The Bi-weekly Excel Template for Hourly Employees simplifies tracking work hours and calculating pay accurately every two weeks. It helps ensure compliance with labor laws by recording overtime and break times efficiently. Using this template improves payroll accuracy and saves time for HR departments managing hourly staff.

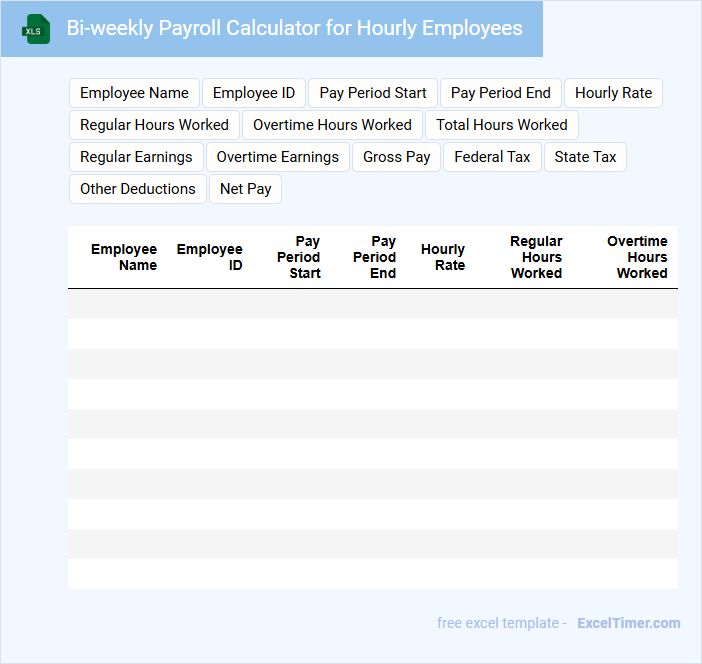

Bi-weekly Payroll Calculator for Hourly Employees

A bi-weekly payroll calculator for hourly employees is a tool designed to accurately compute wages based on hours worked over a two-week period. It typically includes inputs for regular hours, overtime, and applicable tax deductions.

This document usually contains fields for employee details, hourly rates, total hours, and deductions like taxes and benefits. Ensuring compliance with local labor laws and tax regulations is an important consideration for accurate payroll processing.

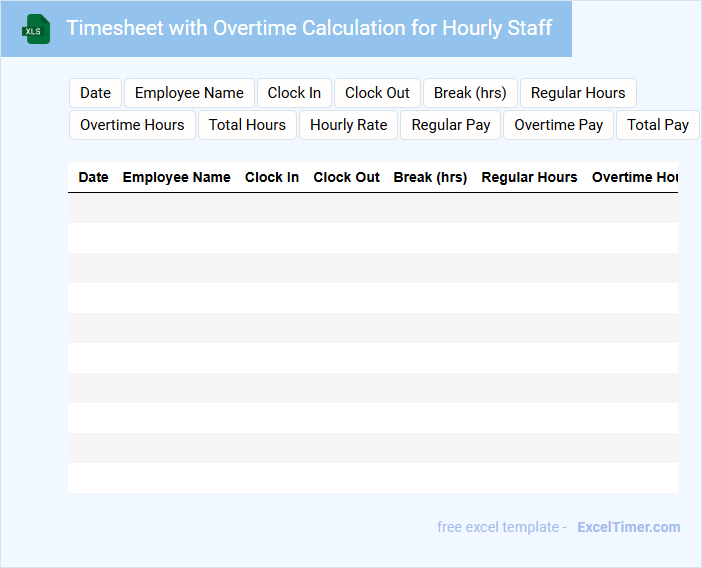

Timesheet with Overtime Calculation for Hourly Staff

What information is typically included in a Timesheet with Overtime Calculation for Hourly Staff? This document usually contains details such as employee hours worked each day, regular hours, and overtime hours calculated based on company policy or labor laws. It helps ensure accurate payroll processing and compliance with labor regulations.

What is an important consideration when using this type of timesheet? Ensuring clear definitions of regular and overtime hours, accurate time tracking methods, and alignment with legal overtime requirements are crucial for fair compensation and audit purposes.

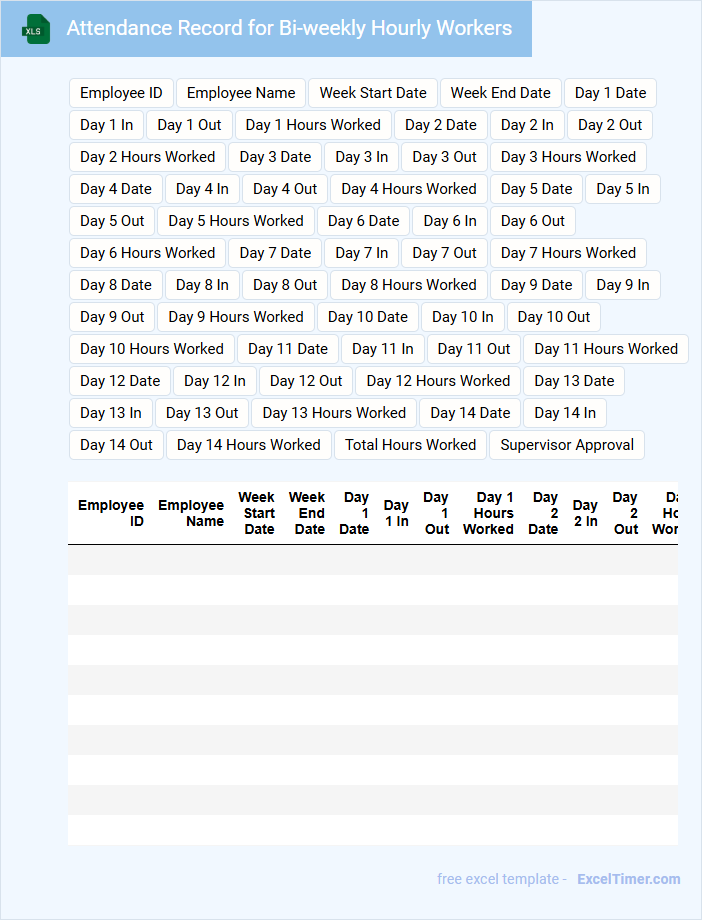

Attendance Record for Bi-weekly Hourly Workers

Attendance Record for Bi-weekly Hourly Workers typically contains detailed logs of hours worked, dates, and attendance status to ensure accurate payroll processing and labor compliance.

- Accurate Time Tracking: Record start and end times for every workday to prevent payroll discrepancies.

- Regular Updates: Maintain the record bi-weekly to ensure timely review and correction of attendance issues.

- Clear Attendance Codes: Use standardized codes for absences, tardiness, and overtime to streamline reporting and analysis.

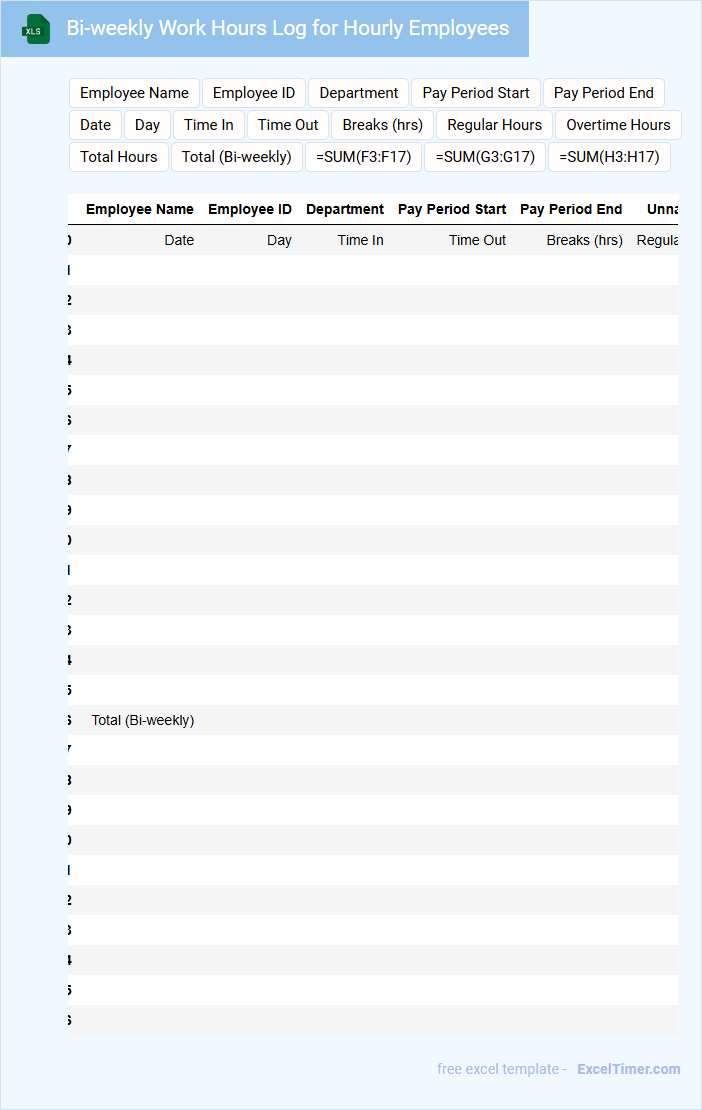

Bi-weekly Work Hours Log for Hourly Employees

What information is typically included in a Bi-weekly Work Hours Log for Hourly Employees? This document usually contains detailed records of hours worked by employees over a two-week period, including start and end times for each shift. It also tracks breaks, total hours worked daily and bi-weekly, and any overtime to ensure accurate payroll and labor compliance.

What are important considerations when maintaining a Bi-weekly Work Hours Log? Accuracy and consistency are crucial to avoid payroll disputes and ensure legal compliance. It is also important to include employee identification, approval signatures, and clearly define break periods and overtime rules.

Wage Tracking Spreadsheet for Hourly Employee Payroll

What information is typically included in a wage tracking spreadsheet for hourly employee payroll? This document usually contains detailed entries of hours worked, hourly rates, and calculated wages for each employee. It helps employers accurately monitor payroll expenses and ensures timely, precise payment of wages.

What is an important feature to include in such a spreadsheet? Including automated formulas for calculating total hours, overtime, and deductions improves accuracy and efficiency. Additionally, clear date and employee identification fields help maintain organized and easily accessible records.

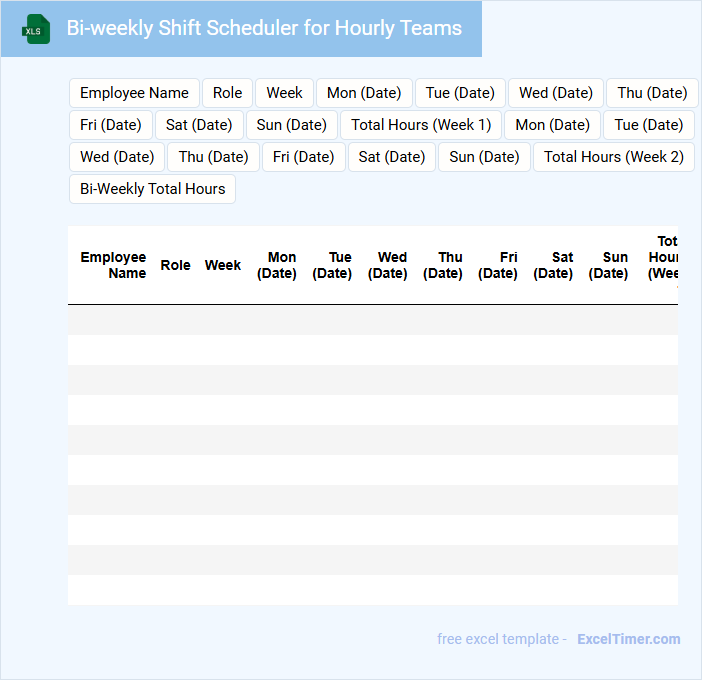

Bi-weekly Shift Scheduler for Hourly Teams

A Bi-weekly Shift Scheduler for hourly teams typically outlines work shifts over a two-week period, ensuring clear communication of assigned hours. It contains the names of team members, specific shift times, and any important notes or exceptions. The document helps manage workforce availability and maintain operational efficiency.

An important suggestion is to include a clear legend or color code for different shift types and ensure that all changes are promptly updated. Additionally, incorporating flexibility for shift swaps and time-off requests can greatly improve team morale and productivity. Regular review and feedback from employees can enhance scheduling accuracy and satisfaction.

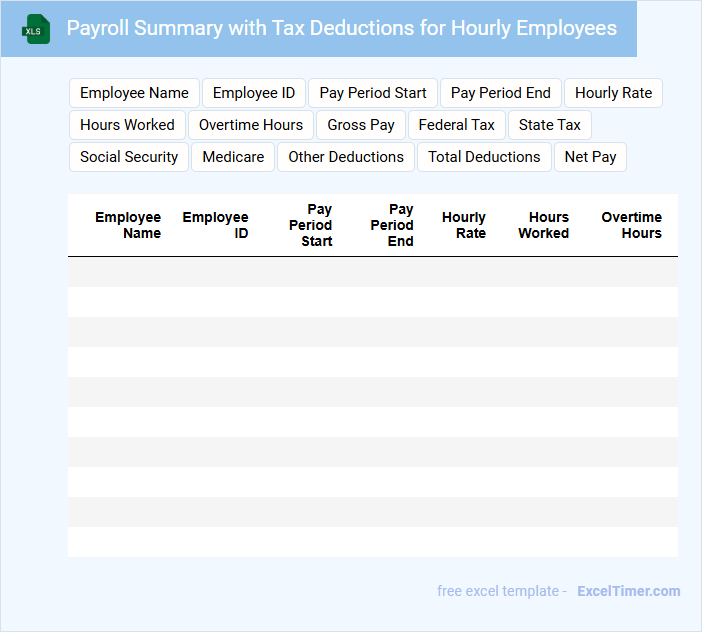

Payroll Summary with Tax Deductions for Hourly Employees

A Payroll Summary with Tax Deductions for Hourly Employees typically contains detailed information on total hours worked, gross pay, and the various taxes withheld, such as federal, state, and Social Security. It provides a clear overview of employee earnings and the deductions applied during the pay period.

Accurate tax deduction reporting is crucial to ensure compliance with government regulations and to prevent payroll errors. Regularly updating tax rates and verifying hours worked are important steps to maintain payroll accuracy.

Timesheet and Payment Record for Hourly Workers

The Timesheet is a document that tracks the hours worked by hourly employees. It helps in accurately calculating wages based on time spent on tasks or shifts.

The Payment Record details all payments made to an employee, ensuring transparency and proper financial tracking. Maintaining accurate records helps in resolving discrepancies and complying with labor laws.

For hourly workers, it is important to regularly update and verify timesheets and payment records to ensure correct compensation and legal compliance.

Bi-weekly Employee Hours Tracker for Payroll Processing

Bi-weekly Employee Hours Trackers for Payroll Processing typically contain detailed records of employees' working hours over a two-week period to ensure accurate payroll calculation.

- Accurate time entries: Ensure all clock-in and clock-out times are precisely recorded to avoid payroll errors.

- Overtime tracking: Clearly document any overtime hours worked to comply with labor regulations and fair pay.

- Employee identification: Include names and ID numbers to correctly associate hours with the right employee.

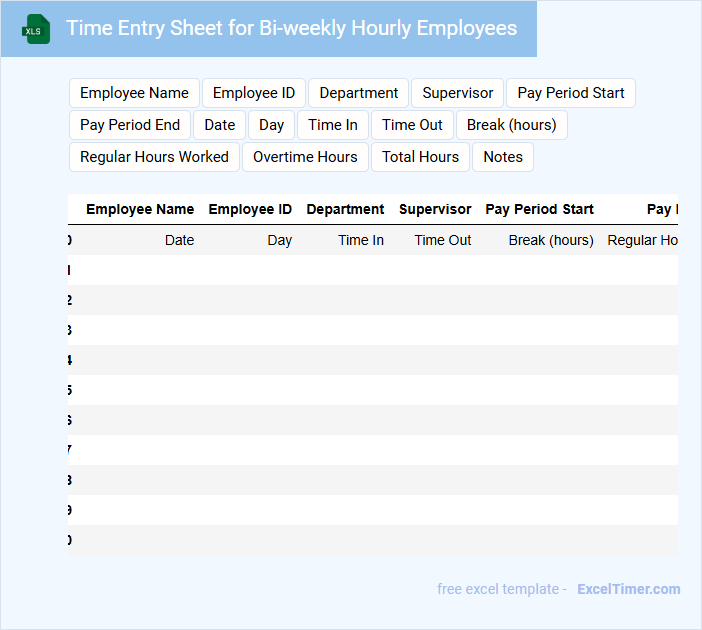

Time Entry Sheet for Bi-weekly Hourly Employees

Time Entry Sheets for Bi-weekly Hourly Employees typically contain detailed records of hours worked over a two-week period. These documents are essential for accurate payroll processing and attendance tracking.

- Include start and end times for each workday to ensure precise hour calculation.

- Specify overtime hours separately to comply with labor regulations.

- Require employee and supervisor signatures for authorization and verification.

Bi-weekly Pay Period Worksheet for Hourly Staff

The Bi-weekly Pay Period Worksheet for hourly staff is typically used to track the total hours worked by employees within a two-week span. It contains fields for recording regular hours, overtime, and any leave taken. This document helps ensure accurate payroll calculation and compliance with labor regulations.

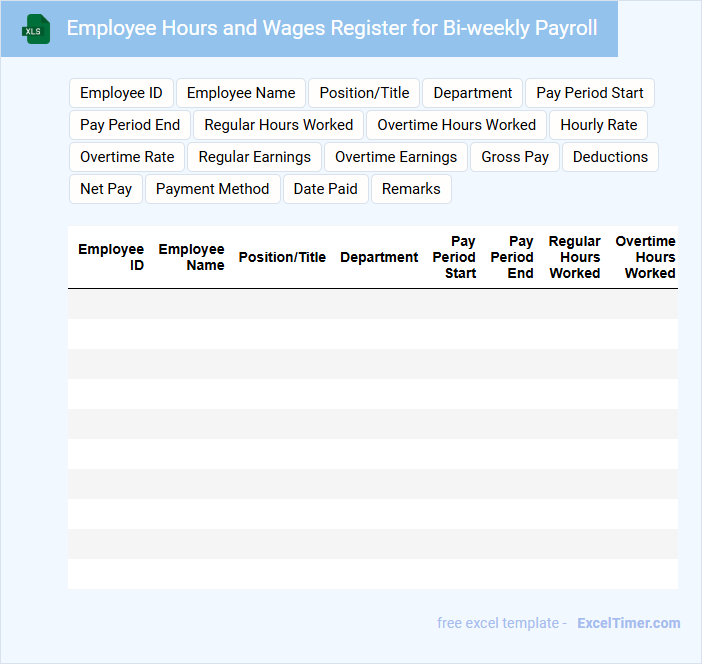

Employee Hours and Wages Register for Bi-weekly Payroll

The Employee Hours and Wages Register for bi-weekly payroll is a crucial document that records the number of hours worked by each employee within a two-week period. This register typically contains detailed information such as employee names, dates, hours worked per day, overtime, and wages earned. Maintaining accuracy in this register is vital for ensuring correct payroll processing and compliance with labor laws.

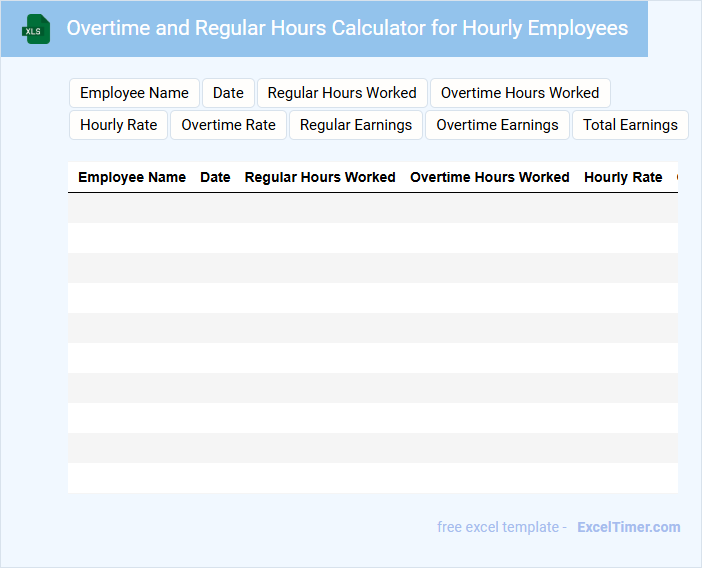

Overtime and Regular Hours Calculator for Hourly Employees

An Overtime and Regular Hours Calculator is a crucial document designed to help hourly employees and employers track and calculate work hours accurately. It typically contains fields for recording daily hours worked, differentiating between regular and overtime hours, and applying appropriate pay rates. Ensuring accurate hour tracking helps prevent payroll errors and maintains compliance with labor laws.

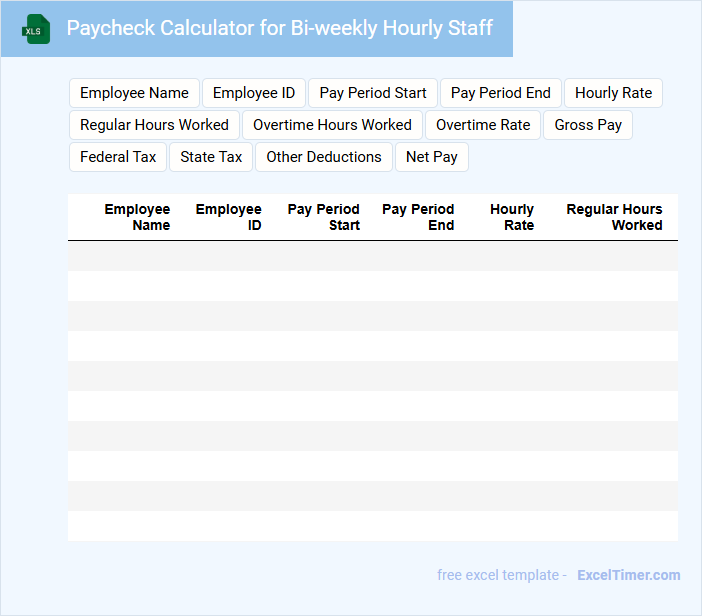

Paycheck Calculator for Bi-weekly Hourly Staff

What information is typically contained in a paycheck calculator for bi-weekly hourly staff? Such a document usually includes employee hours worked, hourly wage rates, tax deductions, and any additional withholdings or benefits. It calculates the net pay by subtracting taxes and deductions from the gross earnings based on bi-weekly periods.

What important factors should be considered when using a paycheck calculator for bi-weekly hourly staff? It is crucial to ensure accurate hourly inputs, correct tax rates, and applicable deductions to avoid errors in payment. Additionally, understanding overtime rules and benefits contributions helps in providing precise paycheck calculations.

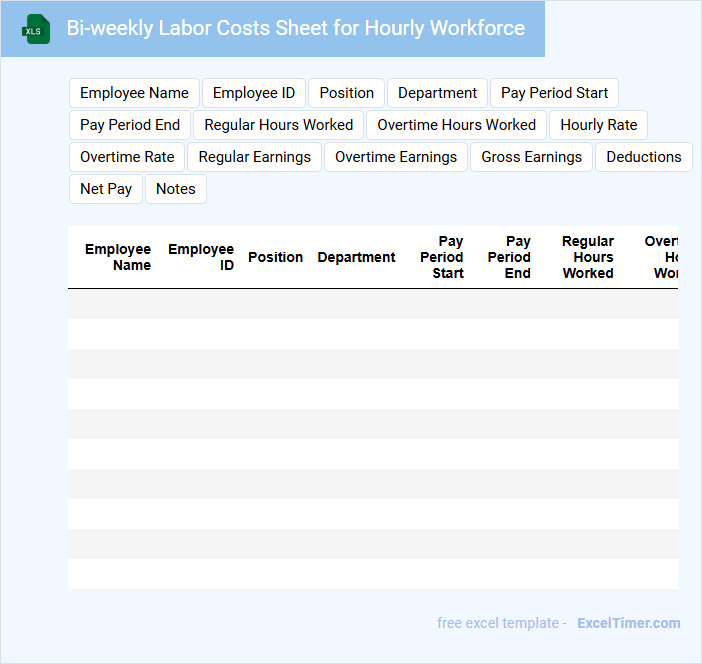

Bi-weekly Labor Costs Sheet for Hourly Workforce

The Bi-weekly Labor Costs Sheet for an hourly workforce typically contains detailed records of hours worked, wage rates, and total labor expenses incurred within a two-week period. It serves as an essential financial document used to track payroll accuracy and labor budgeting.

Key information usually includes employee names, hours logged each day, overtime calculations, and deductions. Maintaining this sheet helps ensure compliance with labor laws and supports efficient labor cost management.

What does "bi-weekly pay" mean for hourly employees in an Excel payroll document?

Bi-weekly pay for hourly employees in an Excel payroll document indicates that employees receive their wages every two weeks, resulting in 26 pay periods per year. The Excel sheet calculates total hours worked within each 14-day cycle and applies the hourly rate accordingly. This schedule helps track consistent and accurate payment intervals for hourly wage tracking and payroll processing.

How do you accurately calculate total bi-weekly hours worked for each employee using Excel formulas?

To accurately calculate total bi-weekly hours worked for each hourly employee in Excel, use the SUM function to add daily hours across the 14-day period. You can enter a formula like =SUM(B2:O2) where B2:O2 represents the range of daily hours for the two-week span. This approach ensures Your bi-weekly total reflects all recorded working hours precisely.

Which Excel functions are essential to compute gross bi-weekly wages for hourly employees?

To compute gross bi-weekly wages for hourly employees, essential Excel functions include SUMPRODUCT for calculating total hours multiplied by hourly rates, IF for handling overtime conditions, and ROUND for ensuring precise payroll values. You can use these functions to accurately aggregate regular and overtime hours, ensuring your payroll calculations are efficient and error-free. Incorporating these formulas allows seamless tracking of bi-weekly earnings directly within your Excel document.

How can overtime hours and rates be tracked and calculated in a bi-weekly timesheet?

Your bi-weekly timesheet for hourly employees can track overtime hours by recording total hours worked each pay period and flagging any hours exceeding 80 hours as overtime. Overtime rates, typically 1.5 times the regular hourly wage, should be applied automatically to those excess hours for accurate payroll calculation. This ensures precise tracking and compensation according to labor laws and company policies.

What is the best way to ensure correct date ranges for each bi-weekly pay period in your Excel document?

Ensure correct date ranges for each bi-weekly pay period in your Excel document by using formulas that automatically calculate start and end dates based on a fixed reference date. Incorporate the DATE and WEEKDAY functions to generate accurate, consistent two-week segments. This method reduces errors and maintains precise payroll scheduling for hourly employees.