A Bi-weekly Excel Template for Budget Planning helps efficiently track income and expenses every two weeks, ensuring accurate financial management. It includes customizable categories, automated calculations, and visual charts to provide clear insights into spending habits. Using this template enables consistent budgeting, reduces financial stress, and supports long-term saving goals.

Bi-weekly Excel Template for Budget Tracking

This Bi-weekly Excel Template for Budget Tracking typically contains financial data organized in a structured format to monitor income, expenses, and savings every two weeks.

- Income and Expense Categories: Clearly defined fields for recording various income sources and expense types to ensure comprehensive tracking.

- Automated Calculations: Formulas that automatically summarize totals and differences for easier budget analysis.

- Visual Summary Tools: Charts or graphs that provide an at-a-glance view of spending patterns and budget adherence.

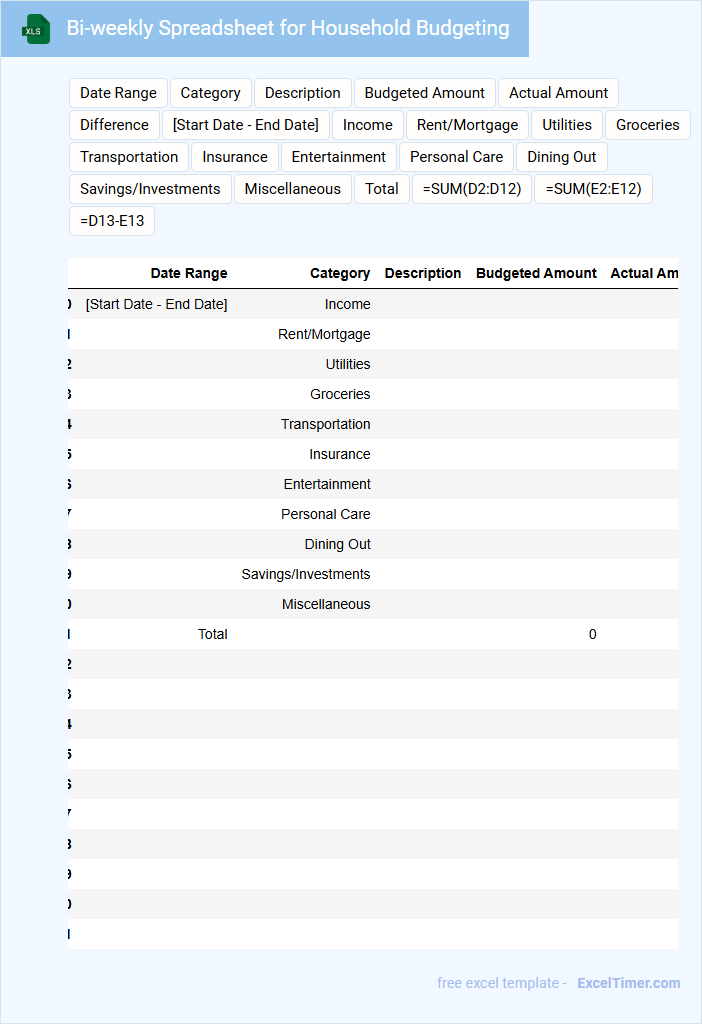

Bi-weekly Spreadsheet for Household Budgeting

A bi-weekly spreadsheet for household budgeting is a tool used to track income and expenses every two weeks to ensure financial stability and effective money management. It helps households plan their spending, save money, and avoid debt by providing a clear overview of their financial situation.

- Include detailed categories for income, fixed expenses, variable expenses, and savings.

- Regularly update the spreadsheet with all transactions to maintain accuracy.

- Set budget limits and monitor spending to stay within financial goals.

Personal Finance Tracker with Bi-weekly Budget Planning

A Personal Finance Tracker with Bi-weekly Budget Planning is a document designed to monitor income, expenses, and savings over two-week periods. It typically contains detailed categories for tracking various cash flows and setting spending limits to help maintain financial discipline. The document supports better decision-making by providing clear visibility into spending patterns and budget adherence.

Important elements include a comprehensive income section, categorized expense lists, and a summary of savings goals. Including reminders for bill payments and irregular expenses ensures accuracy and prevents financial pitfalls. Regularly updating and reviewing the tracker helps in adjusting budgets for changing financial circumstances.

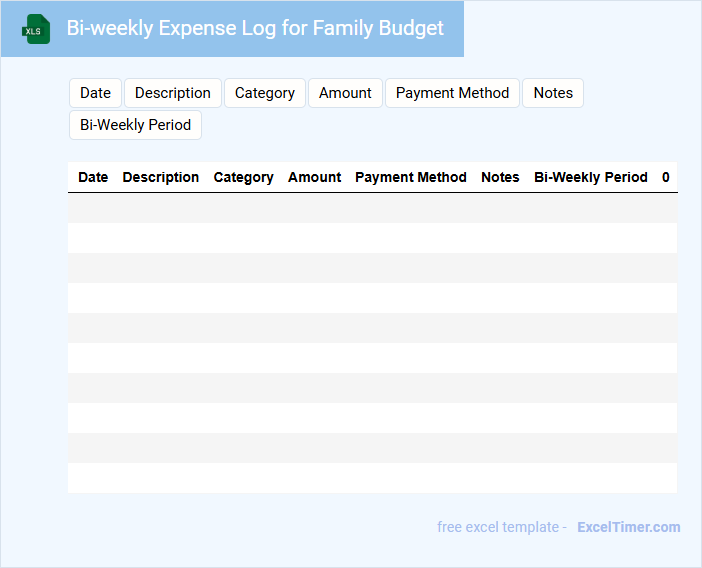

Bi-weekly Expense Log for Family Budget

A Bi-weekly Expense Log for a family budget is a structured document used to record all expenses occurring every two weeks. It helps in tracking spending habits and managing household finances efficiently. Important elements to include are categories of expenses, dates, payment methods, and notes for unusual transactions.

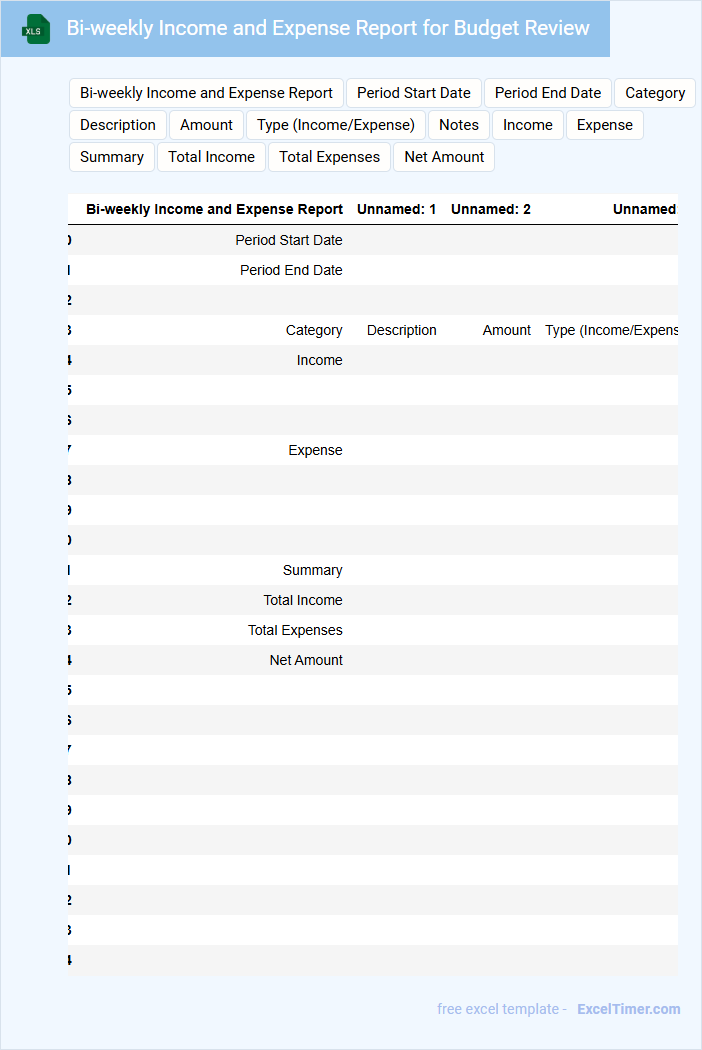

Bi-weekly Income and Expense Report for Budget Review

This Bi-weekly Income and Expense Report for Budget Review typically contains a summary of all incomes and expenditures within a two-week period to help track financial performance and ensure budget adherence.

- Income Sources: Detailed records of all incoming funds categorized by source.

- Expense Categories: Breakdown of all expenses grouped by type for clear visibility.

- Budget Variance: Comparison between actual figures and budgeted amounts to identify discrepancies.

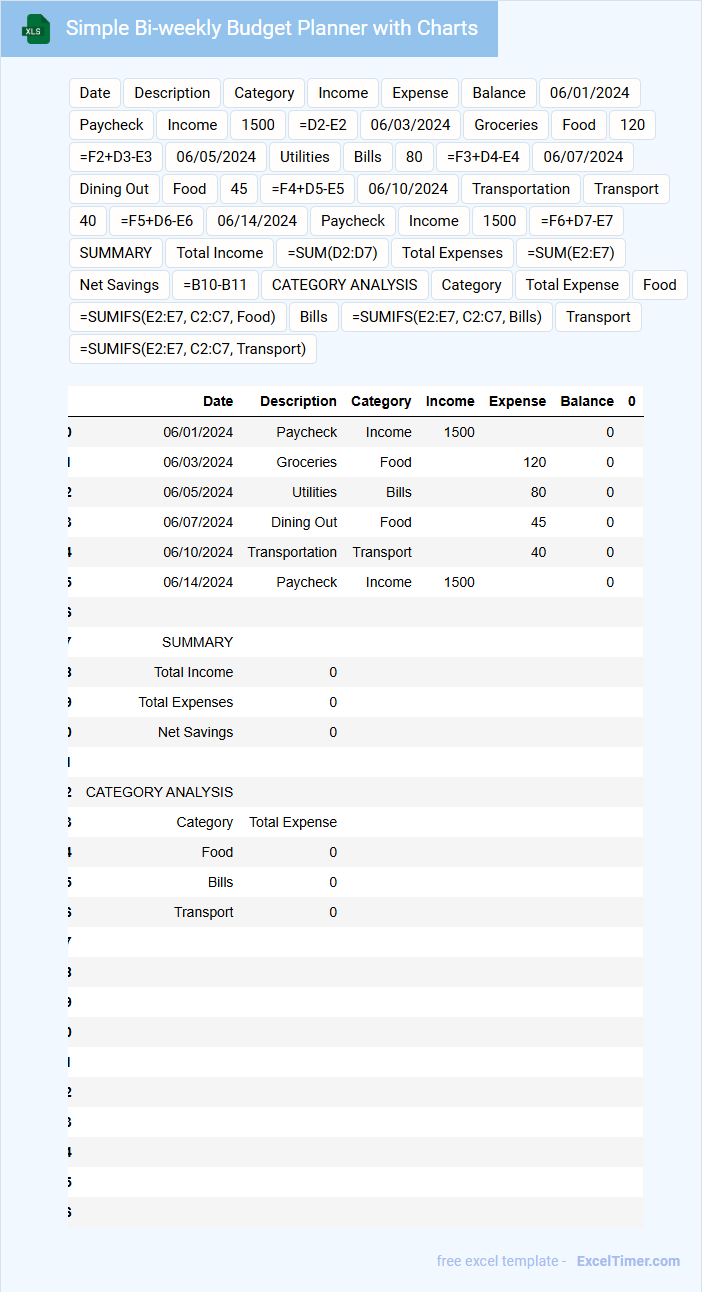

Simple Bi-weekly Budget Planner with Charts

A Simple Bi-weekly Budget Planner is a document designed to help individuals track their income and expenses every two weeks. It typically contains sections for recording sources of income, fixed and variable expenses, and savings goals. Including charts allows users to visually analyze their spending habits and identify areas for improvement.

Bi-weekly Budget Calculator for Home Finances

A Bi-weekly Budget Calculator for Home Finances typically contains income, expenses, and savings information designed to manage household finances effectively. It helps individuals plan their spending and saving every two weeks to maintain financial stability.

- Include all sources of income and categorize expenses accurately.

- Track variable and fixed expenses separately for better forecasting.

- Set realistic savings goals to ensure consistent financial growth.

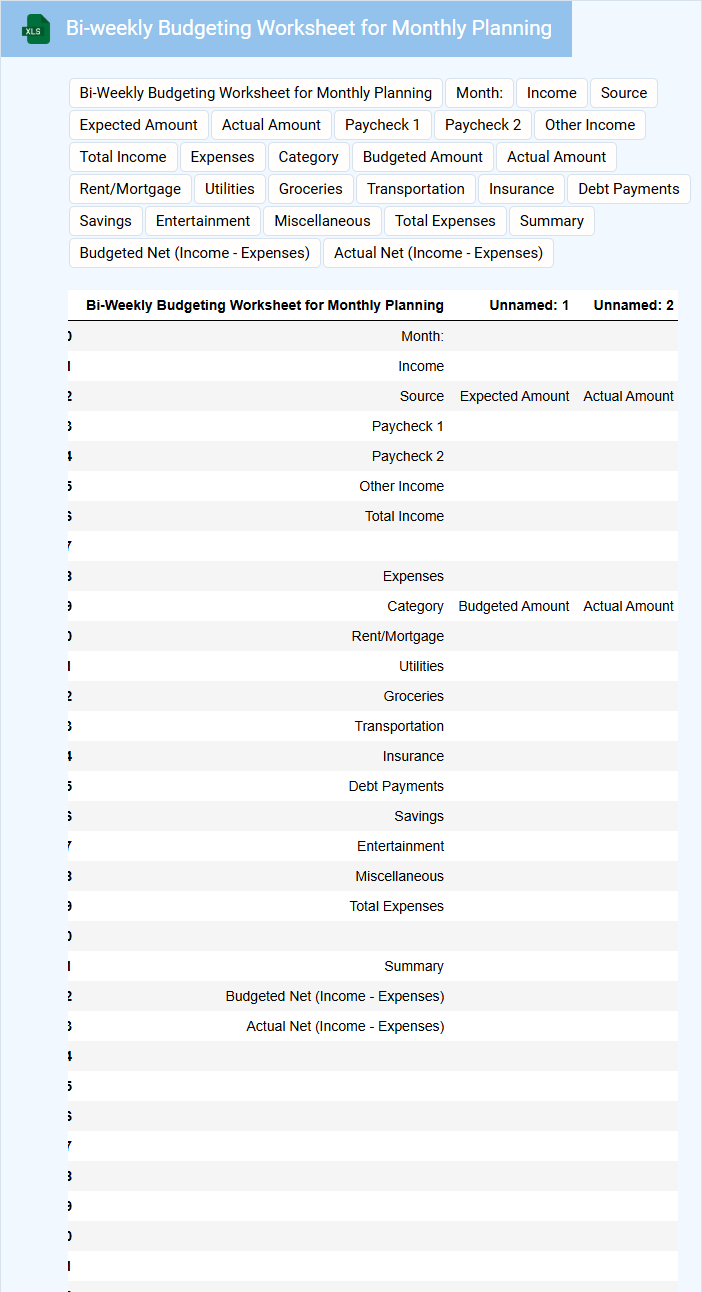

Bi-weekly Budgeting Worksheet for Monthly Planning

A Bi-weekly Budgeting Worksheet is a structured financial tool that helps individuals or households track income and expenses on a bi-weekly basis. It breaks down monthly financial planning into manageable two-week periods, ensuring more precise cash flow management.

This document typically contains sections for income sources, fixed and variable expenses, savings goals, and debt payments. It is important to regularly update and review the worksheet to maintain financial discipline and adjust spending habits accordingly.

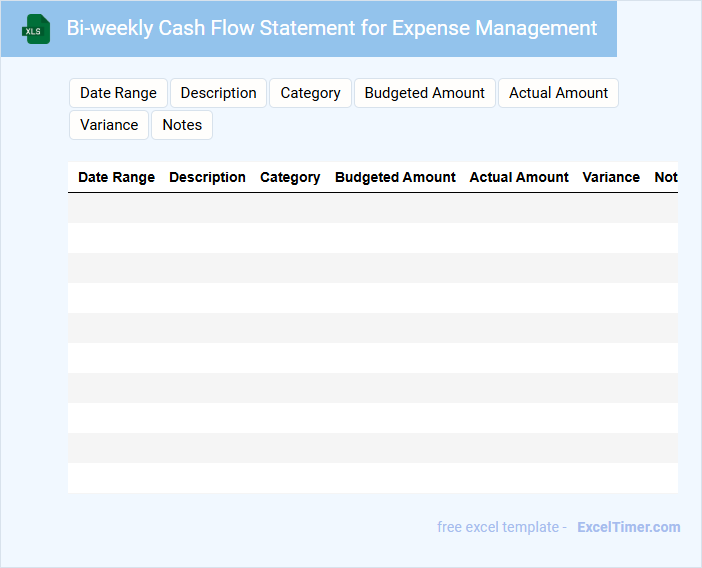

Bi-weekly Cash Flow Statement for Expense Management

A Bi-weekly Cash Flow Statement is a financial document that details cash inflows and outflows over a two-week period, providing a clear snapshot of the company's liquidity. It typically includes sections for operating expenses, income received, and any cash reserves or shortages to track spending against budget. For effective expense management, it is critical to regularly update this statement, ensuring accuracy and timely identification of cash shortages.

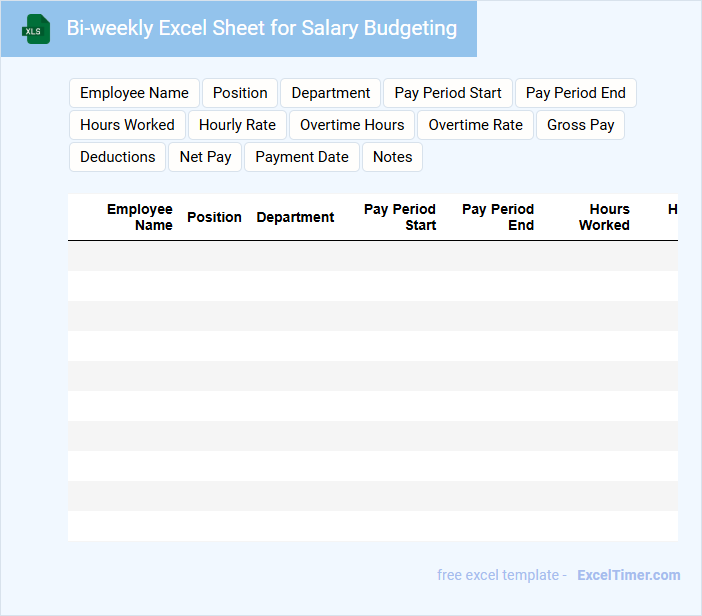

Bi-weekly Excel Sheet for Salary Budgeting

What information is typically included in a Bi-weekly Excel Sheet for Salary Budgeting? This document usually contains detailed records of employee salaries, including base pay, bonuses, deductions, and tax withholdings calculated every two weeks. It helps organizations manage payroll efficiently by tracking salary expenses and forecasting budget needs accurately.

What are important considerations when creating this sheet? It is crucial to ensure data accuracy and consistency, especially with formulas for calculations and date ranges. Additionally, including sections for employee names, job titles, pay rates, and total compensation will optimize the sheet's usability and clarity.

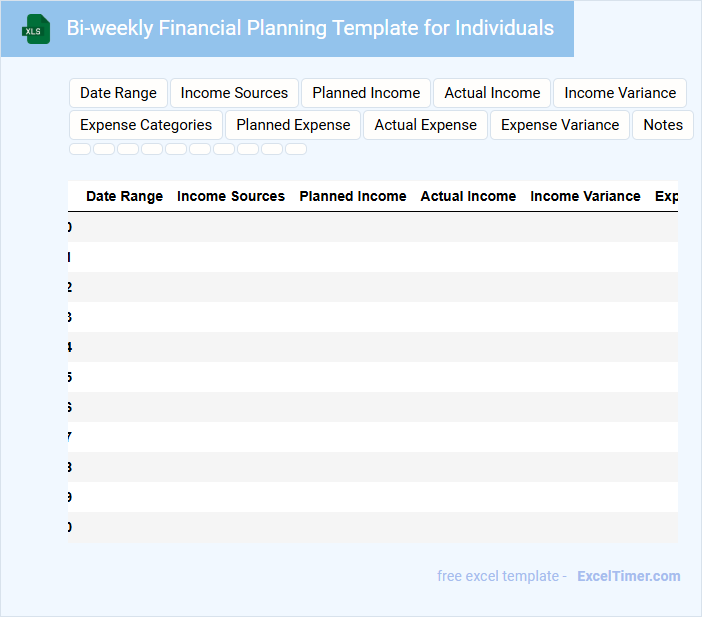

Bi-weekly Financial Planning Template for Individuals

A Bi-weekly Financial Planning Template for individuals typically contains sections for tracking income, expenses, and savings goals over a two-week period. It helps users monitor their cash flow, budget effectively, and adjust spending habits regularly. Important elements include clearly defined categories, space for notes, and an overview of financial progress.

Bi-weekly Forecast Template for Personal Budget

A Bi-weekly Forecast Template for personal budget typically includes an overview of income sources, expense categories, and savings goals projected over a two-week period. It helps individuals track and anticipate their financial flow, ensuring better money management and timely bill payments. Key components often involve estimated earnings, fixed and variable expenses, and adjustments based on previous spending patterns.

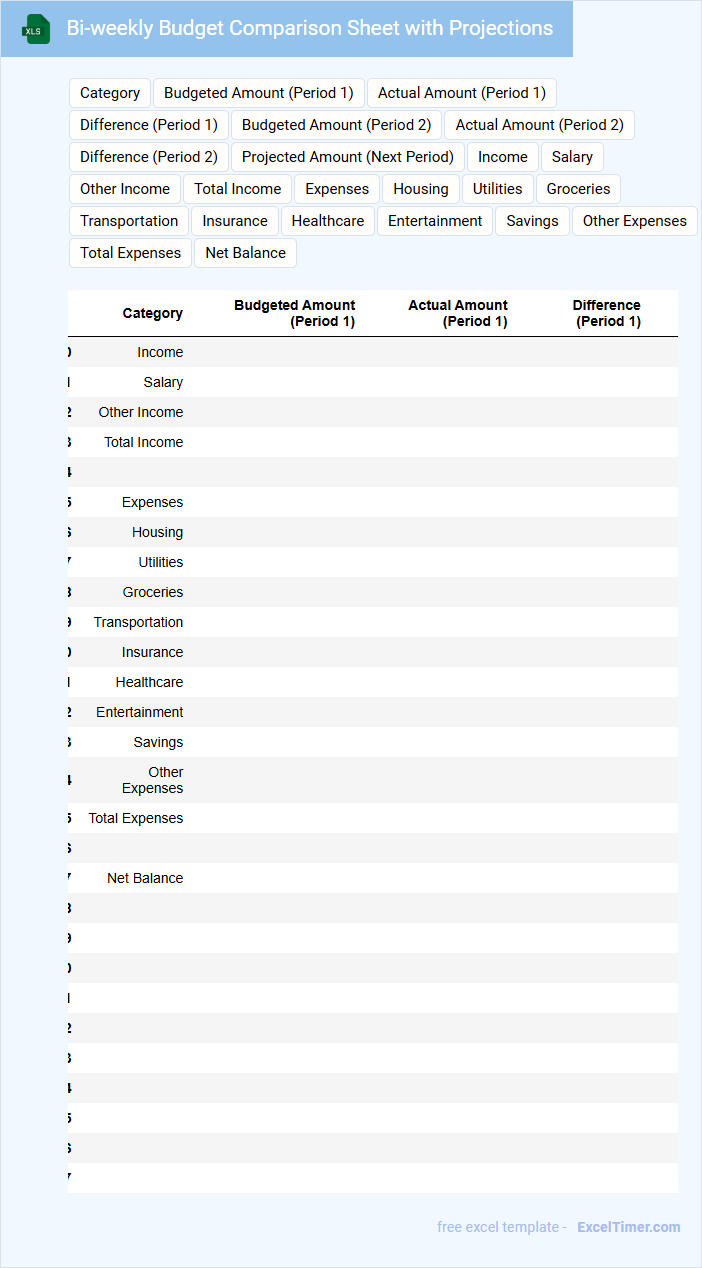

Bi-weekly Budget Comparison Sheet with Projections

A Bi-weekly Budget Comparison Sheet typically contains a detailed record of income and expenses tracked every two weeks to help manage finances effectively. It includes actual spending versus budgeted amounts, highlighting variances to control overspending.

This document often features projections that forecast future expenses and income based on current trends, aiding in long-term financial planning. Regular updates and accuracy in data entry are crucial for making informed decisions.

Bi-weekly Bill Tracking Template for Budget Control

What is typically included in a Bi-weekly Bill Tracking Template for Budget Control? This document usually contains sections for listing all recurring bills with their due dates and amounts, updated every two weeks to ensure accuracy and timeliness. It helps users monitor expenses regularly, avoid late payments, and maintain better control over their budget.

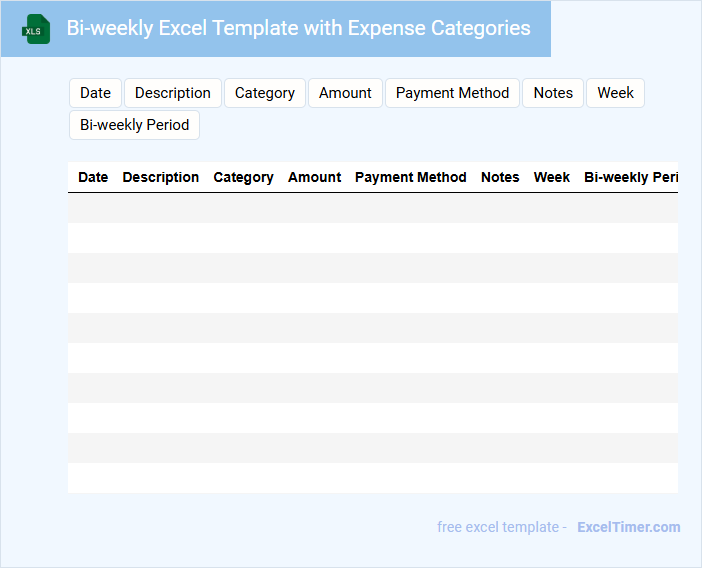

Bi-weekly Excel Template with Expense Categories

What content is typically included in a Bi-weekly Excel Template with Expense Categories? This document usually contains detailed sections for tracking income and various expense categories on a two-week basis, helping users monitor their financial activities. It often includes predefined categories such as rent, utilities, groceries, transportation, and entertainment to ensure comprehensive expense management and budgeting.

What important features should be considered when creating this template? It is crucial to have clear categorization and automated calculations for totals and balances to enhance usability and accuracy. Additionally, incorporating customizable fields for unexpected expenses and visual charts for quick financial analysis can significantly improve the template's effectiveness.

How do you set up a bi-weekly income and expense tracker in an Excel budget sheet?

Create two columns labeled "Income" and "Expenses" with corresponding bi-weekly dates to organize entries systematically. Use Excel formulas such as SUMIFS to calculate total income and expenses for each bi-weekly period. Incorporate conditional formatting to highlight over-budget expenses for efficient financial tracking.

Which Excel formulas efficiently calculate total bi-weekly savings and spending?

Excel formulas like SUMIFS efficiently calculate total bi-weekly savings and spending by summing amounts based on date ranges and categories. Use your budget dates as criteria to capture accurate bi-weekly totals, enhancing your financial planning. Applying these formulas ensures precise tracking of your budget allocations every two weeks.

How can you visualize bi-weekly budget trends using Excel charts?

Create a line chart in Excel to visualize bi-weekly budget trends by plotting dates on the X-axis and budget amounts on the Y-axis. Use a table with bi-weekly intervals and corresponding budget data to generate the chart. Incorporate data labels and trendlines to highlight fluctuations and patterns over time.

What is the best way to categorize recurring bi-weekly expenses in Excel?

Create a dedicated column labeled "Bi-Weekly Recurring Expenses" in your Excel budget planning document to clearly identify these costs. Use consistent date intervals, such as every 14 days, and apply Excel's Data Validation or conditional formatting to ensure entries follow the bi-weekly schedule. Summarize totals with SUMIFS functions to track and forecast recurring bi-weekly expenses efficiently.

How do you project future balances based on bi-weekly budgeting in an Excel document?

Your bi-weekly budgeting Excel document projects future balances by calculating income and expenses every two weeks, updating cash flow accordingly. Formulas track cumulative totals and apply scheduled transactions to forecast available funds. This method ensures accurate financial planning aligned with your payment cycles.