The Bi-weekly Excel Template for Personal Finance helps users track income, expenses, and savings every two weeks, ensuring precise budgeting. It provides clear categories and automated calculations to simplify financial management and improve cash flow visibility. This template is essential for maintaining consistent control over personal finances and achieving financial goals efficiently.

Bi-Weekly Budget Tracker for Personal Finance

A Bi-Weekly Budget Tracker is a financial document designed to monitor income and expenses over a two-week period. It helps individuals manage personal finance by breaking down spending and savings to ensure better financial control.

This document typically contains categorized expense entries, income sources, and a summary of financial goals. An important suggestion is to regularly update and review the tracker to identify spending patterns and adjust budgets effectively.

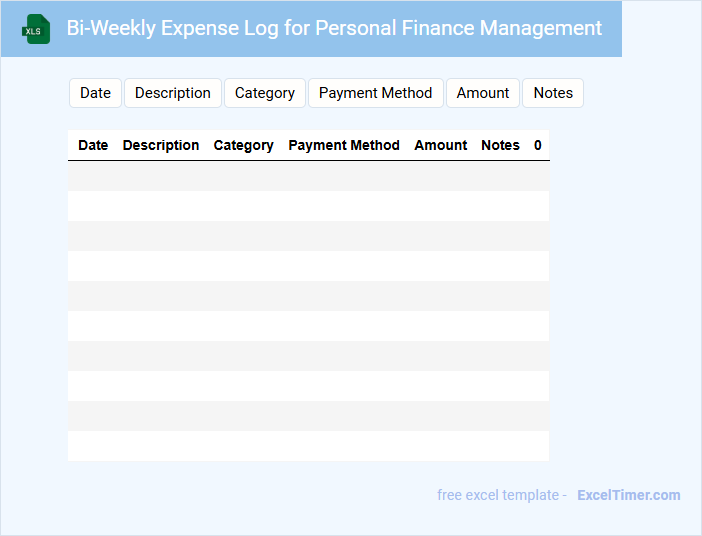

Bi-Weekly Expense Log for Personal Finance Management

A Bi-Weekly Expense Log is a document used to track all personal expenses incurred within a two-week period, helping individuals manage their finances more effectively. It typically includes categories such as groceries, entertainment, bills, and miscellaneous spending. Keeping an accurate and detailed log is crucial for identifying spending patterns and making informed budgeting decisions.

Bi-Weekly Savings Plan with Spending Tracker

A Bi-Weekly Savings Plan with a Spending Tracker is a financial document designed to help individuals manage their savings and expenses every two weeks. It typically outlines income, savings goals, and tracks spending patterns to promote better financial habits.

These documents often include sections for recording income, categorizing expenses, and monitoring progress toward savings targets. Including a clear summary of financial goals and alerts for overspending are important features to maximize its effectiveness.

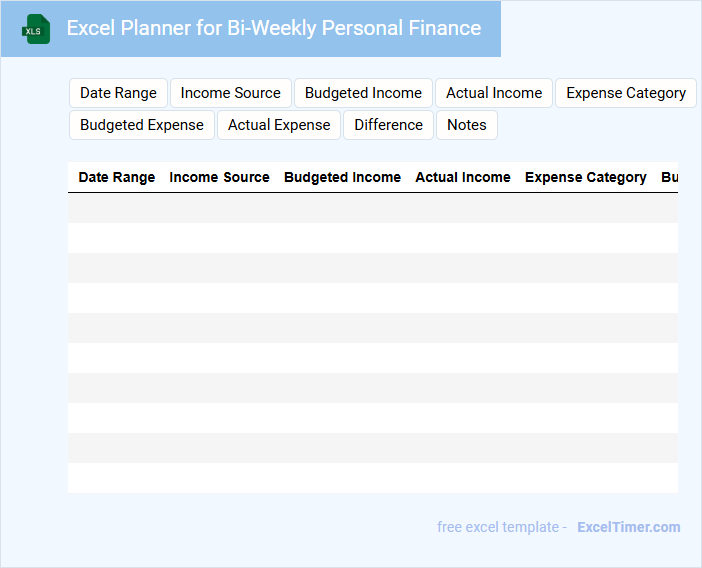

Excel Planner for Bi-Weekly Personal Finance

An Excel Planner for Bi-Weekly Personal Finance typically contains detailed budgeting templates tailored for a two-week income and expense cycle. It usually includes sections for tracking income, fixed and variable expenses, and savings goals every two weeks. This type of document is designed to enhance financial discipline and ensure timely bill payments within a bi-weekly timeframe.

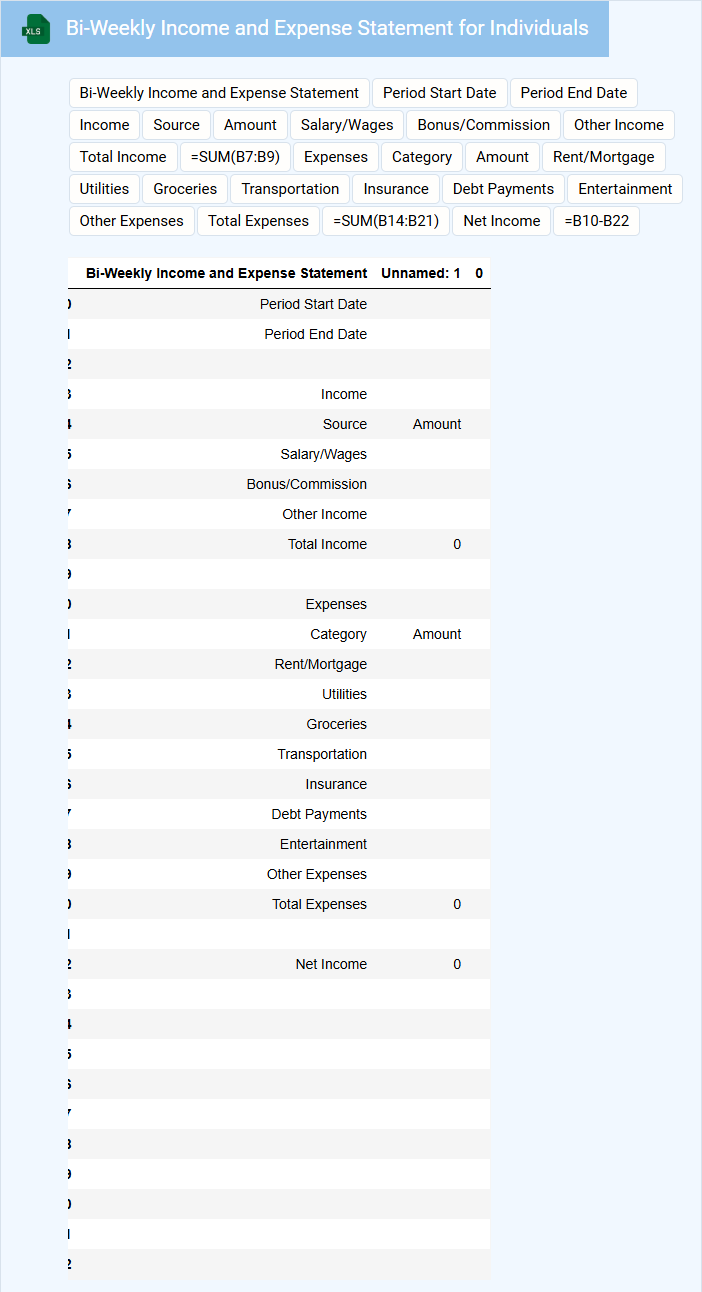

Bi-Weekly Income and Expense Statement for Individuals

A Bi-Weekly Income and Expense Statement is a financial document that outlines an individual's earnings and expenditures over a two-week period. It helps in tracking money flow and managing budgets effectively. This statement typically contains detailed entries of all sources of income as well as itemized expenses, giving a clear picture of financial health. For better accuracy, it's important to regularly update this statement and categorize expenses properly to identify spending patterns.

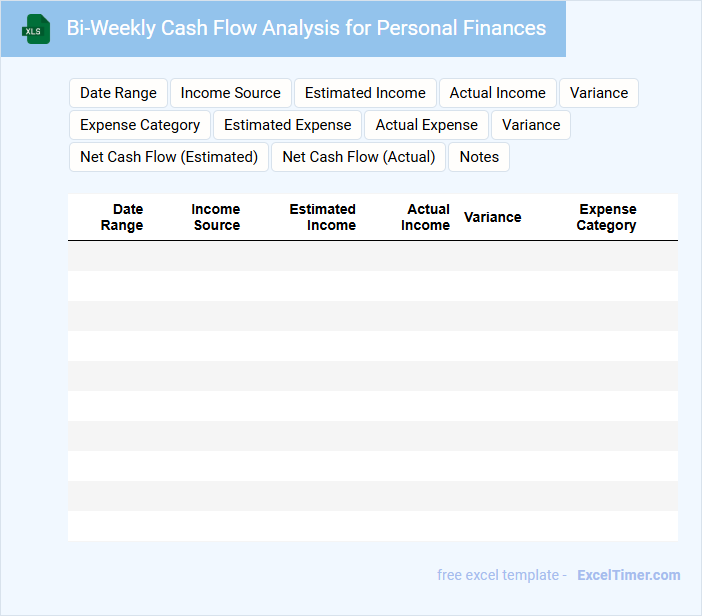

Bi-Weekly Cash Flow Analysis for Personal Finances

A Bi-Weekly Cash Flow Analysis for Personal Finances is a document that tracks income and expenses every two weeks to help manage and optimize financial health. It provides a clear picture of cash inflows and outflows, enabling better budgeting and spending decisions.

- List all sources of income and categorize every expense accurately.

- Identify recurring payments and potential savings opportunities.

- Review the cash flow summary regularly to adjust financial strategies.

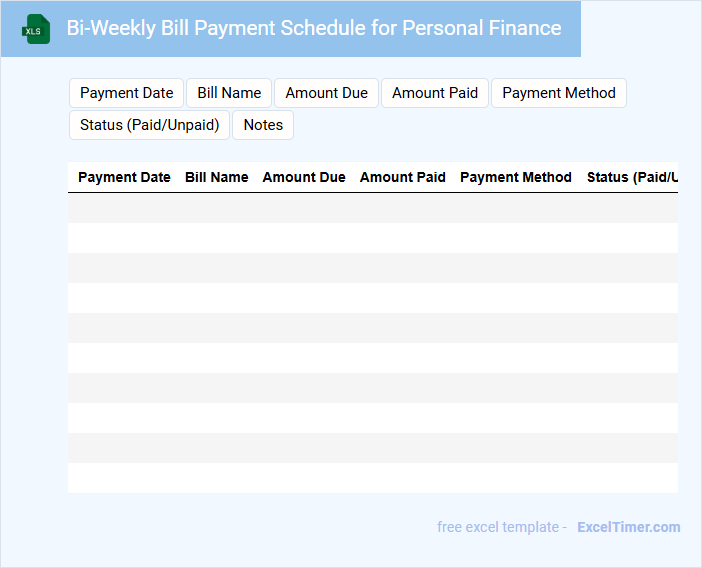

Bi-Weekly Bill Payment Schedule for Personal Finance

A Bi-Weekly Bill Payment Schedule is an essential tool used to organize and track personal financial obligations every two weeks. It typically contains due dates, payment amounts, and the payee details, helping to avoid missed payments and late fees. This schedule aids in budgeting effectively by aligning bill payments with income cycles, ensuring financial stability.

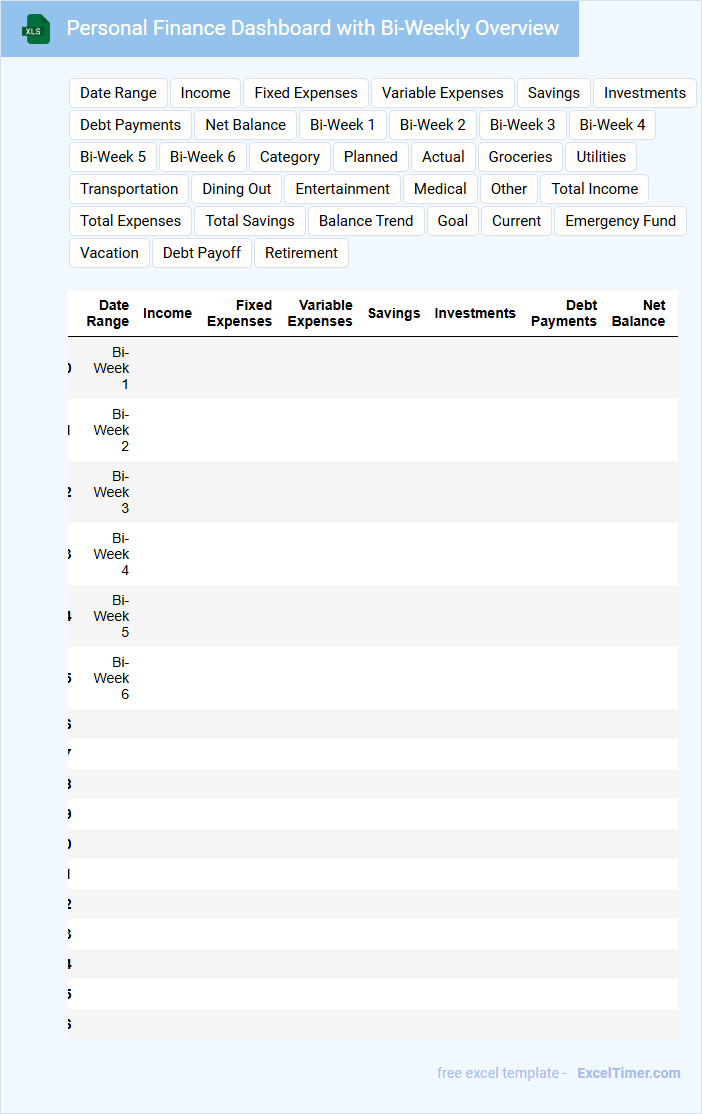

Personal Finance Dashboard with Bi-Weekly Overview

A Personal Finance Dashboard typically contains detailed summaries of income, expenses, savings, and investments, allowing users to monitor their financial health effectively. It often includes visual elements like charts and graphs to offer a clear and quick overview of financial trends. For a bi-weekly overview, it is important to focus on tracking cash flow within each two-week period to manage budgeting and avoid overspending.

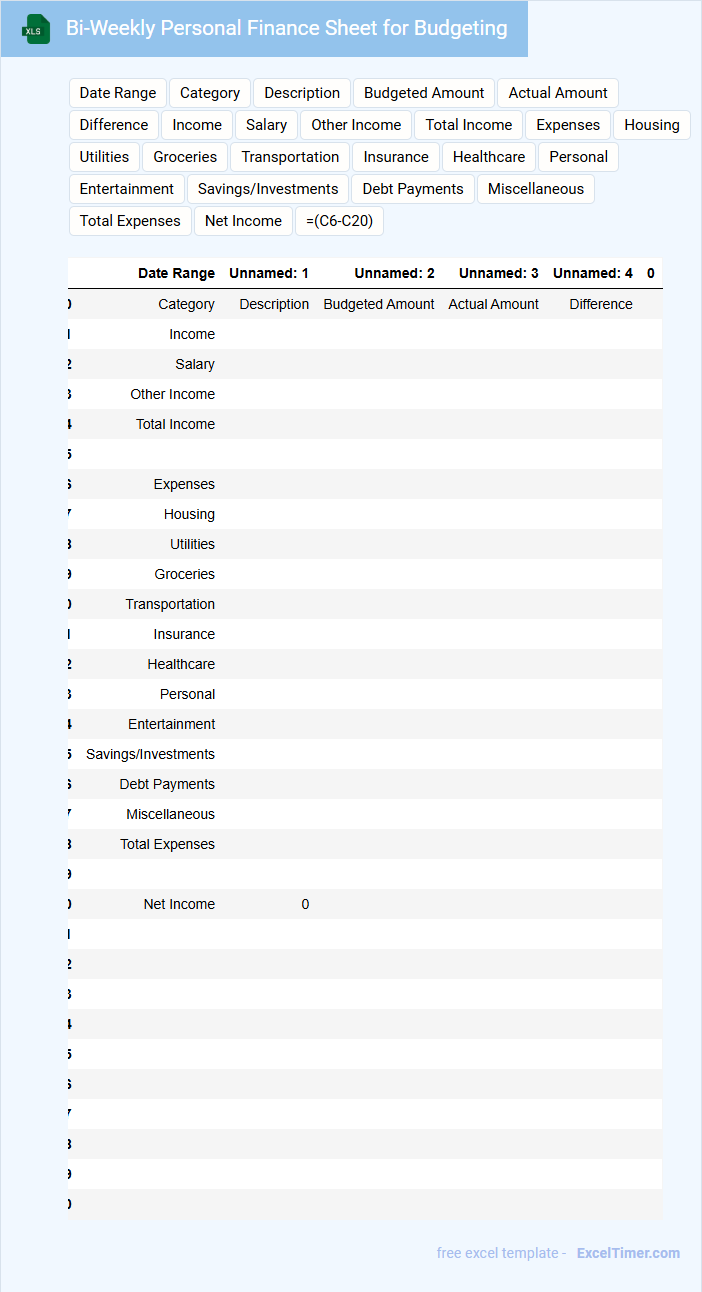

Bi-Weekly Personal Finance Sheet for Budgeting

A Bi-Weekly Personal Finance Sheet is a structured document used to track income, expenses, and savings over a two-week period. It helps individuals maintain a clear overview of their financial situation by breaking down budget categories and payment schedules.

This type of document usually contains sections for income sources, fixed and variable expenses, debt payments, and savings goals. Keeping detailed records and regularly updating the sheet ensures effective budgeting and improved financial discipline.

Excel Template for Tracking Bi-Weekly Expenses

An Excel template for tracking bi-weekly expenses is designed to help users monitor and manage their spending over a two-week period. It simplifies budgeting by categorizing expenses and providing a clear overview of financial habits.

- Include categories such as groceries, utilities, and entertainment to organize expenses effectively.

- Incorporate formulas to automatically calculate totals and variances for quick analysis.

- Add a summary section to compare planned versus actual expenses for better budgeting.

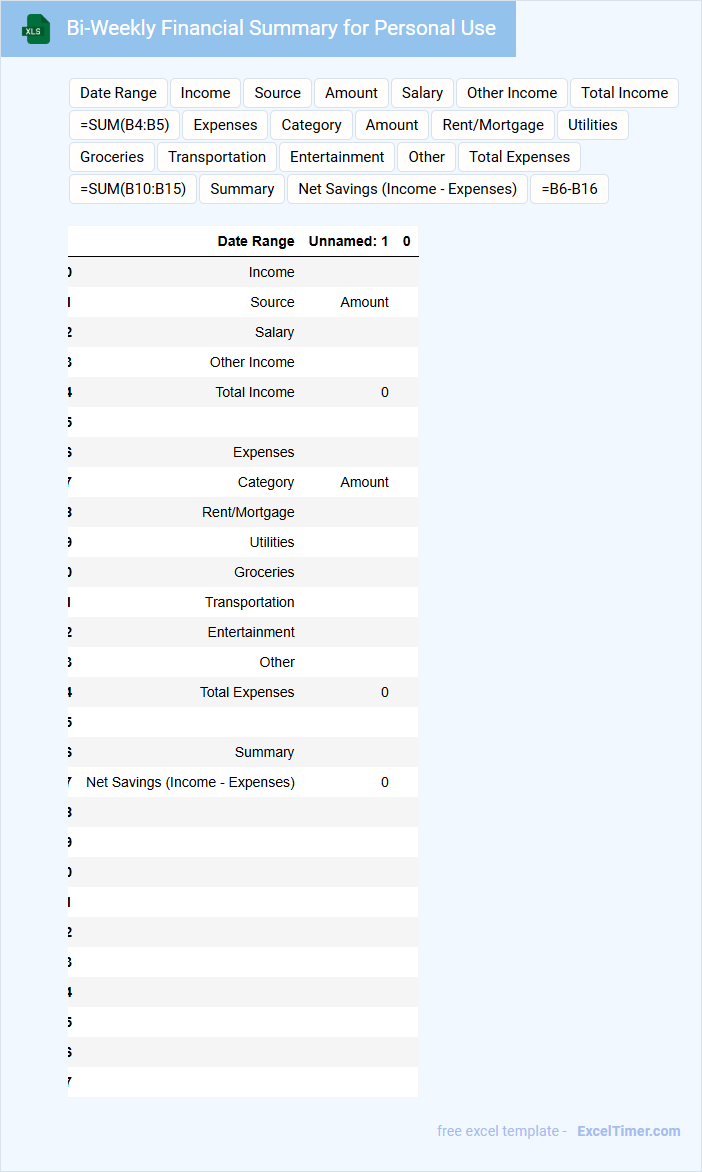

Bi-Weekly Financial Summary for Personal Use

A Bi-Weekly Financial Summary for personal use is a concise document that outlines your income, expenses, and savings over a two-week period. It helps track financial habits and provides an overview of your financial health. Including categorized expenses and comparison with previous periods can significantly enhance its usefulness.

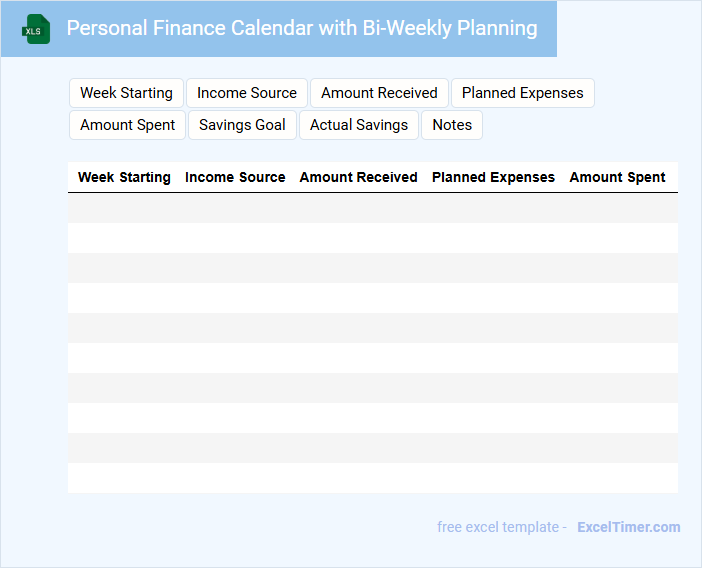

Personal Finance Calendar with Bi-Weekly Planning

A Personal Finance Calendar with bi-weekly planning is designed to help individuals track their income, expenses, and savings on a consistent two-week basis. It usually includes sections for paydays, bill due dates, budget goals, and financial reminders.

The key feature is its ability to promote disciplined money management by breaking down monthly finances into manageable intervals. This approach helps prevent overspending and ensures timely bill payments for better cash flow control.

For best results, regularly update your calendar and review your spending to adjust your budget efficiently.

Bi-Weekly Debt Repayment Tracker for Individuals

The Bi-Weekly Debt Repayment Tracker is a vital document designed to help individuals monitor their debt payments every two weeks, ensuring consistent progress towards financial freedom. It typically contains fields for payment dates, amounts paid, remaining balance, and interest accrued.

This tracker emphasizes the importance of maintaining a strict repayment schedule to avoid missed payments and reduce interest costs over time. Including sections for notes and reminders can enhance accountability and clarity during the repayment process.

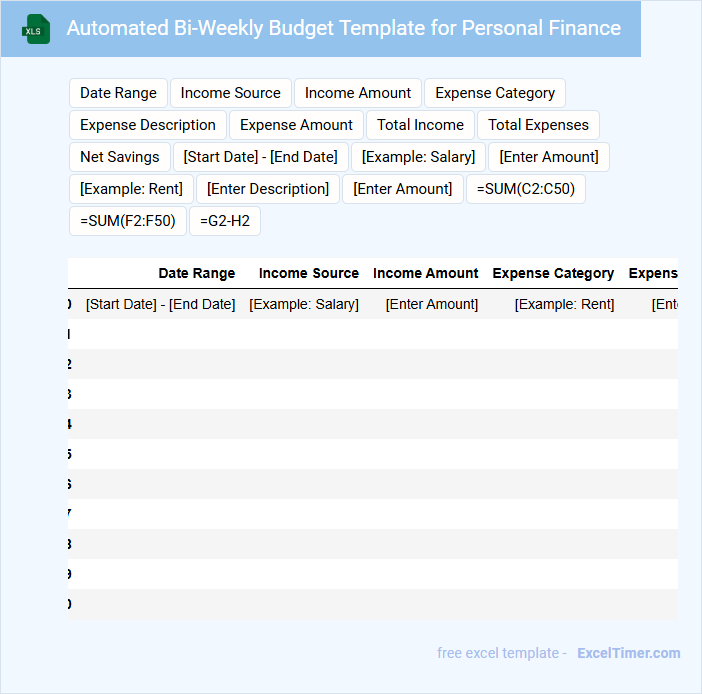

Automated Bi-Weekly Budget Template for Personal Finance

This document typically contains a structured framework to track and manage personal finances on a bi-weekly basis.

- Income tracking: Record all sources of income for accurate budgeting.

- Expense categorization: Organize spending into categories to monitor financial habits.

- Savings and goals: Set and update financial goals to ensure steady savings growth.

Bi-Weekly Financial Goals Tracker for Personal Finance

A Bi-Weekly Financial Goals Tracker is typically a document designed to monitor personal income, expenses, and savings over two-week periods. It helps in organizing and evaluating financial progress regularly to ensure goals are met efficiently. Key components often include sections for tracking income sources, expense categories, and progress toward specific savings or debt reduction targets.

Important suggestions for using this type of document include setting clear and measurable financial goals, maintaining consistency in recording all transactions every two weeks, and regularly reviewing the tracker to adjust spending habits. Additionally, incorporating a summary section that highlights overall progress can enhance motivation and focus. Using color-coding or visual charts can also improve clarity and engagement.

What is the meaning of "bi-weekly" in the context of personal finance and paycheck frequency?

Bi-weekly in personal finance refers to events occurring every two weeks, especially regarding paycheck frequency. Your paycheck typically arrives 26 times per year under a bi-weekly schedule. This impacts budgeting and expense planning by spreading income evenly across the calendar year.

How can you use Excel to create a bi-weekly budget template for tracking income and expenses?

Excel allows you to create a bi-weekly budget template by setting up columns for income sources, expense categories, and dates spanning every two weeks. Use Excel formulas like SUM and IF to automatically calculate totals and categorize spending efficiently. Your bi-weekly budget template helps track cash flow and manage personal finances with precision.

What are the benefits and challenges of managing bills and savings on a bi-weekly rather than monthly basis?

Managing bills and savings on a bi-weekly basis aligns with common pay periods, improving cash flow management and reducing the risk of late payments. This method enables faster debt reduction and more consistent saving habits due to more frequent contributions. Challenges include increased tracking complexity and potential confusion with budgeting, requiring careful coordination of payment schedules.

How can Excel formulas help calculate total income and deductions for a bi-weekly pay period?

Excel formulas automate the calculation of total income and deductions for a bi-weekly pay period by summing individual entries such as salaries, bonuses, and tax withholdings. Using functions like SUM and IF, your spreadsheet efficiently tracks and updates financial data every two weeks. This precise approach helps you manage cash flow and budget effectively throughout the pay cycle.

Why is it important to adjust financial goals and planning in Excel to account for months with three bi-weekly paychecks?

Adjusting financial goals in Excel for months with three bi-weekly paychecks ensures accurate budgeting and reflects true income variations. This adjustment helps prevent overspending by aligning expenses with actual cash flow. Excel's structured format allows precise tracking of these income changes, improving financial planning accuracy.