The Annually Tax Planning Excel Template for Real Estate Investors streamlines the process of organizing income, expenses, and deductions specific to property investments. This tool helps investors accurately estimate tax liabilities and optimize financial strategies throughout the year. Efficient use of this template ensures maximized tax benefits and improved cash flow management.

Annual Tax Planning Spreadsheet for Real Estate Investors

Annual Tax Planning Spreadsheets for Real Estate Investors typically contain detailed financial data and projections to optimize tax liabilities throughout the fiscal year. They serve as essential tools for strategic tax management and compliance.

- Include income sources, deductions, and estimated tax payments for accurate forecasting.

- Track depreciation schedules and property-related expenses to maximize tax benefits.

- Incorporate potential changes in tax laws to adjust planning accordingly.

Tax Deduction Tracker for Real Estate Investors

A Tax Deduction Tracker for Real Estate Investors is a document designed to record and organize deductible expenses related to property investments. It helps investors maximize their tax savings by keeping detailed and accurate financial records.

- Include all expenses such as mortgage interest, repairs, and property management fees.

- Regularly update the tracker to ensure no deductible expense is missed.

- Keep receipts and supporting documents linked to each recorded deduction for easy reference during tax filing.

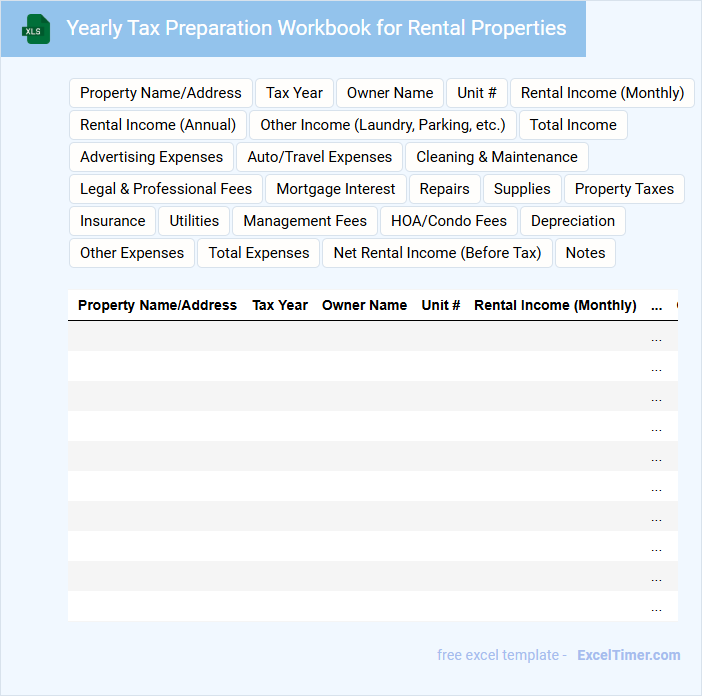

Yearly Tax Preparation Workbook for Rental Properties

The Yearly Tax Preparation Workbook for rental properties typically contains detailed financial records, including income, expenses, and depreciation related to the rental units. It serves as an organized tool to ensure all deductible items are accounted for during tax filing. Proper documentation helps maximize tax benefits and minimize potential audits.

Important elements to include are a summary of rental income, categorized expenses, and records of capital improvements. Additionally, tracking mileage and property-related loan interest is essential. Keeping accurate and updated records throughout the year simplifies the tax preparation process significantly.

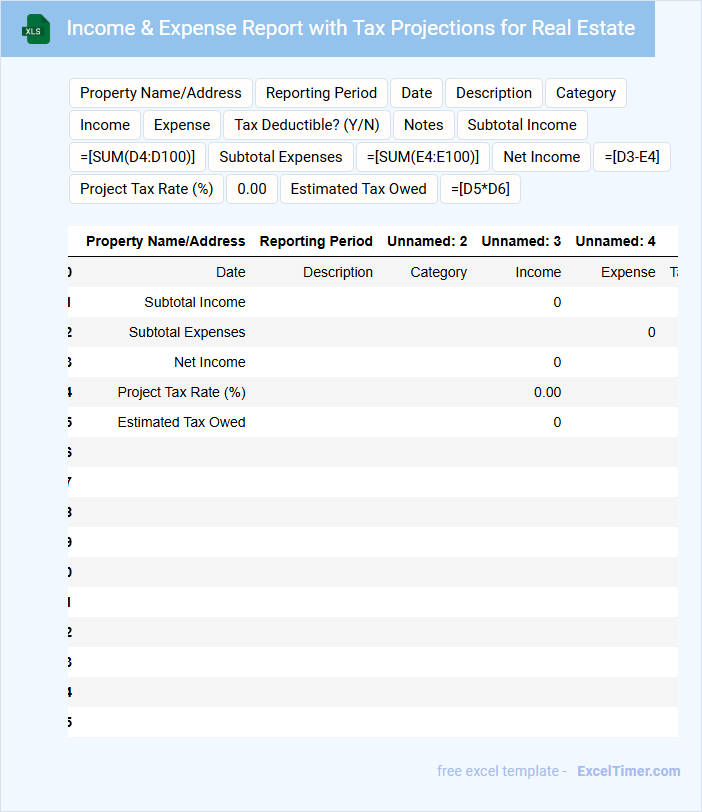

Income & Expense Report with Tax Projections for Real Estate

An Income & Expense Report with Tax Projections for Real Estate typically contains detailed records of all income generated and expenses incurred by a property throughout a specific period. This document also includes projected tax liabilities based on current tax regulations and expected income. It is essential for investors and property managers to analyze profitability and plan for future tax obligations efficiently.

To ensure accuracy, it is important to include all sources of income, such as rent and ancillary fees, as well as comprehensive listings of operating expenses. Including tax deductions and credits relevant to real estate investments can provide a clearer financial outlook. Additionally, regularly updating projections based on changes in tax laws helps maintain the reliability of the report for decision-making purposes.

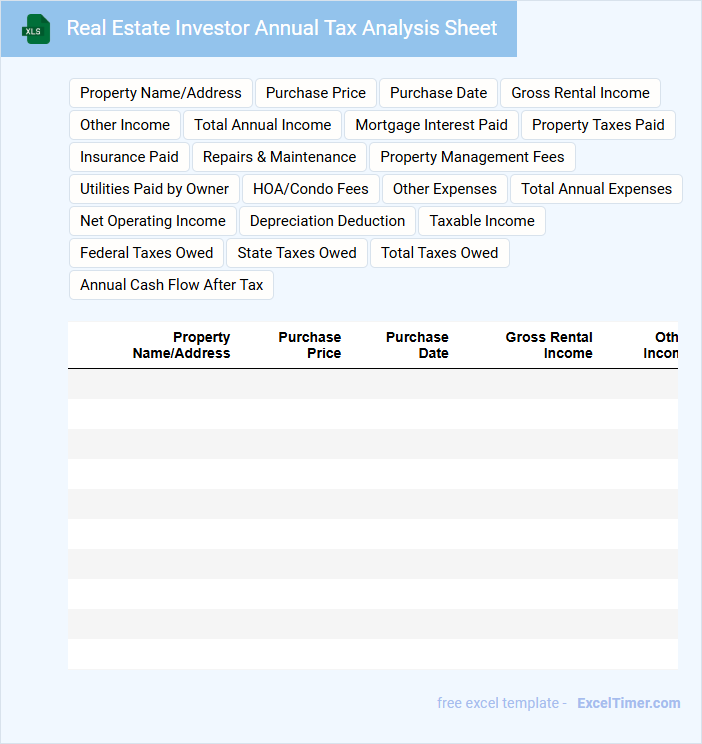

Real Estate Investor Annual Tax Analysis Sheet

What information is typically included in a Real Estate Investor Annual Tax Analysis Sheet? This document generally contains detailed records of rental income, expenses, depreciation, and capital gains or losses related to property investments. It helps investors accurately calculate their taxable income and plan for tax payments while identifying potential deductions.

Why is it important to maintain an accurate Real Estate Investor Annual Tax Analysis Sheet? Keeping comprehensive and organized tax records ensures compliance with tax laws and maximizes allowable deductions. This practice ultimately supports better financial planning and prevents costly errors during tax filing.

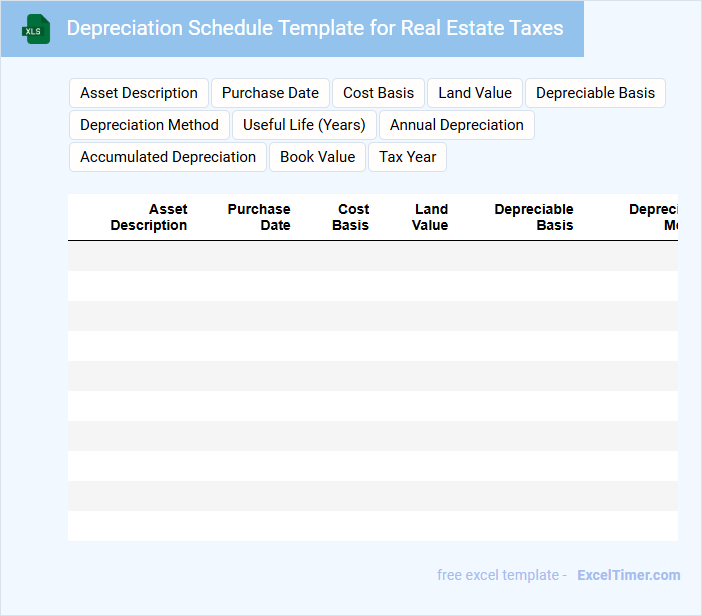

Depreciation Schedule Template for Real Estate Taxes

A Depreciation Schedule Template for Real Estate Taxes typically contains detailed asset information and calculations to track property value reduction over time for tax purposes.

- Asset Identification: Clearly lists all depreciable property assets including purchase dates and costs.

- Depreciation Methods: Specifies methods used such as straight-line or declining balance for accuracy.

- Tax Compliance: Ensures all data aligns with IRS rules and local tax regulations to maximize deductions.

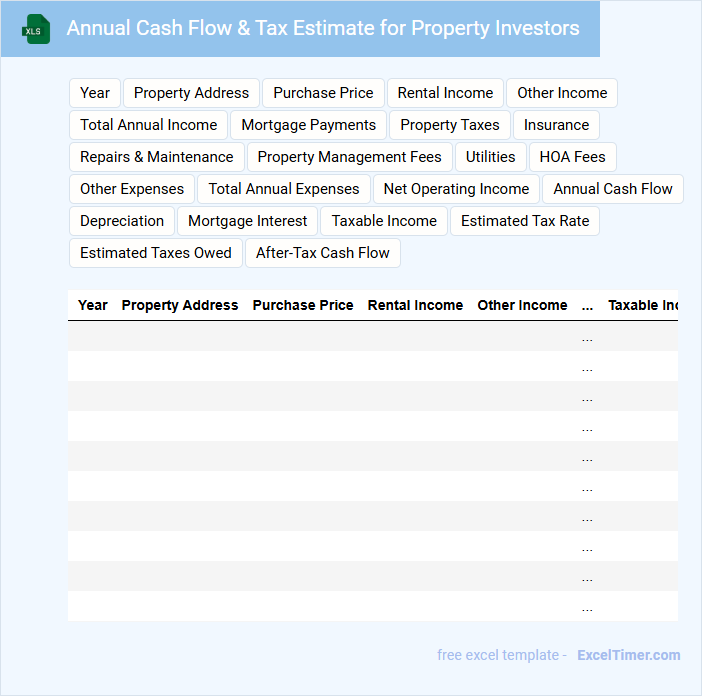

Annual Cash Flow & Tax Estimate for Property Investors

What information does an Annual Cash Flow & Tax Estimate for Property Investors typically include? This document usually contains a detailed summary of expected rental income, operating expenses, mortgage payments, and tax deductions for the property. It helps investors forecast their net cash flow and plan for tax liabilities to optimize investment returns.

What is an important consideration when using this estimate? It is crucial to update income and expense assumptions regularly to reflect real market conditions and changes in tax laws, ensuring accurate financial planning and compliance. Additionally, consulting with a tax professional can maximize deductions and minimize tax burdens effectively.

Capital Gains Planning Excel for Real Estate Investors

What information is typically included in a Capital Gains Planning Excel for Real Estate Investors? This document generally contains detailed records of property purchases, sales, expenses, and calculations of capital gains or losses. It helps investors track their taxes accurately and optimize their investment strategies by forecasting potential tax impacts.

What is an important consideration when using this Excel for planning? Ensuring up-to-date tax rates and regulations are incorporated is crucial, as tax laws frequently change. Accurately capturing all deductible expenses and holding periods can significantly affect capital gains calculations and improve overall tax planning efficiency.

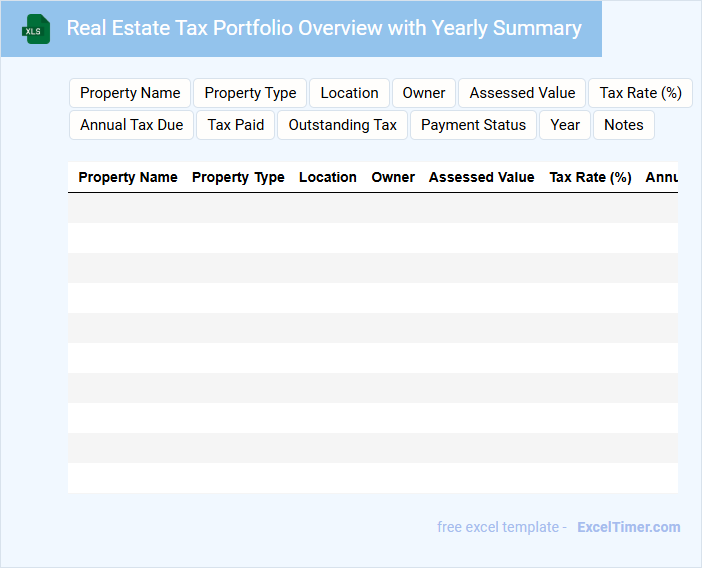

Real Estate Tax Portfolio Overview with Yearly Summary

A Real Estate Tax Portfolio Overview with Yearly Summary typically contains detailed information about property tax obligations, assessment values, and payment histories for a portfolio of real estate assets.

- Property Tax Details: Provides comprehensive data on tax rates, assessed values, and exemptions per property.

- Yearly Summary: Summarizes annual tax payments, outstanding liabilities, and changes in assessments over time.

- Compliance and Planning: Highlights important deadlines, potential tax savings, and strategies for tax optimization across the portfolio.

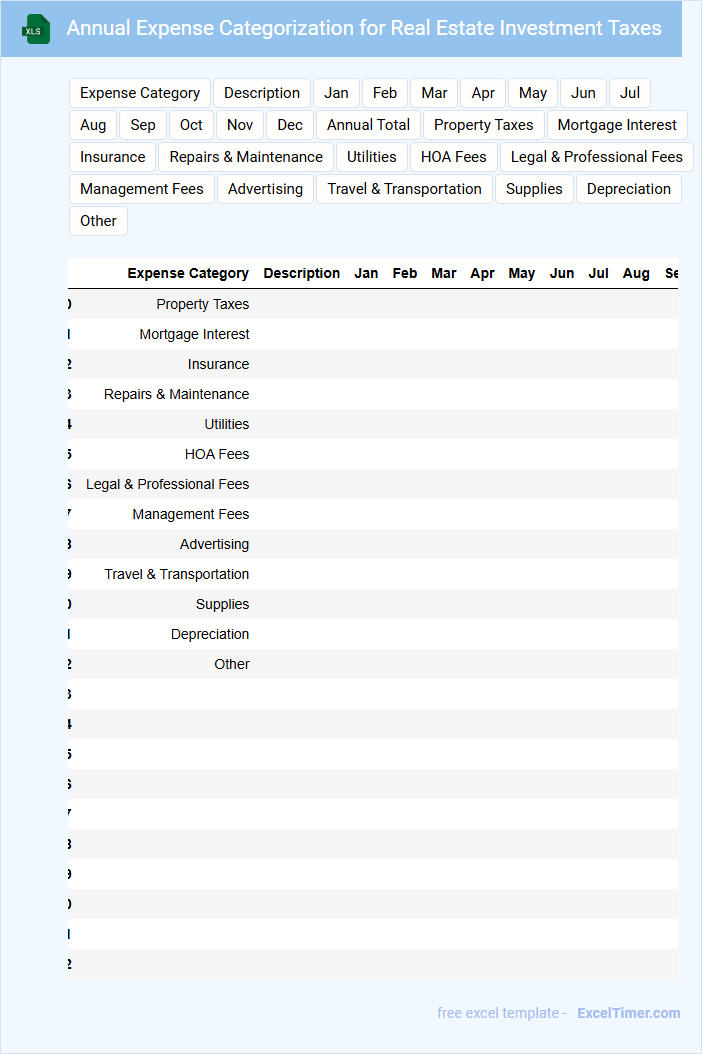

Annual Expense Categorization for Real Estate Investment Taxes

What information does an Annual Expense Categorization for Real Estate Investment Taxes typically contain? This document usually lists and organizes all expenses related to real estate investments, such as maintenance, repairs, property management fees, and mortgage interest. It helps investors accurately track deductible expenses, ensuring compliance with tax regulations and optimizing tax benefits.

Why is it important to categorize these expenses carefully? Proper categorization allows for precise tax reporting, potentially reducing taxable income and avoiding audits. It is essential to keep detailed records and separate personal from business expenses to maintain clarity and support deductions during tax filing.

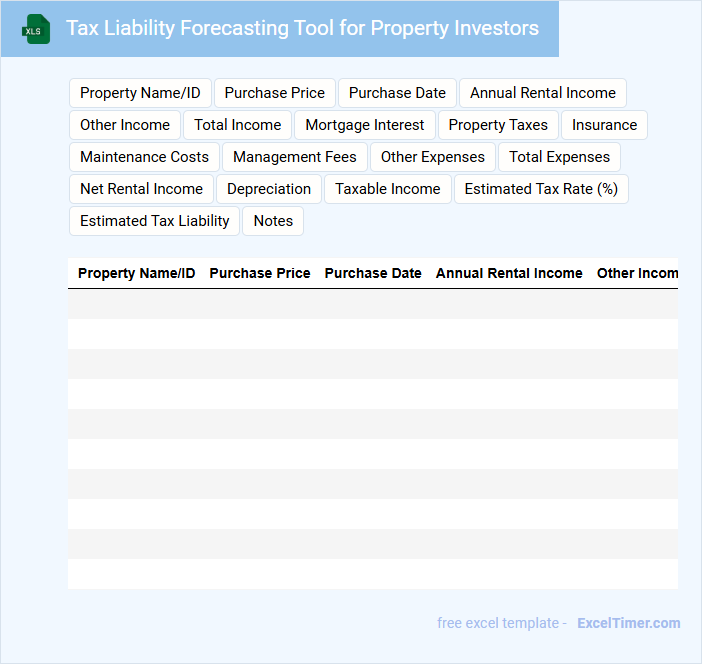

Tax Liability Forecasting Tool for Property Investors

This document typically contains detailed financial projections and tax implications tailored to property investors to help them anticipate their future tax obligations.

- Income Estimations: Forecasts of rental income and potential capital gains are critical for accurate tax liability calculations.

- Deduction Analysis: Identification of allowable expenses and deductions ensures investors maximize their tax benefits.

- Regulatory Updates: Inclusion of current tax laws and changes helps maintain compliance and optimize financial planning.

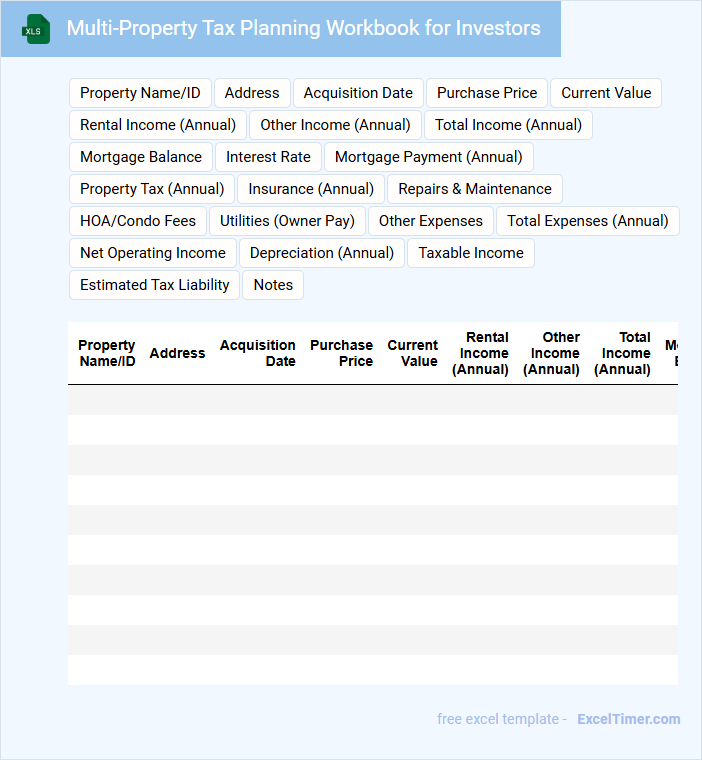

Multi-Property Tax Planning Workbook for Investors

The Multi-Property Tax Planning Workbook is a comprehensive document designed to help investors organize and strategize their tax-related information across multiple real estate holdings. It typically contains sections for tracking income, expenses, depreciation schedules, and tax liabilities for each property. This workbook is essential for maximizing tax benefits and ensuring compliance with tax laws.

Investors should pay particular attention to accurately documenting purchase prices, loan details, and capital improvements for proper depreciation calculations. Including a section for tax deduction tracking and estimated quarterly tax payments can prevent financial surprises. Regularly updating the workbook throughout the year enhances its effectiveness as a planning tool.

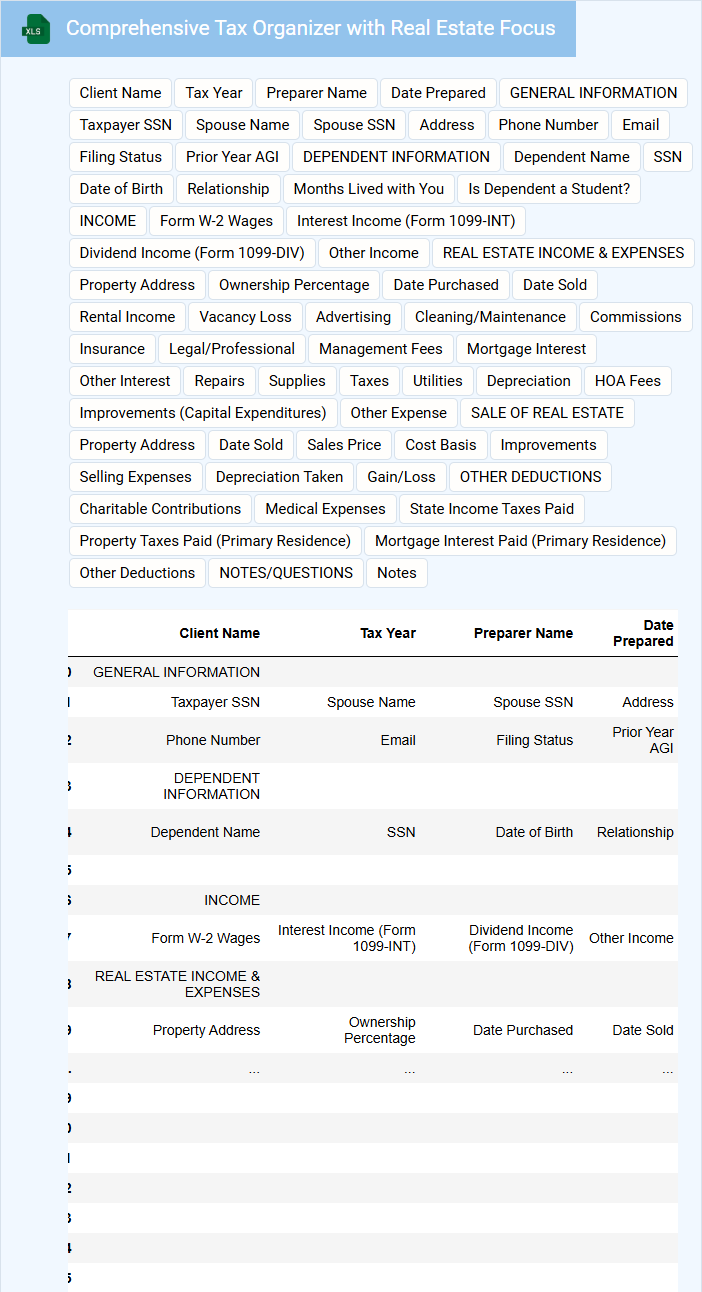

Comprehensive Tax Organizer with Real Estate Focus

A Comprehensive Tax Organizer with a real estate focus typically contains detailed financial information pertinent to both individual and investment properties. It gathers income, expenses, mortgage details, and tax documents to streamline the tax filing process. Key sections often include property acquisitions, rental income records, and deductible expenses related to real estate.

Important considerations include ensuring all rental income is fully documented, accurately reporting mortgage interest and property taxes paid, and including any records of capital improvements. Organizing receipts, lease agreements, and expense reports enhances accuracy and reduces audit risks. Keeping a clear summary of property-related transactions throughout the year is also highly recommended.

Using this organizer helps taxpayers and professionals efficiently manage real estate tax obligations while maximizing potential deductions. It supports compliance with IRS requirements and aids in strategic tax planning. Prioritizing thoroughness and accuracy in this document is crucial for optimizing tax outcomes.

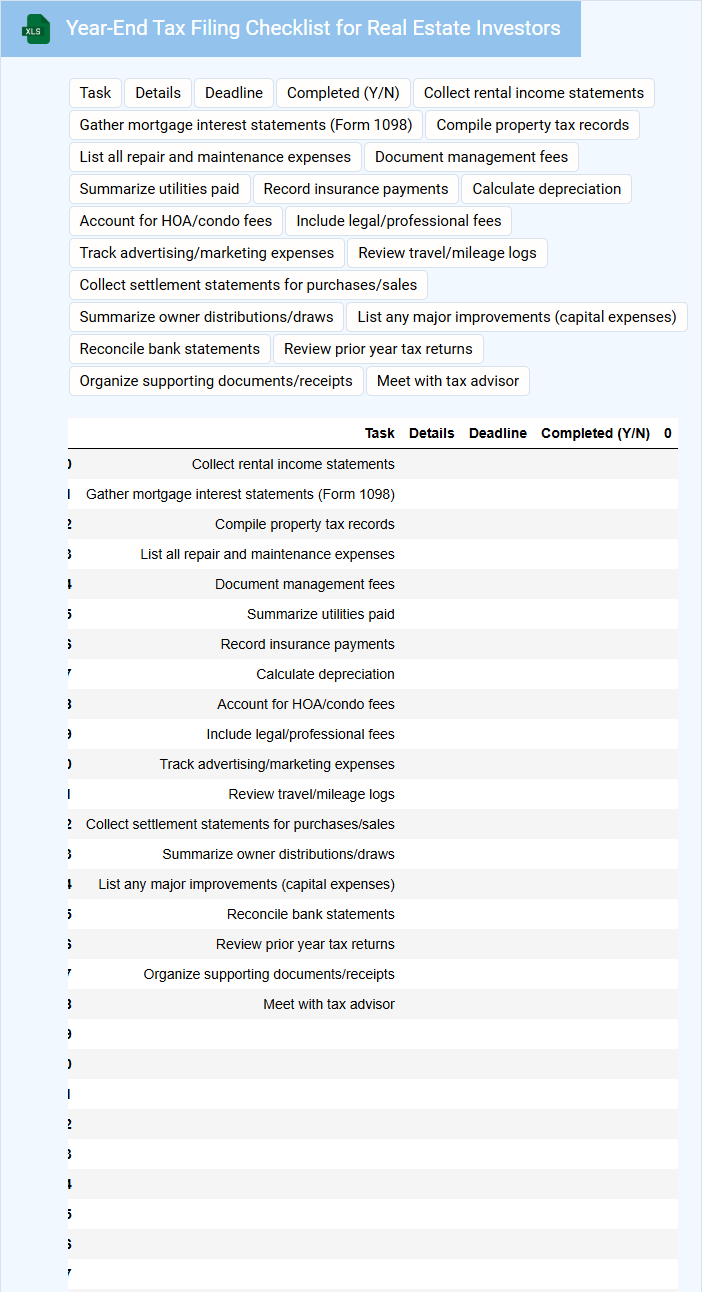

Year-End Tax Filing Checklist for Real Estate Investors

Year-End Tax Filing Checklist for Real Estate Investors typically contains essential documents and information needed to accurately report income, expenses, and deductions related to real estate investments.

- Income Documentation: Gather all rental income statements and 1099 forms received throughout the year.

- Expense Records: Compile receipts and records for repairs, maintenance, mortgage interest, and property taxes paid.

- Depreciation Details: Review and update depreciation schedules for all owned properties to maximize tax benefits.

Recordkeeping & Tax Compliance Tracker for Real Estate

What information is typically included in a Recordkeeping & Tax Compliance Tracker for Real Estate? This document usually contains detailed records of all financial transactions, property details, tax filings, and compliance deadlines related to real estate activities. It helps ensure accuracy and timeliness in managing taxes and legal obligations.

What important aspects should be considered when maintaining this tracker? It is crucial to regularly update all entries, maintain organized receipts and documents, and set reminders for tax deadlines to avoid penalties and optimize tax benefits. Consistent review and reconciliation with official records enhance reliability and compliance.

What are the key deductible expenses in real estate investing for annual tax planning purposes?

Key deductible expenses for real estate investors in annual tax planning include mortgage interest, property taxes, insurance premiums, repairs and maintenance costs, and depreciation. Operating expenses such as property management fees, legal fees, and utilities also qualify as deductions. Tracking these expenses accurately ensures maximum tax benefits and compliance with IRS regulations.

How does depreciation impact annual taxable income for real estate investors?

Depreciation reduces your annual taxable income by allowing real estate investors to deduct the cost of property improvements over time. This non-cash expense lowers taxable profits, enhancing cash flow without affecting actual income. Properly accounting for depreciation in your tax planning maximizes deductions and investment returns.

What documentation is essential to maintain for optimizing annual real estate tax filings?

You must maintain detailed records of property purchase agreements, rental income statements, expense receipts, and depreciation schedules to optimize annual real estate tax filings. Accurate documentation of mortgage interest, property taxes, and capital improvements supports maximizing deductible expenses. Keeping organized records ensures compliance and facilitates efficient tax planning for real estate investments.

How can 1031 exchanges be utilized in annual tax planning for real estate portfolios?

1031 exchanges allow real estate investors to defer capital gains taxes by reinvesting proceeds from sold properties into like-kind properties, optimizing tax liabilities annually. Utilizing this strategy in tax planning preserves investment capital and enhances portfolio growth without immediate tax burdens. Incorporating 1031 exchanges maximizes tax deferral benefits, crucial for effective annual tax planning in real estate portfolios.

What are the implications of passive activity loss rules on yearly real estate investment taxes?

Passive activity loss (PAL) rules limit the ability of real estate investors to deduct losses from rental properties against other income, impacting annual tax planning. Investors must carefully track and categorize income and losses to optimize tax benefits under IRS Section 469. Effective tax strategies can leverage allowable passive losses to reduce taxable income in profitable years.