The Bi-weekly Excel Template for Salary Calculation streamlines payroll processing by accurately computing employee wages every two weeks. It ensures precise deductions, overtime, and benefits integration, reducing manual errors and saving time. Customizable formulas and clear layouts enhance usability for HR and finance teams.

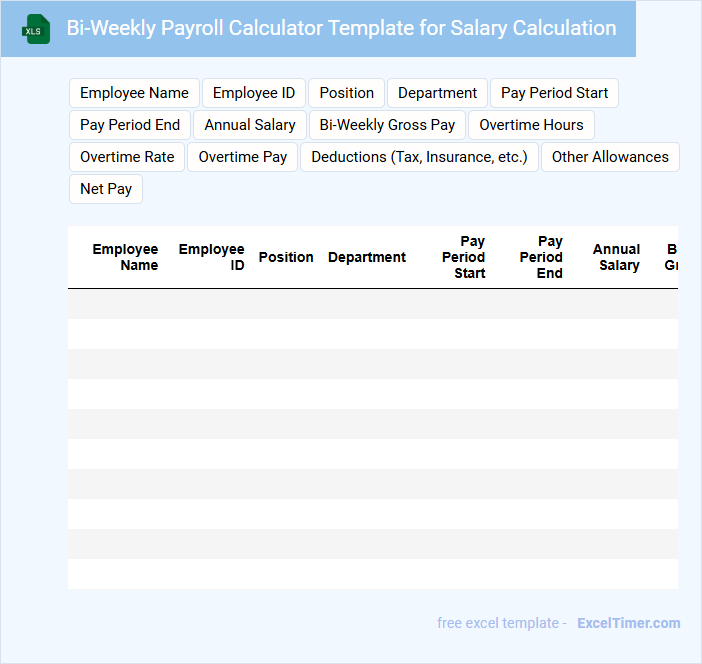

Bi-Weekly Payroll Calculator Template for Salary Calculation

A Bi-Weekly Payroll Calculator Template is designed to simplify the salary calculation process by breaking down earnings into two-week periods. It typically includes sections for employee details, hours worked, overtime, deductions, and net pay. Ensuring accuracy in tax rates and deduction entries is crucial for reliable payroll management.

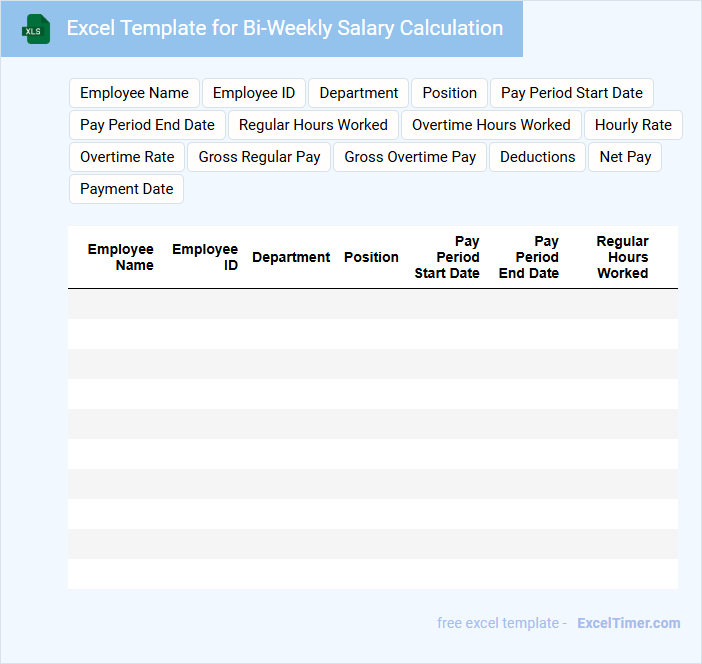

Excel Template for Bi-Weekly Salary Calculation

This Excel template is designed to streamline the calculation of bi-weekly salaries for employees, ensuring accuracy and efficiency in payroll processing. It typically includes fields for hours worked, pay rates, deductions, and net pay.

- Ensure formulas automatically update totals when data is entered to minimize errors.

- Include clear labels and instructions for ease of use by HR personnel.

- Incorporate sections for tax withholdings and other mandatory deductions.

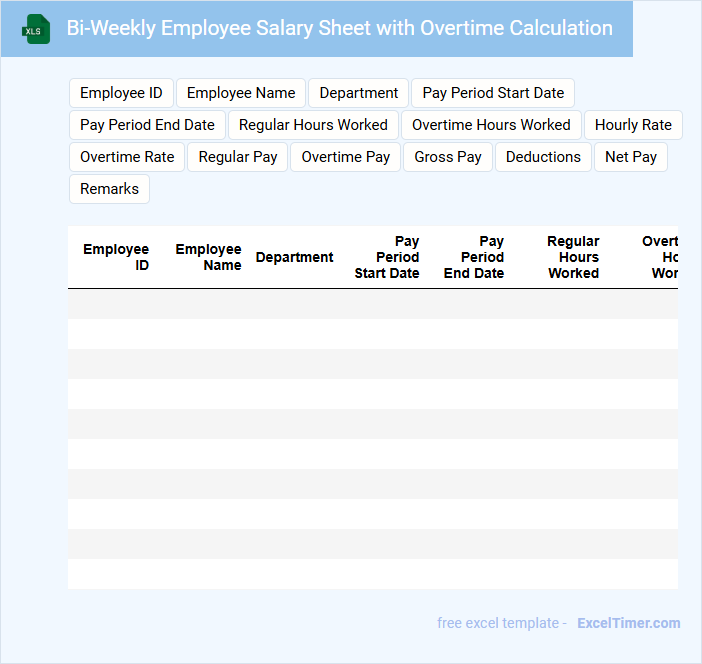

Bi-Weekly Employee Salary Sheet with Overtime Calculation

This Bi-Weekly Employee Salary Sheet typically contains employee details, base salary, hours worked, overtime hours, and total pay calculations. It provides a clear overview of compensation for the two-week period.

Including accurate Overtime Calculation is crucial to ensure fair payment for extra hours worked beyond regular shifts. This document also helps maintain compliance with labor laws and facilitates payroll processing.

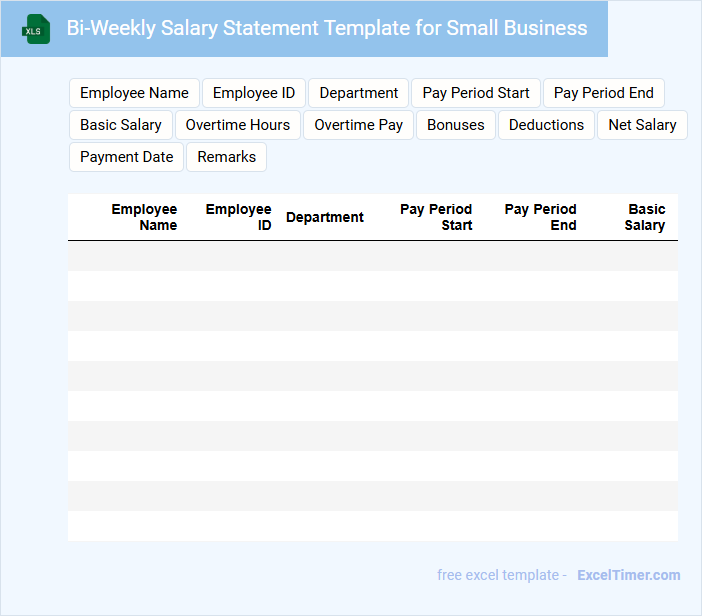

Bi-Weekly Salary Statement Template for Small Business

A Bi-Weekly Salary Statement Template typically contains detailed information about an employee's earnings for a two-week period, including gross pay, deductions, and net pay. It also lists withholding taxes, benefits contributions, and any other adjustments.

For small businesses, accuracy in payroll calculations and clear breakdowns are essential to avoid disputes and ensure compliance with tax regulations. Maintaining consistent documentation improves financial transparency and employee trust.

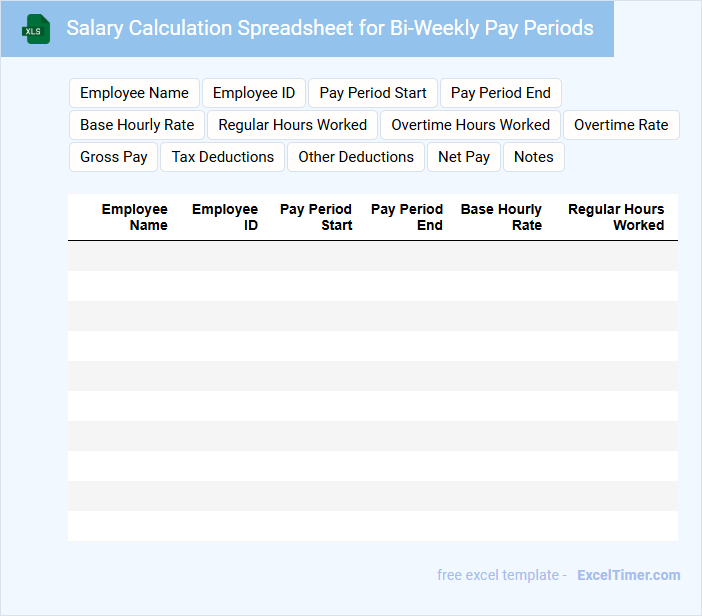

Salary Calculation Spreadsheet for Bi-Weekly Pay Periods

A Salary Calculation Spreadsheet for Bi-Weekly Pay Periods typically contains employee details, hours worked, pay rates, deductions, and net pay. This document is essential for tracking earnings accurately over 14-day cycles.

It often includes formulas to automate calculations for taxes, benefits, and overtime, ensuring consistency and reducing errors. Maintaining up-to-date records is crucial for compliance and payroll auditing purposes.

Ensure the spreadsheet uses clear labels and secure access to protect sensitive payroll data.

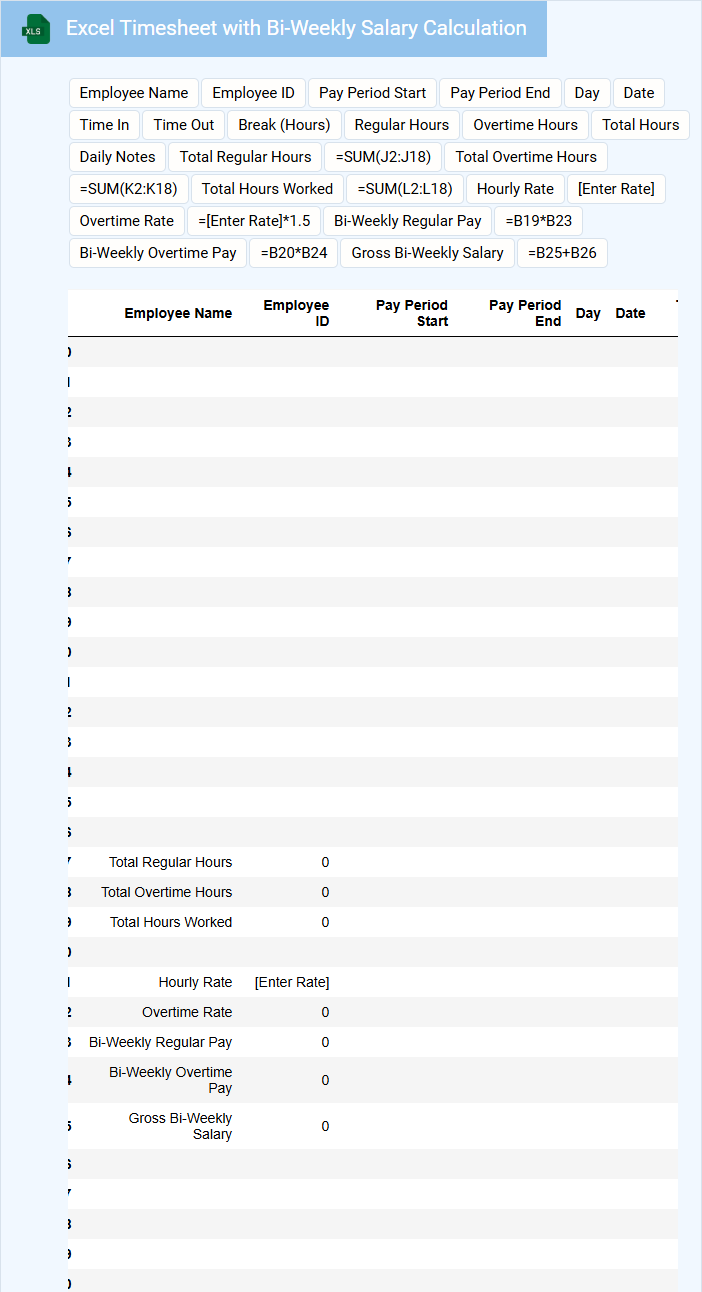

Excel Timesheet with Bi-Weekly Salary Calculation

Excel Timesheet with Bi-Weekly Salary Calculation is a document used to track employee hours and compute earnings over a two-week period efficiently.

- Accurate time entries are essential to ensure precise salary calculations.

- Clear layout helps employees and payroll staff easily review hours worked and payment details.

- Formulas for automatic calculation minimize errors and save time during payroll processing.

Bi-Weekly Salary Payment Tracker for HR

What information does a Bi-Weekly Salary Payment Tracker for HR typically contain? This document usually includes details such as employee names, payment dates, salary amounts, deductions, and net pay for each bi-weekly period. It helps HR departments maintain accurate records of payroll transactions and ensures timely and correct salary disbursements.

What are important aspects to consider when using this tracker? It is crucial to regularly update employee data, verify payment calculations for accuracy, and maintain confidentiality to protect sensitive financial information. Additionally, integrating the tracker with attendance and tax records enhances payroll efficiency and compliance.

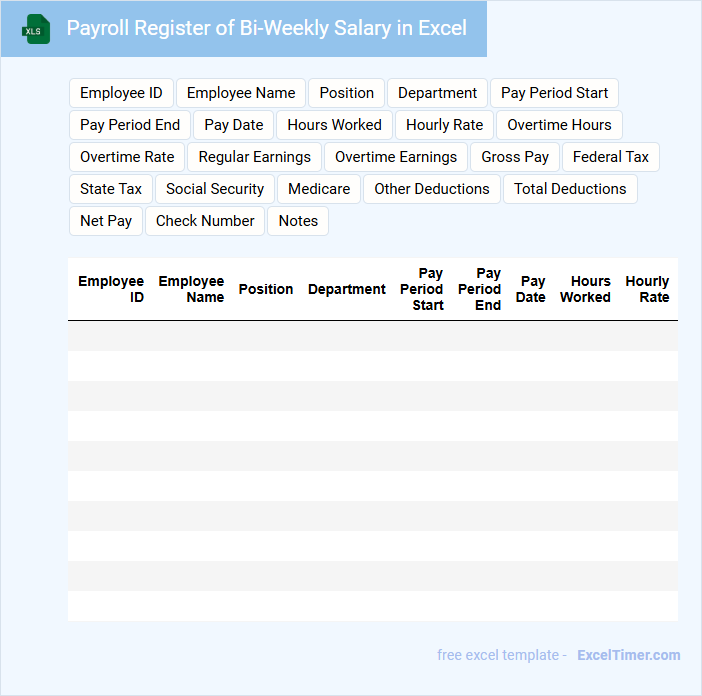

Payroll Register of Bi-Weekly Salary in Excel

A Payroll Register for Bi-Weekly Salary in Excel typically contains detailed employee payment information including hours worked, gross pay, deductions, and net pay for each pay period. This document helps organizations track and manage employee compensation efficiently.

It is important to ensure accuracy in employee data entry and formulas to avoid payroll errors and maintain compliance with tax regulations. Regular updates and backups of the Excel file are also recommended for data security and integrity.

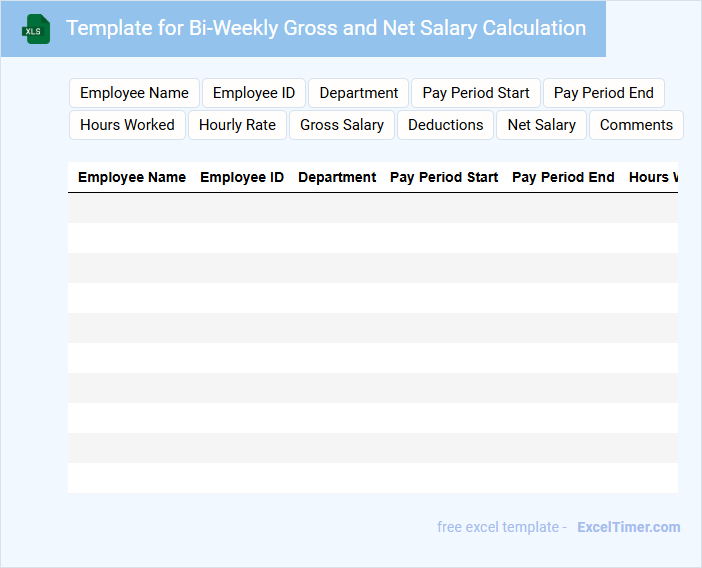

Template for Bi-Weekly Gross and Net Salary Calculation

This template typically contains detailed records of employee hours, hourly rates, and applicable deductions to calculate gross and net salaries accurately. It ensures transparency and consistency in payroll management across bi-weekly periods.

Important elements include clearly defined tax deductions and benefit contributions for precise net salary computation. Utilizing this template helps streamline payroll processing and maintain compliance with labor regulations.

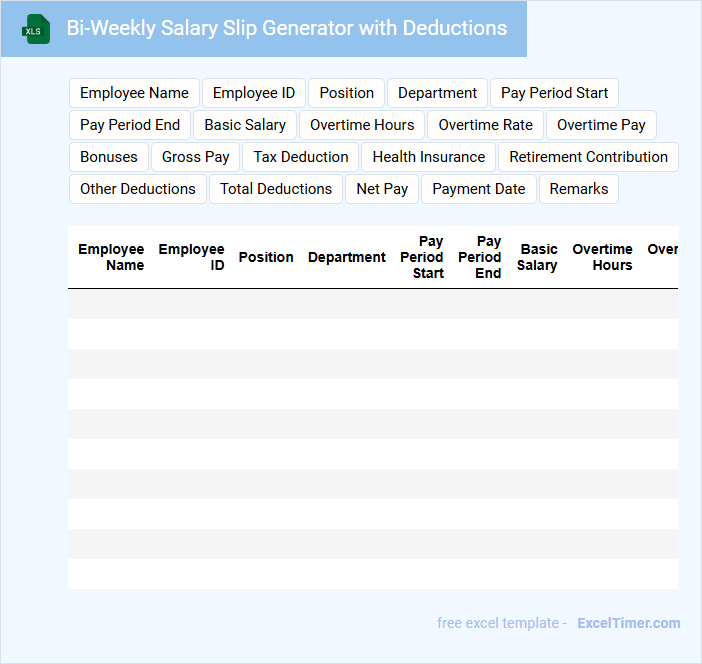

Bi-Weekly Salary Slip Generator with Deductions

A Bi-Weekly Salary Slip Generator is a tool designed to create detailed salary slips every two weeks, outlining an employee's earnings for that period. It usually includes basic salary, allowances, and various deductions such as taxes and insurance.

Including deductions clearly on the slip is essential for transparency and employee trust. Ensuring accuracy in tax rates and deduction calculations is a crucial aspect to maintain compliance and clarity.

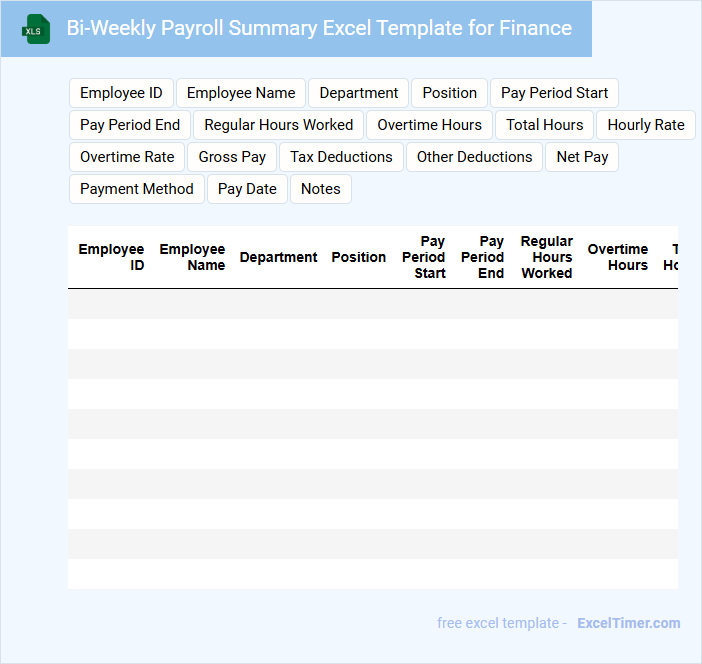

Bi-Weekly Payroll Summary Excel Template for Finance

This Bi-Weekly Payroll Summary Excel Template is designed to provide a clear overview of employee wages and deductions over a two-week period. It is essential for efficient financial tracking and ensuring accurate payroll processing within the finance department.

- Include detailed columns for employee names, hours worked, and gross pay.

- Incorporate automatic calculations for taxes, deductions, and net pay.

- Ensure the template allows for easy filtering and summary of payroll costs by department or project.

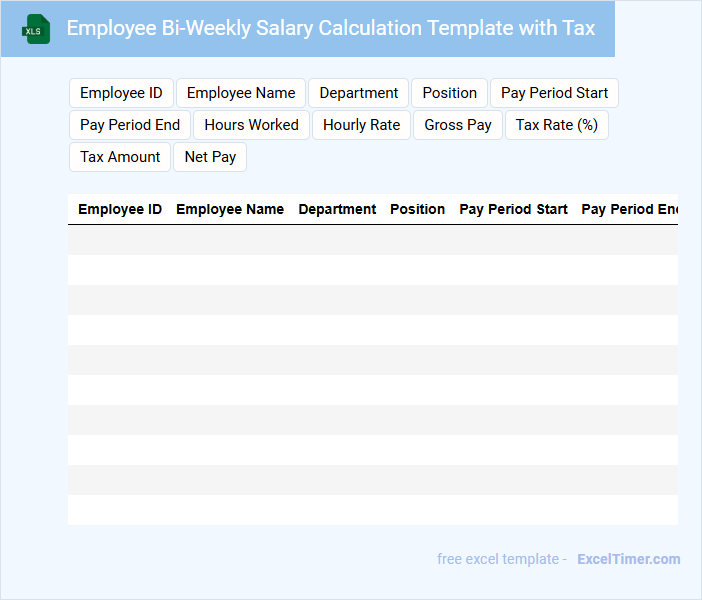

Employee Bi-Weekly Salary Calculation Template with Tax

The Employee Bi-Weekly Salary Calculation Template typically contains fields for hours worked, hourly rates, and gross pay to ensure accurate payroll processing. It also includes sections for tax deductions and other withholdings to calculate the net salary correctly.

For optimal use, it's important to keep the tax rates updated according to current regulations. Additionally, including fields for overtime and benefits can improve the accuracy and completeness of the salary calculation.

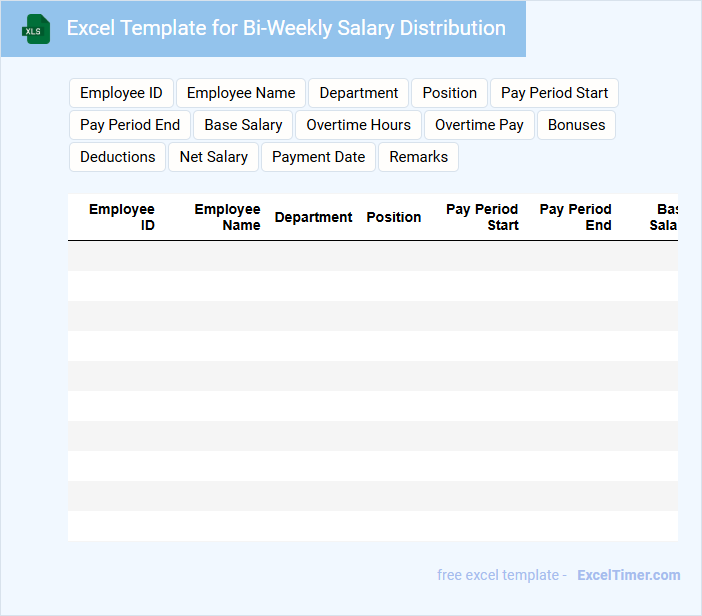

Excel Template for Bi-Weekly Salary Distribution

An Excel Template for Bi-Weekly Salary Distribution typically contains structured payroll data for employees over a two-week period.

- Employee Details: Includes names, IDs, and roles necessary for individual salary computation.

- Salary Components: Covers basic pay, allowances, deductions, and net salary in clearly defined columns.

- Summary and Validation: Features totals, tax calculations, and error-checking formulas to ensure accuracy.

Bi-Weekly Pay Sheet for Employee Salary Tracking

A Bi-Weekly Pay Sheet is a crucial document used for employee salary tracking, summarizing all wages paid over two-week periods. It typically contains employee names, hours worked, pay rates, deductions, and net pay. Keeping this document accurate ensures timely payroll processing and financial accountability.

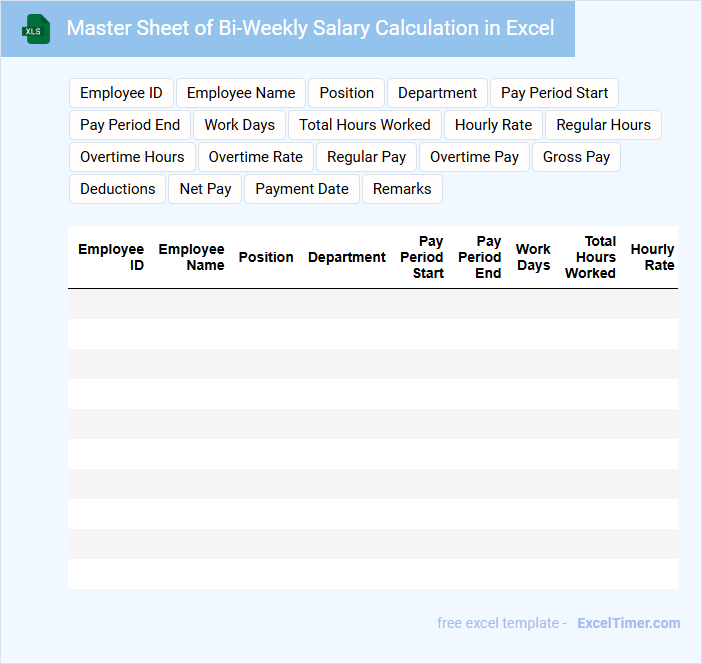

Master Sheet of Bi-Weekly Salary Calculation in Excel

Master Sheet of Bi-Weekly Salary Calculation in Excel typically contains detailed employee wage data and calculates earnings over two-week periods.

- Employee Information: Include names, ID numbers, and pay rates for accurate tracking.

- Hours Worked: Record regular and overtime hours clearly for precise wage calculation.

- Automatic Calculations: Use formulas to compute gross pay, deductions, and net salary efficiently.

What is the formula to calculate gross bi-weekly salary based on an annual salary in Excel?

To calculate gross bi-weekly salary from an annual salary in Excel, use the formula: =AnnualSalary/26. There are 26 bi-weekly periods in a year, making this division accurate for bi-weekly salary calculation. Replace "AnnualSalary" with the cell reference containing the annual salary amount.

How do you set up Excel to automatically distinguish between bi-weekly and monthly salary calculations?

To set up Excel for automatic distinction between bi-weekly and monthly salary calculations, create a drop-down menu using Data Validation to select the pay frequency. Use IF formulas to apply different salary computation methods based on the selected option, such as dividing the annual salary by 26 for bi-weekly or by 12 for monthly calculations. This setup ensures your spreadsheet dynamically adjusts to Your chosen salary period without manual recalculation.

Which Excel function can be used to count the number of bi-weekly pay periods in a year?

The Excel function =INT(365/14) calculates the number of bi-weekly pay periods in a year by dividing 365 days by 14-day intervals. This function returns 26, representing the total bi-weekly periods annually. Using this formula helps ensure accurate salary calculations based on bi-weekly pay schedules.

How can overtime pay be incorporated into a bi-weekly salary calculation formula in Excel?

In Excel, incorporate overtime pay into a bi-weekly salary calculation by multiplying overtime hours by the overtime rate (usually 1.5 times the regular hourly rate) and adding the result to the regular pay. Use a formula like: =(Regular Hours * Hourly Rate) + (Overtime Hours * Hourly Rate * 1.5). This ensures accurate calculation of total earnings including overtime within the bi-weekly pay period.

What steps are necessary in Excel to track and sum bi-weekly salary payments across months?

To track and sum bi-weekly salary payments across months in Excel, set up columns for payment dates and corresponding amounts, ensuring each date falls within a bi-weekly schedule. Use the SUMIFS function to total payments within specific month ranges by referencing the payment date column. Your spreadsheet will automatically update totals as new bi-weekly entries are added.