The Bi-weekly Excel Template for Part-time Workers simplifies tracking hours, calculating wages, and managing schedules efficiently. It ensures accurate payroll processing by automatically summing total hours worked and applying the correct pay rates. This template is essential for maintaining organized records and reducing errors in payment for part-time employees.

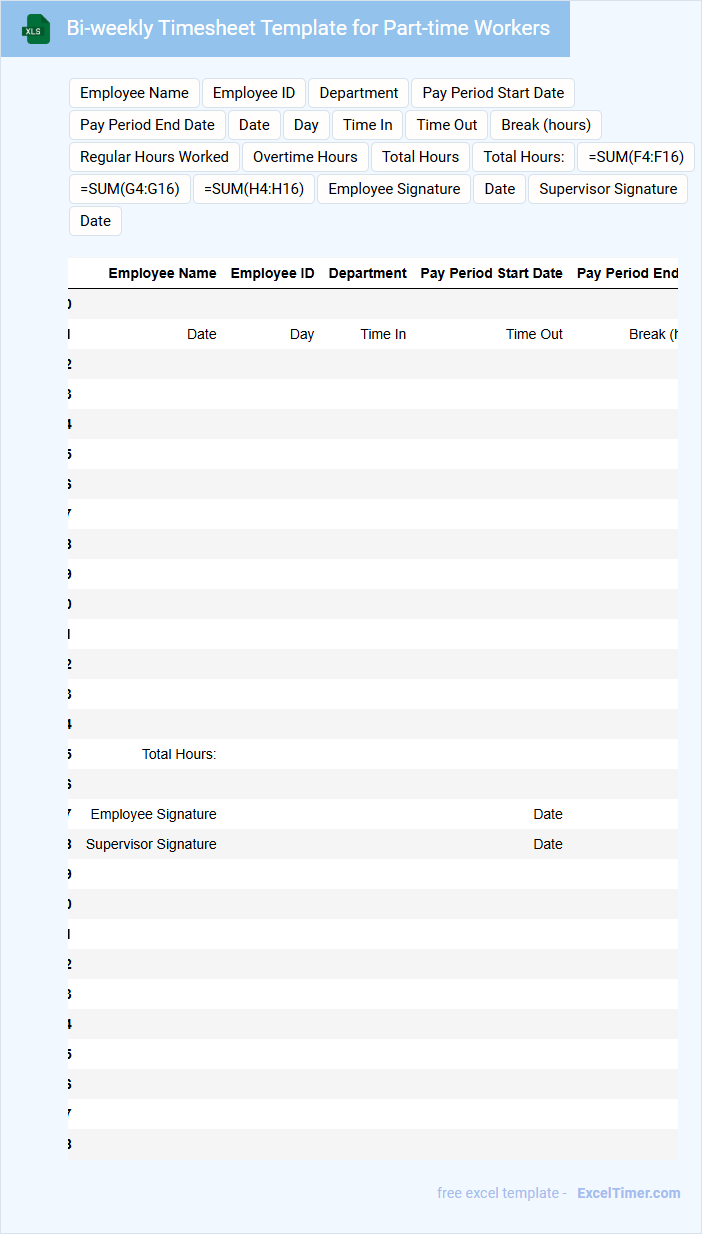

Bi-weekly Timesheet Template for Part-time Workers

What information does a Bi-weekly Timesheet Template for Part-time Workers typically include? This document usually tracks the hours worked by part-time employees over a two-week period, detailing daily start and end times, breaks, and total hours worked. It helps employers ensure accurate payment and compliance with labor regulations.

What are important elements to include in such a timesheet? Key features should be clear date ranges, employee identification, space for supervisors' approval, and fields for notes on overtime or leave taken, to maintain transparency and precise record-keeping.

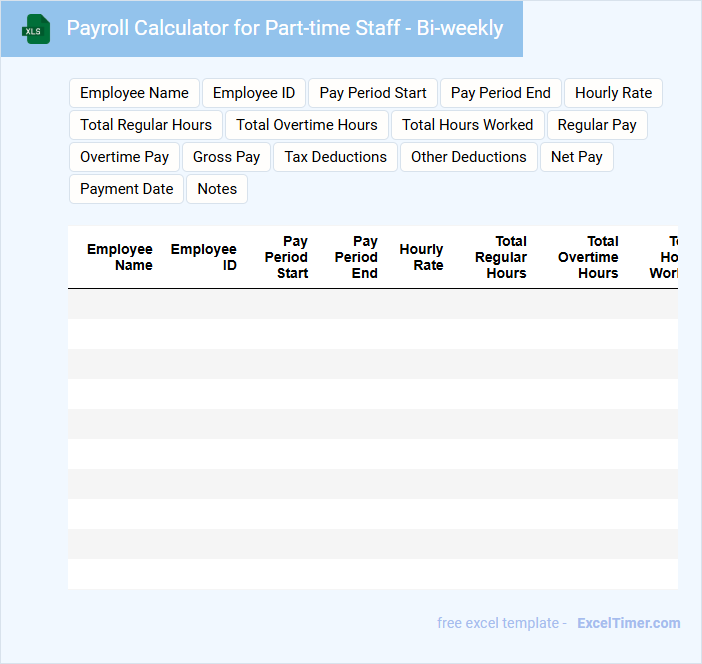

Payroll Calculator for Part-time Staff - Bi-weekly

This document typically contains a payroll calculator designed specifically for part-time staff paid on a bi-weekly basis. It includes fields for hours worked, pay rate, and deductions to accurately compute net pay. The calculator also helps ensure compliance with tax regulations and labor laws.

Important elements to include are overtime calculations, tax withholding options, and deduction fields for benefits or garnishments. Clear instructions should be provided to ensure accuracy when entering data. Additionally, automated summaries for gross pay, taxes, and net pay enhance usability and reduce errors.

Attendance Tracker with Bi-weekly Layout for Part-time Employees

What information is typically included in an Attendance Tracker with Bi-weekly Layout for Part-time Employees? This type of document generally contains employee names, dates covering each bi-weekly period, and daily attendance markers such as hours worked or presence status. It is designed to streamline monitoring of work hours and ensure accurate payroll calculations for part-time staff.

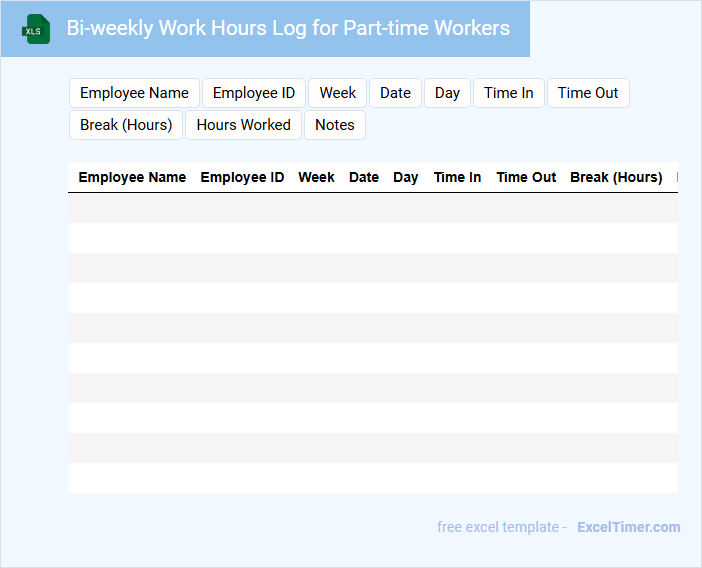

Bi-weekly Work Hours Log for Part-time Workers

A Bi-weekly Work Hours Log for part-time workers typically contains detailed records of hours worked each day over a two-week period. It includes start and end times, total hours per shift, and breaks taken to ensure accurate payroll processing. Maintaining this log helps track attendance, monitor overtime, and verify compliance with labor regulations.

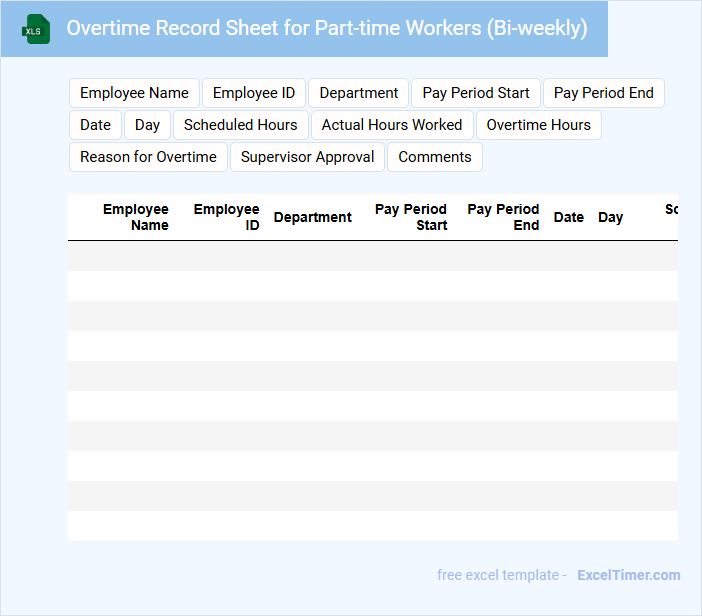

Overtime Record Sheet for Part-time Workers (Bi-weekly)

What information is typically included in an Overtime Record Sheet for Part-time Workers (Bi-weekly)? This document usually contains the employee's name, hours worked beyond regular schedule, and dates of overtime worked to ensure accurate tracking and payroll processing. It helps both the employer and employee maintain clear records of extra hours worked for fair compensation.

What important details should be included for effective record-keeping? Ensure the sheet includes exact dates, start and end times of overtime, total overtime hours per day, and a section for supervisor approval to verify accuracy and prevent disputes. Additionally, including calculation fields for overtime pay rates can streamline payroll management.

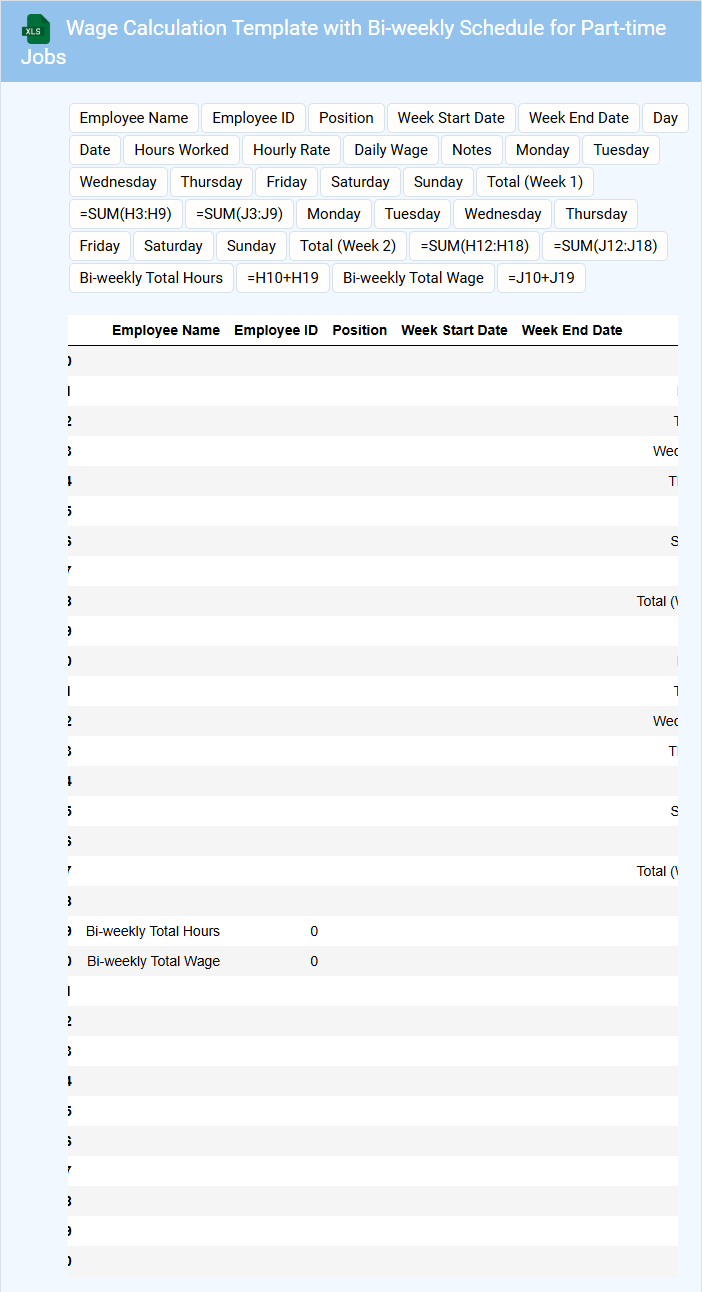

Wage Calculation Template with Bi-weekly Schedule for Part-time Jobs

A Wage Calculation Template with a bi-weekly schedule is designed to systematically track hours worked and compute earnings for part-time employees. It ensures accurate and timely payment by organizing data in two-week intervals. This document is essential for payroll management and compliance with labor regulations.

Part-time job wage templates usually include employee details, hourly rates, total hours, deductions, and net pay. Precise record-keeping of bi-weekly periods helps avoid errors in compensation. Including clear sections for overtime and tax calculations is highly recommended.

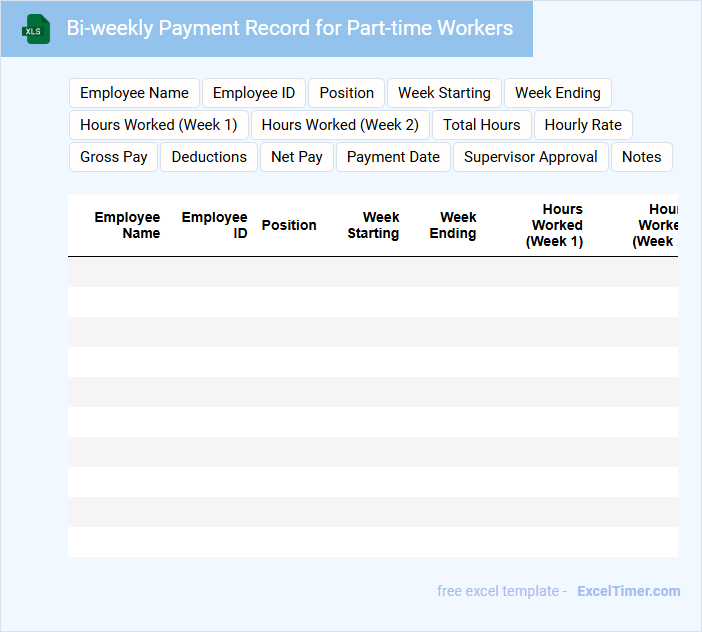

Bi-weekly Payment Record for Part-time Workers

The Bi-weekly Payment Record for part-time workers is a document that tracks the wages paid every two weeks. It typically contains details such as hours worked, pay rate, deductions, and net pay. This record is crucial for maintaining accurate payroll and ensuring compliance with labor laws.

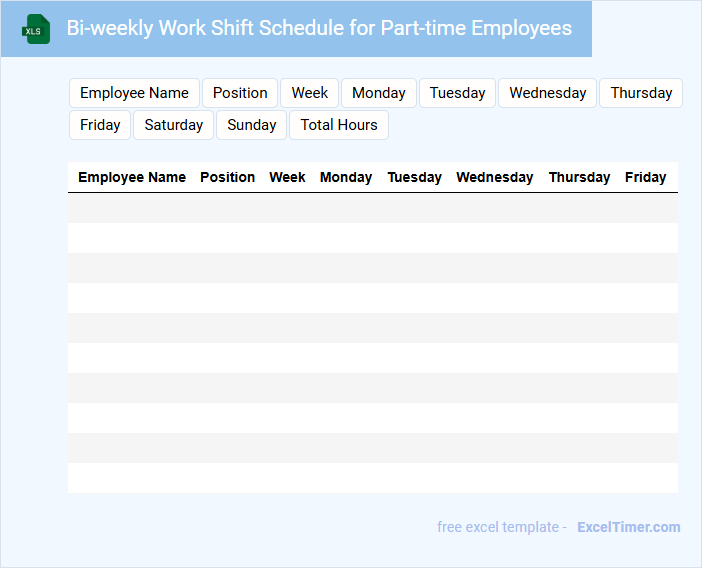

Bi-weekly Work Shift Schedule for Part-time Employees

This document is typically a schedule outlining the specific work shifts allocated to part-time employees over a two-week period. It includes details such as dates, times, and assigned employees to ensure adequate coverage and efficient workforce management.

Key elements to focus on include employee availability, shift preferences, and compliance with labor regulations to avoid conflicts or overtime issues. Clear communication of this schedule helps in maintaining productivity and employee satisfaction.

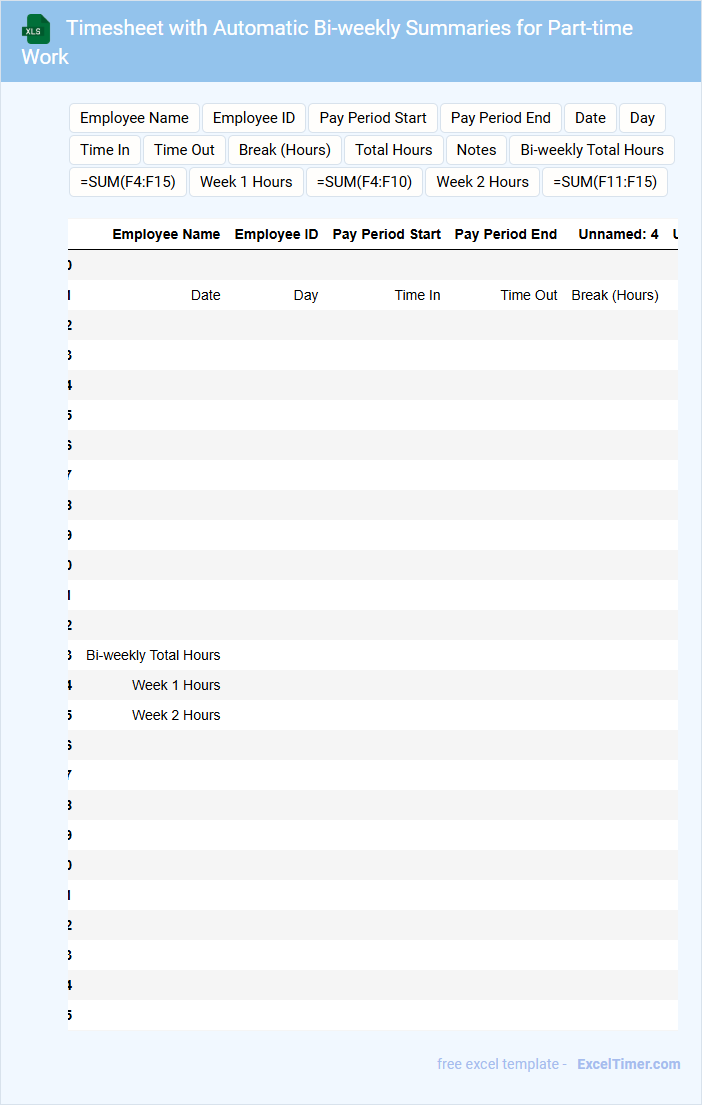

Timesheet with Automatic Bi-weekly Summaries for Part-time Work

A Timesheet with Automatic Bi-weekly Summaries for Part-time Work is a document used to accurately record the hours worked by employees within a two-week period. It typically contains fields for daily clock-in and clock-out times, total hours worked each day, and automatic calculation of bi-weekly totals. This type of timesheet helps streamline payroll processing and simplifies tracking part-time workers' schedules.

Bi-weekly Earnings Tracker for Part-time Workers

A Bi-weekly Earnings Tracker for part-time workers typically contains detailed records of hours worked, hourly wages, and total earnings for each pay period. It also includes deductions such as taxes and any additional bonuses or tips received.

This document is essential for monitoring income consistency and ensuring accurate payment over time. Important elements to include are clear date ranges and a summary of cumulative earnings.

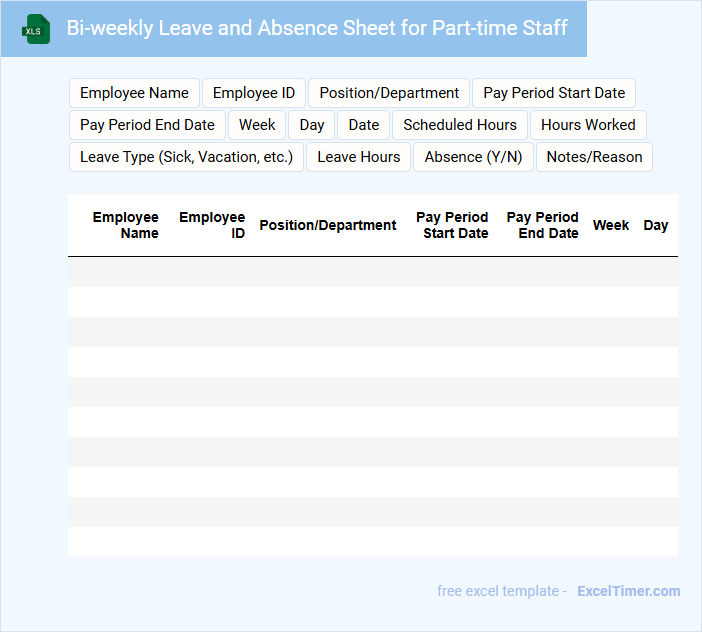

Bi-weekly Leave and Absence Sheet for Part-time Staff

The Bi-weekly Leave and Absence Sheet for part-time staff typically contains detailed records of employee attendance, including dates of leave, types of absence, and hours worked. This document is essential for accurate payroll processing and compliance with labor regulations.

It provides a clear overview of employee availability and helps managers plan staffing needs effectively. Ensuring all entries are updated timely and accurately is crucial for maintaining reliable records.

Important suggestions include regularly reviewing the sheet for discrepancies and clearly defining absence categories to avoid confusion.

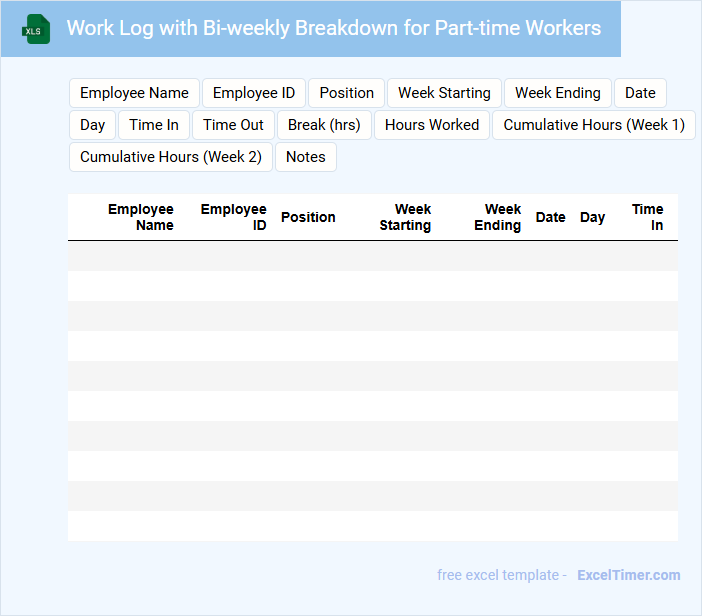

Work Log with Bi-weekly Breakdown for Part-time Workers

What does a Work Log with Bi-weekly Breakdown for Part-time Workers typically contain? This document usually includes detailed records of hours worked, tasks completed, and any significant notes or issues encountered during each bi-weekly period. It helps employers track productivity and ensures accurate payroll processing for part-time employees.

Why is it important to maintain a detailed bi-weekly work log? Keeping an accurate log supports transparent communication between workers and management, aids in performance evaluation, and helps identify workload patterns or necessary adjustments. Including clear dates, task descriptions, and total hours worked are essential elements to ensure the log's effectiveness.

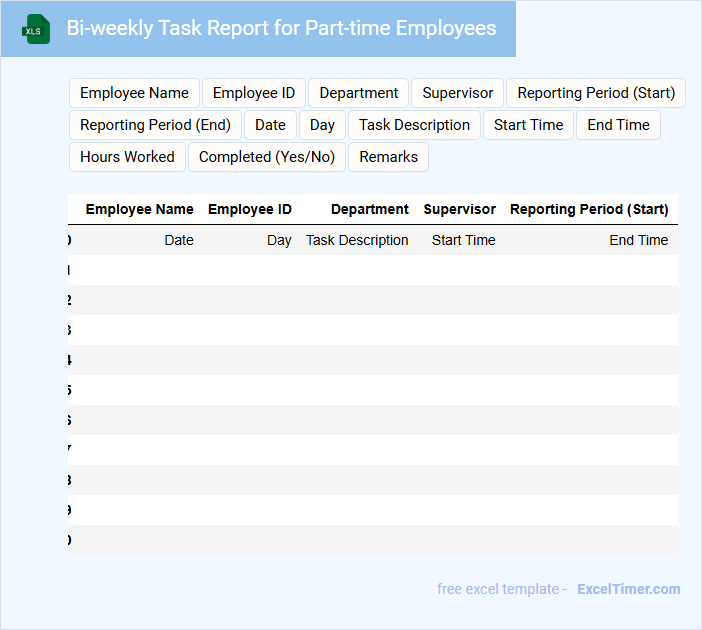

Bi-weekly Task Report for Part-time Employees

What information is typically included in a bi-weekly task report for part-time employees? This document usually contains a summary of tasks completed, hours worked, and any challenges faced during the two-week period. It helps managers track progress, evaluate performance, and identify areas needing support or improvement.

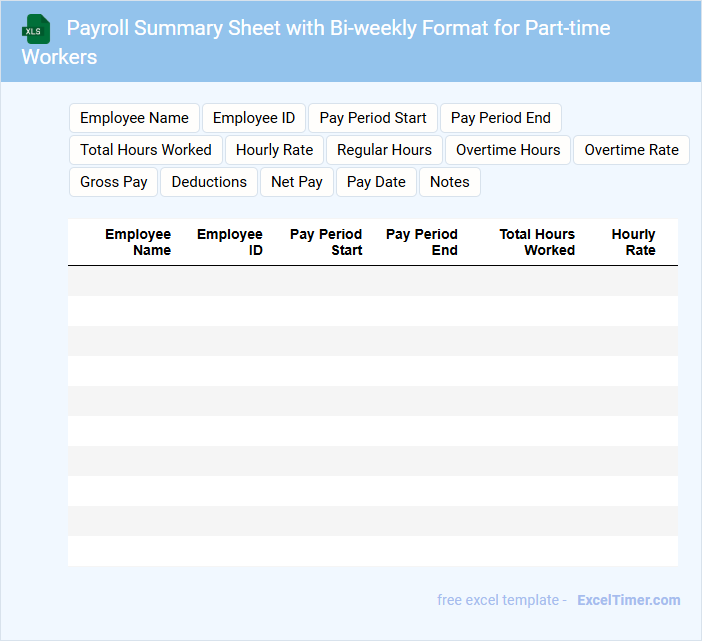

Payroll Summary Sheet with Bi-weekly Format for Part-time Workers

A Payroll Summary Sheet in a bi-weekly format for part-time workers typically contains detailed records of employee hours, wages, and deductions over a two-week period. It includes essential data such as hours worked, overtime, gross pay, taxes, and net pay to ensure accurate compensation. This document is crucial for maintaining compliance with labor laws and facilitating efficient payroll processing.

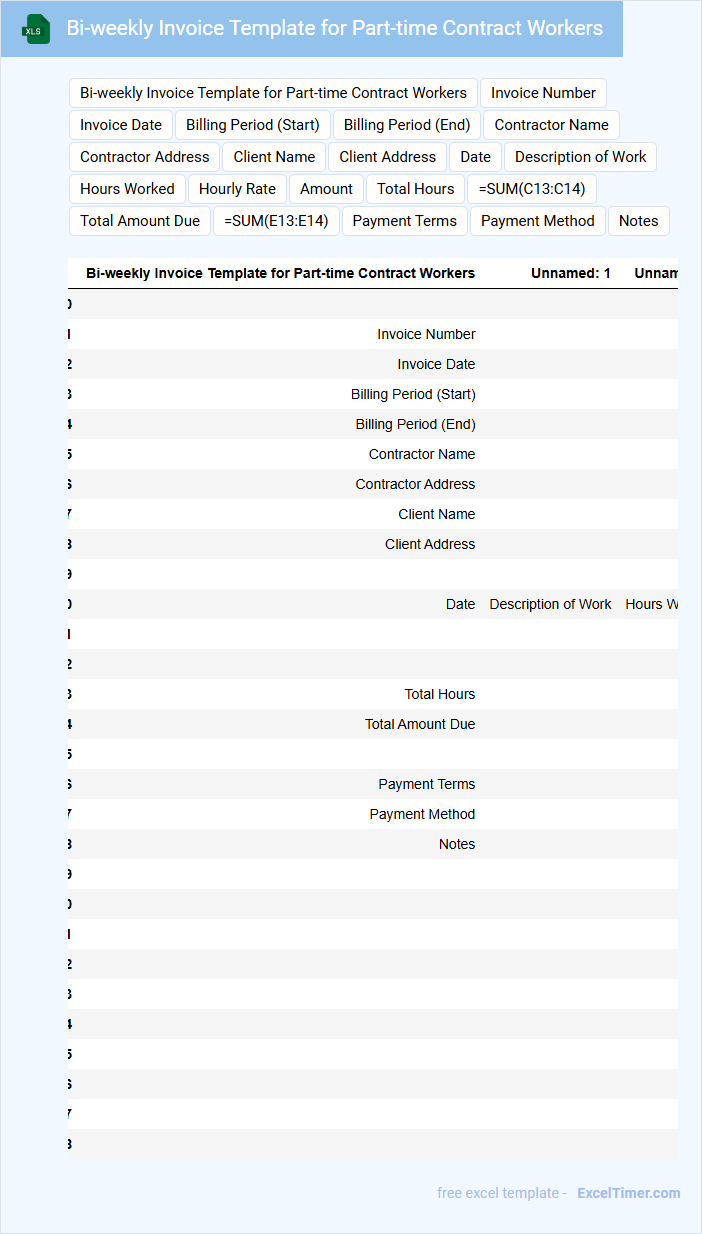

Bi-weekly Invoice Template for Part-time Contract Workers

A Bi-weekly Invoice Template for part-time contract workers typically contains detailed information about the hours worked, the rate per hour, and the total payment due for each bi-weekly period. It also includes essential details such as the contractor's name, contact information, and payment terms to ensure clarity and professionalism.

Including an itemized breakdown of tasks or projects completed during the period helps maintain transparency and avoids payment disputes. It is important to clearly state the invoice number and the due date to facilitate timely payments.

What does "bi-weekly" mean in terms of payroll frequency for part-time workers?

Bi-weekly payroll frequency for part-time workers means employees are paid every two weeks, resulting in 26 pay periods annually. This schedule ensures consistent payment intervals regardless of monthly variations. Employers often use bi-weekly pay to simplify payroll processing and budgeting.

How is the total number of work hours calculated for part-time workers on a bi-weekly basis in Excel?

In Excel, the total number of work hours for part-time workers on a bi-weekly basis is calculated by summing the daily hours logged over two consecutive weeks using the SUM function. Your worksheet should include columns for each workday's hours and a formula that adds these values for a 14-day period. This approach ensures accurate tracking of part-time hours and easy payroll management.

What essential Excel formulas are used to compute bi-weekly earnings for part-time employees?

Key Excel formulas for computing bi-weekly earnings of part-time workers include SUMPRODUCT to calculate total pay by multiplying hours worked by hourly rates, IF to manage overtime conditions, and ROUND to format earnings accurately. The formula =SUMPRODUCT(HoursRange, RateRange) efficiently totals regular earnings while =IF(Hours>StandardHours, (StandardHours*Rate) + ((Hours-StandardHours)*OvertimeRate), Hours*Rate) calculates overtime pay. Using =ROUND(TotalEarnings, 2) ensures that the final bi-weekly payment is presented with two decimal precision.

How should Excel columns be structured to track bi-weekly attendance and pay for part-time staff?

Excel columns for tracking bi-weekly attendance and pay for part-time workers should include Employee ID, Name, Pay Period Start Date, Pay Period End Date, Total Hours Worked, Hourly Rate, Overtime Hours, Overtime Rate, Gross Pay, Taxes Withheld, and Net Pay. Incorporate separate columns for attendance details such as Days Worked, Absences, and Leave Types to ensure comprehensive monitoring. Use date or time-stamped columns to facilitate accurate bi-weekly calculations and payroll processing.

What adjustments are needed in Excel to manage overtime or varying hours within a bi-weekly period for part-time workers?

Adjust your Excel sheet to include separate columns for regular hours, overtime hours, and total hours worked within each bi-weekly period. Implement formulas to calculate overtime pay based on your company's rules, such as hours exceeding 40 per week. Use conditional formatting to highlight variations or discrepancies in hours for accurate payroll management.