The Bi-weekly Budget Excel Template for Household Management helps users track income and expenses every two weeks, ensuring better financial control. It simplifies expense categorization and provides clear summaries to avoid overspending. Regular use promotes consistent savings and budget adherence for effective household money management.

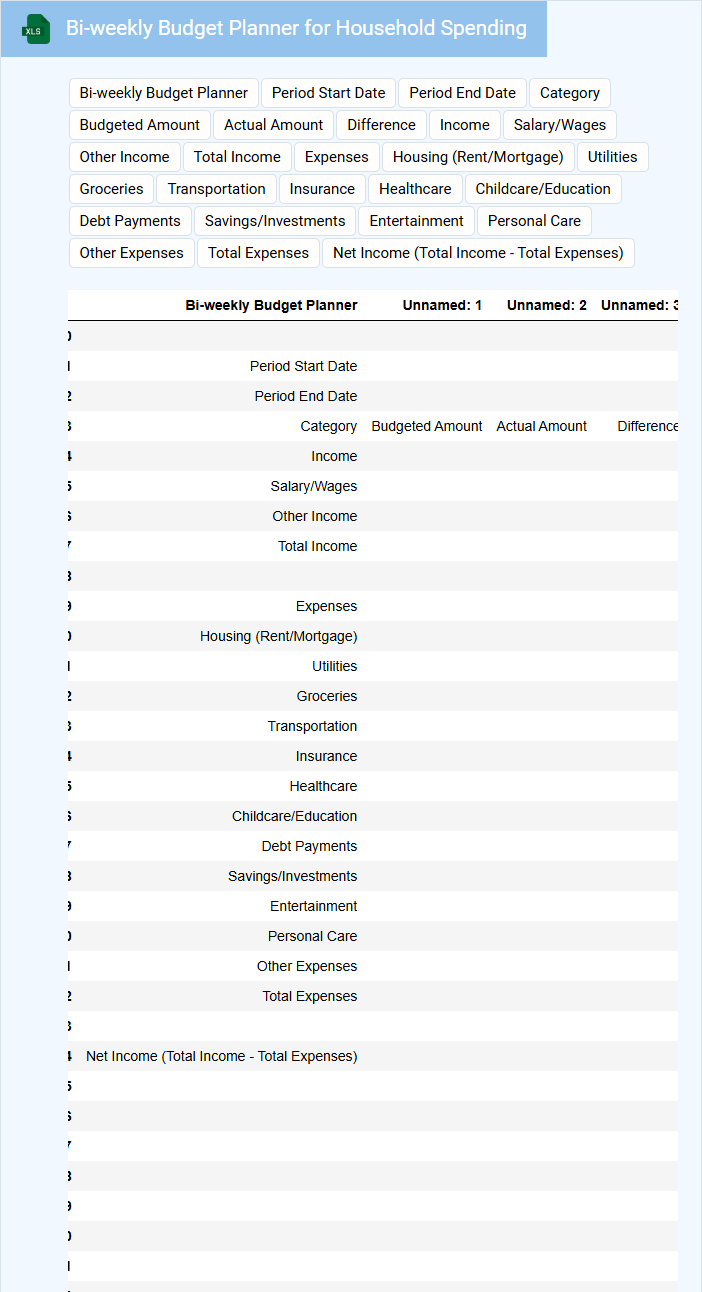

Bi-weekly Budget Planner for Household Spending

The Bi-weekly Budget Planner is a document designed to track household income and expenses every two weeks. It helps in managing spending, ensuring bills are paid on time, and identifying saving opportunities.

Typically, it contains income sources, fixed and variable expenses, and a summary of the remaining balance. For best results, consistently updating and reviewing the planner is important to maintain financial control.

Bi-weekly Expense Tracker for Family Finances

A Bi-weekly Expense Tracker for Family Finances typically contains detailed records of all household expenses incurred every two weeks, categorized by type such as groceries, utilities, and entertainment. This document helps families monitor their spending habits and identify areas where they can save money. Maintaining accurate and up-to-date entries is essential for effective financial management.

It also includes a summary of total income versus total expenses to provide a clear overview of the family's budget status for the period. Tracking recurring payments and unexpected costs is important to avoid overspending and ensure financial stability. Setting budget goals and reviewing the tracker regularly can enhance financial discipline and planning.

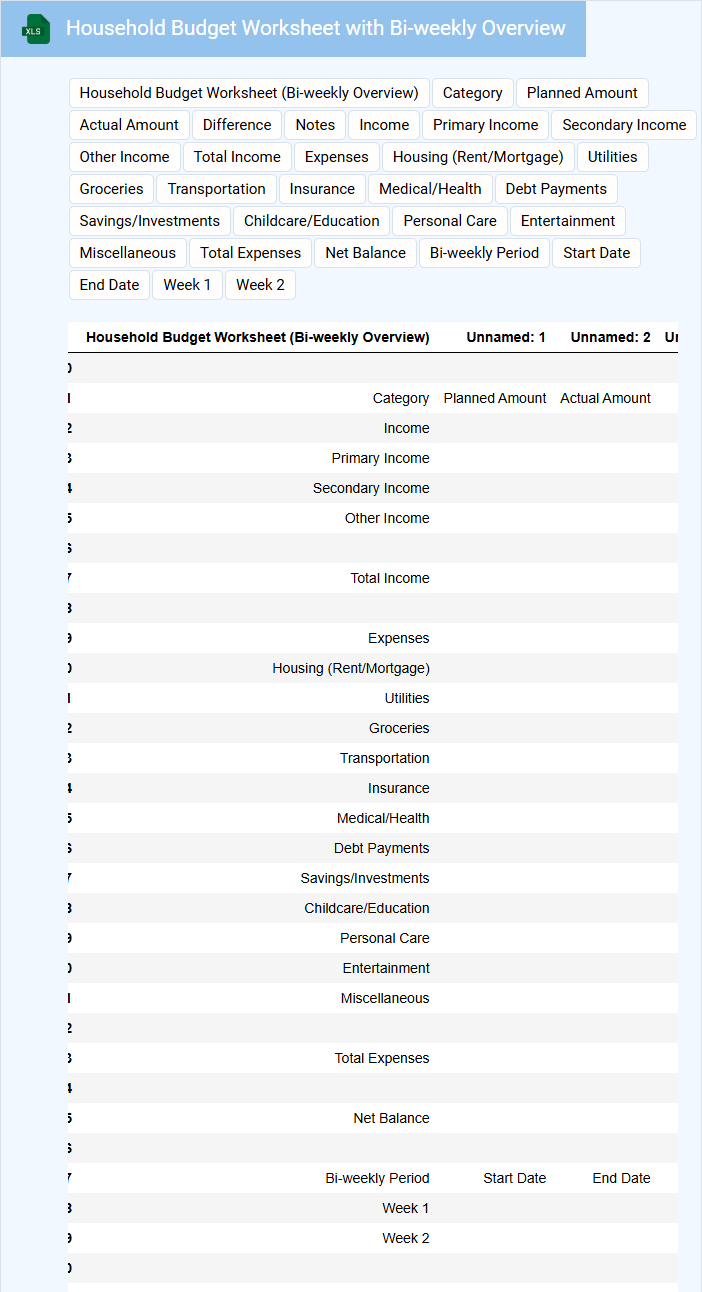

Household Budget Worksheet with Bi-weekly Overview

A Household Budget Worksheet with Bi-weekly Overview is a financial document designed to help individuals or families track income and expenses every two weeks for better money management.

- Income Tracking: Record all sources of income received on a bi-weekly basis to understand cash flow clearly.

- Expense Categorization: List and categorize expenses to identify spending patterns and areas to cut costs.

- Savings Goals: Set and monitor savings targets to ensure financial stability and future planning.

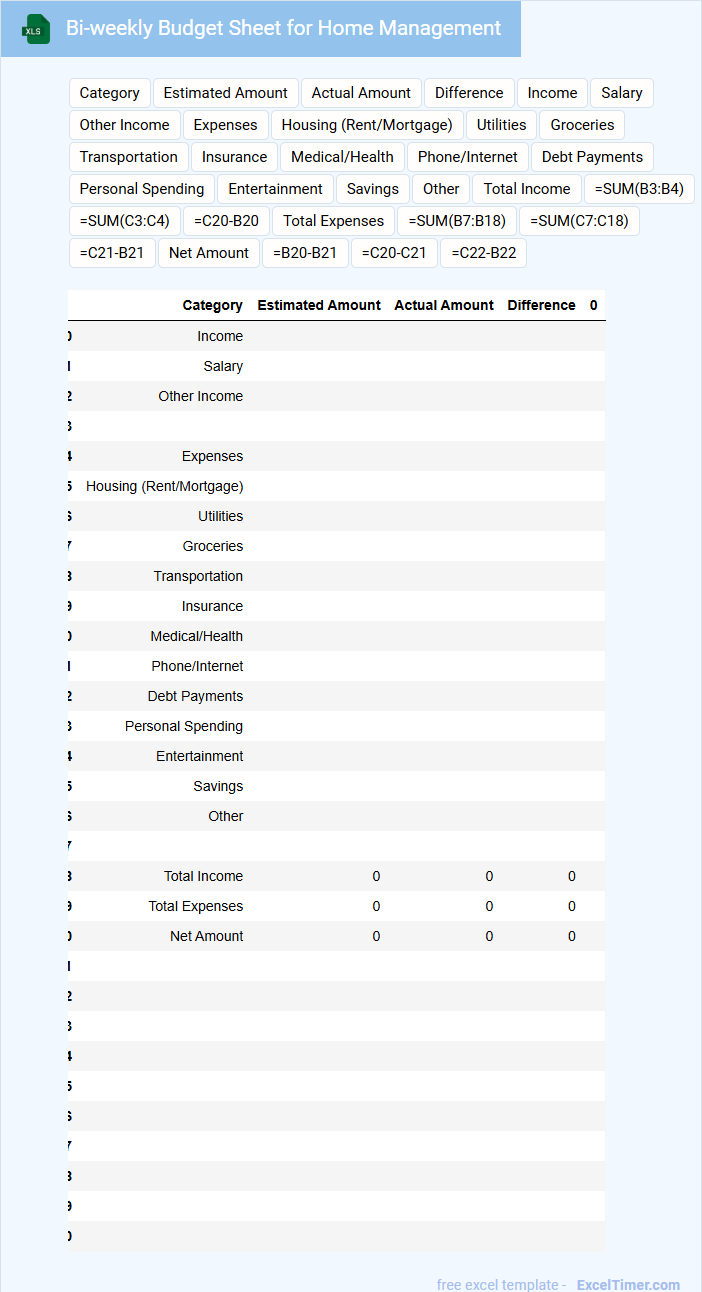

Bi-weekly Budget Sheet for Home Management

A Bi-weekly Budget Sheet for home management typically contains detailed records of income and expenses tracked every two weeks. It helps in monitoring spending patterns and ensuring financial stability within the household. Important elements include categorized expenses, savings goals, and unexpected costs to maintain balanced finances.

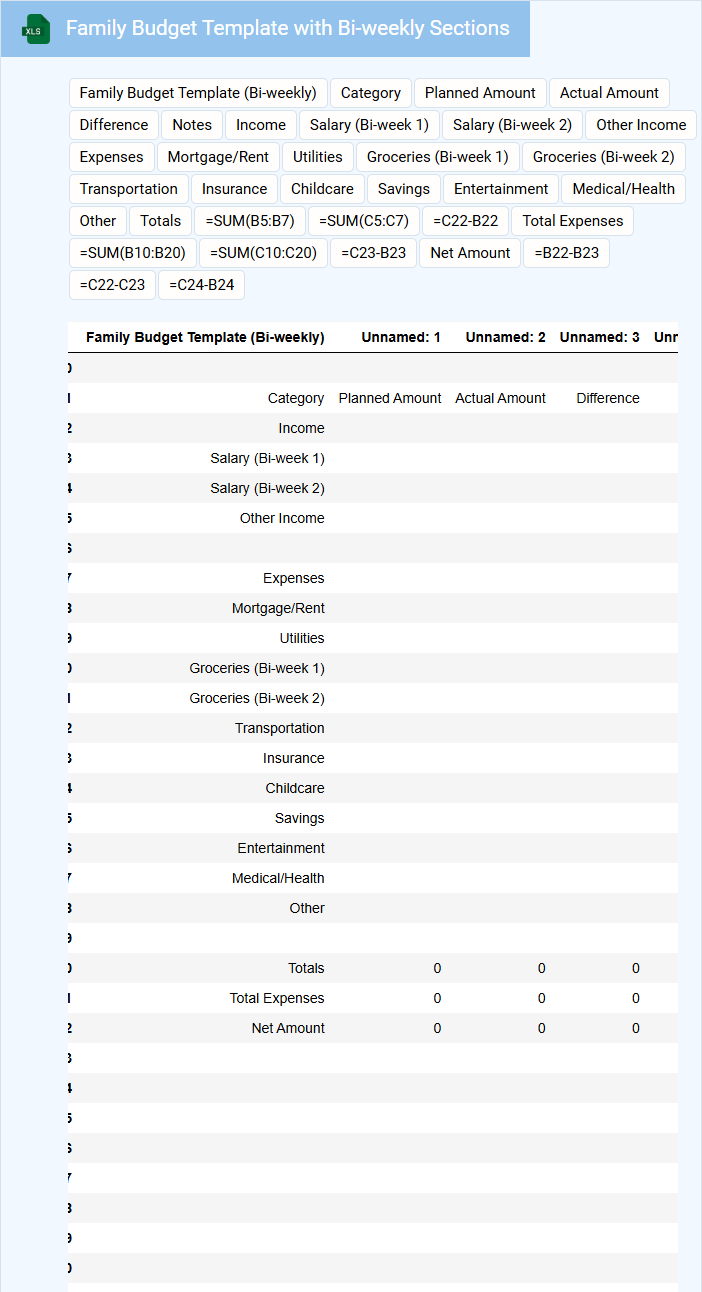

Family Budget Template with Bi-weekly Sections

What information does a Family Budget Template with Bi-weekly Sections usually contain? This type of document typically includes income sources, categorized expenses, and savings goals divided into bi-weekly periods. It helps families plan and track their finances more accurately by aligning with their pay cycle.

What is an important suggestion for using a Family Budget Template with Bi-weekly Sections? Consistently updating the template with actual expenses and income every two weeks ensures better control over spending and prevents budget shortfalls. Additionally, setting aside funds for unexpected costs in each bi-weekly section promotes financial stability.

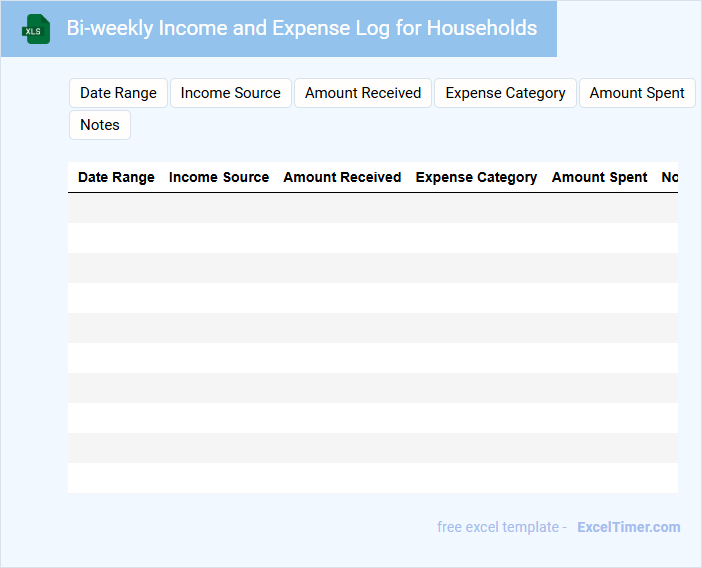

Bi-weekly Income and Expense Log for Households

What information is typically included in a Bi-weekly Income and Expense Log for Households? This document usually contains detailed records of all income sources and expenses incurred over a two-week period. It helps households track their financial activities, manage budgets, and identify spending patterns effectively.

Why is it important to maintain this log accurately? Keeping precise and consistent entries ensures better financial planning, avoids overspending, and supports savings goals. Regular updates and categorization of expenses improve clarity and facilitate informed decision-making.

Home Management Budget Tracker with Bi-weekly Format

A Home Management Budget Tracker with a bi-weekly format is designed to help individuals or families monitor their income and expenses every two weeks, ensuring consistent and manageable financial planning. This type of document typically contains categories for income sources, fixed and variable expenses, savings goals, and debt payments. An important suggestion for effective use is to regularly update the tracker to reflect actual spending and avoid overspending between pay periods.

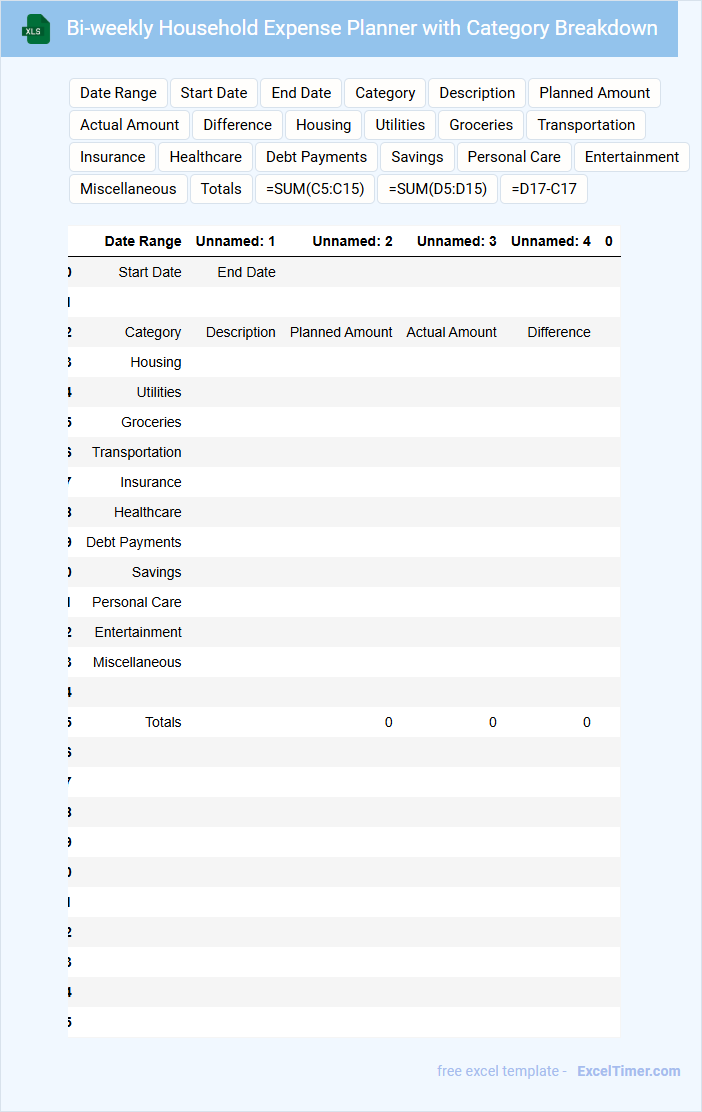

Bi-weekly Household Expense Planner with Category Breakdown

A Bi-weekly Household Expense Planner with Category Breakdown is a document designed to help individuals or families track and manage their expenses every two weeks by organizing spending into distinct categories.

- Expense Tracking: It records all income and expenditures within a bi-weekly period for accurate budgeting.

- Category Breakdown: Expenses are divided into categories such as groceries, utilities, and entertainment for detailed analysis.

- Financial Planning: It helps identify spending patterns and areas to save money to maintain household financial health.

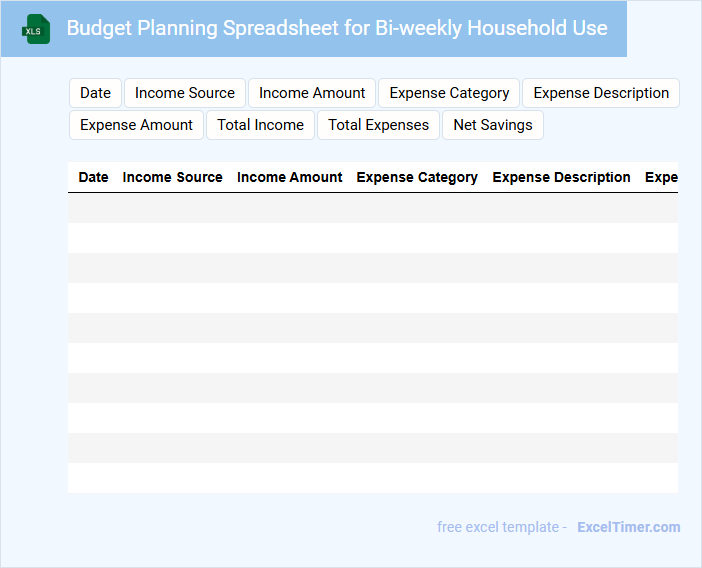

Budget Planning Spreadsheet for Bi-weekly Household Use

What information is typically included in a Budget Planning Spreadsheet for Bi-weekly Household Use? This document usually contains detailed entries of income sources, recurring expenses, and occasional costs, all organized by bi-weekly periods, allowing for precise tracking and planning of household finances. It helps users manage cash flow effectively and adjust spending habits to meet financial goals within each bi-weekly cycle.

What is an important consideration when creating this type of spreadsheet? It is essential to categorize expenses clearly and include automatic calculations for savings and debt repayments. This ensures the spreadsheet remains user-friendly and provides accurate real-time insights for better financial decision-making.

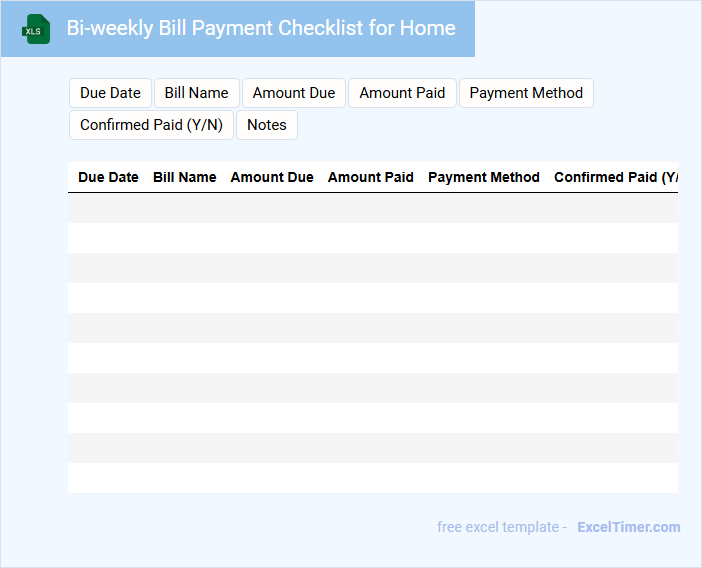

Bi-weekly Bill Payment Checklist for Home

A Bi-weekly Bill Payment Checklist for home is a practical document that helps individuals organize and track their recurring household expenses every two weeks. It typically contains a list of bills, amounts due, due dates, and payment methods to ensure timely payments and avoid late fees. An important suggestion is to regularly update the checklist to account for any new bills or changes in amounts to maintain financial accuracy and control.

Personal Budget Template with Bi-weekly Tracking

What information is typically included in a Personal Budget Template with Bi-weekly Tracking? This type of document usually contains sections for income sources, fixed and variable expenses, and savings goals, all organized on a bi-weekly basis to match pay periods. It helps users monitor their cash flow more accurately and make adjustments as needed to stay within their budget.

What important tips should be considered when using this template? It is crucial to record all income and expenses consistently every two weeks to maintain accurate tracking. Additionally, regularly reviewing and updating the budget can help identify spending patterns and ensure financial goals are met.

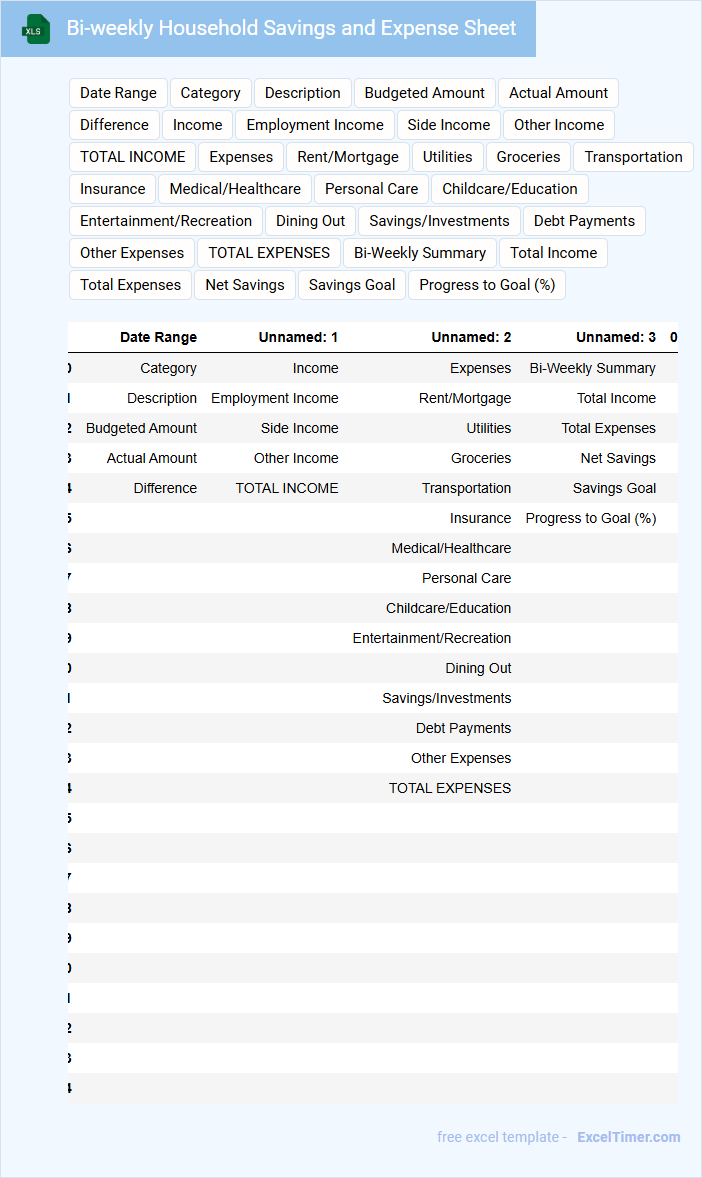

Bi-weekly Household Savings and Expense Sheet

This document typically contains records of income, expenses, and savings tracked over two weeks to help households manage their finances effectively. It offers a structured overview for budgeting and identifying spending patterns.

- Include all sources of income and categorize expenses clearly.

- Regularly update the sheet to maintain accuracy and track progress.

- Highlight savings goals to encourage consistent contributions.

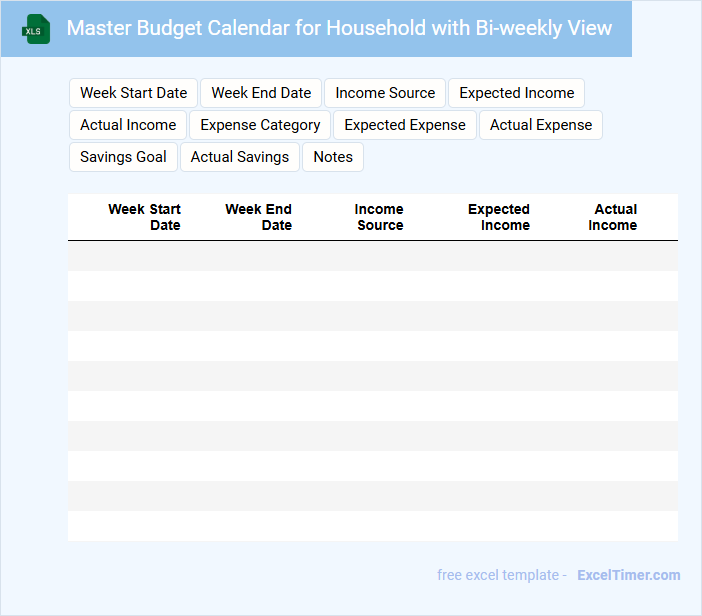

Master Budget Calendar for Household with Bi-weekly View

What does a Master Budget Calendar for Household with Bi-weekly View usually contain and why is it important? This type of document typically includes a detailed schedule of all expected household incomes, expenses, bill due dates, and savings goals organized in two-week intervals. It helps families manage their finances more effectively by providing clear visibility into their cash flow patterns and ensuring timely payments and savings contributions.

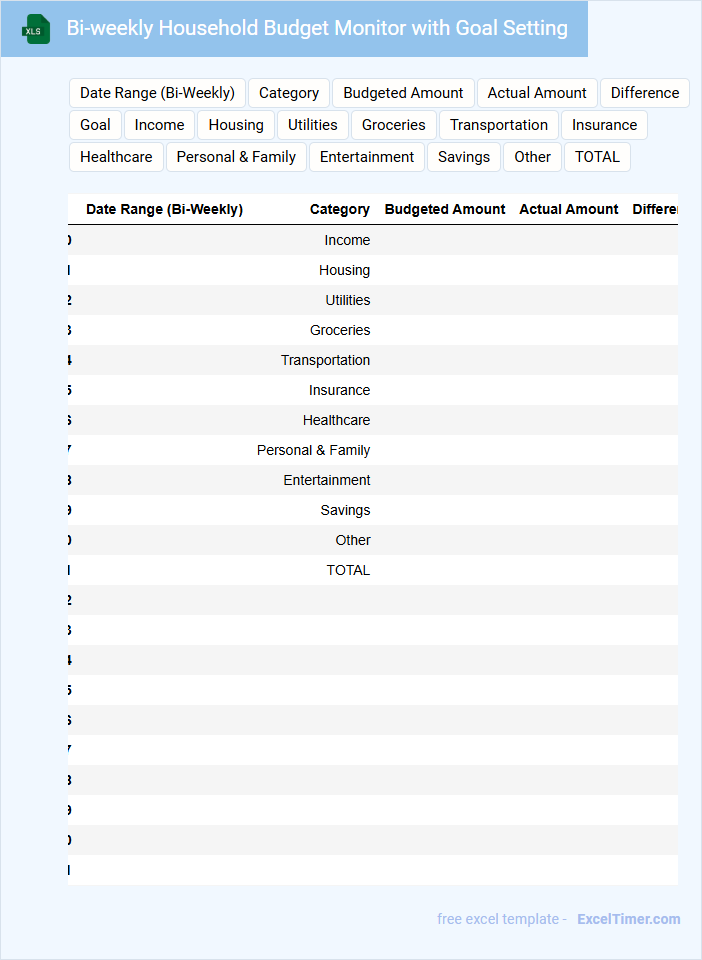

Bi-weekly Household Budget Monitor with Goal Setting

A Bi-weekly Household Budget Monitor typically contains detailed records of income and expenses tracked every two weeks to maintain financial awareness. It helps families manage cash flow by categorizing spending and identifying saving opportunities. For effective goal setting, including clear, measurable financial targets is essential. This document usually features sections like expense categories, incoming funds, and notes on discretionary spending to highlight trends. Tracking progress towards set goals bi-weekly encourages accountability and timely adjustments. Prioritizing emergency fund contributions and debt repayment goals can improve long-term financial stability.

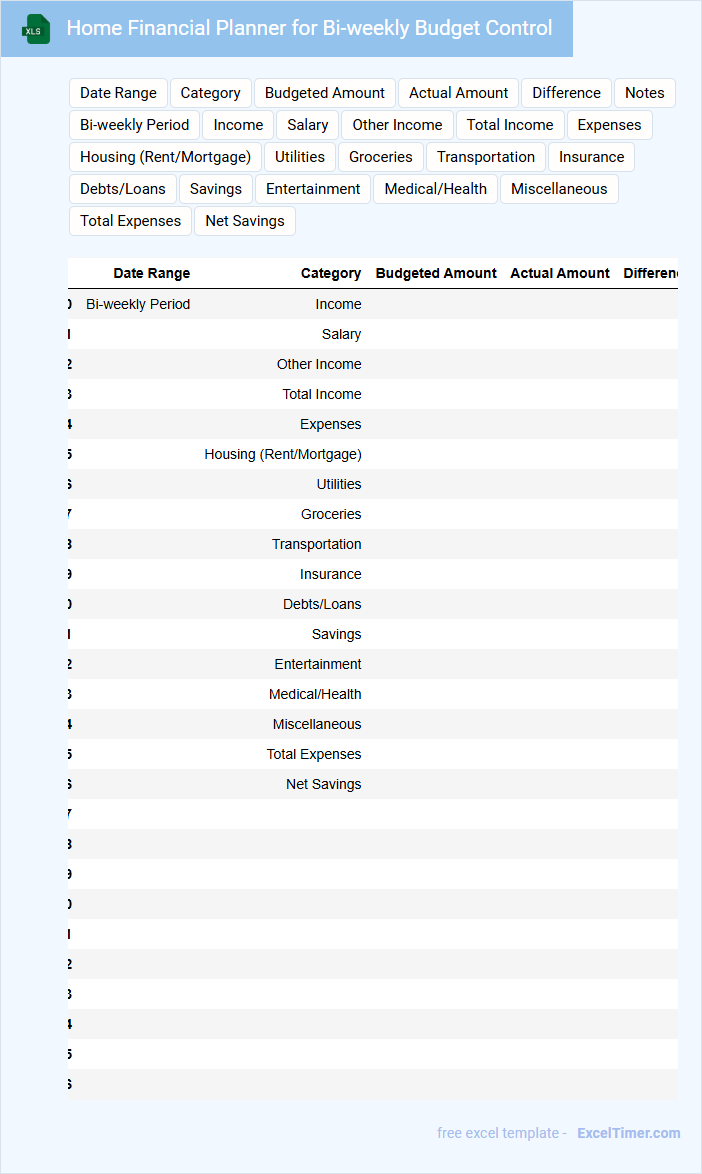

Home Financial Planner for Bi-weekly Budget Control

What does a Home Financial Planner for Bi-weekly Budget Control typically contain? This document usually includes detailed income tracking, expense categorization, and savings goals tailored for a bi-weekly pay schedule. It helps individuals manage their finances more effectively by breaking down budgets into manageable two-week periods, ensuring timely bill payments and optimized cash flow.

What important elements should be included in a Home Financial Planner for Bi-weekly Budget Control? It is essential to have clear sections for fixed and variable expenses, a calendar view aligning with pay periods, and a review area to track progress and adjust spending. Additionally, incorporating emergency fund targets and debt repayment plans enhances financial stability and long-term planning.

What key income and expense categories should be included in a bi-weekly household budget?

Your bi-weekly household budget should include key income categories such as salary, freelance earnings, and investment returns. Essential expense categories to track are housing costs, utilities, groceries, transportation, insurance, and discretionary spending. Accurate categorization helps ensure effective financial management and savings growth.

How can you track and update bi-weekly budget allocations effectively using Excel formulas?

Use Excel formulas like SUMIFS to track bi-weekly budget allocations by categorizing expenses within specific date ranges. Apply conditional formatting to highlight overspending in each category for timely budget adjustments. Create dynamic drop-down lists for expense categories and use the TODAY() function to automate current bi-weekly periods.

Which Excel features best help visualize spending patterns and budget variances bi-weekly?

Excel features like PivotTables and conditional formatting help visualize bi-weekly spending patterns and budget variances effectively. Charts, especially column and line graphs, provide clear insights into household expenses over each two-week period. Your use of slicers can enhance data interaction for better budget management.

What functions or tools in Excel can automate reminders for upcoming household bills?

Excel's built-in functions like TODAY() combined with conditional formatting can highlight upcoming household bills based on due dates. Using formulas such as IF and DATE to trigger reminders, you can set alerts within the spreadsheet. Integrating VBA macros enables automated pop-up notifications for bi-weekly budget bill reminders.

How can historical bi-weekly budget data be analyzed in Excel to improve future financial planning?

Historical bi-weekly budget data in Excel can be analyzed using pivot tables to track spending patterns and highlight category variances. Conditional formatting identifies overspending trends, while charts visualize cash flow fluctuations over time. Utilizing these insights enables more accurate forecasting and optimized household financial management.