The Annually Asset Depreciation Excel Template for Photographers helps track the decreasing value of photography equipment over time, ensuring accurate financial records. It simplifies tax calculations by providing a clear yearly depreciation schedule tailored to commonly used photography assets. Using this template can optimize expense reporting and enhance budgeting for equipment upgrades.

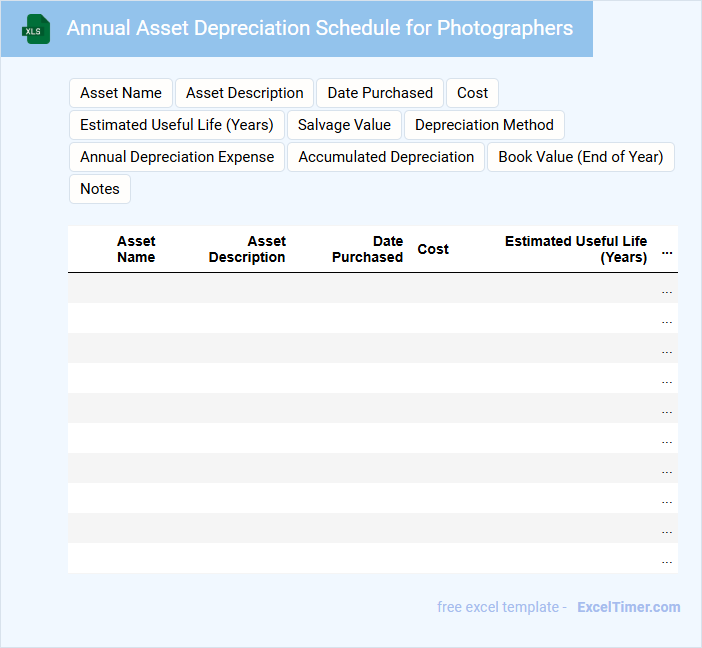

Annual Asset Depreciation Schedule for Photographers

What information is typically included in an Annual Asset Depreciation Schedule for Photographers? This type of document usually contains a detailed list of photography equipment and assets, their purchase dates, original costs, and calculated depreciation values over time. It helps photographers track the decreasing value of their assets for tax and accounting purposes, ensuring accurate financial reporting and asset management.

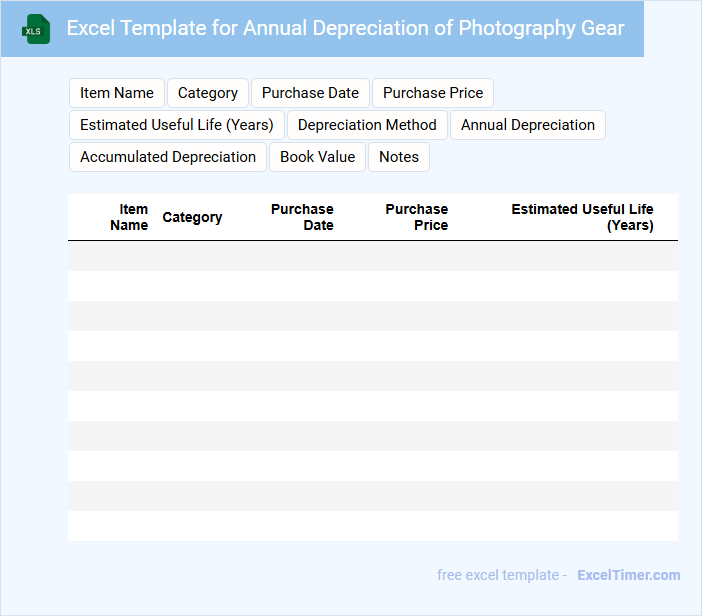

Excel Template for Annual Depreciation of Photography Gear

This document is an Excel template designed to track and calculate the annual depreciation of photography equipment. It helps photographers manage asset values and plan for future replacements effectively.

- Include detailed lists of all photography gear with purchase dates and costs.

- Incorporate depreciation methods suitable for electronic and technical equipment.

- Provide clear summaries of annual depreciation values for budget planning.

Yearly Asset Depreciation Tracker for Photographers

A Yearly Asset Depreciation Tracker for photographers is a specialized document that helps monitor the decreasing value of photography equipment over time. It typically contains details such as purchase dates, original costs, depreciation rates, and current book values. Keeping this tracker updated ensures accurate financial records and aids in tax reporting and equipment management.

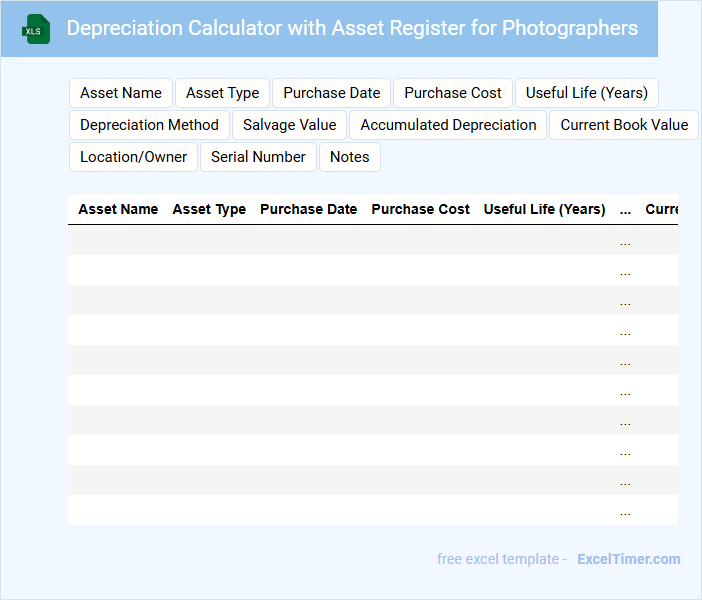

Depreciation Calculator with Asset Register for Photographers

A Depreciation Calculator with Asset Register for Photographers is a specialized tool designed to track and calculate the decreasing value of photography equipment over time. This document typically contains detailed listings of assets, including purchase date, cost, and accumulated depreciation. It is essential for photographers to maintain accurate records to optimize tax deductions and manage asset replacement effectively.

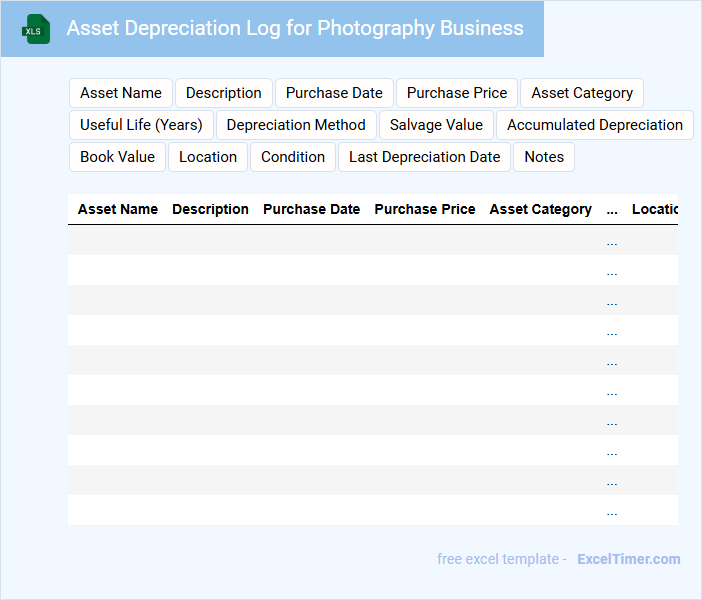

Asset Depreciation Log for Photography Business

An Asset Depreciation Log for a Photography Business typically contains detailed records of the depreciation values of various photography equipment over time. This document helps track the reduction in value for tax and accounting purposes effectively.

- Include the purchase date and original cost of each asset.

- Record the depreciation method used (e.g., straight-line or declining balance).

- Update the log regularly to reflect changes in asset value and condition.

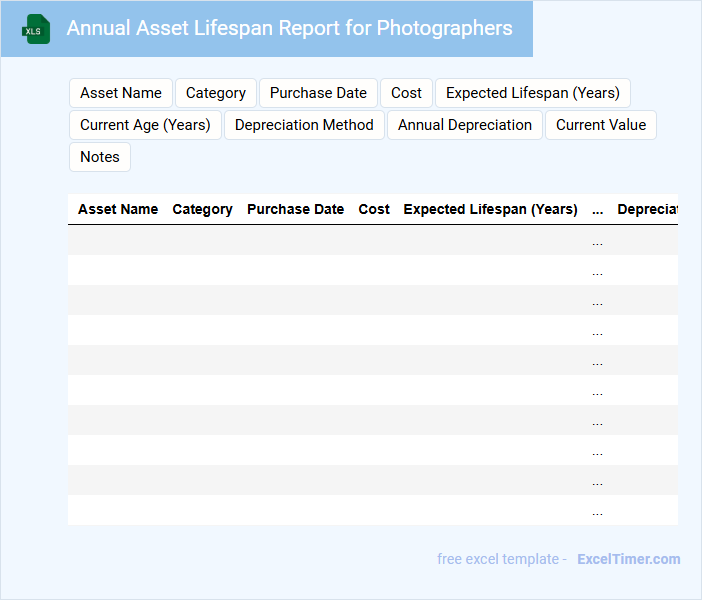

Annual Asset Lifespan Report for Photographers

The Annual Asset Lifespan Report for Photographers typically contains detailed evaluations of equipment durability, usage statistics, and recommendations for maintenance or replacement.

- Equipment Inventory: A comprehensive list of all photographic gear including cameras, lenses, and accessories.

- Performance Analysis: Assessment of the condition and effectiveness of each asset over the year.

- Replacement Planning: Strategic suggestions for upgrading or retiring outdated or damaged equipment.

Equipment Depreciation Sheet with Formulas for Photographers

An Equipment Depreciation Sheet is a crucial document that helps photographers track the decreasing value of their gear over time. It typically includes the purchase date, initial cost, expected lifespan, and depreciation method used.

For photographers, maintaining this sheet ensures accurate financial records and better asset management. Including clear formulas for straight-line or declining balance depreciation can simplify calculations and improve reporting efficiency.

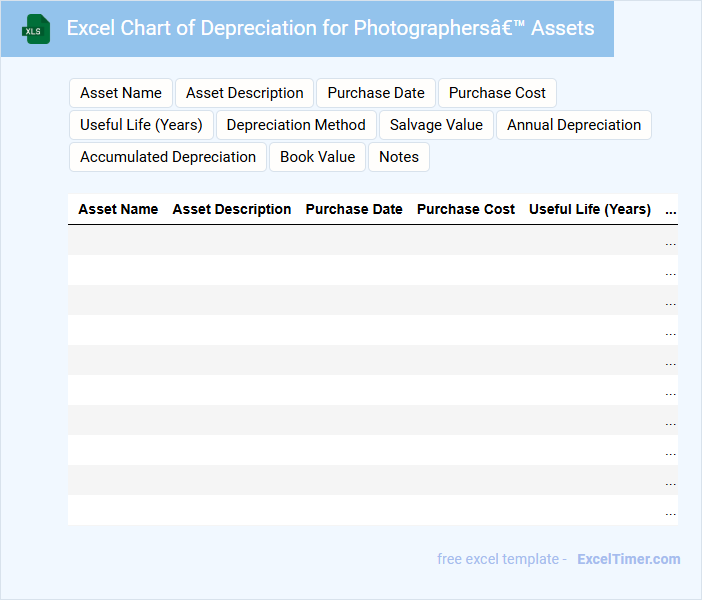

Excel Chart of Depreciation for Photographers’ Assets

An Excel Chart of Depreciation for photographers' assets typically contains detailed information about the decreasing value of equipment such as cameras, lenses, and lighting over time. It includes asset purchase dates, initial costs, depreciation methods, and accumulated depreciation values. This document is essential for tracking the financial health of photography businesses and planning future investments.

It is important to ensure accuracy in recording purchase prices and depreciation rates to reflect true asset value. Including visual charts can help in quickly assessing asset performance. Regularly updating the chart allows for better budgeting and tax reporting.

Annual Asset Value Tracker with Depreciation for Photographers

What information is typically included in an Annual Asset Value Tracker with Depreciation for Photographers? This document usually contains a detailed list of photography equipment, including purchase dates, original costs, and current valuations adjusted for depreciation. It serves to monitor asset values over time, helping photographers manage their investments and prepare for tax deductions or insurance claims effectively.

What is an important consideration when maintaining this document? Regular updates and accurate depreciation calculations are crucial to reflect the true worth of the equipment, ensuring financial records remain reliable and useful for decision-making and financial planning.

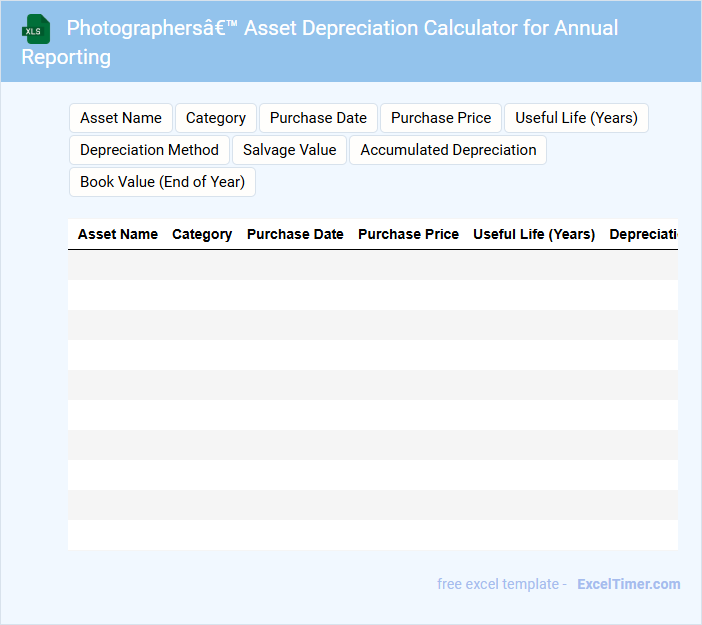

Photographers’ Asset Depreciation Calculator for Annual Reporting

Photographers' Asset Depreciation Calculator for Annual Reporting typically contains detailed records of equipment costs, usage periods, and depreciation methods to accurately track asset value over time.

- Cost Tracking: It includes original purchase prices and any additional expenses related to maintenance or upgrades.

- Depreciation Methods: Common methods like straight-line or declining balance are outlined for consistent annual calculations.

- Usage Documentation: Records of usage periods help determine depreciation schedules and support financial reporting accuracy.

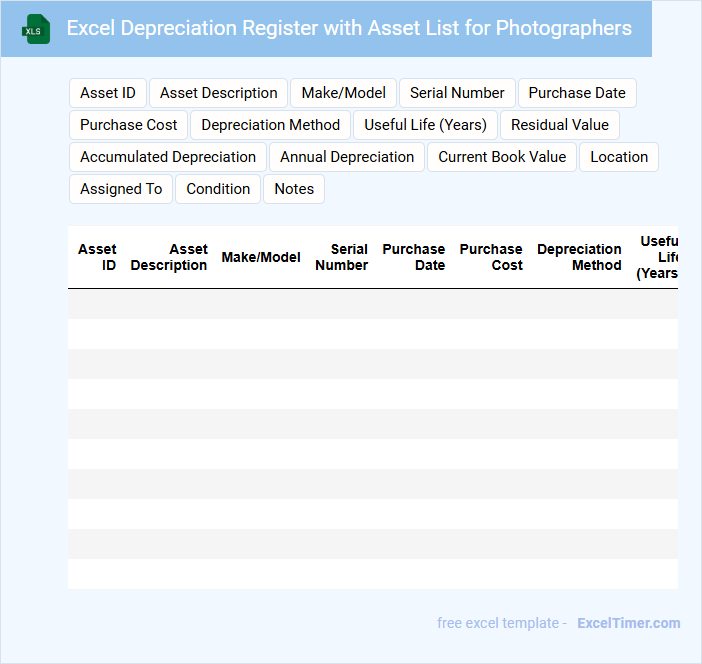

Excel Depreciation Register with Asset List for Photographers

What information does an Excel Depreciation Register with Asset List for Photographers typically include? It usually contains detailed records of photographic equipment, purchase dates, costs, and accumulated depreciation. This document helps photographers track asset value over time and manage financial reporting accurately.

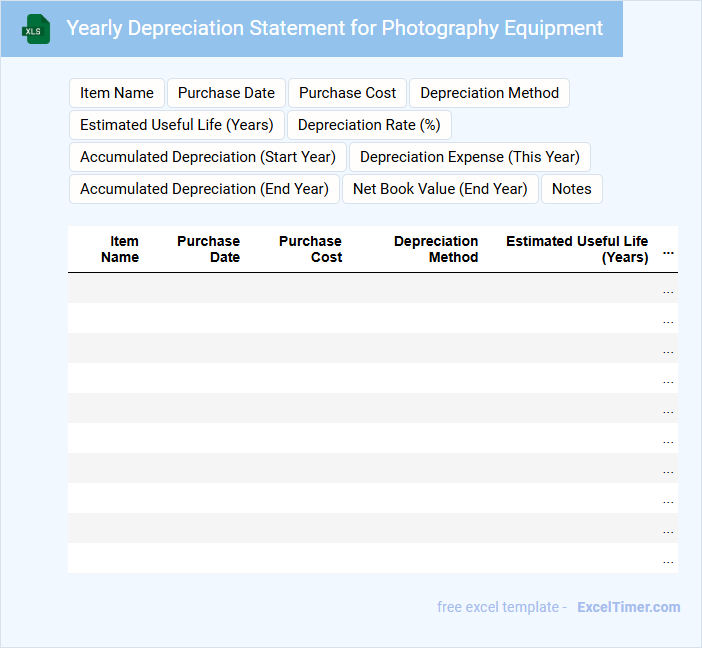

Yearly Depreciation Statement for Photography Equipment

A Yearly Depreciation Statement for Photography Equipment typically outlines the annual loss in value of photographic assets due to usage and obsolescence.

- Asset Identification: Clearly list each piece of equipment with its purchase date and original cost.

- Depreciation Method: Specify the calculation method used, such as straight-line or declining balance.

- End-of-Year Value: Provide the book value after subtracting depreciation for accurate financial tracking.

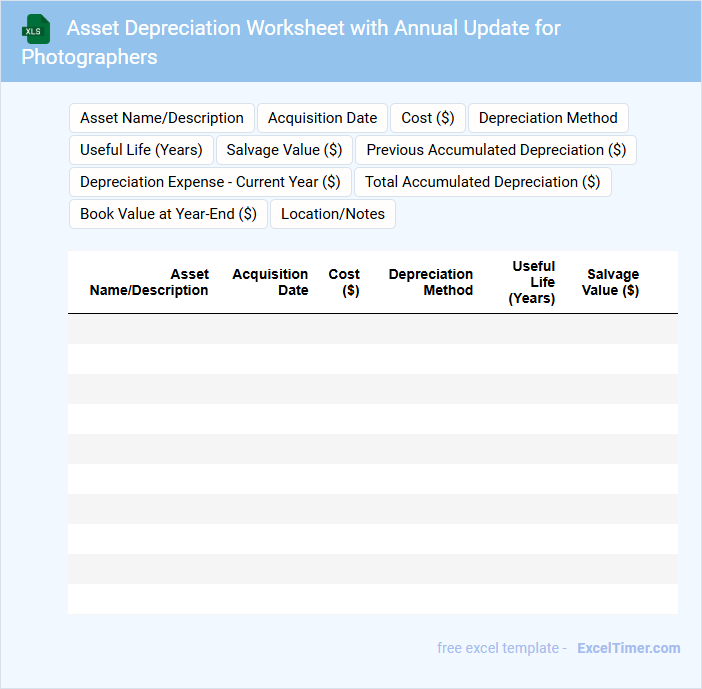

Asset Depreciation Worksheet with Annual Update for Photographers

An Asset Depreciation Worksheet is a vital document that helps photographers systematically track the depreciation of their equipment over time. Typically, it contains detailed information about each asset's purchase date, cost, useful life, and accumulated depreciation. This allows for accurate financial reporting and tax deductions by updating values annually.

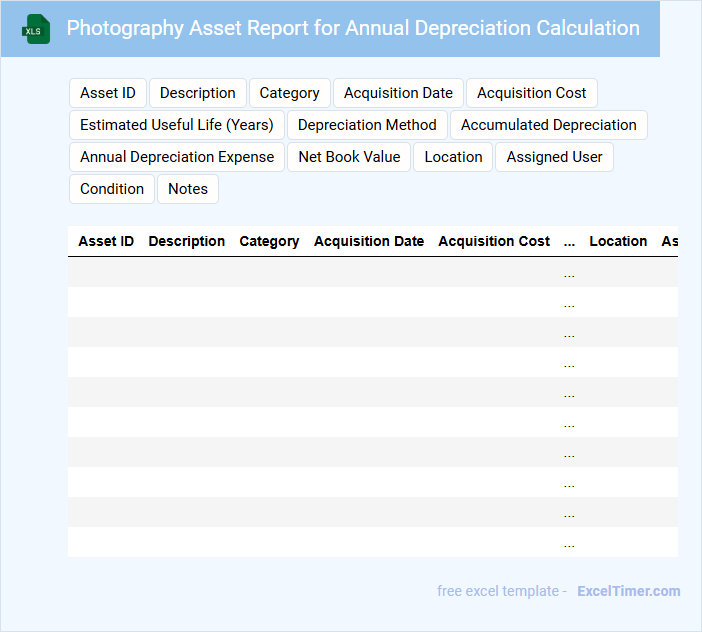

Photography Asset Report for Annual Depreciation Calculation

Photography Asset Reports typically contain detailed information about various photographic equipment, including purchase dates, depreciation schedules, and current valuations. This document is essential for accurately calculating the annual depreciation of photography assets, ensuring precise financial reporting. Key elements such as asset condition, usage history, and maintenance records are recommended for inclusion to enhance the report's reliability.

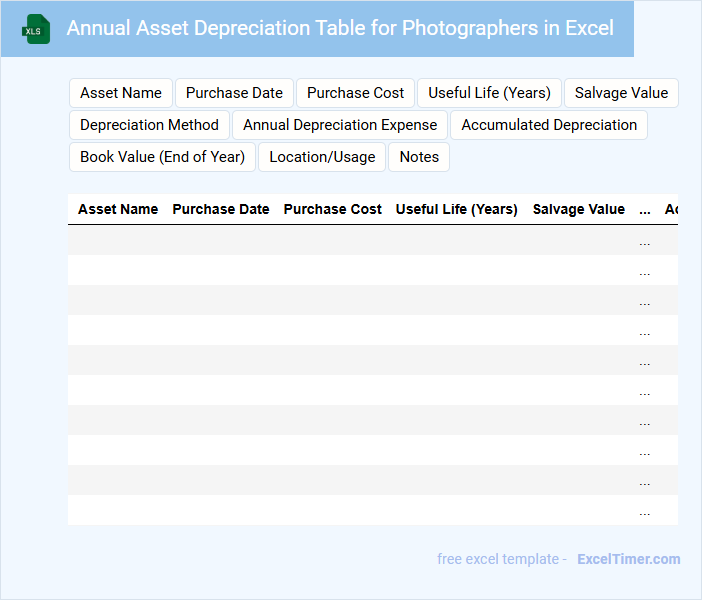

Annual Asset Depreciation Table for Photographers in Excel

What information is typically contained in an Annual Asset Depreciation Table for Photographers in Excel? This document usually includes a detailed list of photographic equipment such as cameras, lenses, and lighting gear, along with their initial cost, depreciation rate, and accumulated depreciation over time. It helps photographers track the decreasing value of their assets for financial planning and tax purposes.

What important factors should photographers consider when creating this depreciation table? It is essential to use accurate purchase dates and realistic depreciation methods, like straight-line or declining balance, to reflect true asset value. Additionally, periodically updating the table ensures precise asset management and compliance with accounting standards.

What is the annual depreciation rate for photography equipment in Excel?

The annual depreciation rate for photography equipment in Excel is commonly set between 10% and 25%, depending on the asset's useful life and expected wear. Photographers typically apply the straight-line method by dividing the asset's initial cost by its estimated useful years. Excel formulas like =Cost/Useful_Life or =SLN(Cost, Salvage, Life) calculate precise annual depreciation values.

How do you set up a straight-line depreciation formula for cameras and lenses in Excel?

Set up straight-line depreciation in Excel by entering the initial cost of cameras and lenses, their expected useful life in years, and the salvage value. Use the formula =(Cost - Salvage Value) / Useful Life to calculate annual depreciation expense per asset. Apply this formula across each asset row to track yearly depreciation consistently throughout your asset list.

Which Excel functions help track accumulated depreciation for photo assets year by year?

Excel functions such as SLN (Straight-Line Depreciation), DB (Declining Balance), and DDB (Double Declining Balance) calculate annual depreciation for photo assets. The SUM function tracks accumulated depreciation by summing yearly values across periods. Combining these with cell referencing enables precise year-by-year depreciation tracking in photography asset management.

How can you use Excel to compare initial asset costs to their book value over time?

Excel helps photographers track asset depreciation by calculating yearly reductions from initial costs to book values using functions like SLN or DB. Creating depreciation schedules with columns for purchase price, accumulated depreciation, and current book value offers clear visual comparisons. Charts and conditional formatting further illustrate asset value declines, enhancing financial decision-making over time.

What method does Excel offer to automate depreciation schedules for multiple photography assets?

Excel offers the SLN (Straight-Line), DB (Declining Balance), and DDB (Double Declining Balance) functions to automate annual asset depreciation schedules for multiple photography equipment. These built-in functions simplify calculating consistent depreciation over the assets' useful lives. Using asset purchase cost, salvage value, and estimated lifespan, photographers can efficiently manage and forecast equipment depreciation in their Excel sheets.