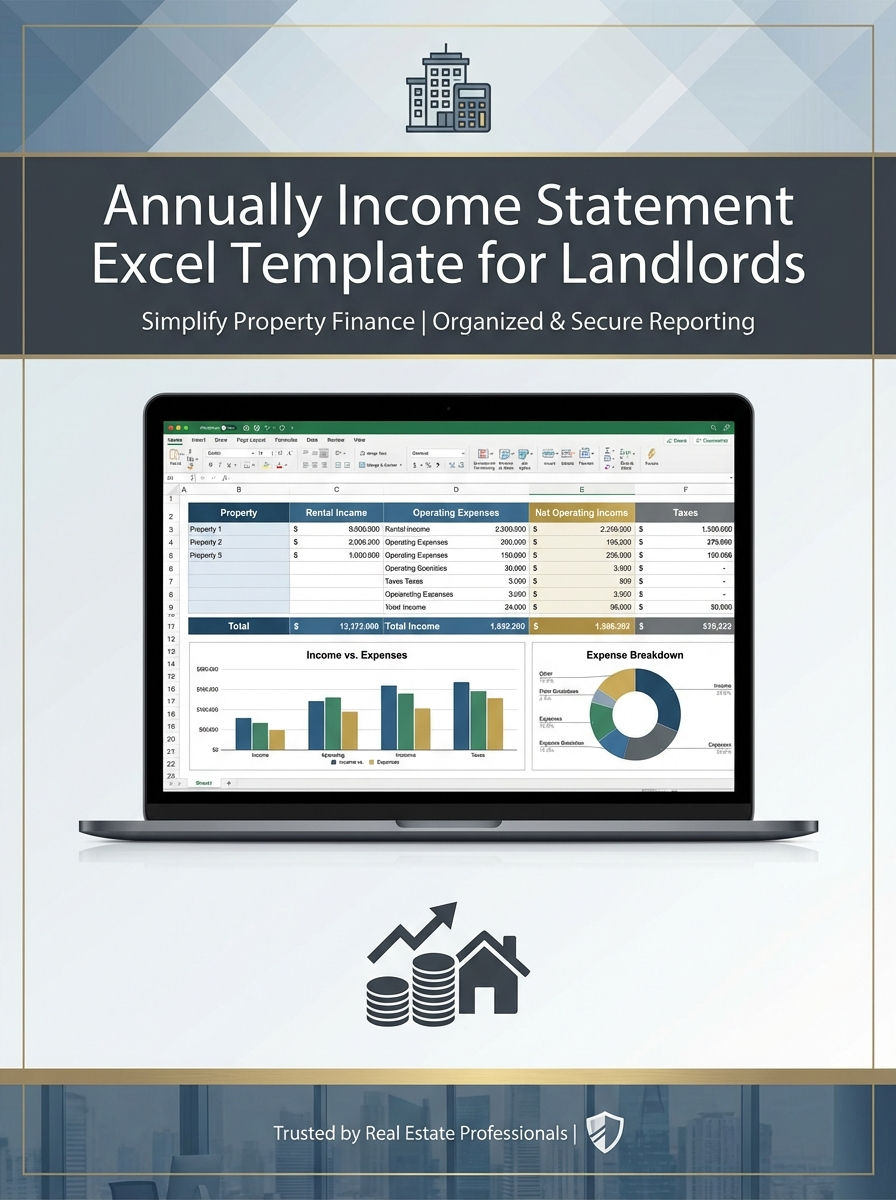

The Annually Income Statement Excel Template for Landlords provides a streamlined way to track rental income, expenses, and net profit over the year. Its user-friendly design helps landlords manage financial records efficiently, ensuring accurate reporting and tax preparation. This template is essential for maximizing rental property profitability and maintaining organized financial documentation.

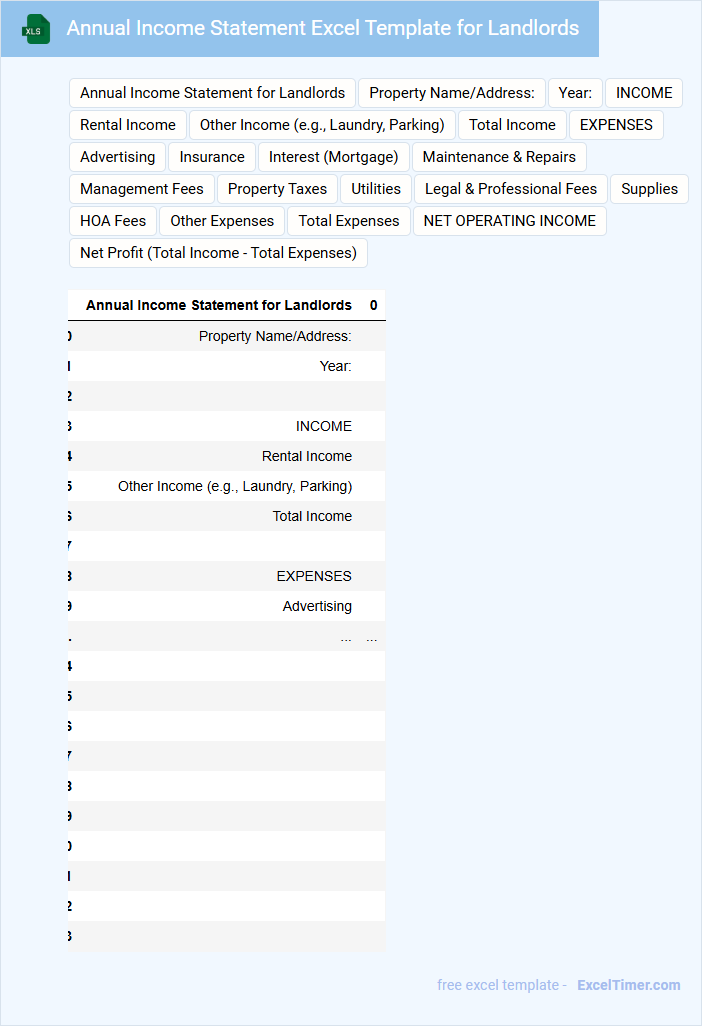

Annual Income Statement Excel Template for Landlords

What information is typically included in an Annual Income Statement Excel Template for Landlords? This document usually contains detailed records of rental income, property-related expenses, and net profit or loss for the year. It helps landlords track financial performance and make informed decisions about property management and taxation.

What is an important feature to consider when using this template? Ensuring the template clearly categorizes income and expenses, such as rent received, maintenance costs, and mortgage payments, is crucial for accuracy and ease of use. Additionally, having summary sections for total income, total expenses, and net income enhances financial analysis and reporting.

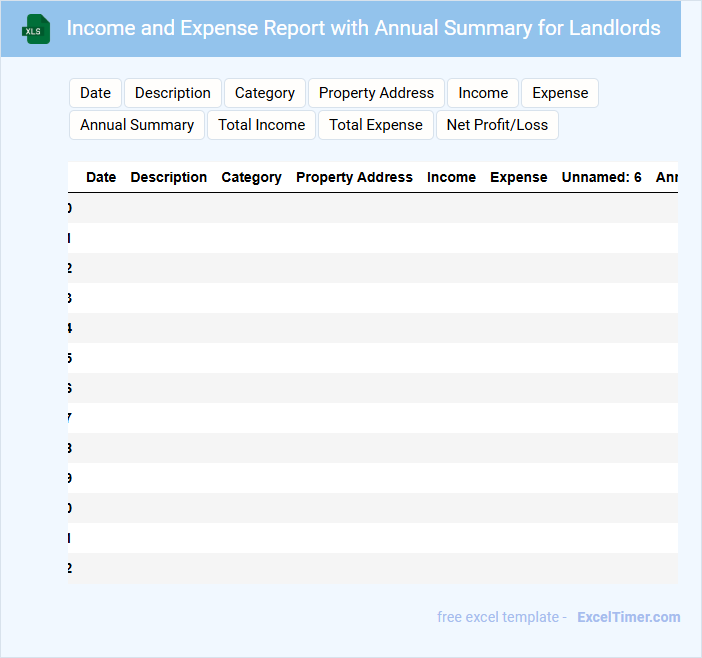

Income and Expense Report with Annual Summary for Landlords

An Income and Expense Report with an Annual Summary for Landlords typically contains detailed records of rental income received, expenses incurred for property maintenance, and other financial transactions related to managing rental properties. This document provides a clear overview of the financial performance of rental units over the year, helping landlords track profitability and prepare for tax filing. It is essential for landlords to regularly update this report to maintain accurate financial records and make informed decisions for future investments.

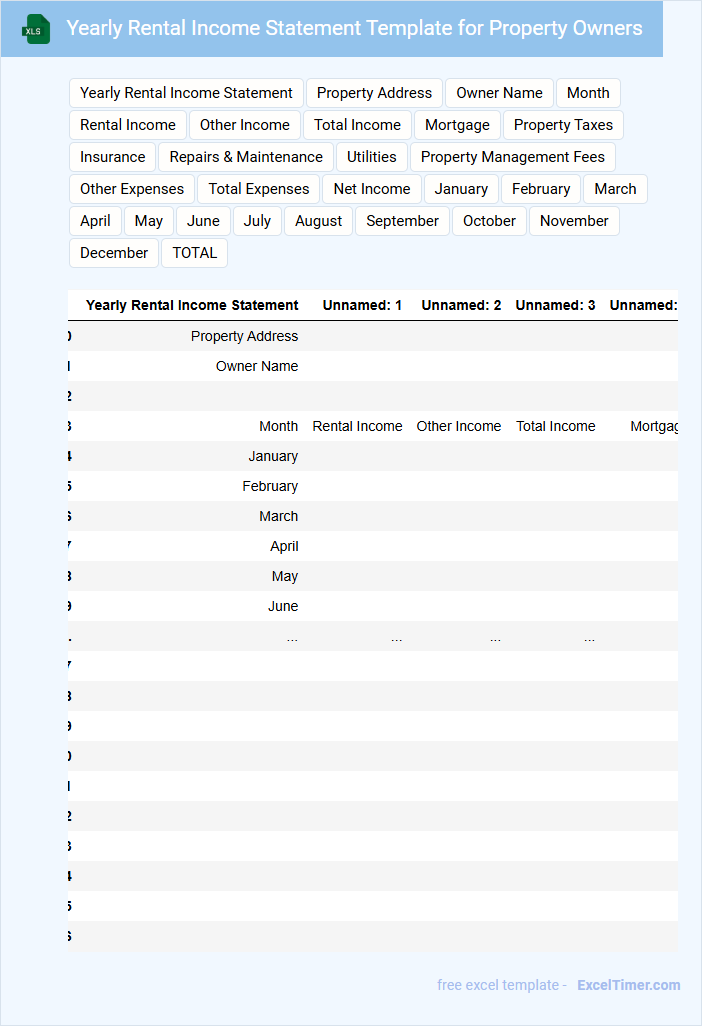

Yearly Rental Income Statement Template for Property Owners

A Yearly Rental Income Statement Template is typically used by property owners to track all income generated from rental properties over the course of a year. It includes details such as rental income, expenses, taxes paid, and net profit. This document helps landlords maintain accurate financial records for tax reporting and financial analysis.

One important suggestion is to ensure consistency in recording all rental transactions and expenses throughout the year to maintain accuracy. Including a summary section for total earnings and deductions can aid in quick financial reviews and decision-making.

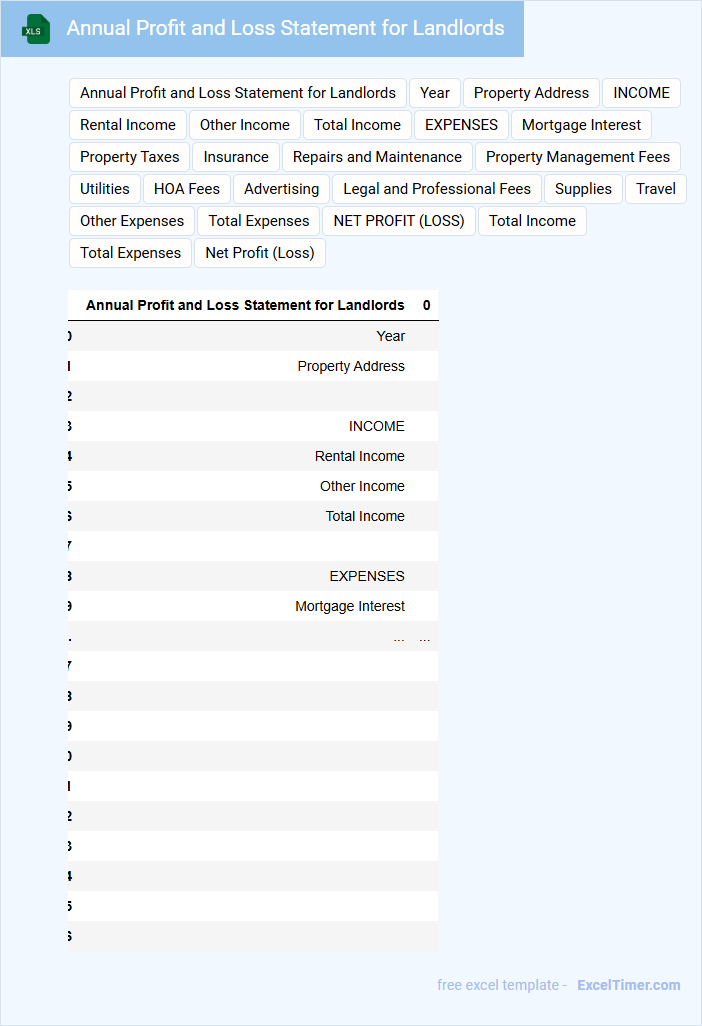

Annual Profit and Loss Statement for Landlords

The Annual Profit and Loss Statement for landlords is a financial document summarizing income and expenses related to rental properties over a year. It highlights the net profit or loss from rental activities, essential for tax reporting and financial planning.

This statement usually contains rental income, maintenance costs, mortgage interest, taxes, and other property-related expenses. Reviewing these items helps landlords make informed decisions about property management and investment strategies.

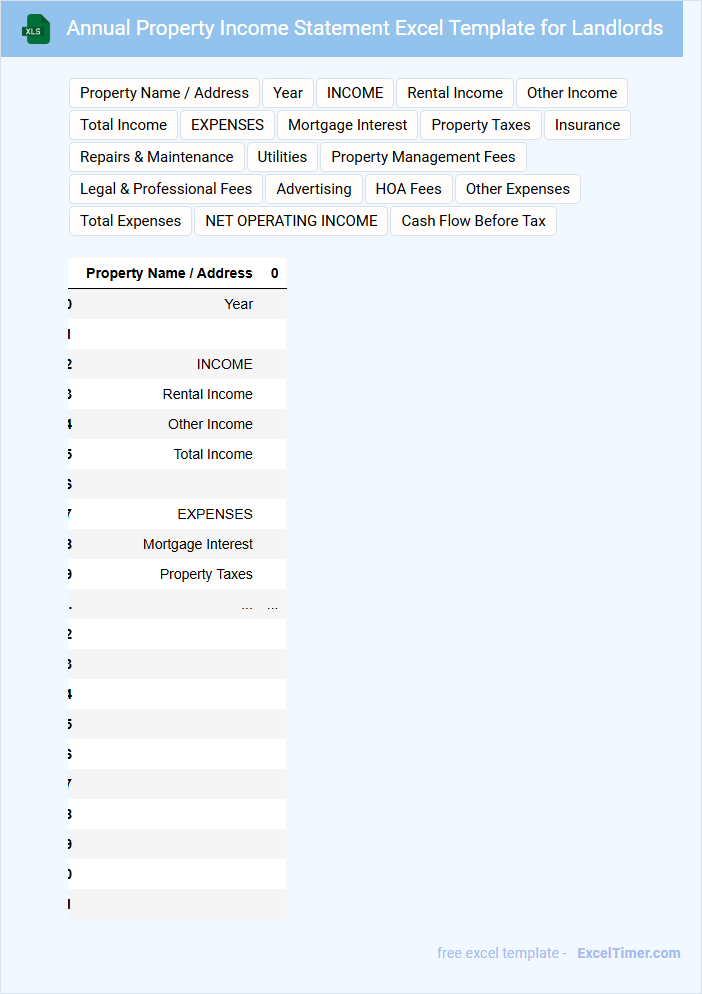

Annual Property Income Statement Excel Template for Landlords

An Annual Property Income Statement Excel Template for landlords typically contains detailed records of rental income, expenses, and net profit from properties owned over a year. This document helps landlords track financial performance and ensure accurate accounting. It is essential for budgeting, tax preparation, and assessing investment returns.

Landlord Annual Earnings Statement with Expense Tracker

The Landlord Annual Earnings Statement with Expense Tracker typically contains detailed records of rental income and all related expenses incurred over the year. It is an essential document for landlords to monitor profitability and financial health of rental properties.

Important elements to include are precise income entries, categorized expense tracking, and summary totals for easy analysis. Regularly updating this statement ensures accurate reporting for tax purposes and effective property management.

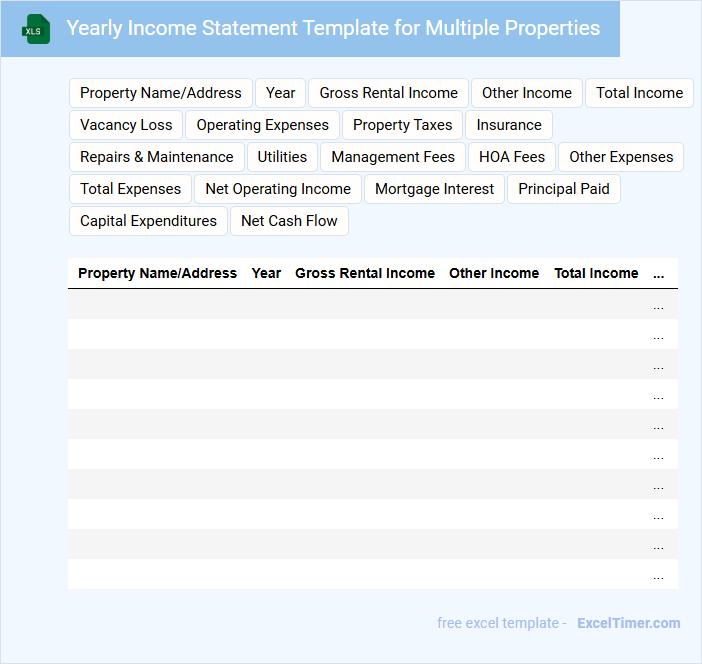

Yearly Income Statement Template for Multiple Properties

What information is typically included in a Yearly Income Statement Template for Multiple Properties? This document usually contains detailed revenue and expense data for each property over the year, including rent collected, maintenance costs, taxes, and other operational expenses. It helps property owners track financial performance, compare profits across properties, and make informed investment decisions.

What is an important suggestion when using this template? Ensure that all income and expenses are categorized consistently and updated regularly to maintain accuracy. Including notes for unusual or one-time expenses can provide clearer insights when analyzing yearly financial trends.

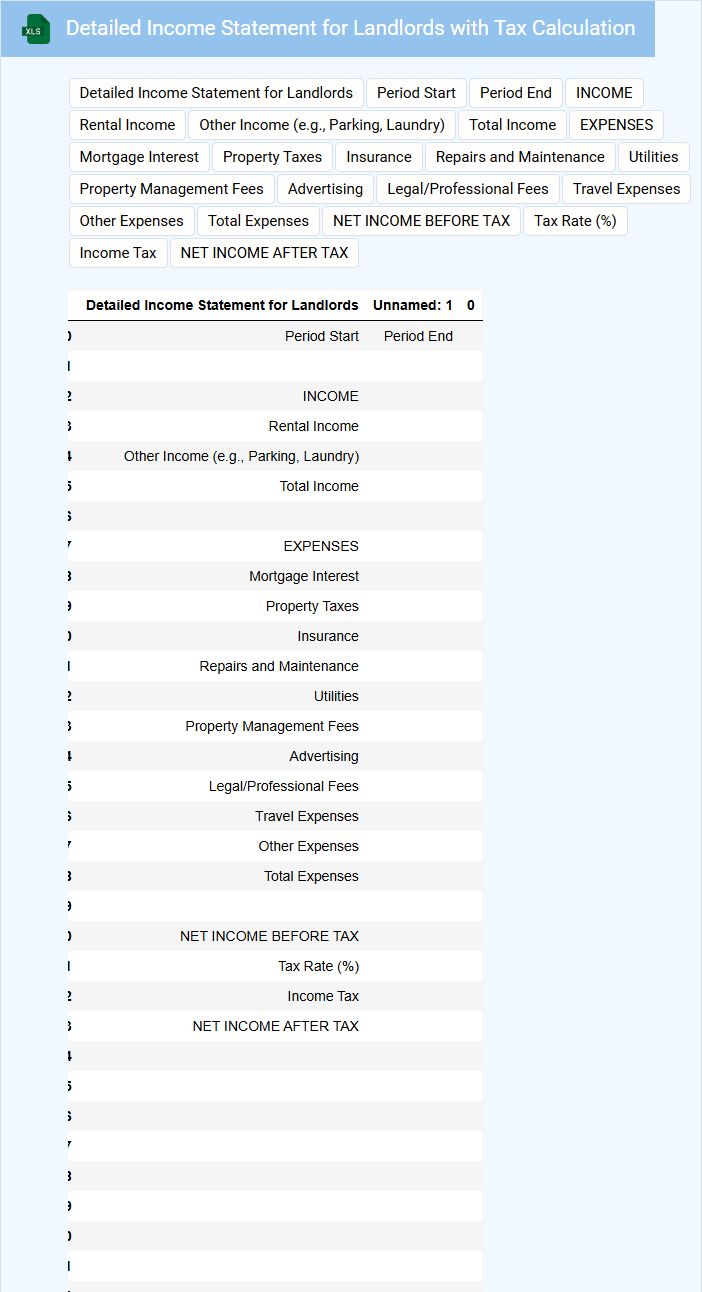

Detailed Income Statement for Landlords with Tax Calculation

A Detailed Income Statement for landlords typically contains a comprehensive breakdown of rental income, operating expenses, and net profit. It also includes adjustments for depreciation, interest, and other tax-deductible expenses to accurately reflect taxable income.

This document is essential for understanding the financial performance of rental properties and ensuring compliance with tax regulations. Key suggestions include keeping thorough records of all income and expenses and consulting with a tax professional to optimize deductions.

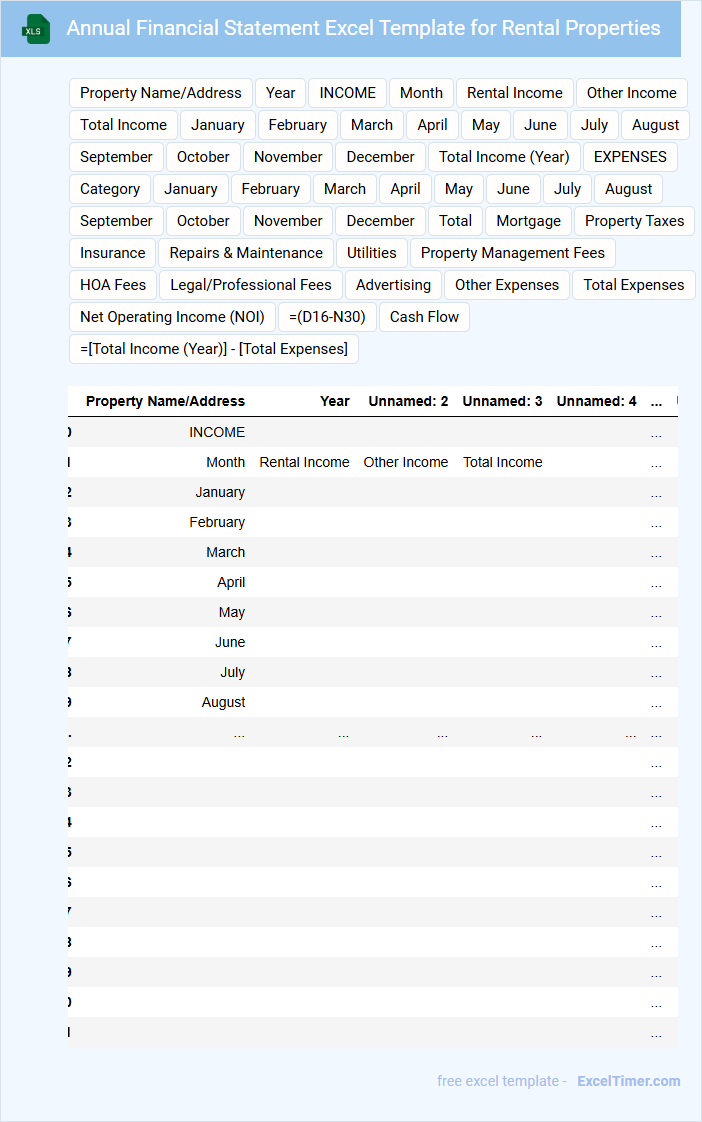

Annual Financial Statement Excel Template for Rental Properties

An Annual Financial Statement Excel Template for Rental Properties typically contains detailed income and expense records, balance sheets, and cash flow statements. This document helps landlords keep track of their financial performance over the year.

It is important to ensure accuracy in recording rental income and maintenance costs to get a clear financial picture. Consistently updating the template can aid in budgeting and tax preparation.

Annual Income Tracker with Statement for Landlords

An Annual Income Tracker with Statement for Landlords is a document that details the yearly rental income earned from properties. It helps landlords monitor their cash flow and ensure all payments are recorded accurately.

This document typically contains tenant payment schedules, total received rent, and any outstanding balances. Including clear breakdowns of income sources and dates is crucial for transparency and tax purposes.

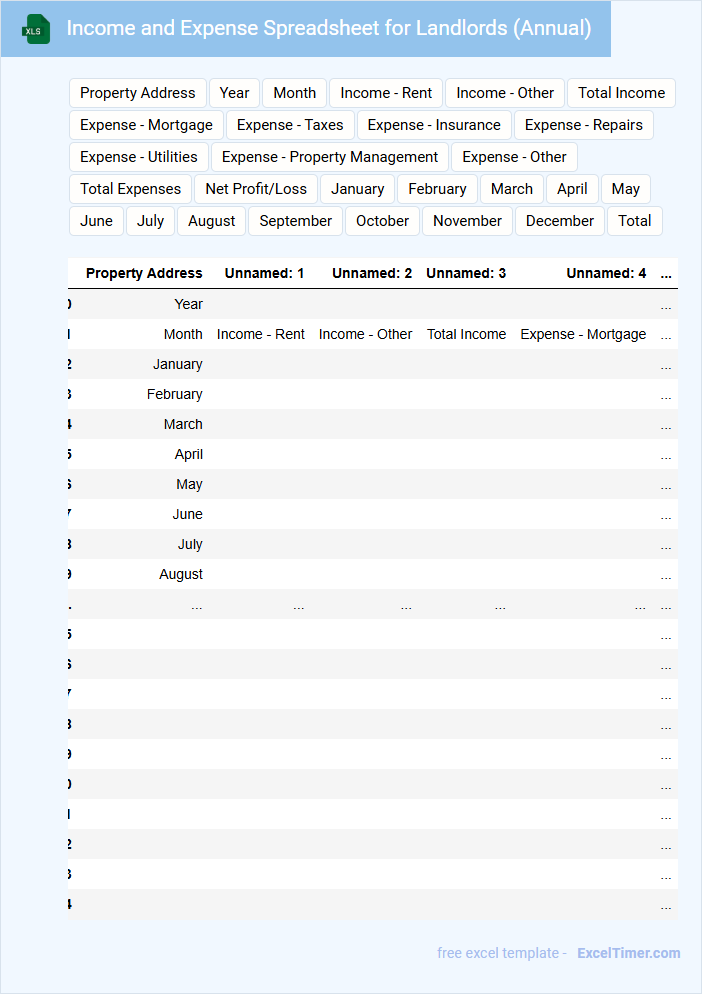

Income and Expense Spreadsheet for Landlords (Annual)

An Income and Expense Spreadsheet for Landlords (Annual) typically contains a detailed record of all rental income and property-related expenses throughout the year. This document helps landlords track cash flow, evaluate profitability, and prepare for tax filings. Accurate categorization and timely updates are essential to ensure financial clarity and maximize deductions.

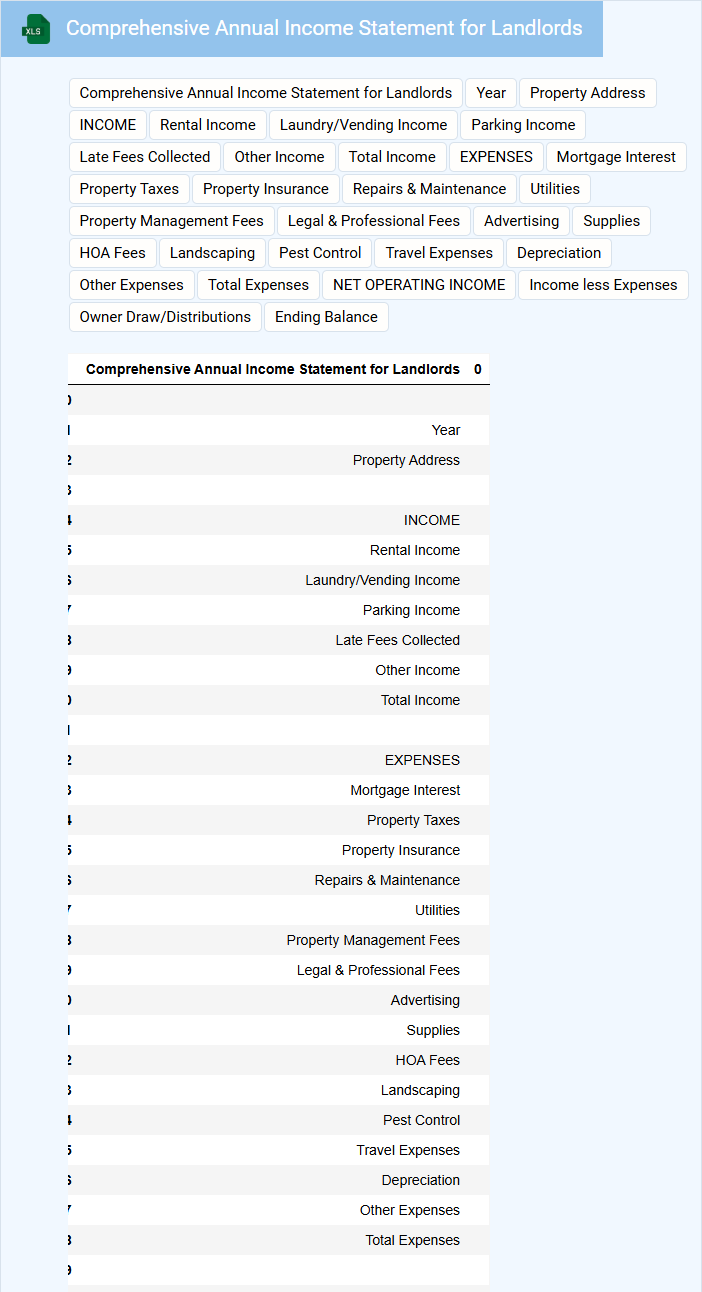

Comprehensive Annual Income Statement for Landlords

What information does a Comprehensive Annual Income Statement for Landlords typically contain? This document usually includes detailed records of all rental income, expenses, and net profit related to property management over the year. It provides landlords with a clear financial overview, helping in budgeting, tax preparation, and assessing investment performance.

What is an important consideration when preparing this statement? Accuracy in tracking all income streams and expenses, including maintenance costs and vacancies, is crucial to reflect the true financial status. Consistent documentation ensures reliable data for decision-making and compliance with financial regulations.

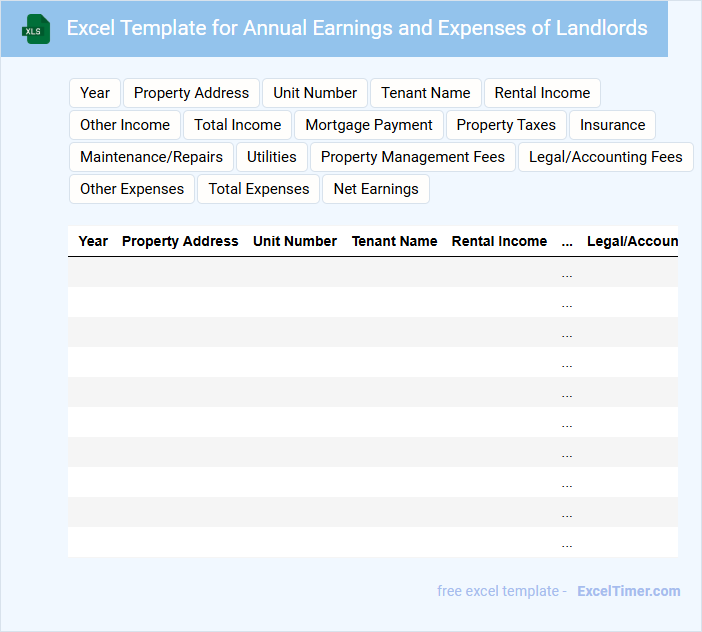

Excel Template for Annual Earnings and Expenses of Landlords

An Excel Template for Annual Earnings and Expenses of Landlords is designed to help property owners efficiently track their financial activities. It typically contains sections for rental income, maintenance costs, mortgage payments, and other related expenses. This document allows landlords to monitor profitability and prepare accurate tax reports.

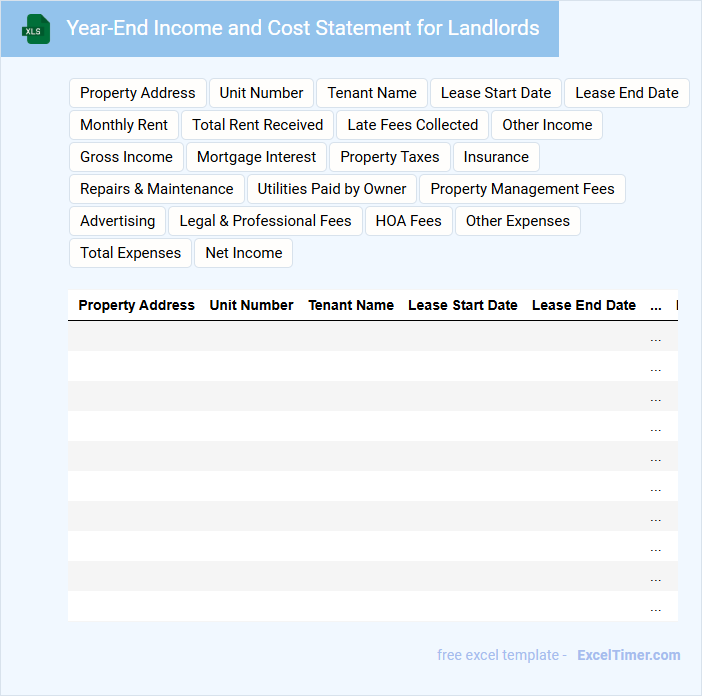

Year-End Income and Cost Statement for Landlords

The Year-End Income and Cost Statement for landlords is a crucial financial document that summarizes the total income generated and expenses incurred from rental properties throughout the year. It typically includes rental income, maintenance costs, property taxes, and other operational expenses. This statement helps landlords evaluate their net profit, prepare for taxes, and make informed decisions for future property investments.

Annual Rental Property Income Statement with Summary

What information is typically included in an Annual Rental Property Income Statement with Summary? This document usually contains details of all rental income received over the year, along with itemized expenses such as maintenance, property management fees, and taxes. It provides a clear overview of the net profit or loss generated by the property, helping landlords track financial performance.

Why is it important to include a summary in this income statement? The summary highlights key financial figures like total income, total expenses, and net income, making it easier to quickly assess the property's profitability. Including this section also aids in tax preparation and financial planning for future investments.

What are the main components of an annually Income Statement for landlords in Excel?

An annual income statement for landlords in Excel typically includes rental income, operating expenses such as maintenance and property management fees, and net operating income. It also covers non-operating expenses like mortgage interest and depreciation, culminating in the net income or profit for the year. These components help landlords analyze profitability and manage cash flow effectively.

How do you accurately categorize rental income and operating expenses on the statement?

Accurately categorize rental income by recording all tenant payments, including rent and fees, under recurring revenue. Operating expenses should include property management, maintenance, utilities, insurance, and taxes directly related to your rental properties. Proper classification ensures your annual income statement reflects true profitability and aids in effective financial analysis.

What formulas or functions are essential for calculating net operating income (NOI) in Excel?

To calculate net operating income (NOI) in your annual income statement for landlords, use the formula: =SUM(Total Rental Income) - SUM(Operating Expenses). Essential Excel functions include SUM to total income and expenses, and IFERROR to handle any calculation errors. These ensure accurate NOI analysis for effective property management.

How can you use Excel to track and summarize depreciation and mortgage interest deductions annually?

Use Excel to track annual depreciation by creating a fixed asset schedule that calculates monthly or yearly depreciation expense based on the asset's cost and useful life using functions like SLN. Record mortgage interest payments from loan statements and sum them annually with SUMIFS to capture interest portions in the deduction period. Summarize these deductions in a dedicated Income Statement worksheet, linking depreciation and mortgage interest totals to automatically update and support accurate landlord tax reporting.

What layout or template features optimize clarity and financial analysis for landlords in the Income Statement?

A clear annual Income Statement for landlords features categorized income and expense sections, including rental income, maintenance costs, and property taxes. Your template should use distinct columns for actual, budgeted, and variance figures to enhance financial analysis. Incorporating ratios like net operating income and cash flow margins optimizes clarity for informed decision-making.