The Bi-weekly Budget Excel Template for College Students helps organize expenses and track income efficiently on a two-week basis, aligning with common student pay periods. It includes customizable categories such as tuition, groceries, and entertainment, enabling clear financial planning and control. This tool supports better money management, reducing the risk of overspending and promoting savings throughout the academic term.

Bi-weekly Budget Tracker for College Students

A Bi-weekly Budget Tracker for College Students is a document used to monitor income and expenses every two weeks, helping maintain financial discipline. It is essential for managing limited funds effectively over the academic term.

- Include sources of income such as part-time jobs or allowances.

- Track fixed and variable expenses like rent, groceries, and entertainment.

- Set savings goals and review spending habits regularly to stay on budget.

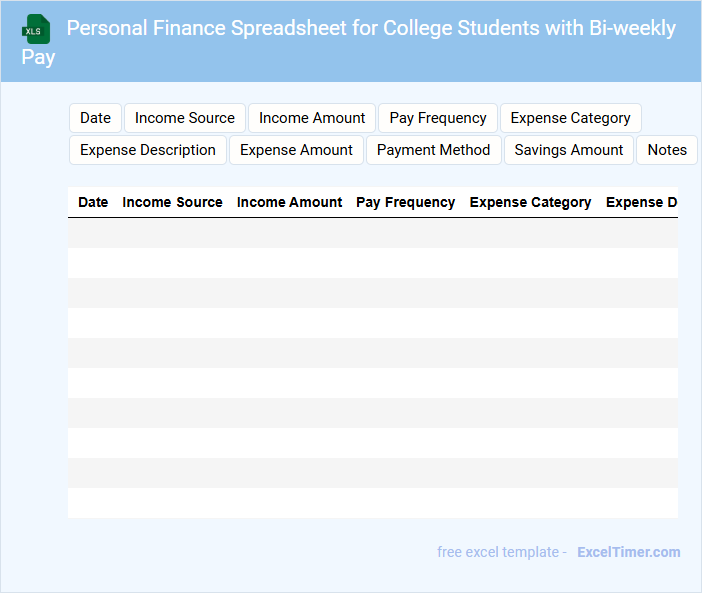

Personal Finance Spreadsheet for College Students with Bi-weekly Pay

A Personal Finance Spreadsheet for college students typically contains income, expenses, and savings categorized for easy tracking. This document helps to monitor bi-weekly paychecks and manages budget effectively within the academic timeline. It is essential for students to prioritize tracking fixed expenses and unexpected costs to maintain financial stability.

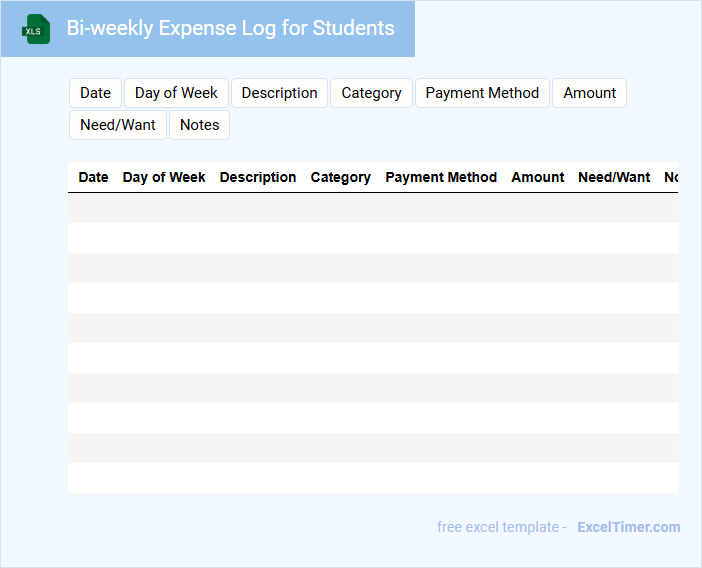

Bi-weekly Expense Log for Students

A Bi-weekly Expense Log for students typically contains detailed records of all expenditures made within a two-week period, including categories such as food, transportation, and study materials. This document helps students track their spending habits and manage their budget effectively.

Important elements to include are the date, description of the expense, amount spent, and the payment method used. Keeping this log updated regularly encourages financial discipline and aids in identifying areas where savings can be made.

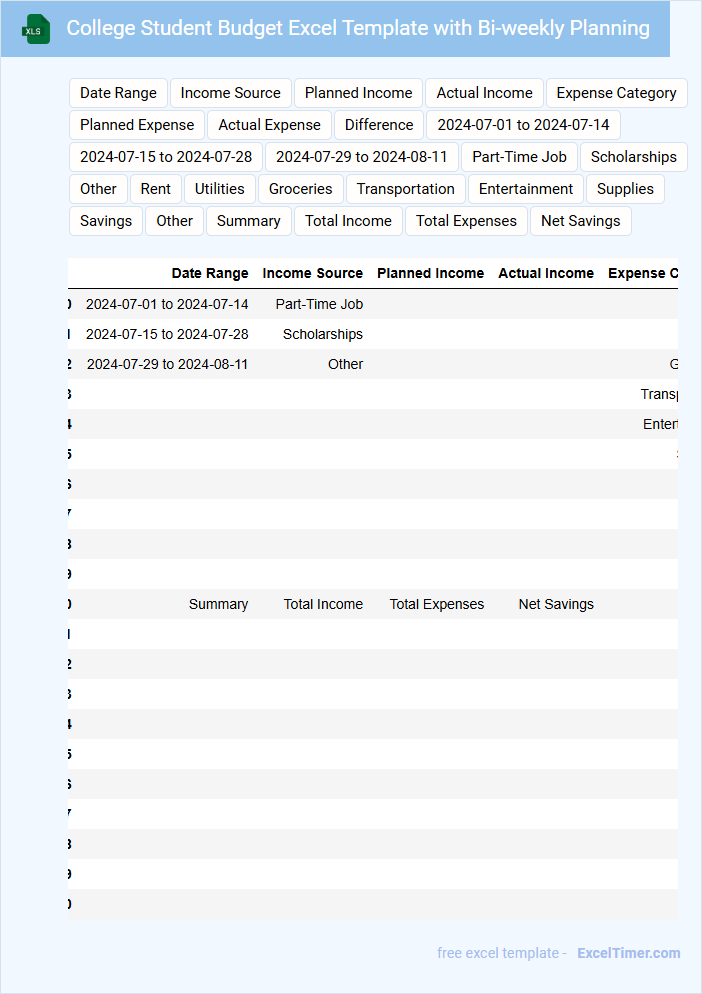

College Student Budget Excel Template with Bi-weekly Planning

A College Student Budget Excel Template is typically designed to help students organize their finances by tracking income and expenses on a bi-weekly basis. It usually contains sections for tuition fees, housing costs, food, transportation, and entertainment expenses. An important feature to include is a clear summary of savings goals and upcoming due dates for bills to ensure timely payments.

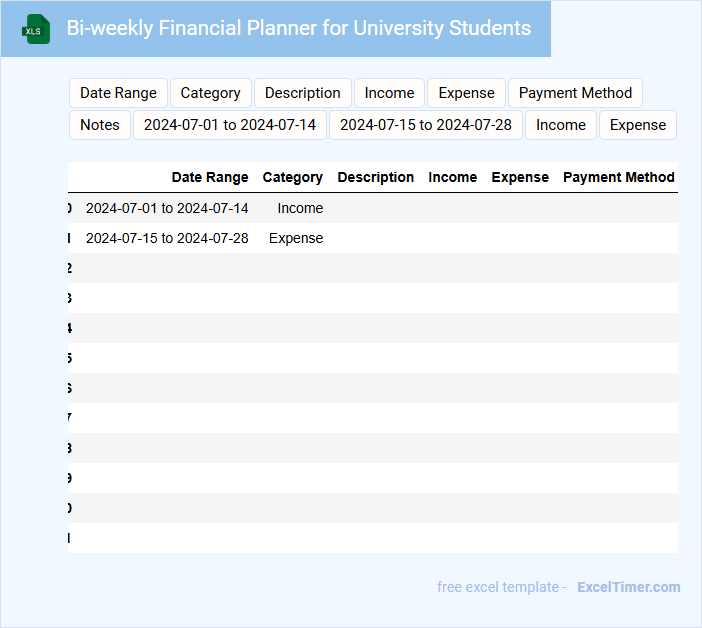

Bi-weekly Financial Planner for University Students

A Bi-weekly Financial Planner for University Students typically contains detailed budgeting, expense tracking, and financial goal setting to help manage finances effectively over two-week periods.

- Budget Allocation: Clearly outline expected income and categorize expenses to maintain control over spending.

- Expense Monitoring: Record all expenditures bi-weekly to identify spending patterns and areas for improvement.

- Financial Goals: Set short-term saving goals related to tuition, books, or personal needs to stay motivated and on track.

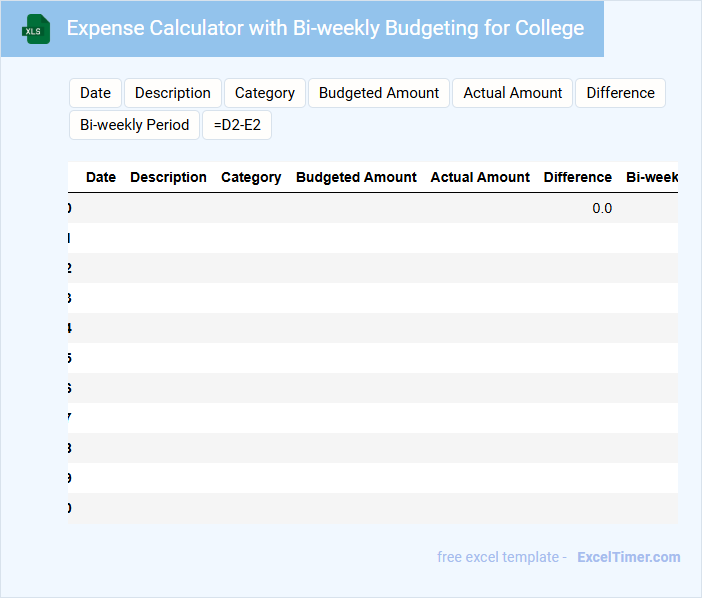

Expense Calculator with Bi-weekly Budgeting for College

An Expense Calculator with Bi-weekly Budgeting for College is designed to help students track their spending and manage finances effectively. It typically contains sections for income, fixed expenses, variable expenses, and savings goals aligned with a bi-weekly schedule.

Such a document is essential for maintaining a balanced budget and preventing overspending during the semester. Important elements to include are clear categorization of expenses, reminders for due dates, and a summary of budget versus actual spending.

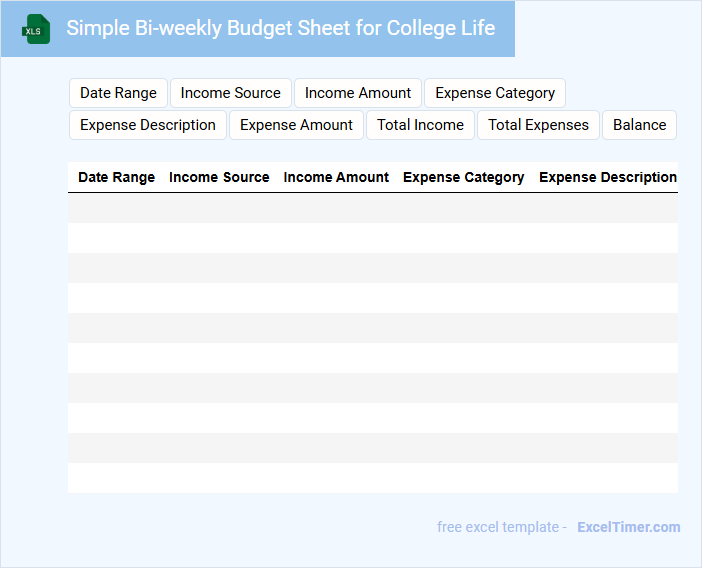

Simple Bi-weekly Budget Sheet for College Life

A Simple Bi-weekly Budget Sheet for College Life typically contains essential financial tracking information to help students manage their income and expenses effectively.

- Income Sources: It includes areas to record all regular income such as part-time jobs, scholarships, or allowances.

- Expense Categories: It outlines common expenses like groceries, transportation, and entertainment to monitor spending habits.

- Savings Goals: It encourages setting aside money for future needs or emergencies to promote financial discipline.

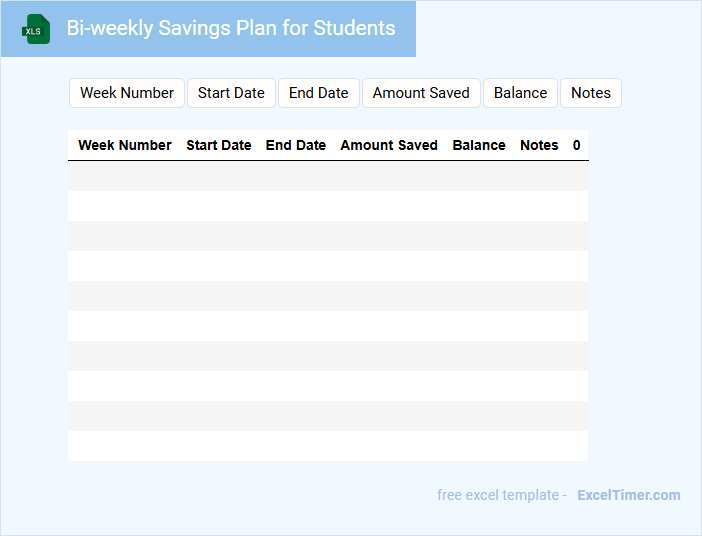

Bi-weekly Savings Plan for Students

A Bi-weekly Savings Plan for students outlines a structured approach to manage finances by setting aside money every two weeks. This document typically includes a schedule for deposits, savings goals, and budgeting tips to ensure consistent growth in savings. Important for students, it emphasizes discipline, financial planning, and tracking expenses.

Bi-weekly Spending Tracker for Undergraduate Students

A Bi-weekly Spending Tracker is a financial document designed to monitor and manage expenses over two-week periods. It typically contains categories such as tuition, food, transportation, and entertainment to help students stay within budget. This tool encourages responsible spending habits and supports financial planning during undergraduate studies.

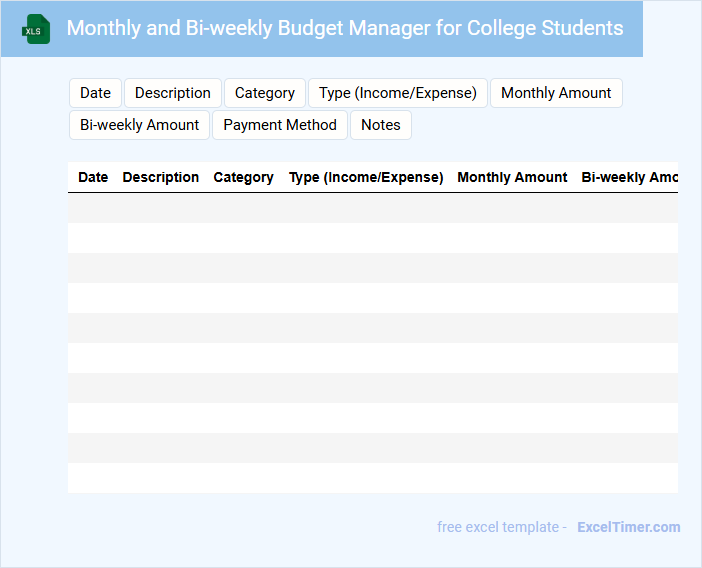

Monthly and Bi-weekly Budget Manager for College Students

This document serves as a Monthly and Bi-weekly Budget Manager, designed to help college students track their income and expenses systematically. It typically contains sections for income sources, fixed and variable expenses, and savings goals.

Using this budget manager encourages financial discipline by highlighting spending patterns and helping prioritize essential costs. Students should focus on accurately recording every transaction to maintain an effective budget.

Income and Expense Sheet for College Students with Bi-weekly Tracking

What information is typically included in an Income and Expense Sheet for College Students with Bi-weekly Tracking? This document usually contains detailed records of all income sources, such as part-time jobs and allowances, alongside categorized expenses like tuition, groceries, and entertainment. It helps students monitor their financial habits every two weeks to maintain budget control and improve spending decisions.

Bi-weekly Allowance Tracker for Students

A Bi-weekly Allowance Tracker for Students is a document designed to monitor and manage the allowance received and spent every two weeks. It helps students develop budgeting skills and maintain financial discipline.

- Record all sources of income and amounts received during each bi-weekly period.

- Track and categorize expenditures to identify spending patterns and necessary adjustments.

- Set clear saving goals and monitor progress to encourage responsible money management.

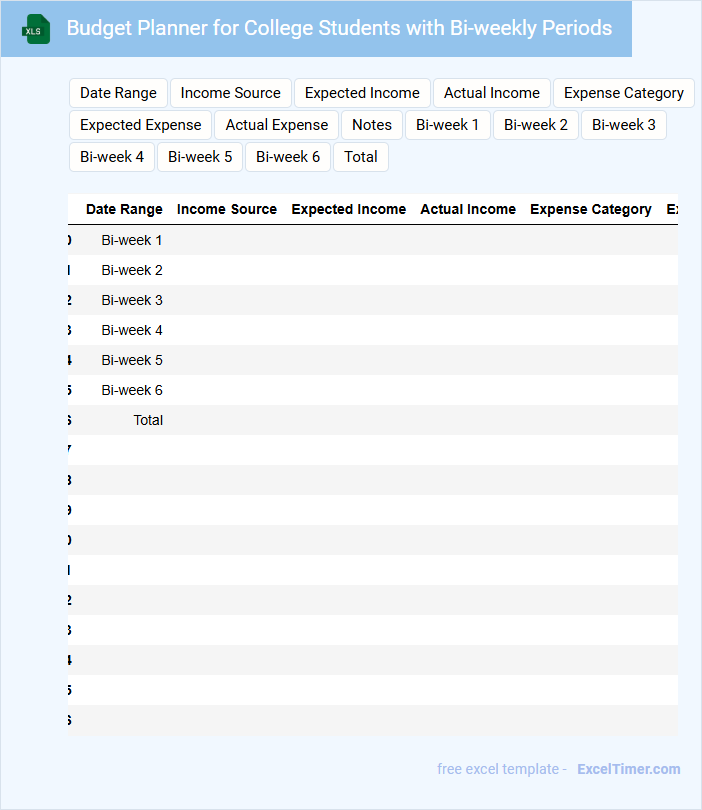

Budget Planner for College Students with Bi-weekly Periods

A Budget Planner for College Students with Bi-weekly Periods typically includes income tracking, expense categorization, and savings goals aligned with the student's academic calendar. It helps students manage their finances effectively by monitoring spending habits every two weeks.

Important aspects to consider are setting realistic spending limits and prioritizing essential expenses to avoid debt. Consistent review and adjustment of the budget ensure financial stability throughout the semester.

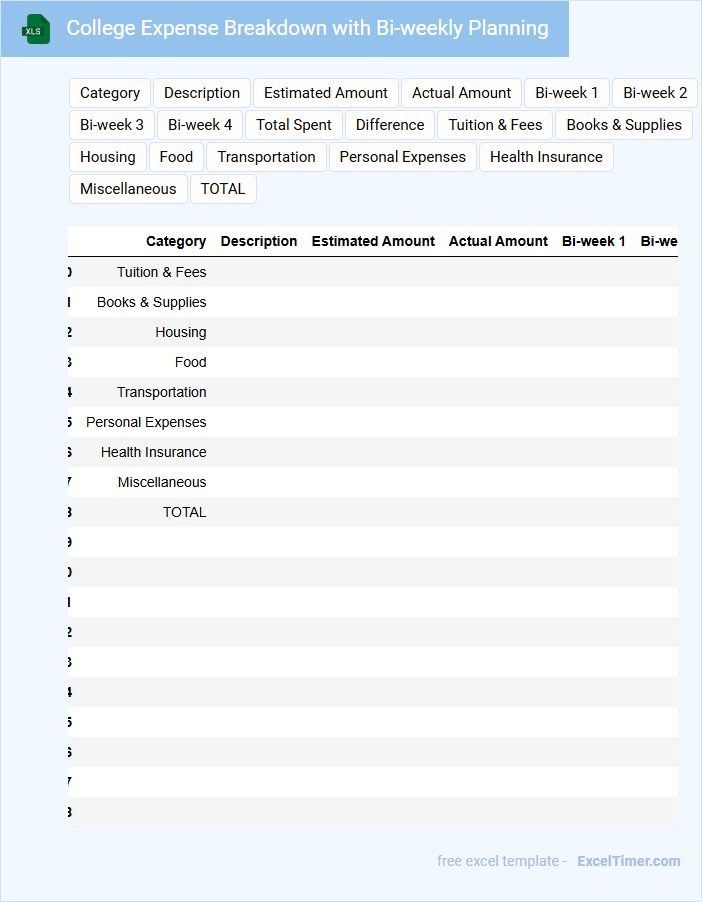

College Expense Breakdown with Bi-weekly Planning

A College Expense Breakdown document typically outlines the detailed costs associated with attending college, including tuition, housing, textbooks, and other fees. It helps students and parents understand where money is being allocated during the academic year. Incorporating a bi-weekly planning approach ensures consistent budgeting and timely management of expenses.

Important elements to include are a categorized list of expenses, payment deadlines, and a bi-weekly cash flow schedule. Tracking both fixed and variable costs can improve financial clarity and avoid surprises. Including savings goals for unexpected expenses is also recommended to maintain a balanced budget throughout the semester.

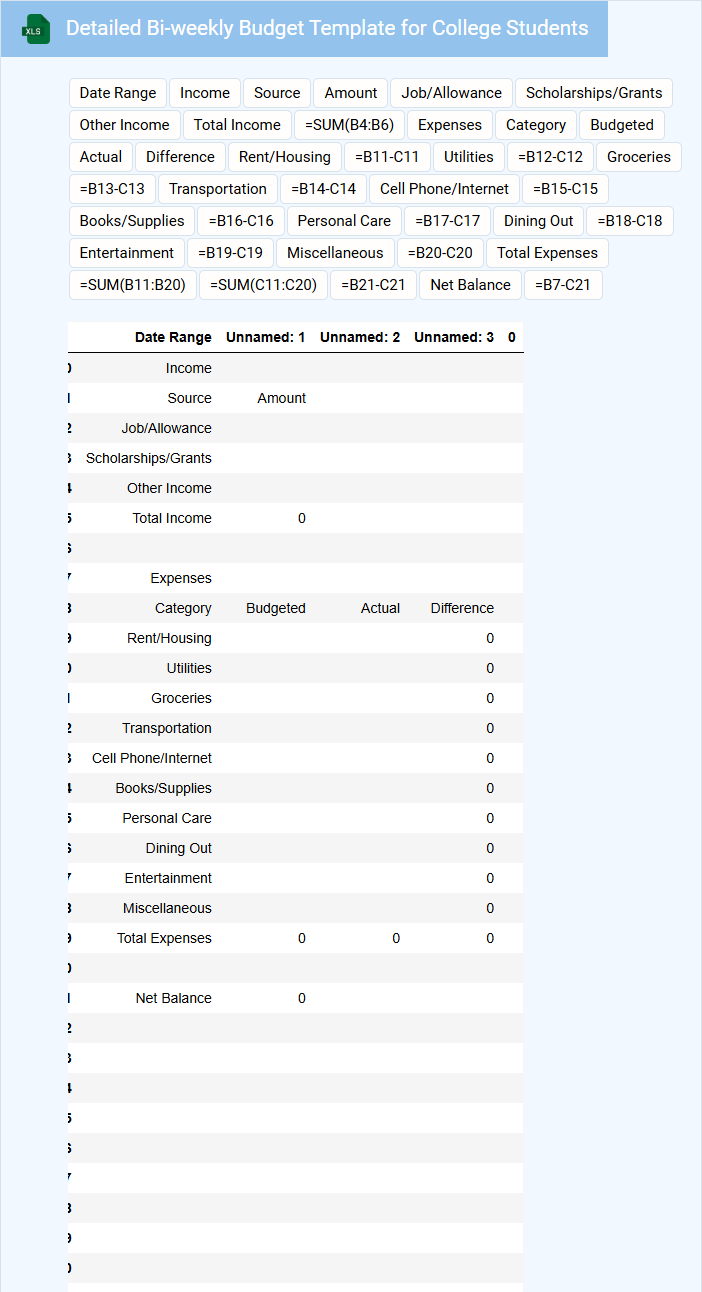

Detailed Bi-weekly Budget Template for College Students

This document typically contains a comprehensive breakdown of income and expenses over a two-week period to help college students manage their finances effectively.

- Income Sources: Track all sources of money, including part-time jobs, allowances, and scholarships.

- Expense Categories: Categorize spending into essentials like rent, food, transportation, and discretionary items.

- Savings Goals: Set clear savings targets to build financial discipline and emergency funds.

What are the essential income sources to include in a bi-weekly budget for college students?

Essential income sources to include in a bi-weekly budget for college students are part-time job earnings, financial aid disbursements, scholarships, parental support, and any freelance or gig work income. Tracking these income streams ensures accurate cash flow management throughout the semester. Including irregular sources such as tax refunds or one-time grants enhances budget precision.

Which categories should be prioritized for expenses in a bi-weekly college student budget?

Prioritize essential categories such as tuition, rent, groceries, transportation, and textbooks in your bi-weekly college budget. Allocating funds to utilities, cell phone bills, and health insurance ensures stable living and access to resources. Tracking discretionary spending on entertainment and dining helps maintain a balanced financial plan for college life.

How can tracking spending bi-weekly help college students prevent overspending?

Tracking spending bi-weekly helps college students stay aware of their financial habits by providing regular insights into income and expenses. This method enables early identification of overspending patterns, allowing timely adjustments to stay within budget limits. Consistent monitoring promotes disciplined money management and supports long-term financial stability during college.

What methods can college students use to effectively manage variable expenses in a bi-weekly budget?

College students can track variable expenses using detailed expense categories and regularly update their bi-weekly budget to reflect actual spending. Utilizing mobile budgeting apps that sync with their bank accounts helps monitor real-time changes in expenses. Implementing the envelope system or setting spending limits for categories like dining and entertainment ensures better control over fluctuating costs.

How does setting savings goals impact the financial stability in a college student's bi-weekly budget?

Setting savings goals in a bi-weekly budget for college students fosters financial discipline by allocating specific amounts toward future needs or emergencies. This practice reduces reliance on credit and helps build an emergency fund, enhancing overall financial stability. Consistent savings contribute to managing expenses effectively and preventing debt accumulation during college years.