Bi-weekly Bill Payment Excel Template for Families helps organize and track recurring expenses efficiently, ensuring timely payments and avoiding late fees. The template simplifies budgeting by breaking down monthly bills into manageable bi-weekly amounts, improving cash flow management for family finances. Customizable features allow families to update bill details, due dates, and payment status, enhancing financial accountability.

Bi-Weekly Bill Payment Tracker for Families

A Bi-Weekly Bill Payment Tracker is a document designed to help families monitor and manage their recurring expenses efficiently. It typically contains a list of bills, payment due dates, amounts, and statuses to ensure timely payments. This organizer aids in budgeting and avoiding late fees by providing a clear overview of financial obligations every two weeks.

An effective tracker should include columns for bill type, payment amount, due date, paid status, and notes for any relevant details. Families should regularly update the tracker to reflect recent payments and upcoming bills to stay on top of their finances. Additionally, setting reminders aligned with the tracker can help ensure no payments are missed.

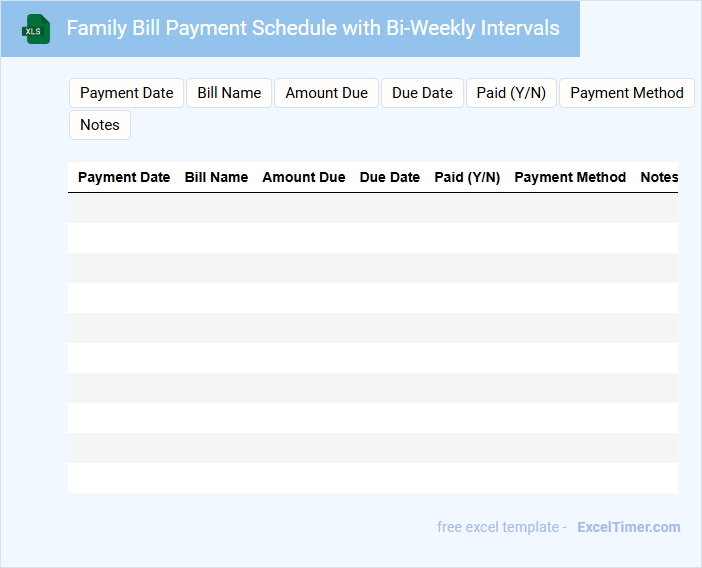

Family Bill Payment Schedule with Bi-Weekly Intervals

What information is typically included in a Family Bill Payment Schedule with Bi-Weekly Intervals? This document usually contains a detailed list of all recurring family expenses, such as utilities, rent, and subscription services, organized by payment dates occurring every two weeks. It helps families manage their cash flow effectively by tracking when each bill is due to avoid late payments and maintain financial stability.

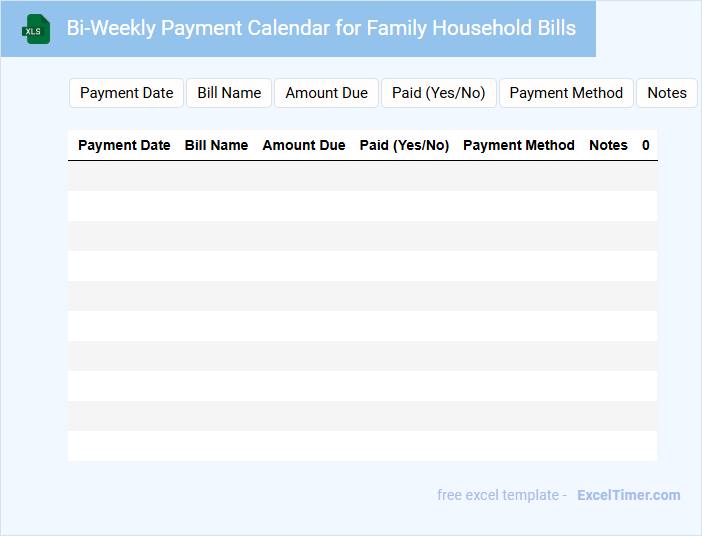

Bi-Weekly Payment Calendar for Family Household Bills

A Bi-Weekly Payment Calendar is a practical tool designed to help families organize their household bills and manage finances efficiently. It typically contains scheduled due dates for various recurring expenses, such as utilities, rent, and subscriptions, aligned with a bi-weekly pay cycle. This document ensures timely payments and minimizes late fees by providing clear visibility of upcoming financial obligations.

Important suggestions include consistently updating the calendar to reflect any changes in bill amounts or due dates, setting reminders for payment deadlines, and prioritizing high-impact expenses that affect credit scores or essential services. Additionally, including buffer periods for payment processing can prevent accidental late payments, contributing to smoother financial management.

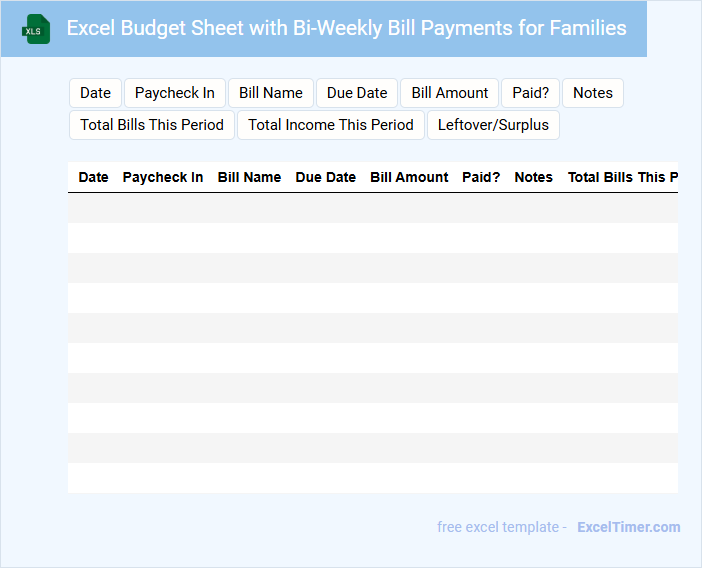

Excel Budget Sheet with Bi-Weekly Bill Payments for Families

An Excel Budget Sheet with Bi-Weekly Bill Payments is designed to help families manage their finances effectively by tracking income and expenses on a regular schedule. This document usually contains categories for bills, income sources, savings goals, and a breakdown of bi-weekly payment amounts. It is important to include clear labeling of payment deadlines and a summary of total costs to avoid missed payments and ensure financial stability.

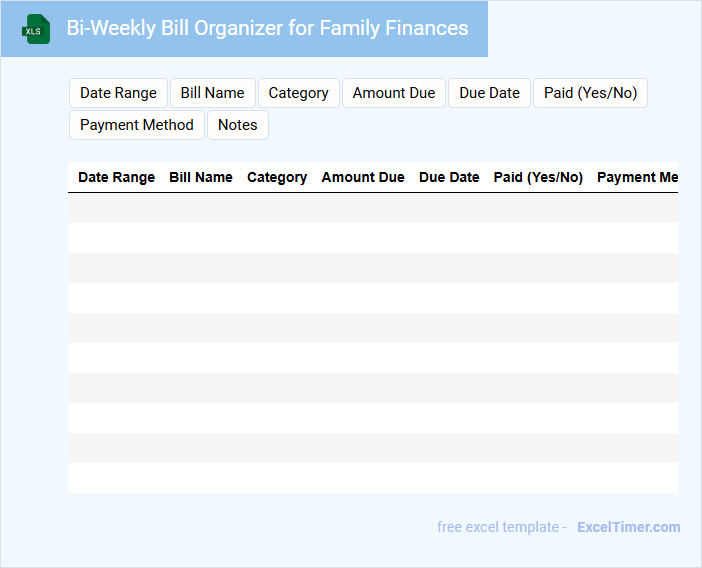

Bi-Weekly Bill Organizer for Family Finances

This document is a Bi-Weekly Bill Organizer designed to help families manage their finances effectively. It typically contains sections for tracking income, expenses, due dates, and payment statuses every two weeks.

Maintaining this organizer ensures timely payments and prevents missed bills, contributing to better budgeting. It is important to regularly update the document and review recurring expenses for accuracy and savings opportunities.

Bi-Weekly Family Expense Tracker with Bill Payments

What information is typically included in a Bi-Weekly Family Expense Tracker with Bill Payments? This type of document usually contains detailed records of all family expenses incurred every two weeks, along with a schedule of bill payments. It helps in monitoring financial habits and ensuring timely payments to avoid penalties.

Why is accurate categorization and timely updating important in this tracker? Accurate categorization allows clear visibility into spending patterns, helping families identify areas to save money. Timely updates ensure bills are paid on schedule, maintaining good credit and avoiding late fees.

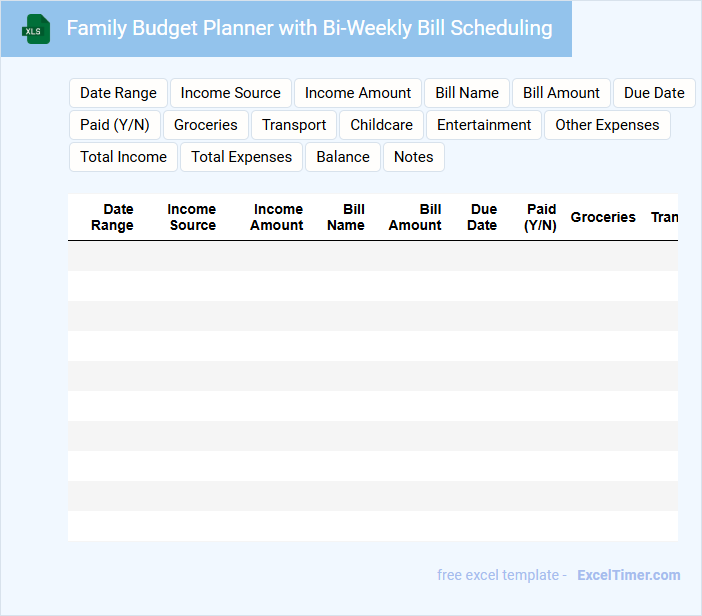

Family Budget Planner with Bi-Weekly Bill Scheduling

A Family Budget Planner with Bi-Weekly Bill Scheduling is a financial document designed to help households manage their income and expenses efficiently. It typically contains sections for tracking income sources, categorizing expenses, and scheduling bill payments on a bi-weekly basis to align with pay periods. This type of planner aids families in avoiding late payments and ensuring they stay on top of their financial obligations.

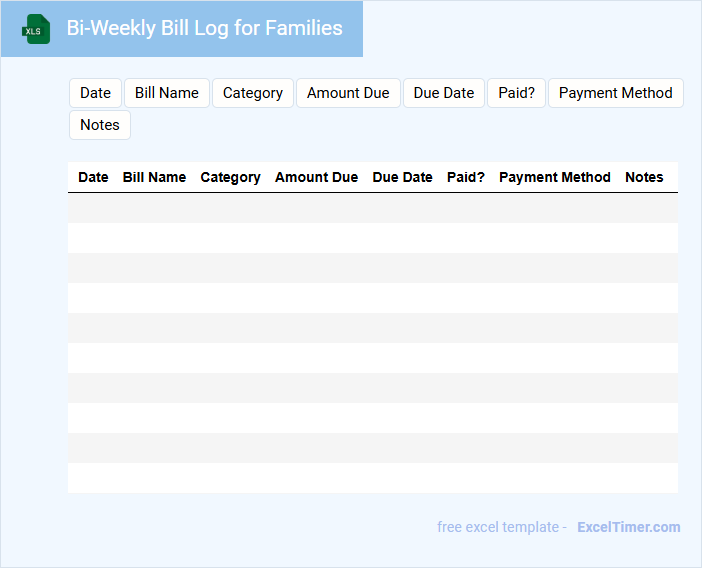

Bi-Weekly Bill Log for Families

A Bi-Weekly Bill Log for Families is a financial tracking document designed to help households monitor and manage their expenses every two weeks. It typically contains details such as due dates, payment amounts, and bill categories to ensure timely payments and avoid late fees. Maintaining this log promotes budgeting discipline and provides a clear overview of recurring financial obligations.

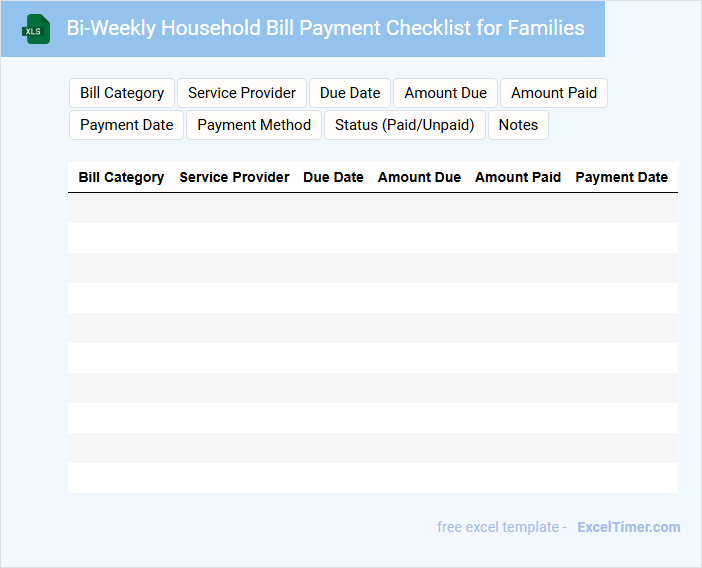

Bi-Weekly Household Bill Payment Checklist for Families

A Bi-Weekly Household Bill Payment Checklist is a structured document that helps families track and manage recurring expenses every two weeks. It typically includes due dates, payment amounts, and methods for bills such as utilities, mortgage, and subscriptions. This checklist ensures timely payments, preventing late fees and maintaining a good credit score. Keeping it updated regularly is crucial for financial organization and stress reduction. Important suggestions include categorizing bills by priority and setting reminders aligned with pay periods. Regularly reviewing the checklist can optimize household budget planning and cash flow management.

Comprehensive Family Bill Tracker with Bi-Weekly Payments

A Comprehensive Family Bill Tracker is an essential tool used to organize and monitor all household expenses, ensuring timely payments and budget management. It typically contains detailed records of bill amounts, due dates, payment methods, and payment frequency, especially emphasizing bi-weekly schedules. For optimal use, it is important to maintain accurate updates and categorize bills by priority to avoid missed payments and unnecessary fees.

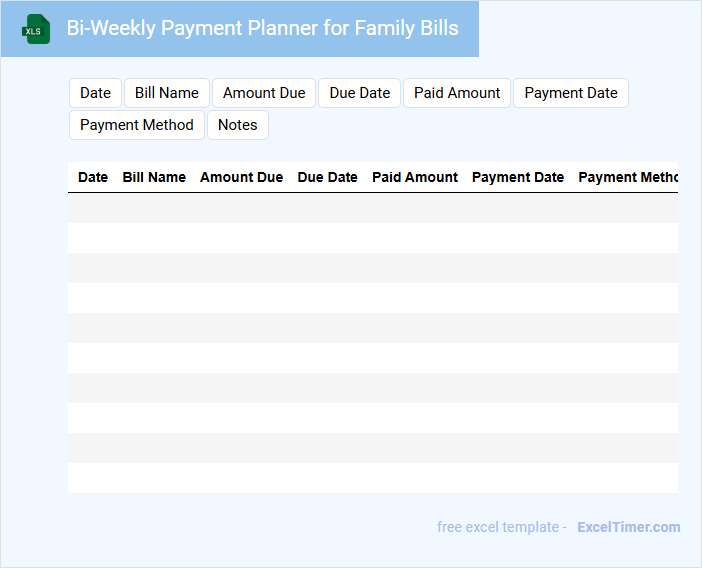

Bi-Weekly Payment Planner for Family Bills

A Bi-Weekly Payment Planner for family bills is a document designed to organize and schedule recurring expenses every two weeks. It typically includes sections for bill names, due dates, amounts, and payment status to help track financial obligations efficiently. This planner ensures timely payments, avoids late fees, and aids in budgeting by providing a clear overview of expected costs within each pay period.

When creating this planner, it is important to list all fixed and variable family bills comprehensively to avoid missing any payments. Include reminders for due dates and prioritize bills based on their impact on family essentials. Additionally, tracking payment confirmations and adjusting amounts as bills fluctuate helps maintain accuracy and financial control.

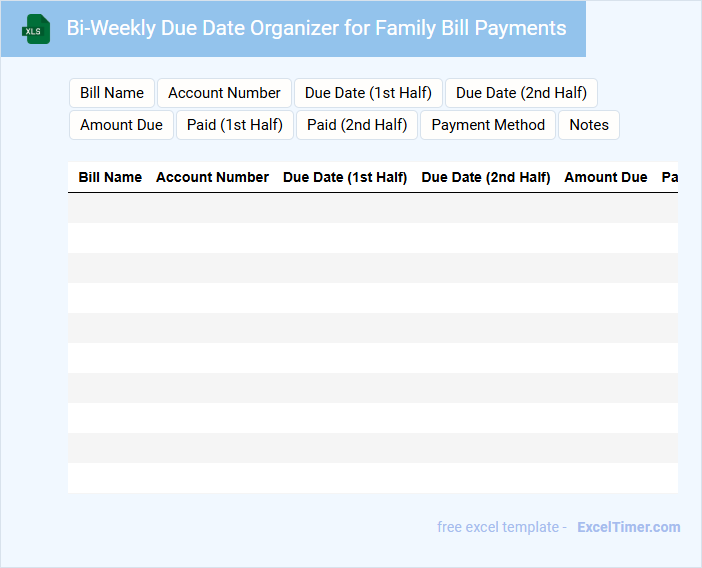

Bi-Weekly Due Date Organizer for Family Bill Payments

The Bi-Weekly Due Date Organizer for family bill payments is a document designed to track and manage recurring expenses every two weeks. It typically contains sections for bill names, due dates, amounts, and payment status to ensure timely payments. This organizer helps families avoid late fees and maintain a clear financial overview.

To optimize its use, include reminders for upcoming payments and categorize bills by priority or type. Adding a notes section for confirmation numbers or payment methods can improve accuracy. Consistent updates and review of the organizer will help sustain effective bill management.

Family Bills Excel Template with Bi-Weekly Payment Tracking

What information is typically included in a Family Bills Excel Template with Bi-Weekly Payment Tracking?

This type of document usually contains categories for various household expenses, due dates, payment amounts, and fields to mark payments as completed. It helps families organize and monitor their bills on a bi-weekly schedule to ensure timely payments and avoid missed deadlines. The template often includes summary sections for total expenses and upcoming payments for better financial planning.

Important Suggestions:

- Include clear categories for recurring bills such as utilities, rent/mortgage, groceries, and subscriptions.

- Incorporate automated formulas to calculate totals and outstanding balances.

- Design the layout for easy updating every pay period with conditional formatting for overdue payments.

- Ensure privacy by protecting sensitive data and maintaining backups.

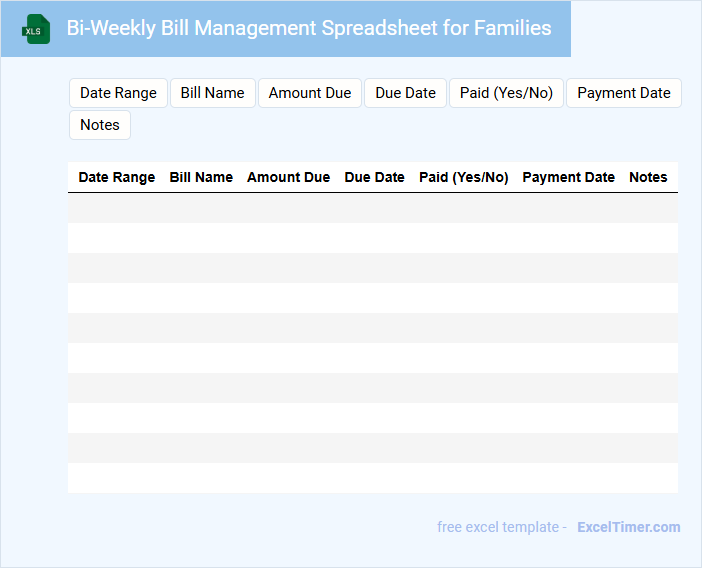

Bi-Weekly Bill Management Spreadsheet for Families

What information is typically included in a Bi-Weekly Bill Management Spreadsheet for Families? This type of document usually contains detailed records of all recurring bills and expenses due every two weeks, such as utilities, rent or mortgage, and subscriptions. It helps families track payment dates, amounts, and budgets to ensure bills are paid on time and manage finances effectively.

What important features should be included in a Bi-Weekly Bill Management Spreadsheet for Families? Essential components include clear categorization of bills, a bi-weekly calendar view for payment deadlines, and space for notes or reminders. Including summary sections for total expenses and remaining budget can help families maintain financial control and avoid late fees.

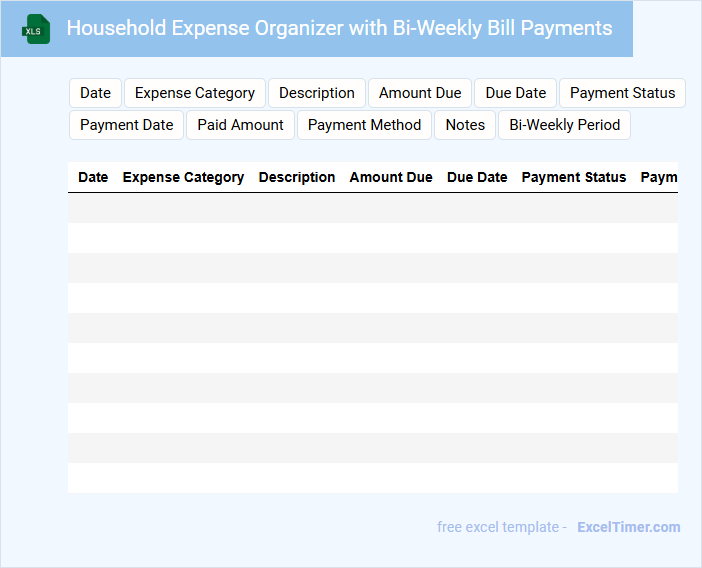

Household Expense Organizer with Bi-Weekly Bill Payments

A Household Expense Organizer with Bi-Weekly Bill Payments typically contains a detailed record of income, fixed and variable expenses, and scheduled payment dates. It helps individuals manage their finances by tracking bills that are paid every two weeks to avoid missed deadlines.

Important suggestions include setting reminders for bill due dates and reviewing expenses regularly to identify areas for savings. Maintaining accurate and updated records ensures better budgeting and financial control.

What are the main advantages of using a bi-weekly bill payment schedule for families?

A bi-weekly bill payment schedule helps families manage cash flow by spreading out expenses evenly throughout the month. You can reduce late fees and improve credit scores by ensuring timely payments. This approach also helps in budgeting by aligning payments with typical pay periods.

How does a bi-weekly payment plan affect the total annual payments compared to monthly payments?

A bi-weekly bill payment plan results in 26 half-payments per year, equating to 13 full payments annually, which is one more full payment than the 12 monthly payments. This increases your total annual payments, reducing the overall interest or outstanding balance faster. Families using this plan can save money and pay off bills quicker compared to standard monthly payments.

Which common bills or expenses are most suitable for bi-weekly payment in a family budget?

Common bills suitable for bi-weekly payment in a family budget include mortgage or rent, utility bills such as electricity and water, and loan repayments like car loans or personal loans. Setting bi-weekly payments helps align expenses with regular income schedules, improving cash flow management. This method also potentially reduces interest costs on loans through more frequent payments.

What Excel formulas or functions can automate tracking and scheduling of bi-weekly payments?

Use the Excel formula =EDATE(start_date, (ROW()-1)*0.5*12) to generate bi-weekly payment dates starting from a specific date. Apply SUMIFS to calculate total payments within a date range for accurate expense tracking. Leverage conditional formatting with formulas like =MOD(ROW(),14)=0 to highlight bi-weekly payment rows automatically.

How can families use Excel to forecast cash flow impacts when switching to bi-weekly bill payments?

Families can use Excel to forecast cash flow impacts by inputting their regular bills and payment dates into a bi-weekly schedule, allowing you to visualize payment timing shifts and total monthly outflows. Utilizing Excel formulas such as SUMIFS and date functions helps calculate exact payment amounts and upcoming due dates for accurate budgeting. This method provides clear insights into how bi-weekly payments affect overall cash flow stability and financial planning.