The Bi-weekly Excel Template for Payment Schedule allows precise tracking of payments made every two weeks, ensuring accurate budgeting and financial planning. It simplifies managing income and expenses by providing organized, easy-to-update schedules and automatic calculations. This template is essential for maintaining consistent cash flow visibility and avoiding missed or late payments.

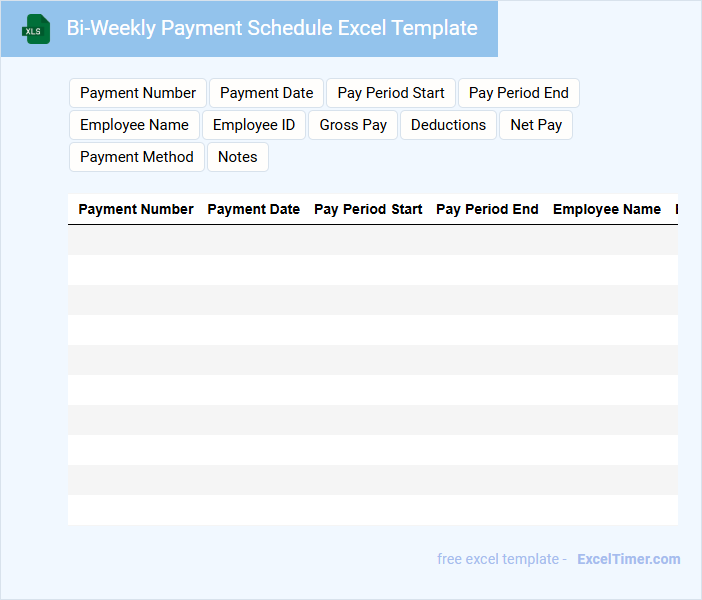

Bi-Weekly Payment Schedule Excel Template

Bi-Weekly Payment Schedule Excel Templates typically contain detailed payment dates and amounts for employees or contractors on a bi-weekly basis. They help streamline payroll processing and ensure timely payments.

- Include clear date ranges and corresponding pay periods for accuracy.

- Incorporate columns for deductions, taxes, and net pay to capture full payroll details.

- Use formulas to automate calculations and reduce errors.

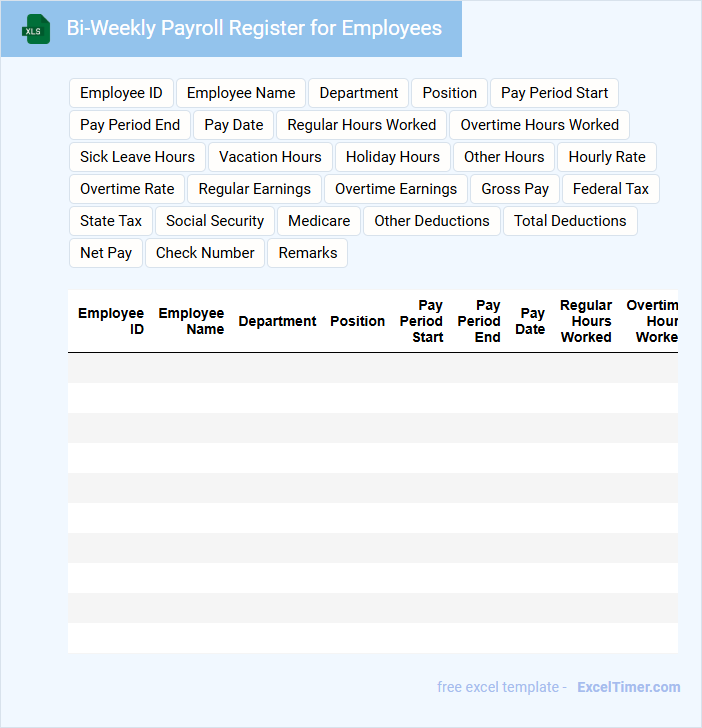

Bi-Weekly Payroll Register for Employees

A Bi-Weekly Payroll Register for Employees is a document that records detailed payment information for employees over a two-week pay period. It ensures accurate tracking of wages, taxes, and deductions.

- Include employee names, hours worked, and pay rates for clarity.

- Record all deductions and tax withholdings to maintain compliance.

- Double-check totals to prevent payroll errors and discrepancies.

Bi-Weekly Tracker for Payment Schedules

A Bi-Weekly Tracker for Payment Schedules is a document used to monitor and manage payments occurring every two weeks. It helps ensure timely payments and accurate financial record-keeping.

- Include payment dates and corresponding amounts clearly to avoid confusion.

- Track payment status to quickly identify missed or pending payments.

- Maintain a running balance to assess overall financial standing effectively.

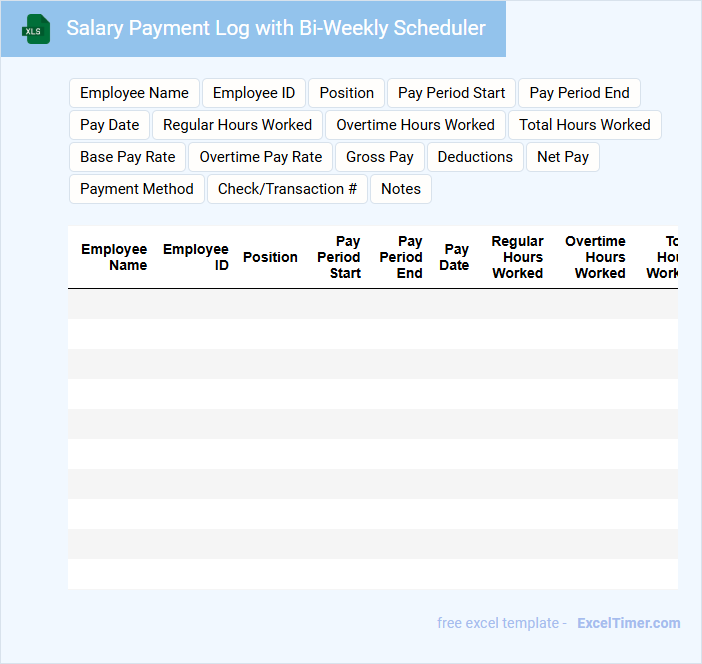

Salary Payment Log with Bi-Weekly Scheduler

A Salary Payment Log with a Bi-Weekly Scheduler is a record-keeping document used by organizations to track employee salary disbursements systematically every two weeks. It ensures timely and consistent payments, reducing payroll errors. This log typically includes employee names, pay periods, payment dates, and amounts paid.

The bi-weekly scheduler component helps in planning and automating payroll cycles, making financial forecasting easier for the company. Maintaining this log fosters transparency and accountability in remuneration processes. It is important to regularly update the log and verify entries to avoid discrepancies and ensure compliance with labor regulations.

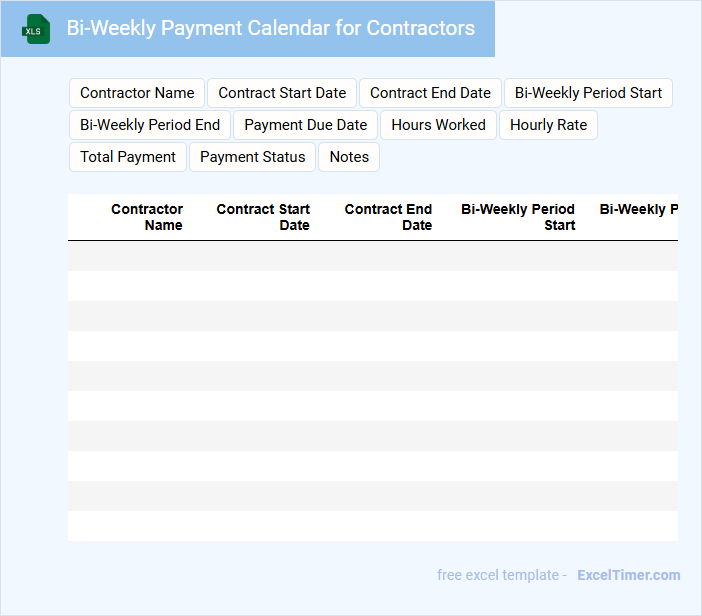

Bi-Weekly Payment Calendar for Contractors

What information is typically included in a Bi-Weekly Payment Calendar for Contractors? This type of document usually contains scheduled payment dates, the amount to be paid, and the specific contractor or project details. It helps contractors and clients keep track of payment cycles, ensuring timely transactions and clear expectations for both parties.

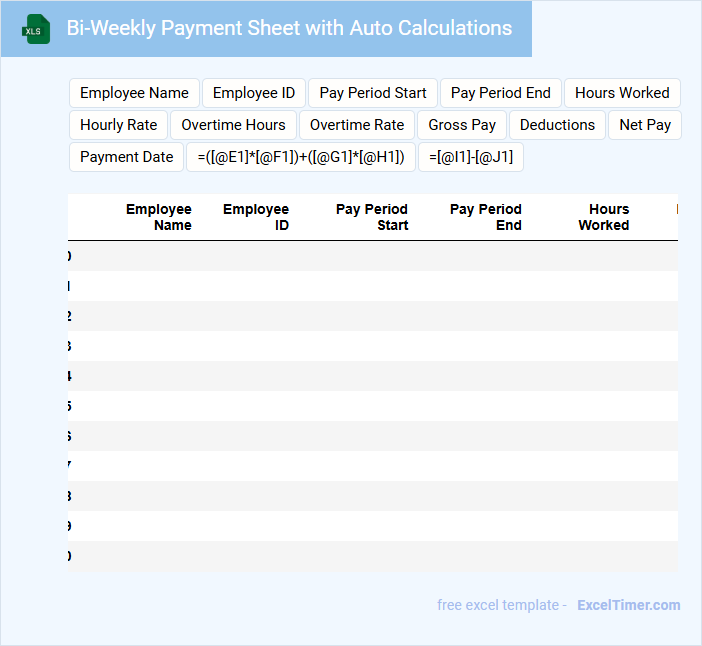

Bi-Weekly Payment Sheet with Auto Calculations

A Bi-Weekly Payment Sheet with Auto Calculations is typically used to track employee payments over a two-week period efficiently. It includes automatic formulas to sum hours worked and calculate total pay, reducing manual errors.

- Ensure it contains clear date ranges and employee identification details.

- Include fields for hours worked, overtime, deductions, and bonuses.

- Validate formulas to accurately compute gross and net payments automatically.

Simple Bi-Weekly Payment Tracker for Staff

A Simple Bi-Weekly Payment Tracker for staff is a document designed to record and monitor employee payments efficiently. It typically contains details such as employee names, payment dates, amounts paid, and any deductions or bonuses. Ensuring accuracy and clarity is essential for maintaining transparent payroll records.

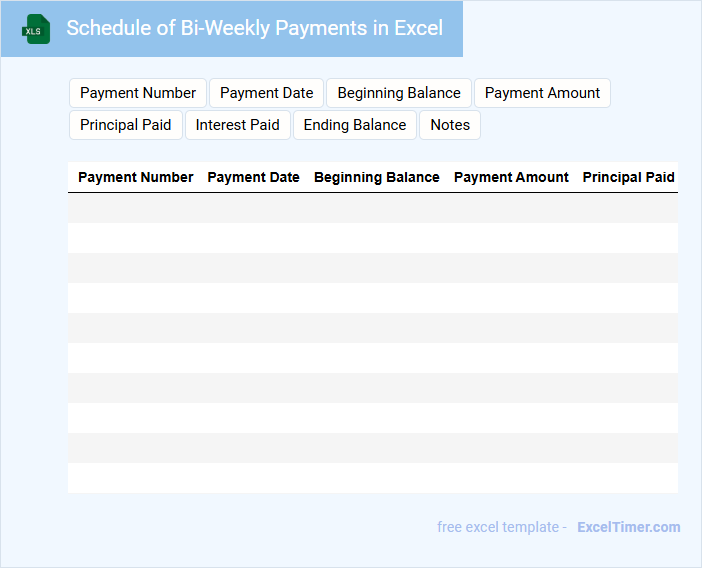

Schedule of Bi-Weekly Payments in Excel

A Schedule of Bi-Weekly Payments in Excel typically contains a detailed timeline of payment dates and amounts for loans or bills paid every two weeks. It helps in tracking payments and managing finances efficiently.

- Include payment dates and corresponding amounts for clear tracking.

- Calculate remaining balance after each payment to monitor progress.

- Use conditional formatting to highlight upcoming or missed payments.

Bi-Weekly Payment Tracker with Deductions

A Bi-Weekly Payment Tracker with deductions is a document designed to monitor and record earnings and reductions from an individual's paycheck every two weeks. It typically includes details such as gross pay, taxes withheld, insurance premiums, and other deductions, ensuring accurate tracking of net income. Maintaining this tracker helps in budgeting and financial planning. This type of document is important for managing payroll transparency and ensuring all deductions are correctly applied. It serves as a reference for both employees and employers to verify payment accuracy. Regular updates and careful record-keeping are essential for effective use.

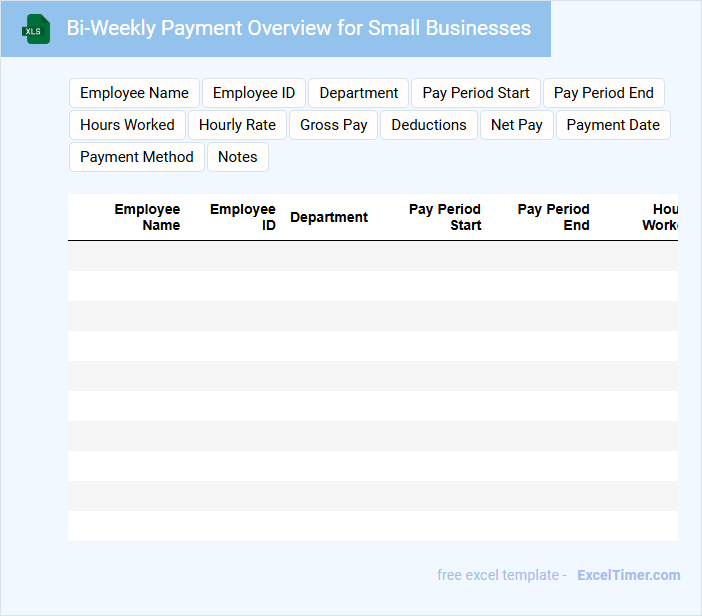

Bi-Weekly Payment Overview for Small Businesses

A Bi-Weekly Payment Overview for small businesses is a crucial document that details all transactions and payments made every two weeks. It typically includes a summary of expenses, revenue, and outstanding invoices within the period. This overview helps business owners maintain accurate cash flow tracking and financial planning.

Excel Tracker with Bi-Weekly Payment Planning

An Excel Tracker with Bi-Weekly Payment Planning is typically used for managing and organizing payment schedules efficiently. It includes detailed records of payment dates, amounts, and due statuses to ensure timely financial tracking.

This type of document helps streamline budgeting and cash flow management by providing clear visibility of upcoming payments. For optimal use, ensure to include automated reminders and summary reports to avoid missed deadlines.

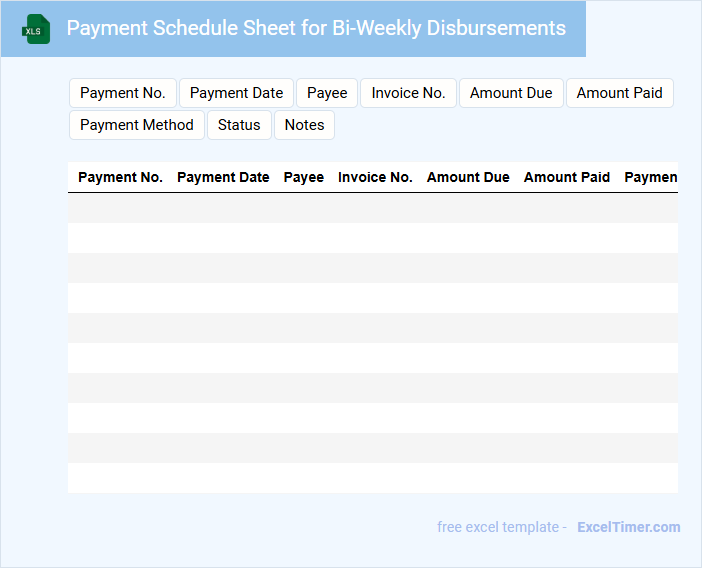

Payment Schedule Sheet for Bi-Weekly Disbursements

Payment Schedule Sheets for Bi-Weekly Disbursements typically outline the dates and amounts scheduled for employee or contractor payments every two weeks. This document ensures clear communication and accurate tracking of payment timelines.

- Include precise payment dates to avoid confusion and delays.

- Clearly state the payment amounts and any deductions or bonuses.

- Maintain a record of approved disbursements for auditing purposes.

Template for Bi-Weekly Payroll Payment Schedules

A Bi-Weekly Payroll Payment Schedule template typically contains detailed information about employee payment dates over a two-week period. It includes pay periods, payment processing dates, and deadlines for submitting payroll information. This document ensures consistent and timely compensation management for both employers and employees.

Essential elements to include are clearly defined pay periods, cut-off dates for timesheet submission, and designated payment dates. It is also important to integrate tax deduction reminders and employee classification details. Utilizing this template helps maintain payroll accuracy and compliance with labor regulations.

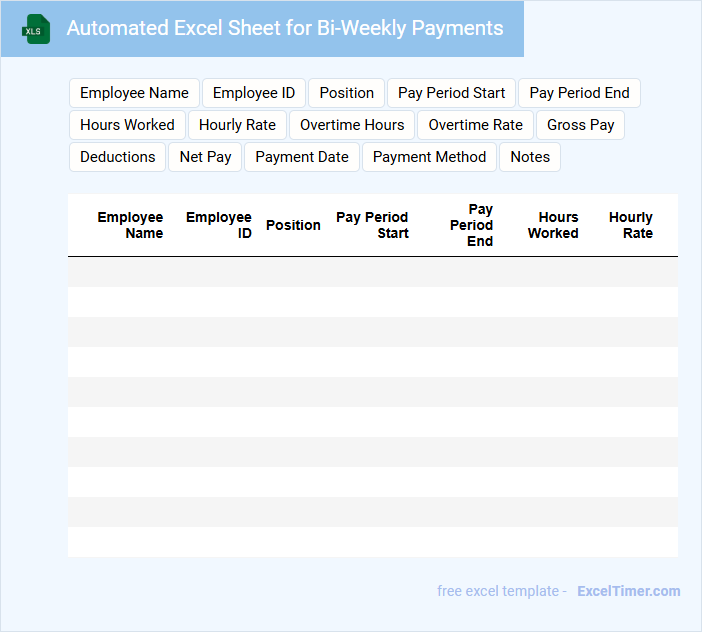

Automated Excel Sheet for Bi-Weekly Payments

What content is typically included in an automated Excel sheet for bi-weekly payments? This type of document usually contains employee names, payment dates, hours worked, pay rates, and calculated gross/net pay. It is designed to streamline payroll processing, ensuring accurate and timely payment every two weeks.

What important features should be incorporated in such a document? Key elements include formulas for automatic calculations, validation rules to prevent entry errors, and clear summaries to track total payroll expenses and deductions. Proper formatting and protection mechanisms are also essential to maintain data integrity and confidentiality.

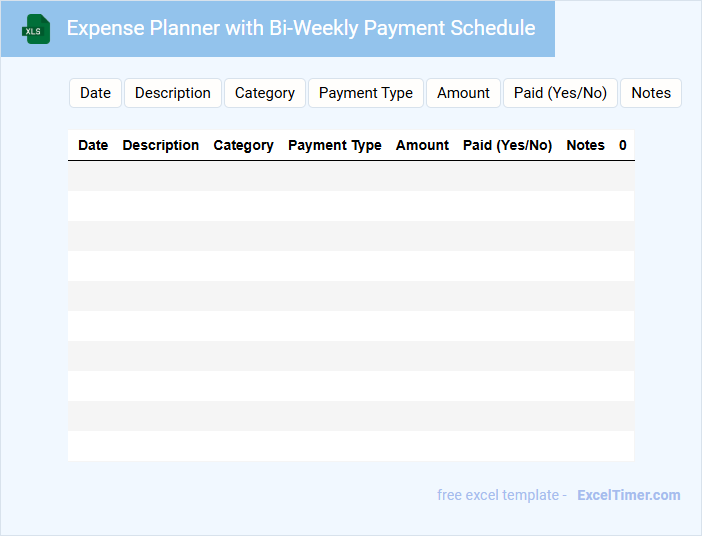

Expense Planner with Bi-Weekly Payment Schedule

An Expense Planner with a Bi-Weekly Payment Schedule typically contains detailed listings of income sources, anticipated expenses, and payment dates aligned with a bi-weekly cycle. This document helps users track their cash flow accurately and avoid missed payments by organizing expenses around paycheck intervals.

It is important to include categories for fixed and variable expenses, along with space for notes on due dates and payment methods. Regularly updating the planner ensures financial goals are met and unexpected costs are managed effectively.

How does a bi-weekly payment schedule differ from a monthly schedule in Excel calculations?

A bi-weekly payment schedule in Excel calculates payments every two weeks, resulting in 26 payments per year, while a monthly schedule has 12 payments annually. Bi-weekly calculations require adjusting formulas to account for 14-day intervals and potentially using WEEKNUM or DATE functions for accuracy. Monthly schedules typically use EOMONTH or DATE functions to align payments with month-end dates.

What formula can be used to auto-generate bi-weekly payment dates in an Excel column?

Use the formula =A1+14 in the Excel column, where A1 contains the initial payment date. This formula adds 14 days to each date, producing a bi-weekly payment schedule. Drag the formula down the column to auto-generate subsequent payment dates.

How can you calculate the total number of bi-weekly payments per year in Excel?

To calculate the total number of bi-weekly payments per year in Excel, divide the number 52 by 2, reflecting the weeks in a year. Use the formula =52/2 to return 26, representing your bi-weekly payment count annually. This formula optimizes your payment schedule for precise financial planning.

What Excel functions help track due dates and intervals for bi-weekly payments?

Excel functions such as DATE, WEEKDAY, EDATE, and IF combined with conditional formatting efficiently track due dates for bi-weekly payments. The formula =A1+14 calculates the next payment date by adding 14 days to the previous payment date in cell A1. Using conditional formatting with TODAY() highlights overdue or upcoming payments, ensuring timely tracking within the bi-weekly payment schedule.

How do you adjust Excel payment schedules if the bi-weekly payday falls on a holiday or weekend?

Adjust Excel bi-weekly payment schedules by using formulas that identify weekends and holidays, such as WORKDAY or NETWORKDAYS functions, to automatically shift paydays to the next business day. Incorporate a holiday list as a reference range to ensure accurate adjustments. This method ensures accurate payroll timing and compliance with payment policies.