income, expenses, and net profit for a specific year. This document helps landlords and property managers track financial performance and prepare for tax filings. Key details often include rental payments received, maintenance costs, mortgage interest, and other deductible expenses.

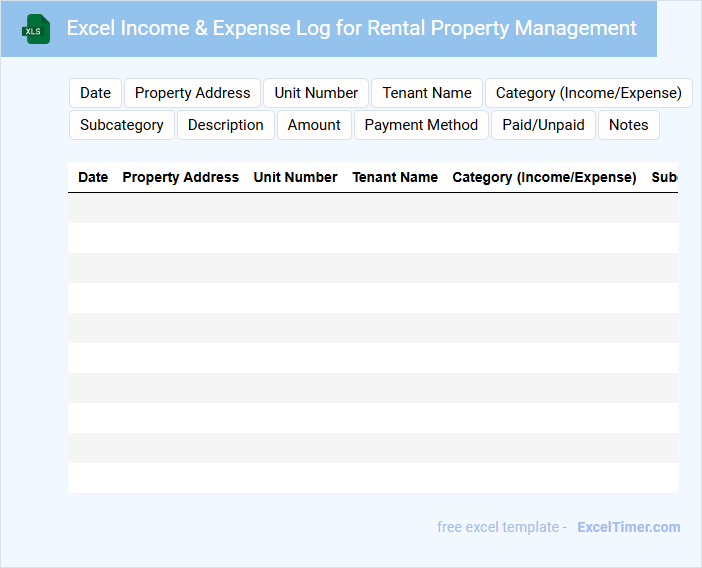

Excel Income & Expense Log for Rental Property Management

An Excel Income & Expense Log for rental property management is a vital document that tracks all financial transactions related to rental properties. It usually contains detailed records of income from rent payments and expenses such as maintenance, utilities, and taxes. This organized log helps landlords monitor cash flow and prepare accurate financial reports.

It is important to include clear categories for each type of income and expense, timely entries, and precise balances to ensure clarity and usability. Incorporating formulas to automatically calculate totals and net income can enhance efficiency. Additionally, regularly updating the log supports better financial decision-making for property management.

Rental Property Income Tracker with Annual Overview

This document typically contains detailed records of rental income and expenses, along with an annual summary to help property owners monitor financial performance.

- Income Tracking: Systematically record monthly rental payments to ensure accurate revenue accounting.

- Expense Documentation: Keep track of all related costs, including maintenance, taxes, and management fees for precise profit calculation.

- Annual Overview: Summarize yearly totals and trends to evaluate the property's financial health and guide future decisions.

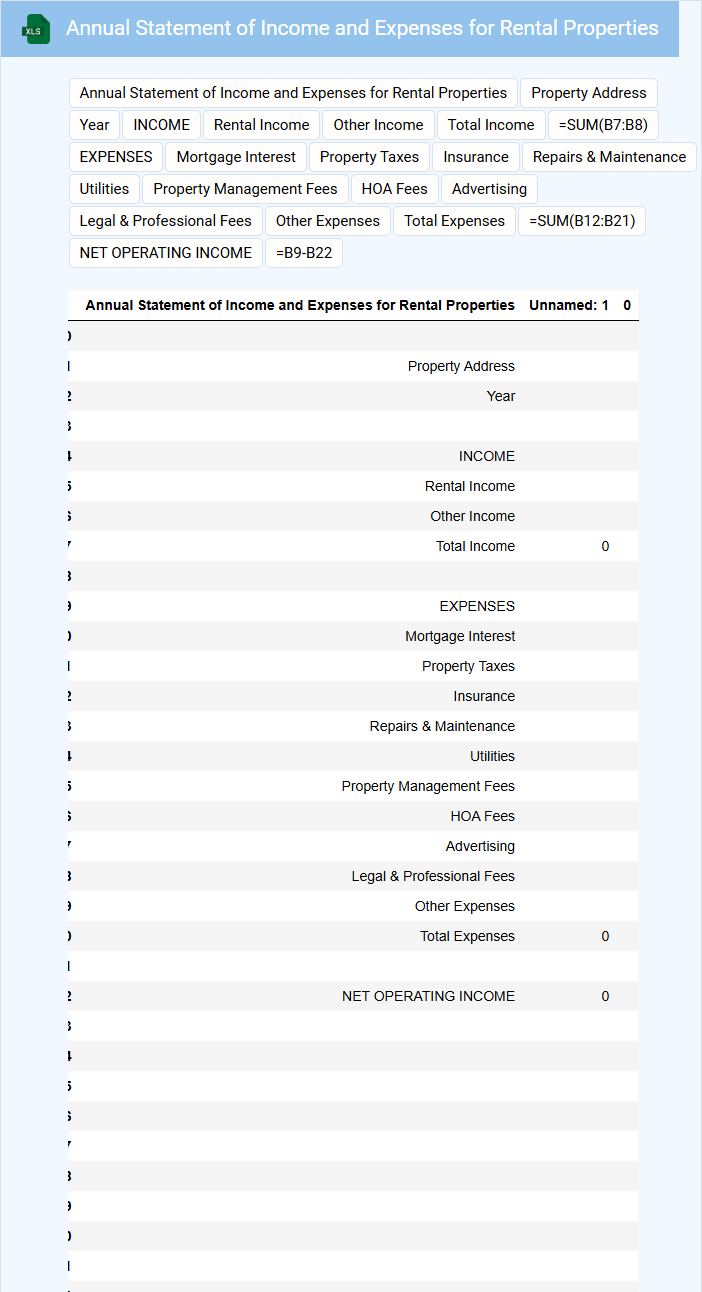

Annual Statement of Income and Expenses for Rental Properties

What information is typically included in an Annual Statement of Income and Expenses for Rental Properties?

This document usually contains detailed records of all rental income received and expenses incurred for maintaining rental properties over the year. It helps property owners track financial performance and prepare accurate tax filings.

Important elements to include are rental income, maintenance costs, property taxes, mortgage interest, insurance, and any other operating expenses. Ensuring accuracy and completeness in reporting these figures is essential for effective property management and financial planning.

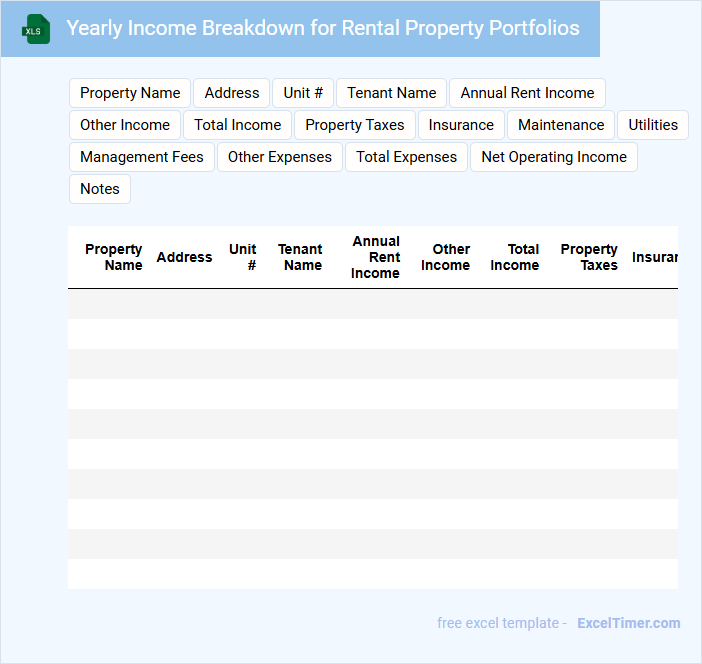

Yearly Income Breakdown for Rental Property Portfolios

A Yearly Income Breakdown for Rental Property Portfolios typically contains detailed financial summaries of rental income, expenses, and net profit across all properties owned throughout the year. This document helps landlords and investors track the performance and cash flow of their rental investments efficiently.

It often includes income sources, vacancy rates, maintenance costs, and tax implications to provide a comprehensive view of profitability. Regularly updating and reviewing this breakdown is crucial for making informed investment decisions and optimizing portfolio growth.

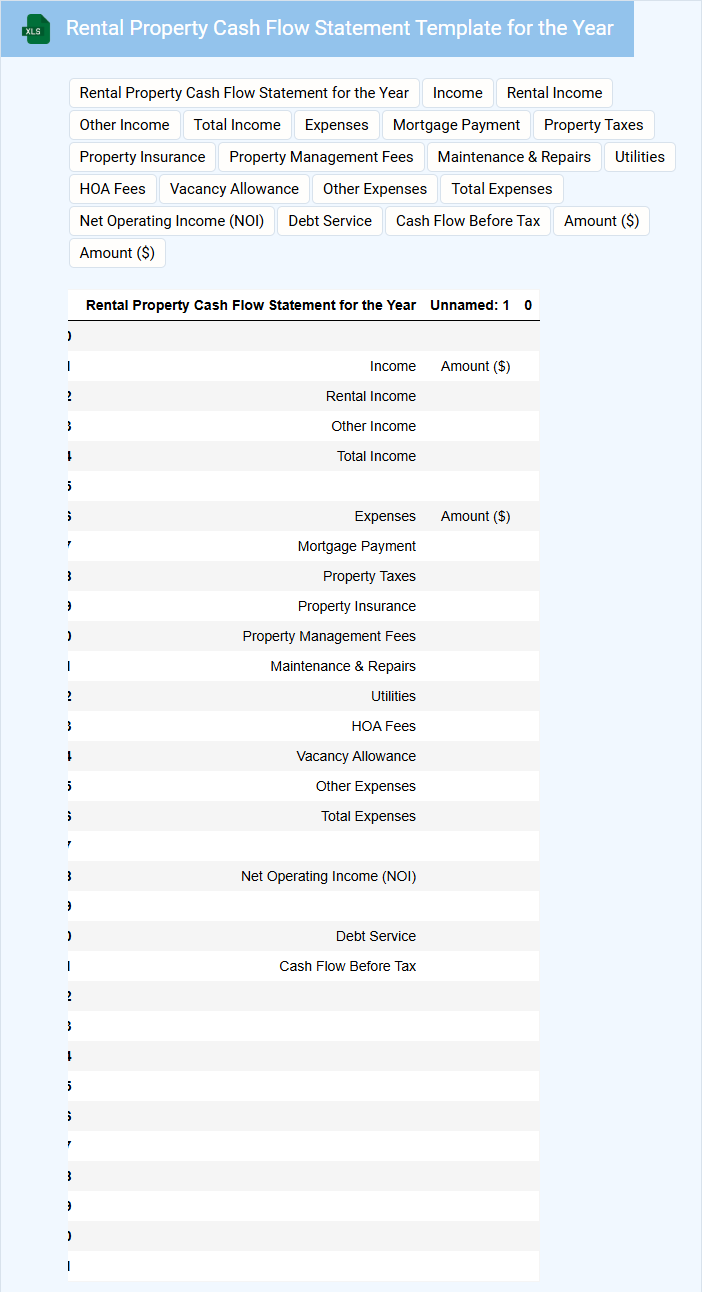

Rental Property Cash Flow Statement Template for the Year

The Rental Property Cash Flow Statement is a financial document that tracks the income and expenses related to a rental property over a specific year. It typically contains detailed records of rental income, operating expenses, mortgage payments, and net cash flow. This statement helps property owners evaluate the profitability and financial health of their investments.

Important elements to include are accurate rental income figures, expense categories such as maintenance and taxes, and loan repayment details. Clearly separating operating and financing activities improves clarity and analysis. Consistent updates and documentation ensure the statement remains a reliable tool for decision-making.

Excel Annual Report Template for Rental Income Tracking

An Excel Annual Report Template for Rental Income Tracking typically contains detailed financial data and summaries to monitor rental income performance over the year.

- Income Summary: Provides a clear overview of total rental income earned during the year.

- Expense Tracking: Highlights all relevant costs and expenditures associated with rental properties.

- Tenant Information: Maintains a record of tenant details and payment histories for accurate analysis.

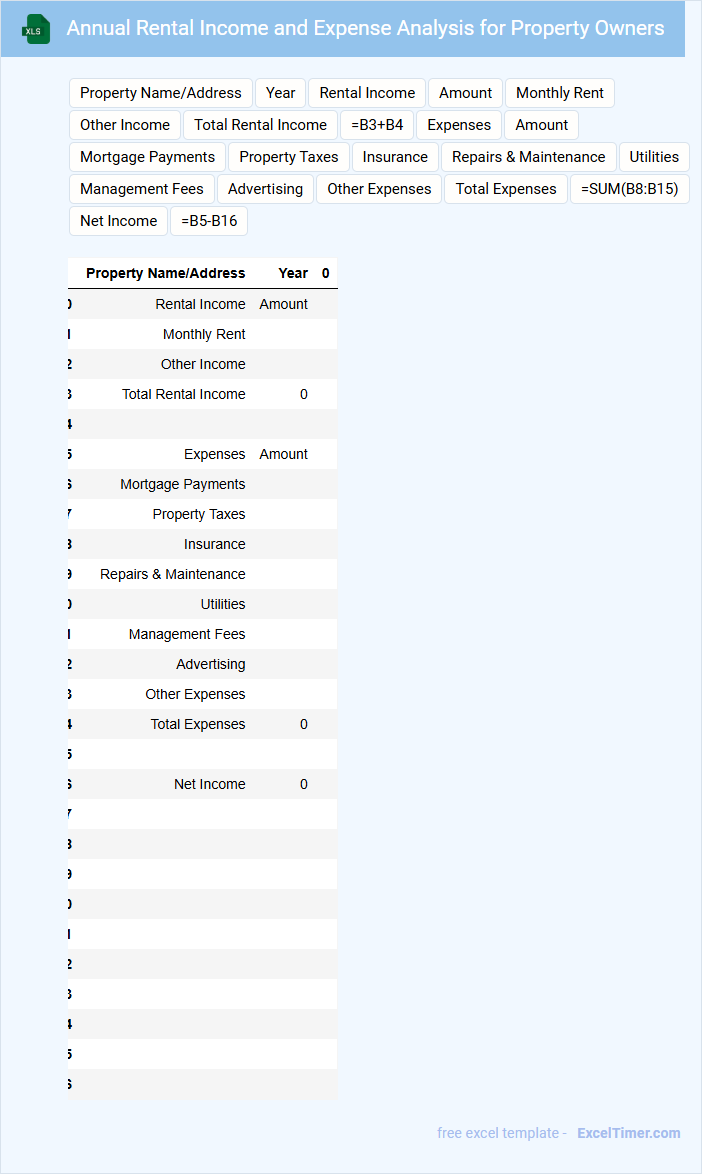

Annual Rental Income and Expense Analysis for Property Owners

The Annual Rental Income and Expense Analysis document typically contains detailed financial records of rental income and associated expenses over a one-year period. It helps property owners track profitability and identify trends in earnings versus costs. This report is crucial for making informed decisions about property management and future investments.

Yearly Tracker with Summary for Rental Property Income

A Yearly Tracker with Summary for rental property income is a document designed to efficiently record and monitor all rental revenues and related expenses throughout the year. It typically contains monthly income entries, expense logs, and a summary section highlighting net profit or loss. This document helps landlords maintain clear financial oversight and simplifies tax reporting.

Important elements to include are detailed entries for rental payments, maintenance costs, property taxes, and any other deductions to ensure accuracy. Regularly updating the tracker improves financial planning and investment analysis. Additionally, incorporating automated calculations and visual summaries can enhance usability and insight.

What key columns should be included in an annual income tracker for rental properties (e.g., property address, rent collected, expenses, net income)?

An annual income tracker for rental properties should include key columns such as Property Address, Rent Collected, Maintenance Expenses, Property Taxes, Insurance Costs, and Net Income. Tracking each property's monthly and annual Rent Collected alongside detailed Expenses enables accurate calculation of Net Income. Your tracker will provide clear insights into the financial performance of each rental asset throughout the year.

How can you categorize and itemize various types of income and expenses for each rental property annually in Excel?

Create separate columns for each income type such as rent, late fees, and laundry revenue, and categorize expenses into maintenance, utilities, taxes, and mortgage payments. Use Excel tables to organize data by property, enabling easy filtering and monthly or annual summation with functions like SUMIFS. Implement pivot tables to generate detailed reports showing total income, expenses, and net profit per rental property annually.

Which Excel formulas or functions (e.g., SUMIFS, VLOOKUP) are most effective for summarizing annual income and expenses per property?

Use SUMIFS to accurately summarize annual income and expenses per property by specifying criteria like property name and date range. VLOOKUP helps quickly retrieve property-specific details, enhancing your income tracking accuracy. Combining these functions ensures comprehensive and organized financial analysis in your rental properties tracker.

How can you use conditional formatting in Excel to quickly identify rental properties with negative cash flow over the year?

Use conditional formatting in your Excel Income Tracker to highlight negative cash flow by applying a rule that formats cells with annual income totals below zero. Select the range containing yearly cash flow data, choose "Highlight Cell Rules," then "Less Than," and enter 0 to automatically flag properties losing money. This visual alert helps you quickly identify underperforming rental properties for better financial management.

What are the best practices for structuring and updating the tracker to ensure accurate, year-end financial reporting for rental properties?

Structure the Annually Income Tracker by categorizing rental income, expenses, and tax-related entries into clear, separate columns with consistent date formats. Update the tracker regularly with verified transaction details, including rent payments, maintenance costs, and property taxes, to maintain accuracy. Implement data validation rules and use Excel formulas to automate calculations, ensuring reliable, year-end financial summaries for rental properties.