The Bi-weekly Excel Template for Team Payroll Deductions streamlines tracking and calculating employee deductions, ensuring accuracy and compliance with payroll regulations. It allows easy customization for various deduction categories such as taxes, insurance, and retirement plans, helping managers maintain clear financial records. This template enhances efficiency by automating complex calculations and reducing errors associated with manual payroll processing.

Bi-weekly Payroll Deductions Tracker for Team Members

A Bi-weekly Payroll Deductions Tracker for Team Members is a document that records all deductions from employees' payrolls every two weeks. It helps ensure accurate tracking and compliance with company policies and legal requirements.

- Include detailed deduction categories such as taxes, benefits, and loan repayments.

- Record the employee's name, pay period, and total deductions for clarity.

- Regularly update and review the tracker to avoid discrepancies and errors.

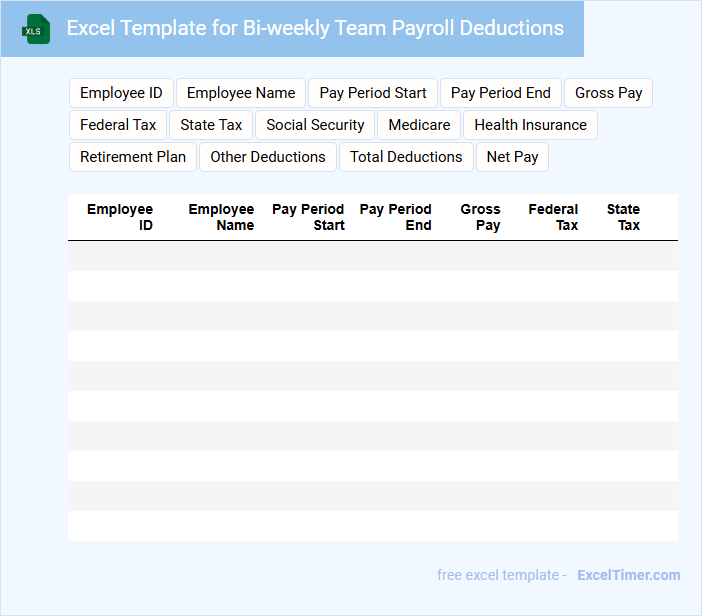

Excel Template for Bi-weekly Team Payroll Deductions

What information is typically contained in an Excel template for bi-weekly team payroll deductions? This type of document usually includes employee names, payroll periods, gross wages, and detailed deduction categories such as taxes, insurance, and retirement contributions. It organizes and calculates these amounts to ensure accurate payroll processing and compliance with company policies.

What important factors should be considered when using this template? It is crucial to ensure data accuracy and update deduction rates regularly to comply with current laws and company agreements. Additionally, incorporating clear labels and formulas within the template enhances usability and prevents calculation errors.

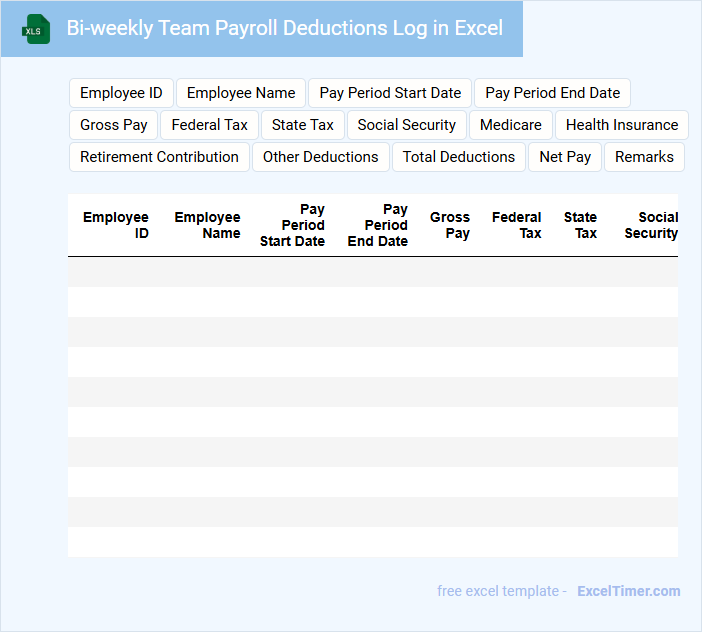

Bi-weekly Team Payroll Deductions Log in Excel

What information does a Bi-weekly Team Payroll Deductions Log in Excel typically contain? This document usually includes detailed records of all payroll deductions applied to each team member for a two-week period, such as taxes, benefits, and other withholdings. It helps ensure accuracy in payroll processing and provides a clear audit trail for financial tracking and compliance purposes.

What is an important consideration when maintaining this log? It is essential to keep the log updated and error-free, regularly verifying deduction amounts against pay stubs and company policies to prevent discrepancies. Using clear labels and organized columns in Excel enhances readability and facilitates quick data analysis.

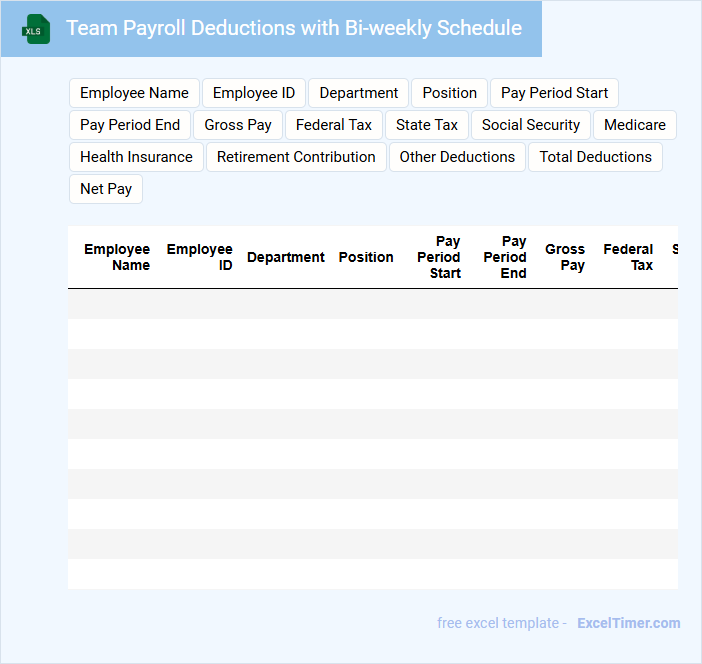

Team Payroll Deductions with Bi-weekly Schedule

The Team Payroll Deductions document typically contains detailed records of all deductions made from employee salaries on a bi-weekly basis. It includes information about taxes, benefits, and other mandatory or voluntary deductions. Ensuring accuracy and clarity in these records is crucial for maintaining employee trust and regulatory compliance.

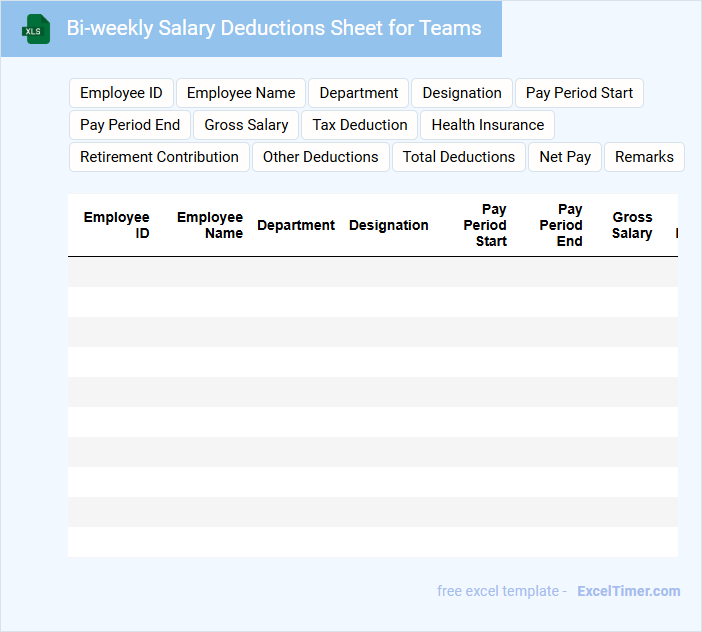

Bi-weekly Salary Deductions Sheet for Teams

The Bi-weekly Salary Deductions Sheet is a critical document that outlines all deductions made from employees' salaries during each two-week pay period. This sheet typically includes items such as taxes, insurance premiums, retirement contributions, and any other authorized deductions. Maintaining accurate and detailed records helps ensure transparency and facilitates error-free payroll processing for teams.

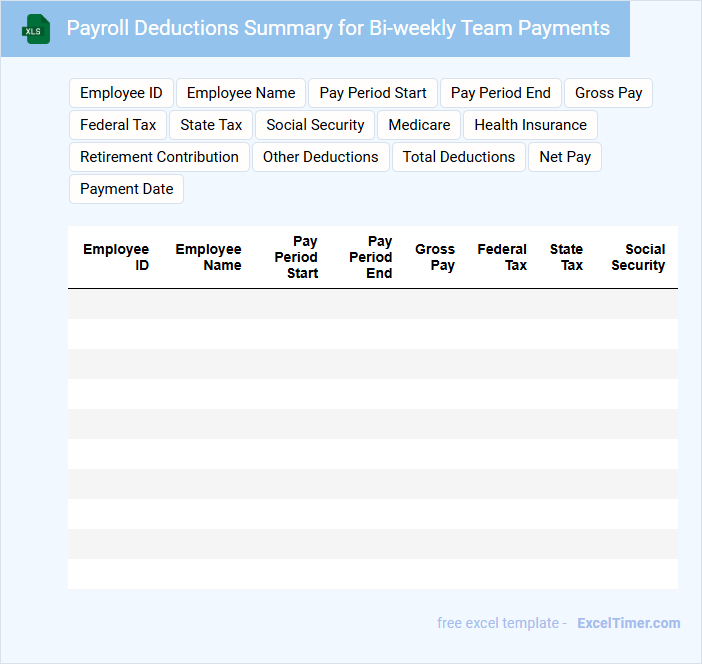

Payroll Deductions Summary for Bi-weekly Team Payments

What information is typically contained in a Payroll Deductions Summary for Bi-weekly Team Payments? This document usually lists all deductions made from employees' gross pay, such as taxes, insurance premiums, retirement contributions, and other withholdings. It provides a clear overview of amounts deducted per pay period, ensuring transparency and accurate record-keeping for both employers and employees.

What is an important consideration when preparing this summary? It is crucial to verify the accuracy of deduction calculations and compliance with current tax laws and company policies. Ensuring timely updates and clear communication of any deduction changes to the team helps maintain trust and avoid payroll discrepancies.

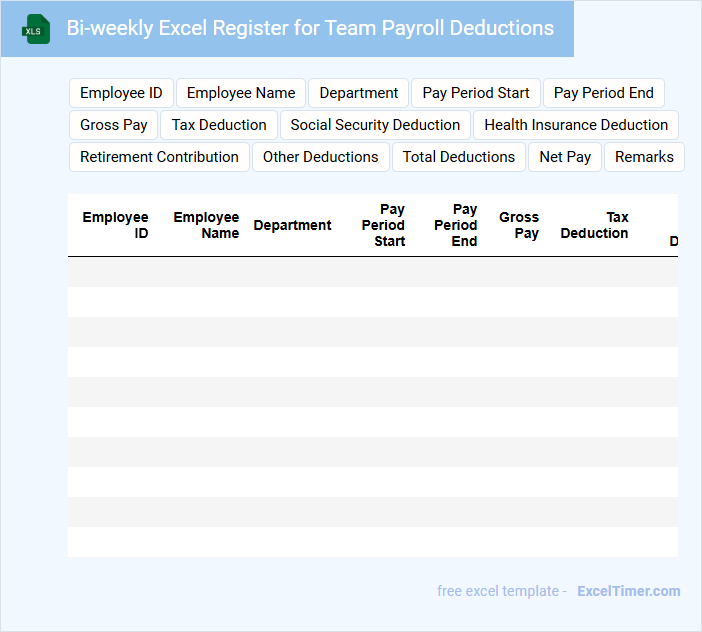

Bi-weekly Excel Register for Team Payroll Deductions

The Bi-weekly Excel Register for Team Payroll Deductions is a detailed document tracking employee deductions every two weeks. It typically contains names, deduction types, amounts, and payroll dates. This register ensures accurate financial management and compliance with company policies.

Important elements include clear identification of deduction categories and employee authorization status. Properly maintained, it facilitates transparent payroll processing and audit readiness. Regular updates and validation of data are crucial to avoid errors.

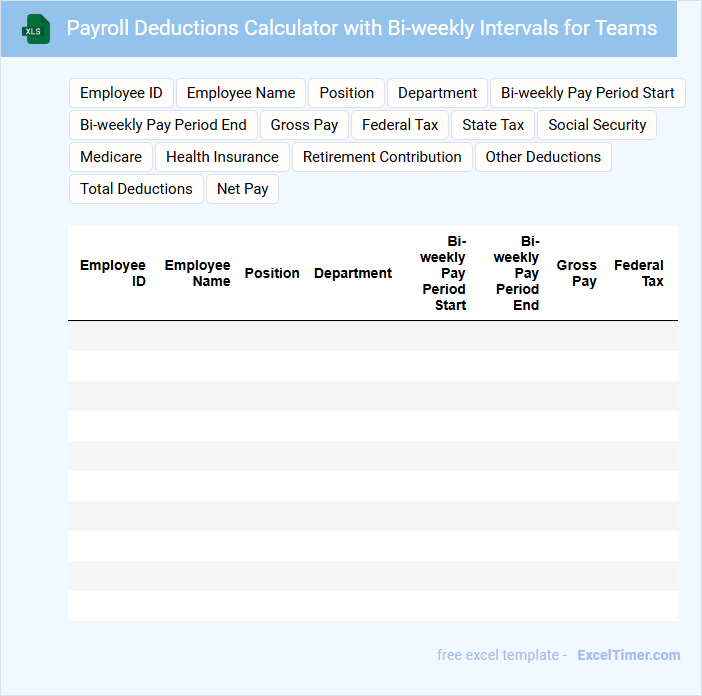

Payroll Deductions Calculator with Bi-weekly Intervals for Teams

This document typically contains detailed information on payroll deductions, outlining various mandatory and voluntary withholdings such as taxes, insurance, and retirement contributions. It serves as a guide to ensure accurate calculation and compliance with legal requirements during the payroll process.

The document usually includes instructions for using a bi-weekly intervals calculator designed to help teams split payroll deductions correctly over 26 pay periods in a year. Clear examples and formulas improve usability and minimize errors in financial planning.

Excel Sheet for Tracking Bi-weekly Team Payroll Deductions

This type of document typically contains detailed records of payroll deductions for team members over bi-weekly periods, ensuring accurate and timely financial tracking. It is essential for maintaining transparent and organized employee compensation data.

- Include columns for employee names, deduction types, and deduction amounts for clarity.

- Ensure the data is updated regularly to reflect any changes in payroll deductions accurately.

- Incorporate formulas to automatically calculate total deductions and net pay for efficiency.

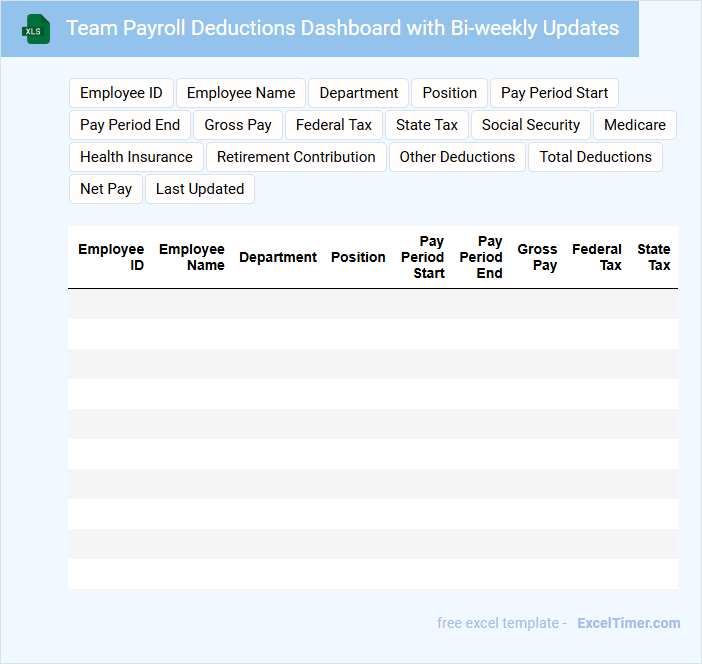

Team Payroll Deductions Dashboard with Bi-weekly Updates

A Team Payroll Deductions Dashboard typically contains detailed records of all payroll deductions made from employees' salaries, categorized for clarity and ease of analysis. It provides bi-weekly updates to ensure that payroll data is accurate and current, facilitating timely financial management. Key elements include deduction types, amounts, employee details, and summary statistics for quick reference.

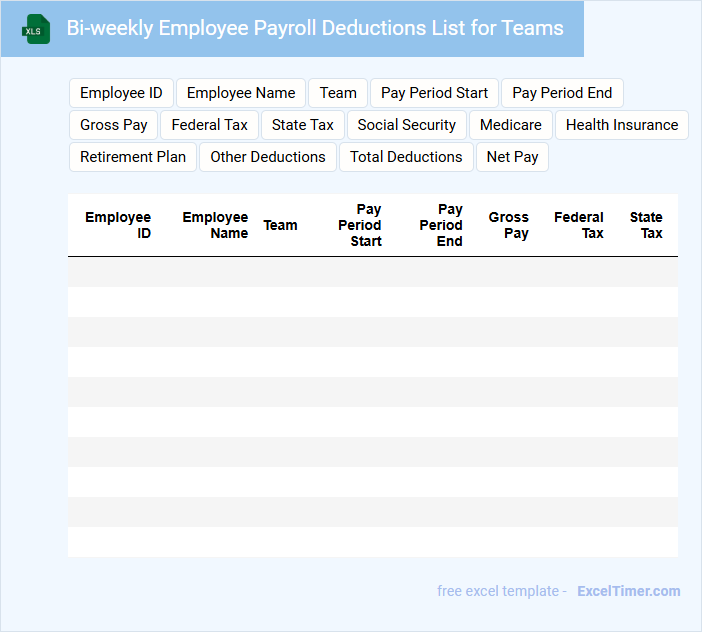

Bi-weekly Employee Payroll Deductions List for Teams

The Bi-weekly Employee Payroll Deductions List for teams is an essential document that details all deductions made from employees' wages during a two-week pay period. It typically includes information about taxes, benefits, and other withholdings for each employee. Ensuring accuracy and consistency in this list is crucial for payroll management and compliance purposes.

Important elements to include are employee names, unique identification numbers, deduction categories, amounts deducted, and the effective dates. Using clear and organized formatting enhances readability and helps avoid payroll discrepancies. Regular review and verification against time sheets and benefit enrollments are recommended to maintain the list's accuracy.

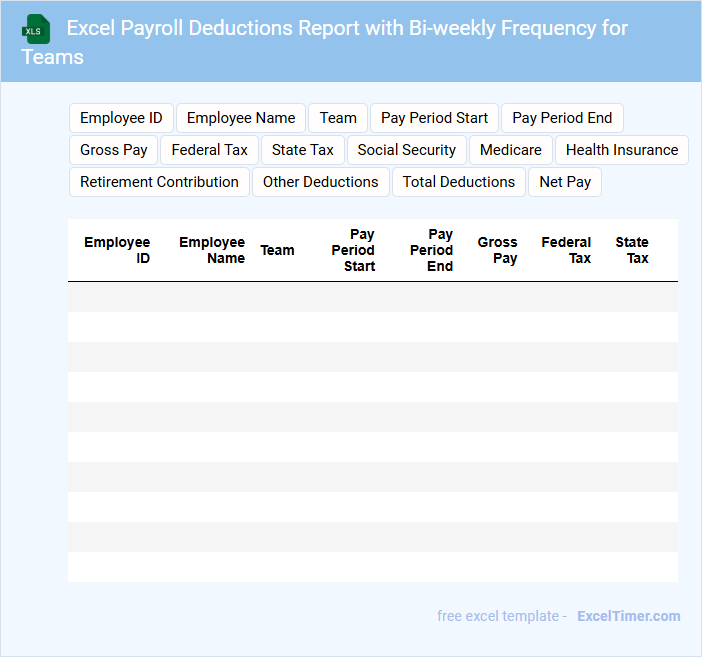

Excel Payroll Deductions Report with Bi-weekly Frequency for Teams

An Excel Payroll Deductions Report with bi-weekly frequency for teams typically contains detailed records of employee payroll deductions over a two-week pay period. This document includes categories such as taxes, benefits, and other withholdings, organized for each team member. It is crucial for accurate payroll processing and financial transparency within the organization.

To optimize this report, ensure consistent and clear categorization of deduction types and integrate automated formulas to minimize errors. Including a summary section highlighting total deductions per team enhances quick review and decision-making. Regularly updating the report and verifying data accuracy is essential for compliance and audit purposes.

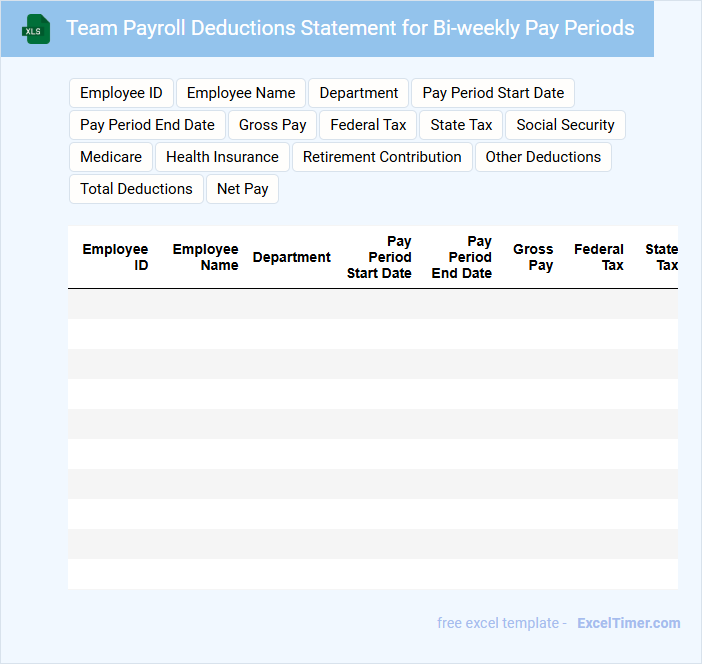

Team Payroll Deductions Statement for Bi-weekly Pay Periods

What information is typically included in a Team Payroll Deductions Statement for Bi-weekly Pay Periods? This document usually contains detailed listings of all deductions subtracted from each team member's gross pay, such as taxes, insurance premiums, and retirement contributions. It provides transparency and ensures employees understand how their net pay is calculated for each bi-weekly pay period.

Important considerations when preparing this statement include accuracy in deduction amounts and clear categorization so employees can easily verify their individual contributions. Additionally, including summary totals and ensuring compliance with relevant payroll regulations enhances the usefulness and reliability of the statement.

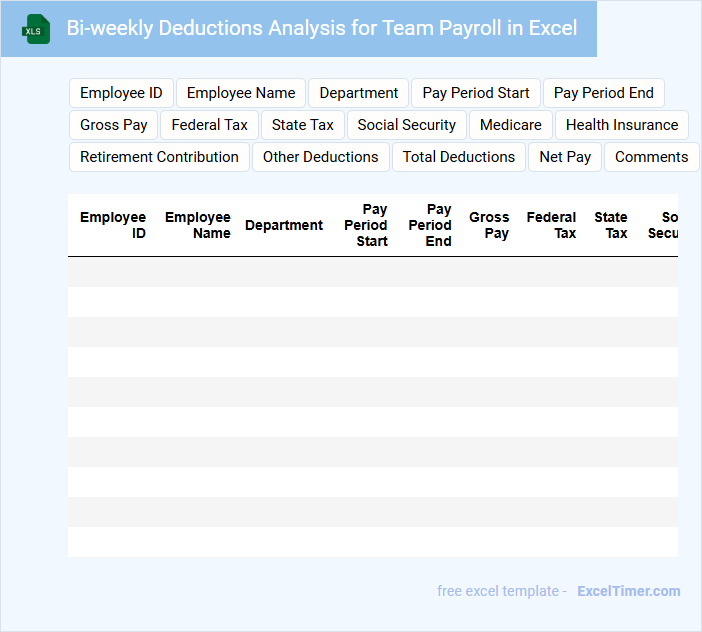

Bi-weekly Deductions Analysis for Team Payroll in Excel

What information is typically included in a Bi-weekly Deductions Analysis for Team Payroll in Excel? This document usually contains detailed records of all payroll deductions such as taxes, insurance, retirement contributions, and other withholdings for each team member over a two-week period. It organizes data systematically to help track, analyze, and ensure accuracy in payroll processing and compliance.

What is an important consideration when preparing this analysis? Ensuring data accuracy and up-to-date deduction rates is crucial since errors can lead to financial discrepancies or legal issues. Additionally, incorporating clear labels, consistent formatting, and summary sections enhances readability and facilitates quick decision-making.

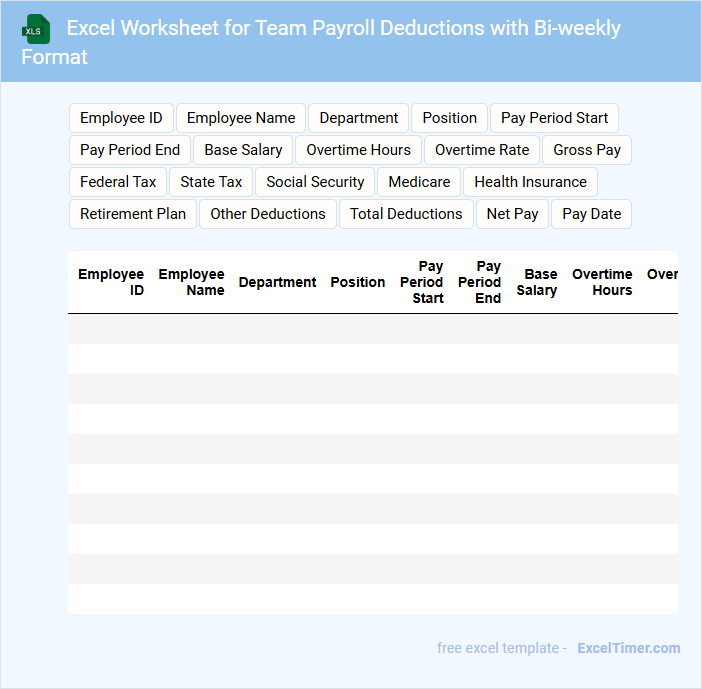

Excel Worksheet for Team Payroll Deductions with Bi-weekly Format

An Excel Worksheet for Team Payroll Deductions with a bi-weekly format typically contains detailed records of employee earnings and deductions calculated every two weeks. It includes columns for employee names, gross pay, tax deductions, benefits, and net pay, facilitating transparent payroll management. Maintaining accuracy and regular updates ensures compliance with tax regulations and employee satisfaction.

How does the bi-weekly payroll schedule impact total annual pay periods for team members?

A bi-weekly payroll schedule results in 26 total pay periods annually for team members. This schedule ensures consistent deductions are applied every two weeks, aligning with the 52 weeks in a year. Tracking payroll deductions on a bi-weekly basis enhances accuracy in annual compensation management.

Which specific payroll deductions must be accurately calculated every bi-weekly cycle?

Your bi-weekly payroll deductions must accurately include federal income tax, Social Security tax, Medicare tax, state and local taxes, retirement contributions, and health insurance premiums. Precise calculation of these deductions ensures compliance with regulations and correct net pay for each team member. Regular review of tax rates and contribution limits is essential for maintaining accuracy every payroll cycle.

How are overtime hours and deductions reflected in a bi-weekly team payroll Excel document?

Overtime hours in a bi-weekly team payroll Excel document are recorded separately and multiplied by the overtime pay rate to calculate extra earnings. Payroll deductions, such as taxes and benefits, are automatically subtracted from the gross pay to determine net pay. Your document ensures accurate tracking of both overtime compensation and deduction details for transparent payroll management.

What formulas ensure correct calculation of taxes and benefits for each team member bi-weekly?

To ensure accurate calculation of taxes and benefits for each team member bi-weekly, use the formulas SUMPRODUCT for payroll deductions and IF functions to apply tax brackets. VLOOKUP or INDEX-MATCH can reference individual tax rates and benefit percentages from a master data table. Your Excel document should integrate these formulas to automate precise bi-weekly payroll calculations.

How does the track historical deduction changes across multiple bi-weekly periods?

The Excel template tracks historical deduction changes by recording and timestamping each bi-weekly payroll period's deductions in a structured tabular format. It uses separate columns for each deduction category alongside date or period identifiers, enabling clear comparison over time. This systematic approach facilitates easy auditing and analysis of payroll deduction trends for the team.