![]()

The Bi-weekly Excel Template for Bill Payment Tracking helps organize and monitor expenses every two weeks, ensuring timely payments and avoiding late fees. It features customizable fields for due dates, payment amounts, and reminders to maintain financial discipline. Utilizing this template streamlines budget management and enhances cash flow visibility.

Bi-weekly Excel Template for Bill Payment Tracking

A bi-weekly Excel template for bill payment tracking typically contains structured data fields to monitor and manage recurring expenses every two weeks.

- Payment Dates: Clearly marked bi-weekly payment intervals to avoid missing due dates.

- Bill Categories: Organized sections for utilities, rent, subscriptions, and other expense types.

- Payment Status: Visual indicators such as checkboxes or color codes to track paid and unpaid bills efficiently.

Simple Tracker for Bi-weekly Bill Payments

What information does a simple tracker for bi-weekly bill payments usually contain? It typically includes details like the bill name, due date, payment amount, and payment status. This helps users keep organized and ensures timely payments to avoid late fees.

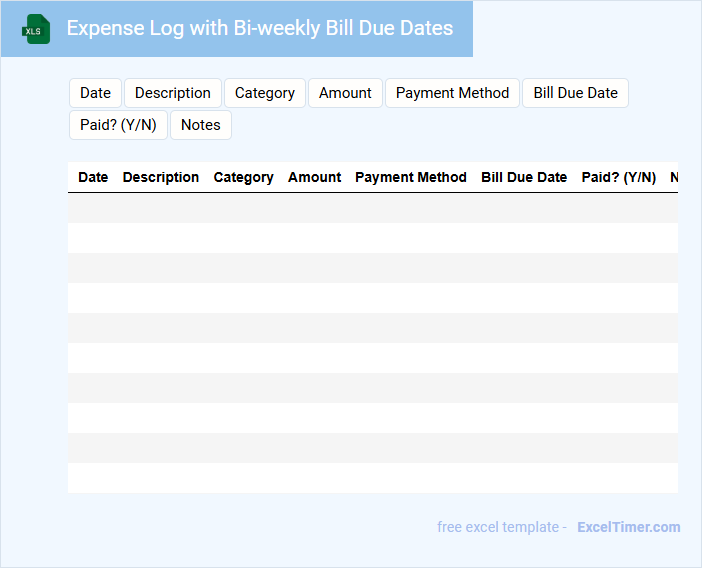

Expense Log with Bi-weekly Bill Due Dates

An Expense Log with bi-weekly bill due dates is a document used to track financial expenditures along with scheduled bill payments every two weeks. It helps individuals or businesses monitor cash flow and avoid late fees by organizing payment timelines clearly.

This type of log typically contains dates, amounts, categories of expenses, and notes about payment status or upcoming bills. To maximize its effectiveness, regularly updating the log and setting reminders for due dates are important practices.

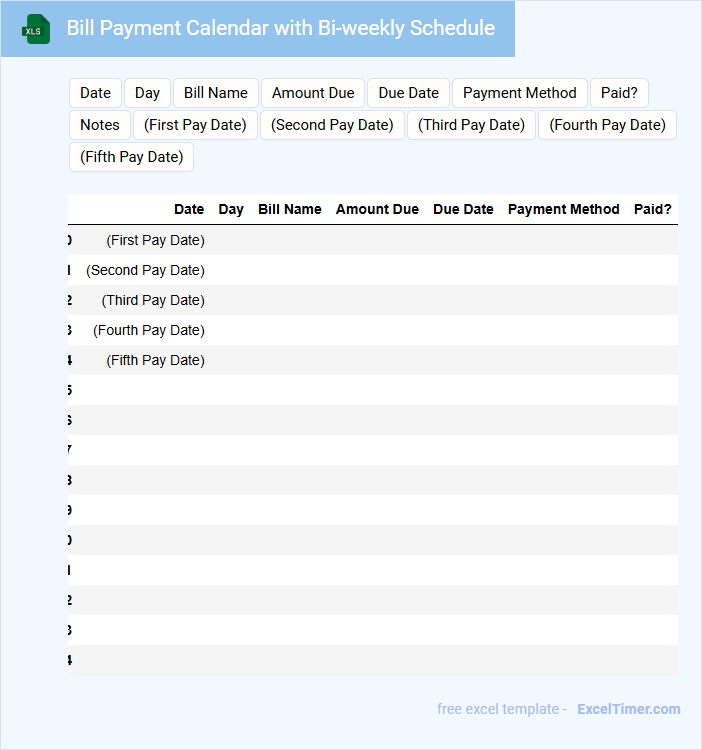

Bill Payment Calendar with Bi-weekly Schedule

A Bill Payment Calendar with a bi-weekly schedule is a document used to organize and track payment dates for recurring expenses. It helps individuals manage their finances by clearly displaying due dates occurring every two weeks. This type of schedule aligns payments with pay periods to avoid missed bills.

Typically, this calendar contains the list of bills, due dates, amounts, and payment methods. It ensures timely payments and helps in budgeting by forecasting cash flow on a bi-weekly basis. Including reminders and notes for each payment can improve financial discipline.

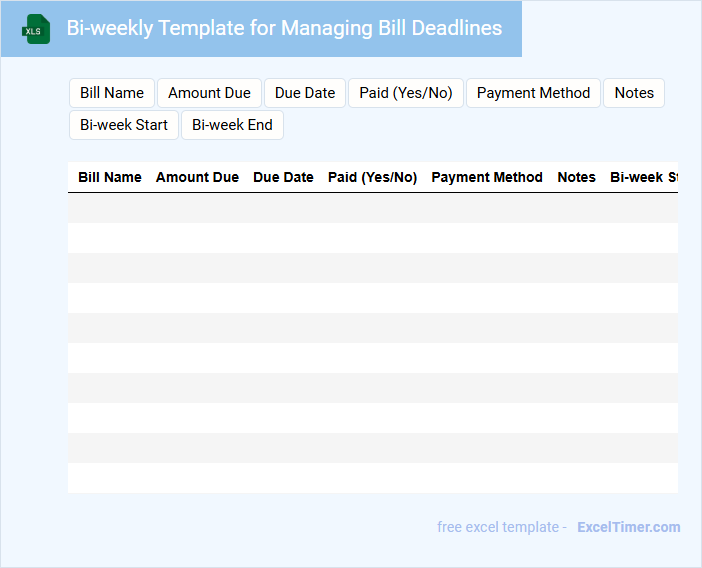

Bi-weekly Template for Managing Bill Deadlines

This document typically contains a schedule to track bill payment deadlines occurring every two weeks.

- Bill Names: Clearly list each bill to be paid within the bi-weekly period.

- Due Dates: Include exact due dates to ensure timely payments.

- Payment Status: Track whether the bills have been paid or are pending.

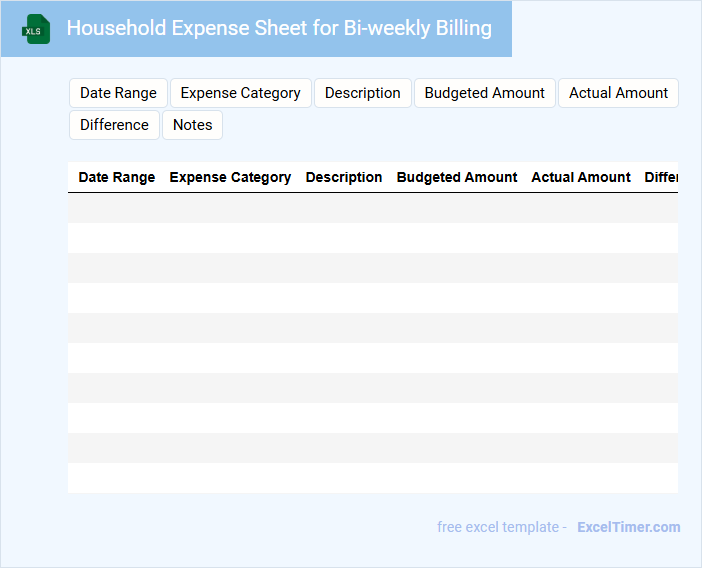

Household Expense Sheet for Bi-weekly Billing

What information is typically included in a Household Expense Sheet for Bi-weekly Billing? This document usually contains detailed records of all household expenses incurred within a two-week period, including utilities, groceries, rent or mortgage, and miscellaneous costs. It helps in tracking spending patterns and ensuring bills are paid on time.

What is an important consideration when managing a Household Expense Sheet for Bi-weekly Billing? Consistently updating the sheet every two weeks is crucial to maintain accurate financial records and avoid missing due dates. Categorizing expenses clearly also aids in budgeting and identifying areas to reduce costs.

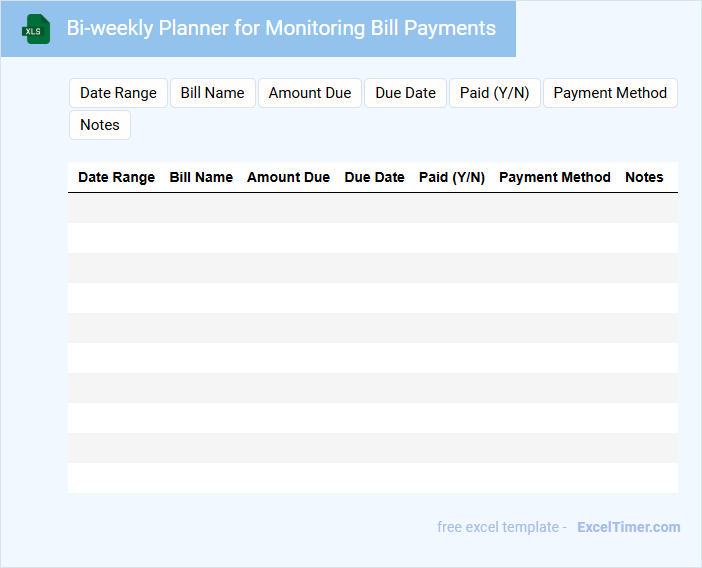

Bi-weekly Planner for Monitoring Bill Payments

A Bi-weekly Planner for Monitoring Bill Payments is a document designed to help individuals or households track their expenses and ensure timely payments every two weeks. It typically contains scheduled payment dates, amounts due, and reminders to avoid late fees.

- Include the list of recurring bills with due dates to maintain consistent tracking.

- Incorporate payment methods and confirmation sections for better accountability.

- Provide a running balance or budget overview to manage cash flow efficiently.

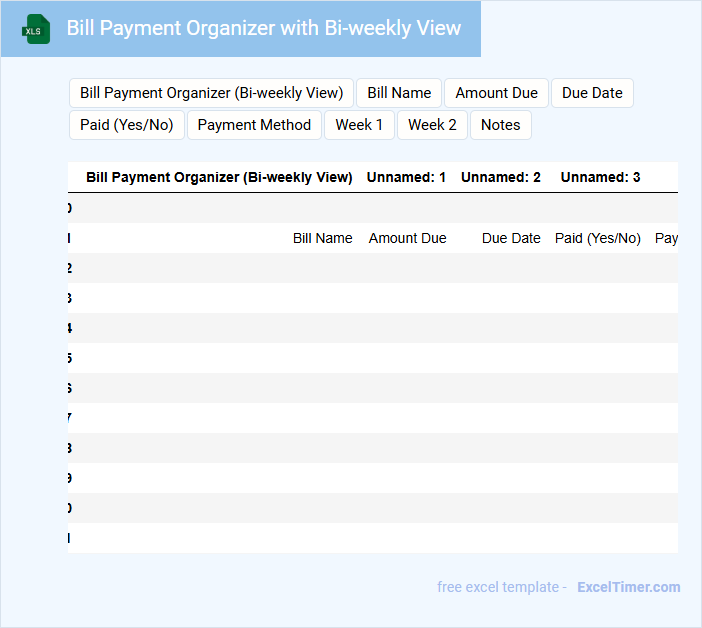

Bill Payment Organizer with Bi-weekly View

This document typically contains a detailed schedule of bill payments organized bi-weekly to help track due dates and manage finances efficiently. It offers a clear overview of upcoming financial obligations, reducing the risk of missed payments.

- Include all recurring and one-time bills along with their amounts and due dates.

- Highlight payment methods and confirmation details to ensure proper tracking.

- Update the organizer regularly to reflect any changes in bills or payment schedules.

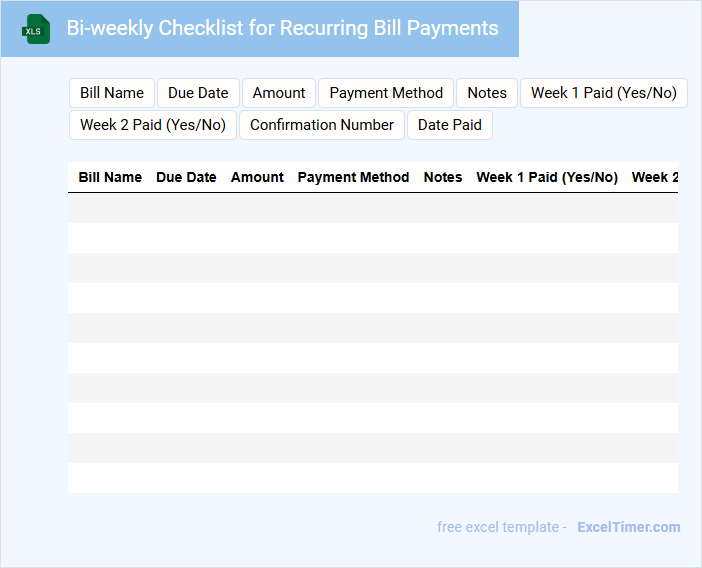

Bi-weekly Checklist for Recurring Bill Payments

This document, known as a Bi-weekly Checklist for recurring bill payments, typically contains a detailed list of all bills that must be paid every two weeks to avoid late fees. It ensures that every payment is accounted for and scheduled accordingly.

The checklist usually includes payment due dates, amount due, payment methods, and confirmation spaces. To maximize efficiency, always double-check the payment amounts and keep records of all transactions.

Payment Schedule with Bi-weekly Tracking

A Payment Schedule with Bi-weekly Tracking document typically outlines the detailed timing and amounts of payments made every two weeks. It helps in managing cash flow efficiently and ensuring timely transactions between parties. This document often includes dates, payment amounts, and balance updates for clear financial tracking.

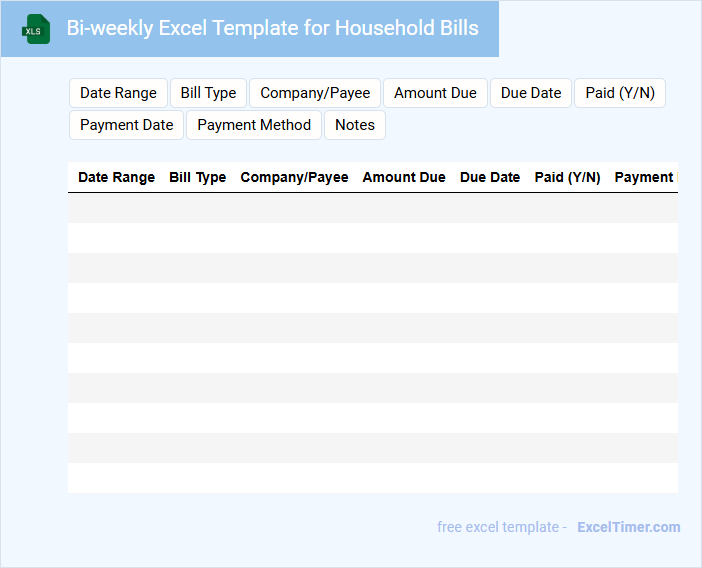

Bi-weekly Excel Template for Household Bills

A Bi-weekly Excel Template for Household Bills is typically designed to help users track and manage their recurring expenses every two weeks. This document usually contains sections for listing bill types, due dates, amounts, and payment status. An important feature to include is a summary table that automatically calculates total expenses and outstanding balances.

Monthly and Bi-weekly Bill Payment Tracker

What information is typically included in a Monthly and Bi-weekly Bill Payment Tracker? This document usually contains details about various bills such as due dates, payment amounts, and payment status to help individuals stay organized. It also includes sections for tracking payment methods and notes for any discrepancies or reminders.

What is an important consideration when using a Monthly and Bi-weekly Bill Payment Tracker? Consistency in updating the tracker after each payment ensures accurate financial management and prevents missed deadlines. Additionally, categorizing bills by type and priority can improve budgeting and timely payments.

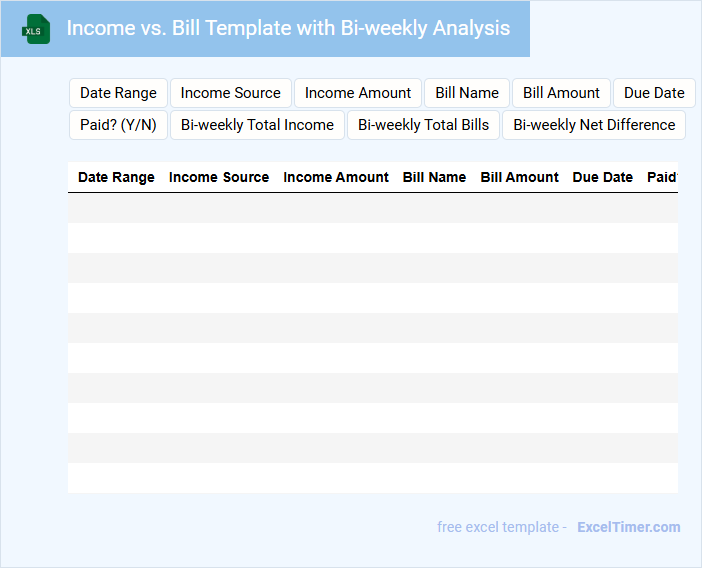

Income vs. Bill Template with Bi-weekly Analysis

This document typically contains a detailed comparison of income and expenses analyzed on a bi-weekly basis to help manage personal or business finances effectively.

- Income Tracking: Record all sources of income within each bi-weekly period for accurate budgeting.

- Expense Categorization: List and categorize bills and expenses to identify spending patterns.

- Bi-Weekly Analysis: Compare income versus bills every two weeks to ensure financial balance and prepare for future costs.

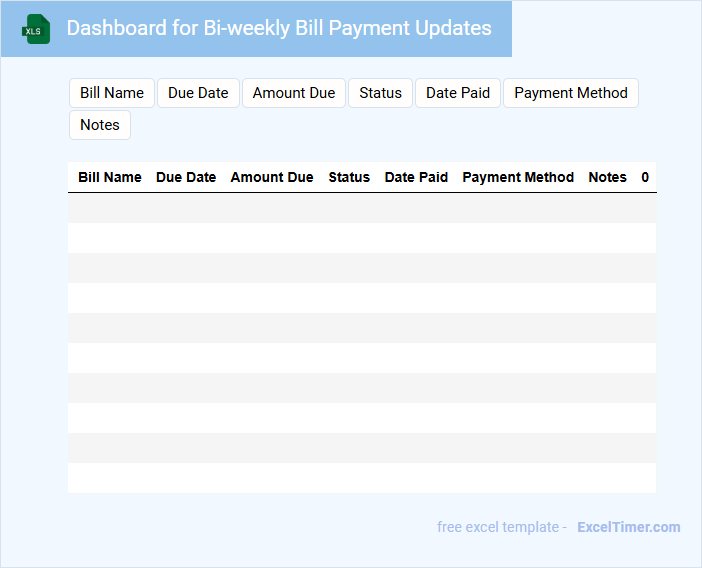

Dashboard for Bi-weekly Bill Payment Updates

A dashboard for bi-weekly bill payment updates typically contains summarized financial data, including due dates, payment statuses, and outstanding balances. It provides users with a clear overview of their payment schedule to ensure timely settlements. Key features often include alerts for overdue bills and graphical representations of payment history. Important suggestions for this dashboard include ensuring real-time data accuracy, integrating user-friendly filters, and maintaining visual clarity for quick decision-making.

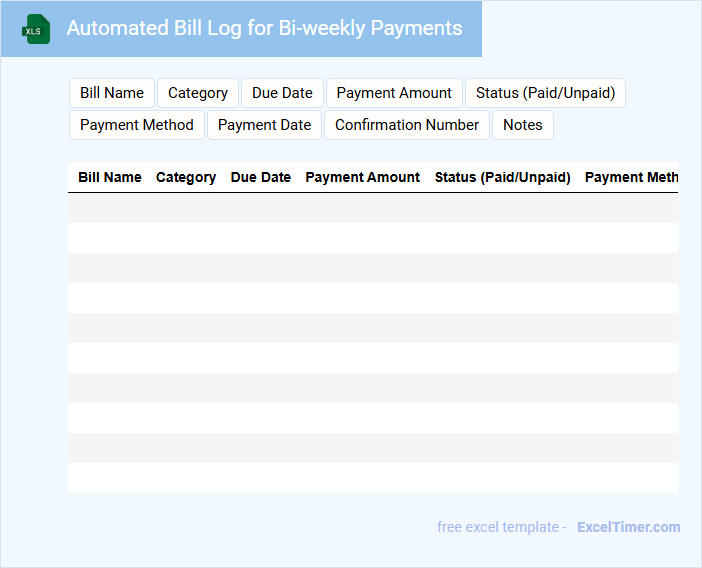

Automated Bill Log for Bi-weekly Payments

An Automated Bill Log for bi-weekly payments typically records detailed transactions including payment dates, amounts, and payees. It ensures accuracy and timeliness by automatically updating bill statuses and payment confirmations.

This document helps streamline financial tracking and avoid missed payments through consistent scheduling. To optimize its use, regularly verify data accuracy and integrate reminders for upcoming payments.

What are the key columns needed for a bi-weekly bill payment tracking sheet in Excel?

A bi-weekly bill payment tracking sheet in Excel should include key columns such as Bill Name, Due Date, Amount Due, Payment Date, Payment Method, and Payment Status. Including a Notes column allows you to track additional details or changes related to your payments. This structure helps ensure timely payments and accurate financial management.

How can conditional formatting highlight overdue bi-weekly bills?

Conditional formatting in Excel can highlight overdue bi-weekly bills by comparing the bill due dates to the current date using a formula like =AND(A2<>"", A2 To track the next due date for each bi-weekly bill, use the formula =A2 + 14, where A2 is the cell containing the last payment date. This formula adds 14 days to the previous bill date, ensuring accurate bi-weekly scheduling. Your Excel document will automatically update upcoming bill payments for efficient tracking. Automate payment status updates for recurring bi-weekly bills in Excel by creating a macro or VBA script that marks payments as "Paid" or "Pending" based on the current date and the bill's due date. Utilize Excel formulas like IF and TODAY alongside conditional formatting to visually track overdue or upcoming payments. Integrate data validation and dynamic date fields to ensure accurate and timely updates without manual intervention. Use a combination of a Gantt chart and conditional formatting in Excel to visualize upcoming and paid bi-weekly bills clearly. Create a table with bill names, due dates, and payment status, then apply color-coded bars or cells to represent payment progress. Incorporate filters or slicers to easily track and manage bill payments over each bi-weekly period.What formula tracks the next due date for each bi-weekly bill?

How do you automate payment status updates for recurring bi-weekly bills?

What is the best way to visualize upcoming and paid bi-weekly bills in Excel?