Bi-weekly Savings Plan Excel Template for College Students offers an organized and efficient way to track savings goals and manage finances on a bi-weekly basis. This template helps college students plan their budget, monitor expenses, and ensure consistent savings throughout the semester. Customizable features allow users to adjust savings goals and timelines, promoting financial discipline and long-term money management.

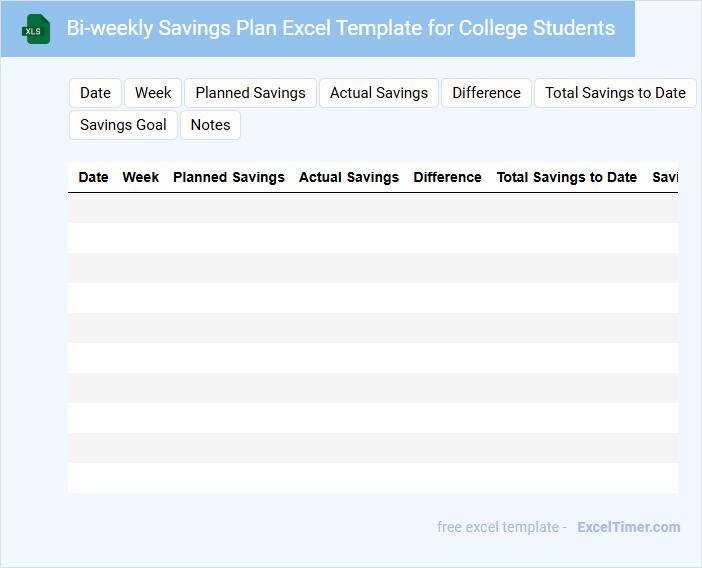

Bi-weekly Savings Plan Excel Template for College Students

What information is typically included in a Bi-weekly Savings Plan Excel Template for College Students? This type of document usually contains sections for income sources, expense tracking, and savings goals updated on a bi-weekly basis. It helps students organize their finances efficiently by providing a clear overview of their budgeting and saving progress.

What are some important features to include in this template? Key elements should be automatic calculations, easy-to-read charts, and customizable fields to accommodate varying income and expenses. Including reminders for due dates and tips for saving can also enhance its usefulness for college students managing tight budgets.

Expense Tracker with Bi-weekly Savings for College Students

An Expense Tracker is a document designed to record and monitor daily expenditures, helping college students manage their finances effectively. It typically includes categories like food, transportation, and entertainment to provide a clear overview of spending habits.

For a Bi-weekly Savings plan, this type of document also tracks income and allocates specific amounts to savings every two weeks. This encourages consistent saving behavior crucial for covering future college expenses or emergencies.

It is important to regularly update the tracker and set realistic savings goals to maximize financial stability throughout the semester.

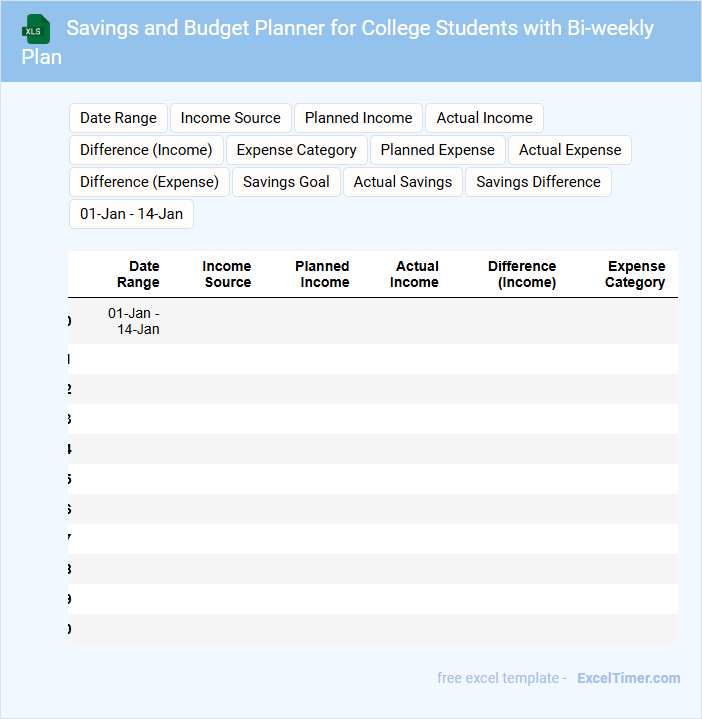

Savings and Budget Planner for College Students with Bi-weekly Plan

What information does a Savings and Budget Planner for College Students with Bi-weekly Plan usually contain? This document typically includes details about income sources, expected expenses, and a schedule for tracking savings goals on a bi-weekly basis. It helps students manage their finances effectively by breaking down their budget into manageable, two-week periods.

What is an important suggestion for using this planner effectively? It is crucial to record all income and expenditures consistently every two weeks to maintain an accurate overview of financial health. Additionally, setting realistic savings goals and adjusting the budget according to changing needs can enhance financial discipline and ensure funds are allocated wisely.

Bi-weekly Financial Goals Tracker for Students

The Bi-weekly Financial Goals Tracker is a document designed to help students monitor their income, expenses, and savings every two weeks. It typically includes sections for recording budgets, tracking expenditures, and setting financial targets.

Maintaining a consistent overview of financial activities enhances money management skills and supports achieving monetary objectives. One important suggestion is to regularly update the tracker to accurately reflect spending habits and progress toward goals.

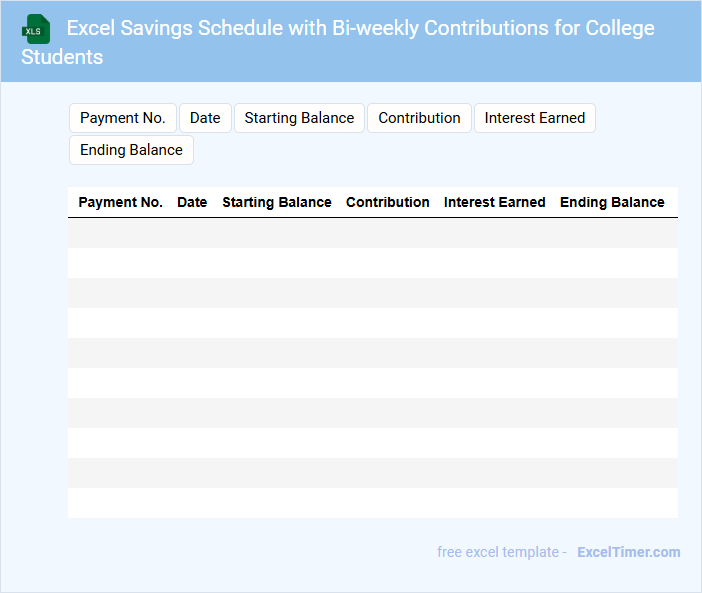

Excel Savings Schedule with Bi-weekly Contributions for College Students

This document typically outlines a structured savings plan designed for college students making bi-weekly contributions. It helps track savings progress and optimize financial goals over time.

- Includes a detailed timeline of bi-weekly deposits and projected balance growth.

- Highlights key milestones such as semester start dates and tuition due dates.

- Suggests realistic contribution amounts aligned with student income and expenses.

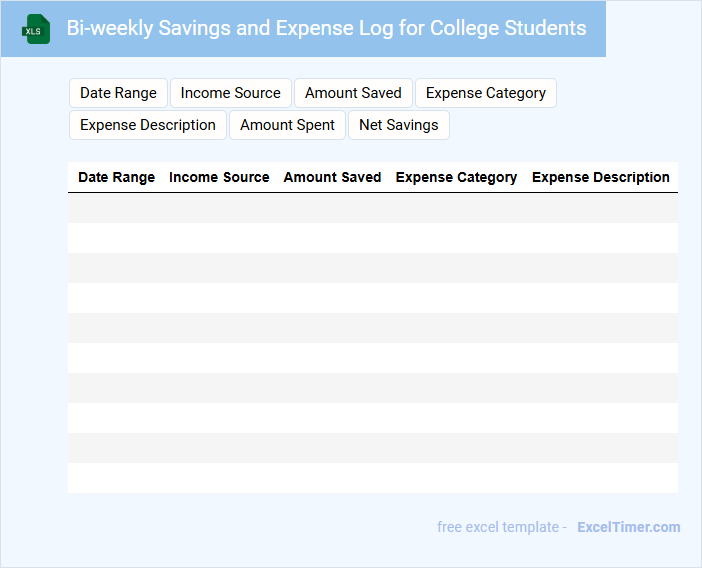

Bi-weekly Savings and Expense Log for College Students

A Bi-weekly Savings and Expense Log for college students typically contains detailed records of income, expenses, and savings tracked every two weeks. It helps students monitor their spending habits and identify areas where they can cut costs or increase savings. Maintaining this log encourages financial discipline and promotes better money management during college years.

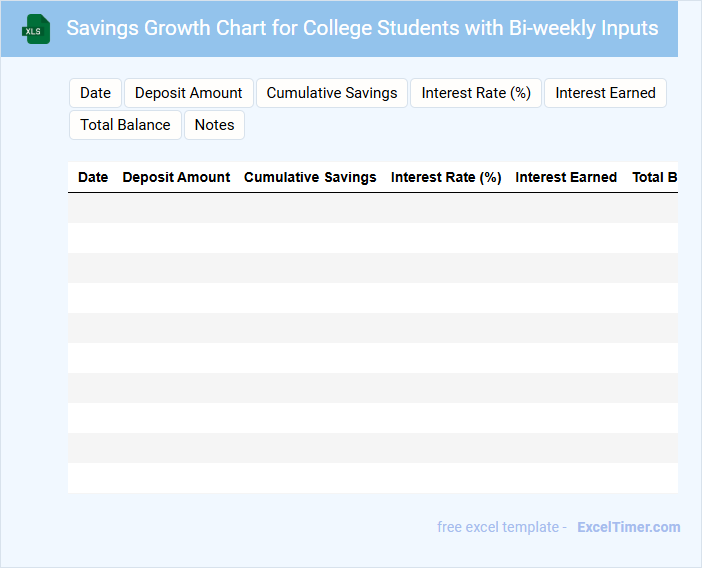

Savings Growth Chart for College Students with Bi-weekly Inputs

The Savings Growth Chart for college students with bi-weekly inputs is a vital financial tracking tool that helps students visualize their savings progress over time. This document typically contains detailed entries of bi-weekly deposits, projected interest or returns, and cumulative savings growth. It is essential for students to regularly update their contributions and monitor their financial goals to maximize their saving efficiency.

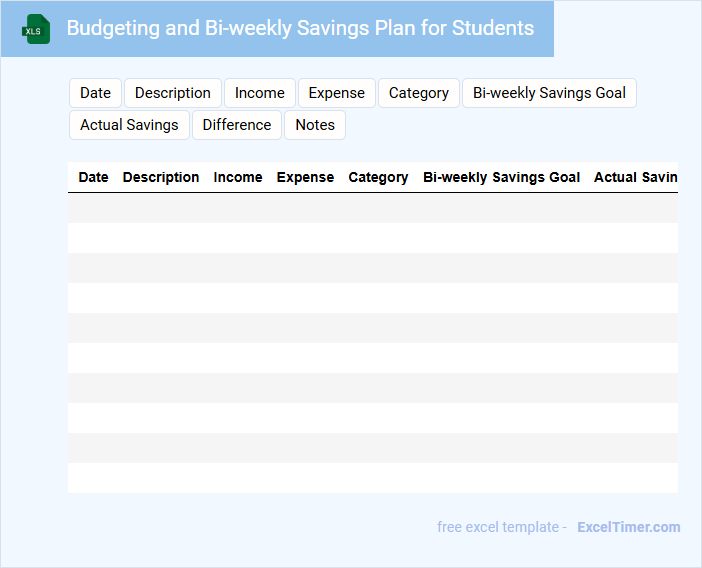

Budgeting and Bi-weekly Savings Plan for Students

What information is typically included in a Budgeting and Bi-weekly Savings Plan for Students? This document usually contains detailed income sources, expense tracking, and a planned schedule for setting aside savings every two weeks. It helps students manage their finances responsibly by outlining spending limits and goals to ensure financial stability throughout their academic period.

What are the important aspects to consider when creating a Budgeting and Bi-weekly Savings Plan for Students? It is crucial to accurately estimate monthly income and fixed vs. variable expenses, prioritize essential needs over wants, and set realistic savings targets. Consistency in updating the plan and monitoring progress ensures effective financial discipline and prepares students for unexpected costs.

Bi-weekly Savings Tracker for College Essentials

A bi-weekly savings tracker for college essentials is a practical document used to monitor and manage finances over two-week periods, helping students stay on budget. It typically contains categories for essential expenses like textbooks, supplies, and personal items, along with columns for tracking income and savings goals. This type of tracker aids in building disciplined saving habits and ensures that students are prepared for upcoming college costs.

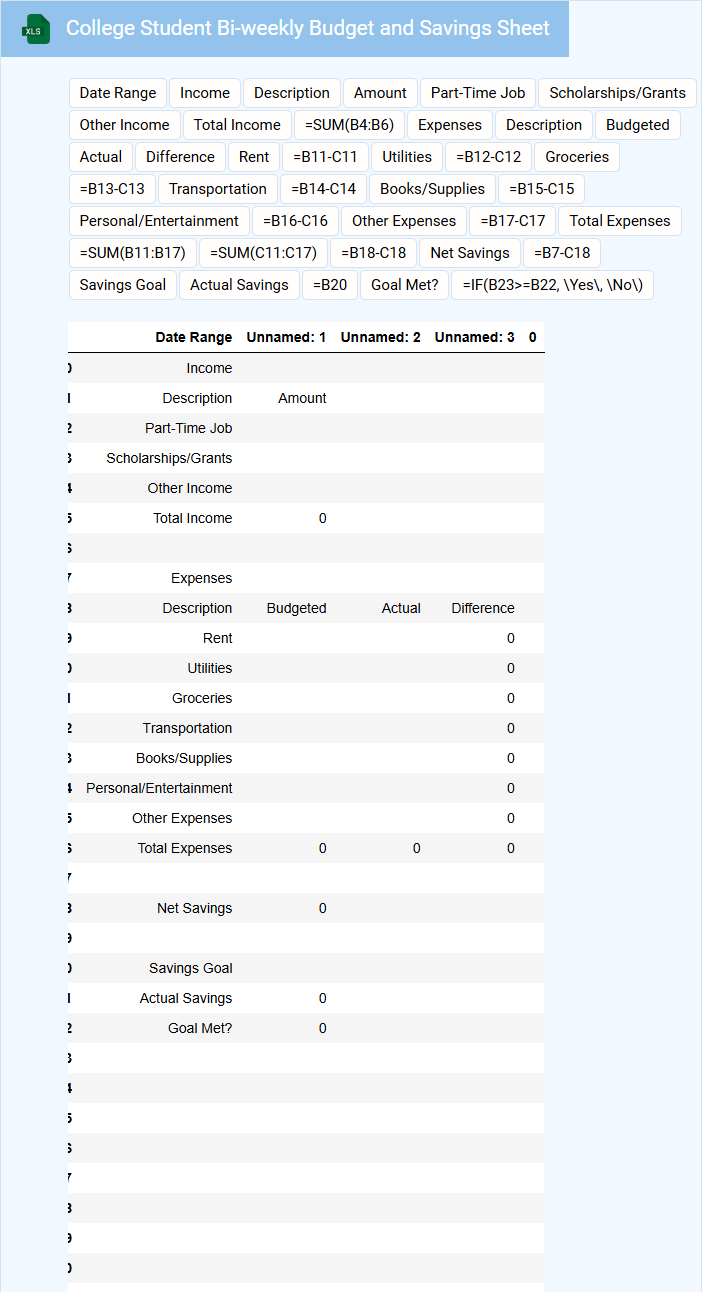

College Student Bi-weekly Budget and Savings Sheet

A College Student Bi-weekly Budget and Savings Sheet is a financial document designed to track income and expenses occurring every two weeks. It helps students manage their cash flow and prioritize spending while planning for future savings.

This type of document usually contains categories like tuition, rent, groceries, transportation, and entertainment. It is essential to include both fixed and variable expenses to create an accurate financial overview.

For effective use, regularly updating the sheet and setting realistic savings goals are important steps to maintain financial discipline.

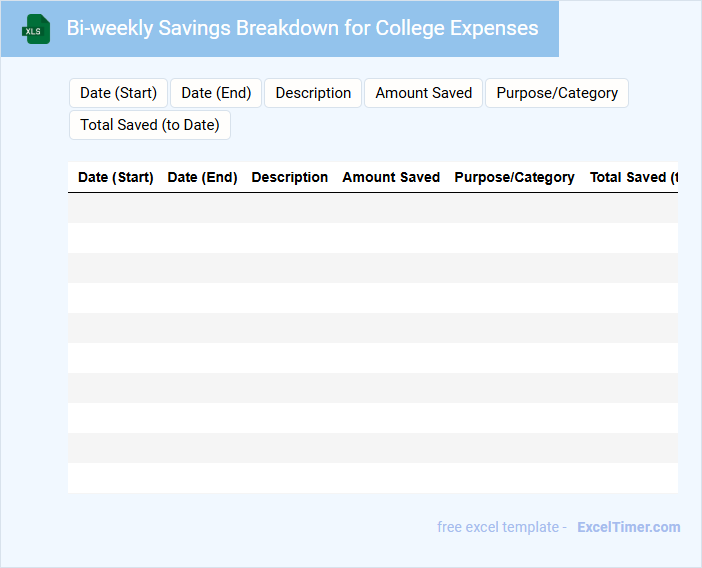

Bi-weekly Savings Breakdown for College Expenses

A Bi-weekly Savings Breakdown document typically outlines the total income, expenses, and amount saved every two weeks. It helps individuals track financial progress and manage their budget effectively.

This type of document is especially useful for managing college expenses, such as tuition, books, and living costs. Important elements to include are fixed costs, variable expenses, and a savings goal summary.

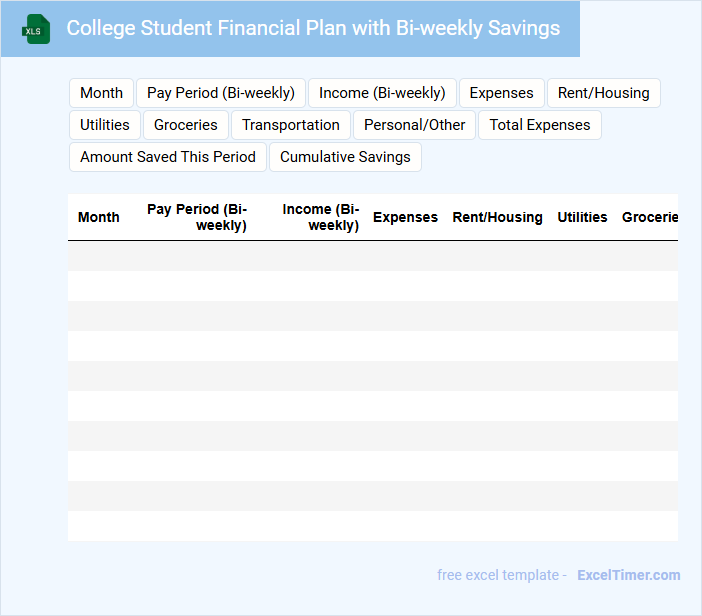

College Student Financial Plan with Bi-weekly Savings

A College Student Financial Plan is a document that outlines a student's income, expenses, and savings goals during their college years. It typically contains a detailed budget, sources of income such as scholarships or part-time jobs, and a savings strategy. For students using bi-weekly savings, tracking regular deposits helps in managing cash flow effectively and achieving financial stability.

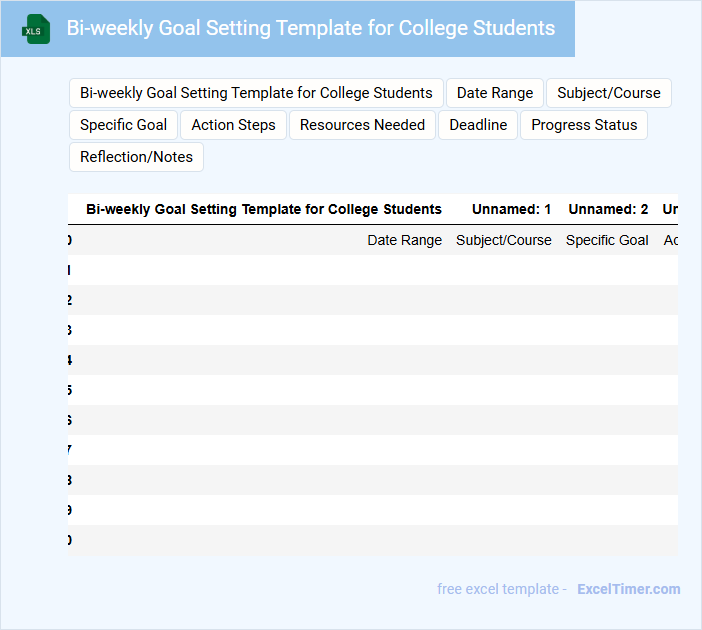

Bi-weekly Goal Setting Template for College Students

A Bi-weekly Goal Setting Template for college students typically contains sections to outline academic, personal, and extracurricular objectives. It helps students track their progress regularly and stay organized by breaking down goals into manageable two-week periods. Key elements include specific tasks, deadlines, and reflection prompts to encourage consistent improvement.

Important aspects to include are prioritization of goals, measurable outcomes, and time management strategies. This template should also provide space for reviewing achievements and adjusting future goals accordingly. Incorporating motivational quotes or reminders can further enhance student engagement and focus.

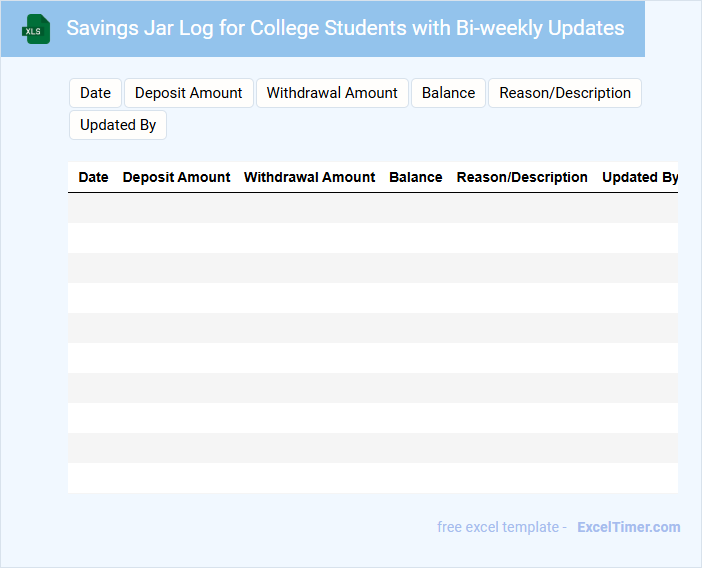

Savings Jar Log for College Students with Bi-weekly Updates

This document tracks and organizes savings efforts specifically for college students, with updates occurring every two weeks to reflect progress. It helps students monitor their financial goals and adjust saving strategies accordingly.

- Contains detailed records of deposits and withdrawals made bi-weekly.

- Includes a summary of savings milestones and total amounts saved.

- Offers motivational tips and budgeting advice tailored for college expenses.

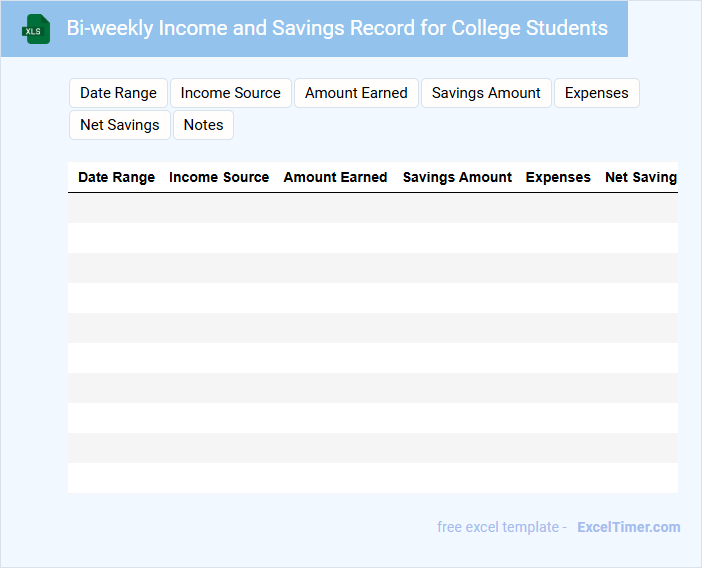

Bi-weekly Income and Savings Record for College Students

A Bi-weekly Income and Savings Record for college students typically includes details about all sources of income received every two weeks, such as scholarships, part-time jobs, or allowances. It also tracks expenses and the amount saved during the same period to help manage finances effectively.

This document is essential for maintaining financial discipline and planning future budgets. Regularly updating this record promotes better money management and helps identify spending patterns that can be adjusted for improved savings.

What is the purpose of implementing a bi-weekly savings plan for college expenses?

A bi-weekly savings plan helps you systematically allocate funds to cover college expenses, reducing financial stress and preventing debt accumulation. This approach leverages consistent, manageable contributions aligned with pay periods to maximize savings growth. Effective planning ensures sufficient resources for tuition, textbooks, and living costs throughout the academic year.

How do you calculate the amount to save every two weeks based on your total savings goal and timeline?

Calculate your bi-weekly savings amount by dividing your total savings goal by the number of two-week periods within your timeline. For example, if your goal is $1,200 to save over 12 weeks, divide $1,200 by 6 bi-weekly intervals to get $200 per period. This method ensures consistent progress toward your college savings plan.

Which Excel formulas can be used to automatically update your savings progress each period?

Excel formulas such as SUM, IF, and PMT can be used to automatically update your savings progress each bi-weekly period in a College Students Savings Plan. The SUM formula tracks total contributions, while IF conditions adjust for missed or extra deposits. PMT calculates the required periodic payment to reach your savings goal efficiently.

How can you visualize your bi-weekly savings growth over time using Excel charts?

Create a line chart in Excel by plotting bi-weekly savings amounts on the Y-axis against time intervals on the X-axis. Use cumulative savings data to illustrate growth trends and set consistent date labels for clarity. Highlight key milestones or targets using data markers to enhance visual impact and track progress effectively.

What methods can you use in Excel to track income sources and ensure consistent bi-weekly contributions?

Use Excel tables and named ranges to organize income sources with columns for date, amount, and description. Implement formulas like SUMIFS to calculate total income within bi-weekly periods. Set up conditional formatting and data validation to monitor consistent bi-weekly contributions and highlight missed payments.