A Bi-weekly Excel Template for Mortgage Amortization simplifies tracking loan payments by breaking them down into bi-weekly intervals, helping users visualize principal and interest reduction over time. This template enhances financial planning by showing how making payments every two weeks instead of monthly can significantly reduce the loan term and total interest paid. Accurate amortization schedules within the spreadsheet assist in managing mortgage payoff strategies effectively.

Bi-weekly Excel Template for Mortgage Amortization

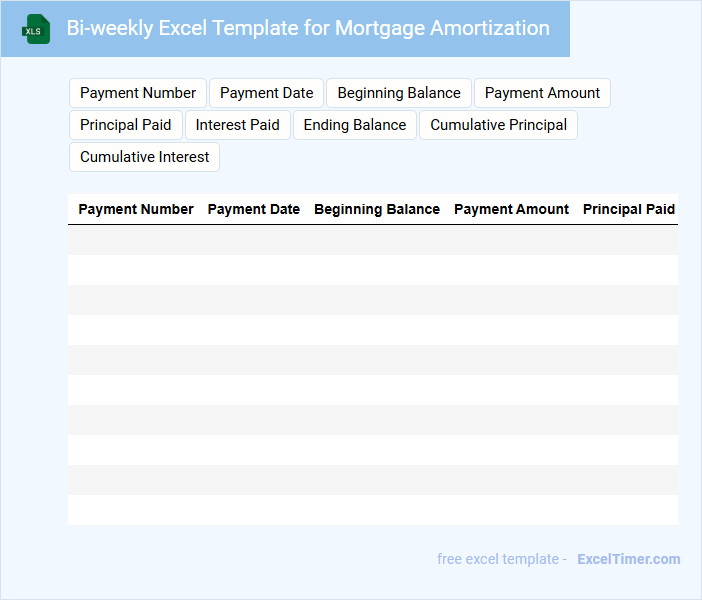

A Bi-weekly Excel Template for mortgage amortization typically contains scheduled payment dates, principal and interest breakdowns, and running balance summaries. It helps users track their mortgage progress efficiently with automated calculations.

This template often includes visual charts for quick insight and allows adjustments for extra payments or interest rate changes. Ensuring accuracy in formulas and clarity in data presentation is essential for effective financial planning.

Mortgage Amortization Schedule with Bi-weekly Payments

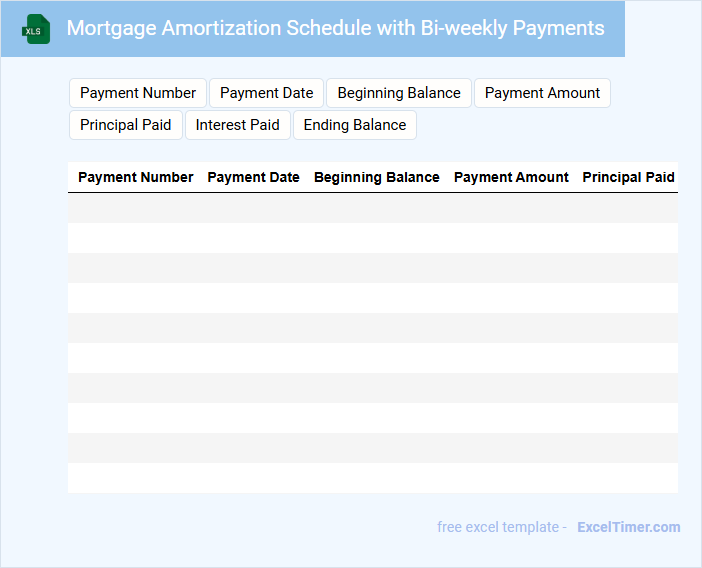

A Mortgage Amortization Schedule with bi-weekly payments outlines the breakdown of each payment towards principal and interest over the life of the loan. It typically shows the decreasing balance and how interest savings accumulate faster compared to monthly payments.

This document helps borrowers understand their payment timeline and total interest costs, promoting better financial planning. Important to note is that making bi-weekly payments can significantly reduce the loan term and overall interest paid.

Bi-weekly Payment Tracker for Mortgage Amortization

A bi-weekly payment tracker for mortgage amortization is a document designed to monitor and record mortgage payments made every two weeks. It helps homeowners ensure timely payments and track interest savings over time.

- Include columns for payment date, amount paid, principal, and interest.

- Incorporate a running balance to show the decreasing mortgage principal.

- Highlight cumulative interest saved compared to a monthly payment schedule.

Excel Template for Bi-weekly Mortgage Repayment

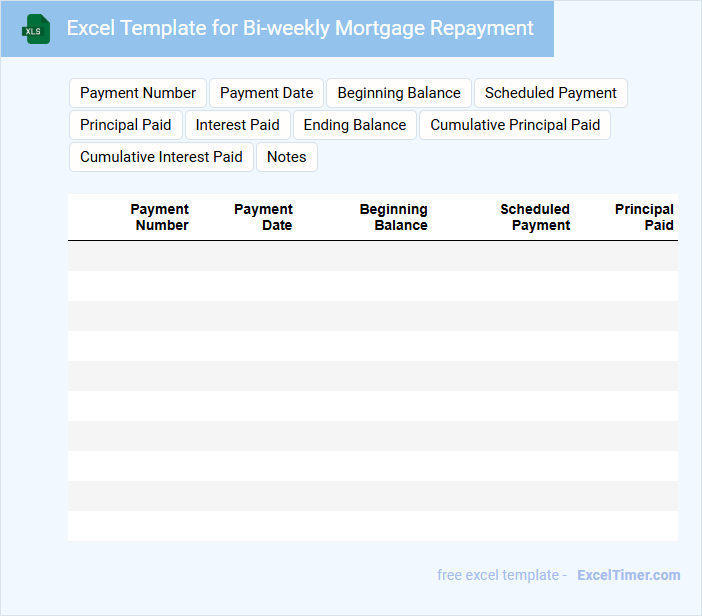

An Excel Template for Bi-weekly Mortgage Repayment typically contains structured tables for tracking payment amounts, due dates, and the outstanding loan balance. It helps users visualize their repayment schedule by breaking down principal and interest components every two weeks. Such templates often include formulas to automatically calculate remaining balances and total interest saved over time.

To optimize usage, ensure the template allows input customization for interest rates and loan terms. Incorporate clear labeling and color coding to differentiate payment stages and important deadlines. Additionally, including a summary dashboard with graphs can provide quick insights into repayment progress.

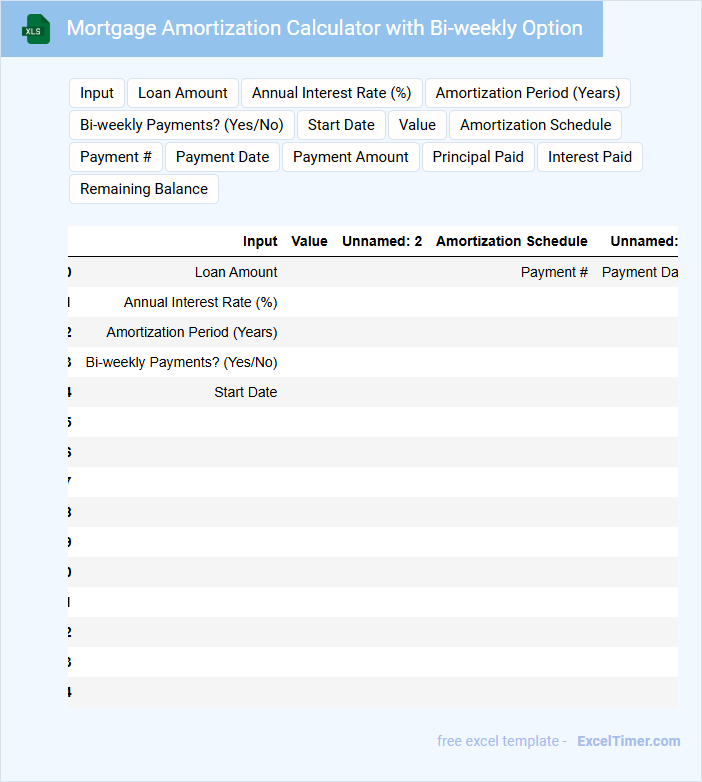

Mortgage Amortization Calculator with Bi-weekly Option

A Mortgage Amortization Calculator with a bi-weekly option is a specialized tool that helps borrowers understand their loan repayment schedule by breaking down each payment into interest and principal components. It typically includes fields for loan amount, interest rate, loan term, and payment frequency, allowing users to see how bi-weekly payments accelerate loan payoff. This document is vital for planning financial strategies and understanding long-term cost savings.

Important considerations when using this calculator include accurately entering the loan details, understanding the impact of bi-weekly payments on interest savings, and reviewing the amortization schedule for any fees or changes in payment terms. Users should also account for any lender-specific policies on payment application.

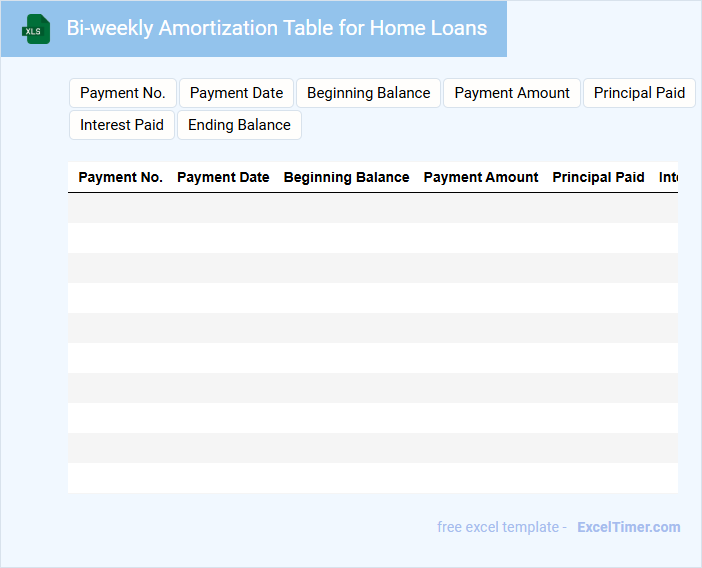

Bi-weekly Amortization Table for Home Loans

A Bi-weekly Amortization Table for home loans is a detailed schedule that breaks down each payment over the life of the loan, showing principal and interest portions. This document helps homeowners track their payment progress and understand how bi-weekly payments can accelerate loan payoff. It usually includes important figures such as payment dates, amounts, and remaining balance after each payment.

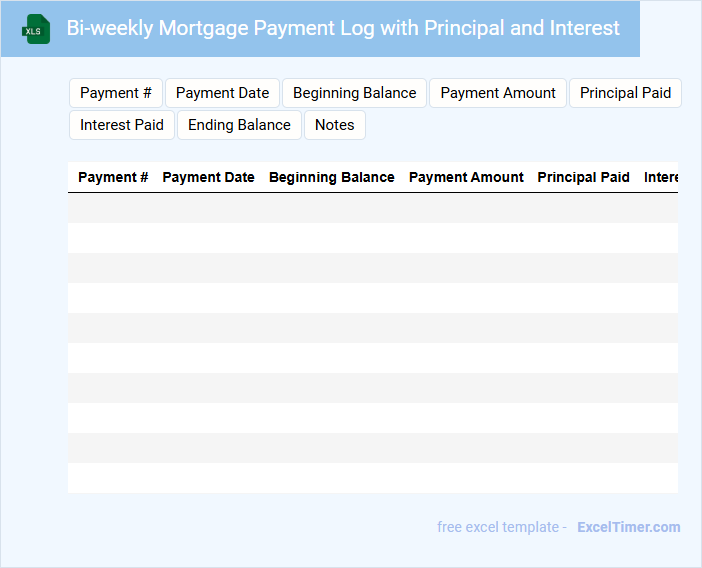

Bi-weekly Mortgage Payment Log with Principal and Interest

A Bi-weekly Mortgage Payment Log with Principal and Interest typically contains records of mortgage payments made every two weeks, detailing the division between principal and interest amounts. It helps track payment progress and ensures timely payments to reduce loan balance effectively.

- Include columns for payment date, principal paid, interest paid, and remaining balance.

- Record payments consistently to monitor loan payoff acceleration accurately.

- Highlight any extra payments or changes in payment amounts for clarity.

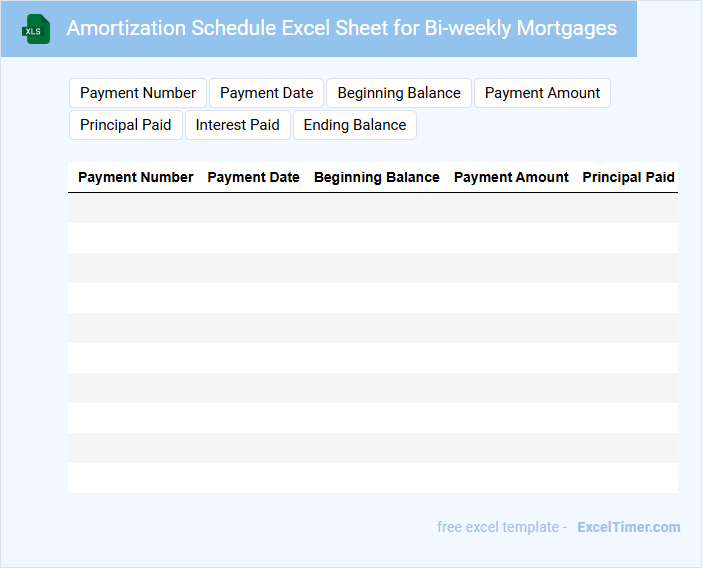

Amortization Schedule Excel Sheet for Bi-weekly Mortgages

An Amortization Schedule Excel Sheet for Bi-weekly Mortgages typically contains detailed payment breakdowns and timelines to track loan repayment effectively.

- Payment Dates: Clear bi-weekly payment schedules marking due dates.

- Principal and Interest Separation: Breakdown of each payment into principal and interest components.

- Remaining Balance: Updated loan balance after each payment to show progress.

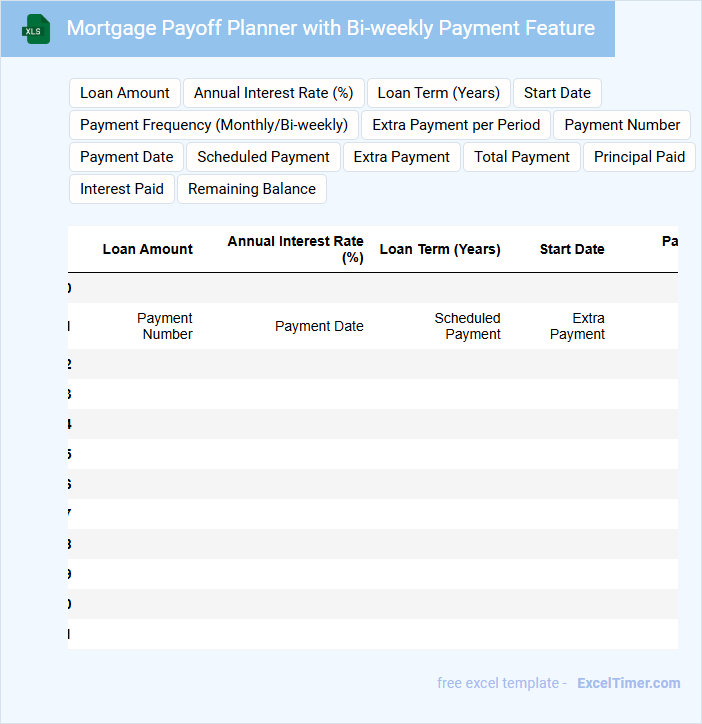

Mortgage Payoff Planner with Bi-weekly Payment Feature

A Mortgage Payoff Planner document typically contains detailed information about loan balances, interest rates, and payment schedules designed to help borrowers manage and accelerate mortgage payments. It often includes a bi-weekly payment feature to illustrate how making payments every two weeks can reduce loan term and interest. For optimal use, it's important to ensure accurate input of loan details and regularly update payment records to track progress effectively.

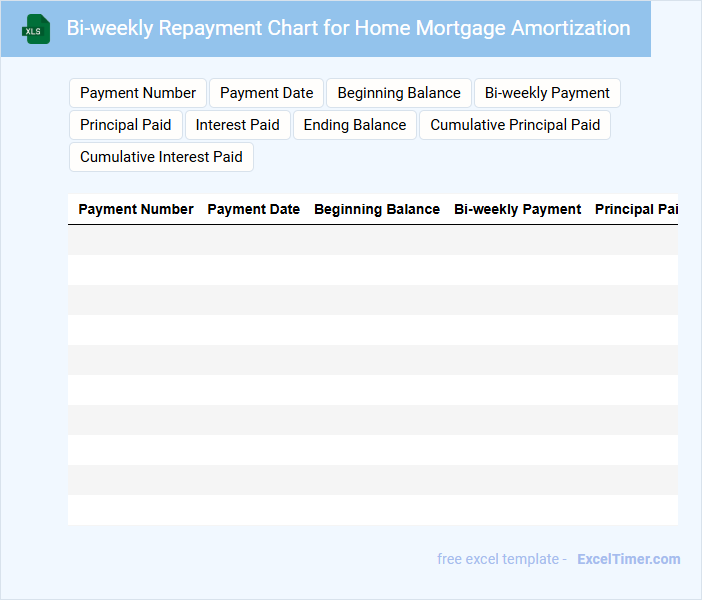

Bi-weekly Repayment Chart for Home Mortgage Amortization

A Bi-weekly Repayment Chart for home mortgage amortization details the payment schedule made every two weeks instead of monthly. It highlights the total amount paid over time and the reduction in principal balance.

This document typically includes the payment dates, amounts, interest portion, principal portion, and remaining balance after each payment. An important suggestion is to ensure clarity in the amortization breakdown for better financial planning and mortgage payoff tracking.

Excel Report for Bi-weekly Mortgage Balance Tracking

An Excel Report for Bi-weekly Mortgage Balance Tracking typically contains updated mortgage balances, payment schedules, and interest calculations. This document helps in monitoring loan reductions and forecasting future payments accurately. It is essential for effective financial planning and timely decision-making.

Important elements to include are the starting balance, payment amounts, interest accrued, and cumulative principal paid. Visual aids like charts or graphs can enhance clarity and trend analysis. Regular updates and error checks ensure data accuracy and reliability.

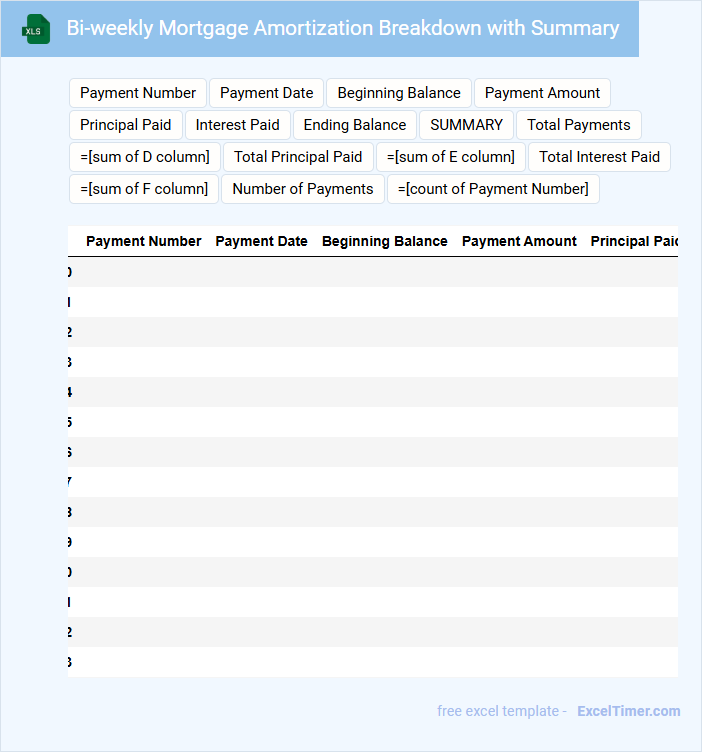

Bi-weekly Mortgage Amortization Breakdown with Summary

What information does a Bi-weekly Mortgage Amortization Breakdown with Summary typically contain? This type of document outlines the schedule of mortgage payments made every two weeks, detailing the portions applied to principal and interest each period. It also provides a summary highlighting total payments, remaining balance, and interest saved over the loan term.

Why is it important to include an accurate summary in this document? Including a clear summary helps borrowers track their progress toward loan payoff, understand savings from accelerated payments, and plan finances effectively. Ensuring transparency and clarity supports informed decision-making about mortgage management.

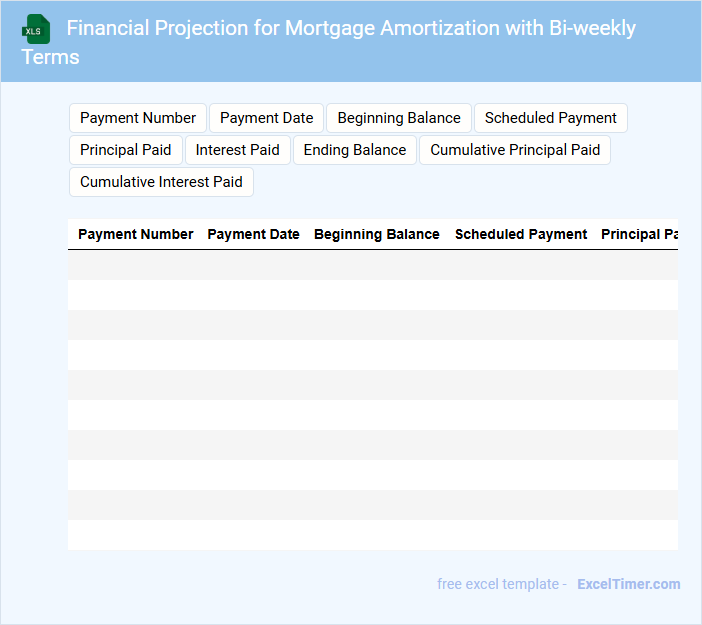

Financial Projection for Mortgage Amortization with Bi-weekly Terms

What does a financial projection for mortgage amortization with bi-weekly terms typically contain? This type of document usually includes detailed schedules showing how payments are applied to both principal and interest over time, emphasizing the benefits of bi-weekly payment frequency. It also highlights the total interest savings and shorter loan term compared to traditional monthly payments, helping borrowers better understand their mortgage payoff timeline.

What important factors should be considered when preparing this projection? Key elements include accurately calculating bi-weekly payment amounts, incorporating the impact of extra payments on principal reduction, and clearly presenting the resulting changes in amortization duration and interest costs. Ensuring the projection is easy to interpret with visual aids like charts can greatly assist in financial planning decisions.

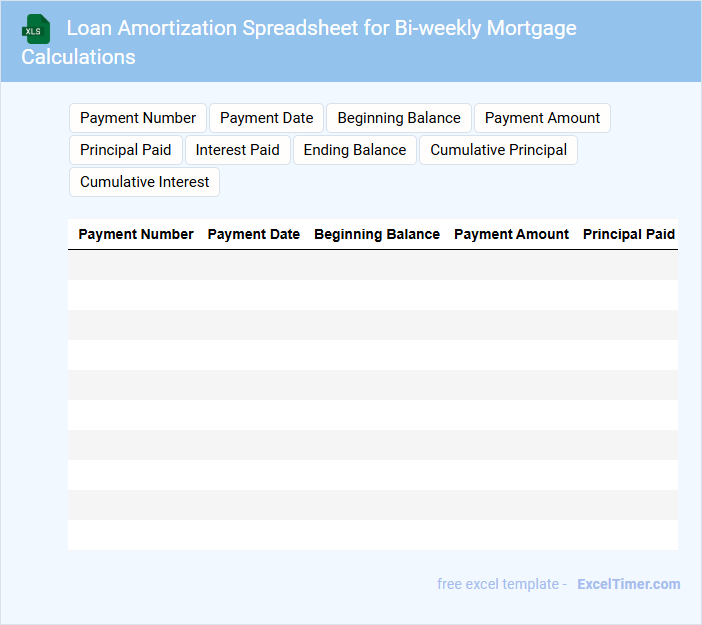

Loan Amortization Spreadsheet for Bi-weekly Mortgage Calculations

A Loan Amortization Spreadsheet for bi-weekly mortgage calculations typically contains detailed payment schedules that break down principal and interest over the loan term. It includes columns for payment dates, payment amounts, remaining balance, and interest accrued to help users track their loan progress accurately. This spreadsheet is essential for budgeting and understanding how making bi-weekly payments can reduce overall interest and shorten loan duration.

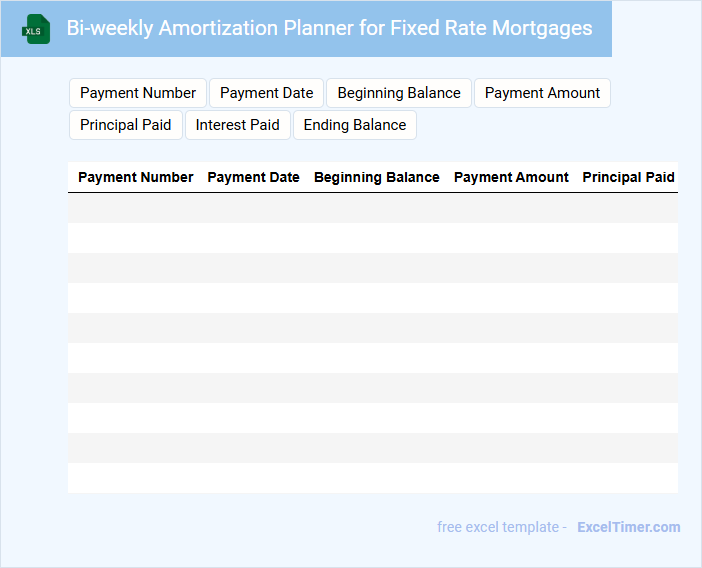

Bi-weekly Amortization Planner for Fixed Rate Mortgages

A Bi-weekly Amortization Planner for Fixed Rate Mortgages typically contains a detailed schedule of payment dates and amounts to help borrowers pay off their loan faster. It outlines how each payment reduces the principal and interest over time, emphasizing the benefits of bi-weekly payments instead of monthly ones. This document is crucial for understanding the long-term savings and timeline of mortgage repayment.

When using this planner, it's important to ensure accurate interest rate inputs to reflect your specific mortgage terms. Additionally, regularly updating payment information can help track progress and adjust for any changes in financial situation. Finally, consider potential prepayment penalties or fees associated with bi-weekly payments to avoid unexpected costs.

How does a bi-weekly payment schedule affect the total interest paid over the mortgage term compared to a monthly schedule?

A bi-weekly payment schedule reduces the total interest paid over the mortgage term by accelerating principal repayment through 26 half payments annually, equivalent to 13 full payments instead of 12. This extra payment decreases the loan balance faster, shortening the amortization period and lowering overall interest costs. Mortgage amortization schedules in Excel clearly demonstrate these savings by comparing bi-weekly versus monthly payment timelines and interest accumulation.

What formula is used in Excel to calculate bi-weekly mortgage payments?

The formula to calculate bi-weekly mortgage payments in Excel is: =PMT(annual_interest_rate/26, total_number_of_bi-weekly_payments, -loan_amount). This divides the annual interest rate by 26 bi-weekly periods and multiplies the loan term by 26 payments per year. Use this formula to determine the fixed bi-weekly payment amount for mortgage amortization.

How do you adjust the number of periods (nper) for bi-weekly payments in Excel's amortization calculations?

To adjust the number of periods (nper) for bi-weekly mortgage payments in Excel, multiply the loan term in years by 26, reflecting 26 bi-weekly periods per year. Use this adjusted nper in the PMT or related amortization formulas to accurately calculate payments. Your amortization schedule will then align with bi-weekly payment timing, improving repayment tracking.

What Excel functions can help track remaining loan balance after each bi-weekly payment?

The Excel functions PMT and IPMT are essential for calculating bi-weekly mortgage payments and interest portions, respectively. Use the PPMT function to determine the principal paid in each period, helping you track your remaining loan balance accurately. Combining these with cumulative formulas provides a detailed amortization schedule tailored for bi-weekly payments.

How does making bi-weekly payments impact the principal reduction in an Excel amortization schedule?

Making bi-weekly payments increases the frequency of mortgage payments in your Excel amortization schedule, resulting in faster principal reduction compared to monthly payments. This accelerated repayment decreases the overall interest paid and shortens the loan term. Your Excel model will show a lower balance and interest accumulation at each bi-weekly interval, enhancing financial efficiency.