The Bi-weekly Pay Slip Excel Template for Hourly Employees simplifies payroll management by accurately calculating wages based on hours worked. This template ensures easy tracking of overtime, deductions, and tax withholdings, enhancing transparency and efficiency. Customizable fields allow employers to tailor the pay slip to comply with specific company policies and labor regulations.

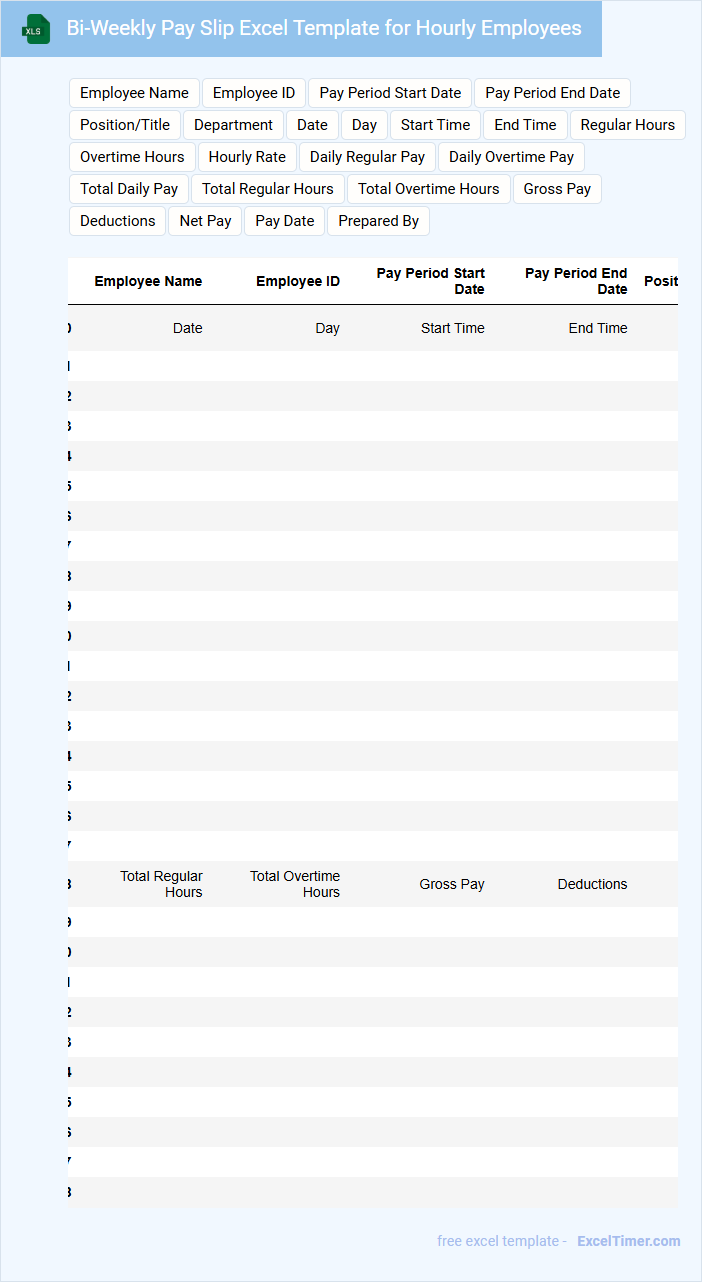

Bi-Weekly Pay Slip Excel Template for Hourly Employees

A Bi-Weekly Pay Slip Excel Template for hourly employees typically contains detailed information about hours worked, pay rates, and deductions for each pay period. It helps both employers and employees keep track of earnings and deductions efficiently. This document ensures transparency and accuracy in wage calculations. An important feature is the automatic calculation of gross pay, taxes, and net pay based on hourly input data. It often includes fields for employee details, pay period dates, and summary totals to simplify payroll processing. Using an easy-to-update template minimizes errors and saves time during payroll preparation.

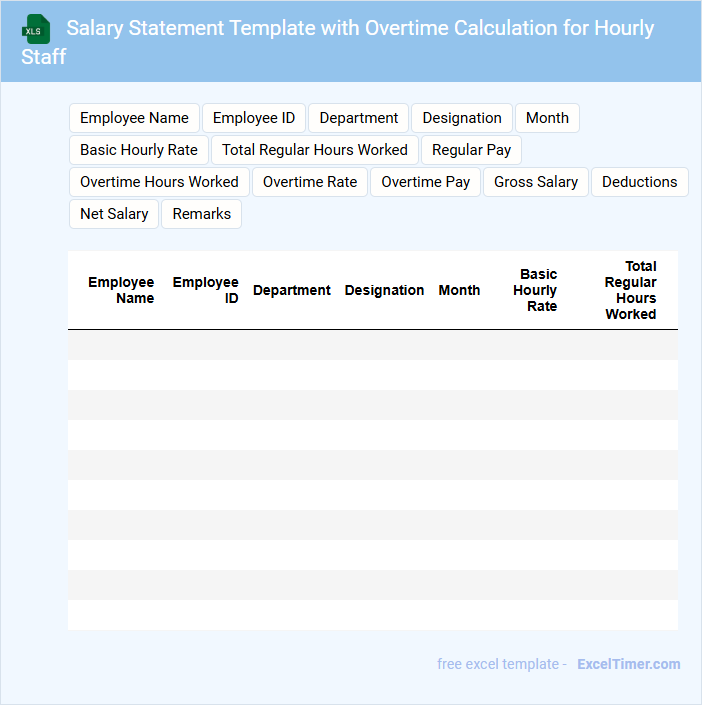

Salary Statement Template with Overtime Calculation for Hourly Staff

A Salary Statement Template with Overtime Calculation for Hourly Staff typically includes employee details, hours worked, regular pay, and overtime pay. It ensures transparent and accurate compensation by clearly outlining all payment components. An important suggestion is to include a detailed breakdown of overtime rates to avoid disputes.

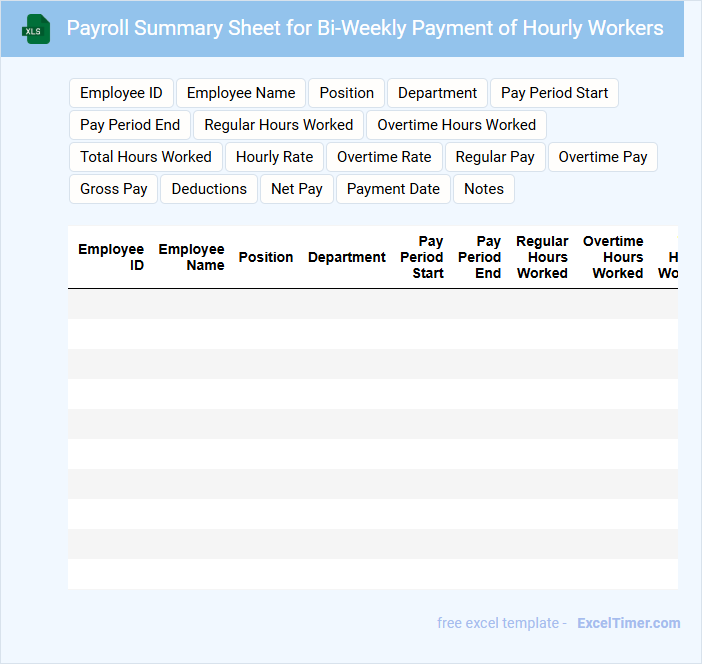

Payroll Summary Sheet for Bi-Weekly Payment of Hourly Workers

A Payroll Summary Sheet for bi-weekly payment of hourly workers typically contains detailed records of hours worked, wages earned, deductions, and net pay for each employee. It serves as a crucial document for ensuring accurate and timely compensation while maintaining compliance with labor laws. Important elements to include are employee identification, total hours, pay rate, gross pay, taxes withheld, and any additional deductions or bonuses.

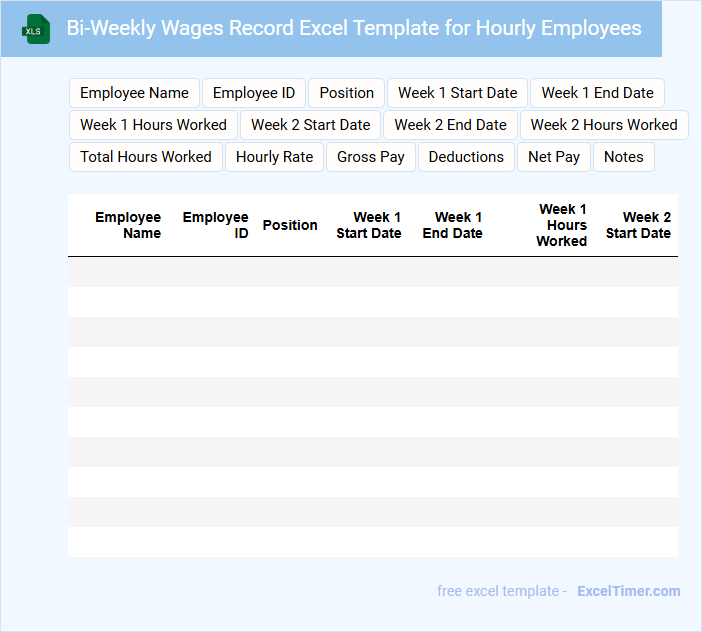

Bi-Weekly Wages Record Excel Template for Hourly Employees

This document typically records the wages and hours worked by hourly employees over a two-week period.

- Accurate Time Tracking: Ensure precise input of worked hours to avoid payroll errors.

- Overtime Calculation: Correctly identify and calculate overtime rates according to company policy.

- Clear Employee Details: Include full employee names and IDs for easy reference and audit.

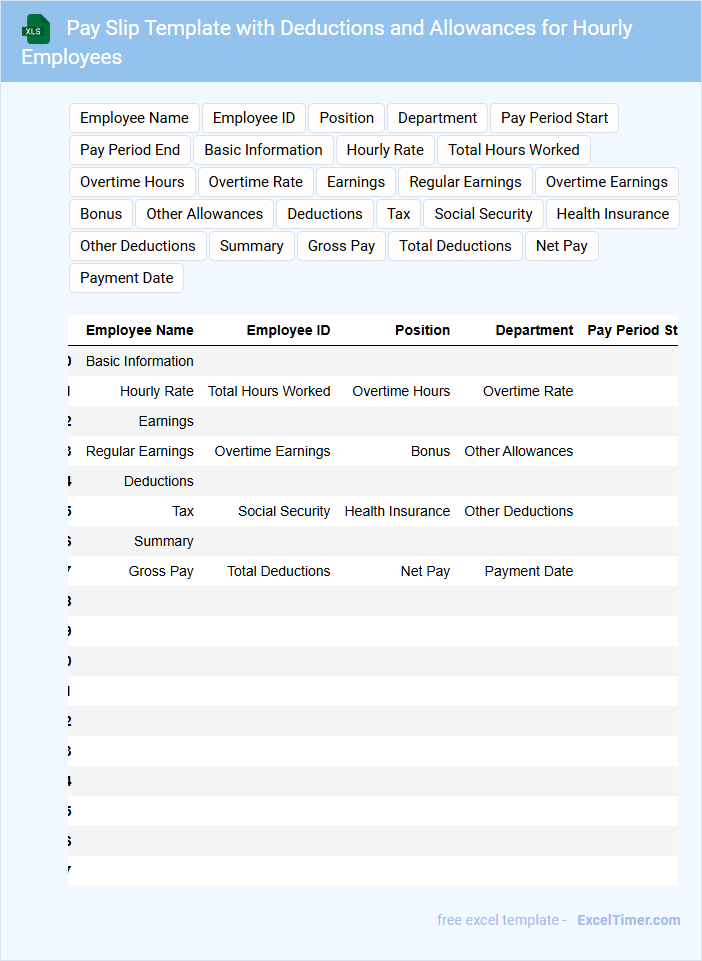

Pay Slip Template with Deductions and Allowances for Hourly Employees

A Pay Slip Template typically contains detailed information about an employee's earnings and deductions within a specific pay period. It includes gross wages, deductions such as taxes and benefits, and the net pay received by the employee.

For hourly employees, this document must clearly show the hours worked, along with any allowances and overtime payments. Ensuring accuracy in deductions and allowances helps maintain transparency and compliance with labor laws.

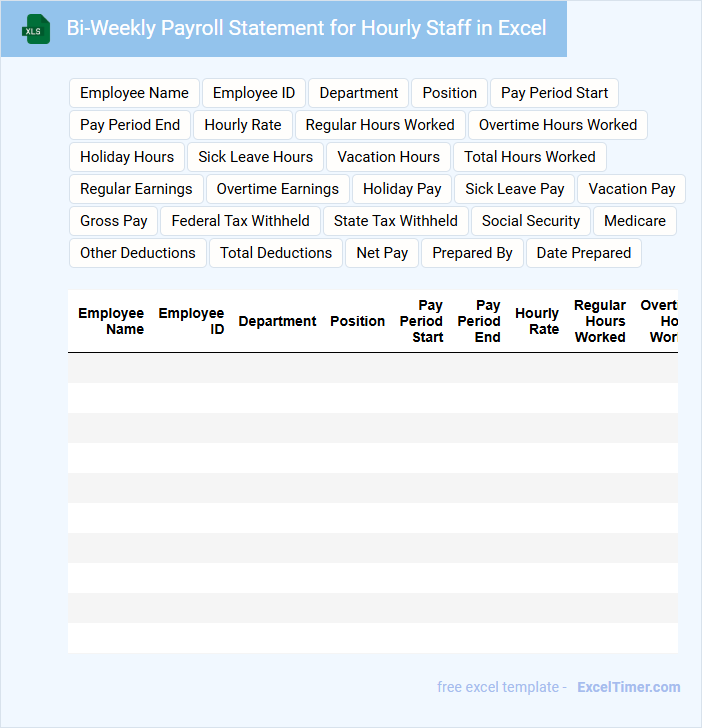

Bi-Weekly Payroll Statement for Hourly Staff in Excel

The Bi-Weekly Payroll Statement for hourly staff typically contains detailed records of hours worked, hourly rates, and gross earnings over a two-week period. It also includes deductions such as taxes, insurance, and retirement contributions, providing a clear summary for both employees and employers.

Such documents are essential for accurate payment processing and regulatory compliance. Ensure the statement is easy to read and includes all relevant deductions and benefits for transparency and verification.

Earnings Report for Bi-Weekly Pay of Hourly Team Members

Earnings reports for bi-weekly pay of hourly team members typically contain detailed records of hours worked, pay rates, deductions, and net earnings.

- Hours Worked: Accurately track and record total hours to ensure precise payment calculations.

- Deductions: Clearly itemize all deductions such as taxes and benefits for transparency.

- Net Earnings: Highlight the final amount paid after all adjustments to avoid discrepancies.

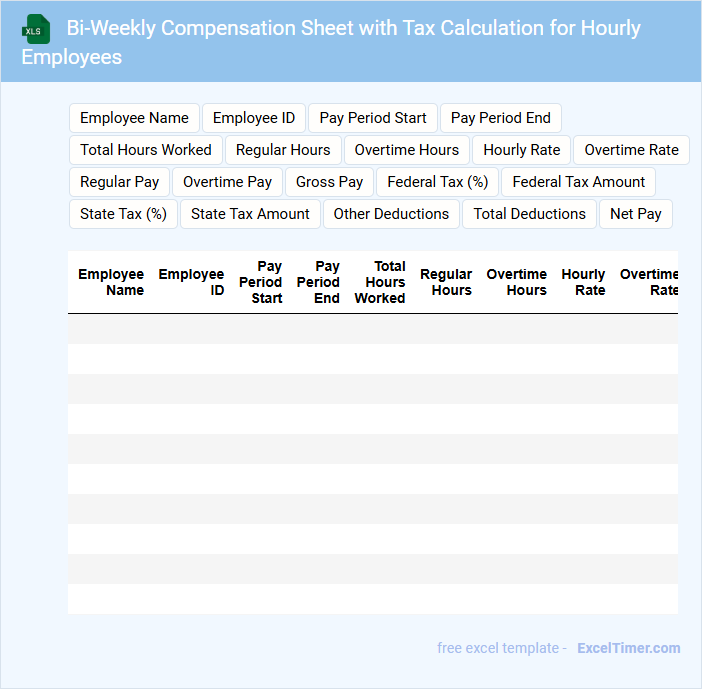

Bi-Weekly Compensation Sheet with Tax Calculation for Hourly Employees

A Bi-Weekly Compensation Sheet is a crucial document that details the earnings and deductions for hourly employees over a two-week period. It typically includes hours worked, pay rate, gross pay, taxes withheld, and net pay. Accurate tax calculation is essential for compliance and employee satisfaction.

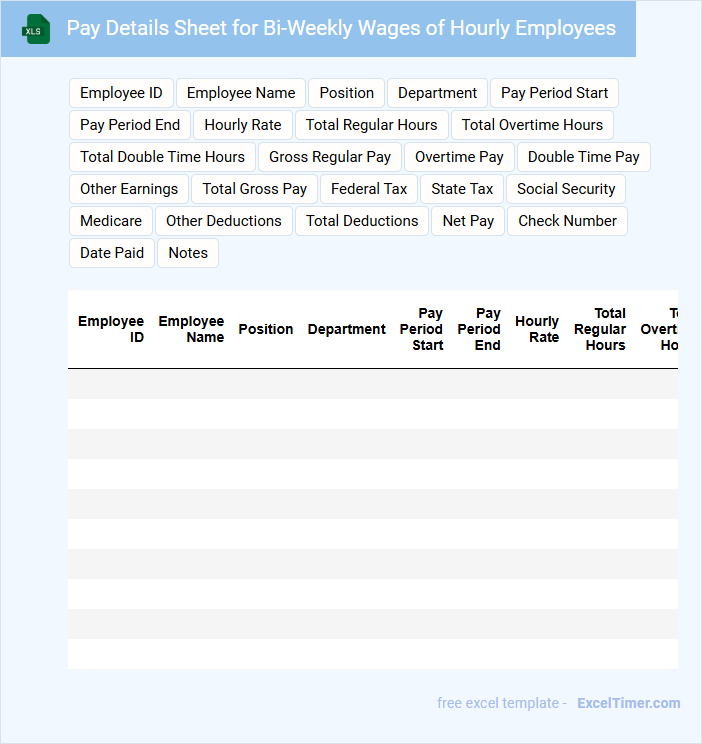

Pay Details Sheet for Bi-Weekly Wages of Hourly Employees

A Pay Details Sheet for Bi-Weekly Wages of Hourly Employees typically contains the breakdown of hours worked, pay rates, and total earnings for each pay period. It ensures transparency and accuracy in employee compensation tracking.

- Include total hours worked, including regular, overtime, and any leave taken.

- Clearly list the hourly wage rates and any applicable bonuses or deductions.

- Provide a summary of net pay after taxes and deductions for clarity.

Excel Pay Slip Template for Hourly Workers with Absence Tracking

What information is typically included in an Excel Pay Slip Template for Hourly Workers with Absence Tracking? This type of document usually contains details such as employee hours worked, hourly rates, total wages earned, and recorded absences like sick leaves or vacation days. It helps in accurately calculating pay while maintaining a transparent record of attendance and absences for both employers and employees.

Bi-Weekly Paysheet with Shift and Hourly Rate Tracking for Hourly Employees

A Bi-Weekly Paysheet with Shift and Hourly Rate Tracking for Hourly Employees typically contains detailed records of hours worked, shifts attended, and corresponding pay rates over a two-week period. It ensures accurate calculation of wages and compliance with labor regulations.

- Include clear identification of employee and pay period dates.

- Track hours worked per shift along with the respective hourly rates.

- Provide a summary of total hours and earnings for ease of review.

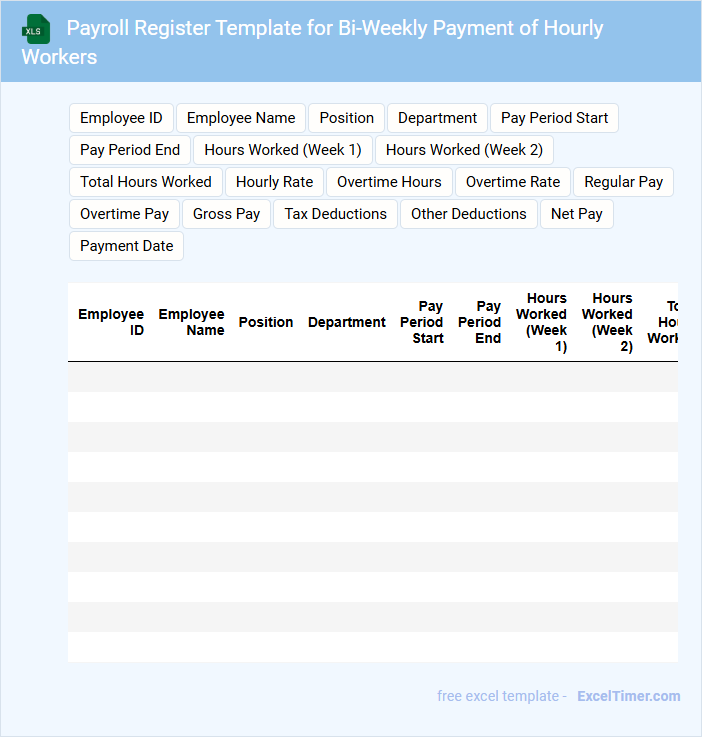

Payroll Register Template for Bi-Weekly Payment of Hourly Workers

A Payroll Register Template for bi-weekly payment of hourly workers typically contains detailed records of employee hours worked, wage rates, and total earnings for each pay period. It includes deductions such as taxes, benefits, and any additional withholdings to ensure accurate net pay calculations. This document serves as a critical tool for payroll processing and financial auditing. Important elements to include are clear employee identification, accurate time tracking, and transparent deduction summaries to maintain compliance and streamline payroll management.

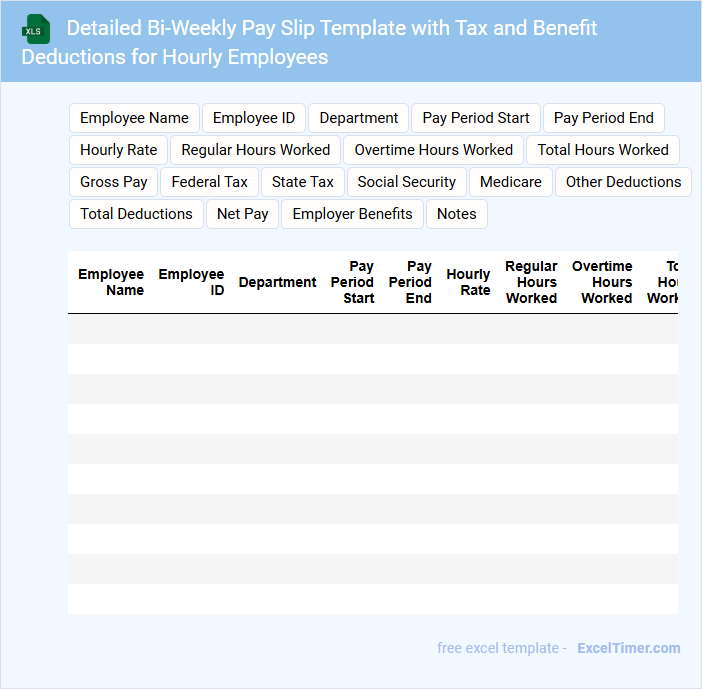

Detailed Bi-Weekly Pay Slip Template with Tax and Benefit Deductions for Hourly Employees

What information is typically included in a detailed bi-weekly pay slip template for hourly employees? A detailed bi-weekly pay slip usually contains employee details, hours worked, hourly rate, gross pay, tax deductions, and benefit contributions. It also itemizes various deductions such as federal and state taxes, social security, and healthcare benefits to provide employees with a clear understanding of their net pay.

What important elements should be highlighted in such a pay slip template? It is crucial to clearly display the pay period dates, total hours worked including overtime, and the specific deduction types with amounts. Additionally, including a section for employer contributions to benefits and providing a summary of year-to-date earnings and deductions helps employees track their financial progress effectively.

Excel Bi-Weekly Payroll Schedule for Hourly Employees

An Excel Bi-Weekly Payroll Schedule for hourly employees typically contains detailed information about work hours, pay periods, and payment dates. It tracks employee hours, calculates wages based on hourly rates, and summarizes total pay for each bi-weekly cycle. This document ensures accurate and timely compensation while maintaining organized payroll records.

Important elements to include are clear employee names, hourly rates, daily hours worked, overtime calculations, and deductions. Including formulas for automatic wage calculations and a summary section for total hours and pay enhances efficiency. Always ensure the schedule is regularly updated and reviewed for accuracy to prevent payment errors.

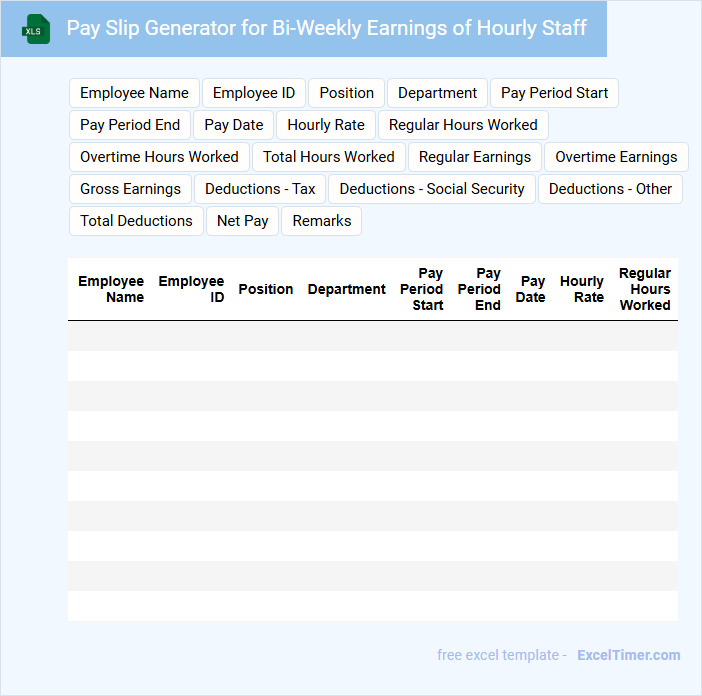

Pay Slip Generator for Bi-Weekly Earnings of Hourly Staff

A Pay Slip Generator for Bi-Weekly Earnings of Hourly Staff is a document that summarizes an employee's wages based on hours worked during a two-week period. It typically includes detailed earnings, deductions, and net pay information.

- Ensure accurate calculation of hours worked, including overtime if applicable.

- Include clear breakdowns of deductions such as taxes and benefits.

- Provide employee identification details and pay period dates for transparency.

What essential details must be included in a bi-weekly pay slip for hourly employees?

A bi-weekly pay slip for hourly employees must include essential details such as employee name, pay period dates, total hours worked, hourly rate, gross pay, deductions (taxes, benefits), and net pay. Your pay slip should also clearly list overtime hours and corresponding pay rates if applicable. This ensures transparency and accurate tracking of your earnings and deductions each pay period.

How is the total bi-weekly gross pay calculated based on hours worked?

Your total bi-weekly gross pay is calculated by multiplying your total hours worked by your hourly wage rate. Overtime hours are typically paid at a higher rate, often time and a half. The sum of regular and overtime pay determines your gross earnings for the pay period.

What deductions commonly appear on an hourly employee's bi-weekly pay slip?

Common deductions on your bi-weekly pay slip for hourly employees include federal and state income taxes, Social Security, Medicare, and contributions to retirement plans or health insurance. Overtime and hourly wages are typically detailed alongside these deductions to provide clear earnings information. Understanding these deductions helps you accurately track your net pay each pay period.

How are overtime hours and pay reflected in a bi-weekly pay slip?

Your bi-weekly pay slip for hourly employees includes a detailed breakdown of regular and overtime hours worked during the pay period. Overtime hours are listed separately with the corresponding pay rate, typically higher than the regular hourly rate, ensuring accurate calculation of total earnings. This clear presentation helps you verify that all hours and overtime compensation are correctly accounted for.

Why is accurate timekeeping crucial for generating a compliant bi-weekly pay slip?

Accurate timekeeping ensures precise calculation of hours worked, overtime, and corresponding wages, which is essential for compliance with labor laws and company policies. It prevents payroll errors that could lead to disputes or legal penalties. Reliable time records support transparent auditing and accurate financial reporting for bi-weekly pay slips.