![]()

The Bi-weekly Excel Template for Loan Repayment Tracking simplifies managing loan payments by organizing due dates and payment amounts every two weeks. It helps users accurately monitor outstanding balances and interest accumulation, ensuring on-time payments and avoiding penalties. Customizable features allow users to tailor the template to different loan types and repayment schedules for optimal financial control.

Bi-weekly Excel Template for Loan Repayment Tracking

A Bi-weekly Excel Template for Loan Repayment Tracking typically contains detailed schedules of payment dates, outstanding balances, and interest calculations. It helps users monitor their loan repayment progress and ensures timely payments. Incorporating automated formulas and clear data entry fields is crucial for accuracy and ease of use.

Loan Repayment Schedule with Bi-weekly Tracking

What information does a Loan Repayment Schedule with Bi-weekly Tracking typically contain? This document outlines the detailed repayment plan including the amount due every two weeks, the principal and interest breakdown, and the remaining loan balance after each payment. It helps borrowers manage their repayments efficiently by providing a clear timeline and tracking mechanism for bi-weekly payments.

What is an important aspect to consider when using a Loan Repayment Schedule with Bi-weekly Tracking? Consistency in making payments on the scheduled dates is crucial to avoid penalties and reduce interest costs over time. Additionally, regularly updating the schedule with actual payments ensures accurate tracking and helps in forecasting loan payoff dates.

Bi-weekly Payment Tracker for Loan Repayment

A Bi-weekly Payment Tracker for loan repayment is a document designed to monitor payments made every two weeks towards a loan. It typically contains key details such as payment dates, amounts paid, remaining balance, and interest accrued. This tracker helps borrowers stay organized and ensure timely payments to reduce debt efficiently.

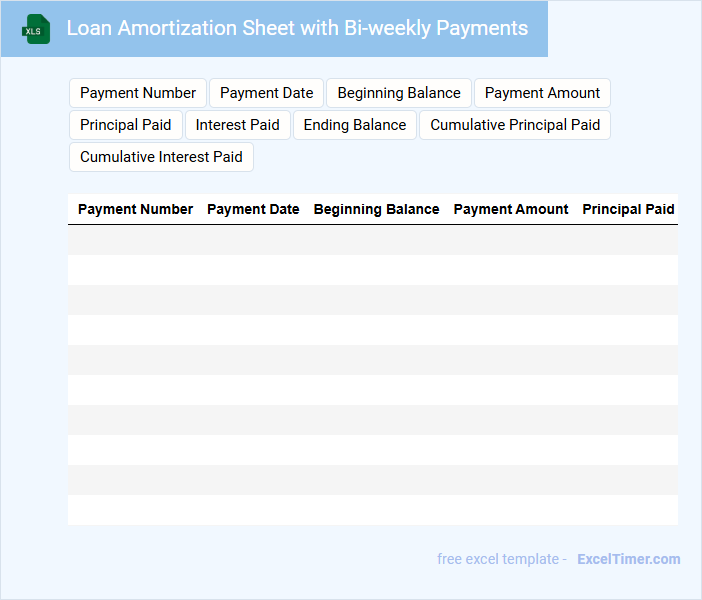

Loan Amortization Sheet with Bi-weekly Payments

A Loan Amortization Sheet with Bi-weekly Payments details the repayment schedule of a loan, showing how each payment is applied towards principal and interest over time. It helps borrowers understand the impact of bi-weekly payments on loan payoff duration and total interest saved.

- This document typically includes payment dates, amounts allocated to principal, interest, and remaining balance.

- It is important to verify that the payment frequency aligns with the bi-weekly schedule to accurately track progress.

- Consider including a summary section highlighting total interest paid and anticipated loan payoff date.

Bi-weekly Debt Payment Schedule for Loan Tracking

A Bi-weekly Debt Payment Schedule is a structured document that outlines the payment plan for loans, specifying due dates and amounts every two weeks. It helps borrowers maintain consistent payments and reduces loan interest over time.

Typically, this document contains the loan amount, payment dates, payment amounts, interest rates, and remaining balance details. Including reminders and early payment options can enhance effective loan tracking.

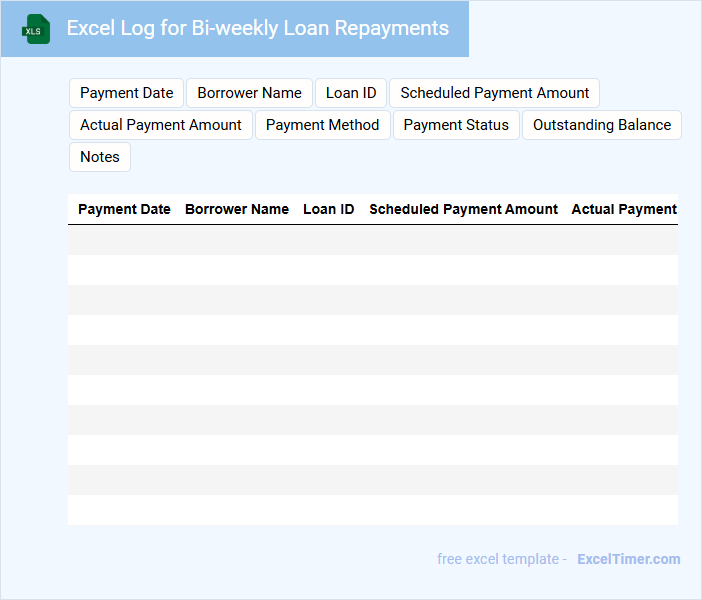

Excel Log for Bi-weekly Loan Repayments

An Excel Log for Bi-weekly Loan Repayments typically contains detailed records of payment dates, amounts paid, and outstanding balances. It helps track the progress of loan repayment systematically to ensure timely payments and avoid penalties.

The log should also include sections for interest calculations and loan terms to monitor the financial impact over time. Maintaining clear and accurate entries is critical for effective loan management and financial planning.

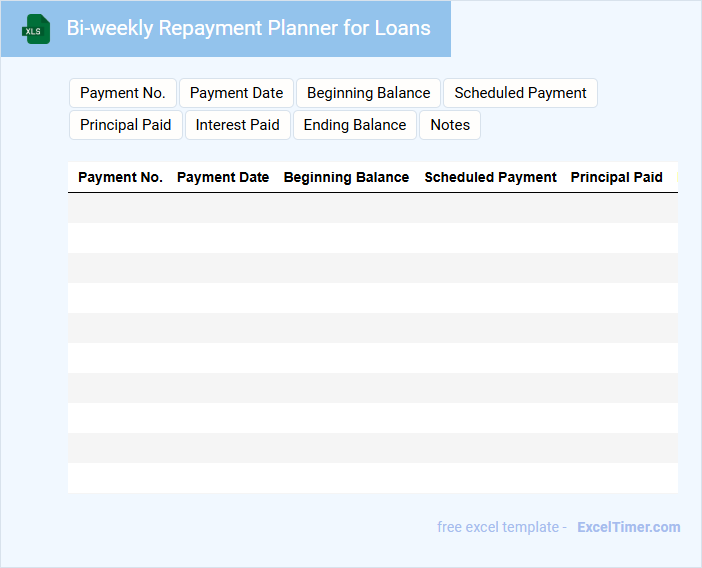

Bi-weekly Repayment Planner for Loans

A Bi-weekly Repayment Planner for loans is a structured schedule designed to track loan payments every two weeks, helping borrowers manage their debt effectively. This type of document typically includes payment dates, amounts due, and remaining balances.

Its main purpose is to facilitate timely repayments and reduce overall interest costs by increasing payment frequency. Important elements to include are clear repayment timelines, interest calculation details, and reminders for upcoming payments.

Loan Tracker with Bi-weekly Repayment Calculation

A Loan Tracker with bi-weekly repayment calculation is a financial document designed to help individuals monitor their loan balances and payment schedules efficiently. It typically contains detailed information on the loan amount, interest rate, payment history, and remaining balance. This type of document is crucial for managing debt and ensuring timely payments to avoid penalties.

Important aspects to include are an accurate breakdown of bi-weekly payment amounts, a clear amortization schedule, and reminders for due dates. Additionally, tracking extra payments and their impact on the loan term can provide valuable insights into reducing interest costs. Regular updates and summaries improve financial awareness and help with budgeting.

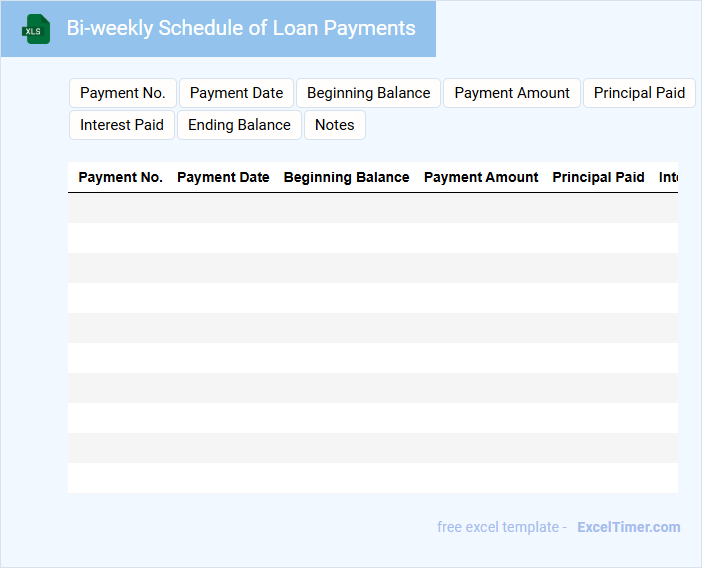

Bi-weekly Schedule of Loan Payments

A Bi-weekly Schedule of Loan Payments document typically outlines the payment dates and amounts due every two weeks, helping borrowers manage their loan repayment efficiently. It provides a clear timeline to track payments and ensures timely fulfillment of financial commitments.

This schedule often includes details such as payment amount, interest breakdown, and remaining balance after each payment. For effective use, it is important to review the schedule regularly and adjust for any changes in loan terms or additional payments.

Template for Tracking Loan Repayment on a Bi-weekly Basis

This document is a Template for Tracking Loan Repayment on a bi-weekly basis, designed to help individuals or organizations monitor their loan payments regularly. It typically includes sections for payment dates, amounts paid, outstanding balances, and interest calculations.

Using this template ensures consistent financial management and helps prevent missed payments or errors in loan tracking. It is important to update the template after every payment to maintain accurate and up-to-date records.

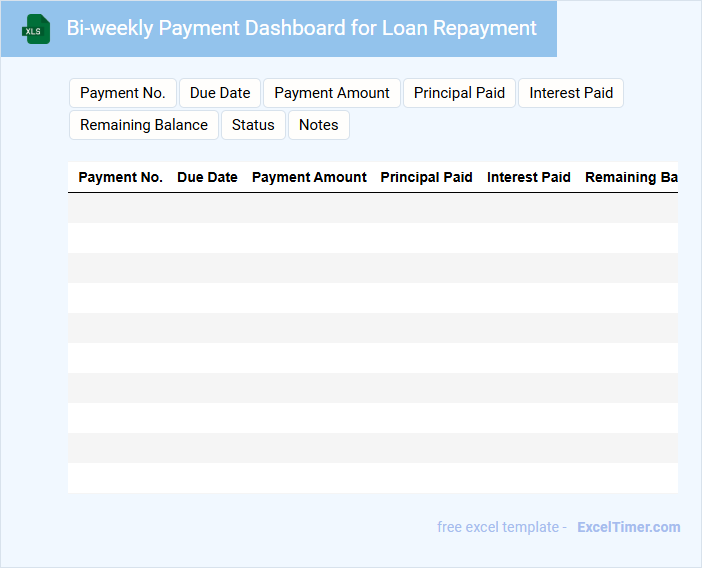

Bi-weekly Payment Dashboard for Loan Repayment

A Bi-weekly Payment Dashboard for loan repayment typically contains detailed tracking of payment schedules, amounts due, and outstanding balances. It provides an at-a-glance view of payment history and upcoming due dates to help manage loan obligations effectively.

Such a document is crucial for maintaining financial discipline and ensuring timely loan repayments. It often includes visual aids like charts and graphs to highlight payment trends and progress.

Important suggestions for this dashboard include integrating real-time updates and setting reminders for upcoming payments to avoid missed deadlines.

Excel Sheet for Bi-weekly Loan Payoff Tracking

An Excel Sheet for Bi-weekly Loan Payoff Tracking typically contains detailed records of loan payments made every two weeks, including principal and interest amounts. It helps users monitor their payoff progress by calculating remaining balances and total interest saved over time. Important elements include columns for payment dates, amounts, and updated loan balances, ensuring accurate and organized financial tracking.

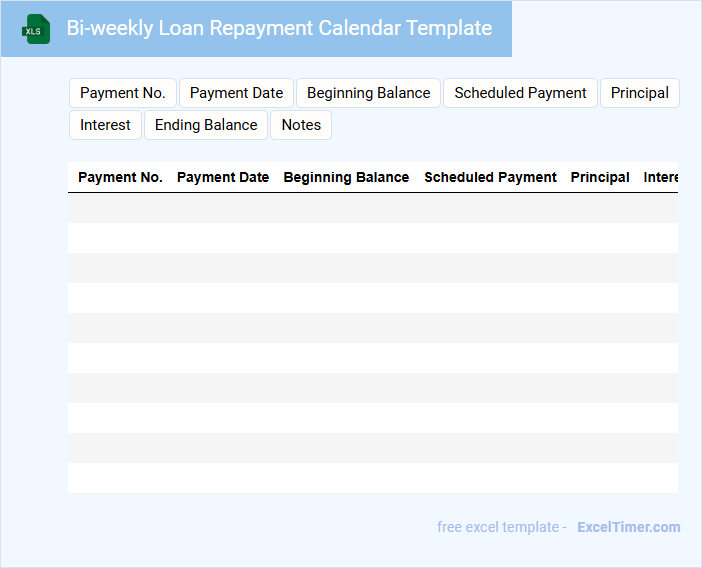

Bi-weekly Loan Repayment Calendar Template

What information does a Bi-weekly Loan Repayment Calendar Template typically contain? This document usually includes scheduled payment dates, amounts due, and remaining loan balances to help borrowers manage their repayment process systematically. It is designed to provide clarity and organization, ensuring timely payments and tracking progress efficiently.

Why is it important to maintain accuracy in a Bi-weekly Loan Repayment Calendar Template? Accurate recording of payment dates and amounts prevents missed payments and potential late fees, improving credit scores and financial planning. Regular updates and reminders are also essential to adapt to any changes in loan terms or payment schedules.

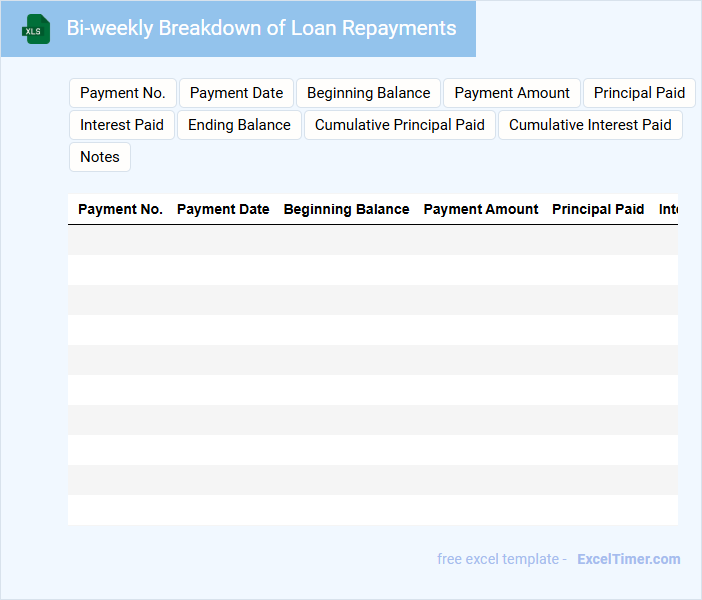

Bi-weekly Breakdown of Loan Repayments

A Bi-weekly Breakdown of Loan Repayments is a document that details each loan payment made every two weeks, showing how payments are applied to principal and interest. It helps borrowers track their progress and manage their repayment schedule effectively.

- Include the payment date, amount, and remaining balance after each payment.

- Highlight total interest paid to date and any changes in payment amounts.

- Specify the loan terms and conditions to provide complete context.

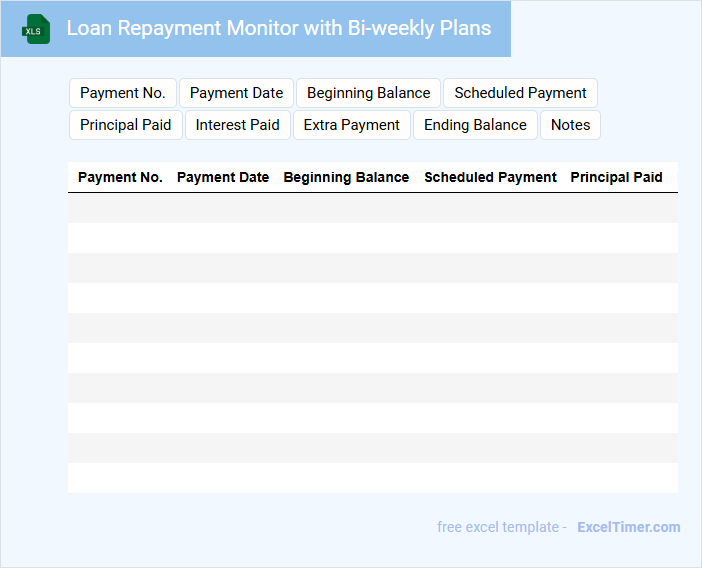

Loan Repayment Monitor with Bi-weekly Plans

A Loan Repayment Monitor with Bi-weekly Plans is a document designed to track the schedule and amounts of loan repayments made every two weeks. It typically contains details such as payment dates, amounts paid, outstanding balances, and interest accrued. This tool helps borrowers manage their debts efficiently by providing a clear overview of payment progress and deadlines.

How do you calculate the number of bi-weekly payment periods within a loan term using Excel formulas?

Calculate the number of bi-weekly payment periods by dividing the loan term in years by the length of each bi-weekly period, typically 2 weeks. Use the formula =ROUNDUP((Loan_Term_Years*52)/2, 0) where 52 represents weeks per year. This returns the total number of bi-weekly periods for accurate loan repayment tracking.

What formula can you use to determine the next bi-weekly due date based on the initial loan date?

Use the formula =A2 + 14 to calculate the next bi-weekly due date, where A2 contains the initial loan date. This adds 14 days to the original date, reflecting the bi-weekly repayment schedule. Copying this formula down the column generates consecutive due dates every two weeks.

How do you structure an Excel table to track both principal and interest reduction for each bi-weekly installment?

Create an Excel table with columns for Date, Bi-Weekly Payment, Principal Paid, Interest Paid, and Remaining Balance to track each installment. Use formulas to automatically calculate principal and interest portions based on your loan amortization schedule. This structure allows you to clearly monitor your loan repayment progress and interest reduction over time.

Which Excel function helps identify overdue or missed bi-weekly payments automatically?

The Excel function IF combined with TODAY and MOD can identify overdue or missed bi-weekly loan payments automatically. Use IF to compare the payment due dates against TODAY's date for overdue status. MOD helps calculate bi-weekly intervals by checking payment dates falling outside the expected schedule.

How can conditional formatting in Excel highlight upcoming or overdue bi-weekly loan repayments?

Use conditional formatting in Excel to highlight bi-weekly loan repayments by setting rules based on due dates. Apply a formula to flag payments due within the next 14 days to highlight upcoming repayments. Configure a separate rule to mark dates past due to track overdue loan payments effectively.