![]()

The Bi-weekly Excel Template for Expense Tracking allows users to efficiently monitor and categorize expenses every two weeks, ensuring better budget management. It features customizable categories, automatic calculations, and clear visual summaries to simplify financial analysis. Regular use of this template helps maintain financial discipline and identify spending patterns over bi-weekly periods.

Bi-weekly Expense Tracking Template for Personal Use

A Bi-weekly Expense Tracking Template is a document designed to help individuals monitor their spending habits over two-week periods. It usually contains categories for income, fixed expenses, variable expenses, and summary totals to easily evaluate financial health. Utilizing this template encourages better budgeting, expense awareness, and savings planning for personal use.

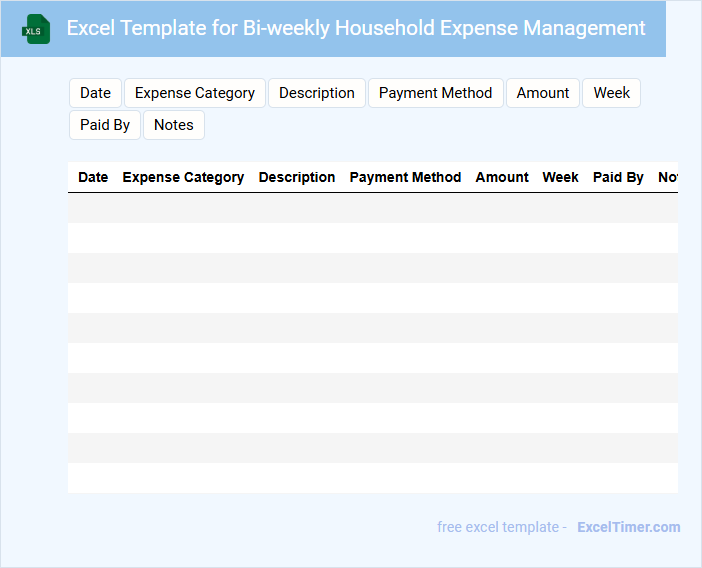

Excel Template for Bi-weekly Household Expense Management

An Excel Template for Bi-weekly Household Expense Management typically contains categorized expense fields, income entries, and summary charts to track spending over two-week periods. It helps users organize and monitor their finances efficiently with built-in formulas for automatic calculations.

This type of document often includes sections for fixed costs, variable expenses, savings goals, and debt tracking. For effective use, it is important to regularly update entries and review the summary to identify spending patterns and adjust budgets accordingly.

Bi-weekly Expense Report with Automated Summaries

A Bi-weekly Expense Report typically contains a detailed record of all expenditures made within a two-week period, categorized by type and department. It often includes automated summaries that highlight total spending, budget variances, and trends to facilitate quick analysis. Ensuring data accuracy and timely submission is crucial for effective financial tracking and decision-making.

Simple Bi-weekly Expense Tracker for Students

A Simple Bi-weekly Expense Tracker for Students is a document that helps monitor and manage spending habits within a two-week period to maintain financial discipline.

- Income and Expenses: Clearly record all sources of income and categorize every expense for accurate tracking.

- Budget Limits: Set realistic spending limits for each category to avoid overspending and encourage savings.

- Regular Updates: Consistently update the tracker every few days to keep finances current and identify spending patterns.

Bi-weekly Budget and Expense Tracker for Families

What information is typically included in a Bi-weekly Budget and Expense Tracker for Families? This document usually contains detailed records of income, expenses, and savings broken down into bi-weekly periods to help families manage their finances effectively. It includes categories such as groceries, utilities, entertainment, and unexpected costs to provide a clear overview of spending habits and financial goals.

What is an important consideration when using this type of tracker? Consistently updating the tracker and categorizing expenses accurately are crucial for gaining meaningful insights. Additionally, setting realistic budget limits and reviewing spending patterns bi-weekly can help families control expenses and improve financial planning.

Expense Tracking Sheet with Bi-weekly Analysis

What information is typically included in an Expense Tracking Sheet with Bi-weekly Analysis?

An Expense Tracking Sheet with Bi-weekly Analysis usually contains detailed records of all expenses incurred within a two-week period, categorized by type such as food, transportation, and utilities. It also includes summary tables and charts to highlight spending patterns and identify areas for potential savings.

For effective use, it is important to update the sheet regularly and review the bi-weekly analysis to adjust budgets and control overspending proactively.

Bi-weekly Template for Tracking Travel Expenses

This document serves as a bi-weekly travel expense tracker designed to monitor and organize expenditures over a two-week period efficiently. It typically includes sections for date, description of expense, category, amount, and payment method to ensure comprehensive expense recording. For optimal use, users should regularly update entries and retain receipts for accuracy and reimbursement purposes.

Excel Log for Bi-weekly Office Expenses

An Excel Log for Bi-weekly Office Expenses is a structured spreadsheet used to track and manage the financial transactions occurring every two weeks within an office setting. It typically contains categories such as date, expense description, amount, payment method, and department. Keeping this log up-to-date aids in accurate budgeting, financial analysis, and expense reporting.

Bi-weekly Tracking Template with Expense Categories

What information is typically included in a Bi-weekly Tracking Template with Expense Categories? This type of document usually contains detailed records of expenses categorized by type within bi-weekly periods to help monitor budgeting and spending patterns. It allows users to track income, expenditures, and savings goals systematically for better financial management.

What is an important consideration when using this template? Ensuring accurate and consistent data entry is vital for reliable tracking and analysis. Additionally, customizing expense categories to reflect personal or business spending habits improves the template's relevance and usefulness.

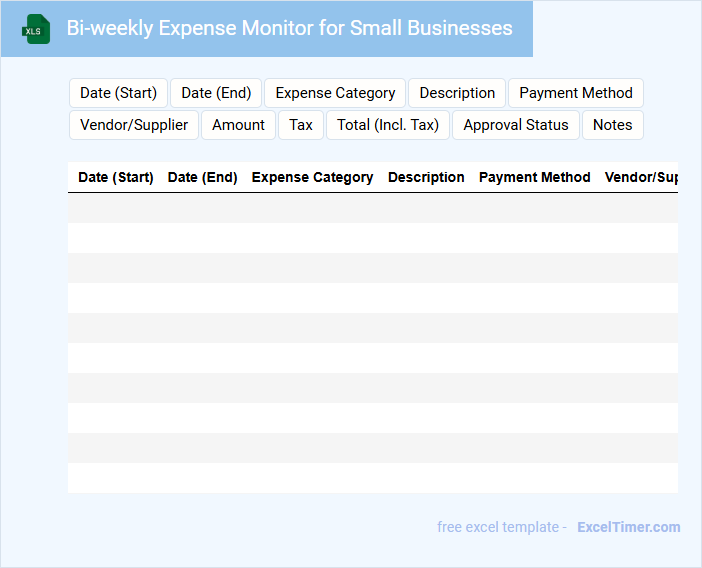

Bi-weekly Expense Monitor for Small Businesses

What information is typically included in a Bi-weekly Expense Monitor for Small Businesses? This document usually contains detailed records of all business expenses incurred over a two-week period, categorized by type such as supplies, utilities, and payroll. It helps small business owners track spending patterns, manage cash flow, and make informed financial decisions.

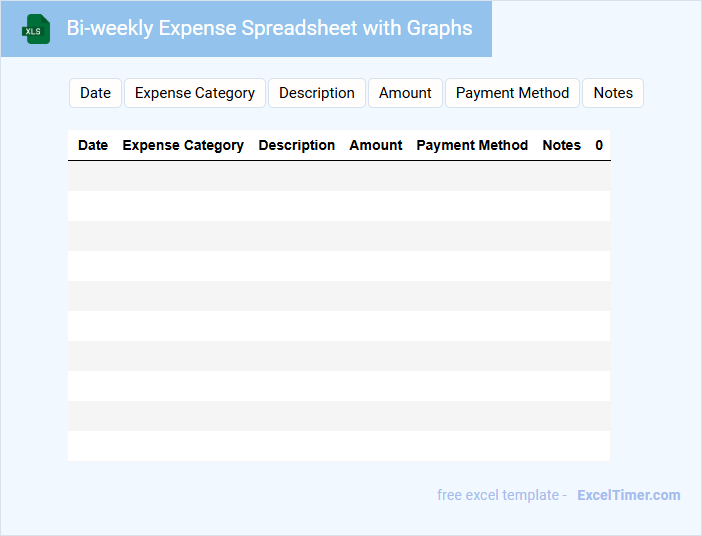

Bi-weekly Expense Spreadsheet with Graphs

A Bi-weekly Expense Spreadsheet is typically used to track and organize expenses incurred every two weeks. It contains detailed entries of various costs, such as bills, groceries, and entertainment, allowing for clear financial monitoring. Including graphs enhances data visualization, making trends and spending patterns easily identifiable.

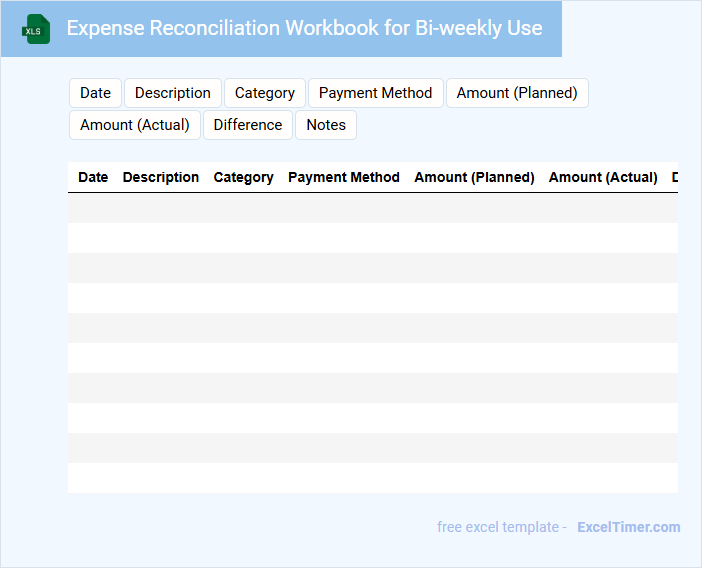

Expense Reconciliation Workbook for Bi-weekly Use

An Expense Reconciliation Workbook for Bi-weekly Use is a document designed to track and verify all expenses incurred within a two-week period. It helps ensure financial accuracy and accountability for budgeting purposes.

- Record all receipts and expenditures with corresponding dates to maintain a clear audit trail.

- Reconcile reported expenses against bank statements or credit card transactions for accuracy.

- Include categories or codes for different types of expenses to facilitate detailed analysis.

Bi-weekly Financial Tracker for Project Expenses

A Bi-weekly Financial Tracker for project expenses is a document that records and monitors all costs incurred every two weeks during a project's lifecycle. It typically includes detailed expense categories, dates, descriptions, and amounts to ensure accurate financial management. Maintaining this tracker helps project managers control budgets and identify discrepancies promptly.

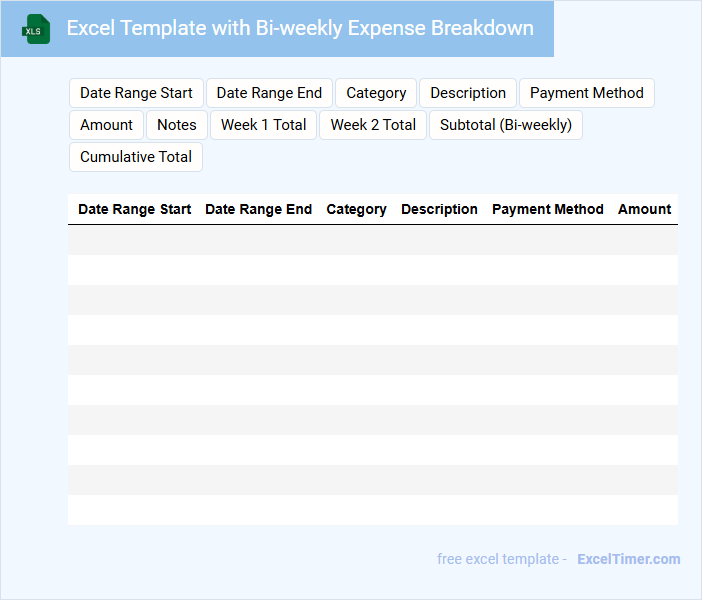

Excel Template with Bi-weekly Expense Breakdown

An Excel Template with Bi-weekly Expense Breakdown is typically used to track and manage expenses over a two-week period for better financial control.

- Consistent Entries: Ensure all expenses are recorded diligently to maintain accuracy.

- Category Segmentation: Separate expenses into clear categories for easy analysis.

- Regular Updates: Update the template bi-weekly to reflect real-time spending and adjustments.

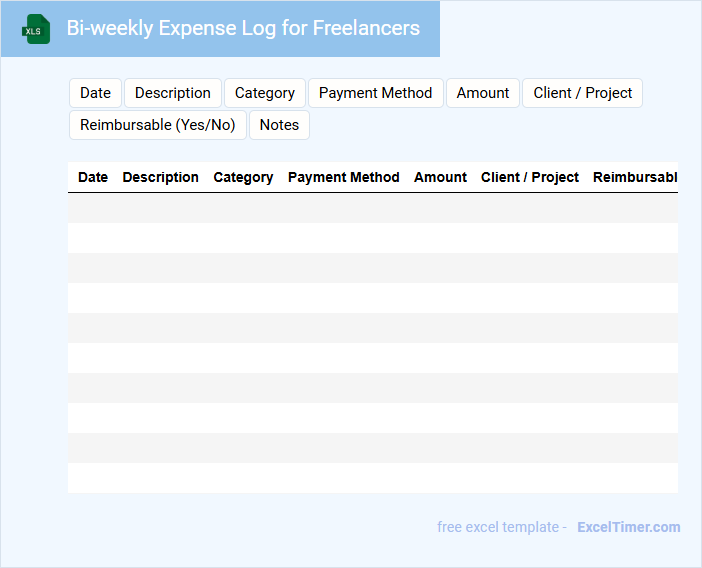

Bi-weekly Expense Log for Freelancers

What information is typically included in a Bi-weekly Expense Log for Freelancers? This document usually contains detailed records of all expenses incurred within a two-week period, categorized by type and date. It helps freelancers track their spending, manage budgets, and prepare accurate financial reports for tax purposes or client reimbursements.

What is an important consideration when maintaining a Bi-weekly Expense Log for Freelancers? Consistency and accuracy are essential to ensure reliable financial tracking, and including receipts or proof of purchase strengthens the validity of the documented expenses. Additionally, regularly updating the log prevents missed entries and simplifies end-of-period financial assessments.

What is the purpose of selecting a bi-weekly period for tracking expenses in an Excel document?

Selecting a bi-weekly period for tracking expenses in an Excel document aligns with common payroll cycles, enabling accurate budgeting and timely financial analysis. This period captures all transactions within two-week spans, facilitating easier comparison and trend identification. Bi-weekly tracking improves cash flow management by providing consistent intervals for reviewing expenses and adjusting budgets.

How should you structure the Excel worksheet to differentiate each bi-weekly expense cycle clearly?

Structure the Excel worksheet with distinct columns labeled for each bi-weekly cycle, including start and end dates to define the period explicitly. Use separate rows for expense categories and individual entries, tagging each with the corresponding cycle date range for clear differentiation. Incorporate summary rows or pivot tables to aggregate expenses by bi-weekly periods for efficient tracking and analysis.

Which Excel formulas are most effective for calculating bi-weekly expense totals and comparisons?

Excel formulas like SUMIFS and SUMPRODUCT efficiently calculate bi-weekly expense totals by summing amounts within specified date ranges. Use IF and VLOOKUP functions to compare expenses across bi-weekly periods and highlight variances. Your bi-weekly expense tracking becomes more accurate and insightful with these formula combinations.

How can you use conditional formatting to highlight overspending within a bi-weekly period?

Use conditional formatting in Excel by selecting the expense cells and applying a rule that highlights values exceeding your bi-weekly budget limit. Set the rule to format cells with amounts greater than the predefined threshold, such as the allocated bi-weekly expense cap. This visual cue helps quickly identify overspending within each bi-weekly period.

What methods can be applied to automatically carry forward remaining balances between bi-weekly intervals?

Your bi-weekly expense tracking in Excel can utilize formulas like OFFSET or INDIRECT combined with named ranges to automatically carry forward remaining balances between intervals. Using Excel's structured tables and dynamic arrays ensures accurate and seamless updates of your remaining balances every two weeks. Implementing Excel's Power Query also allows efficient data refresh and balance continuity across bi-weekly periods.