A Bi-weekly Excel Template for Payroll simplifies the process of calculating employee wages every two weeks, ensuring accurate tracking of hours, deductions, and net pay. This template is essential for maintaining organized payroll records and streamlining tax and compliance reporting. Customizable fields allow businesses to tailor calculations to specific pay rates, bonuses, and benefits.

Bi-weekly Payroll Tracker with Overtime Calculation

What information does a Bi-weekly Payroll Tracker with Overtime Calculation typically include? This document usually contains detailed records of employee hours worked, including regular and overtime hours, to ensure accurate payment every two weeks. It also tracks earnings, deductions, and calculates total payroll amounts to maintain clear financial accountability.

What are the important features to consider when using this type of payroll tracker? It is essential to ensure precise timekeeping, clear distinction between regular and overtime hours, and automated calculations for accuracy. Additionally, integrating compliance with labor laws and tax regulations is crucial for both employers and employees.

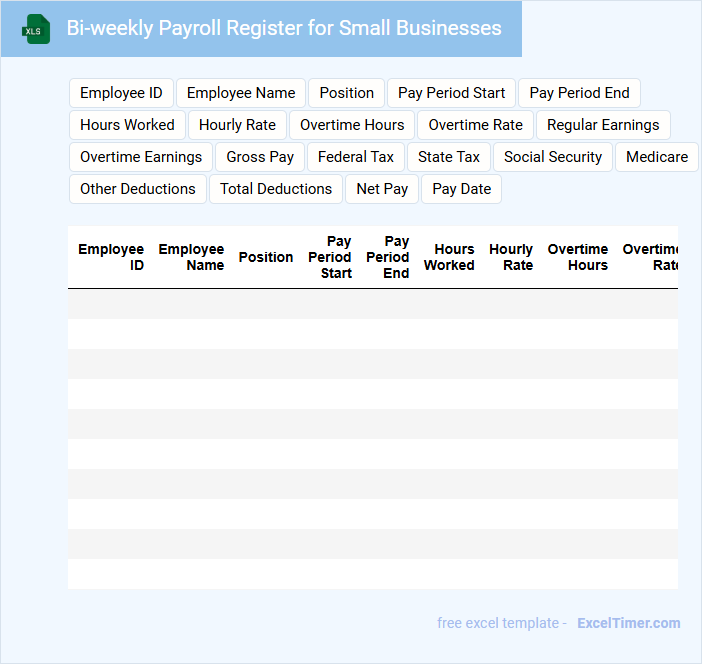

Bi-weekly Payroll Register for Small Businesses

The Bi-weekly Payroll Register is a crucial document that records employee wages for every two-week period. It typically includes employee names, hours worked, gross pay, deductions, and net pay.

Small businesses use this register to track payroll expenses and ensure accurate tax calculations. Maintaining complete and accurate records is important for compliance and financial auditing purposes.

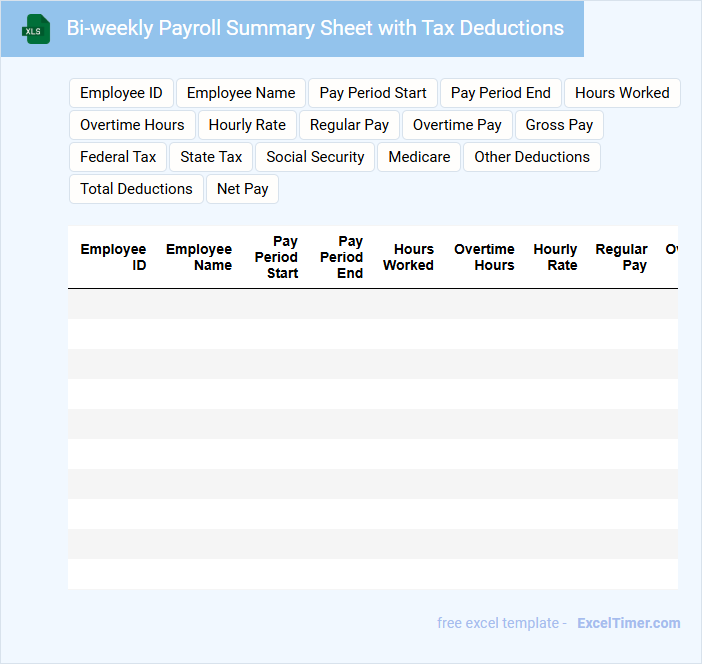

Bi-weekly Payroll Summary Sheet with Tax Deductions

What information is typically included in a Bi-weekly Payroll Summary Sheet with Tax Deductions? This document usually contains detailed records of employees' earnings, hours worked, and the applicable tax deductions for each pay period. It helps ensure accurate payroll processing and compliance with tax regulations by summarizing all payroll transactions bi-weekly.

Important considerations for this document include verifying the correctness of tax deduction rates and ensuring timely updates to reflect any changes in tax laws. Additionally, maintaining confidentiality and accuracy is crucial to protect employee information and avoid payroll discrepancies.

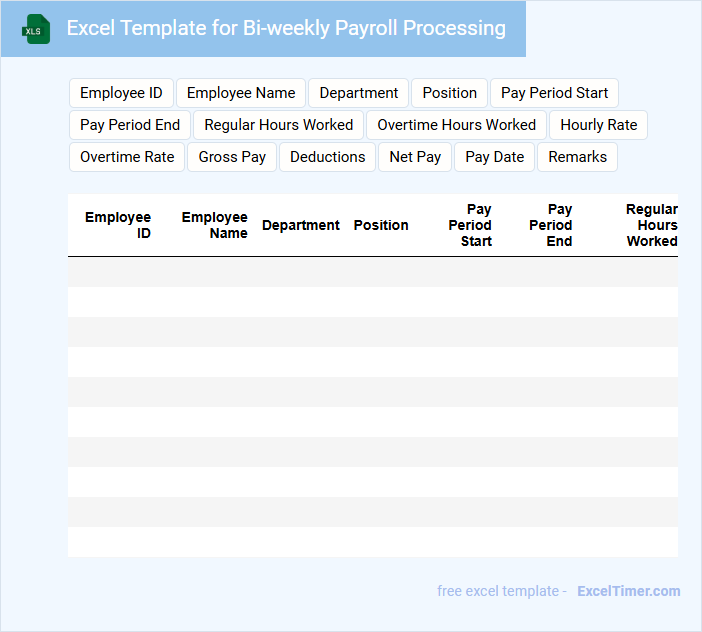

Excel Template for Bi-weekly Payroll Processing

What information is typically included in an Excel template for bi-weekly payroll processing? This type of document usually contains employee details, hours worked, pay rates, and calculated wages for each pay period. It helps streamline payroll calculations and ensures accurate and timely payments.

Bi-weekly Payroll Template with Attendance Tracking

What information is typically included in a Bi-weekly Payroll Template with Attendance Tracking? This type of document usually contains employee details, hours worked, attendance records, salary calculations, deductions, and net pay for each bi-weekly period. It helps ensure accurate and timely payroll processing while keeping track of employee attendance efficiently.

What important elements should be considered when using this template? It is crucial to maintain up-to-date and precise attendance records, include all necessary tax and benefit deductions, and ensure compliance with labor laws to avoid errors and legal issues. Additionally, integrating formulas for automatic calculations can improve accuracy and save time.

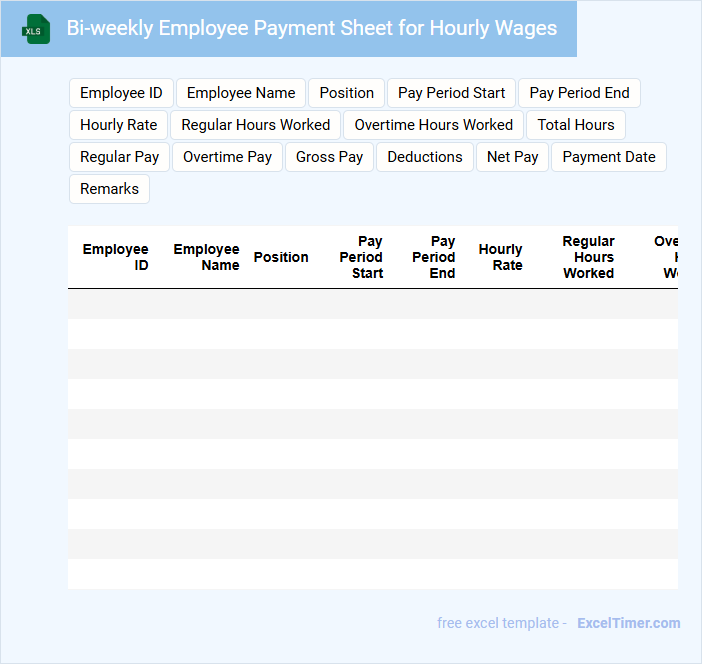

Bi-weekly Employee Payment Sheet for Hourly Wages

What information is typically included in a Bi-weekly Employee Payment Sheet for Hourly Wages? This document usually contains details such as employee names, hours worked, hourly rates, total earnings, deductions, and net pay for the two-week period. It serves as a clear record for payroll processing and ensures accurate compensation tracking for hourly employees.

What important aspects should be considered when preparing this payment sheet? Accuracy in hours recorded, clear breakdown of earnings and deductions, and compliance with labor laws regarding wages and overtime are essential to maintain transparency and avoid payroll disputes.

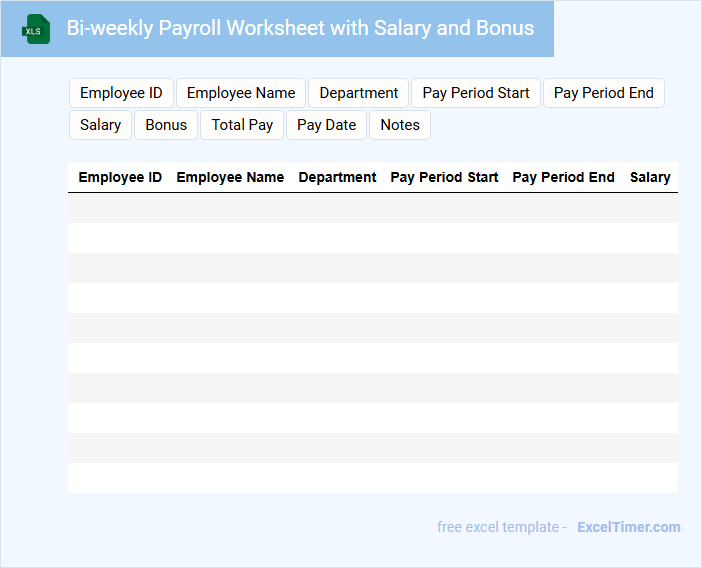

Bi-weekly Payroll Worksheet with Salary and Bonus

A bi-weekly payroll worksheet with salary and bonus typically contains detailed records of employee earnings, including base salaries and additional bonuses for each pay period.

- Employee Information: Ensure each entry includes the employee's full name and identification details for accurate payroll processing.

- Salary Details: Record the bi-weekly base salary amount clearly for each employee to maintain payroll accuracy.

- Bonus Entries: Include all applicable bonuses separately to differentiate them from regular salary components.

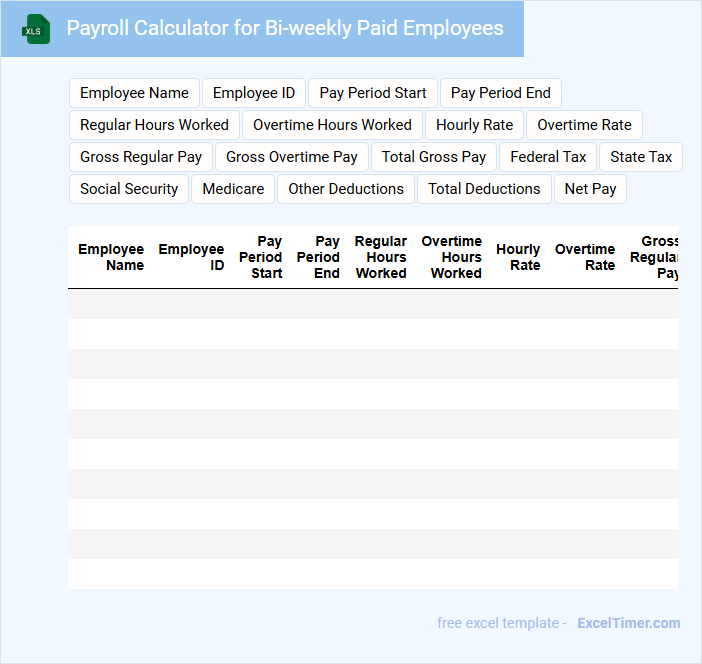

Payroll Calculator for Bi-weekly Paid Employees

Payroll Calculator for Bi-weekly Paid Employees is a document that helps accurately compute employee earnings and deductions for every two-week pay period.

- Accurate Hours Tracking: Ensure precise input of worked hours including overtime to calculate correct wages.

- Deductions and Taxes: Include all relevant deductions such as taxes, benefits, and garnishments for accurate net pay.

- Compliance Checks: Verify the calculator conforms with current labor laws and tax regulations for bi-weekly payroll schedules.

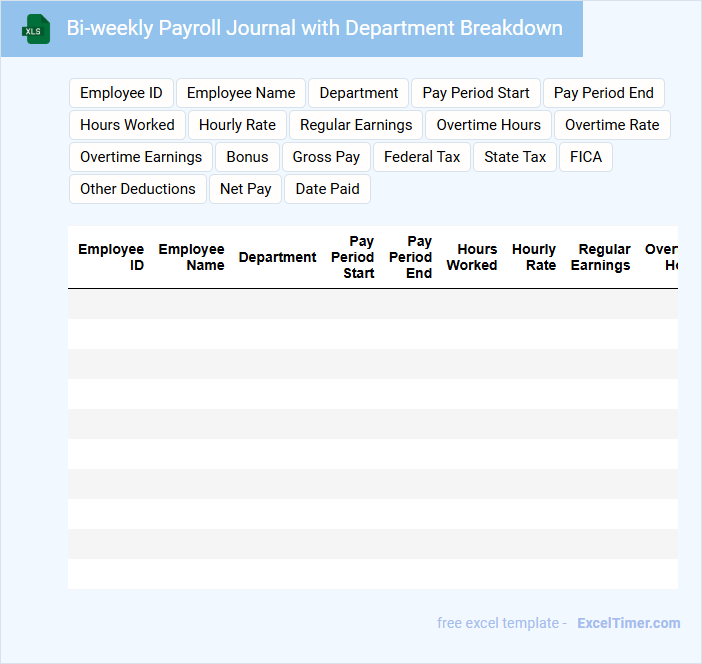

Bi-weekly Payroll Journal with Department Breakdown

A Bi-weekly Payroll Journal typically contains detailed records of employee wages, deductions, and net pay processed every two weeks. It includes a department breakdown to allocate labor costs accurately across various organizational units. This document is essential for ensuring payroll accuracy and compliance with financial reporting requirements.

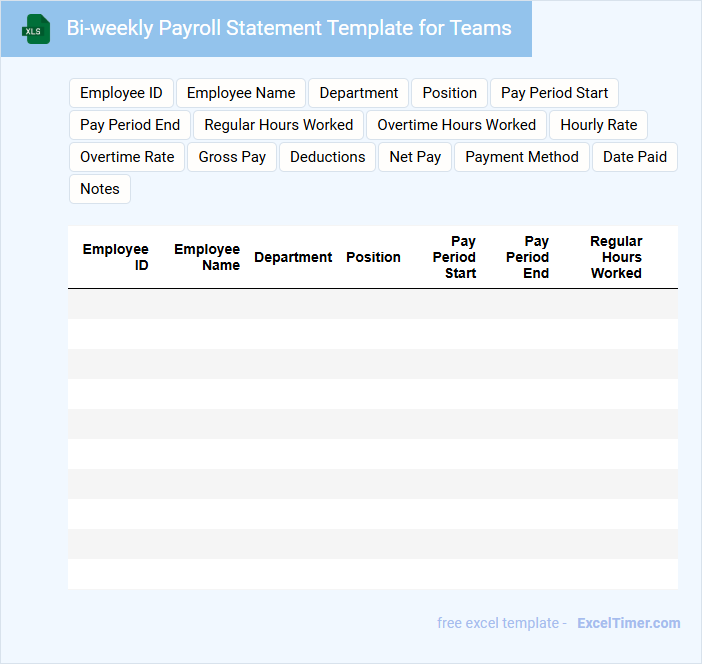

Bi-weekly Payroll Statement Template for Teams

A Bi-weekly Payroll Statement Template for Teams typically contains detailed records of employee earnings and deductions for a two-week pay period.

- Payroll Details: It includes information on gross pay, taxes withheld, and net pay for each team member.

- Employee Information: Contains names, employee IDs, and pay period dates to ensure accurate record-keeping.

- Compliance and Accuracy: Ensures all calculations and tax withholdings comply with legal standards and company policies.

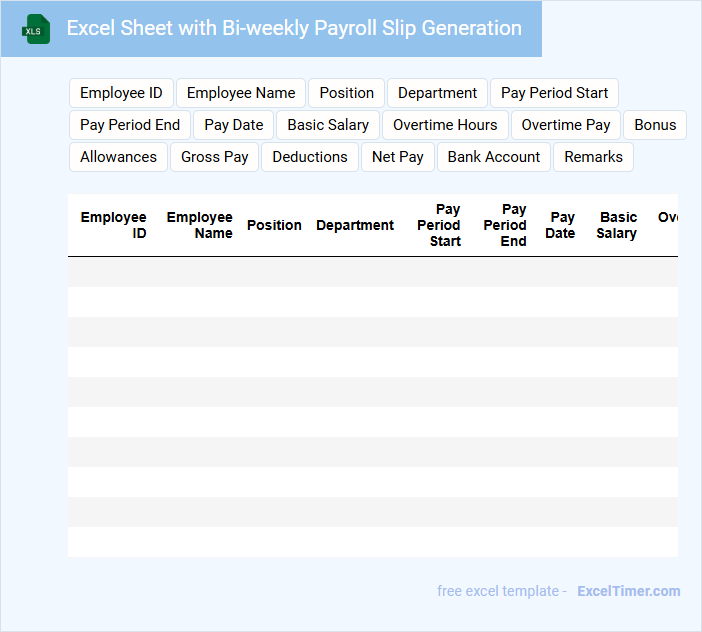

Excel Sheet with Bi-weekly Payroll Slip Generation

An Excel sheet used for bi-weekly payroll slip generation typically contains employee details, salary components, and deductions. It serves as a comprehensive record to calculate and document earnings for every two-week period. Ensuring accuracy and automation within the spreadsheet is crucial for efficient payroll management and compliance.

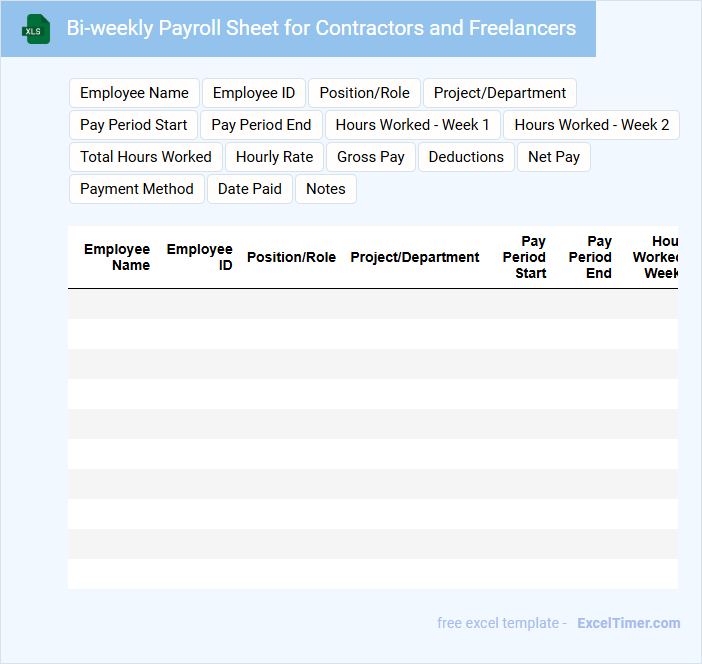

Bi-weekly Payroll Sheet for Contractors and Freelancers

What information is typically included in a bi-weekly payroll sheet for contractors and freelancers? This document generally contains details such as the names of contractors and freelancers, their respective hours worked, payment rates, and total earnings for the pay period. It also includes deductions, taxes withheld, and payment status to ensure accurate and transparent compensation tracking.

What are important factors to consider when preparing this payroll sheet? It's crucial to verify the accuracy of hours reported and payment rates, maintain compliance with tax regulations, and clearly document any reimbursable expenses or contract terms. Keeping detailed records helps prevent disputes and ensures timely payments.

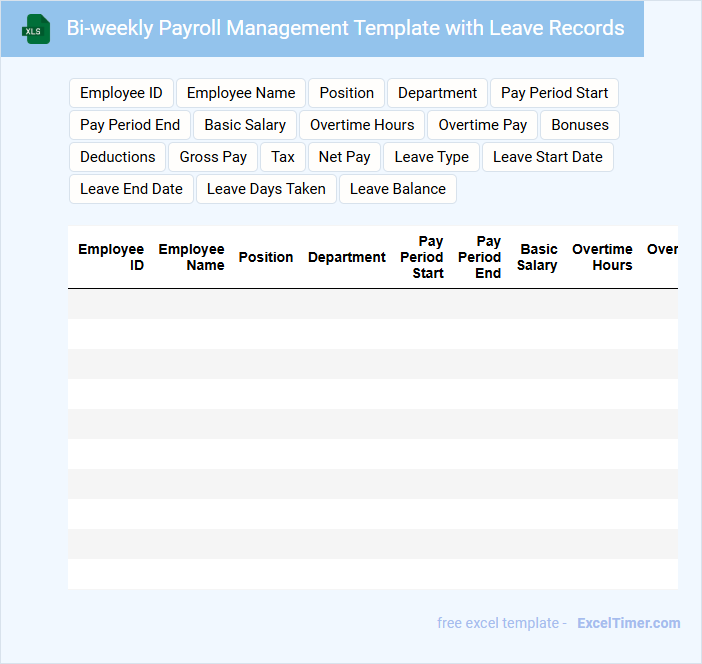

Bi-weekly Payroll Management Template with Leave Records

A Bi-weekly Payroll Management Template typically contains detailed employee payment records, including hours worked, pay rates, and deductions for each two-week period. It also integrates leave records to track absences, ensuring accurate calculation of pay. This type of document is essential for maintaining clear and organized payroll processes to avoid errors and compliance issues.

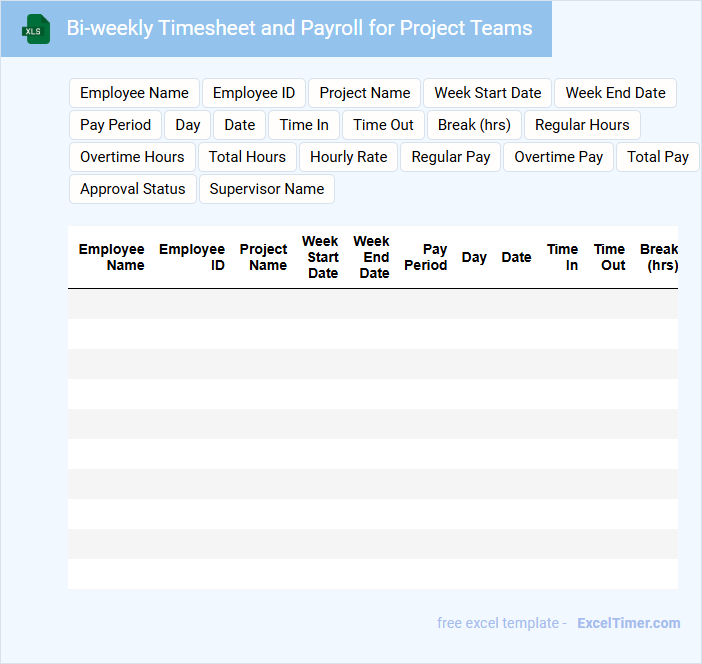

Bi-weekly Timesheet and Payroll for Project Teams

The Bi-weekly Timesheet is a document used to record the hours worked by project team members over a two-week period. It typically includes daily work hours, tasks completed, and any overtime or leave taken during this timeframe.

The Payroll section calculates the total compensation based on the recorded hours and applicable pay rates. Ensuring accurate data entry and timely submission of these timesheets is crucial for proper salary processing and project cost management.

Payroll Ledger for Bi-weekly Pay Periods in Excel

A Payroll Ledger for bi-weekly pay periods is a detailed financial document that tracks employee wages, deductions, and net pay for every two-week cycle. It is essential for maintaining accurate records of payroll transactions and ensuring compliance with tax regulations.

Typically, this document includes employee information, hours worked, gross pay, taxes withheld, benefits, and net paycheck amounts. To optimize its use in Excel, ensure formulas are accurate, and regularly update the ledger to reflect any changes in pay or deductions.

What is the definition and primary purpose of a bi-weekly payroll schedule in Excel?

A bi-weekly payroll schedule in Excel refers to a payment system where employees receive their wages every two weeks, totaling 26 pay periods annually. This schedule streamlines payroll calculations and tracking by automating deductions and earnings within the spreadsheet. Your Excel document ensures precise management of pay dates and employee compensation in a consistent, easy-to-read format.

How do you calculate the number of pay periods in a year using a bi-weekly payroll system?

To calculate the number of pay periods in a year using a bi-weekly payroll system, divide 52 weeks by 2, resulting in 26 pay periods annually. This calculation ensures you accurately track each paycheck in your payroll Excel document. Use this figure to organize and manage your payroll schedule efficiently.

What Excel formulas can be used to automate gross pay calculations for bi-weekly employees?

Excel formulas like =SUM() and =PRODUCT() can automate gross pay calculations for bi-weekly employees by multiplying hourly rates by total hours worked. The formula =IF() helps incorporate overtime rules, ensuring accurate pay. You can customize these formulas based on your payroll structure for precise bi-weekly calculations.

How does Excel handle overtime calculations within a bi-weekly payroll setup?

Excel manages overtime calculations in a bi-weekly payroll setup by using formulas that compare total hours worked against standard bi-weekly hours, typically 80 hours. Overtime hours are calculated by subtracting the standard hours from total hours worked, with the excess multiplied by the overtime pay rate. Payroll templates often include conditional formulas to automate regular and overtime pay computations.

What columns and data fields are essential in an Excel document for accurate bi-weekly payroll tracking?

Essential columns for accurate bi-weekly payroll tracking include Employee ID, Employee Name, Pay Period Start Date, Pay Period End Date, Hours Worked, Overtime Hours, Pay Rate, Gross Pay, Tax Deductions, Other Deductions, and Net Pay. Including a column for Pay Date ensures clarity on when payments are processed. Accurate entry of these fields enables precise calculation and compliance with payroll regulations.